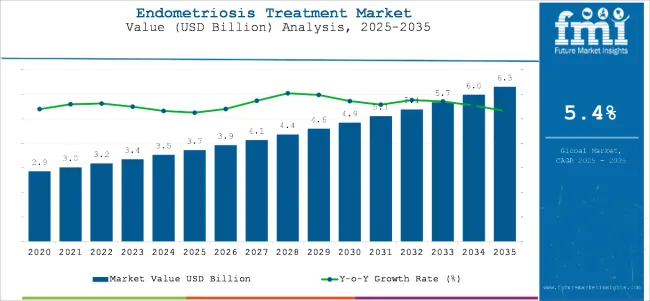

The endometriosis treatment market is worth USD 3.7 billion in 2025 and is set to reach USD 6.30 billion by 2035, which shows 5.4% CAGR.

Endometriosis is a condition characterized by a type of tissue, resembling very closely uterine lining growing outside endometrium. Treatment for endometriosis includes symptomatic relief and preventing disease progression including drugs such as hormonal therapies.

When it comes to endometriosis treatment, increasing disease prevalence and growing awareness coupled with better diagnosis facilities because of advanced diagnostics equipment create a buoyant endometriosis treatment industry. Increased focus on minimal interventions and targeted therapy is driving demand. Government initiatives for women's health, in addition to funding by governments for continuous clinical research on novel drugs, adds steam to this trend. More efforts are put forth to better the quality of life of the affected women, hence new options continue to emerge.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 3.5 billion |

| Estimated Size, 2025 | USD 3.7 billion |

| Projected Size, 2035 | USD 6.30 billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Additionally, other considerable factors pushing the acceptance of endometriosis therapy are the increasing incidences in women like that of pelvic inflammatory disease, uterine fibroids, polycystic ovary syndrome, as well as abnormal menstruation. Such conditions often increase symptoms or raise the risk for endometriosis, hence, on a higher scale, bring patients to doctors for diagnosis. Early detection, brought about by knowledge, motivates women to go for early treatment and hence boosts the need for effective therapies.

Other influences that will fuel the growing adoption of endometriosis treatments are improved diagnostic equipment like better imaging and biomarker-based tests for precise early detection.

Additionally, awareness programs and educational campaigns organized by health agencies, the government, and non-profit organizations, further increases awareness and decreases stigma regarding gynecological health, thus anticipating its growth as more women seek medical care. On the other hand, key drivers are government policies, increasing healthcare expenditure, and increasing establishment of specialty healthcare centers, easing accessibility to endometriosis treatment. Further, research studies on women's health and new drug launches through clinical trials add to the overall market growth of endometriosis treatments.

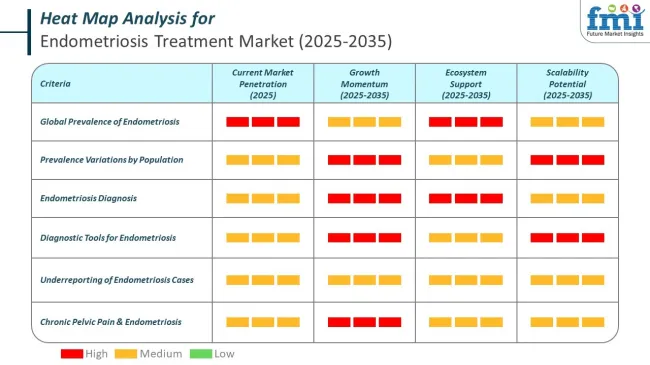

Endometriosis affects a substantial proportion of women of reproductive age, with most global estimates placing prevalence near 10 percent. This equates to roughly 190 million women worldwide, according to who.int and related studies. Broader estimates suggest prevalence can range from 5 to 15 percent depending on population characteristics and diagnostic standards.

A systematic review and meta-analysis suggests the global prevalence may be closer to 18 percent, with rates differing significantly across subgroups. Among infertile women, prevalence can reach 30 to 50 percent, and for women experiencing chronic pelvic pain, estimates range from 15 to 75 percent. Mild (stage 1) cases are consistently more common than advanced stages.

Accurate prevalence figures remain challenging due to the reliance on laparoscopy for definitive diagnosis. While imaging techniques like ultrasound and MRI can detect certain cases, they remain less effective for superficial lesions, contributing to potential underreporting.

Comparative analysis of fluctuations in compound annual growth rate (CAGR) for the global clinical trial market between 2024 and 2025 on six months basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market's growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December

The following table gives the anticipated CAGR of the worldwide Endometriosis Treatment industry for a number of half-yearly periods ranging from 2025 to 2035. During the initial half (H1) of the decade 2024-2034, the company is anticipated to grow at a rate of 5.7%, while during the second half (H2) of the decade 2024-2034, it will grow at a rate of 6.1%.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.7% |

| H2 (2024 to 2034) | 6.1 |

| H1 (2025 to 2035) | 5.4% |

| H2 (2025 to 2035) | 6.0 |

Transitioning into the next period, H1 2025 to H2 2035, the CAGR is estimated to slow down marginally to 5.4% during the first half and moderate down at 6.0% during the second half. During the first half (H1) the market experienced a drop of 70 BPS whereas during the second half (H2), the market experienced a drop of 90 BPS.

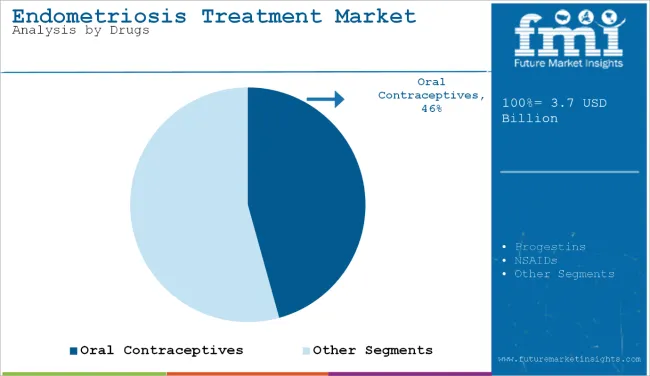

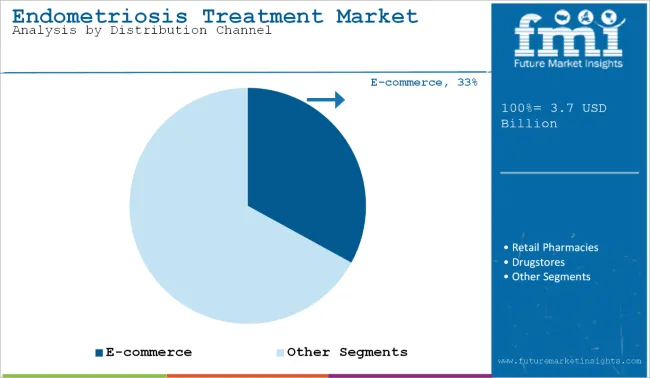

The global endometriosis treatment market is segmented by drugs into Oral Contraceptives, Progestins, NSAIDs, GnRH Analogues, LNR-IUDs, and Others (including aromatase inhibitors, selective estrogen receptor modulators (SERMs), immunomodulators, anti-TNF agents, cannabinoid-based therapies, and novel pipeline drugs such as prostaglandin inhibitors and neuroangiogenesis blockers); by treatment type into Hormonal Therapy and Pain Management; by distribution channel into Hospital Pharmacies, Retail Pharmacies, Drugstores, and e-Commerce; and by region into North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and Middle East and Africa.

Oral contraceptives are projected to retain their leading position with a market share of 46% in 2025, owing to their effectiveness, affordability, and wide clinical adoption for long-term hormonal regulation. Progestins follow closely, favored for their anti-estrogenic action, especially in cases where estrogen suppression is required.

NSAIDs, while commonly used for symptomatic relief of pain, represent a smaller share due to their inability to treat the root cause. GnRH analogues are used for more severe cases, but potential side effects limit their long-term application.

LNR-IUDs (levonorgestrel-releasing intrauterine devices) are increasingly accepted due to localized hormonal delivery with fewer systemic effects. The others category includes aromatase inhibitors, SERMs, immunomodulators, anti-TNF agents, and new pipeline drugs targeting molecular and inflammatory pathways. Though still niche, these alternatives are gaining traction, particularly in treatment-resistant patients and those contraindicated for hormone therapy.

| Drug Type Segment | Market Share (2025) |

|---|---|

| Oral Contraceptives | 46% |

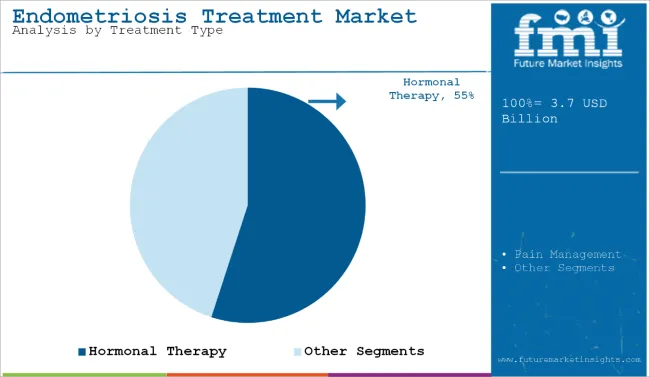

Hormonal therapy is projected to be the most lucrative treatment segment in the endometriosis treatment market, with a CAGR of 5.7% between 2025 and 2035. Its widespread clinical adoption is attributed to its ability to suppress estrogen production, regulate menstrual cycles, and reduce the progression of endometrial lesions. Common drugs under this category include oral contraceptives, progestins, GnRH analogues, and LNR-IUDs, which offer sustained symptom control and are typically recommended as first-line therapy.

Their long-term usability and broad insurance coverage further boost market demand. Additionally, growing awareness and government initiatives to promote women’s health are increasing accessibility to hormonal therapies. Advancements in formulation such as extended-release and localized delivery systems are further enhancing treatment adherence.

On the other hand, pain management which includes NSAIDs and other analgesics plays a critical role in symptom relief but is expected to grow at a relatively slower rate, given its limited impact on disease progression. While still essential in multi-modal care approaches, pain management is primarily reserved for early-stage cases or adjunctive therapy alongside hormonal treatments.

| Treatment Type Segment | CAGR (2025 to 2035) |

|---|---|

| Hormonal Therapy | 5.7% |

Among the distribution channels for endometriosis treatment, e-commerce is projected to witness the fastest CAGR of 6.2% from 2025 to 2035. This surge is fueled by the growing adoption of telemedicine, increased digital health literacy, and patient preference for home delivery of chronic care medications.

Online platforms are increasingly offering prescription fulfillment, consultations, and medication reminders, enhancing convenience and adherence. Furthermore, the COVID-19 pandemic has accelerated consumer reliance on digital pharmacy models, which continues to benefit the segment.

In contrast, hospital pharmacies remain the prominent channel by share due to their integration with diagnostic services and immediate access to advanced therapies, especially for newly diagnosed or complex cases. Retail pharmacies and drug stores are expected to grow at moderate rates, with increasing availability of over-the-counter and prescription hormonal drugs, but without the digital convenience advantage offered by e-commerce.

| Distribution Segment | CAGR (2025 to 2035) |

|---|---|

| E-Commerce | 6.2% |

Growing cases of endometriosis are a good indication of the market for its treatment growing. The higher the number of women who are diagnosed with it, the greater the need for effective treatment methods increases accordingly.

This growing incidence warrants additional medical interventions, including hormonal therapies, pain control treatments, and surgery, in order to manage the chronic pain and infertility caused by the condition. Increased incidence also forces drug companies to demand the formulation of new medicines and targeted therapy drugs that will effectively treat the condition and fewer side effects.

The other public and healthcare sectors are also focusing on additional funding and policy support of women's health. This results in increased availability of specialized endometriosis treatment. Incidence is increasingly common among young people in the developing world and this, with developing healthcare structures, expands further.

More importantly, the social and economic costs of untreated endometriosis force healthcare systems to become more proactive through early diagnosis and advanced treatments, fueling this market. Improved awareness and diagnosis directly relate to the increased prevalence of endometriosis, thereby driving further growth for this market while remaining innovative and accessible.

Growing investments in research and development related to new therapeutic treatments for endometriosis strongly drive the market growth due to hitherto unmet needs for more effective and patient-friendly solutions. Such conventional treatments are usually associated with serious side effects and/or are contraindicated for every patient due to being treated with hormonal therapies or pain management drugs. New investment into research and development converts into better treatment options, with much superior efficacy and minimal side effects, which enhance patients' quality of life.

This keeps the biopharmaceutical companies and their research departments focused on the innovative therapies of not only non-hormonal medications, but also targeted treatments and immunomodulators that link directly into the illness process. For instance, pipeline therapies that specifically target certain inflammatory pathways or molecular processes associated with endometriosis signal brighter prospects for enlarged therapeutic capability. Clinical trials from these investments also hasten drug approvals, thereby increasing the basket size of treatments available in the market.

Further, increasing financial encouragement from governments and private associations to conduct women's health-related studies is also driving innovation in this field. Such advancements draw not only patients but also motivate health care providers toward the acceptance of new therapies. By increasing treatment effectiveness and access, such investments present significant opportunities for pharmaceuticals to drive consistent growth in the endometriosis treatment market.

With innovative therapies being developed for the treatment of endometriosis, there is new business potential based on unmet needs. Current treatments are generally hormone therapies and have disadvantages in the form of side effects or limited use in long-term or specific populations of patients. New and more advanced solutions can offer improved efficacy and patient outcomes.

Pharma firms that concentrate on non-hormonal therapy, targeted medicine, and biologics will be the leaders in the market. For example, therapies based on the identification of specific molecular and inflammatory processes associated with endometriosis will offer better and more effective results, and hence cover a larger number of patients.

Additionally, therapies for endometriosis-related infertility could be addressed to an underdeveloped market. Brand-new therapies with less toxicity and more tolerability would open up the door for wider use in patients unwilling to tolerate existing treatments.

Such partnerships between biopharmaceutical companies, research institutions, and healthcare organizations can accelerate development and commercialization of these drugs. Governments offering funding and grants for women's health research further contribute to the growth potential.

Investing in innovation enables companies to address changing patient needs and enhance their market position, thus gaining access to significant growth opportunities in this vast area.

It takes a typical 7-10 years to diagnose endometriosis in women, starting from when the symptoms begin. The delays are primarily a result of ignorance of the disease among patients as well as health care providers, and also a result of nonspecificity of symptoms, which are easily confused with other conditions such as irritable bowel syndrome and pelvic inflammatory disease.

It is due to the lengthy period consumed in diagnosing the condition that, in most cases, the disease is left undiagnosed or misdiagnosed, further cutting down demand for treatments specific to endometriosis. The trend negatively affects the growth of the market as well as enables the disease to reach its advanced stages, making the treatment options complex and the success of existing therapies limited.

Moreover, delayed diagnosis implies that pharma companies and healthcare service providers cannot avail the resources of a larger patient base. When diagnosis does happen for some patients, the disease has often reached a stage at which only expensive surgical interventions are effective; these interventions may not be widely accessible in resource-poor health systems, narrowing the market opportunity even further.

Closing these delays and achieving the real market potential will need an upgrade in diagnostic tools, raise awareness, and training for medical practitioners on recognizing early symptoms of endometriosis.

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 35.8% in global market. These market leaders are characterized by high production capacity and a wide product portfolio.

These market leaders are distinguished by their extensive expertise in providing their services underpinned by a robust consumer base. Prominent companies within tier 1 include AbbVie Inc., Bayer AG and Pfizer Inc.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 17.5% market share. These are characterized by a strong presence overseas and strong market knowledge.

These market players have good technology and ensure regulatory compliance but may not have access to global reach. Prominent companies in tier 2 include AstraZeneca, Ipsen Pharma, and Amneal Pharmaceuticals, Inc.

Finally, Tier 3 companies, act as a suppliers to the established market players. They are critical to the market because they have specialized services and target niche markets, diversifying the industry. Overall, though the Tier 1 companies are the key drivers in the market, Tier 2 and 3 companies also play an important role, keeping the endometriosis treatment market competitive and dynamic.

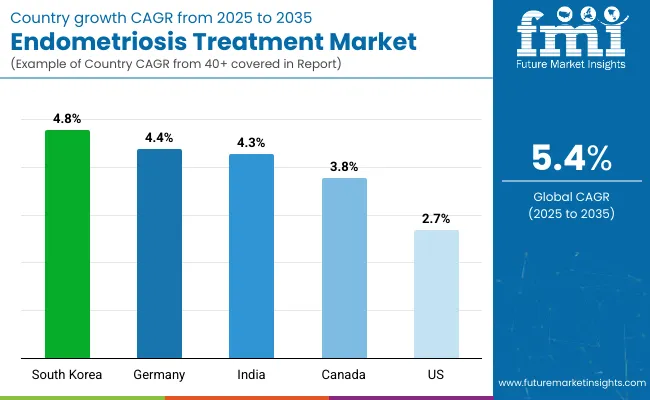

The section below covers the industry analysis for the Endometriosis Treatment market for different countries. Market demand analysis of the major countries in various regions of the world, such as North America, Asia Pacific, Europe, and others, is given. The United States is expected to lead in North America, with a value share of 33.5% until 2035. China is expected to have a CAGR of 4.0% by 2034 in Asia Pacific.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.7% |

| China | 4.0% |

| Canada | 3.8% |

| South Korea | 4.8% |

| Germany | 4.4% |

| India | 4.3% |

This American market for endometriosis treatment is expected to grow with a CAGR of 2.7 % between 2025 and 2035. Presently, it holds maximum market share in the North American market and will continue to do so throughout the forecasted period.

The increasing improvement in the technology to access treatment is likely to propel the market considerably in the USA Expansion of non-hormonal drugs, targeted biologics, and newer surgical procedures like robotic-assisted procedures provides more efficient and individualized care for the patients.

Findings from research innovation give much better returns with less side effect but addresses the shortcomings of conventional treatments, mainly hormonal drugs, which normally resulted in serious side effects. Furthermore, the avenues of Molecular Targeted Therapies, pain management, and non-invasive diagnosis are furthering their contributions towards making therapy much more accessible and feasible.

Because such technologies become available to increasing numbers of individuals, they are certainly bound to enhance patient acceptability and satisfaction, further stimulating market expansion. New treatments also stimulate investments from pharmaceutical firms, healthcare organizations, and research institutes in their additional development. This should become the chief determinant of how America treats endometriosis in the future with increasingly available options coming with increasing research and development.

South Korea is foreseen to maintain a high CAGR of 4.8% throughout the forecast period. The increasing sensitivity of women's health among women in South Korea has been one of the significant factors that contribute to the increasing treatment of endometriosis.

With both the public and private sectors still investing in the programs on women's health, diseases such as endometriosis have gained so much attention; increased funding in research for better diagnosis and methods of treatment saw the development of effective therapies. Government support has also aligned healthcare policies in a way that spreads awareness and early diagnosis, ensuring more women seek treatment on time.

Public campaigns and healthcare programs are reducing the stigma surrounding gynecological conditions, encouraging women to discuss their symptoms openly. This shift in creating an enabling environment will eventually see more women with the condition seeking treatment, hence driving the growth of the treatment options in the country.

Germany will likely be among the major players and will possess a considerable share of the endometriosis treatment market as it seems promising. The robust healthcare system in Germany, coupled with focused efforts toward research and advancements, provides a conducive environment for this new therapy and treatment.

As more funding is directed toward endometriosis research, the pharmaceutical companies and institutions are looking to new drug therapies as well as non-hormonal treatment and advanced surgical methods to offer.

The clinical trials are the provisions for newer methods of treatment and the availability of the latest therapy to patients who may not get these widely. Such trials offer great insight into diseases, pathophysiology, and optimum ways of managing the conditions.

Positive trial results also help in the diffusion of effective therapies and confidence in therapies by providers. Also, such clinical trials inspire the development of more potent and personal treatments for endometriosis, hence driving market growth in Germany as research continues to advance.

Significant investments and attention is evident in the treatment of endometriosis market towards introduction of new series of services to markets. Another fundamental strategic priority for these companies is to actively search for strategic partners to strengthen product portfolios and drive global market position.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 3.7 billion |

| Projected Market Size (2035) | USD 6.30 billion |

| CAGR (2025 to 2035) | 5.40% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/ Volume in units |

| By Drugs | Oral Contraceptives, Progestins, NSAIDs, GnRH Analogues, LNR-IUDs, Others |

| By Treatment Type | Hormonal Therapy, Pain Management |

| By Distribution Channel | Hospital Pharmacies, Retail Pharmacies, Drugstores, e-Commerce |

| Regions Covered | North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, Middle East and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | AbbVie Inc., Bayer AG, AstraZeneca, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Ipsen Pharma, Myovant Sciences, Endoceutics, Inc., Debiopharm Group, Mayne Pharma Group Limited, Noven Pharmaceuticals, Inc., Sun Pharmaceutical Industries Limited, Amneal Pharmaceuticals, Inc., Mylan N.V., Aurobindo Pharma |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

The global endometriosis treatment industry is projected to witness CAGR of 5.4% between 2025 and 2035.

The global endometriosis treatment industry stood at USD 3,508.5 million in 2024.

The global endometriosis treatment industry is anticipated to reach USD 6.30 billion by 2035 end.

India is set to record the highest CAGR of 4.3% in the assessment period.

The key players operating in the global endometriosis treatment industry include AbbVie Inc., Bayer AG, AstraZeneca, Pfizer Inc., Teva Pharmaceutical Industries Ltd., Ipsen Pharma, Myovant Sciences, Endoceutics, Inc., Debiopharm Group, Mayne Pharma Group Limited, Noven Pharmaceuticals, Inc., Sun Pharmaceutical Industries Limited, Amneal Pharmaceuticals, Inc., Mylan N.V. and Aurobindo Pharma

Table 01: Global Market Value (US$ Mn) Analysis and Opportunity Assessment 2014-2030, By Drug

Table 02: Global Market Value (US$ Mn) Analysis and Opportunity Assessment 2014-2030, By Treatment Type

Table 03: Global Market Value (US$ Mn) Analysis and Opportunity Assessment 2014-2030, By Distribution Channel

Table 04: Global Market Value (US$ Mn) Analysis and Opportunity Assessment 2014-2030, By Region

Table 05: North America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 06: North America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 07: North America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 08: North America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 09: Latin America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 10: Latin America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 11: Latin America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 12: Latin America Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 13: Europe Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 14: Europe Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 15: Europe Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 16: Europe Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 17: South Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 18: South Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 19: South Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 20: South Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 21: East Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 22: East Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 23: East Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 24: East Asia Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 25: Oceania Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 26: Oceania Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 27: Oceania Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 28: Oceania Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 29: MEA Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Country

Table 30: MEA Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 31: MEA Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 32: MEA Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channel

Table 33: India Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 34: India Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 35: India Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channels

Table 36: China Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 37: China Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 38: China Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channels

Table 39: Brazil Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Drug

Table 40: Brazil Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Treatment Type

Table 41: Brazil Market Value (US$ Mn) Analysis 2014-2018 and Forecast 2019-2030, By Distribution Channels

Figure 01: Global Market Value Analysis (US$ Mn), 2014-2018

Figure 02: Global Market Value Forecast (US$ Mn), 2019-2030

Figure 03: Global Market Absolute $ Opportunity, 2019 - 2030

Figure 04: Global Market Share Analysis (%), By Drug, 2019-2030

Figure 05: Global Market Y-o-Y Analysis (%), By Drug, 2019-2030

Figure 06: Global Market Attractiveness Analysis by Drug, 2019-2030

Figure 07: Global Market Share Analysis (%), By Treatment Type, 2019-2030

Figure 08: Global Market Y-o-Y Analysis (%), By Treatment Type, 2019-2030

Figure 09: Global Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 10: Global Market Share Analysis (%), By Distribution Channel, 2019-2030

Figure 11: Global Market Y-o-Y Analysis (%), By Distribution Channel, 2019-2030

Figure 12: Global Market Attractiveness Analysis by Distribution Channel, 2019-2030

Figure 13: Global Market Share Analysis (%), By Region, 2019-2030

Figure 14: Global Market Y-o-Y Analysis (%), By Region, 2019-2030

Figure 15: Global Market Attractiveness Analysis by Region, 2019-2030

Figure 16: North America Market Value Share, By Drug, 2019 (E)

Figure 17: North America Market Value Share, By Treatment Type, 2019 (E)

Figure 18: North America Market Value Share, By Distribution Channel, 2019 (E)

Figure 19: North America Market Value Share, By Country, 2019 (E)

Figure 20: North America Market Value Analysis (US$ Mn), 2014-2018

Figure 21: North America Market Value Forecast (US$ Mn), 2019-2030

Figure 22: North America Market Attractiveness Analysis by Drug, 2019-2030

Figure 23: North America Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 24: North America Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 25: North America Market Attractiveness Analysis by Country, 2019-2030

Figure 26: Latin America Market Value Share, By Drug, 2019 (E)

Figure 27: Latin America Market Value Share, By Treatment Type, 2019 (E)

Figure 28: Latin America Market Value Share, By Distribution Channel, 2019 (E)

Figure 29: Latin America Market Value Share, By Country, 2019 (E)

Figure 30: Latin America Market Value Analysis (US$ Mn), 2014-2018

Figure 31: Latin America Market Value Forecast (US$ Mn), 2019-2030

Figure 32: Latin America Market Attractiveness Analysis by Drug, 2019-2030

Figure 33: Latin America Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 34: Latin America Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 35: Latin America Market Attractiveness Analysis by Country, 2019-2030

Figure 36: Europe Market Value Share, By Drug, 2019 (E)

Figure 37: Europe Market Value Share, By Treatment Type, 2019 (E)

Figure 38: Europe Market Value Share, By Distribution Channel, 2019 (E)

Figure 39: Europe Market Value Share, By Country, 2019 (E)

Figure 40: Europe Market Value Analysis (US$ Mn), 2014-2018

Figure 41: Europe Market Value Forecast (US$ Mn), 2019-2030

Figure 42: Europe Market Attractiveness Analysis by Drug, 2019-2030

Figure 43: Europe Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 44: Europe Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 45: Europe Market Attractiveness Analysis by Country, 2019-2030

Figure 46: South Asia Market Value Share, By Drug, 2019 (E)

Figure 47: South Asia Market Value Share, By Treatment Type, 2019 (E)

Figure 48: South Asia Market Value Share, By Distribution Channel, 2019 (E)

Figure 49: South Asia Market Value Share, By Country, 2019 (E)

Figure 50: South Asia Market Value Analysis (US$ Mn), 2014-2018

Figure 51: South Asia Market Value Forecast (US$ Mn), 2019-2030

Figure 52: South Asia Market Attractiveness Analysis by Drug, 2019-2030

Figure 53: South Asia Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 54: South Asia Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 55: South Asia Market Attractiveness Analysis by Country, 2019-2030

Figure 56: East Asia Market Value Share, By Drug, 2019 (E)

Figure 57: East Asia Market Value Share, By Treatment Type, 2019 (E)

Figure 58: East Asia Market Value Share, By Distribution Channel, 2019 (E)

Figure 59: East Asia Market Value Share, By Country, 2019 (E)

Figure 60: East Asia Market Value Analysis (US$ Mn), 2014-2018

Figure 61: East Asia Market Value Forecast (US$ Mn), 2019-2030

Figure 62: East Asia Market Attractiveness Analysis by Drug, 2019-2030

Figure 63: East Asia Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 64: East Asia Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 65: East Asia Market Attractiveness Analysis by Country, 2019-2030

Figure 66: Oceania Market Value Share, By Drug, 2019 (E)

Figure 67: Oceania Market Value Share, By Treatment Type, 2019 (E)

Figure 68: Oceania Market Value Share, By Distribution Channel, 2019 (E)

Figure 69: Oceania Market Value Share, By Country, 2019 (E)

Figure 70: Oceania Market Value Analysis (US$ Mn), 2014-2018

Figure 71: Oceania Market Value Forecast (US$ Mn), 2019-2030

Figure 72: Oceania Market Attractiveness Analysis by Drug, 2019-2030

Figure 73: Oceania Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 74: Oceania Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 75: Oceania Market Attractiveness Analysis by Country, 2019-2030

Figure 76: MEA Market Value Share, By Drug, 2019 (E)

Figure 77: MEA Market Value Share, By Treatment Type, 2019 (E)

Figure 78: MEA Market Value Share, By Distribution Channel, 2019 (E)

Figure 79: MEA Market Value Share, By Country, 2019 (E)

Figure 80: MEA Market Value Analysis (US$ Mn), 2014-2018

Figure 81: MEA Market Value Forecast (US$ Mn), 2019-2030

Figure 82: MEA Market Attractiveness Analysis by Drug, 2019-2030

Figure 83: MEA Market Attractiveness Analysis by Treatment Type, 2019-2030

Figure 84: MEA Market Attractiveness Analysis by Distribution Channels, 2019-2030

Figure 85: MEA Market Attractiveness Analysis by Country, 2019-2030

Figure 86: India Market Value Analysis (US$ Mn), 2014-2018

Figure 87: India Market Value Forecast (US$ Mn), 2019-2030

Figure 88: China Market Value Analysis (US$ Mn), 2014-2018

Figure 89: China Market Value Forecast (US$ Mn), 2019-2030

Figure 90: Brazil Market Value Analysis (US$ Mn), 2014-2018

Figure 91: Brazil Market Value Forecast (US$ Mn), 2019-2030

Figure 92: U. S. Market Value Analysis (US$ Mn), 2019 & 2030

Figure 93: U. S. Market Value Share, By Drug, 2019 (E)

Figure 94: U. S. Market Value Share, By Treatment Type, 2019 (E)

Figure 95: U. S. Market Value Share, By Distribution Channel, 2019 (E)

Figure 96: Canada Market Value Analysis (US$ Mn), 2019 & 2030

Figure 97: Canada Market Value Share, By Drug, 2019 (E)

Figure 98: Canada Market Value Share, By Treatment Type, 2019 (E)

Figure 99: Canada Market Value Share, By Distribution Channel, 2019 (E)

Figure 100: Mexico Market Value Analysis (US$ Mn), 2019 & 2030

Figure 101: Mexico Market Value Share, By Drug, 2019 (E)

Figure 102: Mexico Market Value Share, By Treatment Type, 2019 (E)

Figure 103: Mexico Market Value Share, By Distribution Channel, 2019 (E)

Figure 104: Germany Market Value Analysis (US$ Mn), 2019 & 2030

Figure 105: Germany Market Value Share, By Drug, 2019 (E)

Figure 106: Germany Market Value Share, By Treatment Type, 2019 (E)

Figure 107: Germany Market Value Share, By Distribution Channel, 2019 (E)

Figure 108: U.K. Market Value Analysis (US$ Mn), 2019 & 2030

Figure 109: U.K. Market Value Share, By Drug, 2019 (E)

Figure 110: U.K Market Value Share, By Treatment Type, 2019 (E)

Figure 111: U.K. Market Value Share, By Distribution Channel, 2019 (E)

Figure 112: France Market Value Analysis (US$ Mn), 2019 & 2030

Figure 113: France Market Value Share, By Drug, 2019 (E)

Figure 114: France Market Value Share, By Treatment Type, 2019 (E)

Figure 115: France Market Value Share, By Distribution Channel, 2019 (E)

Figure 116: Italy Market Value Analysis (US$ Mn), 2019 & 2030

Figure 117: Italy Market Value Share, By Drug, 2019 (E)

Figure 118: Italy Market Value Share, By Treatment Type, 2019 (E)

Figure 119: Italy Market Value Share, By Distribution Channel, 2019 (E)

Figure 120: Spain Market Value Analysis (US$ Mn), 2019 & 2030

Figure 121: Spain Market Value Share, By Drug, 2019 (E)

Figure 122: Spain Market Value Share, By Treatment Type, 2019 (E)

Figure 123: Spain Market Value Share, By Distribution Channel, 2019 (E)

Figure 124: Russia Market Value Analysis (US$ Mn), 2019 & 2030

Figure 125: Russia Market Value Share, By Drug, 2019 (E)

Figure 126: Russia Market Value Share, By Treatment Type, 2019 (E)

Figure 127: Russia Market Value Share, By Distribution Channel, 2019 (E)

Figure 128: Japan Market Value Analysis (US$ Mn), 2019 & 2030

Figure 129: Japan Market Value Share, By Drug, 2019 (E)

Figure 130: Japan Market Value Share, By Treatment Type, 2019 (E)

Figure 131: Japan Market Value Share, By Distribution Channel, 2019 (E)

Figure 132: South Korea Market Value Analysis (US$ Mn), 2019 & 2030

Figure 133: South Korea Market Value Share, By Drug, 2019 (E)

Figure 134: South Korea Market Value Share, By Treatment Type, 2019 (E)

Figure 135: South Korea Market Value Share, By Distribution Channel, 2019 (E)

Figure 136: Australia Market Value Analysis (US$ Mn), 2019 & 2030

Figure 137: Australia Market Value Share, By Drug, 2019 (E)

Figure 138: Australia Market Value Share, By Treatment Type, 2019 (E)

Figure 139: Australia Market Value Share, By Distribution Channel, 2019 (E)

Figure 140: New Zealand Market Value Analysis (US$ Mn), 2019 & 2030

Figure 141: New Zealand Market Value Share, By Drug, 2019 (E)

Figure 142: New Zealand Market Value Share, By Treatment Type, 2019 (E)

Figure 143: New Zealand Market Value Share, By Distribution Channel, 2019 (E)

Figure 144: GCC Countries Market Value Analysis (US$ Mn), 2019 & 2030

Figure 145: GCC Countries Market Value Share, By Drug, 2019 (E)

Figure 146: GCC Countries Market Value Share, By Treatment Type, 2019 (E)

Figure 147: GCC Countries Market Value Share, By Distribution Channel, 2019 (E)

Figure 148: South Africa Market Value Analysis (US$ Mn), 2019 & 2030

Figure 149: South Africa Market Value Share, By Drug, 2019 (E)

Figure 150: South Africa Market Value Share, By Treatment Type, 2019 (E)

Figure 151: South Africa Market Value Share, By Distribution Channel, 2019 (E)

Figure 152: Turkey Market Value Analysis (US$ Mn), 2019 & 2030

Figure 153: Turkey Market Value Share, By Drug, 2019 (E)

Figure 154: Turkey Market Value Share, By Treatment Type, 2019 (E)

Figure 155: Turkey Market Value Share, By Distribution Channel, 2019 (E)

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Water Treatment System Market Growth - Trends & Forecast 2025 to 2035

Algae Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Water Treatment Chemical Market Growth – Trends & Forecast 2024-2034

Anemia Treatment Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA