From 2025 to 2035, the enterprise drone management solutions market is projected to experience substantial growth, driven by technological innovation and rising commercial adoption. The market is expected to grow from USD 2.09 billion in 2025 to USD 10.70 billion by 2035, a robust CAGR of 17.7 percent over the forecast period.

As drones are increasingly being used in industries, greater numbers also need to be integrated into sophisticated management solutions. This has led to the emergence of more efficient fleet management, AI -powered analytics and improved regulatory compliance following the gradual introduction of new rules over time. Drones have now become invaluable tools in industries such as logistics, construction, agriculture, and public security. Approving real-time monitoring, automated transport and aerial inspections using drones.

Management systems for drones also enable large UAV operations, monitor airspace regulations with evolving adaptation, and make flight paths more efficient. Among other benefits, the use of cloud-based task force management for drones and real-time air traffic control is improving operations and reducing risks of operation. Several key drivers are powering this industry forward.

More and more drones are being used in industries such as enterprise-scale aerial mapping, precision agriculture, infrastructure surveillance and disaster response, which is increasing demand for large -scale management solutions. Now drones work independently, performing surveillance and preventative checks and making decisions based on facts.

Artificial intelligence also is being used by regulatory policies beyond the line of sight to broaden opportunities for drones in industries that need long range flights (to carry out missions without interruption) or their own choices about where they will go in service. The emergent business models of drone-as-a-service (DaaS) offer companies efficient alternatives to buying drones, which is likely to stimulate more growth in the industry. While the industry poses robust potential for growth, it will be assailed by a variety of challenges.

Stout regulations on UAV deployment can deter their entry into specific industries, such as aviation restrictions or privacy laws. In addition, high capital upfront payments for AI integration, as well as enterprise drone management platforms and security related solutions could be a serious obstacle to small businesses.

Another area of trouble is the fact that the industry must itself be an area with sound cybersecurity structures, because from data safety breaches, network vulnerabilities, potential hacking and attack on communication channels systems for drones have happened before. Both these concerns require extensive treatment.

The industry is witnessing a raft of innovations thanks to technological breakthroughs and novel business models. Utilizing artificial intelligence-based drone air traffic management for UAVs handles management of densely populated airspace, generating both safety and convenience.

Moreover, growth in the adoption of drones for monitoring environment through disaster recovery smart cities reddens the wallets of solution suppliers. At the same time, between the cloud service companies, regulatory organizations and drone technology firms working together tend move ahead technology rapidly and spread practice of enterprise drone management solutions across many industries even more widely. With drone technology continuing to be embraced by industries, we anticipate that this industry will see both seismic change and endless expansion in the years ahead.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 2.09 billion |

| Industry Value (2035F) | USD 10.70 billion |

| CAGR (2025 to 2035) | 17.7% |

Explore FMI!

Book a free demo

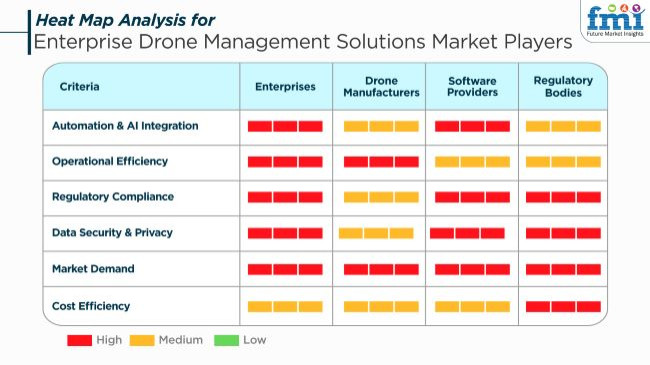

The Industry has been commercially soaring, directed by the higher use of drones in the industrial sectors such as agriculture, logistics, infrastructure inspection, and public safety. In their drive for operational speed and efficiency, enterprises often rely on automation, AI-driven analytics, and real-time data processing.

Drone producers are concerned with new UAV developments such as longer flight duration, better sensors, and less airspace regulation violations. Software developers are also part of the success, providing fleet management platforms, geofencing, automated flight planning, and AI-based analytics. Regulatory authorities, for instance, are focusing on the adherence to airspace regulations, protection of data, and application of safety measures that would cater to the prevention of unauthorized drone activities.

The major factors that drive purchasing decisions are the compliance to regulations, the degree of simplicity in integration with the current enterprise systems, cloud-based analytics, scalability, and the steps taken to ensure cybersecurity. With more and more sectors utilizing drones for the streams of data and automation, the industry for all-encompassing drone management solutions is likely to grow exponentially.

Contract & Deals Analysis – Enterprise Drone Management Solutions Market

| Company | Contract Value (USD Million) |

|---|---|

| DJI Enterprise | Approximately 100 - 110 |

| Parrot SA | Approximately 90 - 100 |

| PrecisionHawk | Approximately 80 - 90 |

| AeroVironment Inc. | Approximately 110 - 120 |

From 2020 to 2024, the industry gained momentum owing to the increased uptake of drones in various industries, including agriculture, logistics, construction, and public safety. Specifically, businesses were now taking advantage of drone technology for aerial mapping, asset monitoring, and automated inspections, thereby improving operational and cost efficiencies.

Advancements in fleet management cloud, AI-based analytics, and real-time data processing helped improve drone capabilities such that enterprises could scale their operations. Besides, regulatory challenges and issues of airspace integration and cybersecurity risks remained significant barriers to widespread adoption, necessitating governments to shape their drone usage policies and security frameworks.

Between the years 2025 to 2035, enterprise drone management foresight would be influenced by developments in autonomous navigation, swarm intelligence, and 5G-enabled remote operations. The AI optimization of flights and the blockchain securing the data will ensure enhanced regulatory compliance and greater operational transparency.

This will be further supported by making the industry's integration of drones with digital twins and IoT ecosystems possible to facilitate predictive maintenance along with real-time decision-making. As air mobility laws evolve, advanced UTM will be adopted by enterprises to pave the way for large-scale drone deployment into the commercial airspace.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| More stringent drone regulations (FAA, EASA, BVLOS) necessitated compliance-oriented drone management platforms for safe flight. | AI-driven, blockchain-protected drone compliance systems provide real-time airspace integration, automated flight approvals, and autonomous regulatory compliance for enterprise fleets. |

| AI-optimized drones maximized real-time data processing for use cases such as agriculture, infrastructure inspection, and logistics. | Artificial intelligence-powered, self-improving drone management systems automatically compute edge-based analytics, allowing for real-time decision-making, mission planning adaptability, and AI-augmented situational awareness. |

| BVLOS-capable enterprise drones opened new applications in delivery, surveillance, and industrial inspection. | AI-integrated, fully autonomous drone fleets leverage satellite connectivity and real-time AI vision for precise, ultra-long-range operations in logistics, emergency response, and aerial mapping. |

| Enterprises leveraged 5G connectivity for real-time drone telemetry, high-resolution streaming, and faster data transfer. | AI-powered, 6G-enabled drone networks enable instant, low-latency communication, real-time swarm intelligence, and high-speed data exchange between autonomous drone fleets. |

| Enterprises used cloud-based drone management platforms for remote fleet monitoring, predictive maintenance, and automated reporting. | AI-native, cloud-agnostic drone command centers enable real-time mission optimization, automated flight path adjustments, and self-healing fleet maintenance solutions. |

| Organizations strengthened drone cybersecurity with end-to-end encryption, AI-driven anomaly detection, and geofencing controls. | Artificial intelligence-based, quantum-safe drone communication protocols eliminate cyber threats, providing tamper-proof data transfer and robust drone operations in hostile environments. |

| Companies embraced DaaS solutions for drone inspections, mapping, and delivery, minimizing the cost of ownership. | AI-based, autonomous DaaS platforms deliver real-time, on-demand drone operations, allowing seamless B2B integrations in sectors like agriculture, energy, and security. |

| Drones were extensively used in smart city surveillance, traffic monitoring, and emergency response. | AI-powered, IoT-based drone networks automatically mesh with smart city infrastructure to provide real-time incident detection, AI-powered urban planning, and self-directed security patrols. |

| Companies investigated energy-efficient drone technology, such as solar-powered and hydrogen-fuel-based UAVs. | AI-optimized, autonomous drone fleets utilize renewable sources of energy, providing carbon-neutral flight operations and environmentally friendly automated drone logistics. |

| AI-powered swarm drones improved coordination in military, disaster relief, and industrial environments. | Completely autonomous, AI-driven swarm drones work together, utilizing real-time decentralized decision-making, swarm-based logistics, and coordinated AI-driven task execution. |

The drone management solutions sector in the enterprise domain is a host to various risks which are related to regulatory compliance, cyber threats, technological advancements, operational safety, and industry competition.

Among the various issues, regulatory compliance is the biggest as the operation of drones is subject to strict aviation regulations, airspace restrictions, and privacy regulations. Governments such as FAA (USA), EASA (Europe), and CAAC (China) set tough BVLOS (Beyond Visual Line of Sight) operation, remote identification, and pilot certification requirements. The companies are obliged to ensure their compliance with the changing regulations besides the avoidance of penalties and the lockdown of operations.

The threats regarding cybersecurity comprise of risks towards drone connection, navigation, and data security. GPS spoofing, signal jamming, and hacking can aggravate drone missions and compromise elite enterprise data. It is important to implement encrypted communication channels, AI-based threat detection, and secure cloud integrations.

Technological breakthroughs in AI automation, swarm intelligence, and real-time analytics are speedily transforming the sector. Companies that do not adopt AI, machine learning, and IoT solutions will be at a risk, compared to the drone fleet management system companies that provide the latest technology.

The safety risks at the operational level are caused by hardware failures, air collisions, and environmental issues. The companies in this regard must make the continuous safety-system, and the AI-enabled hurdle-detector, along with the predictive maintenance software their top priorities to lower the risks.

The industry competition gets tougher as more and more companies are joining like the renowned drone solution manufacturers (DJI, Parrot, Skydio, and the software firms focusing on the enterprise sector). Differentiating the solutions through custom applications for industries such as agriculture, logistics, construction, and security is the prime key to being a good player.

Multirotor (drone) vehicles are the most commonly utilized class in enterprise applications due to their maneuverability,ease of transportability, and hovering abilities. These drones are geared toward aerial inspections,surveillance, and high-precision imaging, so they're the best solution in construction, real estate, security, and agriculture.

This capability to maneuver in urban spaces and narrow ZIP makes them the industry's choice for performing infrastructure monitoring,asset inspection, and emergency response operations more effectively. Industry leaders like DJI Enterprise, Parrot, Autel Robotics, and others areinvesting heavily in researching new sensors, payloads, machine learning algorithms, and cloud-based Fleet management, as well as designing AI-assisted multirotor with real-time imaging and autonomous flying capabilities.

Conversely, fixed-wing drones are used for longer-range missions and cantraverse punishing altitudes in data collection. Long-endurance long-range UAVs are suitablefor mapping, surveying, pipeline monitoring, and environmental research. While fixed-wing UAVs can't hover like the multirotor, they are efficient at covering large distances, which is incredibly usefulfor oil & gas, mining, and agriculture industries, among others.

Withenterprises now looking to engage in large-scale monitoring and analytics, there is a growing adoption of fixed-wing drones for automated aerial surveys and predictive maintenance.

Tarot 2400, Photo from Quantum-Systems Several enterprise-grade fixed-wing drones with a focus on AI-driven data analytics and autonomous navigation that are purchased typically fall in this category of aerial vehicle for businesses, whichis dominated by companies such as senseFly (an AgEagle company), Delair, and Quantum-Systems.

Drone drones havethe most popular use for high-resolution imaging, such as aerial photography and remote sensing. Multispectral sensors, infrared cameras, and AI-improved image processing are utilized by sectors including agriculture, building, anddisaster management to observe crops, evaluate structural integrity, and monitor environmental changes.

The incorporation of real-time geospatial mapping with AI-powered analytics hasenhanced business decision-making. Top technology providers like DJI, Parrot,and FLIR Systems provide Nextgen drone camera solutions incorporating thermal, hyperspectral, and night vision features, aiding enterprises with operational efficiency and safety.

Data acquisition and analytics are another key area oftechnological development and in this respect, drones provide effective means of gathering, processing, and analyzing geospatial data. Big data, AI, and the integration of IoT have created a huge change for flying analytics, providing predictive maintenance to businesses, optimizingasset management, and performing infrastructure monitoring.

Various industries, like telecommunication, utility, and smart cities, are adopting dronesat a rising pace to collect large-scale information and automate processes. They all lead the way forward with cloud-based analytics, 3D modeling, and dashboards that are driven by infield dataprocessing and subsequent in-the-cloud analysis.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.4% |

| China | 11.1% |

| Germany | 9.7% |

| Japan | 9.9% |

| India | 11.5% |

| Australia | 9.8% |

The USA industry is growing at a very fast rate due to surging demand for autonomous aerial surveillance, logistics optimization, and AI-powered drone analytics. The enterprise space is adopting drone management platforms to maximize operational efficiency, enhance safety inspections, and maximize data harvesting.

With additional investments in AI-powered drone fleet management, real-time air monitoring, and secure drone data processing, the enterprise drone solution industry continues to expand. During 2024, the government and business world invested over USD 15 billion in enterprise uses of drones. FMI is of the opinion that the USA industry is slated to grow at 10.4% CAGR during the forecast period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growth in AI-Powered Drone Analytics and Automation | Greater application of drones for remote monitoring, asset inspection, and real-time analysis. |

| Enhancement of Cloud-Based Drone Fleet Security and Management | Enterprise drone platforms powered by AI provide greater scalability, security, and autonomous flying capabilities. |

| Greater Applications in Agriculture, Logistics, and Infrastructure Inspection | Enterprise drone solutions make surveying, delivery logistics, and industrial monitoring easier. |

The Chinese industry is expanding with fast-paced innovation in drone technology, rising adoption of AI-based fleet management, and government-backed programs for smart logistics and urban air mobility. The world's largest industry for drones, China, has witnessed a boom in the demand for enterprise drone solutions in the construction, agricultural, and security industries.

Government emphasis on drone and industrial automation regulation has also strengthened industry growth. Enterprise drone fleet management and AI-based drone analytics accounted for USD 18 billion in investments in China in 2024. FMI believes that the China industry is likely to gain 11.1% CAGR through 2035.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government Support for AI-Enabled Drone Fleet Operations | Policies favoring drone-powered urban integration and logistics increase adoption. |

| Growth of AI and IoT in Enterprise Drone Management | Deployment of AI-powered drones in monitoring, delivery, and surveillance. |

| Increasing Demand for Secure and Scalable Drone Control Solutions | Business drones improve operational efficiency in logistics, agriculture, and public safety. |

The German indsutry is developing with its robust industrial base, rising adoption of autonomous aerial systems, and the increasing importance of regulatory compliance and data protection. As a prime tech hub in Europe, Germany is spending on corporate drone use in smart manufacturing, logistics, and energy grid inspection.

Safe AI-enabled drone flight by the nation has also sparked corporate adoption throughout companies and the government. FMI is of the opinion that the German industry is slated to grow at 9.7% CAGR during the forecast period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| High-Precision Drone Inspection and Surveillance Industry Demand | German industries utilize enterprise drones for industrial security and surveillance. |

| Further Adoption of AI-Driven Drone Data Analytics and Smart Fleet Management | Investment in robotics-based drone logistics for energy, defense, and urban mobility. |

| Improvements in Cybersecurity and Encrypted Drone Communication Systems | Greater adoption of AI-based security frameworks for corporate drone operations. |

Japan's industry is growing with the rise in high-speed drone connectivity, rising applications of AI-based aerial mapping, and enterprise logistics automation technology developments. The technology industry is using drone management platforms for real-time infrastructure monitoring, autonomous security patrolling, and smart city applications. Japan's robotics and AI-based automation leadership has driven faster adoption across industries.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| AI Integration in Drone Traffic Management and Predictive Analytics | Japan takes the lead with AI-guided drone navigation and autonomous airspace management. |

| Increase in Smart Logistics and AI-Based Drone Delivery Solutions | Increased demand for drone-based delivery solutions in e-commerce and supply chain management. |

| Innovation in 5G and IoT for Connectivity in Drone Fleets | Higher deployment of real-time networks for communications between drones in enterprise solutions. |

India's indsutry is also growing very fast, with growing investments in drone-based industrial applications, heightened demand for automated aerial surveying, and government-supported initiatives encouraging the use of UAVs.

With initiatives like 'Make in India' and growth in AI-based logistics, India is witnessing strong demand for enterprise drone management platforms in the sectors of agriculture, defense, and infrastructure monitoring. The growth of indigenously developed drone technology startups and enterprise UAV solutions through AI drives industry growth further. FMI believes that the Indian industry is expected to grow at 11.5% CAGR through the forecast period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Strategies for UAV Upgradation and Digital Airspace Management | Policies favoring enterprise solutions on drones fuel adoption. |

| Growth of AI-Driven Drone Monitoring in Agriculture and Infrastructure | Increased applications of drones in smart farming, construction, and urban monitoring. |

| Growth in Demand for Low-Cost, Scalable Drone Fleet Operations Solutions | Cloud-based drone platform adoption by SMEs and businesses. |

Australia's industry is gradually expanding with rising investment in AI-driven UAV analytics, real-time airborne monitoring, and secure drone usage. Businesses such as agriculture, mining, and logistics companies are embracing drone solutions to improve asset inspection, environment monitoring, and distance security. Smart drone integration and regulation enabled by the nation are driving demand for next-gen enterprise drone platforms.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Government Support for AI-Fueled Drone Management and Air Monitoring | Drone-based business applications in the industry that are supported by policies drive industry growth. |

| IoT-Embedded Drone Fleet Monitoring and AI-Supported UAV Watch | More real-time monitoring drones are being applied across mining, agriculture, and security. |

| Growing Requirement for Cloud-Native, Scale-Out Drone Management Solutions | Drone-enabled platforms with artificial intelligence are implemented by industries to automate, analyze, and govern. |

The industry is rapidly growing due to factors such as increasing adoption of drones in different industries, new regulatory environments, and automation for fleets. These organizations are looking to improve their operations through drone management platforms, optimizing safety compliance, and real-time data collection. AI-based analytics, cloud fleet control, and autonomous drone operations correlate with the industry evolution, allowing enterprises to scale drone programs effectively.

Major companies in the industry include DJI Enterprise, DroneDeploy, PrecisionHawk, Parrot, and Kespry, which provide end-to-end drone fleet management software with automated flight planning and AI-driven analytics for agriculture, construction, energy, and logistics. These companies are focusing on improving data security and regulatory compliance and making it seamless to integrate with enterprise systems.

Contracts in conjunction with drone development are expediting such evolvement by BVLOS operations, 5G-enabled drone connection, and enhancement in edge computing for real-time aerial analytics. The new regulatory environment aims to supervise this approach to the subsistence of applications ranging from infrastructure inspection, asset monitoring, emergency response, and environmental surveying.

To maintain a competitive edge, companies are investing in strategic partnerships with regulatory bodies, AI-enhanced automation technologies, and advanced cybersecurity measures. Thus, a few innovations and further industry competition would also be driven by increased demand for scalable cloud-integrated drone management platforms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| DJI Enterprise | 20-25% |

| Parrot Drones | 15-20% |

| Aerodyne Group | 10-15% |

| PrecisionHawk | 8-12% |

| DroneDeploy | 5-10% |

| Kespry | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| DJI Enterprise | AI-powered drone fleet management, real-time data analytics, and security solutions. |

| Parrot Drones | Enterprise-grade UAVs with automated mapping and industrial inspection features. |

| Aerodyne Group | Cloud-based drone fleet management and AI-driven aerial data solutions. |

| PrecisionHawk | Drone analytics for agriculture, infrastructure, and energy sectors. |

| DroneDeploy | End-to-end drone software platform with AI-based flight planning and data processing. |

| Kespry | Autonomous drone solutions with AI-powered asset monitoring and survey mapping. |

Key Company Insights

DJI Enterprise (20-25%)

DJI powers the arena with AI-oriented fleet management and real-time data analytics glued together by robust security features that enhance industrial drone operations.

Parrot Drones (15-20%)

Parrot specializes in enterprise UAV solutions, providing automated mapping, inspection, and aerial monitoring for industrial applications.

Aerodyne Group (10-15%)

Aerodyne provides a cloud-based drone fleet management service that integrates AI-driven analytics for the agriculture, construction, and energy industries.

PrecisionHawk (8-12%)

PrecisionHawk provides drone-based analytics solutions for agriculture, infrastructure, and environmental monitoring.

DroneDeploy (5-10%)

DroneDeploy is comprised of one end-to-end drone software platform that, through AI-powered automation, brings efficiency to flight planning and the processing of geospatial data.

Kespry (4-8%)

Kespry provides industrial applications with autonomous drone solutions and analysis-driven abilities for monitoring and mapping.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in enterprise drone management by integrating AI-driven automation, cloud-based fleet control, and real-time aerial data analytics. The increasing adoption of drones for commercial applications, regulatory compliance, and automated aerial operations continues to shape the competitive landscape of the industry.

The industry is projected to reach USD 2.09 billion in 2025.

The industry is anticipated to grow to USD 10.70 billion by 2035.

India is forecast to grow at a CAGR of 11.5% from 2025 to 2035, making it one of the fastest-growing markets.

Abbott Laboratories, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Ventana Medical Systems, Inc., Bio-Rad Laboratories Inc., Enzo Life Sciences, Inc., Abcam plc, BioGenex, Cell Signaling Technology, Inc., and Agilent Technologies, Inc. are key players in the industry.

AI-powered enterprise drone management solutions are at the forefront of technological advancements in the industry.

By type, the industry is segmented into multirotor drones, fixed-wing drones, and hybrid drones.

By technology, the industry is segmented into aerial photography and remote sensing, data acquisition and analytics, mapping and surveying, 3D modeling, and others.

By application, the industry is segmented into agriculture, aerial surveillance, disaster relief, oil & gas exploration, environment monitoring, production, manufacturing, and supply chain & logistics.

By region, the industry is segmented into North America, Latin America, Asia Pacific, the Middle East & Africa (MEA), and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.