The market for ethylene copolymers will grow steadily between the years 2025 and 2035 as a result of increasing demand from different industries such as adhesives, construction, automotive, packaging, and industrial uses.

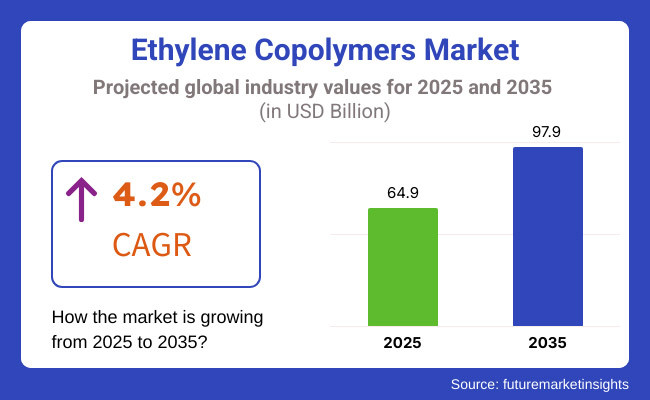

The growing industry is projected to grow at a CARG of 4.2% from USD 64.9 billion in 2025 to USD 97.9 billion in 2035. The lightweight, flexible, and durable materials trend in the consumer goods, food and beverage packaging, and electronics sectors is the single most important factor driving the growth of the industry.

The coatings, adhesives, and industrial part manufacturers apply ethylene copolymers which include ethylene-vinyl acetate (EVA), ethylene-methyl acrylate (EMA), ethylene-ethyl acrylate (EEA), and ethylene-propylene rubber (EPR) because of their superior flexibility, chemical resistance, and adhesion properties. The push towards sustainability and recyclable polymer solutions, along with ongoing research and development are the other factors driving industry growth.

The prominent factor that is dominating the industry is the ongoing trend of bio-based ethylene copolymers, as the industries are embracing circular economy initiatives and the global sustainability regulations. Furthermore, the emergence of electric vehicle (EV) infrastructure, medical films, and polymer composite materials is accelerating the introduction of new applications for ethylene copolymers.

The packaging sector continues to be the main buyer of these materials, utilizing them in packaging foods, manufacturing lamination films, and producing industrial wraps.

The automotive sector is yet another key impetus for this trend, shifting towards lighter, crash-resistant, and weather-resistant materials to produce fuel tanks, under hood components, seals, and interior vehicle parts. The building industry is also a case in point, using ethylene copolymers as adhesives and waterproofing membranes, thereby adding to longer durability, energy efficiency, and performance.

Regulatory matters are also important, as the global rules require manufacturers to switch to sustainable and biodegradable materials. Manufacturers are, therefore, compelled to restructure their supply chains and introduce environmentally friendly alternatives. But, with implementing these strategies, the costs tend to be higher and developing nations often do not have an adequate level of infrastructure for the recycling and waste disposal that will be required.

The market place is also being affected by the competition arising from the regional and global players who are striving to develop performance, scalability, and regulatory compliance of the product, which results in a price war and fragmentation in the industry.

The progress in electric vehicles, renewable energy, and energy-efficient construction, is further promoting the demand for ethylene copolymer insulation materials, adhesives, and coatings. Interactions between industries aiming to lower material weight, boost thermal performance, and broaden durability are a result of ethylene copolymers becoming vital for automotive and building applications.

As time passes and the industry advances, polymer manufacturers, packaging firms, and industrial material suppliers will have immense opportunities for growth. The theme of the future of the ethylene copolymers industry is marked by the progress in high-performance materials, sustainability endeavors, and the growing demand for green alternatives.

Explore FMI!

Book a free demo

For plastic manufacturers, production efficiency is critical and they rate it high, while packaging companies, industrial users and R&D teams assign a medium, adjusting for a balance between throughput and quality. For industrial users, they are under intense margin pressure, and therefore cost competitiveness is particularly important, while for the other two user groups it is of medium importance.

Performance is critical, and the high marks among plastic manufacturers and R&D groups reflect consistent performance in end-use applications. Stakeholders do rank environmental impact as a moderate concern, and R&D do regard environmental impact as a lower priority issue due to their need for innovation.

Lastly, innovation and R&D potential is rated quite differently, as R&D teams see it as being more valuable. Ultimately, the table clearly shows that technical performance, efficiency, and innovation are the driving factors when making decisions in the ethylene copolymer industry.

The ethylene copolymers industry has undergone gradual growth between the periods of 2020 and 2024 primarily under the application areas of the packaging, automotive, and adhesives sectors. The flexible packaging trend gave rise to increased usage of lightweight materials in cars along with the expansion of the solar industry and led to industry growth.

Regulatory pressures for single-use plastics have also forced the use of recyclable and bio-based ethylene copolymers. Manufacturers, on the other hand, faced challenges such as supply chain disruption, rising raw material prices, and general uncertainty. From 2025 to 2035, the world will witness a boom in innovation for sustainable, high-performance copolymers. Bio-based ethylene copolymer development and recyclable formulations will adhere to more stringent environmental regulations. The major end-applications of these niche copolymers will be the automotive and electrical sectors, which will call for enhanced heat and chemical resistance.

Smart packaging is also a possible industry, which will need spectacular barrier properties. In addition, digitalization and AI-guided manufacturing will streamline the production process for cost-efficient and eco-friendly supply chains for ethylene copolymers globally.

Comparative Market Trends 2020 to 2024 VS 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Standards of emissions and industrial safety regulations. | Tighter sustainability regulations driving the need for bio-based and recyclable ethylene copolymers to minimize environmental footprint. |

| Manufacturing of high-performance copolymers of ethylene for automotive and packaging applications. | Advanced polymerization techniques allow enhanced mechanical properties and better recyclability. |

| Strong demand exists in adhesives, packaging films, and coatings. | Increasing applications in renewable energy, medical devices, and sustainable packaging. |

| Increasing trends towards recyclable and low-VOC formulations. | Circular economy projects foster development in biodegradable and upcycled forms of ethylene copolymers. |

| Price volatility based on reliance on petrochemical feedstock. | Guiding development to bio-based sources of ethylene is intended to provide stability in supply and cost-effectiveness. |

| Expansion of flexible packaging, automotive, and construction incidences. | Industry growth is being driven by innovation in lightweight materials, electric vehicle parts, and high-barrier packs. |

The ethylene copolymer industry is also sensitive with regard to volatility in price fluctuation of raw materials due to key feedstocks such as ethylene, vinyl acetate monomer (VAM), and acrylic monomers are highly replaceable and respond to the fluctuations in price of crude oil, supply chain disruptions, and geopolitical factors.

Prices for these materials soar, raising production costs for manufacturers, who can either raise prices or bear margin erosion. It was very competitive and EVA or EAA gets replaced in cost-sensitive applications by alternative materials like LDPE and other copolymers.

At the same time, new elastomers and olefin block copolymers are invading those segments with which you compete in markets for footwear, packaging and adhesives.

Regulatory and environmental risks continue to intensify, specifically for single-use plastics and non-recyclable materials. Tighter regulation of packaging sustainability and food-contact safety can necessitate reformulation or redirect demand to bio-sourced alternatives like EVA from sugarcane.

Demand is also influenced by cyclicality, with segments such as solar panel encapsulants and footwear experiencing booms or busts based on (political) policy changes, economic slowdowns or altering consumer preferences.

A surge in overcapacity, especially in the event of new plants coming online in areas such as Asia, can force prices down and increase competition. Producers need to prioritize cost efficiency, diversification, and innovation in high-performance or environmentally friendly copolymer grades to shield these threats.

The pricing for ethylene copolymers is predominantly cost-plus, with pricing changes to reflect the movements of feedstock prices. If EVA and other copolymers are supplied, many supply contracts are also based on indexation models, where EVA and related copolymers follow ethylene and VAM price movements and can pass through the cost.

But in competitive markets, it’s possible that producers will not be able to pass through fully price increases when raw material costs increase. These are specialty grades where value-based pricing comes into effect (e.g., high-VA EVA for solar encapsulants or EAA in premium packaging adhesives), which is justified due to superior performance.

There is segmentation, where large industrial buyers are negotiating bulk discounting, while smaller customers or niche applications are paying higher per-unit prices.

Furthermore, in response to competitive pricing pressures, we see market-based adjustments, where suppliers seek to respond to, and keep pace with, price decreases to retain share in commodity-type segments.

Promotional strategies, like multi-annual contracts and bundled pricing for specialty applications, stabilize revenues. As sustainability trends increase, some bio-based copolymers may demand a premium; however, their adoption will rely on regulatory incentives and cost competitiveness.

In the long term, raw material trends pricing will be driven still by capacity expansions and shifts to growth applications (e.g., renewable energy, flexible packaging, and automotive materials).

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 3.8% |

| The UK | 4.0% |

| European Union (EU) | 4.1% |

| China | 4.8% |

The United States' ethylene copolymers industry is riding a wave of growth, fueled by demand from the automotive and packaging sectors. The USA industry is spurred by developments in lightweight and high-performance materials, and substantial R&D investment in sustainable polymer technologies.

FMI opines that the USA industry will register a 3.8% CAGR over the study period (2025 to 2035).

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Flexible Packaging Growth | Growing demand for long-term and sustainable packaging solutions propels growth in laminates, wraps, and films, as consumers opt for green alternatives. |

| Automotive Demand | Demand for light polymers to save weight and enhance fuel efficiency is paramount, especially with the growing use of electric vehicles. |

| Polymer Technology Growth | New co-polymer combinations, based on renewable energy and biodegradable raw materials, are enhancing polymer performance while lowering environmental footprint. |

| Regulatory Drive for Sustainability | Government efforts to suppress plastic waste and support environmentally sustainable materials are drawing companies towards sustainable polymer solutions. |

The UK is observing increased demand for ethylene copolymers owing to the increasing spurt in the sustainability culture in packaging, adhesives, and coatings. Government initiatives in favor of the circular economy and the transition towards high-performance plastics also propel the industry.

FMI views that the industry in the UK will grow at a 4.0% CAGR from 2025 to 2035.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Sustainable Packaging Initiatives | Ban on single-use plastics has raised demand for biodegradable and bio-based copolymers to develop sustainable packaging solutions. |

| Construction Sector Growth | Growing application of copolymers as roofing membranes, insulation, and hardness and weatherability-dependent protective coating. |

| Adhesives & Sealants Demand | The demand for copolymer solutions is greatest if there is a requirement for enduring bonding to industries and consumers. |

| Pharmaceutical use | Ethylene copolymers are notably applied in developing drug-delivery systems, tubing for medical application, and device packaging of medications. |

European Union ethylene copolymers industry is growing on the back of environmental policy, industrialization, and heightened development of high-performance polymers. Government schemes such as the EU Green Deal also favor the use of recyclable, bio-based, and sustainable copolymers.

FMI is of the belief that the European Union industry will register a 4.1% CAGR throughout the period of research (2025 to 2035).

Growth Drivers in the European Union

| Key Drivers | Details |

|---|---|

| EU Green Deal Policies | The EU pledge to sustainability makes the use of recyclable and bio-based copolymers a priority in order to harmonize with environmental objectives at the regional level. |

| Growth in Automobile Manufacturing | Use in emission reduction, electric, and hybrid necessitates lighter products, elevating the requirement for ethylene copolymers. |

| Growth in Medical Use | More demand for pharma packaging and medical devices has been created in ethylene copolymers due to non-toxicity and chemical resistance. |

| Investment in Bio-Based Polymers | Investment in production of bio-based copolymers is propelled by the need for sustainable alternatives to replace traditional ethylene products. |

| Infrastructure & Construction Growth | Growing application of ethylene copolymers for waterproofing, corrosion-resistant coatings, and thermal insulation in infrastructure development is rising steadily. |

China also dominates the international ethylene copolymers industry owing to increased industrialization, urbanization, and expenditure on renewable power, electric transport, and packaged consumer goods. Use of ethylene copolymers for packaging is particularly on the uptrend with elevated online shopping trends.

FMI predicts that China's industry is likely to increase at a 4.8% CAGR through the prediction period (2025 to 2035).

Development Drivers in China

| Key Drivers | Details |

|---|---|

| Boom in Packaging Industry | With increasing online shopping, packaging products, including ethylene copolymers, are in high demand online. |

| Technological Advances in Renewable Power | Packaging ethylene copolymers for solar panel packaging owing to China's investment in renewable power is driving the industry. |

| Sustainable Material Use | China encourages the utilization of renewable-based ethylene copolymers and green manufacturing technologies as part of its green efforts. |

| Environmental Recycling Technologies | China is leading in the use of green recycling technologies for ethylene copolymers towards enhancing material sustainability. |

Ethylene copolymers mainly have a share in hot melt adhesives used in Packaging, Woodworking and Textiles. Ethylene Vinyl Acetate (EVA) and Ethylene Butyl Acrylate (EBA) are the most common copolymers in hot melt adhesives because they are known for having good adhesive ability, flexibility and energy-efficient bonding.

This is also driving the growth of this segment further owing to the e-commerce boom and rising demand for eco-friendly packaging solutions. Some companies, such as Henkel, 3M, and Arkema, are at the forefront of this development of bio-based and low-VOC hot melt adhesives to comply with more stringent regulatory standards.

The Asia-Pacific region is witnessing heightened industry proliferation in particular in China and India on account of the boisterous consumer goods as well as logistics industries. The use of ethylene copolymers as modifiers for asphalt are increasing, as the importance of long-lasting roads and better pavement performance continues to grow. Tar playground EP (ethylene propylene) and EVA (ethanol-vinyl acetate) copolymer is used to facilitate heat resistance and improve flexibility and anti-crack.

One of the primary drivers pushing modified asphalt demand higher are booming global infrastructure initiatives, particularly in North America, Europe and developing Asian economies.

High-performance road construction have been intensively invested over the past years by many countries like USA, Germany, and China, while dozens of government continue pursuing sustainable and resilient infrastructure solutions across the globe.

Leading manufacturers such as ExxonMobil, Dow Inc. and BASF are working on advanced polymer-modified asphalt to meet growing durability and environmental requirements.

Ethylene Vinyl Acetate (EVA) accounts for the major industry share among ethylene copolymers owing to its provide excellent flexibility, elastic properties, impact resistance and thermal stability. It has wide applications, used in hot melt adhesives, foam materials, PV encapsulation, flexible packaging etc.

As the demand of solar energy industry beats rising, EVA has been proven to have significant impact on its overall consumption, EVA has eventually become a major material in photovoltaic module encapsulation, EVA is propellant for making fill side of photovoltaic modules sustainable and efficient.

Many of the top solar companies - names like First Solar, Trina Solar and Jinko Solar - use EVA-based encapsulants. In the shoe and automotive industries EVA is used as a low density, shock absorbing materials, Nike and Adidas provide said EVA in these types of performance footwear. EVA demand in the Asia-Pacific region, a hub for solar and vehicles manufacturing, is seen quickening. EBA (Ethylene Butyl Acrylate) also finds growing applications in wire and cable insulation, polymer modification and also used in thermo-adhesive films. It is ideally suited to protective coatings and high performance sealants due to the low temperature flexibility, chemical resistance and compliance with environmental regulations.

Key industries in North America and Europe, such as automotive, electronics and aerospace, require high-performance advanced materials, including EBA. Companies including Arkema and Dow Inc. are developing EBA-based materials for high-voltage insulation and specialty adhesives. As advancing polymer technology continues to contribute to the emergence of more applications for the use of EBA, the market itself continues to steadily expand.

Ethylene copolymer production has a strong concentration and is chiefly controlled by innovative Tier 1 companies running state-of-the-art manufacturing facilities alongside vast production capacities.

Backed by R&D on new materials, the top manufacturers prioritize the production of high-performance goods for various sectors, including packaging, automotive, and construction. They take advantage of their global footprint to approach diverse customer and industrial needs effectively.

The strategy of renewable, research, and development investment enables their product range to be extended even further, thus strengthening their market influence. In addition, they are the role models for the industry, therefore, other companies and sectors emulate their model in strategic decisions and capitalize on their success.

The ethylene copolymers market is intensely competitive and is driven by technological advancements, sustainability initiatives, and multiple applications in various industries.

The prime companies focus on research as well as development, global distribution networks, and strategic collaboration to sustain their market position. The demand for high-performance, recyclable, and bio-based copolymers is enhancing innovation, especially in packaging and automotive applications and in adhesives and coatings.

The Dow Chemical Company, ExxonMobil Chemical, Mitsui Chemicals, and SABIC SK Nexlene Company are prominent players that analyze wide product portfolios with strong supply chain capabilities. Dow excels in high-performance ethylene copolymers for packaging, adhesives, and automotive applications, while ExxonMobil Chemical is known for an advanced polymer technology and worldwide market reach.

Companies that invest in bio-based alternatives, circular economy solutions, and enhanced performance of products will be more favorably placed for sustainable success as sustainability issues and regulatory compliance continue to play a major role in determining the market dynamics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| The Dow Chemical Company | 18-22% |

| ExxonMobil Chemical | 14-18% |

| BASF SE | 12-16% |

| DuPont | 10-14% |

| Celanese Corporation | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| The Dow Chemical Company | Offers a diverse range of ethylene copolymers used in packaging, automotive, and adhesives, with a strong R&D-driven approach. |

| ExxonMobil Chemical | Focuses on high-performance ethylene copolymers for packaging and automotive applications, emphasizing technological advancements. |

| BASF SE | Specializes in high-quality ethylene copolymers, integrating sustainability initiatives for eco-friendly solutions. |

| DuPont | Produces advanced copolymers used in coatings, adhesives, and specialty applications, with a strong focus on innovation. |

| Celanese Corporation | Provides performance-oriented ethylene copolymers for industrial and consumer applications, focusing on durability and flexibility. |

Key Company Insights

The Dow Chemical Company (18-22%)

As the market leader in ethylene copolymers, investing heavily in high-performance applications positions Dow well in individual proprietary formulations for the packaging, adhesives, and automotive market sectors.

ExxonMobil Chemical (14-18%)

With superior technologically advanced copolymers, the company has prioritized global expansion in addition to premium solutions for different applications.

BASF SE (12-16%)

BASF is a leader in terms of sustainable polymer solutions, which includes supplying green materials in its ethylene copolymer production.

DuPont (10-14%)

DuPont specializes in coatings, adhesives, and engineering materials where the application is specialized and performance based.

Celanese Corporation (8-12%)

Celanese manufactures multipurpose, flexible, copolymers for an industrial and consumer audience. This architecture focuses on durability and flexibility.

The market is expected to generate USD 64.9 billion in revenue by 2025.

The market is projected to reach USD 97.9 billion by 2035, growing at a CAGR of 4.2% from 2025 to 2035.

Key manufacturers in the market include DuPont, Celanese Corporation, The Dow Chemical Company, BASF SE, Sipchem, USI Corporation, LyondellBasell Industries N.V., Wacker Chemie AG, ExxonMobil Chemical Company, and Lanxess AG.

Asia-Pacific, particularly China and India, is expected to be a key growth region due to rising demand in packaging, automotive, and construction industries.

Ethylene vinyl acetate (EVA) is the most widely used product segment due to its versatility, flexibility, and extensive application in packaging, footwear, and solar panel encapsulation.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.