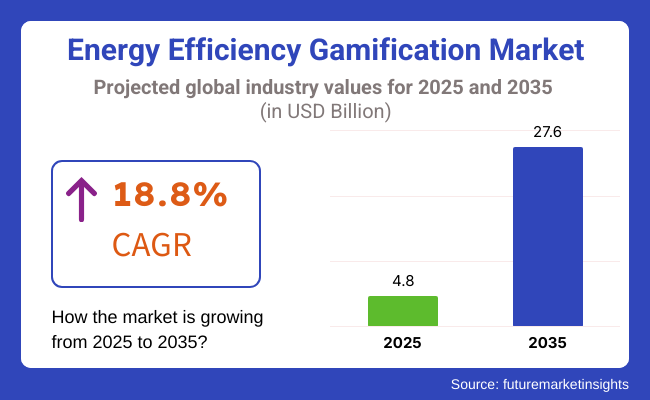

The energy efficiency gamification market is anticipated to increase to USD 4.8 billion in 2025 and reach USD 27.6 billion by 2035, exhibiting a CAGR of 18.8% from 2025 to 2035. Growing focus on sustainability, increased adoption of smart energy solutions, and rising demand for engaging and interactive energy-saving programs are key drivers for the industry.

New trends like AI-driven behavioral analytics, IoT-based gamification platforms, and blockchain-based reward schemes are still expanding industry opportunities. Meanwhile, the convergence of real-time energy monitoring, digital rewards, and user incentive programs is also increasing the effectiveness of energy efficiency programs.

Investments in R&D, regulation-readiness strategies, and alliances among energy service companies, governments, and corporations are boosting business growth. The industry for energy efficiency gamification is gaining momentum as industries, governments, and consumers seek alternative ways to drive energy conservation.

The intersection of AI-powered behavior analysis, IoT-facilitated monitoring, and blockchain-backed rewards is transforming user engagement with energy-saving schemes. With increased adoption in the residential, commercial, and industrial segments, the industry is ready to witness a transformational expansion through regulatory policies, smart energy solutions, and digital incentive mechanisms.

Explore FMI!

Book a free demo

The industry showcases rapid growth since enterprises and individuals look for environmental innovations to cut energy through behavioral engagement. Residential users, whose electronic devices have increased by factors such as smart technology integration, which also brings poor environmental impacts, use high user engagement and integration the most, to monitor and manage energy consumption.

The commercial and industrial sectors display a main concern of cost savings, regulatory compliance, and data analytics for making proper decisions. The government and utility sectors use gamification to create large-scaled sustainable projects and encourage people to change their lifestyles in this way. The educational segment adopts gamified energy management systems/tools to furnish the learning milieu with useful knowledge.

The successive embrace of IoT and AI technologies by the analytics gamification platforms allows energy consumption monitoring tools with real-time data and reward systems for participation. The interest in scalable, flexible, and interactive energy efficiency needs that drive further market growth is expected.

| Organization | Contract Value (USD Million) |

|---|---|

| Southern California Edison (SCE) | Approximately USD 50 - USD 60 |

| Clean Energy Finance Corporation (CEFC) | Approximately USD 340 - USD 350 |

| General Services Administration (GSA) | Approximately USD 390 - USD 400 |

Between 2020 and 2024, the industry experienced significant growth as businesses, governmental organizations, and individual customers embraced energy-saving solutions that gamified the experience. Firms embedded interactive dashboards, real-time feedback, and reward-based messaging into their energy management systems to elicit changes in user behavior.

Corporate sustainability initiatives across business sectors and community energy programs started to integrate gamification to generate interest and participation.

AI analytics granted them with the ability to furnish their users with personalized energy reports. The smart sensors and mobile apps now embedded within home automation systems made it possible for individuals to gain a greater understanding of their energy consumption patterns.

By setting goals for themselves and participating in challenges alongside other "players" (as a recent EPRI report called them), everyday citizens could consider themselves members of a virtual energy-saving fraternity.

From 2025 to 2035, the fourth generation of Energy Efficiency Gamification will be built on AI, blockchain, and hyper-personalization. These elements will have distributed energy platforms which will allow customers to trade energy savings among themselves with economic profit from efficiency incentivizing their every action.

And all of this will happen in smart cities that have been designed to be energy efficient and feature gamified energy solutions built into their architecture. What's more, users in these cities will receive real-time interactive feedback about their energy consumption through AR and other immersive interfaces.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Smart home systems incorporated gamified energy dashboards and reward structures to promote efficiency. | AI-driven, real-time adaptive gamification adjusts energy-saving objectives and process IoT-based energy optimization automatically. |

| Firms embraced gamification in sustainability practices to motivate staff energy-saving activity. | AI-based corporate energy management platforms utilize machine learning to tailor incentives and monitor employee sustainability initiatives. |

| Governments introduced gamified demand-response programs to maximize grid performance. | Blockchain-based, decentralized energy rewards enable consumers to exchange energy savings and support grid stability. |

| Historical usage patterns informed early-stage AI models, which made energy-saving suggestions. | Sophisticated AI algorithms forecast user behavior, dynamically adapting gamification mechanics for maximum engagement and efficiency. |

| Leaderboards and challenges were employed in mobile apps to encourage community-based energy saving. | Immersive AR-based energy gamification revolutionizes user experiences, providing real-time, interactive energy conservation feedback. |

| Initial blockchain uses tested safe tracking of energy savings and reward transactions. | Interoperability among blockchain networks provides open, tamper-evident logging of energy savings and peer-to-peer energy trading. |

| Cities initiated pilot programs combining gamified energy-saving initiatives. | City-scale AI-powered gamification platforms promote citizens' adoption of sustainable energy consumption habits. |

| Growing interest in decentralized platforms for tracking and rewarding energy efficiency gains. | AI-powered energy trading systems enable users to capitalize on energy savings and drive circular energy economies. |

| Initial gamification platforms relied on fixed dashboards and primitive feedback systems. | Interactive AR and VR tools present users with real-time insights into their energy consumption, rendering efficiency efforts both interesting and concrete. |

| Legacy gamification platforms suffered from user burnout and decreasing participation rates. | AI-facilitated adaptive gamification tailors' energy-saving experiences according to real-time engagement levels and behavior insights. |

The industry is not without its share of risks due to issues arising in four major areas like user engagement, technology adoption, norm compliance, and data security. These risks need to be managed appropriately in order to secure industry growth and increase the effectiveness in promoting energy savings.

One of the main issues is user involvement and retention. Gamification is based on psychological motivation and behavioral science to the extent of encouraging people to change their habits to be more energy-efficient. Back then, if the game-rules at the time were not able to life-positively be the driving factor for user adoption, the rates would have gone down.

Badly designed games, a lack of rewards, or a very complex interface may be the causes of demotivating participation on behalf of users, thus, affecting the positive results of the platform.

The other main risk is tech integration and compatibility issues. Energy efficiency gamification is frequently dependent on hardware such as smart meters and IoT appliances, and on software such as the real-time energy monitoring application. Lack of interoperability, which means problems between different hardware and software vendors, can hinder the reliable data collection or data analysis that is necessary for the gamification process. Therefore, the association of both components is a must for the success of the project.

Regulatory issues and data privacy problems are also the threats. Numerous countries have tough energy owning and data protection laws, such as the EU's GDPR and the USA Energy Policy Act. In case gamification platforms improperly collect, stock, or share user energy data, they might be facing either legal actions or loss of credibility among the users.

It can be segmented into education, action, and analytics, wherein education enlightens readers on how to reduce energy consumption and action to start the game, and analytics refers to feedback on the buyer activity.

Gamification in Education uses gamified quizzes, virtual simulations, and knowledge-based competitions to educate users about sustainability and ways to reduce carbon footprints. These solutions have been used across schools, corporations, and government energy programs to help increase energy literacy.

A gameplay design example is JouleBug and Energy Chickens, which use game mechanics to educate users on how everyday activities correlate to energy use. Utilities and environmental organizations use the platforms as well to help promote smart energy habits among consumers.

Action-based gamification targets immediate behavior through goal-setting-based challenges, rewards & interaction. Instead, these platforms leverage rewards and the social aspect of points and leaderboards to promote actual action things like balancing electricity within the home, changing HVAC settings, and partaking in energy challenges. Industry leaders like Opower (Oracle) and WattzOn offer solutions that send customized energy reports, real-time feedback, and social comparisons to users in order to drive them toward sustainability.

The gamification of electricity energy efficiency is focused on the analytics model, which collects, analyses, and visualizes real-time data, which helps users make strategic decisions. AI-powered dashboards and predictive analytics have found their way into various industries, commercial buildings, and smart homes to optimize energy consumption. Companies like Schneider Electric and Siemens incorporate gamified analytics tools to help enterprises achieve energy efficiency goals.

The industry can be segmented on the basis of end-use type into web-based solutions and mobile solutions.

Gamification platforms can be used by energy managers, and the web BOM approach is being used by enterprises, education institutes, and utility companies to push energy consumption. These platforms, available on desktops, are smart meters, IoT devices, and cloud-based energy management systems (EMS).

Data-driven energy engagement web tools from companies such as Opower (Oracle) and Schneider Electric provide users with personalized energy consumption insights, predictive analytics, and real-time feedback on their energy consumption. It helps environmental sustainability initiatives in corporations because they can observe the building in terms of energy and operate in a data-driven approach with web platforms to reduce consumption.

As mobile phones and mobile apps become common, mobile gamification solutions are increasingly popular. Users have access to energy-saving challenges to complete on the go, real-time energy tracking, and customized recommendations as part of these solutions.

These mobile applications, like Joulebug and WattzOn, use gamified motivational systems like push notifications, social sharing, and incentives to drive meaningful behaviour changes toward sustainability. Moreover, energy efficiency solutions based on mobile devices sync with smart home systems, wearable devices, and the Internet of Things (IoT) sensors to send notifications and real-time information on the energy use.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.8% |

| UK | 10.5% |

| European Union | 10.6% |

| Japan | 10.7% |

| South Korea | 10.9% |

The USA industry experiences strong growth with AI-powered gamification solutions encouraging energy-saving habits. Companies design interactive sites that provide immediate feedback, track energy consumption, and reward environmentally friendly behaviors. Gamification takes hold across the residential, commercial, and industrial industries, enabling achievement of countrywide climate goals.

Policy interventions support businesses in spending on data-driven engagement solutions, driving industry penetration. Digital incentives, leaderboards, and AI-powered optimization spur participation levels. FMI expects the American industry to grow at 10.8% CAGR during the research timeline.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Government Policies | Regulatory policies and incentives promote energy-saving habits and encourage businesses towards gamification solutions. |

| Smart Grid Integration | Smart grid programs are facilitated by gamification, allowing consumers to monitor and reduce energy usage. |

| AI & Behavioral Analytics | Artificial intelligence-penetrated insights facilitate greater personalization of energy-saving tips and engagement. |

| Corporate Sustainability | Firms integrate gamification into sustainability programs to support ESG goals and customer values. |

The industry expands as gamification by businesses to support energy-efficient behavior. Businesses leverage mobile apps, AI-driven reward schemes, and live monitoring software to reduce energy wastage. Home automation and firm energy-saving competitions boost user participation.

National carbon reduction ambitions are supported through the regulatory frameworks and green energy tariffs in the nation. The expansion of digital participation tools and behavioral science use increases the popularity of gamification as a vital part of energy management plans.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Green Energy Tariffs | Incentives and tariffs encourage green energy usage with gamified solutions. |

| Home Automation | Smart meter integration and Internet of Things-enabled devices facilitate enhanced monitoring of energy consumption. |

| Regulatory Frameworks | Carbon reduction policies encourage companies to embrace interactive energy solutions. |

| Consumer Participation | Difficulties and rewards in a gamified manner encourage involvement in domestic and commercial energy programs. |

The European Union industry grows with businesses, cities, and homeowners adopting AI-facilitated methods. The most influential countries in gamification activities are Germany, France, and Italy, where technology is utilized for smart cities, enterprise-level sustainability initiatives, and residential energy programs.

Real-time monitoring and point-based reward systems in the form of incentives elicit support from governments and energy providers. The EU has stringent environmental regulations and energy efficiency requirements, compelling companies to invest in AI-driven technologies. FMI opines that the European Union industry is anticipated to grow at 10.6% CAGR during the forecast period.

Growth Drivers in the European Union

| Key Drivers | Details |

|---|---|

| Smart City Development | Cities implement gamified platforms to save energy. |

| Regulatory Compliance | Stringent EU energy regulations compel companies to implement digital energy-saving solutions. |

| Blockchain & Peer-to-Peer Trading | Gamification complements decentralized energy trading and monitoring platforms. |

| Advanced Analytics | Behavioral data improves energy efficiency programs in all industries. |

Japan's industry widens with companies adopting AI-driven dashboards, interactive problems, and virtual rewards into energy efficiency programs. Companies design innovative gamification solutions to maximize power consumption and reduce peak demand. Decarbonization, digital engagement, and sustainability drive demand for energy-conscious solutions in Japan. Smart city projects and consumer electronics industries lead behavior-based energy efficiency program adoption.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Smart City Growth | Gamification is included in urban energy management strategies. |

| AI & Digital Interaction | AI-powered solutions optimize electricity consumption. |

| Consumer Electronics | Companies design interactive platforms for energy-efficient use of devices. |

| Government Incentives | Government programs reward energy-saving behavior. |

South Korea sees the swift evolution of energy efficiency gamification as government agencies, corporations, and tech firms introduce AI-powered platforms to encourage energy savings. The government supports clever energy management programs, and huge usage at household and business levels exists.

Companies integrate real-time monitoring, tailor-made AI-powered rewards, and interactive dashboards to improve the use of energy. Forecasting analytics and digital twins enhance energy-saving apps and make them stronger. FMI is of the opinion that South Korea's industry is expected to grow at 10.9% CAGR during the course of the study.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| Government-Led Initiatives | Strong policy backing drives uptake of smart energy solutions. |

| IoT & Smart Meters | Integrated device connectivity improves energy monitoring. |

| AI-Driven Rewards | Personalized incentives encourage consumer participation. |

| Digital Twins & Analytics | Advanced modeling maximizes predictive energy efficiency programs.a |

The expansion of the industry is fueled by interactive solutions that influence sustainable energy usage, cost reduction, and behavioral engagement. Gamification tools aid organizations in rewarding energy-efficient behaviors through real-time monitoring, AI-based behavioral analytics, and reward-based systems, which are important in the integration of smart grids and demand-side energy management.

Leading companies in the industry are Schneider Electric, Siemens, Johnson Controls, EnerNOC (Enel X), and Opower (Oracle Utilities), and they deploy management and engagement platforms driven by AI, interactive energy dashboards, and cloud-based behavioral analytics. Startups and smaller firms are competing in the energy efficiency gamification domain with solutions such as blockchain-based reward systems, IoT-integrated gamification, and personalized energy-saving challenges.

Mandates for energy conservation, corporate sustainability initiatives, and widespread adoption of AI-powered engagement platforms have been the drivers behind the innovation curve. Companies are investing heavily in gamification models to spur demand response programs upon real-time consumption monitoring and user-personalized incentives that lead to higher acceptance by the masses for sustainable long-term behavior change.

Strategic factors such as AI-engaged consumers, the development of smart home/smart city initiatives, and corporate net-zero commitments are heightening rivalry in the industry. Companies are positioning on gamification frameworks that connect to energy management systems, blockchain incentive programs, and state-of-the-art data visualization tools to differentiate their value proposition and leverage the growing demand for interactive energy efficiency solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric | 20-25% |

| Siemens AG | 15-20% |

| Johnson Controls | 12-17% |

| EnerNOC (Enel X) | 8-12% |

| Opower (Oracle) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric | Develops AI-powered energy monitoring, real-time efficiency analytics, and interactive engagement platforms. |

| Siemens AG | Facilitates gamified energy optimization tools, connectivity to smart grids, and behavior analytics powered through AI. |

| Johnson Controls | Focuses on cloud energy management, incentive-based efficiency programs, and automation in buildings. |

| EnerNOC (Enel X) | Involved with demand responsive programming associated with traditional modeling, real-time tracking of consumption, and gamification of energy savings for enterprises. |

| Opower (Oracle) | Offers AI-augmented energy efficiency solutions coupled with consumer engagement tools for data-based reward programs. |

Key Company Insights

Schneider Electric (20-25%)

They build AI-enabled energy monitoring, real-time efficiency analytics, and interactive engagement platforms designed to drive energy efficiency gamification.

Siemens AG (15-20%)

Gamified efficiency instruments, AI-enabled behavioral tracking, and platforms for real-time optimization lend additional credence to Siemens AG's portfolio of investments in smart energy management.

Johnson Controls (12-17%)

Johnson Controls is focusing on cloud-based energy monitoring, automated programs for efficiency driven by incentives, and smart building management.

EnerNOC (Enel X) (8-12%)

EnerNOC (Enel X) is about optimizing demand response, gamification solutions at the enterprise level, and tracking real-time energy consumption.

Opower (Oracle) (5-9%)

Opower (Oracle) offers AI-enabled energy efficiency platforms for consumers, consumer engagement tools, and interactive data-powered reward programs.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 4.8 billion in 2025.

The industry is predicted to reach a size of USD 27.6 billion by 2035.

Cool Choices Inc., Simple Energy Inc., WeSpire Inc., Creative Roustabouts LLC, JouleBug, Take Charge Challenge, Energy In Time, myEcoNavigator, Schneider Electric SE, Asea Brown Boveri (ABB) Ltd., Eaton Corporation PLC, Cisco Systems Inc., CA Technologies, Emerson Process Management, and Honeywell International Inc. are the key players in the industry.

South Korea, with a CAGR of 18.8%, is expected to record the highest growth during the forecast period.

Education and action are among the most widely used solutions in the industry.

By type, the industry is divided into education, action, and analytics.

By deployment, the industry includes web-based, mobile, and desktop.

By end-user segment is classified into residential, commercial, and industrial.

By region, the industry spans North America, Latin America, Asia Pacific, the Middle East & Africa, and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.