The Global Energy Gel Market is a healthy balance of market scenario in which classic sports nutrition companies lead the pack, although specialist endurance-oriented companies and specialist players are arising rapidly. The market is dominated by 55% large multinational players due to their international brand reputation, better research, and robust distribution channels.

These companies include GU Energy Labs, Clif Bar & Company, and Gatorade and dominate the field by offering science-designed energy gels that cater specifically to athletes and fitness professionals. 25% of the market is controlled by regional champions and niche endurance brands, marketing their products towards distinct sporting groups like long-distance runners, cyclists, and triathletes.

SIS (Science in Sport), PowerBar, and Maurten are specialist brands that sell electrolyte-added and slow-digesting carbohydrate formulations, differentiated in the endurance sports segment. Niche brands and new start-ups account for 15% of the market and specialize in natural, plant-based, and functional energy gels.

Huma Gel and Tailwind Nutrition have found acceptance among dietary-restricted sport enthusiasts favoring clean-label, fruit-flavor, and gut-friendly alternatives. Private labels own 5% of the marketplace, mainly taking a value angle through big retail like Walmart, Amazon, and sports chains.

Explore FMI!

Book a free demo

| Market Structure | Top Multinationals |

|---|---|

| Industry Share % | 55% |

| Key Companies | GU Energy Labs, Clif Bar & Company, Gatorade, PowerBar, SIS (Science in Sport) |

| Market Structure | Regional Leaders |

|---|---|

| Industry Share % | 25% |

| Key Companies | Honey Stinger, Maurten, Tailwind Nutrition |

| Market Structure | Niche Brands & Startups |

|---|---|

| Industry Share % | 15% |

| Key Companies | Huma Gel, EnduroPacks, other emerging brands |

| Market Structure | Private Labels |

|---|---|

| Industry Share % | 5% |

| Key Companies | Walmart’s Sports Nutrition, Amazon Basics, Store Brands |

The market is moderately concentrated, although niche and long-term brands are making inroads, driving competition.

Fruit flavors (30%) lead the energy gel market due to their stimulating flavor and intrinsic popularity, and GU Energy Labs and Clif Bar & Company offer berry, citrus, and tropical. Lemonade/Limeade flavors (20%) are gaining traction, particularly in endurance events, as sportsmen and sportswomen crave sour, moisture-based flavors. Chocolate and coffee/espresso taste appeal to runners and cyclists who want caffeine-laced energy, with SIS, Maurten, and PowerBar providing endurance gels that are high in caffeine. Specialty tastes such as honey-based gels from Honey Stinger and natural chia-based ones from Huma Gel are becoming popular among clean-label consumers.

Multi-serve packs (60%) lead the market since professional and endurance athletes need increased carbohydrate consumption during longer training sessions. Maurten and PowerBar provide bulk-packing, slow-release carbohydrate gels for runners in marathons and triathletes. Casual athletes, gym users, and hikers favor single-serving packs (40%), with leadership provided by Clif Bar & Company and GU Energy Labs. The latest trend involves resealable pouches and squeeze-tube configurations, enhancing ease of use and portability. The customizable, blendable gel solution trend is also on the rise, with companies providing powdered options for energy gels to provide flexibility.

The energy gel industry witnessed tremendous changes in 2024, with companies emphasizing performance-driven products, sustainability, and smart sports collaborations. The following are some of the leading industry trends:

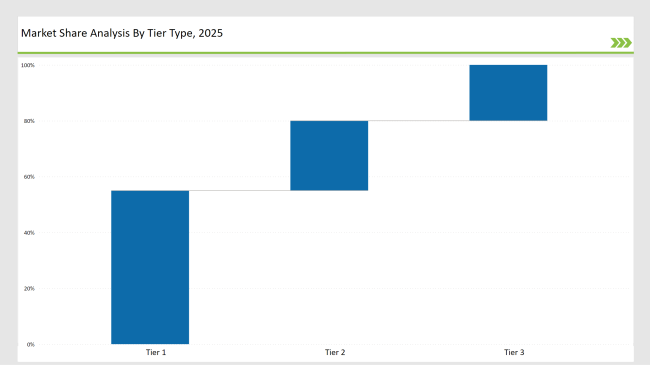

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 55% |

| Example of Key Players | GU Energy Labs, Clif Bar & Company, Gatorade, PowerBar, SIS (Science in Sport) |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 25% |

| Example of Key Players | Honey Stinger, Maurten, Tailwind Nutrition |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Huma Gel, EnduroPacks, new entrants |

| Brand | Key Focus |

|---|---|

| GU Energy Labs | Developed sweat rate tracking technology to optimize energy gel intake for endurance athletes. |

| Clif Bar & Company | Launched energy gels with added adaptogens, targeting stress relief and performance endurance. |

| SIS (Science in Sport) | A sports science research lab opened to improve carbohydrate absorption in gels. |

| PowerBar | Developed low-glycemic, slow-digesting energy gels to sustain athletes in ultra-endurance events. |

| Honey Stinger | Expanded into kid-friendly energy gels, introducing lower-caffeine, naturally sweetened variants. |

| Huma Gel | Created a USDA-certified organic energy gel range, appealing to natural food markets. |

| Tailwind Nutrition | Introduced nighttime recovery energy gels with added magnesium and protein for muscle repair. |

| Gatorade | Partnered with NASA research teams to develop hydration-enhanced energy gels for extreme conditions. |

| Maurten | Expanded its “athlete-exclusive” gel line, offering custom formulations for elite marathoners. |

| EnduroPacks | Integrated AI-driven hydration and energy tracking into its online performance tools. |

Personalized sport nutrition is gaining traction, and AI-driven platforms will enable athletes to personalize energy gels through real-time biometric feedback. Maurten and SIS have already tested individualized carbohydrate-to-electrolyte ratios. Brands will create bespoke energy gels that adapt to an athlete's sweat rate, glycogen state, and endurance intensity in the future. This will result in subscription-based algorithmic energy gel products, wherein consumers get specially designed packs for their training and nutrition requirements. Integration of wearables with energy and hydration apps will further become a part of real-time fueling for performance.

Energy gels have long been sold directly to endurance sports enthusiasts, but the fitness landscape is changing. With HIIT, functional training, and extreme sports on the rise, brands are creating energy gels for weight training, bodybuilding, and general fitness activities. This trend is being spearheaded by Clif Bar and Tailwind Nutrition through the development of dense nutrient energy gels for weight training and circuit training. Pre-workout explosive movement energy gels and recovery-promoting formulations in post-workout muscle repair will be future product directions. Businesses will aim for weekend warriors, gym enthusiasts, and action sport enthusiasts, offering energy gels as a fast, healthy replacement for pre-exercise and post-exercise supplements.

The market is moderately consolidated, with 55% controlled by global leaders like GU Energy Labs, Clif Bar, and PowerBar, while niche endurance brands are expanding market share.

Sustainable packaging, electrolyte-enhanced gels, plant-based formulations, AI-driven personalization, and expansion into casual fitness markets are key trends.

Brands are expanding beyond endurance athletes into functional fitness, HIIT, and casual gym-goers, positioning energy gels as a pre-workout alternative.

D2C platforms, subscription models, and digital sports partnerships are transforming the sales landscape, reducing reliance on retail distribution.

Hydration-focused gels, sweat-rate tracking, slow-release carbohydrates, and caffeine-enhanced variants are shaping the next generation of sports fueling solutions.

Gatorade, EnduroPacks, and Maurten are investing in biodegradable packaging, refillable dispensers, and carbon-neutral production.

Brands are increasing partnerships with Olympic teams, Tour de France cyclists, and ultra-marathon athletes to establish credibility in high-performance sports.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.