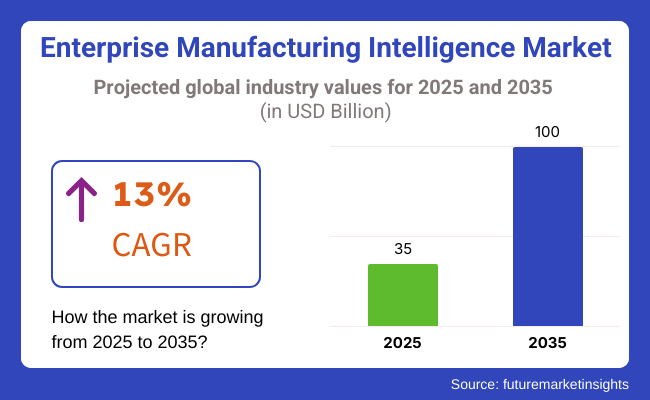

The enterprise manufacturing intelligence market is expected to become USD 35 billion in 2025 and grow to USD 100 billion by 2035, which represents a CAGR of 13% over the forecast period.

Organizations are utilizing AI-based enterprise manufacturing intelligence (EMI) systems, cloud-based analytics, and real-time integration of data technology to enhance their operational efficiency and to make more effective decisions. Spending on smart factory initiatives, predictive maintenance, and digital transformation will further foster industry expansion.

Companies utilize EMI systems to simplify manufacturing processes, improve data openness, and ensure adherence to high-quality standards. The convergence of AI-driven analytics, blockchain-based data protection, and IoT-facilitated manufacturing insights will augment real-time monitoring and automation.

Other than this, increasing adoption of stand-alone and embedded EMI solutions in process and discrete industries will drive the industry. Oil & gas, food & beverage, and semiconductor industries are increasingly implementing EMI software and services to automate processes, reduce production bottlenecks, and ensure regulatory compliance.

Explore FMI!

Book a free demo

The industry is undergoing rapid transformation, driven by the high need for real-time data analytics and enhanced decision-making across numerous areas. Automotive and aerospace industries, being the leaders in real-time analytics, operational efficiency, and regulatory compliance, must employ advanced precision manufacturing methodologies to fulfil their needs. While the food & beverage and pharmaceutical sectors concentrate on adhering to safety norms, they also employ EMI for the detecting of quality flaws.

Compared to other sectors, the electronics sector, which has the highest requirement for speed and visibility in the supply chain, focuses on the AI and IoT combination for predictive metrics and process upgrade. The factor that is determinant in adoption is cost-benefit, which applies especially to industries with less profit margin.

Due to the increase in the Industry 4.0 era, the need for intelligent manufacturing solutions which promote operational efficiency and effective management of the supply chain has risen, turning EMI into an essential technology for the current manufacturing facilities.

| Company | Contract Value (USD Million) |

|---|---|

| Siemens and Altair | Approximately USD 10,500 - USD 10,700 |

| Paeonia Industries and Savant Group | Approximately USD 500 - USD 600 |

The industry grew in size from 2020 to 2024, as manufacturers seeking data-driven initiatives to drive efficiency, minimize downtime, and improve quality. The escalating trend of intelligent manufacturing based on big data, IoT, and AI was the force behind this transformation, redefining how production can be monitored and analyzed. EMI solutions focused on MES and ERP systems helped achieve real-time awareness, predictive maintenance costing and calculation, and workflow optimization.

Adoption was accelerated by the COVID-19 pandemic, that pushed for remote monitoring and automation. Another driving factor for EMI adoption was compliance with regulation (ISO 9001, FDA and others ) that allows achieving traceability and quality control. Well benefited cloud computing brought data together in the mainstream making it possible for people to collaborate. Issues such as data silos, integration challenges and security risks continued to be relevant.

From 2025 to 2035, like everything else, EMI will follow the trend of AI aided analytics, quantum computing and distributed intelligence. Automation will help mechanize scheduling, inventory management and energy efficiency guided by A.I., and quantum computing will bring ultra-high-speed simulation and anomaly detection.

This will enable more robust traceability through blockchain, and open the door for predictive maintenance with digital twins. Edge computing will enable real-time processing, while sustainability enabled by AI and machine learning will optimize power and waste. The future smart factories would be independent and able to adapt to the changing demands of the market as needed.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter industry regulations (ISO 9001, FDA 21 CFR Part 11, GDPR) pushed manufacturers to manage data more effectively, ensure traceability, and document real-time compliance. | AI-driven, blockchain-secured EMI platforms ensure automated regulatory compliance, decentralized verification of data integrity, and real-time audit trails for effective manufacturing governance. |

| AI-driven EMI solutions enabled predictive maintenance, real-time process optimization, and anomaly detection in manufacturing processes. | AI-born, autonomous-improving EMI platforms self-tune manufacturing processes, improve predictive analytics, and provide AI-based autonomous decision-making for smart factories. |

| Industrial producers shifted to cloud-backed EMI platforms to extend data analytics, provide cross-factory visibility, and enhance decision-making. | AI-secured, decentralized EMI ecosystems provide cloud-to-edge real-time synchronization, AI-based predictive analytics, and automated performance tuning for future-generation digital manufacturing. |

| EMI systems embedded in IoT sensors provided real-time machine data for production efficiency optimization and downtime reduction. | Edge-native, AI-powered EMI solutions autonomously monitor real-time IoT data, forecast production inefficiencies, and make self-adjusting smart factories possible with ultra-low latency analytics. |

| Industrial manufacturers adopted digital twins to simulate manufacturing environments, identify inefficiencies, and automate process control. | Digital twin EMI solutions applied in real-time with artificial intelligence automatically track production conditions, forecast failure before it happens, and support AI-facilitated self-optimization of processes. |

| Cyberattacks increased the use of AI-based security monitoring, machine data transmission end-to-end encryption, and zero-trust architecture in EMI solutions. | Quantum-secure, AI-native EMI frameworks proactively identify cyberattacks, apply real-time anomaly blocking, and provide tamper-proof, AI-based manufacturing data protection. |

| Data transmission among production facilities was enhanced through 5G connectivity, facilitating real-time analytics for flexible manufacturing processes. | AI-enabled, 6G-based EMI platforms ensure real-time data synchronization, lightning-fast AI-driven predictive analysis, and real-time autonomous process adaptation for hyperconnected smart manufacturing. |

| Energy-conscious manufacturers optimized energy usage by integrating EMI with energy management systems to minimize carbon footprints. | AI-enabled, carbon-aware EMI solutions use smart energy distribution, real-time sustainability monitoring, and AI-enabled green manufacturing optimization for sustainable industry makeover. |

| Blockchain-enabled EMI solutions enhanced traceability, minimized fraud, and guaranteed secure, transparent manufacturing processes. | AI-powered, decentralized EMI platforms facilitate immutable manufacturing traceability, blockchain-enabled inventory optimization, and AI-powered supply chain risk management. |

| AI-driven EMI facilitated real-time data-driven decision automation, minimizing human intervention and enhancing operational efficiency. | AI-powered, fully autonomous EMI solutions utilize deep learning, self-optimizing industrial analytics, and real-time AI-driven workflow orchestration for next-generation manufacturing intelligence. |

The industry is met with several risks concerning data security, system integration, regulatory compliance, and tangible advancements. Businesses need to prioritize assessing these risks to the full extent for the purpose of ensuring profitability, data accuracy, and business continuity.

Data security and cyber threats come in first on the list of dangers. EMI platforms are seen as the precious stones in the crown with their use of real-time production information in large quantities that is available to be aggregated and analyzed, and this makes them prone to the actions of cybercriminals. If one such incident occurs, the company will accede to discrepancies, cash outflows, and loss of client trust. To address this issue, companies must have strong cyber defenses established.

Another dilemma is system integration and interoperability. EMI solutions should automatically interconnect with the current enterprise resource planning (ERP), manufacturing execution systems (MES), and industrial IoT (IIoT) platforms.

Problems related to compatibility due to the age of some machines (legacy systems) and lack of the newest software (modern EMIs) can trigger data discrepancies and lessen productivity. Manufacturers are responsible for the inclusion of multi-platform integration and real-time data synchronization in all proposed EMI solutions.

Thus, through proactively dealing with these risks, companies will be able to have the smooth EMI implementation as well as the efficiency of the entire operation and even increase the long-term growth of the overall manufacturing sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

| UK | 9.9% |

| European Union | 10.1% |

| Japan | 10.0% |

| South Korea | 10.4% |

The USA industry grows as manufacturers adopt advanced analytics, automation, and predictive maintenance technology. Automotive, aerospace, and industrial manufacturing industries apply EMI solutions for enhanced decision-making and production effectiveness. Government regulations encourage enterprises to implement scalable and secure EMI platforms in order to gain competitiveness in the global industry.

FMI is of the opinion that the USA industry is slated to grow at 10.2% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| AI-Driven Analytics | Firms utilize AI to analyze real-time production data in an attempt to enhance efficiency and minimize downtime. |

| Digital Twin Technology | Enabling businesses to simulate production environments in a quest to inspire maximum predictive operations and maintenance. |

| Regulatory Compliance | Government regulations compel businesses to deploy secure and open EMI systems. |

| Cloud-Based Solutions | Firms invest in scalable EMI solutions based on the cloud to combine and access data with ease. |

The UK industry is expanding, with industries adopting AI-driven analytics, IoT-based monitoring, and automation to improve manufacturing productivity. Companies implement EMI solutions to optimize productivity, automate processes, and deliver quality levels. The government provides support for digital transformation, and hence, companies are modernizing their manufacturing infrastructure.

FMI is of the opinion that the UK industry is slated to grow at 9.9% CAGR during the study period.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| IoT Integration | Temperature manufacturers make use of IoT sensors to monitor performance in real-time and retain predictions to avoid breakdowns. |

| Automation Adoption | Corporations adopt automation to enhance production efficiency and reduce operational costs. |

| Data-Driven Decision-Making | Corporations make use of real-time analysis to simplify resource usage and enhance productivity. |

| Regulatory Frameworks | The government adopts policies promoting digital transformation and industrial modernization. |

The European Union industry is facilitated by collaboration among manufacturers with machine learning, data analytics, and cloud EMI offerings. France, Italy, and Germany are at the forefront of industrial process optimization, process automation, and predictive maintenance. EMI deployment is initiated by increasing manufacturing openness along with quality control needs.

FMI anticipates the EU industry to achieve a 10.1% CAGR during the projected period. FMI is of the opinion that the EU industry is slated to grow at 10.1% CAGR during the study period.

EU Growth Factors

| Key Drivers | Details |

|---|---|

| Industrial Automation | Production processes are confirmed by manufacturers using cutting-edge automation technologies. |

| GDPR Compliance | Businesses implement EMI solutions with secure implementations in order to remain compliant with robust data security measures. |

| AI & Machine Learning | Businesses utilize AI-powered analytics for open processes and efficiency optimization. |

| Digital Twin Enhancement | Industries have digital twin configurations for service and production awareness forecasting. |

The Japanese industry grows as companies embrace AI-based performance monitoring, real-time analytics, and intelligent manufacturing solutions. Industrial robotics and precision manufacturing are the focus in Japan, driving the adoption of EMI platforms. Cloud EMI is embraced by electronics, automotive, and robotics industries to enhance production intelligence and scalability.

FMI is of the opinion that the Japanese industry is slated to grow at 10% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Smart Factory Initiatives | Companies utilize EMI to aid Industry 4.0 and automation initiatives. |

| AI-Based Monitoring | Manufacturers employ AI-based systems to enhance efficiency and minimize errors. |

| High-Tech Manufacturing | The automotive and electronics sectors in Japan depend on EMI to sustain production volumes. |

| Cloud-Based Integration | Companies utilize scalable EMI systems for enhanced data management. |

The South Korean industry experiences rapid growth as companies adopt real-time performance monitoring, AI-based analytics, and data security through blockchain. Government-driven smart factory initiatives propel EMI adoption among industrial manufacturing companies. 5G and edge computing advancements further cement the industry.

FMI is of the opinion that the South Korean industry is slated to grow at 10.4% CAGR during the study period.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| 5G & Edge Computing | Manufacturers employ fast connectivity to operate data in real time. |

| Data Security Blockchain | The industry employs blockchain EMI solutions for greater security and openness. |

| AI-Based Process Optimization | Companies employ AI for production prediction and decision-making. |

| Government Incentives | National policies dictate investment in smart factory technology. |

Based on the deployment model, the industry is segmented into embedded and standalone industries.

Embedded EMI solutions are integrated within existing manufacturing execution systems (MES), enterprise resource planning (ERP), and industrial automation platforms. These solutions enable real-time data analytics, predictive maintenance, and performance monitoring as part of operational workflows with no separate infrastructure requirements.

Some companies that provide embedded EMI systems (e.g., Siemens, Rockwell Automation, GE Digital) integrate with industrial IoT (IIoT) devices and AI-driven analytics to help manufacturers reduce downtime, maximize production efficiency and improve decision-making.

The automotive, aerospace, and pharmaceutical industries have highly complex and automated environments and require the operational excellence provided by real-time insight; therefore, embedded solutions are growing increasingly popular with them.

Standalone EMI solutions are typically standalone analytics platforms that can aggregate data from disparate sources such as shop floor sensors, SCADA systems, or cloud-based industrial data lakes. These solutions offer much more flexibility and are typically used by manufacturers that require customized reporting querying and performance benchmarking across facilities and centralized management of data.

Standalone EMI software with AI-plug-in analytics, KPI tracking, and configurable dashboards are being offered by companies like Schneider Electric, SAP, and ABB. A particularly good model is this deployment type, primarily for the mid-sized and multi-site types of manufacturers in the industry who want to have a scalable implementation for manufacturing intelligence without ripping and replacing their existing infrastructure.

The industry is bifurcated into software and services, both of which are significant contributors to manufacturing industries' data-driven manufacturing operations decision-making approaches.

Software solutions play a key role in EMI systems, providing real-time analytics, predictive maintenance, process optimization, and visualization tools. These allow us to integrate with manufacturing execution systems (MES), enterprise resource planning (ERP), and industrial IoT (IIoT) to have an insightful view of production processes.

Industry leaders such as Siemens, SAP, and Rockwell Automation offer EMI software with AI-powered insight, machine-learning-based anomaly detection, and cloud-based manufacturability intelligence platforms.

These solutions help manufacturers drive out inefficiencies, improve production flows, and enhance their overall equipment efficiency (OEE). With the global trend toward Industry, broad Terms like EMI software are experiencing explosive growth in specific industrial areas (like automotive, pharmaceuticals, and electronics) where every second counts.

Some of the services in the EMI industry include consulting, system integration and implementation, training, and support & maintenance. With the increasing complexity of EMI solutions, organizations need expert guidance to tailor, implement, and optimize these systems to suit their specific manufacturing contexts.

Specialized EMI services are provided by firms such as Schneider Electric, ABB, and Honeywell that assist companies in optimizing operations, data accuracy, and maximizing returns on their technology investments. Managed services and cloud-based EMI support are also growing in demand, as manufacturers can now outsource data analytics and system management, alleviating pressures on in-house IT teams.

The industry is fast growing as an entity because manufacturers transform their operations with data-driven solutions that improve operational efficiency and production visibility as well as real-time decision-making. EMI solutions unite AI-optimized analytics with cloud-enabled intelligence together in a single integration, thus embracing IoT-enabled data collection activities with an end-to-end optimization approach to manufacturing processes, predictive maintenance, and quality control.

Industry leaders like SAP, Rockwell Automation, Emerson Electric, Siemens, and GE Digital have EMI solutions, advanced industrial analytics, and end-to-end digital transformation solutions under their total control. These players are all focusing their interest on predictive analytics, AI-powered readymade and tailored industry solutions, and edge-supported computing, and therefore, competition has been stiffened.

Industry evolution has been mainly the result of Industry 4.0 deployment, smart factory support programs, and the quest for real-time operational insight. Machine learning-based anomaly detection, cloud-native EMI solutions, and adaptive manufacturing intelligence maximize efficiency in production and supply chain workflows.

Regulatory compliance, the importance of cybersecurity in industrial networks, and the convergence of IT with the OT are strategic attributes that are influencing competition. Scalable EMI solutions, AI-enabled decision support systems, and digital twin incorporation are features that can give enterprises a boost toward gaining the edge in next-generation manufacturing intelligence.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SAP SE | 20-25% |

| Rockwell Automation | 15-20% |

| Emerson Electric Co. | 12-17% |

| Siemens AG | 8-12% |

| GE Digital | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| SAP SE | Provides AI-driven enterprise manufacturing intelligence solutions, cloud-based data integration, and predictive analytics. |

| Rockwell Automation | Develops real-time production monitoring, industrial IoT analytics, and workflow automation solutions. |

| Emerson Electric Co. | Specializes in manufacturing execution systems (MES), AI-powered data insights, and process optimization tools. |

| Siemens AG | Focuses on smart manufacturing platforms, IoT-enabled data collection, and digital twin technology. |

| GE Digital | Offers AI-enhanced industrial analytics, cloud-based predictive maintenance, and real-time data processing. |

Key Company Insights

SAP SE (20-25%)

SAP SE is a dominant player in the EMI space, offering AI-based analytics, cloud data management, and real-time production intelligence solutions.

Rockwell Automation (15-20%)

Rockwell Automation works to boost manufacturing productivity through industrial IoT analytics, real-time insights for production, and workflow automation tools.

Emerson Electric Co. (12-17%)

Emerson Electric Co. is a provider of manufacturing execution systems, predictive analytics, and process optimization solutions.

Siemens AG (8-12%)

Siemens AG drives innovation in smart manufacturing with IoT-enabled data platforms, digital twin technology, and advanced industrial automation.

GE Digital (5-9%)

GE Digital builds industrial intelligence on AI with predictive maintenance analytics and cloud-based manufacturing data solutions.

Other Key Players (20-30% Combined)

The industry will continue to grow as industries integrate AI, cloud computing, and real-time analytics to optimize manufacturing processes, improve efficiency, and enhance operational visibility.

The industry is slated to reach USD 35 billion in 2025.

The industry is predicted to reach a size of USD 100 billion by 2035.

Key players include SAP SE, Rockwell Automation, Emerson Electric Co., Siemens AG, GE Digital, Honeywell Process Solutions, AVEVA Group, Oracle Corporation, Schneider Electric, and Dassault Systems.

South Korea, with a CAGR of 10.4%, is expected to record the highest growth during the forecast period.

Embedded solutions are among the most widely used in the industry.

BY deployment type, the industry is divided into embedded and standalone.

By offering, the industry includes software and services.

By end-use industry, the industry is segmented into process industry (chemical, energy & power, food & beverage, oil & gas, pharmaceutical, others - mining & metals, paper & pulp) and discrete industry (aerospace & defense, automotive, medical devices, semiconductors & electronics).

By region, the industry spans North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.