The world environmental catalyst market will increasingly switch between 2025 and 2035 with tightening environmental regulations, emission standards, and growing areas of application of clean industrial technology. Environmental catalysts are primarily responsible for neutralizing offensive car, factory, and power plant emissions.

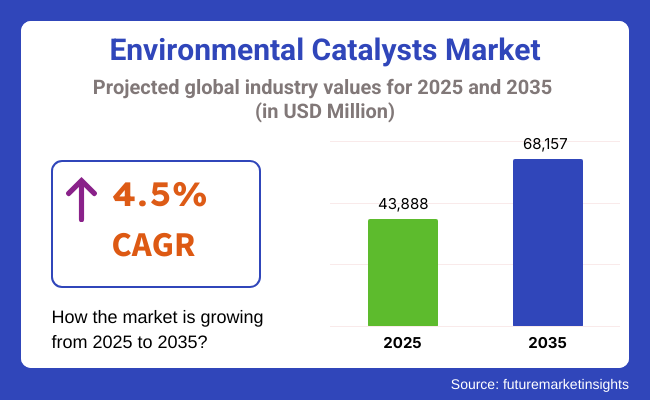

Environmental catalysts speed up the breakdown of harmful pollutants such as nitrogen oxides (NOx), carbon monoxide (CO), hydrocarbons, and volatile organic compounds (VOCs) into less harmful products. Environmental catalyst market is expected to be USD 43,888 million by 2025 and USD 68,157 million by 2035 with 4.5% CAGR.

Market is driven by increasing uses of car catalytic converters, oxidation catalysts, and selective catalytic reduction (SCR) technology in the energy and transport industries. Strict global emission standards, like Euro 7 standards and industrial air quality standards, are leading firms to adopt efficient and more durable catalytic technology.

The North American market is large on the basis of strict emissions standards by the USA Environmental Protection Agency (EPA) and equivalents. Drivers for demand include mass application of diesel engines, petrochemical refinery treatment, and incinerators. Growing technology and investment in low-emitting power generation fuel regional demand further.

Europe is propped up by strong growth as a result of Euro emission rules and tight control of industrial emitters. The UK, Germany, and France are some of the leading drivers for the use of environmental catalysts in the industrial and automobile sectors. European Green Deal and net-zero 2050 are policy goals that are reinforcing a facilitative policy environment to catalytic technology innovations.

Asia-Pacific is the most rapidly growing market, and South Korea, India, China, and Japan are all spending huge amounts in emission control technology. Urban air pollution control and industrial plant upgradation programs subsidized by the government are fuelling demand for industrial and automobile catalysts. Locally manufactured catalytic converters are also gaining momentum.

Challenges: Raw Material Volatility, High Manufacturing Cost, and Limited Adoption in Emerging Economies

Environmental catalyst industry is prone to various threats on the basis of price fluctuation of major raw materials such as the platinum group metals (PGMs) platinum, palladium, and rhodium. These are core premises for catalyst efficacy facilitation but contribute significantly towards production-led cost escalation. In addition, exorbitantly high initial capital together with the inability to adopt regulation in rising geographies of nations deters global acceptance.

Opportunities: Industry Electrification, Circular Economy, and Recycling of Catalysts

Opportunities are in developing low-cost, high-activity catalysts from non-conventional feedstocks or reduced PGM content. Growth in the circular economy and more focus on recycling and recovery of catalysts will render the supply chain sustainable. Furthermore, application of environmental catalysts for hydrogen generation, carbon capture, and waste-to-energy technology presents new growth opportunities.

Between 2020 to 2024, the market was growing with growing interest driven by post-pandemic tightening of automotive emission regulations and production realignment to cleaner production. Ship emission control and industrial flue gas treatment were runaway applications while the largest end-user was the automotive industry. Short-term price spikes were triggered through disruption of catalytic material supply chains.

In the period 2025 to 2035, the industry will witness more use of AI-driven monitoring of catalyst performance, dynamic emission controls to shifting conditions, and recyclable catalytic substrates. Catalysts for the environment will be utilized in recycling the previous system to new heights of global air quality as industries become involved in decarbonisation and cleaner combustion.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with Euro 6/VI, China VI, and USA EPA Tier 3 emission standards shaped adoption. |

| Consumer Trends | Public concern over air pollution encouraged stricter vehicle emissions enforcement. |

| Industry Adoption | Heavy use in automotive SCR systems, refinery desulfurization units, and industrial NOx reduction processes. |

| Supply Chain and Sourcing | Dependence on platinum group metals (PGMs) and vanadium oxide from South Africa, China, and Russia. |

| Market Competition | Dominated by Johnson Matthey, BASF, Umicore, and Clariant with vertically integrated supply chains. |

| Market Growth Drivers | Regulatory-driven demand in automotive and petrochemical sectors. |

| Sustainability and Environmental Impact | Focus on reducing NOx, CO, and particulate emissions in urban and industrial areas. |

| Integration of Smart Technologies | Use of passive monitoring systems and catalyst aging estimations. |

| Advancements in Equipment Design | Conventional honeycomb substrates with coated metal oxides. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Global move toward Euro 7 and off-highway emission rules, alongside industrial VOC and CO control mandates, fuels advanced catalyst demand. |

| Consumer Trends | Broader preference for zero-smog urban zones and low-emission industrial zones supports catalyst integration in energy, shipping, and waste. |

| Industry Adoption | Expansion into hydrogen production (via SMR clean-up), cement kilns, maritime emissions control, and waste incineration gas purification. |

| Supply Chain and Sourcing | Diversification into nanostructured catalyst carriers, cerium-based alternatives, and PGM recycling from scrapped automotive catalysts. |

| Market Competition | Entry of green-tech startups producing bio-catalysts and modular systems for distributed clean energy and microgrid emissions control. |

| Market Growth Drivers | Green hydrogen scale-up, carbon-neutral industrial targets, and circular economy practices drive catalyst deployment in broader ecosystems. |

| Sustainability and Environmental Impact | Emphasis on low-temperature activation, high recyclability, and lifecycle carbon reduction in catalyst design and end-of-life recovery. |

| Integration of Smart Technologies | Growth in AI-driven emissions diagnostics, catalyst efficiency prediction, and smart integration with industrial emission dashboards. |

| Advancements in Equipment Design | Development of 3D-printed catalysts, nano-layered wash coats, and regenerable filters for harsh industrial environments and energy recovery units. |

In the USA, the environmental catalysts market is thriving due to stringent EPA rules on industrial NOx, methane, and volatile organic compound (VOC) emissions. Power plants, cement producers, and refineries are adopting SCR and oxidation catalysts to stay compliant. The push for green hydrogen and low-carbon ammonia also promotes demand for sulfur-resistant reforming catalysts.

| Country | CAGR (2025 to 2035) |

|---|---|

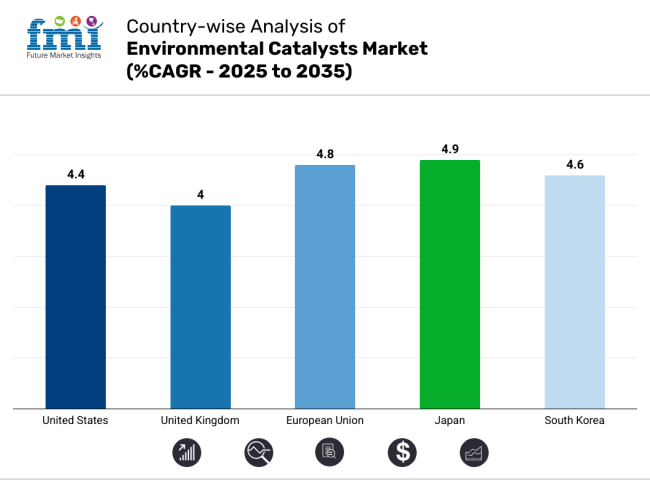

| USA | 4.4% |

The UK market is accelerating under the Net Zero Strategy, Clean Air Zones (CAZ), and decarbonisation of heavy industry. Companies are adopting catalysts in CHP units, biomass plants, and waste incinerators to meet emissions thresholds. Local innovations in catalyst reuse and recovery from end-of-life vehicles are gaining traction.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

EU markets are experiencing catalyst adoption spikes due to the Green Deal, tightened ETS schemes, and aggressive decarbonisation in steel and chemicals. SCR and oxidation catalyst systems are standard in district heating and large-scale furnaces, while R&D in ceramic-based low-PGM catalysts is intensifying.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

Japan’s focus on ultra-low emissions in transportation and energy generation has boosted demand for high-efficiency three-way and NOx reduction catalysts. The market also benefits from automotive catalyst recycling initiatives and applications in advanced fuel processing systems in hydrogen and ammonia production.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

South Korea is integrating environmental catalysts across petrochemicals, shipbuilding, and steel. The push for green steel and marine fuel regulation compliance (IMO Tier III) is stimulating demand. Catalysts for diesel particulate filters and DeNOx applications in power plants are also on the rise.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

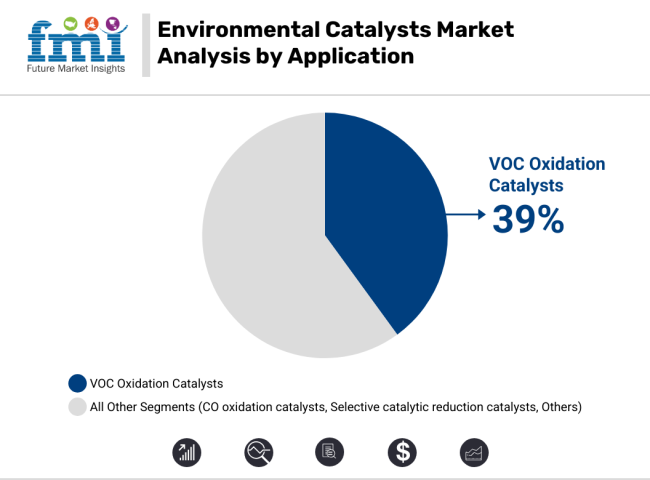

Volatile Organic Compound (VOC) oxidation catalysts will account for the highest market share of 39% in 2025 due to growing stricter environmental regulation of industrial emissions demanding VOC oxidation catalysts, particularly in the application of chemical manufacturing, printing, and automotive coating.

VOC oxidation catalysts oxidize toxic organic vapors to carbon dioxide and water catalytically and hence are in demand in regulated plants. For example, Johnson Matthey has expanded its VOC catalyst operations in Asia because China and India have cracked down on factory emissions.

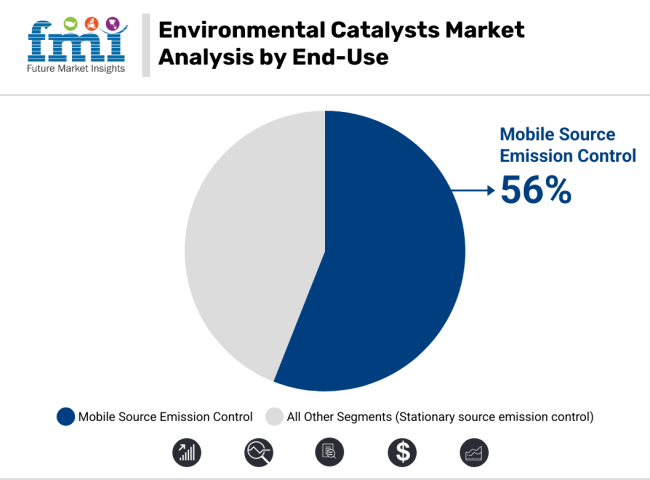

Mobile source emission control business will account for 56% of the environment catalysts market in 2025. It is offset by heavy trucks, light autos, two-wheelers, and off-road construction equipment. Stringent emission standards such as Euro 7 in Europe and Bharat Stage VI in India have propelled the consumption of catalysts in the vehicle exhaust system with more applications.

Umicore and BASF, among others, are stepping up the manufacturing of platinum group metal-based catalysts to meet this growing demand, especially in the developing countries where automobile manufacturing continues to rise.

Environmental catalysts market is growing steadily with tough environmental regulation and global efforts at minimizing industrial emissions. Environmental catalysts are used in the synthesis of several industrial processes such as exhaust emissions of vehicles, chemical synthesis, and the generation of electric power.

The industry is dominated by the existence of various major players making investments in research and development programs, strategic alliances, and geographical expansion as a product portfolio diversification strategy to address changing environmental regulative needs.

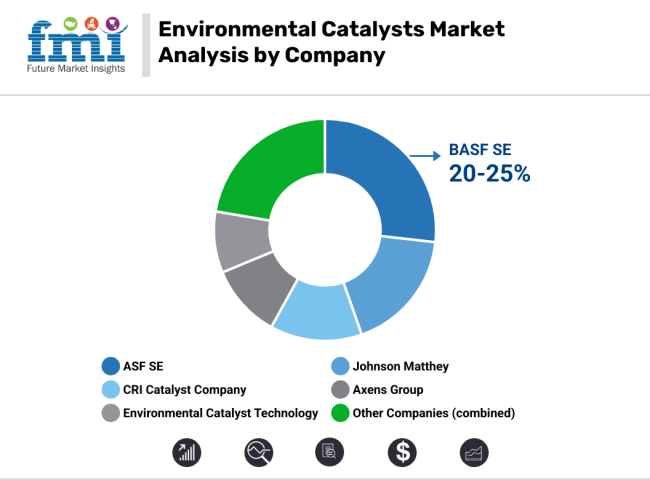

Market Share Analysis by Company

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | In 2024, introduced a new range of VOC oxidation catalysts which are designed to minimize industrial air pollutants. In 2025, expanded production facilities in Asia to fulfill the demand of the region. |

| Johnson Matthey | In 2024, launched sophisticated selective catalytic reduction (SCR) catalysts for vehicle applications. In 2025, collaborated with major automobile manufacturers to produce next-generation emissions control systems. |

| CRI Catalyst Company | Created in 2024 new CO oxidation catalysts for chemical production industries. In 2025, created the optimization of catalyst performance and life using nanotechnology. |

| Axens Group | In 2024, diversified its portfolio with catalysts specifically utilized to enhance sulfur recovery in refinery application. In 2025, partnered with refiners worldwide to begin sustainable operations. |

| Environmental Catalyst Technology | In 2024, launched cost-effective catalysts for city trash treatment ventures. In 2025, invested in catalyst research to make precious metal-reduced catalysts without reducing efficiency. |

Key Company Insights

BASF SE (20-25%)

BASF is market leader with a wide range of environmental catalysts, focusing on innovations for the demands of strict emission legislation for different industries.

Johnson Matthey (15-20%)

Johnson Matthey is strongly known for its automotive emission control catalyst leadership, through ongoing innovation of sophisticated SCR technology to keep pace with changing automotive standards.

CRI Catalyst Company (10-15%)

CRI is a leading manufacturer of chemical industry oxidation catalysts, with a focus on catalyst durability and efficiency improvements through state-of-the-art research.

Axens Group (8-12%)

Axens targets petrochemical and refinery use with catalysts for improved efficiency and environmental solution of the processes.

Environmental Catalyst Technology (5-10%)

This business specializes in municipal and industrial waste treatment, offering cost-effective and effective catalyst solutions for pollution management.

Other Key Players (18-25% Combined)

The overall market size for the environmental catalysts market was approximately USD 43,888 million in 2025.

The environmental catalysts market is projected to reach approximately USD 68,157 million by 2035.

The increasing regulatory pressures to reduce emissions and comply with stringent environmental standards are major drivers. Governments worldwide are implementing tougher regulations on emissions from vehicles and industrial processes, which has spurred demand for effective catalytic solutions.

The top 5 countries driving the development of the environmental catalysts market are the United States, China, Germany, India, and Japan.

On the basis of application, the Volatile Organic Compound (VOC) oxidation catalysts segment is expected to command a significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Nanocatalysts Market Size and Share Forecast Outlook 2025 to 2035

Hydro-processing Catalysts Market Growth - Trends & Forecast 2025 to 2035

Fluid Catalytic Cracking Catalysts Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA