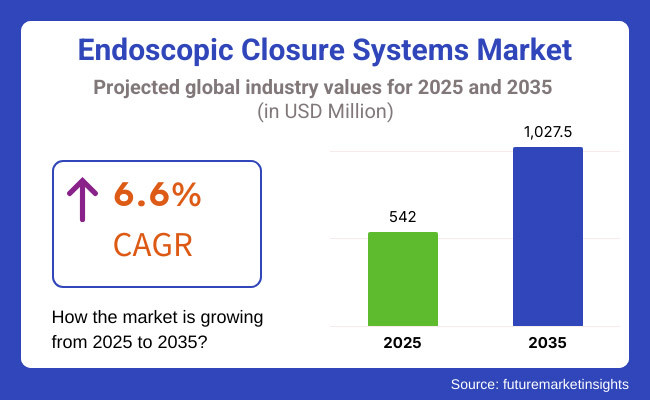

The global market for endoscopic closure systems is forecasted to attain USD 542.0 million by 2025, expanding at 6.6% CAGR to reach USD 1,027.5 million by 2035. In 2024, the revenue of endoscopic closure systems was around USD 513.2 million

The Endoscopic Closure Systems Market is growing rapidly as the number of GI-related diagnoses, such as ulcers, fistulas, and perforations, is on the rise. These conditions require reliable closure solutions, and the physicians have found solace in advanced endoscopic devices to deliver them.

As the emphasis on minimally invasive techniques continues, surgeons seem to prefer clips, sutures, and hemostatic agents over conventional surgical procedures to minimize infections and bleeding while abating the length of hospital stays.

Improved technology of closure devices makes such procedures holistically better. Suture bioabsorbability, computer-aided imaging, and robotic endoscopy maximize accuracy and patient outcome. Likewise, such growth in outpatient endoscopy further reduces the healthcare burden while allowing rapid recovery. However, exorbitant costs of devices, conflicting regulations, and lack of skilled personnel block their greater adoption.

Nevertheless, researchers are continuously developing newer clinical closure technologies for enhanced safety and user-friendliness. With the healthcare scenario witnessing a rising trend toward minimally invasive treatment, the usage of endoscopic closure systems would grow, thus creating opportunities for medical device companies and health providers.

The market for endoscopic closure systems has changed quite a bit, thanks to the developments in the minimally invasive procedures and medical technology. The physician had no other choice but to go for surgery in case of closure of gastrointestinal (GI) perforations and leaks with protracted hospital stays and conferring a greater risk onto the patient. All this changed in the 1990s with the introduction of endoscopic clips, providing a mechanism for closure much less invasive than before.

By the early 2000s, with the introduction of the newer suturing devices and hemostatic agents available to the clinicians, the endoscopic closure systems became safer and more efficient options for outpatient procedures. These devices gained popularity and acceptance with further improvements in imaging technology and flexibility and preciseness of endoscopes.

Set to define the next generations in endoscopic closure are some of the advances in robotic-assisted endoscopic techniques, bioabsorbable technology, and AI-imaging systems. Increasingly, these techniques are finding their way into the practice of many surgeons performing bariatric as well as colorectal surgery, allowing for faster recovery of their patients with fewer complications. Therefore, as the skyline of healthcare moves toward becoming even less invasive, the demand for endoscopic closures systems is bound to rise.

Explore FMI!

Book a free demo

This market for North America concerning endoscopic closure systems is witnessing rapid growth due to the increase in people diagnosed with gastrointestinal illnesses, cancers of the colon, and obesity-related diseases where surgeries of bariatric nature are demanded.

The leading country in advancing the field would be the USA, as this is where much of the development in minimally invasive surgery has taken place with modern capabilities through AI in endoscopic visualization. Also robotic closure systems have been developed. Surgical operations by these means are made even safer, more precise, and better in terms of patient outcomes.

However, the high cost of advanced devices for closure alongside their complicated regulatory approval is a major impediment to their widespread adoption. All these have established the trend of increasing investments into AI-based precision medicine and a wider use of telemedicine in post-surgical monitoring of patients. Hence, the endoscopic closure systems have more to grow in future technology advancements to further help improve the quality of care and recovery for patients.

Europe leads in endoscopic closure systems, with Germany, France, and the UK at the forefront of adopting revolutionary minimally invasive technologies. The regulated nature of EMA disposal gives confidence to both doctors and patients when making use of such products concerning safety and efficacy. Government grants for medical research, coupled with demand for outpatient endoscopic procedures, and population growth of elderly citizens are still some of the drivers of growth in this market.

However, public health care budget constraints and a lengthy regulatory approval process may hinder access to new technology. The trend in the industry toward sustainability initiatives for single-use endoscopic devices holds promise; in this regard, biodegradable sutures and bioengineered closure materials enhance patient outcomes by reducing complications and increasing procedural efficacy. Technology-wise, Europe is still leading the charge to create a roadmap for the future of endoscopic closures.

The Asia-Pacific region is about to witness the most rapid growth in the market of endoscopic closure systems due to increased funding in healthcare, growing demand for minimally invasive procedures, and rapidly advancing medical technology. China, India, and Japan are leading the growth process, facilitated by government-supported healthcare reforms and considerable investments in endoscopic research and development.

That is, with a rising number of patients suffering from gastrointestinal ailments, the demand for intelligent closure systems increases as well. The other factor includes having medical tourism in the region, and integration with more trained endoscopic surgeons contributes to more treatment options. However, the barrier related to the non-uniformity in regulation coupled with the extravagant costs in low-income areas continues to prevent its ubiquity.

Along with that, this particular industry is evolving with AI-based diagnostic devices, the shift toward disposable closure systems, and an increase in the local production of medical devices. These are the trends that redefine the future of endoscopic closures in the region in order to make the procedures even more secure and efficient for the patients.

Challenges

Balancing Innovation and Affordability in Endoscopic Closure Systems

Most hospitals in cost-sensitive markets find the price of endoscopic closure devices, especially for robotic systems, too exorbitant and thus inaccessible. At the same time, they were also limited from using this advanced technology due to financial constraints.

Furthermore, new closure systems face lengthy and stringent regulatory approvals, affecting the business dimension of many smaller manufacturers because it is too time consuming and costly to pass through complex compliance requirements that hinder immediate access to new solutions. The availability of these procedures is also limited in some areas whose qualified endoscopic surgeons are lacking, thereby restricting market expansion.

Post procedural complications, including risk of infection and device migration, further strengthen the argument for stronger, more dependable closure systems. The increasing use of throwaway closure devices is raising medical waste concerns at the same time.

Efforts are being made by manufacturers towards more sustainable approaches, such as the introduction of biodegradable sutures and eco-friendly materials - destined to weigh the advantage of safety over environmental care.

Opportunities

Innovation and Developing Markets in Prospect of Endoscopy Closures

The endoscopic closure systems market is currently most vivid and growing rapidly with exciting technological advancements and better access to healthcare worldwide. There is a continued increase in telemedicine and remote patient monitoring systems which generate a further demand for these innovative closure systems enabling recovery and treatment in outpatient settings. The efforts by hospitals and surgery centers in reducing complications and readmissions are also compelling manufacturers to bring forth more resilient and infection-proof closure devices which guarantee patient safety.

While personalized medicine changes treatment paradigms, companies are developing specific closure solutions tailored to patients' needs to achieve better outcomes. Next-generation bioengineered closure materials are also being designed through collaborations between medical device companies and research organizations, which are likely to trigger innovations in this area.

This drives the demand for cheaper closure systems as poor governments introduce healthcare access into the low-income area. Complementary savings on making budgetary reductions by targeting local distribution are posed as the position to extend advanced endoscopic treatment to better global patient care

Changing Innovation and Policy Trends in Endoscopic Closure Systems

The endoscopic closure markets would not be left behind in the dynamic market that is changing fast and with new technologies making procedures safer and more effective. Robotic-assisted endoscopic closures are viewed as the greatest revolution in terms of surgery since robotic systems, powered by artificial intelligence, offer real-time imaging and automated suturing. These enable surgeons to carry out complex gastrointestinal repairs more accurately and with fewer complications while improving the recovery process for the patients.

On the other hand, scientists are inventing bioabsorbable closure devices that dissolve and disappear spontaneously once healing is accomplished. This feature prevents removal and the associated risks of infection. Bioabsorbable adhesives, sutures, and clips further improve outcomes for the patients, all while scientists continue their tweaking on biodegradable material for green replacements for the older generation.

Regulatory agencies like the FDA and EMA, and PMDA in Japan have also moved to demand a more significant contribution towards safety in which closure devices must be sterile and function properly. Even policymakers are looking into real-life clinical evidence for shaping reimbursement policy and accelerating new technology adoption. All these shifts will usher in an era full of opportunities for innovation and enhanced access to advanced treatments for patients.

The worldwide market for endoscopic closure systems underwent rapid growth from 2020 to 2024, triggered by the increasing cases of gastrointestinal diseases, advancement of minimally invasive surgical technologies, and rising need for robust closure options for endoscopic procedures.

Innovations in technology regarding endoscopic clips and suturing instruments are considered as major advancements that made these surgeries much safer and efficient so that surgery has become a lot more productive for both the patient as well as the surgeon.

Projected to continue growing steadily between 2025 and 2035. Such exciting advancements as artificial intelligence-based robots, vacuum-assisted closure devices, and emerging healthcare infrastructure in developing countries will shape the future. Manufacturers and healthcare professionals must keep in step with demand through innovation, regulatory approvals, and joint partnerships that will inform them in the best ways to deliver optimal care to the patient.

Market Shifts: A Comparative Analysis 2020 to 2024 Vs 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Regulatory agencies gave importance to safety and effectiveness by expediting approvals of new endoscopic closure devices. |

| Technological Advancements | Surgeons used high-end imaging methods and minimal invasive techniques to improve outcomes. |

| Consumer Demand | Patients grew informed and opted for efficient, less invasive treatments. |

| Market Growth Drivers | The increasing incidence of gastrointestinal diseases and the development of medical technology enhanced endoscopic procedures. |

| Sustainability | Manufacturers started creating environmentally friendly processes to minimize the environmental footprint of medical devices. |

| Supply Chain Dynamics | Producers depended on existing distribution channels to maintain availability in major health centers. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Authorities will implement comprehensive guidelines on AI-integrated devices and tailored treatments, which will provide standard care. |

| Technological Advancements | Medical staff will incorporate AI and robotic support in endoscopic procedures, which will allow real-time analysis and better accuracy. |

| Consumer Demand | Patients will opt for customized and home-based endoscopic procedures that suit their lifestyle and comfort. |

| Market Growth Drivers | Increased healthcare infrastructure in emerging economies, R&D spending, and collaborations will fuel market growth. |

| Sustainability | Companies will embrace sustainable practices in full, such as green manufacturing, biodegradable products, and energy-efficient production. |

| Supply Chain Dynamics | Firms will maximize supply chains through digital technologies, providing transparency, efficiency, and timely delivery to distant and underserved areas. |

In the United States, cutting-edge technologies for endoscopic closure account for widespread insurance acceptance that fosters high patient volume for GI and bariatric procedures. Therefore, surgical centers and hospitals invest significantly in advanced technologies that provide better patient outcomes with shorter recovery time.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

Germany is moving into minimally invasive endoscopic approaches supported by advanced hospitals and proficient endoscopists. Its focus on precision medicine and technical innovations will act as a catalyst for market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.4% |

Increased healthcare investments and better access to training in endoscopy are encouraging Indian hospitals and clinics to expand the use of some inexpensive closure methods. The uptrend in the demand for minimally invasive is pushing the growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.3% |

China's fast-growing healthcare infrastructure is driving the applicability of AI-enabled endoscopic procedures. As hospitals upgrade their facilities to meet rising patient demand, it is anticipated that obesity and GI-related ailments will increase.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Brazil is increasing access to advanced endoscopic procedures as health professionals respond to the rising burden of GI diseases. Public policies together with private investments ensure the dissemination of advanced closure technologies across the country.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.8% |

Advancements and Growing Adoption of Endoscopic Clips (Endoclips) in GI Procedures Boost Endoscopic Clips/Endoclips (Over-the-Scope Clips)

Endoscopic clipping (Endoclips) is one of the most popular methods adopted by doctors for GI procedures, which is a secure way to stop bleeding, close perforations, and treat lesions post-polypectomy. The newest advancement of this is over-the-scope clips (OTSC), which compress quite massively, thus being extremely effective in the treatment of GI perforation, fistula, and anastomotic leakages.

Such closing systems are increasingly required for patients undergoing treatment of peptic ulcers, colorectal cancer, and obesity surgery. The trend of doing minimal invasive surgery is picking up North America and Europe among others, much because of sophisticated endoscopy facilities and the growing trend towards non-surgical treatments. Asia-Pacific on the other hand has very high growth as endoscopic surgery is becoming more common in the region.

Moreover, endoscopic closure is changing in the future with new emerging technologies such as accurate AI-assisted clip application for closure, bioabsorbable clips dissolving over time, and sensor-laden smart endoclips that track healing in real time. These advancements are promising in terms of improving patient outcomes and on the expansion of the frontier of endoscopic care.

Expanding Applications and Future Innovations in Overstitch Endoscopic Suturing Systems Drive the Overstitch Endoscopic Suturing System

The Overstitch endoscopic suturing system is fast gaining acceptance because of its capability of achieving secure, full-thickness closure of the tissue, thus making it effective for closing up large defects, fistulas, and for reoperation of bariatric procedures. Unlike normal endoclips, Overstitch allows true suturing within the GI tract, thus making it very useful. It is best used for closing post-surgical leaks and optimizing bariatric procedures.

The factors favoring acceptance are the growing demand for endoscopic sleeve gastroplasty (EGS), augmented bariatric surgical volumes, and the preference of patients for non-surgical weight-loss therapies. North America, being the frontrunner in this regard, reflects an increased demand for both gastroenterology and centers performing bariatric surgeries; however, Europe and Asia-Pacific are slowly but steadily increasing in their adoption due to the augmented performances of obesity-related procedures.

In light of these advancements, robot-assisted endoscopic suturing is likely to be seen in future applications with clearer sight of the suturing process, biodegradable sutures that allow reversible closure and artificial intelligence-based suturing techniques that will provide more advanced endoscopic repairs for patients and improve the applications of such systems in minimally invasive surgery.

Hospitals- Leading the Adoption of Advanced Endoscopic Closure Systems

Hospitals have become the foremost users of endoscopic closure systems, as they treat innumerable patients with well-facilitated endoscopy suites and expert surgical teams. These centers routinely perform complex procedures such as GI bleeds management, esophageal perforation repair, and bariatric surgery revision, which are all necessitating excellent closure technologies such as OTSC and endoscopic suturing.

Many of the factors driving demand in this market include the increase in the incidence of gastrointestinal diseases, the rising acceptance of non-invasive treatment modalities, and the increasing application of AI technology in hospital endoscopy departments.

Ambulatory Surgical Centers- Rise in Demand for Day Care Expanding Role in Endoscopic Closure Systems

The contribution of the ambulatory surgical centers (ASCs) to the endoscopic closure systems market is more and more increasing. For their inexpensive nature, shorter recovery times, and the growing interest in outpatient procedures, ASCs are the choice preferred by many patients.

These places continue to carry out routine procedures, such as polypectomy and ulcer closure, and bariatric endoscopic revision, using advanced closure methods such as endoclips and suturing systems for safe and efficient results. This market is being driven by the trend towards outpatient services, increasing same-day requests for gastrointestinal procedures, and increasing coverage by insurance for endoscopy procedures.

The market is very dynamic and fast growth is taking place in this sector for endoscopic closure systems, mostly on account of increased demand for minimally-invasive procedures and state-of-the-art advancements in the endoscopic field. More gastrointestinal and bariatric procedures are being performed that further accelerate the pace of innovations for suturing devices, clip-based closure systems, and bioabsorbable materials.

All incumbent players in the medical device sector who comprehend the endoscopy specialty, even the newcomers, are now compelled to compete with each other in bringing to market the most useful and user-friendly solutions. The scenario boosts ongoing developments in patient care, evolving procedures to be safer, more effective, and less invasive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 22-26% |

| Johnson & Johnson, Services Inc. | 18-22% |

| Boston Scientific Corporation | 10-14% |

| Olympus Corporation | 8-12% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Medtronic plc | Leads the industry with cutting-edge endoscopic suturing tools, clip-based closure systems, and minimally invasive surgical devices. |

| Johnson & Johnson, Services Inc. | Offers high-performance endoscopic closure solutions in the form of suture-based products and hemostatic clips. |

| Boston Scientific Corporation | Expertise in endoscopic closure systems for GI procedures with self-expanding clips and hemostatic products |

| Olympus Corporation | Innovates state-of-the-art endoscopic closure technologies focusing on precision, safety, and ease of use |

Key Company Insights

Medtronic

The company holds the largest market share in endoscopic closure with about 22-26%, its unique suturing and clip-based technologies making minimally invasive interventions both safer and relatively easy to perform.

Johnson & Johnson Service Inc. (18-22%)

The company has years of surgical experience that have helped them develop a suite of superior quality endoscopic suturing and hemostatic closure products trusted by medical practitioners all over the world.

Boston Scientific Corporation (10-14%)

The precision and the simple design emphasize the latest closure systems that improve such gastrointestinal endoscopy procedures.

Olympus Corporation (8-12%)

It is a merger of an endoscopic visualization innovation combined with superior closure technologies that improve accuracy and patient outcomes

Other Key Players (25-30% Combined)

A number of other firms significantly contribute to the drug delivery technology market by innovating specialized products and increasing their international presence. Some of these include:

The overall market size for Endoscopic Closure Systems Market was USD 542.0 million in 2025.

The Endoscopic Closure Systems Market is expected to reach USD 1,027.5 million in 2035.

Rising awareness and growing demand for non-invasive procedure drive the growth of this market.

The top key players that drives the development of Drug Delivery Technology Market are, Medtronic plc, Johnson & Johnson, Services Inc., Boston Scientific Corporation and Olympus Corporation.

Endoscopic clips/Endoclips in product type of Endoscopic Closure Systems market is expected to command significant share over the assessment period.

Endoscopic clips/Endoclips (Over-the-scope Clips), Overstitch endoscopic suturing system, Cardiac septal defect occluders, Endoscopic vacuum-assisted closure systems and Others

Gastrointestinal (GI) Bleeding Management, Post-Endoscopic Mucosal Resection (EMR) Closure, Closure of Perforations and Fistulas, Anastomotic Leak Repair, Bariatric Surgery, Gastroesophageal Reflux Disease (GERD) Repair, Colon Diverticula Procedures, Stent Fixation, Pediatric GI Closure Procedures, Others Procedures

Hospitals, Ambulatory Surgical Centers and Specialty Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.