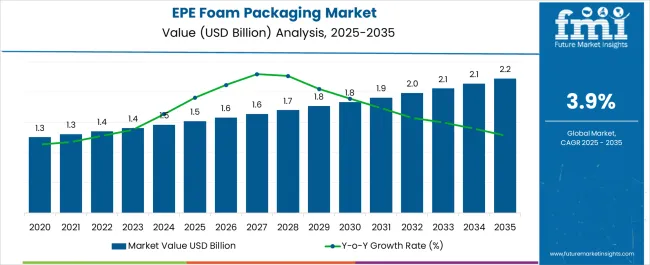

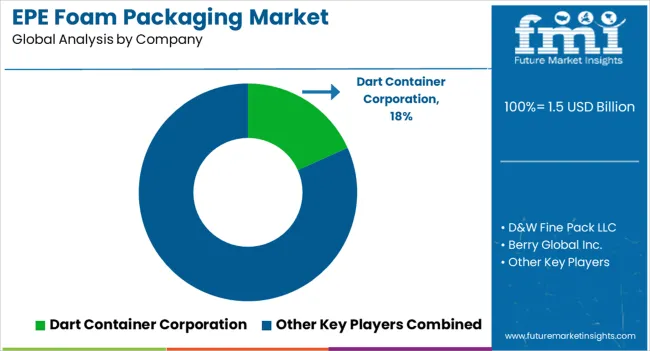

The EPE Foam Packaging Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| EPE Foam Packaging Market Estimated Value in (2025 E) | USD 1.5 billion |

| EPE Foam Packaging Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 3.9% |

The EPE foam packaging market is experiencing strong demand driven by its lightweight properties, cushioning performance, and versatility across a wide range of applications. The rising need for protective packaging solutions in electronics, consumer goods, and industrial supply chains has accelerated adoption.

Increased e commerce activities and global trade have further boosted demand for reliable protective materials that ensure product safety during long distance shipping. Advances in manufacturing techniques and recyclability initiatives are strengthening the market outlook, aligning with sustainability goals while maintaining performance standards.

Regulatory emphasis on eco friendly alternatives and the growing preference for reusable and recyclable protective materials are also influencing growth. With continued innovation in product design and integration into diverse industries, the market is positioned for sustained expansion as both manufacturers and end users seek cost effective, durable, and sustainable packaging options.

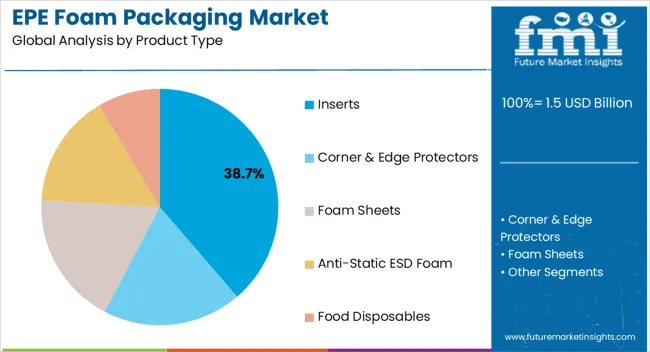

The inserts segment is expected to hold 38.70% of total market revenue by 2025 within the product type category, making it the dominant segment. Its growth is being driven by the ability to provide superior cushioning, shock absorption, and customized protection for fragile and high value products.

Inserts are widely used to enhance product safety during transit and storage, supporting their adoption across electronics, automotive components, and consumer goods. The demand for precision fit and lightweight protection has reinforced their presence in modern packaging, ensuring operational efficiency and reduced product damage.

These advantages continue to establish inserts as the preferred choice within the product type category.

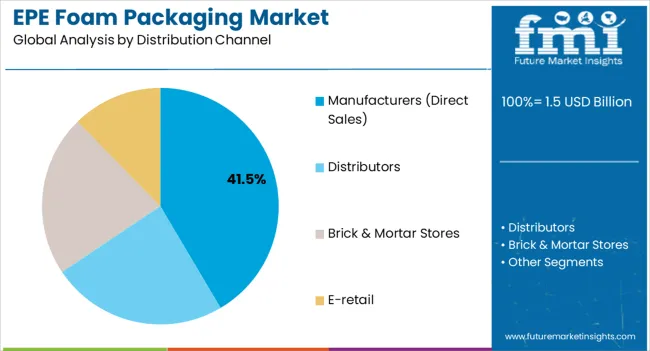

The manufacturers direct sales segment is projected to account for 41.50% of total market revenue by 2025 within the distribution channel category, positioning it as the leading segment. This dominance is supported by the ability of manufacturers to offer tailored solutions, maintain direct client relationships, and ensure cost competitiveness.

Direct sales channels provide end users with greater flexibility in design customization and bulk ordering, while also reducing reliance on intermediaries. Large volume buyers in electronics, automotive, and industrial sectors have favored direct engagement to streamline supply chains and improve turnaround times.

These advantages have consolidated the leadership of manufacturers direct sales in the distribution channel segment.

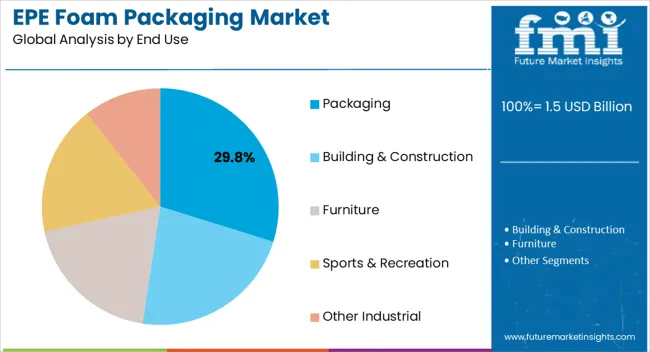

The packaging segment is projected to contribute 29.80% of total market revenue by 2025 under the end use category, making it the most prominent segment. This growth is being driven by rising consumer demand for safe and sustainable packaging solutions across retail, e commerce, and industrial applications.

EPE foam packaging provides lightweight and durable protection, reducing shipping costs and product damage rates. Additionally, its versatility in creating customized shapes and inserts has made it highly adaptable to diverse product categories.

As sustainability considerations grow, EPE foam continues to be refined for recyclability and reusability, further supporting its adoption. These factors have established packaging as the leading end use segment in the EPE foam packaging market.

From 2020 to 2025, the global EPE Foam Packaging market experienced a CAGR of 2.8%, reaching a market size of USD 1.5 billion in 2025.

EPE foam was primarily used for packaging electronic products, but its use has since expanded to other industries, such as automotive, healthcare, and food and beverage. The increasing demand for sustainable packaging solutions has also driven the growth of the EPE foam market, as it is recyclable and can be reused multiple times.

The global EPE Foam packaging market is estimated at around USD 1.5 Billion by the year 2025, accelerating with a CAGR of 4.1% between 2025 and 2035. According to the study on the analysis of EPE Foam Packaging Market, it is expected to increase to roughly USD 2.2 Billion by 2035.

The growing trend towards sustainable packaging materials, EPE foam packaging, which is recyclable and eco-friendly. The end-use industries of EPE foam packaging, such as electronics, automotive, and healthcare, which is likely to drive the demand for EPE foam packaging. The increasing use of EPE foam for packaging is becoming more diverse since the material can be utilised for buffers, ribs, encapsulation blocks, sticky back sheets, support pads and corner pads.

It is less expensive and more durable than other materials and is widely used in the packaging of consumer electronics including as washing machine, refrigerator, televisions, laptop computers, desktop computers, and other equipment.

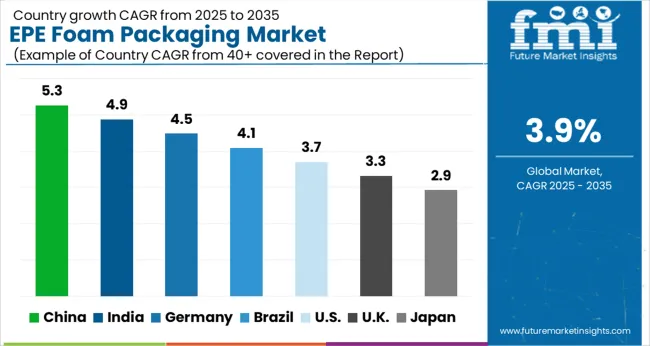

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 497.6 million |

| CAGR % 2025 to End of Forecast (2035) | 3.6% |

EPE (expanded polyethylene) foam is a versatile material that is widely used in packaging applications due to its excellent shock absorption, cushioning, and insulation properties. The demand for EPE foam packaging in the United States is driven by various factors such as the growth of e-commerce and the increasing need for safe and secure packaging for various products. EPE foam packaging is used in a wide range of industries such as electronics, healthcare, automotive, food and beverage, and consumer goods.

| Country | India |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 238.6 million |

| CAGR % 2025 to End of Forecast (2035) | 5.6% |

The packaging industry in India is expected to grow rapidly in the coming years, driven by the growth of e-commerce, the expansion of organized retail, and increased demand from the manufacturing and pharmaceutical sectors. These trends are likely to fuel the demand for EPE foam packaging in India. With the increasing focus on sustainable packaging, there is also a growing trend towards the use of eco-friendly and biodegradable materials in the Indian packaging industry, which could impact the demand for EPE foam packaging in the long run.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 456.4 million |

| CAGR % 2025 to End of Forecast (2035) | 5.1% |

China's rapid economic growth and increasing demand for packaged goods have contributed to the growth of the EPE foam packaging market in recent years. In addition, the growth of e-commerce in China has fueled the demand for lightweight and protective packaging materials, making EPE foam an attractive option for many businesses.

The anti-static ESD foam market segment holds a major share in the EPE (Expanded Polyethylene) foam packaging market due to the increasing demand for electronic products and the need for their safe transportation and storage. ESD foam is commonly used for packaging electronic components such as microchips, circuit boards, and other sensitive electronic devices.

ESD foam is also used in the aerospace, automotive, and medical device industries, where it provides protection against electrostatic discharge during handling and assembly processes. With the increasing adoption of electronic devices in various industries, the demand for ESD foam packaging is expected to continue to grow in the coming years.

Furthermore, the rise in demand for lightweight and eco-friendly packaging solutions is also driving the growth of the EPE foam packaging market, of which anti-static ESD foam is a key segment. EPE foam is a recyclable material that offers excellent shock absorption and cushioning properties, making it an ideal material for packaging fragile and sensitive products.

Although, the demand for anti-static ESD foam in the EPE foam packaging market is driven by the increasing need for safe and secure transportation of electronic components and the growing demand for lightweight and eco-friendly packaging solutions.

Insulation packaging is designed to protect products from temperature fluctuations, moisture, and other environmental factors that can damage or compromise their quality.

One of the major factors driving the rising demand for insulation packaging is the increasing need for temperature-controlled packaging solutions. Many products, such as food, pharmaceuticals, and medical devices, require specific temperature conditions to maintain their quality and efficacy. Insulation packaging helps to keep these products at the required temperature during transportation and storage.

Another factor driving the demand for insulation packaging is the growth of e-commerce. With more people shopping online, there is an increased need for effective packaging solutions to protect products during shipping. Insulation packaging helps to keep products safe from temperature changes, moisture, and other hazards during transit. In addition to temperature control, insulation packaging also offers excellent cushioning and protection for fragile and sensitive products. This is particularly important in industries such as electronics and automotive, where products can be easily damaged during transportation.

EPE foam is an excellent packaging material for food service products because of its lightweight, cushioning, and insulating properties. It can help to protect food products during transport, storage, and distribution, and it can also help to keep food fresh and at the desired temperature.

In the food service industry, EPE foam packaging is commonly used for take-out containers, cups, and trays. It is also used for packaging perishable food items such as fruits, vegetables, and meats. The use of EPE foam packaging in the food service industry has increased over the years due to its many benefits, including its affordability, durability, and recyclability.

Furthermore, the increasing demand for food delivery and take-out services due to changing consumer lifestyles has also contributed to the growth of the EPE foam packaging market in the food service industry. EPE foam packaging is a cost-effective and efficient solution for food delivery and take-out, as it is lightweight, easy to transport, and can be customized to fit different food items.

Although, the food service industry is a major contributor to the growth of the EPE foam packaging market, and this trend is likely to continue as the industry continues to evolve and adapt to changing consumer needs and preferences.

Market players can focus on differentiating themselves through unique product offerings and value-added services. For example, they can develop customized EPE foam solutions for specific industries or applications, such as medical devices or automotive components.

They can also offer additional services such as design, prototyping, and testing to help customers optimize their packaging solutions. Market players can leverage technology such as automation and data analytics to improve efficiency, reduce costs, and offer faster turnaround times.

Key strategies in EPE Foam Packaging market:

Product Innovation

EPE foam packaging market could be the incorporation of smart technology into the foam packaging. This could involve embedding sensors into the foam that can detect changes in temperature, humidity, or other environmental factors that could impact the contents of the packaging. The sensors could then transmit this information in real-time to a smartphone app or other device, allowing the user to monitor and adjust the packaging as needed.

This innovation could be particularly useful for industries such as pharmaceuticals or food packaging, where temperature control and monitoring are critical. Additionally, this technology could help reduce waste by allowing companies to more accurately monitor the condition of their products and avoid discarding them prematurely due to uncertainty about their storage conditions.

Customization:

EPE foam packaging is to offer personalized foam inserts that are specifically tailored to the shape and size of the product being packaged. This could involve using 3D scanning technology to create a digital model of the product, which could then be used to design a foam insert that perfectly fits the product's dimensions and shape. Customization would ensure that the product is securely and efficiently packed, reducing the risk of damage during transportation. Additionally, companies could offer customized branding on the foam inserts, such as embossing or printing the company logo onto the foam. This would not only improve brand recognition but also add an extra layer of professionalism and attention to detail to the packaging.

Sustainability:

EPE foam packaging market is to develop foam packaging that is completely biodegradable and compostable. This could be achieved by using natural materials such as starch or cellulose to create the foam, rather than petroleum-based materials.

The foam could also be treated with enzymes or other additives to speed up the degradation process. This innovation would demonstrate a commitment to sustainability and responsible environmental stewardship, helping to build customer loyalty and brand reputation.

Strategic Expansion:

Companies could explore opportunities in the construction industry, where EPE foam is increasingly being used as a lightweight and durable insulation material. Companies could target the automotive industry, where EPE foam is used in sound insulation and vibration dampening applications.

Key Players in the EPE Foam Packaging market

The global EPE foam packaging market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the EPE foam packaging market is projected to reach USD 2.2 billion by 2035.

The EPE foam packaging market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in EPE foam packaging market are inserts, corner & edge protectors, foam sheets, anti-static esd foam and food disposables.

In terms of distribution channel, manufacturers (direct sales) segment to command 41.5% share in the EPE foam packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Repetitive Transcranial Magnetic Stimulation Market Size and Share Forecast Outlook 2025 to 2035

Cellular Repeater Market Analysis – Growth & Forecast 2024-2034

Repeater Market Trends – Growth & Forecast 2024-2034

Independent Lodgings Market Size and Share Forecast Outlook 2025 to 2035

Sleeper Pads Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Tick Repellent Manufacturers

Tick Repellent Market Growth – Size, Trends & Forecast 2024-2034

Water Repellent Agent Market

Cyclin-Dependent Kinase Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Insect Repellent Apparel Market Size and Share Forecast Outlook 2025 to 2035

Digital Repeater Market Growth – Trends & Forecast through 2034

Ischemia Reperfusion Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Mosquito Repellent Candles Market Analysis – Trends, Growth & Forecast 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Automatic Dependent Surveillance-Broadcast (ADS-B) System Market Size and Share Forecast Outlook 2025 to 2035

Robotics Sweeper Market

Transfusion Dependent Thalassaemia Management Market - Trends & Future Outlook 2025 to 2035

Natural Insect Repellent Market Analysis - Trends, Growth & Forecast 2025 to 2035

Compact Road Sweepers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA