The global enterprise laboratory informatics market is set to witness USD 5.4 billion in 2025. The industry is poised to register 8.3% CAGR from 2025 to 2035, witnessing USD 11.6 billion by 2035.

Demand for enterprise grade laboratory informatics solutions is primarily fueled by the growing need of efficient management of data while meeting stringent regulatory requirements and enhanced productivity in research. The utilization of electronic platforms is increasingly being used in laboratories to monitor samples, automate reporting, and link laboratory equipment with fewer manual errors and greater operational accuracy.

The enterprise laboratory informatics is the department that deals with electronically based methods for laboratory automation, control of data, and regulatory compliance in the healthcare, biotechnology, pharmaceutical, and chemicals sectors.

With the increased use of automation, AI-driven analytics, and cloud-based laboratory services, laboratories are now adopting enterprise informatics systems to enhance efficiency, ensure data integrity, and facilitate collaboration. Laboratory automation solutions such as LIMS, ELNs, and SDMS are revolutionizing the way research laboratories and companies manage complex datasets and automate procedures.

Specified cloud informatics solutions for most critical elements of laboratory informatics are facilitating seamless collaboration, seamless remote access of lab information and real-time fact-based decision-making. Data safety, traceability, and openness in research and quality control workflows are also becoming more robust by being integrated with Internet of Things (IoT) devices and blockchain technology.

While industries are grappling with digitization, companies are making investments in low-cost, scalable informatics platforms that can be integrated with enterprise resource planning (ERP) and existing laboratory systems.

The biotechnology and pharmaceutical sectors are driving the trend with laboratory informatics, depending on these technologies for drug discovery, clinical research, and regulatory submissions. IAVO technology is a powerful driver for laboratory workflow automation and enhanced analytical precision for the chemical and environmental sectors.

The industry will grow exponentially due to ongoing development in AI-powered automation, cloud computing, and data analytics. As laboratories strive to become more efficient, data compliant, and in line with global standards, investment in next-generation informatics solutions, in general, is only increasing. From cultivating the quality of scientific research to interconnection with pioneering digital technologies, laboratory informatics can facilitate higher productivity, collaboration, and data-driven decision-making.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 5.4 billion |

| Industry Value (2035F) | USD 11.6 billion |

| CAGR (2025 to 2035) | 8.3% |

Explore FMI!

Book a free demo

Automated systems, cloud computing, and artificial intelligence-based data analysis are primarily the forces behind the significant changes in the industry. Laboratories are recognizing the role of the cloud as a solution for the management, efficiency, and integration of contemporary lab instruments.

Technology & connectivity issues also play a major role in the process. Integrative researchers and service providers need to find a common ground between functionality and mobility. Evolving artificial intelligence technologies and solutions with blockchain and IoT are likely to improve operation inside the laboratory.

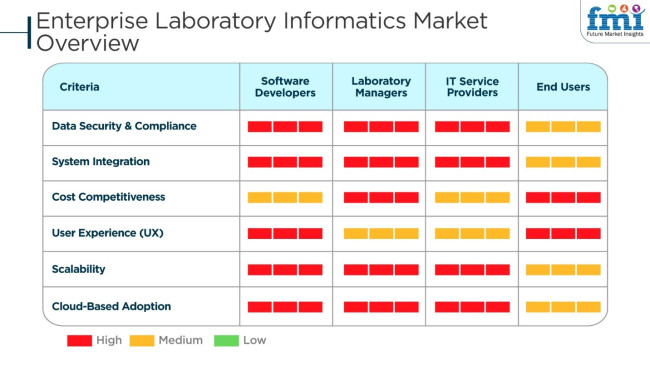

The major criteria when purchasing these instruments include the adherence to regulations (FDA, ISO, HIPAA), the cost-effective capabilities, cloud compatibility, and the utilization of AI for analytics which, in combination with, the above aspects, lead to their widespread use in the pharmaceutical, biotechnology, and chemical industries.

| Company | Thermo Fisher Scientific |

|---|---|

| Contract/Development Details | Thermo Fisher secured a multi-year contract with a leading pharmaceutical company to provide enterprise laboratory informatics solutions, including LIMS (Laboratory Information Management System) and ELN (Electronic Lab Notebook) for research and quality control. |

| Date | March 15, 2024 |

| Contract Value (USD Million) | Approximately USD 90 - USD 100 |

| Estimated Renewal Period | 5 years |

| Company | Waters Corporation |

|---|---|

| Contract/Development Details | Waters Corporation entered into an agreement with a global biotech firm to deploy cloud-based laboratory informatics software for data integrity, compliance, and automated workflows. |

| Date | July 22, 2024 |

| Contract Value (USD Million) | Approximately USD 80 - USD 90 |

| Estimated Renewal Period | 6 years |

| Company | PerkinElmer Inc. |

|---|---|

| Contract/Development Details | PerkinElmer expanded its laboratory informatics portfolio through a strategic partnership with a major healthcare research institute, focusing on AI-driven data analytics and regulatory reporting solutions. |

| Date | October 10, 2024 |

| Contract Value (USD Million) | Approximately USD 70 - USD 80 |

| Estimated Renewal Period | 5 years |

| Company | Agilent Technologies |

|---|---|

| Contract/Development Details | Agilent announced a collaboration with a top-tier chemical analysis laboratory to implement next-generation informatics platforms for seamless integration of instruments, data analysis, and real-time decision-making. |

| Date | January 5, 2025 |

| Contract Value (USD Million) | Approximately USD 60 - USD 70 |

| Estimated Renewal Period | 4 years |

High Implementation Costs and Data Security Concerns

The implementation of enterprise laboratory informatics is a major challenge owing to high installation costs and security of data. Laboratories and research centers struggle to justify the cost of shifting to completely digitalized data management systems, especially in cost-conscious markets. The inclusion of AI-powered analytics, cloud-based laboratory data management, and IoT-supported lab monitoring also heightens cybersecurity concerns, data interoperability, and regulatory compliance.

In addition, facilitating continuous integration with existing systems and new lab informatics platforms makes adoption a hurdle. In order to overcome such hurdles, technology vendors need to emphasize modular, scalable solutions, robust cybersecurity, and compliance-based frameworks to facilitate wider adoption and increased industry growth.

AI and Cloud-Driven Laboratory Informatics Solutions

Artificial intelligence and cloud-based technologies are transforming the industry by facilitating real-time data analysis, predictive diagnostics, and improved laboratory automation. AI-based informatics solutions offer in-depth insights, automated data curation, and streamlined research workflows, enhancing decision-making for businesses.

Cloud-based LIMS platforms facilitate easy data sharing, compliance tracking, and integration with healthcare and research databases, minimizing operational inefficiencies and maintaining data integrity.

As industries emphasize laboratory automation, regulatory compliance, and real-time analytics, AI-powered and cloud-based laboratory informatics solutions adoption will gain speed. Organizations making investments in AI-powered laboratory data management, cloud-based research platforms, and compliance-oriented informatics solutions will attain a competitive edge in the rapidly changing marketplace.

From 2020 to 2024, the industry experienced expansion as laboratories are adapting to digital advances. This has brought efficiency in managing the data, regulatory compliance, and enhancing operational efficiency. This raised an unprecedented demand for Laboratory Information Management Systems (LIMS) and Electronic Lab Notebooks (ELNs) that drove the need for automation in the pharmaceutical, biotech, and chemical industries.

Cloud-based computing platforms became common in informatics, enabling access anytime and anywhere with real-time collaboration. Integration with artificial intelligence and data analytics software supported better decision-making, and also adherence to stringent regulatory requirements made sure that investments are made in safe and scalable informatics solutions.

Between 2025 and 2035, new AI, machine learning, and blockchain trends will reorient laboratory informatics as it introduces stronger data security, predictive analytics, and process automation. Standards within the industry would be built around creating cloud-native and interoperable systems to facilitate smooth data sharing across global research networks. Enterprise laboratory informatics would thrive with the shift toward sustainability and digitalization in labs.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory agencies like the FDA, EMA, and ISO imposed tighter compliance on laboratory data integrity, compelling labs to implement secure, audit-ready informatics solutions. | AI-powered regulatory compliance automation guarantees real-time compliance with changing industry regulations, allowing automated audit trails, electronic lab notebooks (ELNs), and digital signatures for effortless validation. |

| AI-facilitated informatics platforms that were optimized to analyze data better, automate workflows, and recognize patterns better in the labs. | Self-sustaining labs with AI-facilitated capabilities utilize predictive analytics, real-time anomaly identification, and self-improving algorithms to hasten drug discovery, material science, and targeted diagnostics. |

| Laboratories have moved away from local informatics systems to cloud-based Laboratory Information Management Systems (LIMS) to gain better accessibility, collaboration, and scalability. | Artificial intelligence-based multi-cloud informatics environments facilitate remote lab operations in real-time, decentralized research collaboration, and data sharing across institutions with sophisticated security measures. |

| Internet of Things-based instruments and networked devices automated sample tracking, minimizing errors and enhancing the accuracy of laboratory operations. | AI-based smart laboratories employ autonomous Internet of Things-based robotics and AI-based decision-making for completely automated, high-throughput research spaces with minimal human intervention. |

| Laboratories have been struggling with the integration of various sources of data. All of them desire the standardization of the protocols of communication and data formats. | A real-time harmonization of data across different systems stands for in-house enterprise-wide data lakes, ELNs, LIMS, and CDS interoperate using artificial intelligence-informed informatics platforms. |

| The increasing risk of cyber-attacks and data breaches has forced laboratories to upgrade systems on encryption, role-based access, and blockchain-enabled data integrity validation. | Quantum-resistant encryption-based AI-powered cybersecurity solutions guard principal research data, offering tamper-evident digital evidence and compliance with global data protection regulations. |

| These systems offered instant insights for optimizing experimental results and lessening the duration of R&D cycles within the setting of AI-based decision-support systems in the laboratory. | Automatic interpretation of difficult data, the formation of real-time hypotheses, and the assistance of researchers with AI-guided predictive modeling for expedited discovery. |

| The laboratories adopted electronic records and energy-efficient systems to avoid and minimize the paper content and impact on the environment. | AI-led sustainability analytics optimize laboratory resources and transform the green laboratory into one that runs on smart energy management, green chemistry tracking, and carbon-neutral research operations. |

| Laboratory informatics solutions have entered genomic research, enabling advancement in precision medicine with AI-driven data analysis. | AI genomic informatics platforms allow for real-time analysis of multi-omic data to accelerate drug development, gene therapy research, and patient-specific treatment protocols. |

| AI-based lab informatics platforms assisted in compound screening, biomarker discovery, and further development of early-stage drug development. | AI-based lab informatics platforms assisted in compound screening, biomarker discovery, and further development of early-stage drug development. |

In the industry of enterprise laboratory informatics, the topmost risk is data security and regulatory compliance. Laboratory informatics systems deal with sensitive data related to research, patient records, and also intellectual property, making them a target for potent cyber threats and data breaches. Compliance with the likes of HIPAA, GDPR, FDA 21 CFR Part 11, and Good Laboratory Practices (GLP) is a must and failing to do so means the company has to go through legal penalties and infringe on its reputation.

Integration issues and interoperability risks are primary worries. Enterprise laboratory informatics tools, like Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), and Scientific Data Management Systems (SDMS), are required to be integrated smoothly into the existing technical ecosystem which includes the enterprise software, the analytical instruments, and the cloud platforms. If they are not compatible, it may disrupt laboratory operations and increase costs, and the time added to implementation can add more pressure.

The costly implementation and maintenance likewise financial risks for laboratories which are primarily for small and mid-sized enterprises (SMEs). The application of informatics solutions, which are also IT solutions, brings concrete barriers to small and mid-sized companies (SMEs) due to the necessary first expense, ongoing software updates, and IT infrastructure which comes from their restricted budget.

Technological improvements accompanied by rapid innovation provide both opportunities and perils. The introduction of automated artificial intelligence (AI), the cloud-based data management system, and blockchain for the data security issue are the necessities for the companies to stay ahead in the race, so they must be regularly updated. Dealing with the failure of adopting the new technologies results in carrying the old systems and bad productivity.

A LIMS (Laboratory Information Management System) is a highly competent software to manage and optimize laboratory processes such as sample tracking, data management, compliance with various regulations, and much more. They make laboratory more efficient - digitizing data entry, developing standard operating procedures, and delivering real-time analytics for timely decision-making.

Thermo Fisher Scientific Company is among the best LIMS providers and has SampleManager LIMS, an integrated platform that provides data management, workflow automation, and regulatory compliance capabilities. In this sense, it is a highly favored technology for improving laboratory efficiency and data integrity in pharmaceutical, environmental, and clinical research laboratories.

Software solutions comprise LIMS, ELNs, Scientific Data Management Systems (SDMS), and other types of Informatics platforms. These solutions enable the seamless operation of laboratories by enhancing data collection, automation, and analysis.

Open Lab CDS by Agilent Technologies, Inc. is a chromatography data system that integrates with lab instruments and ensures compliance and high-quality analysis of the disparate data collected over time. Agilent provides software solutions for pharmaceutical, chemical, and food testing laboratories.

Cloud-based enterprise laboratory informatics is increasingly becoming the more widely used solution compared to on-premise systems, and there are several reasons for this shift. One of the most significant advantages of cloud-based systems is the scalability they offer.

Organizations can easily scale up or down based on their specific needs, whether it's handling an increase in data or adding new functionalities. This flexibility is particularly valuable for enterprises that need to adapt quickly to changes in laboratory requirements or workflows without the burden of investing in additional infrastructure.

The pharma industry is among the key end-use industries for enterprise laboratory informatics. There are various reasons why this industry greatly depends on laboratory informatics solutions. It has sophisticated process of drug discovery, development, and manufacturing where data management, regulatory compliance, and accuracy become essential.

Laboratory informatics solutions allow pharmaceutical firms to efficiently handle large volumes of data created during research and development, clinical trials, and manufacturing operations. Laboratory informatics solutions streamline processes, enhance data accuracy, and make data easily accessible and analyzable, which is critical for making informed decisions across the product life cycle.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 9.3% |

| China | 9.8% |

| Germany | 8.7% |

| Japan | 8.9% |

| India | 10.1% |

| Australia | 8.5% |

The USA industry is expanding at a fast rate fueled by the growing use of cloud-based lab management systems, digitalization of the life sciences sector, and artificial intelligence-based data analytics. Laboratory informatics is used by the pharmaceutical and healthcare sectors to automate laboratory activities, offer regulatory compliance, and enable data-driven decision-making.

Ongoing investment in electronic laboratory notebooks (ELNs), lab information management systems (LIMS), and artificial intelligence (AI) data integration ongoing continues to demand enterprise laboratory informatics solutions. Public and private sector spending on laboratory automation and informatics infrastructure in the year 2024 surpassed USD 12 billion. FMI is predicting the USA industry to expand at a 9.3% CAGR over the course of the study.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Development of Cloud-Based Lab Management Systems | Greater adoption of SaaS-based informatics platforms enhances productivity and collaboration. |

| Evolutions in AI-Powered Data Analytics | AI-powered lab informatics solutions enhance data integration, analysis, and decision support. |

| Expanding Applications in the Pharmaceuticals, Biotechnology, and Healthcare Industries | Lab informatics enhances compliance, R&D effectiveness, and drug development processes. |

The enterprise lab informatics industry of China is growing because of record growth in the pharmaceutical, chemical, and biotech sectors as well as government-led initiatives for digital healthcare. Being the world's largest API manufacturer, China is witnessing a growing need for laboratory data management, AI-based lab automation, and cloud informatics solutions.

Emphasis on digitalized healthcare and regulatory compliance has also driven industry growth. China spent USD 14 billion in laboratory informatics and AI-based research solutions in 2024. FMI estimates China's industry to expand at a 9.8% CAGR during the forecast period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Incentives for Pharma and Digital Healthcare R&D | Compliance-eliciting policies and laboratory automation fuel adoption. |

| Faster Adoption of Big Data and AI for Laboratory Processes | Increased application of analytics and machine learning for improving research results. |

| Aggressive Adoption in Chemical Testing, Food Safety, and Biopharma | Informatics in the lab enhances regulatory compliance and data accuracy. |

Germany's pharma and biotech sectors drive the nation's enterprise laboratory informatics industry thanks to sophisticated pharma and biotech industries, expanding laboratory digitization, and rising regulatory compliance emphasis.

Germany, as the leading research science center in Europe, is investing in LIMS, ELNs, and data-centric laboratory automation to propel greater operational efficiency. The necessity to adhere to GDPR and data privacy has also contributed to the increased adoption of strong informatics platforms. FMI projects Germany's industry to achieve an 8.7% CAGR during the study period

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Strong Adoption of Digital Lab Technologies | German pharmaceutical companies and research centers utilize informatics to maintain data integrity and productivity. |

| Growing Need for Compliant and Secure Laboratory Informatics | Stringent EU regulations fuel expenditure on data protection and audit trails. |

| Technical Developments in AI and IoT-Based Laboratory Automation | Greater use of IoT devices to monitor the laboratory in real time. |

Japan's enterprise lab informatics industry is growing with the evolution of precision medicine, growth in biomedical research funding, and adoption of AI-based laboratory automation. Laboratory informatics is being used by the life sciences and pharmaceutical sectors to automate clinical trial and research operations.

Japan's leadership in robotics and AI has driven the adoption of digital laboratory management systems for life sciences and healthcare applications. FMI expects Japan's industry to grow at 8.9% CAGR during the forecast period.

Growth Drivers in Japan

| Driver | Details |

|---|---|

| Adoption of AI and Robotics in Laboratory Informatics | Japan leads in lab automation and analytics through AI. |

| Advances in Genomics and Precision Medicine | Rising need for bioinformatics solutions in research for personalized medicine. |

| Evolution of Cloud-Based Laboratory Management Systems | Rising adoption of SaaS-based lab informatics platforms for smooth data sharing. |

India's corporate laboratory informatics sector is expanding very fast on the back of growth in pharma R&D investments, rising demand for digital lab solutions, and growing clinical research activity. Along with government schemes like 'Make in India' and growing usage of AI-driven lab automation, India is also seeing robust demand for cost-competitive and scalable laboratory informatics solutions. Growing adoption of cloud-based ELNs and LIMS is also fueling industry growth. FMI expects the Indian industry to register a 10.1% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Policies for Digital Healthcare and Pharma R&D | Government policies for digitalization propel informatics adoption. |

| Expansion in Contract Research Organizations (CROs) and Biotech Startups | Demand for cloud-based laboratory management systems is on the rise. |

| Emerging Demand for Low-Cost and Scalable Informatics Solutions | Small and medium-sized businesses are embracing AI-based platforms. |

Australia's enterprise lab informatics market is gradually expanding because of rising investment in biotech research, digital health, and data analytics using AI. Research institutions by the Australian government, pharma institutions, and university institutions are adopting laboratory informatics to increase regulatory compliance and process automation. The Australian government's commitment towards creating life sciences innovation is promoting high-end informatics solution adoption.

Growth Drivers in Australia

| Key Drivers | Information |

|---|---|

| Government Initiatives towards Biomedical Research and Digitalization of Health | Policies to fuel lab automation and informatics adoption. |

| Scaling Data-Driven and AI Lab Analytics | Greater use of predictive analytics and machine learning in lab research. |

| Greater Demand for Cloud-Based and Secure Informatics Solutions in the Lab | Industry verticals are utilizing SaaS-based offerings to foster collaboration and data integrity. |

The enterprise laboratory informatics market is on the ascent with a paramount for optimized data management systems, regulatory compliance mechanisms, and AI-enabled analytics footprints in laboratory settings. The healthcare, pharmaceutical, biotech, and chemical organizations hence benefit from such advanced development because they bring better data accuracy and worker productivity by improving research and quality control processes.

The trend in the competition is moving toward cloud-based LIMS, ELNs, and AI-enabled data analytics, where key players are focusing on improving efficiency and decision-making in laboratories. Market dynamics are accented by strategic partnerships, mergers, and acquisitions to optimize informatics capabilities and integrate with automation technologies.

Continued by regulatory compliance, which is a key differentiator, companies invest in just those compliant, validated, secure platforms that encompass strict industry standards such as FDA 21 CFR Part 11 and ISO 17025. That is coupled with the increasing demand for real-time collaboration and remote access through interoperable, scalable solutions, which raises the competition level.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific | 20-25% |

| LabWare | 15-20% |

| PerkinElmer Inc. | 10-15% |

| Abbott Informatics | 8-12% |

| Agilent Technologies | 5-10% |

| Dassault Systèmes | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific | LIMS, ELN, and cloud-based informatics solutions for lab automation. |

| LabWare | Comprehensive LIMS solutions tailored for various industries. |

| PerkinElmer Inc. | AI-powered analytics, electronic laboratory notebooks, and data management platforms. |

| Abbott Informatics | STARLIMS solutions for compliance, quality control, and lab efficiency. |

| Agilent Technologies | Integrated informatics platforms for analytical laboratory data management. |

| Dassault Systèmes | BIOVIA solutions for research data management, collaboration, and automation. |

Key Company Insights

Thermo Fisher Scientific (20-25%)

The leader in the enterprise laboratory informatics sector, Thermo Fisher provides LIMS, ELN, and cloud-based solutions for automating processes and compliance with regulations.

LabWare (15-20%)

LabWare specializes in full-scale LIMS solutions with applications for any industry, from pharmaceuticals to environmental research, and as such, robust lab data management.

PerkinElmer Inc. (10 to 15%)

PerkinElmer is engaged in providing artificial intelligence-powered analytics and electronic laboratory notebooks capable of providing the best efficiencies to laboratories in streamlining their operations and improving data accuracy.

Abbott Informatics (8-12%)

With its STARLIMS solutions on data integrity, data security, and effectiveness, Abbott's STARLIMS solutions are usually regarded as very much preferred solutions in highly regulated industries.

Agilent Technologies (5-10%)

Integrated informatics platforms from Agilent Technologies aim to be designed for analytical laboratories with unified data management and workflow automation.

Dassault Systèmes (4-8%)

BIOVIA solutions from Dassault Systèmes empower data-smart research, collaboration, and automation inside labs.

Other Key Players (30-38% Combined)

The industry is slated to reach USD 5.8 billion in 2025.

The industry is predicted to reach USD 11.9 billion by 2035.

LabWare, LabVantage Solutions, Inc., Agilent Technologies, Waters, LabLynx, Dassault Systèmes, LABWORKS LLC, Autoscribe Informatics, PerkinElmer, and Accelerated Technology Laboratories are key players in the laboratory information management systems (LIMS) industry.

India, slated to grow at 10.1% CAGR during the forecast period, is poised for the fastest growth.

Laboratory Information Management Systems (LIMS), Electronic Lab Notebooks (ELN), Scientific Data Management Systems (SDMS), and Laboratory Execution Systems (LES) are among the most widely used solutions in the enterprise laboratory informatics market.

By type the market segments into LIMS, ELN, CDS, EDC, CDMS, LES, ECM, and SDMS.

In terms of components, the market is segmented into software and services.

In terms of delivery, the market categorizes into on-premise and cloud.

By industry, market includes CRO, CMO, Pharma, Biotech, Chemical, Agriculture, Oil, and Gas.

Region-wise, it covers North America, Latin America, Asia Pacific, MEA, and Europe.

DC Power Systems Market Trends - Growth, Demand & Forecast 2025 to 2035

Residential VoIP Services Market Insights – Trends & Forecast 2025 to 2035

Switching Mode Power Supply Market - Growth & Forecast 2025 to 2035

Safety Mirrors Market - Growth & Forecast 2025 to 2035

Heat Interface Unit Market Analysis - Size, Demand & Forecast 2025 to 2035

Induction Motors Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.