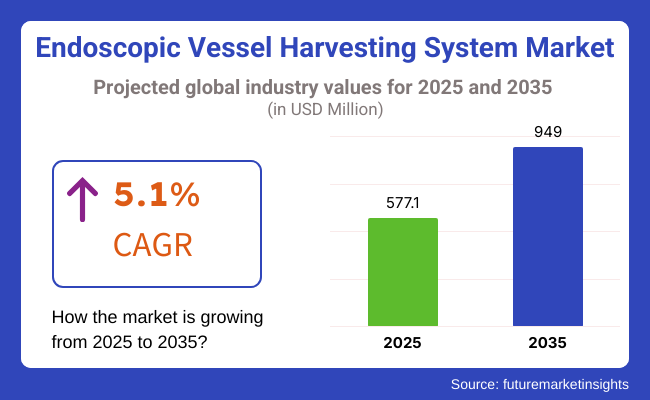

In 2025, endoscopic vessel harvesting systems would become one of the most promising businesses reaching a value of USD 577.1 million globally and continue growing with a CAGR of 5.1% to reach USD 949.0 million in 2035. From that, the year 2024 had approximately USD 552.2 million income from endoscopic vessel harvesting systems.

This segment of the market for endoscopic vessel harvesting (EVH) systems is expected to progress at a constant rate from 2025 to 2035, most probably due to the increase in prevalence of cardiovascular diseases, increased use of market's popularity for less invasive surgical techniques, and advancement in endoscopic technologies.

Thus, the market is perceived to be somewhat above USD 577.0 million in 2025, while it could rise to about USD 949.0 million in 2035, equivalent to a compound annual growth rate (CAGR) of 5.1% during the forecast period.

The growing incidence of ischemic heart diseases across the globe, or generally referred to as coronary artery diseases, increased the frequency of coronary artery bypass grafting (CABG) surgeries where the endoscopic vein harvesting was hugely taken advantage of the products.

Through EVH procedures, surgical trauma can be avoided by surgeons, thus good patient recovery times, and minimization of postoperative complications. They are using advanced imaging technology, some electrocautery tools giving precision as to get the job done and robot-assisted EVH is proving the alternative to open vessel harvesting.

In addition, with EVH introduction, perceptions of procedures become efficient and also higher success rates. However high cost and need for training and regulatory challenges still remain very important hurdles. Some opportunities may be visible in emerging markets innovation in the robotic surgery process and the usage of surgical robotics.

In the historical years, the endoscopic vessel harvesting (EVH) system market has seen considerable growth with developments in minimally invasive surgical procedures and the growing usage of off-pump coronary artery bypass (OPCAB) procedures. EVH systems were initially employed mainly for saphenous vein harvesting in coronary artery bypass grafting (CABG).

Later, the technology progressed to feature radial artery and other vessel harvesting, making the procedure more efficient, minimizing surgical trauma, and also bettering the recovery of patients.

From 2020 to 2024, the EVH (endoscopic vessel harvesting) market was on a meteoric rise, leveraging the increasing prevalence of cardiovascular illness, the surge in coronary artery bypass graft (CABG) surgeries, and minimally invasive surgery.

Skills that are the result of utilization of EVH systems such as the less surgical trauma, with fewer infection risks and faster healing of the patients apart from open vessel harvesting surgical processes are what have made these systems the most sought after for quality health care. The major hindrances to the implementation of such systems were pricing, requirement of training, and performance standardization.

Explore FMI!

Book a free demo

The market will benefit from the existence of modern healthcare techniques, numerous coronary artery bypass graft (CABG) operations, and also good payback policies. At the same time, due to the growing popularity of robot-assisted EVH in the USA and Canada and the increase in research on minimally invasive surgical techniques, the sector continues to expand. Moreover, the legislation that motivates the medical sphere with innovative solutions in cardiology remains on a healthy level.

A healthcare establishment is well represented by the fact that old people represent the biggest sector, making up most of the cases of cardiovascular diseases (CVDs) through which minimally invasive operations are encouraged to be developed and supported by the governments.

On top of that, Germany, France, and the UK have noticed the effect of evolving surgical technology on EVH and the fact that healthcare funds are now given to the goal to remove barriers for patients to receive the necessary care. The improvement in hospital infrastructure and training for doctors is impacting market growth positively as well.

The sector is projected to grow the most rapidly, being driven by increased healthcare spending, better access to highly advanced technology in surgery, and also by growing the number of lifestyle-related heart diseases. The different contributors to the regional market growth include China, Japan, and India.

The strong development of medical tourism and the raised awareness of minimally invasive procedures in the cardiovascular area make it possible for the participants to get more popular in these regions.

The not so familiar with electronic vessel harvesters (EVH), the long time required for training and a lack of awareness of the market in some regions may be the main barriers against sales and executive acceleration.

Furthermore, lack of confidence in the very long term survival of vessel collection and the risk of using it incorrectly can be some of the factors affecting the approval of the technology. Regulations that are tough and the slow approval process of some EVH systems in clinical settings can inhibit the wide adoption of the new technology.

Endoscopic imaging technology getting better, strongly present AI-enabled surgical devices, and even hybrids of surgery. These three are the best outcomes for business growth. Telemedicine and virtual CV surgeon training programs are showing improvement in the area of EVH.

Other than that, the linkages between hospitals and medical device manufacturers to develop economically friendly products are projected to be a catalyst feasible for both of them. Bioengineering of grafts and using analytics through AI for real-time intraoperative assistance are also showing signs of changes in the future technology of EVH.

The period from 2020 to 2024 saw the EVH market expanding on a continual basis with all the cardiovascular diseases due to the incessant increase in the number of CABG surgeries and developments in minimally invasive surgery.

The mandate for EVH was largely owed to the fact that it brought along with it way less surgical trauma, decreased wrong infection factors, and people got hospital all the faster right back home. On the contrary, the bright side was rather the advantages of the EVH approach-the EVH system by the fact that it was more minimally invasive than the traditional open vessels surgery, less trauma was inflicted on the patient, the risk of infections was lower and the recovery period was faster.

Nonetheless, the reluctance to its adoption was due to a number of concerns, like the high cost of EVH systems, the necessity of advanced surgical skills, and the variance of procedure outcomes.

In the period before 2025 to 2035, technology will be the main player in influencing the market by bringing to life such technologies as AI-powered harvesting techniques, robot-assisted EVH systems, and upgraded endoscopic equipment. The regulatory bodies will have the responsibility of post-market surveillance and thereby intensify procedural safety and long-term graft patency.

The trend to value-based care will determine savings; for example, the use of disposable and ergonomic EVH systems will be cost-saving while on the part of hospitals, green surgical components will be the best choice among different similar equipment.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | FDA and CE approvals focused on safety, sterility, and procedural efficacy. Standardization of EVH techniques varied across healthcare systems. |

| Technological Advancements | Adoption of advanced endoscopic tools improved procedural efficiency. Manual and motorized EVH systems remained standard. |

| Consumer Demand | Growing demand for minimally invasive procedures due to reduced complications and faster recovery times. |

| Market Growth Drivers | Rising incidence of cardiovascular diseases and increasing CABG procedures. Demand for faster recovery and better post-surgical outcomes. |

| Sustainability | Efforts to reduce surgical waste through improved sterilization and reusable components. |

| Supply Chain Dynamics | Reliance on major medical device manufacturers in North America and Europe. Supply chain disruptions due to raw material shortages. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter guidelines on long-term graft performance and surgeon training. AI-driven compliance tracking ensures optimal surgical outcomes. |

| Technological Advancements | Robotic-assisted EVH systems enhance precision and reduce human error. AI-powered imaging optimizes vein selection and harvesting techniques. |

| Consumer Demand | Increased preference for AI- and robot-assisted procedures to improve graft viability and procedural consistency. |

| Market Growth Drivers | Expansion of precision medicine and AI-guided surgical planning. Integration of remote-assisted EVH systems in telemedicine and robotic surgery. |

| Sustainability | Widespread use of biodegradable and recyclable surgical components. Energy-efficient EVH system designs reduce environmental impact. |

| Supply Chain Dynamics | Increased localization of production to minimize supply risks. Growth in 3D-printed surgical tools for custom EVH system components. |

Market Outlook

The United States endoscopic vessel harvesting (EVH) systems market is continuously growing due to the increasing lifestyle-related health problems, like cardiovascular diseases, and the growing demand for minimally invasive surgeries.

The use of these systems in the bypass surgery of the coronary arteries by blockage has become even more widespread as a result of the aforementioned factors, the procedure of which reduces the possibility of negative effects on the patient's surgical reaction and contributes its perfection to the patient's new life.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 2.1% |

Market Outlook

There is increasing optimism regarding the EVH systems market in Germany, mainly because of a promising healthcare system and good professional attention to advanced surgeries. The stressed management towards improvement in surgery results and quality patient care are conducive in using EVH systems in cardiovascular surgeries.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.8% |

Market Outlook

India's EVH systems market is an emerging industry which is driven by the rising burden of cardiovascular diseases and the growth of the healthcare infrastructure. The is gained of the adaption of the minimally invasive surgical techniques in urban medical centers to the market extension as well.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.9% |

Market Outlook

Japan's EVH systems market is extremely sophisticated owing to state-of-the-art medical developments and the healthcare system's emphasis on minimally invasive procedures. The country's aging population and high healthcare standards are the pivot that drives the preference of EVH systems for cardiac surgery in.

Market Growth Factors

Technological Innovation: Technology in the health sphere is developing constantly in Japan and all that is why the most up-to-date EVH machines are available on the market. Aging Demographics: A big AT INCREASE IN THE CARDIAC

Healthcare Quality Standards: Japan's strict compliance to the best medical practices is enabling the implementation of advanced surgical techniques.

Research and Development: The EVO, inevitably closely linked to the ongoing R&D procedures, also contributes to the blending and scoring of the EVH technologies of the future, are thoroughly explained in the rest of this book. Patient Outcomes Focus: The best practice involves introducing new minimally invasive procedures like EVH that, in turn, have the best patient outcomes.

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 4.6% |

Market Outlook

The market for EVH systems in Brazil is increasing, sustained by healthcare improvements and rising awareness of minimally invasive surgical options. The growing incidence of cardiovascular diseases calls for effective surgical management and impels the acceptance of EVH systems.

Market Growth Factors

Market Forecast

| Year | CAGR (2025 to 2035) |

|---|---|

| 2025 to 2035 | 3.5% |

Disposable Endoscopic Vessel Harvesting System

Disposable EVH systems hold the chief market share on account of their sterilization features, convenience, and reduced chances of cross-contamination. Single-use systems are the mainstay for cardiac interventions, especially CABG, where harvesting of the radial artery or saphenous vein becomes mandatory.

The increasing incidence of cardiovascular diseases and the growing volume of CABG procedures are the chief propellers of this segment. Hospitals and surgery centers prefer a single-use approach as it avoids the reprocessing of EVH systems with the potential drawbacks of increased infection rate and procedural bottlenecks.

Advancements in technology offer better endoscopic visualization and precision devices, which will also improve procedural success rates. North America and Europe take the lead in the market, as strong infection control practices and acceptance of minimally invasive surgical procedures remain highest.

The market in the Asia-Pacific region is growing as cardiac diseases increase and access to advanced surgical technology improves.

Reusable Endoscopic Vessel Harvesting System

Reusable EVH systems are gaining momentum, particularly in cost-conscious healthcare markets that value cost-effectiveness and sustainability. Reusable multiple-use reusable EVH systems are economically worthwhile when sterilized, while the disposable ones do not add long-term economic worth.

Hospitals and operating rooms in developing countries also favor reuse of EVH systems due to their capacity to utilize resources as conservatively as possible and avoid wastage. Technological improvements, such as improved durability, ergonomic designs, and better reprocessing technology, are becoming more capable of making reusable systems competitive in the market.

Concerns of sterilization requirements and risks of contamination are still on the agenda for implementation. A moderate market demand for reusable EVH systems exists in North America and Europe, primarily in those facilities having strong reprocessing protocols.

Meanwhile, Asian-Pacific, Latin American, and Middle Eastern emerging markets are increasingly turning towards reusable systems due to their constrained budgets and efforts to roll out cost-effective surgical solution

Saphenous Vein

The sapenous vein extended long up into the human anatomy, downward extending from the foot to the groin. Most importantly, it is used for the CABG that harvests this vein for use as bypass conduits to restore appropriate blood flow in blocked coronary arteries.

EVH has transformed this process by providing for a harvesting approach that reduces surgical trauma to lower the risk of infection and enhances recovery compared to open harvesting. The saphenous vein is also desirable because it is readily available and of sufficient length and has multiple grafts that will likely support its use.

Continued innovations in minimally invasive harvesting techniques will increase saphenous vein viability and optimize long-term graft patency and surgical outcomes.

Radial Artery

The radial artery is, in fact, the most vital of blood vessels of the forearm, lying from the brachial artery to the wrist. This was the main site of pulse checking and blood pressure measurement. The radial artery is meant to act as an alternate conduit to the saphenous vein for CABG purposes.

Compared to the saphenous vein, the radial artery has superior long-term patency due to its muscular structure and lesser predisposition to develop atherosclerosis. The advent of endoscopic valve harvesting techniques for the radial artery is associated with better cosmetic outcomes and fewer complications with reduced surgical trauma.

However, concerned vasospasm and the risk of ischemia to the hand necessitate appropriate selection of patients and thorough preoperative assessment. With the advances in harvesting techniques and pharmacological management, an increasing number of younger patients requiring long-lasting revascularization options would be put onto the list for radial artery grafting.

Endoscopic vessel harvesting (EVH) systems haunt the market with the competition raging from top players worldwide and from domestic players. They grow increasingly with the rise in the prevalence of cardiovascular diseases, advances in minimally invasive surgical approaches, increased consumer preference for procedures that minimize rehabilitation time and complications, and increased need for technology adoption in EVH.

Firms find the ground to invest in precision engineering, automation, and the better ergonomics of the users. Established manufacturers and up-rising brands will both contribute to the ever-changing landscape of EVH technology in the continuous dynamic industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Getinge AB | 24.6% |

| Terumo Corporation | 18.5% |

| LivaNova PLC | 13.5% |

| KARL STORZ SE & Co. | 9.6% |

| Saphena Medical Inc. | 7.5% |

| Other Companies (combined) | 26.5% |

| Company Name | Key Offerigns /Activities |

|---|---|

| Getinge AB | Offers the Vasoview Hemopro series, advanced EVH systems designed to enhance conduit quality and minimize thermal spread during harvesting. |

| Terumo Corporation | Provides the VirtuoSaph Plus EVH system, focusing on user-friendly design and improved patient outcomes through minimally invasive procedures. |

| LivaNova PLC | Develops innovative EVH solutions emphasizing ergonomic design and efficiency in vessel harvesting for coronary artery bypass grafting (CABG) surgeries. |

| KARL STORZ SE & Co. | Offers a range of endoscopic instruments and systems tailored for vessel harvesting, known for their precision and reliability in surgical applications. |

| Saphena Medical Inc. | Specializes in unitary endoscopic vessel harvesting systems aimed at improving procedural efficiency and patient recovery times. |

Key Company Insights

Getinge AB (24.6%)

A market leader in EVH, Getinge AB is known for its Vasoview Hemopro series, which makes use of simultaneous cut-and-seal technology to enhance conduit quality and minimize thermal injury during vessel harvesting.

Terumo Corporation (18.5%)

Terumo VirtuoSaph Plus EVH system is engineered to be easy to use with an ergonomic design that supports minimally invasive vessel harvesting, thus improving patient outcomes.

LivaNova PLC (13.5%)

LivaNova concentrates on designing EVH solutions that emphasize ergonomics for the surgeon and procedural efficiency, which leads to enhanced recovery for patients undergoing CABG surgery.

KARL STORZ SE & Co. (9.6%)

Renowned for precision engineering, KARL STORZ offers endoscopes and accessories that enable vessel harvesting with proficiency and durability alongside surgical performance.

Saphena Medical Inc. (7.5%)

Saphena Medical provides unitary EVH systems intended to simplify the harvesting procedure with the goal of decreasing operative time and improving patient recovery.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global endoscopic vessel harvesting system industry is projected to witness CAGR of 5.1% between 2025 and 2035.

The global Endoscopic Vessel Harvesting System industry stood at USD 552.24 million in 2024.

The global rare neurological disease treatment industry is anticipated to reach USD 949.0 million by 2035 end.

China is expected to show a CAGR of 4.6% in the assessment period.

The key players operating in the global endoscopic vessel harvesting system industry are Getinge AB, Terumo Corporation, LivaNova PLC, KARL STORZ SE & Co., Saphena Medical Inc. and Other market players.

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Stable Angina Management Market Analysis by Drug Class, Distribution Channel, and Region: Forecast for 2025 to 2035

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Panuveitis Treatment Market Analysis & Forecast by Drug Class, Route of Administration, Distribution Channel, and Region Through 2035

Phenylketonuria Therapeutics Market Analysis & Forecast by Drug Type, Route of Administration, Distribution Channel, and Region Through 2035

Dental Practice Management Software Market Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.