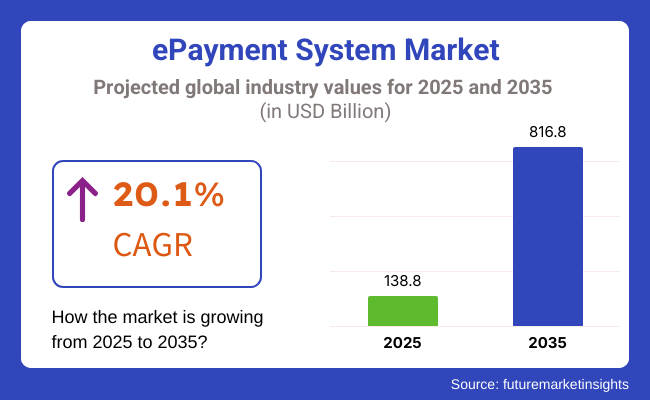

The ePayment system market is projected to reach USD 138.8 billion in 2025 and expand to USD 816.8 billion by 2035, driven by a compound annual growth rate (CAGR) of 20.1%. This rapid expansion is fueled by advancements in mobile technology, the proliferation of e-commerce platforms, and the increasing shift toward cashless and contactless transactions across developed and emerging economies.

Key growth drivers include rising consumer demand for secure, fast, and convenient digital payment options, the integration of biometric authentication, and the widespread adoption of digital wallets and mobile payment apps. Financial institutions and fintech companies are accelerating innovation in e-payment platforms to meet evolving user expectations and regulatory standards.

Challenges include cybersecurity risks, regulatory compliance complexities, and limited digital infrastructure in some regions, which may slow adoption. However, increasing internet penetration, government initiatives promoting digital payments, and innovations such as blockchain-based systems and AI-driven fraud detection present substantial opportunities for industry expansion.

Emerging trends include the rise of real-time payment systems, embedded finance, and cross-border ePayment solutions, transforming the global payments landscape and enhancing financial inclusion.

Explore FMI!

Book a free demo

Between 2020 and 2024, sales grew rapidly, fueled by the use of digital payment solutions, increasing financial inclusion, and increased cybersecurity. The COVID-19 pandemic further spurred the transition to cashless transactions, and digital payments became the go-to choice for businesses and consumers.

Mobile payments via platforms such as Apple Pay, Google Pay, and PayPal skyrocketed, with contactless payment methods like NFC cards and QR code scanning becoming the norm. Blockchain and cryptocurrency adoption picked up pace, with Visa and Mastercard embracing crypto payments and governments looking into Central Bank Digital Currencies (CBDCs).

AI-based fraud prevention, biometric verification, and multi-factor authentication enhanced payment security, while regulatory environments matured to deal with inconsistencies and better protect consumers. Issues like cybersecurity attacks, regulatory loopholes, and the digital divide remained, but in 2024, there were global standards for interoperability and security. Throughout 2025 to 2035, the ePayment sector will be influenced by AI automation, decentralized finance (DeFi), and biometric technology.

During 2025 to 2035, artificial intelligence-based financial assistants will automate payments, anticipate expenditure habits, and optimize personal finance planning. Blockchain-based DeFi platforms and smart contracts will lower fees, allow real-time cross-border settlement, and automate payment contracts.

Biometric and voice payments through facial recognition, palm vein scanning, and voice biometrics will be convenient and secure. Blockchain and AI will enable low-cost real-time cross-border payment, and IoT-enabled devices will power automated smart home and vehicle payments. Green digital payment infrastructure, such as carbon-free data centers and energy-efficient processing, will be the standard. Quantum computing and quantum-resistant cryptography will secure payments, offering fraud detection at higher speed and verifiable, secure proof of transactions, changing the future of payments.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| PSD2, GDPR, and regional regulatory compliance | Global standardization of digital payment policies, AI-driven compliance enforcement |

| AI-driven fraud detection, contactless payments | Decentralized finance (DeFi), biometric authentication, and voice-activated payments |

| Mobile wallets, e-commerce payment integration | IoT-based payments, cross-border real-time settlements |

| NFC-based payments, blockchain integration | Quantum computing-driven security, AI-driven predictive financial automation |

| Reduction of paper transactions, digital-first banking | Carbon-neutral digital payment infrastructure, sustainable blockchain solutions |

| AI-powered fraud prevention, real-time transaction tracking | Self-learning AI payment optimization, automated smart contracts |

| Supply chain disruptions, cybersecurity concerns | Scalable AI-driven payment processing, interoperability between global financial networks |

| Digital transformation, COVID-19-driven cashless adoption | Scaling of AI automation, end-to-end decentralized worldwide payment systems |

The industry is going through a very fast evolution because of the growing global trend of cashless payment forms like digital wallets and contactless payments. Businesses operating in the retail and e-commerce space are looking for a payment method that is not only fast and secure but also user-friendly to the customer to enrich the customer experience.

The BFSI sector faces the requirements of high security, fraud prevention, and regulatory compliance, which are issues that arise due to the nature of financial transactions. Healthcare providers are asking for secure and HIPAA-compliant payment processing schemes for applications such as medical billing and patient transactions.

Government entities' key issues are regulatory adherence, fraud protection, and integration with other infrastructure. The travel and hospitality sectors are concentrating on a multi-currency-friendly interface with international payment processing that is fast and easy. Some of the major trends include blockchain-based payments, AI-imposed fraud detection, biometric authentication, and cross-border transactions in real-time that form the digital payment future.

Contract & Deals Analysis

| Company | Contract Value (USD Million) |

|---|---|

| Visa | Approximately USD 80 - 90 |

| Mastercard | Approximately USD 70 - 80 |

| PayPal | Approximately USD 60 - 70 |

| Square | Approximately USD 50 - 60 |

| Stripe | Approximately USD 90 - 100 |

In 2024 and early 2025, there was robust growth driven by the increasing shift towards digital and contactless transactions. Leading companies such as Visa, Mastercard, PayPal, Square, and Stripe have secured significant contracts and strategic partnerships to enhance security, reliability, and innovation in payment processing. These developments reflect the industry's commitment to digital transformation, ensuring seamless and secure transactions across diverse markets.

The ePayment industry is vulnerable to cyber threats like data breaches, phishing emails, and fraud. When digital transactions increase, cybercriminals get interested in the payment gateways, aiming at financial losses and negative publicity. Minimizing these threats is through strong encryption, multi-factor authentication, and real-time fraud detection systems.

Regulatory compliance challenges are the main hurdles for the industry. Governments are monitoring data security laws like GDPR, PCI DSS, and PSD2 in their strict formality to protect user data. The company's failure to obey may lead to high penalties and lawsuits. Regular updates of the system and compliance audits are the two things that businesses operating in various regions must perfor.m

Operational disruptions can result from system downtimes, network failures, or technical glitches. Companies that rely on online payments are greatly affected even by the smallest detours, as they can lead to significant revenue losses. Measures like operational efficiency, redundancy steps, and contingency strategies will help lower the risks.

The absence of consumer trust and adoption barriers is the major drawback to growth. Customers may have concerns about security issues, hidden fees for some transactions, and difficulty in using new payment methods that they have never used before. Successful communication, strong security frameworks, and easy-to-use interfaces are the key factors that lead to getting consumers' trust and increasing the adoption rate.

| Segment | Value Share (2025) |

|---|---|

| Solution | 65.8% |

The solution segment is expected to lead the ePayment Systems market during the forecast period, owing to the advancement in technology; it is anticipated that the solution segment is estimated to represent ~65.8% of the total ePayment Systems market share in 2025. This growth is fueled by the increasing use of digital wallets, artificial intelligence fraud detection tools, blockchain transactions, and real-time payment processing.

Successful companies and financial institutions are using advanced payment software for better security, efficiency, and user experience. Major players like PayPal, Stripe, and Square are expanding their solution portfolios, while banks and fintech organizations are increasingly embracing tailored payment platforms to address changing customer needs.

The services segment is expected to dominate in 2025, accounting for a share of 34.2%, driven by rising demand for payment integrations, consulting, and managed services. With companies moving towards a smooth omnichannel payment experience, service providers play a major role in deploying systems, cybersecurity, regulations compliance, and cloud-based infrastructure/facility management. Increasing focus on fraud prevention, AI-based analytics, and secure transaction frameworks is additionally propelling the demand for professional services.

Cloud-based and AI-enhanced solutions would fuel innovation as the digital payments landscape continues to evolve. Now, the confluence of IoT and payment processing infrastructure will open the door to SMEs across industries, and contactless payment will become the backbone of the ePayment domain while improving efficiency, security, and convenience for both merchants and consumers.

| Segment | Value Share (2025) |

|---|---|

| Cloud-based | 75.4% |

The global ePayment Systems market is rapidly transitioning towards cloud-based deployment, which will dominate 58.3% of the overall share by the year 2025. The rising deployment of cloud-native payment platforms, AI-based fraud detection, and scalable payment infrastructures drive this growth. Emerging payment technologies like blockchain, real-time payments, IoT-based transactions, etc., have made operations flexible, economical, and palatable over the cloud. AWS (Amazon Web Services), founded in 2006, powers the cloud infrastructure for most of the banks globally and enables cloud adoption in financial services, offering banks, fintech, and e-commerce companies an optimized payment processing journey while securing it.

The on-premises deployment segment is estimated to account for 41.7% of the share in 2025, owing to industries that demand higher data control, compliance with stricter regulations, and improvement in security measures. Some of the larger enterprises, such as those in banking, financial services, and government sectors, would prefer on-premises payment solutions due to concerns about data privacy, latency, and integration with on-premises legacy systems. For such enterprises, leading key participants such as FIS, ACI Worldwide, and Fiserv are providing in-depth on-premises payment gateways and AI in fraud management systems.

Due to that very cost-effective, real-time, globally accessible option, the cloud segment is meant to witness faster adoption as digital transformation accelerates. Nonetheless, there will always be a need for on-premises solutions in cases where businesses require a customized and high-security payment processing environment, making both deployment models relevant in the ever-evolving ePayment industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| The USA | 11.2% |

| The UK | 10.5% |

| France | 9.8% |

| Germany | 9.5% |

| Italy | 8.9% |

| South Korea | 12.0% |

| Japan | 10.2% |

| China | 13.5% |

| Australia | 9.3% |

| New Zealand | 8.5% |

2025 to 2035 CAGR is expected to be 11.2%, driven by high fintech adoption, changing regulatory landscapes, and digital wallet growth. PayPal, Apple Pay, and Stripe are leading the industry and indicate robust local growth as BNPL products gain traction. Enhanced security features and government support for open banking will drive growth. Contactless and QR-code payments are being adopted by major retailers as well as small businesses, which is fueling the growth in the USA

Growing demand for borderless payments stimulates innovation as banks embrace blockchain technology. Tech players continue to dominate, with Google Pay and Square picking up growing traction. Mergers and acquisitions by fintech participants drive scalability and efficiency.

Pioneers like Revolut, Monzo, and Barclays are at the forefront, setting the stage for instant payments and cryptocurrency-based transactions. Contactless payment is almost everywhere, indicating widespread customer adoption and making the UK industry robust.

Government policies encouraging open banking force fintech startups, resulting in a highly competitive landscape, cross-border commerce, especially in the EU, forces frictionless cross-border payments. High smartphone penetration guarantees that mobile wallets and P2P transactions will expand further.

9.8% is the CAGR between 2025 and 2035, as rigorous regulation renders it a secure digital payments platform. Industry growth is fueled by French incumbents such as Worldline and BNP Paribas, while new entrants offer AI-driven fraud prevention. Mobile payments are increasingly gaining traction among young people who value convenience and speed. Strong government support and tech-led solutions provide backing to the industry in France.

E-Commerce expansion, facilitated by Cdiscount and others, highlights end-to-end payment solutions. Pressure from the French government for a cashless future propels uptake, especially in cities. With the development of the digital euro ongoing, the Central Bank Digital Currency (CBDC) may transform the future.

2025 to 2035 CAGR is predicted at 9.5%, with digitalization gaining momentum in the largest European economy. Cash is still the choice of some consumers, but companies such as Wirecard (before the scandal) and N26 encourage contactless payments and mobile banking. Conventional banks offer instant payment processing to hold onto market share, propelling sales in Germany.

E-commerce growth prompts a heightened need for online secure payment, and Klarna and Paydirekt lead the way. Wider promotion by the government, backed by regulatory powers, secures solid momentum for growth. The detection of fraud using artificial intelligence is of new importance with growing transaction volumes.

2025 to 2035 CAGR is 8.9% and is driven by the growth of mobile banking as well as fintech firms. Although Italy has never been a leader in digital, firms such as Nexi and Satispay are spearheading the charge towards cardless and mobile payments. Smartphone penetration at high levels is driving eWallet and QR-code payments, thereby driving the industry in Italy.

The pandemic caused augmented contactless utilization, and nowadays, businesses emphasize frictionless payment tools. The reward of cashless transactions by the government incentivizes SME digitization, while the tourism and retail industry employs advanced ePayment technology to address foreign buyers.

CAGR from 2025 to 2035 is 12.0% and places South Korea as a leader in digital payments. Brand dominance by the likes of Kakao Pay, Naver Pay, and Samsung Pay also reflects the technology-savvy consumers. Super apps are complemented by bundled financial services so that transactions can be smooth across platforms.

Government encouragement of blockchain-driven payment systems heightens security and efficiency. Highly developed internet networks in South Korea facilitate real-time mobile payments, while AI-aided prevention of fraud limits risk. Payment adoption by the e-commerce and gaming sectors further rises.

CAGR of 2025 to 2035 is projected to be 10.2%, driven by the rising adoption of cashless technologies. Rakuten Pay, PayPay, and Line Pay are dominant brands driving cash-to-digital wallet adoption. Government-led campaigns are supporting QR-code payments.

Tourism is another key factor, with shops making provisions to handle foreign payment methods. Japan's aging population is an issue and a challenge as companies create accessible ePayment systems for senior citizens.

2025 to 2035 CAGR is estimated at 13.5%, with China being the most lucrative industry. WeChat Pay and Alipay are the undisputed champions, handling billions of transactions daily. The central bank is also launching a CBDC.

E-commerce behemoths such as Alibaba and JD.com are driving demand for frictionless payments. Super apps bring together social, banking, and payments in an interdependent digital economy. AI-powered fraud detection makes transactions safer, further enhancing consumer trust in digital payments.

2025 to 2035 has a forecasted CAGR of 9.3%, driven by fintech advancement and smartphone penetration. Digital lead growth is driven by brands such as Afterpay and Commonwealth Bank, while stability is provided through regulatory environments. Tap-and-go payment technology is the standard now, and even small businesses have embraced contactless payment strategies, driving the industry in Australia.

The expansion of BNPL services influences consumers' consumption patterns, particularly in retail. Cross-border transactions with the Asia-Pacific region gain prominence, leading to increased demand for multi-currency payment facilities. Real-time payment systems, backed by the Reserve Bank of Australia, also make transactions more convenient.

8.5% CAGR from 2025 to 2035 is anticipated, representing consistent growth in digital payments. Laybuy and ASB Bank are some of the businesses that advocate cashless payment, and government-supported fintech projects allow for speedy innovation. QR-code payments and mobile wallets are becoming popular, especially in city-based locations.

Small firms adopt ePayment platforms to accommodate digitally born customers. Post-pandemic recovery of travel and tourism boosts international payment compatibility needs. Business houses make investments in sophisticated fraud detection and encryption technology since security concerns come to the forefront, increasing customer confidence.

The payment systems market is growing fast, creating advantages in doing business across global commerce and financial systems with digital transactions. This mobile commerce, contactless payments, and regulatory policies that promote cashless economies drive companies to refine their specifications on real-time payment processing, AI-enabled fraud detection, and security applications on the blockchain.

Key players in this business are PayPal, Visa, Mastercard, Square, Stripe, and all the other players that are offering secure, scalable, and integrated solutions for payment transactions and consumers taking on businesses. The promise of established players to be

Emerging trends include biometric authentication, innovations in cross-border payments, and the development of central bank digital currencies (CBDCs), which together will represent a major force in shaping transaction infrastructures. With these, businesses expect seamless API-driven integrations, omnichannel payment acceptance, and data-driven financial insight into digital commerce optimization.

Some key strategic factors include adherence to the regulatory framework governing global financial transactions, the resilience of cybersecurity, and improvement in user experience. As digital payments increasingly become the norm, competition impels change in instant settlement networks and tokenization of transactions, and advances AI-powered personalization to reshape the future of payments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PayPal Holdings Inc. | 20-25% |

| Visa Inc. | 15-20% |

| Mastercard Inc. | 12-16% |

| Square (Block, Inc.) | 10-14% |

| Stripe | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| PayPal Holdings Inc. | Ensures safe online transactions, person-to-person money transfers, and worldwide e-commerce solutions. |

| Visa Inc. | We specialize in digital card-based transactions, contactless payments, and instant review of fraud. |

| Mastercard Inc. | Engines of disruption may be established in AI-based risk evaluation and tokenized payment security. |

| Square (Block, Inc.) | Mobile payment, business solutions for SMEs, and blockchain financial services. |

| Stripe | Provides developer-friendly APIs for e-commerce, subscription billing, and global payment processing. |

Key Company Insights

PayPal Holdings Inc. (20-25%)

PayPal leads the ePayment market with an extensive range of online and mobile payment solutions, with seamless cross-border transactions and AI-powered fraud protection.

Visa Inc. (15-20%)

Visa is a pioneer of secure digital payments with contactless and tokenized payment options that increase user convenience and security.

Mastercard Inc. (12-16%)

Mastercard is leading digital payments by deploying AI for fraud detection, real-time authentication, and an expanding network of secure global partnerships.

Square (Block, Inc.) (10-14%)

Square enhances accessibility in mobile payment solutions, point-of-sale innovation and facilitation, and cryptocurrency payment integration for businesses and consumers.

Stripe (6-10%)

Stripe is transforming e-commerce payments as it creates developer-friendly application programming interfaces, a seamless pathway to worldwide payment processing, and subscription revenue mechanisms.

Other Key Players (30-40% Combined)

The overall market size for the ePayment System Market was USD 138.8 billion in 2025.

The ePayment System Market is expected to reach USD 816.8 billion in 2035.

The demand will grow due to increasing digital transactions, rising adoption of contactless payments, and government initiatives promoting cashless economies.

The top 5 countries driving the ePayment System Market are the USA, China, India, Germany, and the UK.

The segmentation is into solutions (payment gateway, payment processing, payment wallet, payment security, and fraud management, and point of sale (POS)) and services (consulting & advisory, integration & implementation, support & maintenance, and managed services).

The segmentation is into on-premises and cloud.

The segmentation is into small and medium enterprises (SMEs) as well as large enterprises.

The segmentation is into BFSI, retail, healthcare, media & entertainment, IT & telecom, transportation & logistics, and others.

The segmentation is into North America, Latin America, Europe, East Asia, South Asia, Oceania, and Middle East & Africa.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.