The epidural guidance systems market is projected to be worth USD 1.51 billion in 2025. The industry is likely to surpass USD 5.37 billion by 2035 at a CAGR of 13.7% during the projection period.

In 2024, the epidural guidance systems market also grew significantly to an estimated valuation of around USD 1.2 billion. The growth was facilitated by various factors such as rising chronic pain conditions, expansion in the geriatric population, and improvements in healthcare infrastructure. Technical advancements, such as the integration of computer-assisted navigation with real-time imaging modalities like ultrasound and fluoroscopy, improved the accuracy and safety of epidural procedures.

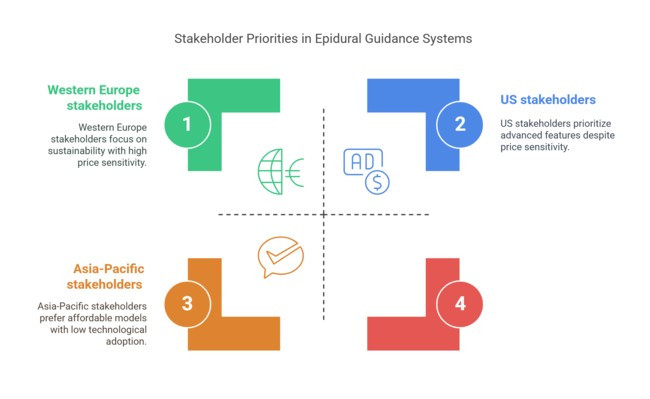

At the regional level, North America continued to be at the forefront, supported by highly developed health systems and a high rate of uptake of medical technology. The United States, specifically, experienced an explosion in the use of ultrasound guidance for epidurals, enhancing precision and patient safety.

The United Kingdom in Europe saw major growth as a result of the increasing application of Point-of-Care Ultrasound (POCUS) for epidural procedures. In contrast, the Asia-Pacific nations, including China and Japan, saw higher adoption levels of AI-based technologies and precise imaging within epidural guidance systems.

Looking towards 2025 and beyond, the epidural guidance systems industry is expected to see further growth. Some major drivers in the market are various technologies continued development, expanding numbers of procedures performed, and greater emphasis on patient safety and outcomes. The convergence of robotics and AI will add further to procedural precision and efficiency. Nevertheless, technical issues like stringent regulatory needs could be a constraint to industry growth.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.51 billion |

| Industry Value (2035F) | USD 5.37 billion |

| CAGR (2025 to 2035) | 13.7% |

The epidural guidance systems industry is in a solid growth pattern, fueled by increased demand for accuracy in pain management procedures and technologies like AI-based imaging. Medical providers and medtech firms that provide sophisticated, easy-to-use systems will reap the most benefit, while old device makers and countries with less adoption will be at risk of losing industry share. The industry's momentum is likely to be sustained through 2025 and beyond as patient safety and procedural efficiency become priority concerns.

Speed Up AI-Based Product Development

Make investments in combining AI and real-time imaging technologies in epidural guidance systems to improve procedural accuracy and safety. Invest most in R&D in smart navigation and feedback devices to stand out in a more competitive industry.

Align with Evolving Clinical Protocols and Training Requirements

Partner with healthcare facilities to create training modules and certification programs that reflect new clinical usage of ultrasound and computer-guided procedures. Clinician adoption will fuel industry use and institutional acceptance.

Grow Through Strategic Alliances and M&A

Form distribution alliances in high-growth industries such as Asia-Pacific and make strategic acquisitions of niche imaging technology or robotics firms to extend industry capabilities. Developing an entire solution set will enhance the industry position and global penetration.

| Risk | Probability - Impact |

|---|---|

| Regulatory Changes | High - Significant: Ongoing updates to medical device regulations (e.g., EU MDR, US FDA) could delay product launches or incur high compliance costs. |

| Technological Obsolescence | Medium - High: Rapid technological advancements in imaging and AI could make existing systems obsolete, requiring constant innovation. |

| Supply Chain Disruptions | High - Medium: Material shortages or logistical issues, such as semiconductor shortages, may impact production timelines and costs. |

| Priority | Immediate Action |

|---|---|

| Regulatory Compliance Monitoring | Ensure alignment with evolving regulatory standards (e.g., EU MDR, US FDA) to avoid delays and fines. |

| Technology Upgrades and Innovation | Initiate R&D on AI and machine learning integration for more efficient epidural guidance systems. |

| Supply Chain Diversification | Diversify supplier base for critical components to mitigate risk of delays due to global supply chain disruptions. |

To keep ahead in the developing epidural guidance systems industry, the business has to take regulatory compliance seriously by getting ahead of upcoming standards, especially within the EU and the US. Along with a focus on adopting superior technologies such as AI and automation strategically, this will help keep the business ahead of technology obsolescence.

Secondly, there is a need to diversify the supply chain as well as engage in strong partnerships when it comes to sourcing components. This will assist in reducing the risks of material shortages and production delays. These actions will not only cement the firm's place but also ensure continued growth through innovation, regulatory compliance, and operational resilience. In the future, all these aspects should be at the center of the company's 12-month roadmap.

Global Trends:

Regional Variance:

Global Consensus:

Regional Preferences:

Conclusion:

| Countries | Regulatory Impact and Mandatory Certifications |

|---|---|

| United States | The Food and Drug Administration (FDA) regulates epidural guidance systems as medical devices. Manufacturers must obtain FDA approval through the 510(k) industry notification process, demonstrating that the device is safe and effective. Compliance with Quality System Regulation (QSR) standards is also mandatory. |

| India | The Central Drugs Standard Control Organization (CDSCO) oversees medical devices. Epidural guidance systems are classified as Class C devices, requiring an MD-9 manufacturing license. Manufacturers must adhere to the Medical Device Rules, 2017, and ensure compliance with ISO 13485 standards. Importers need an MD-15 import license. |

| European Union | Medical devices are regulated under the EU Medical Device Regulation (MDR). Epidural guidance systems must obtain CE marking by demonstrating compliance with MDR requirements, including clinical evaluations and adherence to ISO 13485 for quality management systems. Notified Bodies assess conformity before industry entry. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) regulates medical devices. Compliance with the ISO 80369-6 standard for neuraxial applications is mandatory to prevent misconnections. Manufacturers must obtain PMDA approval and ensure adherence to Japan's Pharmaceutical and Medical Device Act (PMD Act). |

| Brazil | The National Health Surveillance Agency (ANVISA) is responsible for medical device regulation. Manufacturers must obtain ANVISA approval, demonstrating compliance with Brazilian Good Manufacturing Practices (BGMP). In June 2024, Milestone Scientific received ANVISA approval to industry its CompuFlo ® Epidural System in Brazil. |

| China | The National Medical Products Administration (NMPA) regulates medical devices. Epidural guidance systems require Class II or III registration, depending on risk classification. Manufacturers must provide clinical data and comply with China’s Good Manufacturing Practices (GMP). |

| Australia | The Therapeutic Goods Administration (TGA) oversees medical devices. Devices must be included in the Australian Register of Therapeutic Goods (ARTG). Compliance with the Essential Principles and demonstration of conformity assessment, often through CE marking or FDA approval, is required. |

| Canada | Health Canada regulates medical devices under the Medical Devices Regulations. Epidural guidance systems are classified as Class II or III devices, necessitating a Medical Device License (MDL). Manufacturers must comply with ISO 13485 and obtain a Medical Device Single Audit Program (MDSAP) certificate. |

| United Kingdom | Post-Brexit, the Medicines and Healthcare Products Regulatory Agency (MHRA) governs medical devices. Devices require UK Conformity Assessed (UKCA) marking. CE marking is recognized until June 2023, after which UKCA marking becomes mandatory. Compliance with UK MDR 2002 regulations is required. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) regulates medical devices. Epidural guidance systems require Class III approval. Manufacturers must submit technical documents, including clinical data, and comply with Korea Good Manufacturing Practice (KGMP) standards. |

Between 2025 and 2035, Image Guidance will be the most profitable technology segment in the epidural guidance systems industry. Growth is being fueled by the greater use of sophisticated imaging methods like fluoroscopy and ultrasound, especially for high-accuracy uses such as spine surgeries, pain relief, and delivery during labor. Image-guided systems offer better safety, lower complication rates, and quicker recovery times, which makes them the better option for both healthcare providers and patients.

Also, the growth of minimally invasive procedures and advancements in real-time imaging technology are adding to the demand. With increasing affordability and adoption, the Image Guidance technology segment is likely to expand with a CAGR of around 8.5% from 2025 to 2035, which would be higher compared to the rate of overall industry growth of 7.3%.

Between 2025 to 2035, the Portable modality segment will be the highest revenue earning, as an increased demand is seen for compact and point-of-care solutions. The portability of epidural guidance systems makes their application feasible in diverse environments, such as ambulatory surgical centers and outpatient clinics, enhancing accessibility and ease for patients. As the trend towards decentralized healthcare continues and cost-saving measures become necessary, portable systems are highly beneficial.

Their application in low-resource settings and their transportation ease in emergency or rural care settings add to the rising interest. With these benefits, the Portable modality segment will grow at a rate of 9.0% CAGR during 2025 to 2035, much greater than the overall industry growth rate.

During 2025 to 2035, Pain Management is likely to be the most profitable application segment. The rising incidence of chronic pain disorders and the worldwide push towards non-opioid pain relief are fueling the use of epidural guidance systems in pain management. Technologies capable of delivering medications with pain-relieving effects more precisely with few side effects are catching a strong tide.

In addition, because medical systems attempt better solutions in handling pain under acute and chronic circumstances, epidural guidance systems promise to solve these problems more efficiently. Demand for minimally invasive pain treatments will propel the growth of this segment, recording an estimated 8.7% CAGR from 2025 to 2035 compared to the growth rate of the total industry.

The Lumbar will remain the highest-value spinal region during 2025 to 2035, primarily driven by the high utilization of epidural injections of the lumbar area and spine surgery. The increasing prevalence of lumbar degenerative diseases, including herniated discs and spinal stenosis, is driving the demand for lumbar epidural guidance systems.

Furthermore, the demand for accurate and safe delivery of treatment in lumbar spine procedures is also on the rise as minimally invasive procedures become more popular. This segment is set to grow by a CAGR of around 8.2% between the years 2025 and 2035 and hence is a prime focus area for investment and growth in the future.

Between the years 2025 and 2035, Hospitals are expected to be the most profitable end-user segment. Hospitals are the main venues where intricate surgeries like spine, thoracic, and orthopedic surgeries are conducted, where epidural guidance systems play a key role.

The increasing number of procedures performed in surgery, as well as the growing emphasis on enhancing patient outcomes, will encourage the use of these systems within hospitals. Also, hospitals will be more likely to embrace newer technologies because of their capacity for higher volumes of procedures and for investing in advanced equipment.

This segment is likely to expand at a CAGR of 8.1% during 2025 to 2035, holding sway in the overall industry.

The United States is the major player in the epidural guidance systems industry, spurred by a large healthcare infrastructure base, high penetration of advanced technologies, and growing demand for minimally invasive treatments.

The increase in chronic pain conditions, as well as developments in imaging modalities and spinal surgeries, will continue to drive the industry forward. A transition to outpatient procedures, including ambulatory surgical centers, will also fuel adoption. Moreover, the increasing demand for user-friendly and portable systems is redefining the industry landscape. The regulatory support and reimbursement policies for innovative medical devices in the U.S. are also driving industry growth.

FMI projects that USA epidural guidance systems sales are likely to rise at a CAGR of 8.5% during the projection period between 2025 and 2035

India's healthcare industry is developing very fast, with rising healthcare access, increasing medical infrastructure, and growing awareness of advanced medical technology. The increasing prevalence of chronic pain disorders and spinal diseases has increased the demand for epidural guidance systems in surgery and pain management.

Furthermore, the growing use of minimally invasive surgeries and increased investment in healthcare infrastructure are likely to fuel growth. Yet, price sensitivity is a challenge the industry faces, with emphasis on cost-saving and low-cost options. As the appeal for portable systems and innovative imaging technology continues to grow, India is likely to emerge as an important industry for epidural guidance systems.

FMI projects that India epidural guidance systems sales are likely to rise at a CAGR of 8.1% during the projection period between 2025 and 2035

With China's growing old age population, high chronic disease incidence, and greater investment in the health sector, China's healthcare industry is rapidly increasing. Pain management, orthopedic, and spinal surgeries will always be in substantial demand in this industry, meaning epidural guidance systems have vast opportunities to expand.

Government efforts and growing private healthcare are encouraging people to adapt more to new technologies. China's healthcare infrastructure is emphasizing modernization and increasing access to advanced medical technology, particularly in tier-2 and tier-3 cities.

FMI projects that China epidural guidance systems sales are likely to rise at a CAGR of 8.3% during the projection period between 2025 and 2035

The UK is experiencing consistent growth in the epidural guidance systems industry, driven by an aging population, increased demand for minimally invasive techniques, and technology innovation in imaging. The National Health Service (NHS) has been working to enhance patient outcomes, promoting greater use of new technologies like ultrasound and fluoroscopy. Additionally, the demand for outpatient procedures and less invasive surgery is further stimulating the expansion of epidural guidance systems.

FMI projects that UK epidural guidance systems sales are likely to rise at a CAGR of 7.8% during the projection period between 2025 and 2035

Germany's healthcare infrastructure is renowned for its cutting-edge medical technologies, and the use of epidural guidance systems is expanding, especially in pain treatment, thoracic, and spinal surgery. Its aging population and increased incidence of chronic diseases are driving the demand for minimally invasive and accurate medical interventions.

The nation's well-established healthcare system, combined with effective reimbursement policies for sophisticated medical devices, is propelling the use of epidural guidance systems. Germany also takes the lead in the use of automation and image-guided systems in surgery.

FMI projects that Germany’s epidural guidance systems sales are likely to rise at a CAGR of 8.2% during the projection period between 2025 and 2035

South Korea is embracing advanced medical technologies at a very fast rate, with the epidural guidance systems industry reaping the rewards of imaging innovations and rising demand for minimally invasive surgical procedures. The healthcare sector is investing heavily in updating infrastructure and delivering high-quality care, which is driving the need for accurate and dependable medical devices.

Since they aim at outpatient care, particularly in ambulatory surgery centers, portable systems are in high demand. Regulatory support and robust economic growth are also anticipated to fuel adoption even further.

FMI projects that South Korea epidural guidance systems sales are likely to rise at a CAGR of 8.0% during the projection period between 2025 and 2035

Japan's aging population and a high prevalence of chronic pain and spinal disorders are major drivers of the epidural guidance systems industry. Increasing demand for sophisticated, non-invasive, and accurate solutions for pain management and spinal surgery is on the rise.

Though Japan traditionally lags behind in adopting new technologies, the demand for minimally invasive and portable equipment is picking up with evolving healthcare requirements and increasing outpatient care focus. Government initiatives aimed at modernizing healthcare in Japan are also driving industry expansion.

FMI projects that Japan epidural guidance systems sales are likely to rise at a CAGR of 7.6% during the projection period between 2025 and 2035

France's healthcare system is established, and its medical device industry is also experiencing robust demand for epidural guidance systems, especially in orthopedic surgeries and pain management. As the number of surgeries increases and minimally invasive methods gain more emphasis, the industry for epidural guidance is predicted to grow even further. France's strong public healthcare system will facilitate the implementation of advanced technologies, and the quest for improved patient outcomes will keep fueling the demand for these systems.

FMI projects that France's epidural guidance systems sales are likely to rise at a CAGR of 7.9% during the projection period between 2025 and 2035

Italy's medical sector is being transformed by moving towards more advanced medical technologies with increased emphasis on patient-centric treatments and minimally invasive techniques. The increasing need for epidural guidance systems for the treatment of chronic pain conditions and spinal pathologies is promoting demand. Cost control challenges for Italy's health sector also exist, but implementation of advanced portable medical devices will increase, especially in outpatient environments.

FMI projects that Italy's epidural guidance systems sales are likely to rise at a CAGR of 7.5% during the projection period between 2025 and 2035

The medical devices and advanced technologies in Australia and New Zealand are developing very fast, with more investments in medical devices and advanced technologies. The epidural guidance systems are in high demand due to the high incidence of spinal conditions, pain management requirements, and the popularity of minimally invasive surgeries. The healthcare infrastructure in Australia is especially strong, with good government support and funding for advanced medical devices. The demand for mobile and stable systems in outpatient clinics is increasing in both nations.

FMI projects that Australia-NZ epidural guidance systems sales are likely to rise at a CAGR of 8.4% during the projection period between 2025 and 2035

The epidural guidance systems industry is moderately consolidated with a dominant few players leveraging technological know-how and robust distribution networks. Competitors are specialized or low-price players. Leadership companies compete in terms of innovations in imaging precision, AI integrations, and robotic-assisted systems, together with strategic relationships with hospitals and research institutions. Pricing approaches differ, with high-end players emphasizing cutting-edge features and others aiming at cost-conscious industries. Growth strategies include expansion in emerging industries and acquisitions to bolster product portfolios.

Key Developments & News (2024)

Ultrasound-Based Systems, Optical Systems, Electromagnetic Systems, Pressure-Based Systems, Traditional Landmark Technique

Hospitals, Ambulatory Surgical Centers, Pain Management Clinics, Academic and Research Institutes

Labor Pain Management, Chronic Pain Management, Surgical Procedures, Diagnostic Procedures

Standalone Systems, Portable/Handheld Systems, Integrated Operating Room Systems

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

The increasing demand for minimally invasive surgeries and advanced imaging technologies is driving industry growth.

Ultrasound is the most widely used technology due to its non-invasive nature and real-time imaging capabilities.

Key applications include pain management, spine surgery, and orthopedic surgeries.

The USA, China, and India are expected to experience significant growth due to improving healthcare infrastructure and increasing patient demand.

High costs of advanced systems and regulatory hurdles are significant challenges in industry expansion.

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Region

Table 02A: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 02B: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 06: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 07: North America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 08: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 09: North America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 11: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 12: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 13: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 14: Latin America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 16: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 17: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 18: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 19: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 20: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 21: Europe Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 22: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 23: Europe Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 24: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 25: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 26: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 27: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 28: South Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 29: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 30: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 31: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 32: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 33: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 34: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 35: East Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 36: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 37: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 38: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 39: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 40: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 41: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 42: Oceania Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 43: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 44: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 45: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 46: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 47: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 48: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Table 49: Middle East & Africa Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 50: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Technology

Table 51: Middle East & Africa Market Volume (Units) Analysis and Forecast 2012 to 2033, by Technology

Table 52: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Modality

Table 53: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Application

Table 54: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Spinal Region

Table 55: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by End User

Figure 01: Global Market Volume (Units), 2012 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Pricing Analysis per unit (US$), in 2022

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2012 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2032

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Technology

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Technology

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Technology

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, by Modality

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Modality

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, by Modality

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, by Application

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Application

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, by Application

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Spinal Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Spinal Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Spinal Region

Figure 20: Global Market Value Share (%) Analysis 2023 and 2033, by End User

Figure 21: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by End User

Figure 22: Global Market Attractiveness Analysis 2023 to 2033, by End User

Figure 23: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 24: Global Market Y-o-Y Growth (%) Analysis 2022 to 2033, by Region

Figure 25: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 26: North America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 27: North America Market Value (US$ Million) Forecast, 2022-2032

Figure 28: North America Market Value Share, by Technology (2023 E)

Figure 29: North America Market Value Share, by Modality (2023 E)

Figure 30: North America Market Value Share, by Application (2023 E)

Figure 31: North America Market Value Share, by Spinal Region (2023 E)

Figure 32: North America Market Value Share, by End User (2023 E)

Figure 33: North America Market Value Share, by Country (2023 E)

Figure 34: North America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 35: North America Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 36: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 38: North America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 39: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 40: USA Market Value Proportion Analysis, 2022

Figure 41: Global Vs. USA Growth Comparison

Figure 42: USA Market Share Analysis (%) by Technology, 2023 & 2033

Figure 43: USA Market Share Analysis (%) by Modality, 2023 & 2033

Figure 44: USA Market Share Analysis (%) by Application, 2023 & 2033

Figure 45: USA Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 46: USA Market Share Analysis (%) by End User, 2023 & 2033

Figure 47: Canada Market Value Proportion Analysis, 2022

Figure 48: Global Vs. Canada. Growth Comparison

Figure 49: Canada Market Share Analysis (%) by Technology, 2023 & 2033

Figure 50: Canada Market Share Analysis (%) by Modality, 2023 & 2033

Figure 51: Canada Market Share Analysis (%) by Application, 2023 & 2033

Figure 52: Canada Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 53: Canada Market Share Analysis (%) by End User, 2023 & 2033

Figure 54: Latin America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 55: Latin America Market Value (US$ Million) Forecast, 2022-2032

Figure 56: Latin America Market Value Share, by Technology (2023 E)

Figure 57: Latin America Market Value Share, by Modality (2023 E)

Figure 58: Latin America Market Value Share, by Application (2023 E)

Figure 59: Latin America Market Value Share, by Spinal Region (2023 E)

Figure 60: Latin America Market Value Share, by End User (2023 E)

Figure 61: Latin America Market Value Share, by Country (2023 E)

Figure 62: Latin America Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 63: Latin America Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 64: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 65: Latin America Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 66: Latin America Market Attractiveness Analysis by End User, 2023 to 2033

Figure 67: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 68: Mexico Market Value Proportion Analysis, 2022

Figure 69: Global Vs Mexico Growth Comparison

Figure 70: Mexico Market Share Analysis (%) by Technology, 2023 & 2033

Figure 71: Mexico Market Share Analysis (%) by Modality, 2023 & 2033

Figure 72: Mexico Market Share Analysis (%) by Application, 2023 & 2033

Figure 73: Mexico Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 74: Mexico Market Share Analysis (%) by End User, 2023 & 2033

Figure 75: Brazil Market Value Proportion Analysis, 2022

Figure 76: Global Vs. Brazil. Growth Comparison

Figure 77: Brazil Market Share Analysis (%) by Technology, 2023 & 2033

Figure 78: Brazil Market Share Analysis (%) by Modality, 2023 & 2033

Figure 79: Brazil Market Share Analysis (%) by Application, 2023 & 2033

Figure 80: Brazil Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 81: Brazil Market Share Analysis (%) by End User, 2023 & 2033

Figure 82: Argentina Market Value Proportion Analysis, 2022

Figure 83: Global Vs Argentina Growth Comparison

Figure 84: Argentina Market Share Analysis (%) by Technology, 2023 & 2033

Figure 85: Argentina Market Share Analysis (%) by Modality, 2023 & 2033

Figure 86: Argentina Market Share Analysis (%) by Application, 2023 & 2033

Figure 87: Argentina Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 88: Argentina Market Share Analysis (%) by End User, 2023 & 2033

Figure 89: Europe Market Value (US$ Million) Analysis, 2012 to 2022

Figure 90: Europe Market Value (US$ Million) Forecast, 2022-2032

Figure 91: Europe Market Value Share, by Technology (2023 E)

Figure 92: Europe Market Value Share, by Modality (2023 E)

Figure 93: Europe Market Value Share, by Application (2023 E)

Figure 94: Europe Market Value Share, by Spinal Region (2023 E)

Figure 95: Europe Market Value Share, by End User (2023 E)

Figure 96: Europe Market Value Share, by Country (2023 E)

Figure 97: Europe Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 98: Europe Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 99: Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 100: Europe Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 101: Europe Market Attractiveness Analysis by End User, 2023 to 2033

Figure 102: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 103: UK Market Value Proportion Analysis, 2022

Figure 104: Global Vs. UK Growth Comparison

Figure 105: UK Market Share Analysis (%) by Technology, 2023 & 2033

Figure 106: UK Market Share Analysis (%) by Modality, 2023 & 2033

Figure 107: UK Market Share Analysis (%) by Application, 2023 & 2033

Figure 108: UK Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 109: UK Market Share Analysis (%) by End User, 2023 & 2033

Figure 110: Germany Market Value Proportion Analysis, 2022

Figure 111: Global Vs. Germany Growth Comparison

Figure 112: Germany Market Share Analysis (%) by Technology, 2023 & 2033

Figure 113: Germany Market Share Analysis (%) by Modality, 2023 & 2033

Figure 114: Germany Market Share Analysis (%) by Application, 2023 & 2033

Figure 115: Germany Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 116: Germany Market Share Analysis (%) by End User, 2023 & 2033

Figure 117: Italy Market Value Proportion Analysis, 2022

Figure 118: Global Vs. Italy Growth Comparison

Figure 119: Italy Market Share Analysis (%) by Technology, 2023 & 2033

Figure 120: Italy Market Share Analysis (%) by Modality, 2023 & 2033

Figure 121: Italy Market Share Analysis (%) by Application, 2023 & 2033

Figure 122: Italy Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 123: Italy Market Share Analysis (%) by End User, 2023 & 2033

Figure 124: France Market Value Proportion Analysis, 2022

Figure 125: Global Vs France Growth Comparison

Figure 126: France Market Share Analysis (%) by Technology, 2023 & 2033

Figure 127: France Market Share Analysis (%) by Modality, 2023 & 2033

Figure 128: France Market Share Analysis (%) by Application, 2023 & 2033

Figure 129: France Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 130: France Market Share Analysis (%) by End User, 2023 & 2033

Figure 131: Spain Market Value Proportion Analysis, 2022

Figure 132: Global Vs Spain Growth Comparison

Figure 133: Spain Market Share Analysis (%) by Technology, 2023 & 2033

Figure 134: Spain Market Share Analysis (%) by Modality, 2023 & 2033

Figure 135: Spain Market Share Analysis (%) by Application, 2023 & 2033

Figure 136: Spain Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 137: Spain Market Share Analysis (%) by End User, 2023 & 2033

Figure 138: Russia Market Value Proportion Analysis, 2022

Figure 139: Global Vs Russia Growth Comparison

Figure 140: Russia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 141: Russia Market Share Analysis (%) by Modality, 2023 & 2033

Figure 142: Russia Market Share Analysis (%) by Application, 2023 & 2033

Figure 143: Russia Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 144: Russia Market Share Analysis (%) by End User, 2023 & 2033

Figure 145: BENELUX Market Value Proportion Analysis, 2022

Figure 146: Global Vs BENELUX Growth Comparison

Figure 147: BENELUX Market Share Analysis (%) by Technology, 2023 & 2033

Figure 148: BENELUX Market Share Analysis (%) by Modality, 2023 & 2033

Figure 149: BENELUX Market Share Analysis (%) by Application, 2023 & 2033

Figure 150: BENELUX Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 151: BENELUX Market Share Analysis (%) by End User, 2023 & 2033

Figure 152: East Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 153: East Asia Market Value (US$ Million) Forecast, 2022-2032

Figure 154: East Asia Market Value Share, by Technology (2023 E)

Figure 155: East Asia Market Value Share, by Modality (2023 E)

Figure 156: East Asia Market Value Share, by Application (2023 E)

Figure 157: East Asia Market Value Share, by Spinal Region (2023 E)

Figure 158: East Asia Market Value Share, by End User (2023 E)

Figure 159: East Asia Market Value Share, by Country (2023 E)

Figure 160: East Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 161: East Asia Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 162: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 163: East Asia Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 164: East Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 165: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 166: China Market Value Proportion Analysis, 2022

Figure 167: Global Vs. China Growth Comparison

Figure 168: China Market Share Analysis (%) by Technology, 2023 & 2033

Figure 169: China Market Share Analysis (%) by Modality, 2023 & 2033

Figure 170: China Market Share Analysis (%) by Application, 2023 & 2033

Figure 171: China Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 172: China Market Share Analysis (%) by End User, 2023 & 2033

Figure 173: Japan Market Value Proportion Analysis, 2022

Figure 174: Global Vs. Japan Growth Comparison

Figure 175: Japan Market Share Analysis (%) by Technology, 2023 & 2033

Figure 176: Japan Market Share Analysis (%) by Modality, 2023 & 2033

Figure 177: Japan Market Share Analysis (%) by Application, 2023 & 2033

Figure 178: Japan Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 179: Japan Market Share Analysis (%) by End User, 2023 & 2033

Figure 180: South Korea Market Value Proportion Analysis, 2022

Figure 181: Global Vs South Korea Growth Comparison

Figure 182: South Korea Market Share Analysis (%) by Technology, 2023 & 2033

Figure 183: South Korea Market Share Analysis (%) by Modality, 2023 & 2033

Figure 184: South Korea Market Share Analysis (%) by Application, 2023 & 2033

Figure 185: South Korea Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 186: South Korea Market Share Analysis (%) by End User, 2023 & 2033

Figure 187: South Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 188: South Asia Market Value (US$ Million) Forecast, 2022-2032

Figure 189: South Asia Market Value Share, by Technology (2023 E)

Figure 190: South Asia Market Value Share, by Modality (2023 E)

Figure 191: South Asia Market Value Share, by Application (2023 E)

Figure 192: South Asia Market Value Share, by Spinal Region (2023 E)

Figure 193: South Asia Market Value Share, by End User (2023 E)

Figure 194: South Asia Market Value Share, by Country (2023 E)

Figure 195: South Asia Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 196: South Asia Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 197: South Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 198: South Asia Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 199: South Asia Market Attractiveness Analysis by End User, 2023 to 2033

Figure 200: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 201: India Market Value Proportion Analysis, 2022

Figure 202: Global Vs. India Growth Comparison

Figure 203: India Market Share Analysis (%) by Technology, 2023 & 2033

Figure 204: India Market Share Analysis (%) by Modality, 2023 & 2033

Figure 205: India Market Share Analysis (%) by Application, 2023 & 2033

Figure 206: India Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 207: India Market Share Analysis (%) by End User, 2023 & 2033

Figure 208: Indonesia Market Value Proportion Analysis, 2022

Figure 209: Global Vs. Indonesia Growth Comparison

Figure 210: Indonesia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 211: Indonesia Market Share Analysis (%) by Modality, 2023 & 2033

Figure 212: Indonesia Market Share Analysis (%) by Application, 2023 & 2033

Figure 213: Indonesia Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 214: Indonesia Market Share Analysis (%) by End User, 2023 & 2033

Figure 215: Malaysia Market Value Proportion Analysis, 2022

Figure 216: Global Vs. Malaysia Growth Comparison

Figure 217: Malaysia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 218: Malaysia Market Share Analysis (%) by Modality, 2023 & 2033

Figure 219: Malaysia Market Share Analysis (%) by Application, 2023 & 2033

Figure 220: Malaysia Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 221: Malaysia Market Share Analysis (%) by End User, 2023 & 2033

Figure 222: Thailand Market Value Proportion Analysis, 2022

Figure 223: Global Vs. Thailand Growth Comparison

Figure 224: Thailand Market Share Analysis (%) by Technology, 2023 & 2033

Figure 225: Thailand Market Share Analysis (%) by Modality, 2023 & 2033

Figure 226: Thailand Market Share Analysis (%) by Application, 2023 & 2033

Figure 227: Thailand Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 228: Thailand Market Share Analysis (%) by End User, 2023 & 2033

Figure 229: Oceania Market Value (US$ Million) Analysis, 2012 to 2022

Figure 230: Oceania Market Value (US$ Million) Forecast, 2022-2032

Figure 231: Oceania Market Value Share, by Technology (2023 E)

Figure 232: Oceania Market Value Share, by Modality (2023 E)

Figure 233: Oceania Market Value Share, by Application (2023 E)

Figure 234: Oceania Market Value Share, by Spinal Region (2023 E)

Figure 235: Oceania Market Value Share, by End User (2023 E)

Figure 236: Oceania Market Value Share, by Country (2023 E)

Figure 237: Oceania Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 238: Oceania Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 239: Oceania Market Attractiveness Analysis by Application, 2023 to 2033

Figure 240: Oceania Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 241: Oceania Market Attractiveness Analysis by End User, 2023 to 2033

Figure 242: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 243: Australia Market Value Proportion Analysis, 2022

Figure 244: Global Vs. Australia Growth Comparison

Figure 245: Australia Market Share Analysis (%) by Technology, 2023 & 2033

Figure 246: Australia Market Share Analysis (%) by Modality, 2023 & 2033

Figure 247: Australia Market Share Analysis (%) by Application, 2023 & 2033

Figure 248: Australia Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 249: Australia Market Share Analysis (%) by End User, 2023 & 2033

Figure 250: New Zealand Market Value Proportion Analysis, 2022

Figure 251: Global Vs New Zealand Growth Comparison

Figure 252: New Zealand Market Share Analysis (%) by Technology, 2023 & 2033

Figure 253: New Zealand Market Share Analysis (%) by Modality, 2023 & 2033

Figure 254: New Zealand Market Share Analysis (%) by Application, 2023 & 2033

Figure 255: New Zealand Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 256: New Zealand Market Share Analysis (%) by End User, 2023 & 2033

Figure 257: Middle East & Africa Market Value (US$ Million) Analysis, 2012 to 2022

Figure 258: Middle East & Africa Market Value (US$ Million) Forecast, 2022-2032

Figure 259: Middle East & Africa Market Value Share, by Technology (2023 E)

Figure 260: Middle East & Africa Market Value Share, by Modality (2023 E)

Figure 261: Middle East & Africa Market Value Share, by Application (2023 E)

Figure 262: Middle East & Africa Market Value Share, by Spinal Region (2023 E)

Figure 263: Middle East & Africa Market Value Share, by End User (2023 E)

Figure 264: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 265: Middle East & Africa Market Attractiveness Analysis by Technology, 2023 to 2033

Figure 266: Middle East & Africa Market Attractiveness Analysis by Modality, 2023 to 2033

Figure 267: Middle East & Africa Market Attractiveness Analysis by Application, 2023 to 2033

Figure 268: Middle East & Africa Market Attractiveness Analysis by Spinal Region, 2023 to 2033

Figure 269: Middle East & Africa Market Attractiveness Analysis by End User, 2023 to 2033

Figure 270: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 271: GCC Countries Market Value Proportion Analysis, 2022

Figure 272: Global Vs GCC Countries Growth Comparison

Figure 273: GCC Countries Market Share Analysis (%) by Technology, 2023 & 2033

Figure 274: GCC Countries Market Share Analysis (%) by Modality, 2023 & 2033

Figure 275: GCC Countries Market Share Analysis (%) by Application, 2023 & 2033

Figure 276: GCC Countries Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 277: GCC Countries Market Share Analysis (%) by End User, 2023 & 2033

Figure 278: Türkiye Market Value Proportion Analysis, 2022

Figure 279: Global Vs. Türkiye Growth Comparison

Figure 280: Türkiye Market Share Analysis (%) by Technology, 2023 & 2033

Figure 281: Türkiye Market Share Analysis (%) by Modality, 2023 & 2033

Figure 282: Türkiye Market Share Analysis (%) by Application, 2023 & 2033

Figure 283: Türkiye Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 284: Türkiye Market Share Analysis (%) by End User, 2023 & 2033

Figure 285: South Africa Market Value Proportion Analysis, 2022

Figure 286: Global Vs. South Africa Growth Comparison

Figure 287: South Africa Market Share Analysis (%) by Technology, 2023 & 2033

Figure 288: South Africa Market Share Analysis (%) by Modality, 2023 & 2033

Figure 289: South Africa Market Share Analysis (%) by Application, 2023 & 2033

Figure 290: South Africa Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 291: South Africa Market Share Analysis (%) by End User, 2023 & 2033

Figure 292: Northern Africa Market Value Proportion Analysis, 2022

Figure 293: Global Vs Northern Africa Growth Comparison

Figure 294: Northern Africa Market Share Analysis (%) by Technology, 2023 & 2033

Figure 295: Northern Africa Market Share Analysis (%) by Modality, 2023 & 2033

Figure 296: Northern Africa Market Share Analysis (%) by Application, 2023 & 2033

Figure 297: Northern Africa Market Share Analysis (%) by Spinal Region, 2023 & 2033

Figure 298: Northern Africa Market Share Analysis (%) by End User, 2023 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biopsy Guidance System Market Size and Share Forecast Outlook 2025 to 2035

Autonomous Ultrasound Guidance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Systems Administration Management Tools Market Size and Share Forecast Outlook 2025 to 2035

VRF Systems Market Growth - Trends & Forecast 2025 to 2035

Cloud Systems Management Software Market Size and Share Forecast Outlook 2025 to 2035

Hi-Fi Systems Market Size and Share Forecast Outlook 2025 to 2035

Cough systems Market

Backpack Systems Market Size and Share Forecast Outlook 2025 to 2035

Unmanned Systems Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Catheter Systems Market

Reporter Systems Market

Aerostat Systems Market

Cryogenic Systems Market Size and Share Forecast Outlook 2025 to 2035

Air Brake Systems Market Growth & Demand 2025 to 2035

Metrology Systems Market

Fluid Bed Systems Market

Cognitive Systems Spending Market Report – Growth & Forecast 2016-2026

Nurse Call Systems Market Insights - Size, Share & Forecast 2025 to 2035

Excitation Systems Market Analysis – Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA