In years to come the EDC market will experience a quantum leap forward-this is due to fast-growing requirements for PVC manufacturing agricultural chemicals, and solvent uses. DC is a major raw material for vinyl chloride monomer (VCM), mainly used to produce Polyvinyl chloride (PVC). As PVC demand grows in construction, automobile insulation materials and other products, so too will EDC needs increase and this market get ever larger.

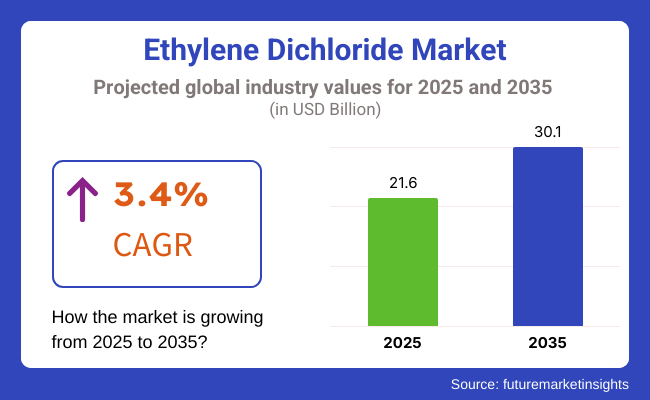

The global market was worth USD 21.6 Billion in 2025. By 2035, it is expected to reach USD 30.1 Billion-a stable CAGR of 3.4% over the forecast period. However, apart from its role in PVC manufacture, ethylene dichloride can also be applied as a solvent for cleaning, degreasing, and in particular industrial procedures. It has the additional benefit of being used across so many different industries.

Recent technological breakthroughs in production methods have intensified the efficiency and output of EDC plants. These developments enable manufacturers to meet the growing demand while at the same time reducing both environmental impact and operating costs. Use of feedstock itself has changed-witness the more flexible sourcing of raw materials by producers when natural gas and crude oil can be used to produce ethylene.

As a result of these environmental pressure points, cleaner, more sustainable methods for EDC production are being developed. Manufacturers are trying to concentrate in less chlorine use, reduced waste and system to recover the residuals in such a manner that complies environmental standards as well as delivering long-term market stability.

Explore FMI!

Book a free demo

North America’s steady stream of EDC exports shows that it is a significant player in this market. Most likely due to established contacts and PVC production facilities, the region also has a well-developed supply chain for all types of products, which has been key in making these markets viable.

Especially with the flourishing shale gas industry, North America is abundant in ethylene feedstock, making sure that EDC production can progress smoothly and at comparatively low prices.

In terms of demand and production, the United States continues to be the major consumer and producer of EDC in this region. Its various domestic projects in recent years are driving market growth even further. In both EDC and downstream PVC production, North America's chemical companies have unveiled plans to line up within the next year alone a variety of plant expansion projects.

The reason for this is that they are eager to meet increasing demand from construction, automotive, and healthcare sectors, where PVC is widely applied as pipe insulation, window frames or electrical wiring covering. Also the implementation of stricter safety and environmental regulations is pushing producers to adopt cleaner production technologies.

These measures include better emissions control, energy-efficient plant operations, and advanced waste management systems. They may represent a significant extra cost for businesses, but they also ensure that EDC production will continue to be part of this region's heritage.

In the ethylene dichloride market Europe holds a high proportion. Production and consumption in Germany, France, and Netherlands take the lead among these countries any of which could easily rank itself as a major centre for chemical industries East of Germany is the PVC heart, and this explains partly why that consumes EDC so much.

And its old developers were necessarily very familiar with every variety of dyeing resin; these pioneering types had to of course first be invented by exploratory procedures on a large scale in Europe, Germany is both the largest producer and consumer; it has administrative divisions that sound a lot like those of each other because its high concentration in PE production facilities guarantees labour welfare.

The French and Dutch also play important role for this gas that is essential in PVC production, with unrestricted output facilities starting outside their country but providing everything across the three.

Both France and the Netherlands respectively have all required turning equipment as well as skilled workers who are at home wherever there's a market for instance an Asian buyer wants it turned into five metres long, then that is what they deliver The construction industry's emphasis on sustainable, energy-efficient materials is also driving up demand for PVC products, which in turn drives the EDC market.

Europe's environmental regulations are among the strictest in the world, so they have spurred innovation and adoption of more environmentally friendly production methods by its producers.

That amounts to closed-loop systems for catching chlorine and other by-products; as well as methods reducing energy use and emissions of CO2. But all these efforts not just ensure compliance but have also brought Europe's manufacturers an edge in global markets.

In the entire period of expectation, the EDC market in the Asia-Pacific region is likely to see the fastest growth. The rapidly industrializing growing populations of countries like China, India, Japan, Korea, this trend will certainly keep continuing for some time into the future its propellant is pervading other regions and making them more efficient and modern. In particular, demand for PVC has grown with the trend towards urbanization and infrastructure development.

In the wake of this increased need, PV manufacturing capacity has also expanded to meet it head-on drawing direct strength from more demand in only part. A boost in the demand for PVC means directly boosting the demand for ethylene dichloride China, the largest producer and consumer of PVC within this region, uses EDC to produce vinyl chloride monomer.

EDC output in China is expected to grow steadily with the construction and infrastructure projects that are now underway. In addition, China is modernizing its production facilities. This has two results: one is that the output of these facilities is increasing; on the other hand, since their operations have become more efficient and economical, performance should continue to be relatively stable.

India is a potential market, which comes after China. Investment in PVC plants there has been growing continuously and new production units are being installed. With the government moving its focus to the construction of affordable housing and infrastructure investment, the demand for PVC pipes, profiles and fittings is picking up. All these are totally dependent upon sources of stable EDC supply; thus new EDC production plants are now being set up or old ones expanded so that they can meet this need more effectively.

Challenges

Environmental and Regulatory Compliance: As the chemical industry faces increasing pressure in terms of emissions, waste and by-products, EDC manufacturers need to invest in environmentally friendly technologies.

Feedstock Volatility: Price volatility in ethylene and chlorine, which is driven by crude oil and natural gas prices, brings impeded onto production scheduling and cost control. This volatility has the potential to squeeze margins for producers and ruin long-term investment strategies.

Infrastructure and Logistics: Because it is a dangerous material, ethylene dioxide must be safely transported and stored. The continuous reliable safe infrastructure of logistics is now an eternal task is particularly problematic in places with little transport infrastructure or strict ship-ping regulations.

Opportunities

Sustainable Production Innovations: Significant improvements such as low-emission process technologies and closed-loop systems with a better future enable one another. These technologies do not only decrease the environmental footprint of manufacturers but also save money in the long run.

Emerging Markets in Asia and Africa: Industrialization and urbanization in developing markets present opportunities for growth. As developing markets expand into the automotive, construction and manufacturing sectors, demand for PVC and hence EDC will grow

Focus on Recycling and Circular Economy: The advance of PVC product recycling technologies can benefit the EDC market indirectly. By aligning themselves with a circular economic strategy, companies are able to lower waste and make their operations more sustainable, enjoying a higher position and being welcomed by environmentally-minded customers.

The global ethylene dichloride (EDC) market has been considerably driven by the high demand for PVC production, a solvent, and as chemical intermediates. EDC is the feedstock from which vinyl chloride monomer (VCM) the precursor to polyvinyl chloride (PVC) is produced and it was witnessing stable demand from construction, automotive, packaging and electrical sectors.

Investments in urban infrastructure, residential housing and industrialization drove growth in PVC-based applications, consequently paving the way for steady demand for ethylene dichloride.

The chemical industry was likewise a major consumer of ethylene dichloride and used it in chlorinated solvents, cleaning agents, and the manufacture of specialty chemicals. PVC Coatings, Plastic Components, and Interior Trim: The automotive industry sector began to rely more on PVC coatings, plastic parts, and interior trims, leading to an increase in the demand for EDC-based materials.

Further, the demand for PVC insulation is increasing in the electrical and electronics industry such as wires and cables and protective coating which also emerged as a key factor supporting market growth.

Fossil fuel-based industries experienced a tumultuous ride in 2023, under the impact of environmental concerns and regulatory pressures that affected market dynamics. As a result of these regulations, incurred EDC producers had to invest and develop in advanced emission control systems, energy-efficient production technologies, and alternative feedstock solutions to meet sustainability objectives

With the growing emphasis on sustainability, technologies for biological EDC production, enhanced waste recovery units, and green PVC formulations were created. Chemical companies investigated carbon capture technologies and chlorine recycling processes to reduce the environmental footprint of EDC production.

Regardless of regulations and economic tendencies, the EDC market is on the rise because modernization, growth of industry and expansion in PVC applications continue. With industries searching for both low-cost and high-performance raw materials, EDC remained a key building block for manufacturers globally, laying the groundwork for new innovation and evolvement in the market.

The PVC sector will continue to lead demand for the consumption of EDC, with the emerging next-generation materials in construction, as well as automotive and packaging becoming smart polymers, self-healing plastics and high-durability PVC composites. AI-based real-time process monitoring, predictive maintenance, and automated production scheduling will help manufacturers optimize EDC synthesis, lower waste, and improve energy efficiency.

The pressure towards greening from across the globe will push for greener methods of producing EDC, including, but not limited to, electrified cracking processes, recycling systems for chlorine, and carbon-neutral feedstock.

Companies develop new pathways bio-based Ethylene production, helping to decrease dependency on raw materials from petroleum. Circular economy principles will be embedded, pushing investments to focus on recycling PVC waste, Chemical Upcycling and low-emission EDC processing to reduce the industry’s carbon footprint.

The automotive and aerospace industries will embrace EDC-based advanced polymers that are lightweight, strong, and energy-efficient. As EVs and autonomous transport usage keep climbing, also demand for EDC-based PVC coatings, lightweight composite panel, battery insulation materials will rise exponentially. Therefore, with the growth in lightweight, anti-corrosive components for vehicles, the demand for efficient polymer solutions will never fall off.

The electronics and semiconductor industries will further drive EDC market growth, as PVC-insulated wiring, flexible circuit boards, and protective coatings are crucial to miniaturized high-performance electronic devices. Heat-resistant and chemically inert derivatives of PVC will be used for next-gen chip manufacturing, smart electronics and IoT-based consumer devices.

As the decade progresses, AI powered chemical process optimization, quantum computing material discovery, and real-time EDC production analytics will allow manufacturers to achieve higher efficiency, lower downtime and create better consistency of the product.

Chemical traceability using block chain technology will provide end-to-end transparency of the chemical supply chain, ensuring compliance with environmental and safety regulations and preventing counterfeit, thus securing global trade networks.

In 2035, the industry landscape will be shaped by sustainable EDC production, AI-enhanced chemical engineering and next-generation polymer applications. The combination of carbon-neutral synthesis, smart automation and closed-loop chemical recycling will create a resilient, efficient, and environmentally responsible EDC market.

There will be much research and development across industries as we shift toward greener and smarter material solutions, and in this sense ethylene dichloride will remain one of the main building blocks of new innovations across construction, automotive, packaging, and high-tech industries.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter VOC emission rules, safety regulations, and sustainable chemical mandates. |

| Technological Advancements | Adoption of energy-efficient cracking processes, chlorine recovery, and emission control systems. |

| Industry Applications | Used in PVC production, solvents, pharmaceuticals, and industrial coatings. |

| Adoption of Smart Equipment | Companies integrated real-time monitoring, automated quality control, and smart manufacturing. |

| Sustainability & Cost Efficiency | Shift toward low-carbon production, eco-friendly plasticizers, and bio-based PVC alternatives. |

| Data Analytics & Predictive Modeling | AI-powered chemical diagnostics, demand forecasting, and process automation improved efficiency. |

| Production & Supply Chain Dynamics | Market faced supply chain disruptions, geopolitical trade tensions, and raw material shortages. |

| Market Growth Drivers | Growth was fueled by construction expansion, urbanization, and rising PVC demand. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Governments will enforce carbon-neutral production, chlorine recycling mandates, and AI-driven emission monitoring. |

| Technological Advancements | Growth in AI-powered process automation, electrified EDC production, and blockchain-enabled chemical traceability. |

| Industry Applications | Expansion into self-repairing PVC composites, AI-optimized polymer coatings, and lightweight aerospace polymers. |

| Adoption of Smart Equipment | Rise of self-learning chemical reactors, AI-assisted PVC formulation, and autonomous material testing. |

| Sustainability & Cost Efficiency | Adoption of circular PVC recycling, electrified EDC synthesis, and carbon-negative polymer chemistry. |

| Data Analytics & Predictive Modeling | Growth in quantum computing-based material discovery, AI-driven process efficiency, and blockchain-secured PVC traceability. |

| Production & Supply Chain Dynamics | AI-optimized global supply chain networks, decentralized PVC recycling hubs, and green chemistry innovations. |

| Market Growth Drivers | Market expansion will be driven by sustainable chemical production, AI-driven material innovation, and next-gen polymer applications. |

The USA ethylene dichloride (EDC) market is witnessing steady growth on the back of strong growth in PVC production, increasing industrial solvent requirements, and improved sustainable process chemical technologies.

USA construction activity, which is being spurred by new residential building and replacement infrastructure projects, is propelling demand for PVC pipe, siding, and flooring material, thus increasing EDC use. Westlake Chemical, Olin Corporation, and Formosa Plastics are increasing EDC and VCM production capacity to address escalating demand.

Besides this, the pharma raw material drug, cleaner, and paint thinner segment of solvents is also observing increasing demand for EDC. Increasing applications of EDC as a chemical feedstock to produce specialty chemicals are also boosting market growth.

Technological innovation in chlor-alkali processes and green EDC production technologies is promoting uptake of energy-efficient production. Construction of low-emission EDC production plants is gaining priority in Environmental Protection Agency (EPA) regulations, stimulating innovation in green production technologies.

Increasing demand for PVC materials, expanding industrial solvent utilization, and high investment in green chemical production have driven the USA EDC market to record steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.1% |

The UK ethylene dichloride (EDC) market is facing moderate growth from rising infrastructure developments, growing PVC application demand, and investments in green chemical solutions.

The construction industry in the UK, fueled by urban regeneration programs supported by the government and the construction of housing, is generating demand for building materials on the basis of PVC, which is dependent on the production of EDC-based VCM. Enhanced weather ability, weight savings, and recyclability of high-performance PVC formulations are being investigated and developed by companies.

In addition, the EDCs are expanding applications in industrial coatings, pharma, and adhesives in the chemical manufacturing industry, with upcoming demand for high-purity solvents of EDC. The specialty chemical manufacturing in the UK is also enhancing growth more due to niche application.

The UK's sustainability pledges and strict VOC regulations under REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) are driving firms towards low-emission EDC manufacturing technologies. Investments in circular economy programs and solvent recovery operations are also influencing the future of the UK's EDC market.

With increasing investments in infrastructure, increasing use of PVC, and growing interest in eco-friendly chemical solutions, the UK EDC market will witness stable growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.0% |

The European ethylene dichloride (EDC) market is witnessing stable growth with increasing production of PVC, increasing usage in industrial coatings & adhesives, and increasing investment in the manufacturing of green chemicals.

The construction industry of the EU, more so in Germany, France, and Italy, is a huge consumer of PVC products, thereby creating demand for the utilization of EDC for VCM manufacturing. Growing applications of corrosion-free, light-weight PVC products in automotive parts, sanitary fixtures, and infrastructure growth are driving market expansion in EDC.

Apart from specialty coatings, adhesives, and sealants, EDC consumption is being propelled by aerospace, industrial manufacturing, and automotive sectors. Polymer processing along with solvent-based coatings are increasingly being demanded.

Tough environmental regulations within the EU are stimulating investment into green EDC manufacturing technologies. Firms are implementing low-carbon chlorine production and energy-effective EDC manufacture processes in conformity with Green Deal goals.

With increasing investments in infrastructure, rising consumption of PVC, and mounting focus on green chemistry, the European EDC market will expand steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.3% |

Japan's ethylene dichloride (EDC) market is progressing step by step with growing demand in high-performance PVC applications, rising applications in specialty chemicals, and evolving green manufacturing technology.

Japanese automotive and electronics sectors, dominated by Toyota, Honda, and Sony, are increasingly employing high-performance PVC formulations for wiring, insulation, and polymer components of lighter weight. The movement towards fuel-efficient and electric vehicles (EVs) is also boosting demand for high-performance PVC material, hence propelling consumption of EDC.

Japan's expanding chemical industry, especially in pharma intermediates and high-purity solvents, is helping to drive EDC consumption in specialty coatings and industrial processing. And the greener focus in the country for chemical production is fueling investment in less energy-intensive manufacturing and recycling EDC technologies.

With increasing demand for high-performance PVC, rising applications in specialty chemicals, and growing investment in green production technologies, the Japanese EDC market will continue to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

The South Korean ethylene dichloride (EDC) market is experiencing a steady growth as a result of growing construction activity, growing electronics manufacturing demand, and growing investment in green EDC production.

South Korea's building construction business, including urban development and smart city construction, is driving PVC pipe, fitting, and structural component demand, sustaining rising EDC consumption. LG Chem and Lotte Chemical are increasing VCM capacity to satisfy market demand.

The electronics sector, dominated by industry leaders Samsung and SK Hynix, is also creating demand for EDC-based specialty coatings, insulators, and semiconductor packaging. Rollout of 5G networks, AI computing, and EV battery manufacture are expected to drive the use of PVC and high-performance polymer coatings as well.

Besides, South Korea's 2050 carbon neutrality pledge is driving investment in low-carbon and energy-efficient technology in EDC production, which is reducing the environmental impact of chemical production.

With growing demand in construction & infrastructure, growing uses in electronics production, and strong investment in green manufacturing, the South Korean EDC market is likely to grow steadily.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.3% |

The ethylene dichloride, particularly VCM and ethylene amines segments, have a significant market share owing to VCM-based EDC-based formulations and widespread acceptance of EDC for enhancing chemical processing, polymer production, and various special applications in both companies and industries.

With proper access to it, these applications are crucial for quality polymerization, optimized chemical synthesis, and cost-effective material creation across various industries, including construction, automotive, medicines, and packaging.

Ethylene dichloride (EDC) is notably used as a feedstock for the manufacturing of vinyl chloride monomer (VCM), which is an important building block for polyvinyl chloride (PVC), a widely used plastic. Conventional monomers have low polymerization ranges, but using VCM allows polymerization behaviour to scale effectively with high purity, importantly aiding in the production of varied PVC products across infrastructure, automotive, consumer goods, etc.

As industries increasingly focus on high-performance, durable, and cost-effective polymer solutions, the growing consumption of PVC-based products across construction, piping systems, and electrical insulation sectors acts as the profitable trend for the uptake of EDC in the manufacturing of VCM.

Prior studies show that the VCM polymerized from EDC has better polymerization stability, enhanced mechanical properties, and better weather resistance, marking PVC as one of the most important substances in modern industrial applications.

Due to a growing preference by healthcare industries for sterilizable, lightweight, and chemically resistant materials, the trend of VCM applications for medical-grade plastics comprising biocompatible PVC (utilized in tubes, blood bags, and pharmaceutical packaging) has reinforced market demand.

While green PVC formulations containing recycled material, bio-based plasticizers, and sustainable additives have boosted adoption owing to tighter environmental rules and improved lifecycle management, varied sentence structure and length introduce complexity.

New high-performance PVC products with augmented impact resistance, UV stabilization, and antimicrobial properties have expanded use and markets through auto interiors demanding durability, protective coatings for a range of materials, and smart packaging solutions requiring enhanced product safety and preservation. Alongside shorter sentences, some that elaborate on initiatives or applications arise from ingenious material technology.

Rising preference for durable, lightweight, and thermally stable materials was a key contributor for market growth owing to adoption of EDC in production of high-purity VCM for use in chlorinated polymer formulations used as industrial coatings, insulation foams, and synthetic leather applications.

It is precisely this expertise that is giving VCM production a hard time as regulatory bodies penalize carbon emissions, raw material prices rise and the toxicity of vinyl chloride is questioned.

However, new innovations like closed-loop VCM production, AI-backed polymerization control, and next-generation sustainable PVC alternatives should improve process efficiency, environmental sustainability, and cost-effectiveness, driving continued growth of VCM applications in EDC production.

They have seen robust market penetration across adhesives, coatings, pharmaceuticals, and agrochemicals, wherein manufacturers increasingly use ethylene amines derived from EDC to enhance the chemical reactivity, stability of polymers and crosslinking efficiency. Ethylene amines are more nitrogen-functionalized, bond better, more soluble, and particularly suitable for high-performance chemical formulations than traditional amines.

Improving the adhesion properties, corrosion resistance, and catalytic efficiency of amine-based compounds has made products like epoxy curing agents, fuel additives, and chelating agents increasingly popular, with EDC-derived synthesis routes leading the pack. Ethylene amines, studies suggest, aid in effective crosslinking of resins, stability while combusting fuel and also process chemicals industrially for ubiquitous applications.

The application of ethylene amines in water treatment chemicals such as chelating agents for heavy metal removal and scale inhibitors along with pH stabilizers, has increased the demand for ethylene amines as the industry also aims to improve wastewater treatment and environmental remediation with sustainable, high-performance solutions.

Ethylene amines are being integrated into agrochemical formulations ranging from pesticide stabilizers to herbicide activators, nitrogen-rich fertilizer additives, which has further boosted market growth by providing footprint development including crop protection, nutrient delivery, and soil fertility enhancement.

Bio-based synthesis, with reduced environmental impact, and improved functional versatility has led to the optimization of next-generation ethylene amine derivatives, thus contributing to the global market growth and selectivity in the pharmaceuticals, adhesives, and high-performance coatings.

Increasing use of ethylene amines as hair conditioning agents, emulsifiers and skin moisturizers−primarily used in personal care and cosmetic applications have remained a supporting pillar toward the growth of ethylene amines market as formulators tend to look for multifunctional, skin-friendly and biodegradable amine compounds.

Emerging Innovations: Opportunities & Market Expansion While some challenges lie ahead for high production EDC-based ethylene amines, innovations such as AI-assisted amine synthesis, nanostructured ethylene amines, and hybrid bio-based amine formulations are helping ensure competitive advantages in process efficiency, cost-effectiveness, and sustainability, thus aiding in the further expansion of the ethylene amines market in EDC-based applications.

The direct chlorination and oxychlorination workflow segments are two key market driving forces, as industries evolve more efficient EDC generating processes, improving chemical purity, process performance and financial savings.

Among them, direct chlorination has become one of the most common processes for EDC production, exhibiting high reaction efficiency, excellent yield consistency, and controlled incorporation of chlorine atom and large-scale industrial applications. Compared to alternative methods, direct chlorination offers stable products, which facilitates downstream processing in the synthesis of vinyl chloride monomer and ethylene amines.

Direct chlorination is being adopted due to the increasing demand for economical EDC biosynthesis, VCM and polymer production, scalable and high-purity routes to synthesis that can improve chemical conversion rates while minimizing byproducts.

Direct chlorination methods based on these chlorine production reactions yield a more selective product, generate less waste stream, and are more economically favorable, making them the process of choice for larger-volume EDC manufacture.

Market demand has been reinforced with the rapid growth of direct chlorination in the production of chlorinated solvents associated with the design of optimal reaction conditions, better catalyst efficiency, and improved recovery of chlorine, which have resulted in wider adoption of direct chlorination in polysiloxane processing and resin processing, among others.

Although direct chlorination has the benefits of being a cheap route to EDC, its disadvantages include high risks during chlorine handling, process safety concerns, and restrictions by regulations on chlorinated emissions.

Nevertheless, developments in AI-based chlorination monitoring, superior chlorine containment technologies and novel catalytic chlorination are all contributing to greater process stability environmental compliance and cost-effectiveness, barring any major market reductions in direct chlorination-centered EDC production.

Oxychlorination is robustly adopted in the market and is being embraced in areas such as high purity EDC production, sustainable chemical processes, and closed-loop chlorine recovery systems, as industries are increasingly dependent on addressing efficient oxychlorination pathways to allow them to maximize feedstock utilization and address chlorine byproduct waste.

Oxychlorination: The process provides an energy-efficient, ecohgiendly method for chlorination as compared to the traditional use of chlorination thus reducing the environmental pollution and increasing the overall product quality.

With increasing demand for oxychlorination-based EDC production used in vinyl chloride and chlorinated intermediate synthesis, industries are seeking cleaner, low-emission production processes enabling improved reaction kinetics, thus, promoting the adoption of advanced oxychlorination technologies.

The role of oxychlorination in the production of next-generation polymers and solvents, such as those produced using AI-assisted process control, in-process reaction monitoring, and catalytic efficiency optimized for eco-friendly production in sustainable chemical manufacturing has further catalyzed market demand leading to higher adoption rates.

Oxychlorination is still limited by process heat control, catalyst adjustment, and chlorine conversion and has not received as much attention as other methods for producing high-purity, eco-friendly EDC synthesis.

Nonetheless, advances in developments, such as nanocatalyst oxychlorination, hybrid chlorine recovery systems, and AI-assisted reaction modeling, are positively impacting the scalability, cost-effectiveness, and sustainability of the process, which is subsequently driving a favorable market outlook for oxychlorination-based EDC production.

Rising demand for polyvinyl chloride (PVC) production, chemical intermediates, and industrial solvents are expected to drive the growth of the ethylene dichloride (EDC) market. To improve efficiency, cost-effectiveness, and regulatory compliance, firms are concentrating on synthesis of high-purity EDC, chemical process optimization via AI, and sustainable chlorine-based manufacturing.

Global chemical manufacturers, as well as regional chlor-alkali producers, are part of the hypothesized market, each advancing technologies such as EDC production, energy-efficient distillation, and sustainable approaches to chlorine sourcing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| OxyChem (Occidental Petroleum Corporation) | 15-20% |

| Westlake Chemical Corporation | 12-16% |

| Formosa Plastics Corporation | 10-14% |

| Shin-Etsu Chemical Co., Ltd. | 7-11% |

| Tosoh Corporation | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| OxyChem (Occidental Petroleum Corporation) | Produces high-purity EDC for PVC manufacturing, with a focus on energy-efficient chlorination and ethylene cracking technologies. |

| Westlake Chemical Corporation | Specializes in integrated chlorine and EDC production for PVC, offering cost-effective bulk supply and sustainable process innovations. |

| Formosa Plastics Corporation | Manufactures EDC-based chemical intermediates and solvent solutions, integrating closed-loop chlorine recycling for sustainable production. |

| Shin-Etsu Chemical Co., Ltd. | Provides high-performance EDC for PVC polymerization and industrial solvents, optimizing supply chain efficiencies. |

| Tosoh Corporation | Develops chlor-alkali-based EDC production, ensuring high-purity distillation for downstream PVC and chemical synthesis applications. |

Key Company Insights

OxyChem (Occidental Petroleum Corporation) (15-20%)

OxyChem is a market leader in ethylene dichloride (EDC), providing high-efficiency EDC production for PVC polymerization, combining low-energy chlorination and AI-based process automation.

Westlake Chemical Corporation (12-16%)

Westlake is a leading Vertically Integrated EDC and PVC Producer focused on low costs, along with green and sustainable chlorine-based processes.

Formosa Plastics Corporation (10-14%)

High-purity EDC is developed by Formosa Plastics as a key monomer for use in producing plastic resins and solvents, and the company also employs recyclable chlorine processing to minimize environmental degradation.

Shin-Etsu Chemical Co., Ltd. (7-11%)

Shin-Etsu provides high-performance EDC for PVC production and solvent applications, ensuring low-contaminant chemical synthesis.

Tosoh Corporation (5-9%)

Tosoh produces industrial-grade ethylene dichloride (EDC) for PVC resins and coatings, combining chlor-alkali innovation for controlled, cost-effective EDC synthesis.

Other Key Players (40-50% Combined)

Next-gen EDC production, sustainable chlorine sourcing, and AI-driven process optimization are offered with input from a few chemical producers. These include:

The overall market size for Ethylene Dichloride Market was USD 21.6 Billion in 2025.

The Ethylene Dichloride Market is expected to reach USD 30.1 Billion in 2035.

The demand for the ethylene dichloride market will be driven by its growing use in polyvinyl chloride (PVC) production, driven by expanding construction and automotive industries. Increasing demand for lightweight materials, infrastructure development, and advancements in chemical manufacturing will further boost market growth.

The top 5 countries which drives the development of Ethylene Dichloride Market are USA, UK, European Union, Japan and South Korea.

Vinyl Chloride Monomer (VCM) and Ethylene Amines Drive Market to command significant share over the assessment period.

Lubricant Additives Market Growth – Trends & Forecast 2025 to 2035

Biocompatible Polymers Market Trend Analysis Based on Product, Polymer, Application, and Region 2025 to 2035

Aviation Titanium Alloy Market Analysis by Type, Application, Microstructure, and Region: Forecast for 2025 to 2035

Bioenzyme Fertilizer Market Analysis & Forecast by Product Type, Form, End Use, and Region Through 2035

Wooden Decking Market Analysis & Forecast by Wood Type, Construction Type, Application, and Region through 2035

Hindered Amine Light Stabilizers (HALS) Market Analysis by Application, Type, and Region Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.