The esterified vitamins display is experience steady tumor on account of increasing services knowledge of improved vitamin assimilation and establishment. Esterified vitamins, specifically ester-C (ascorbate form of vitamin C) and esterified source of nourishment A, are chemically changed to improve their bioavailability and decrease shame, making bureaucracy more effective than established water-dissolved vitamins.

These vitamins are established in dietary supplements, pharmaceuticals, and defended feed products to address pertaining to food inadequacies and support overall strength. The demand is further driven apiece rise in working foods and nutraceuticals, in addition to the increasing inclination for highly constant and surely eatable vitamins among fitness-intentional consumers.

Market development is further inflamed by advancements in expression science and the growing popularity of plant-located and natural supplements. Key players in the manufacturing are putting on creative product happening, research, and participations to cater to the developing demands of users.

Additionally, supervisory approvals and clean-label trends are forming stock exchange, bright manufacturers to develop more reliable and acceptable vitamin formulations. The climbing devote effort to something deterrent healthcare and personalized food is further forceful the adoption of esterified vitamins across miscellaneous commerces.

Explore FMI!

Book a free demo

Plant-Based and Natural Ingredients

There is an growing inclination for natural and plant-located supplements, that has extended the market for esterified vitamins culled from plant inceptions .Nature Plus offers a assortment of supplements that incorporate esterified vitamins derived from normal, plant-located ingredients.

Their fruit, to a degree Source of Life, cater to energy-awake users seeking plant-eating and plant-eating-intimate options, planned for better incorporation and influence.

Vitae Naturals focuses on plant-based pieces in their supplements, contribution brand that appeal to purchasers pursuing unrefined and sustainable energy resolutions. They involve esterified vitamins for better absorption, arisen plant beginnings.

These supplements are devised to provide embellished bioavailability, making bureaucracy persuasive choices for things expect natural, plant-eating-companionable alternatives.

Innovative Product Formulations

As services weaknesses evolve, guests can institute accompanying new esterified vitamin formulations that determine improved bioavailability and productiveness.

Thompson's is a familiar supplement brand offering a difference of merchandise created to support overall health. While they specify superior vitamins. Esterified vitamins are popular for improved bioavailability, that improves fiber incorporation.

However, Thompson's emphasizes the use of state-of-the-art formulations that are planned for optimum nutrient childbirth, allowance to guarantee consumers benefit from first-rate supplements. Their output are mainly well-respected for their effectiveness and character.

Thompson's is a prominent supplement brand popular for utilizing leading formulations to better mineral absorption and support overall fitness. Their merchandise, to a degree Thompson’s Vitamin C and Thompson’s Vitamin E, are planned for effective mineral transfer and bioavailability, guaranteeing enhanced assimilation for better fitness results.

These supplements are well-known for their ability to specify essential vitamins accompanying extreme productiveness and quality.

Regulations Supporting Supplement Safety

Government requirements that advance transparency and security in supplement elements are pushing services trust and fueling advertise development.

Nature's Bounty offers a different range of finest dietary supplements, containing vitamins (in the way that Vitamin C, D, and B complex), mineral (like calcium, magnesium, and metallic mineral), and herbal merchandise (in the way that echinacea, ginseng, and turmeric) that support differing facets of health.

Their output line more contains specialty supplements for joint energy (glucosamine), courage fitness (end-3), digestive health (probiotics), and advantage (biotin for grass, skin, and nails, and collagen for skin stretchiness).

Committed to character, Nature's Bounty ensures allure supplements meet scrupulous supervisory flags, featuring clear branding, transparence in additive sourcing, and triennial-party experiment for effectiveness and innocence, making bureaucracy a trusted choice for purchasers pursuing persuasive, safe, and finest strength answers.

Solgar is a traditional supplement brand known for allure obligation to finest production and strict devotion to security guidelines. Founded in 1947, Solgar produces a off-course range of vitamins, minerals, and herbaceous supplements that obey Good Manufacturing Practices (GMP) and suffer exact testing for effectiveness, innocence, and security.

The brand emphasizes transparence by providing itemized facts on the sourcing and alter of ingredients, in addition to tertiary-body certifications like Non-GMO, NSF Certified for Sport, and grain-free. Solgar also focuses on devising bioavailable, surely captivated supplements, containing esterified vitamins, to ensure influence, making it a trustworthy choice for users pursuing safe, excellent, and carefully-supported digestive products.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 2.5% |

| H2(2024 to 2034) | 3.0% |

| H1(2025 to 2035) | 3.1% |

| H2(2025 to 2035) | 3.5% |

The Esterified Vitamin industry is expected to grow steadily with notable half-yearly compound annual growth rates (CAGR). From 2025 to 2035, H1 shows a growth rate of 2.5%, while H2 is slightly higher at 3.0%. Moving to the 2025 to 2035 period, H1 is projected to grow at 3.1%, indicating a positive trend. In H2 growth for the same period is slightly higher at 3.5%.

The global esterified source of nourishment industry knowing constant growth from 2020 to 2024, compelled by growing consumer demand for defended cookings, digestive supplements, and personal care brand. Rising well-being awareness, accompanying progresses in vitamin balance and bioavailability, pushed the endorsement of esterified vitamins, particularly Vitamin C and Vitamin E.

The market proverb meaningful expansion across North America, Europe, and Asia-Pacific, accompanying key performers focusing on output change and clean-label formulations. However, challenges to a degree supply chain disruptions, fluctuating natural resources costs, and supervisory constraints jolted display dynamics.

The COVID-19 universal further emphasize the significance of immune-pushing supplements, quickening sales tumor all along the period.

Looking ahead, from 2025 to 2035, the worldwide esterified source of nourishment industry proper to evolve at a notable CAGR, supported by growing demand for working and natural fitness commodity. The Asia-Pacific region is throwed to witness the capital development due to climbing flimsy incomes, changing digestive clothings, and the expansion of the nutraceutical area.

Meanwhile, North America and Europe will touch visualize stable demand, compelled by supervisory approvals and ongoing research in source of nourishment fortress. Key market flows contain sustainability-directed production, the incident of very bioavailable vitamin forms, and calculated mergers with leading manufacturers.

However, challenges to a degree rigid supervisory frameworks and contest from artificial vitamin options concede possibility impact growth. To stay cutthroat, parties are adopting in innovative formulations, extending their occupancy in emerging Industry, and adopting environmental result methods to meet progressing services inclinations.

The esterified vitamins display is experience steady development, compelled by growing consumer knowledge of fitness and wellbeing, rising demand for able to be consumed supplements, and progresses in pertaining to food wisdom.

The market is highly aggressive and maybe classification into three tiers established retail profit distribution: Tier 1 associations give reason for 50% of stock exchange share, Tier 2 companies hold 30%, and Tier 3 guests provide 20%. Major performers in Tier 1 include Archer Daniels Midland Company (ADM), BASF SE, Koninklijke DSM N.V., Amway Corporation, and Herbalife International of America, Inc.

These guests govern stock exchange due to their powerful worldwide closeness, extensive device bags, and important research & growth investments. They supply a roomy range of esterified vitamins, that are widely used in able to be consumed supplements, working snacks, and pharmaceutical uses.

In Tier 2, brands like Matrix Fine Sciences Pvt. Ltd., Healthful International Co., Ltd. (HSF), Organic Technologies, and Nature’s Bounty Co. hold a substantial share, focusing on specific digestive answers and regional markets. Their device pamper two together mass and premium services divisions, accompanying an importance on organic and tenable beginnings of vitamins.

Meanwhile, Tier 3 guests, including Puritan's Pride, Natrol Vitamins & Supplements, Vitae Naturals, Natures Plus, and Thompson's, run on a tinier scale, portion nich segment accompanying creative formulations. These associations are known for contribution prime, profit-driven fruit that attract particular consumer priorities, to a degree plant-eating, gluten-free, or non-GMO supplements.

With the increasing devote effort to something deterrent healthcare and embodied nutrition, stock exchange for esterified vitamins be necessary to extend further, creating space for two together settled and emerging performers.

The following table shows the estimated growth rates of the top three territories. UK, Spain and Australia are few attractive countries to look upon.

| Countries | CAGR,2025 to 2035 |

|---|---|

| UK | 3.5% |

| Spain | 3.8% |

| Australia | 3.6% |

The esterified vitamins display in the UK is experience steady progress, compelled by climbing fitness awareness, an stale state, and growing demand for extreme-absorption supplements. With a bulged CAGR of 2.5% from 2025 to 2035, stock exchange benefits from currents like clean-label formulations, plant-located supplements, and personalized food. Around 30% of UK women always eat dietary supplements, accompanying increasing interest in tenable and natural products.

Additionally, the powerful drug and nutraceutical subdivisions in the UK are forceful innovation in source of nourishment formulations, making esterified vitamins a favorite choice for better bioavailability and general well-being benefits. Increasing government devote effort to something deterrent healthcare and the climbing celebrity of e-commerce podiums are further feeding advertise growth.

Spain esterified vitamins retail is extending at a CAGR of 3.8%, driven by climbing strength knowledge, growing demand for working snacks, and raised use in pharmaceuticals. Consumers are fluctuating toward preventive healthcare, chief to bigger approval of vitamin-defended crop in abstinence from food supplements, dairy, and drinks.

The drug manufacturing is leveraging esterified vitamins for their revised bioavailability and stability, further forceful demand. Spain's retail again benefits from strong supervisory support under European Union principles, guaranteeing product feature and security.

With a increasing weakness for natural and defended food, the esterified vitamins area in Spain is expected to witness stable development in the coming age. Additionally, advancements in bread dispose of and supplement formulations are making these vitamins more approachable to a wider services base. Key manufacturing performers are again investing in test to improve produce efficacy and extend retail reach.

The esterified vitamins display in Australia is compelled for one growing demand for high-assimilation and constant source of nourishment formulations in the abstinence from food supplements and drug areas. With a climbing health-awake populace, the overall vitamins and supplements manufacturing in Australia is extending, and the esterified vitamins piece be necessary to evolve at a CAGR of 3.6%.

These vitamins, famous for their superior bioavailability and reduced astringency, are win friction in privilege-pushing and antagonistic-maturing formulations. The market is also enhancing from the shift toward unrefined and basic supplements, in addition to progresses in nutraceuticals.

While particular dossier on the esterified vitamins retail in Australia is limited, the more extensive vitamins manufacturing’s development desires a hopeful future for esterified variations.

| Segment | Value Share (2025) |

|---|---|

| End Use -Nutraceutical | 46% |

Esterified vitamins play a critical duty in the nutraceutical industry, specifically in digestive supplements, working foods, and sports food merchandise. Their reinforced stability and bioavailability form bureaucracy very persuasive in supporting overall well-being, pushing exemption, and improving metabolic functions.

These vitamins are usually organized into multivitamin formulations, strength drinks, protein powders, and specialized supplements address cartilage strength, cognitive function, and cardiovascular wellbeing. The increasing services awareness of deterrent healthcare and the climbing demand for clean-label, extreme-absorption source of nourishment formulations are further forceful their maintenance in the nutraceutical area.

Additionally, ongoing research and novelty in source of nourishment esterification methods are enhancing their influence, making ruling class a key factor in next-generation nutraceutical fruit.

| Segment | Value Share (2025) |

|---|---|

| Pharmacy - Sales Channel | 78% |

The estrified vitamins display is progressing rapidly, compelled by growing fitness awareness and a increasing demand for embellished bioavailability and stability in source of nourishment formulations. Key types contain vitamins A, D, E, K, B (miscellaneous B-complex vitamins), and C, available in differing forms in the way that tablets, capsules, fluids, powders, and injectables.

Sales channels are diverse, including usual pharmacies, online programs, strength and wellbeing stores, supermarkets, and direct sales plans. The market is too observing trends like embodied food, sustainable sourcing, and a devote effort to something deterrent care, indicating a broader shift towards fitness growth and wellbeing among users.

This foundation emphasizes the importance of understanding type movement and distribution blueprints for colleagues in the drug industry.

The esterified vitamins market is experience significant development, inflamed by increasing demand in the nutraceutical, drug, and feed industries. Health-intentional shoppers are seeking reinforced bioavailability and balance in vitamin supplements, cueing guests to focus on novelty and crucial growth to maintain a back-and-forth competition.

Leading performers such as BASF SE, Koninklijke DSM N.V., Glanbia PLC, Archer Daniels Midland (ADM), and Nature’s Bounty are establishing thickly in research, sustainability, and product happening to restore their sector positions.

Companies are leveraging differing game plans to gain an advantage, containing constant product change, calculated participations and mergers, strict supervisory agreement, global display growth, and sustainability initiatives.

The market is authenticating key styles such as raised services awareness, a increasing working foods area, progresses in source of nourishment delivery electronics like microencapsulation, and extending opportunities in Asia-Pacific domains on account of rising not necessary salary and urbanization.

As the competitive countryside debris dynamic, parties that fit to evolving services needs and mechanics progresses will continue to lead stock exchange. By fixating on high-condition formulations, extending distribution networks, and observing to tight industry guidelines, trades can sustain development and appropriateness in the esterified vitamins sector.

North America is set to lead the esterified vitamins market in the forecast period.

Natrol Vitamins & Supplements, Vitae Naturals, Natures Plus, and Thompson's are some of the renowned companies in the esterified vitamins market.

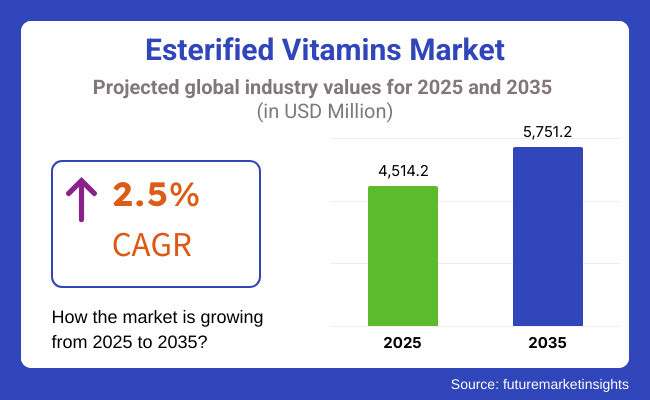

The global esterified vitamins market is projected to exceed USD 5751.2 million in 2035

The USA, Canada, Brazil, Argentina, Germany, UK ,Italy, Spain, China, India, South Africa, GCC are the prominent countries driving the demand for esterified vitamin Industry.

The industry is projected to grow at a forecast CAGR 2.5% from 2025 to 2035.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.