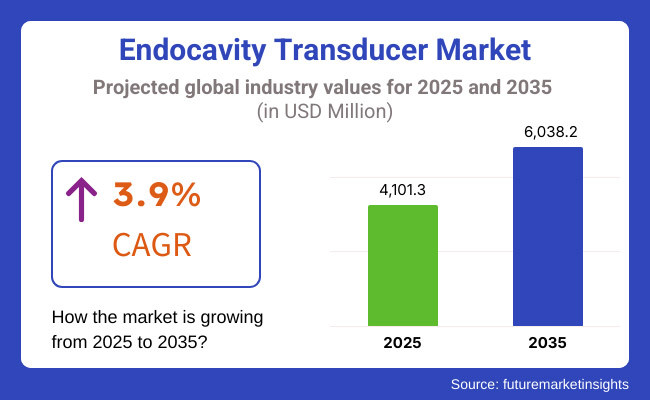

The global market for endocavity transducers is forecasted to attain USD 4,101.3 million by 2025, expanding at 3.9% CAGR to reach USD 6,038.2 million by 2035. In 2024, the revenue of this market was around USD 3,956.6 million.

The market for Endocavity Transducers is expanding with increased cases of gynecological, urological, and colorectal disorders. There is an emerging rate of prostate and cervical cancer that further raises the demand for advanced imaging equipment.

Most medical professionals today are looking for minimally invasive diagnostics, which leads to a surge in demand for endocavity transducers. The endocavity transducers give accurate, real-time images that allow diseases to be detected early.

Technological advancements such as high-frequency transducers and 3D/4D imaging also improve diagnosis accuracy. AI-based ultrasound systems are also being put up in hospitals and clinics more and more, improving efficiency and reducing errors. The increasing number of elderly populations, especially in Europe and North America, is also increasing the use of ultrasound imaging for urology and gynecology.

In the coming days, portable and wireless ultrasound machines will increase the ease of imaging, particularly in tiny clinics and inaccessible locations. Emerging markets in the Asia-Pacific region and Latin America present enormous future growth potential because healthcare systems here are becoming complex, and early-stage detection of the disease is getting increasingly recognized.

The Endocavity Transducer Market has seen big changes as ultrasound tech improved and doctors wanted improved diagnostic tools. At first, doctors used basic ultrasounds that didn't show much detail. These old probes gave fuzzy pictures, making it hard to spot problems in women's, men's, and gut health.

As time passed, companies made probes that used higher frequencies, leading to clearer images and helping doctors make more accurate diagnoses. The move towards less invasive surgeries made these devices more popular, as they showed real-time images to catch diseases. As ultrasound tech improved, 3D and 4D imaging became more common,letting doctors see organs in more detail.

The market grew as hospitals and clinics started using portable ultrasounds and ones with AI, which sped up diagnoses and made them more effective. As more people learned about catching diseases, health systems worldwide started using endocavity probes in regular check-ups, which made them more used in different areas of medicine.

Explore FMI!

Book a free demo

The North American endocavity transducer market continues to grow, thanks to the region's top-notch healthcare system more cases of prostate and gynecological cancers, and big-name medical imaging companies setting up shop. The USA leads the pack, with many hospitals and specialty clinics using cutting-edge ultrasound tech.

Government programs that push for early disease detection and good insurance coverage for diagnostic imaging help the market expand. Yet pricey equipment and tough FDA rules still pose problems. The market looks set to keep growing as more AI-powered ultrasound solutions come into play more money goes into telemedicine, and people want portable wireless transducers.

Europe is a key market for endocavity transducers. This growth stems from its strong public healthcare system more use of less invasive diagnostic methods, and government support for medical imaging research. Germany, France, and the UK lead the pack.

They have top-notch medical facilities and focus on finding cancer . Yet, rules from the European Medicines Agency (EMA) and efforts to cut costs in national health systems slow market growth.

The market has new chances to grow as more people use AI in imaging more clinical studies look at how to use endocavity ultrasound, and tele-ultrasound services expand. Also more teamwork between public and private groups in medical research speeds up new ideas in ultrasound tech.

The Asia Pacific region is also witnessing high growth in the market for endocavity transducers. This is mainly because there is a rise in the number of individuals suffering from gynecological and urological issues. Healthcare is becoming more accessible, and medical imaging is also becoming better.

China, Japan, and India are leading the way. Their governments embrace new medical equipment and are spending money on improving diagnostic imaging. But there are some challenges. Some people can’t afford these devices. Also, rules can be confusing, and there aren’t enough trained radiologists.

On the bright side, more healthcare providers are using AI for diagnosis. Local companies are starting to make ultrasound machines, and there’s a growing need for portable ultrasound in rural areas. Mobile healthcare programs and government efforts to catch diseases early are also helping the market grow

Premium prices of endocavity transducer is a major challenge

The considerable challenge facing the Endocavity Transducer Market is the unaffordability of high-end advanced ultrasound systems and transducers. High-frequency-based 3D/4D imaging transducers provide the highest standard of activeness, but they are quite costly. Most young clinics and healthcare centers in developing areas cannot afford to be able to buy these high-end devices, restricting their usage.

On top of that, high maintenance and replacement costs have become financial burdens. In order to ensure complete patient safety, specific sterilization has to be done on endocavity transducers and proper handling, but usually common usage leads to wearing out and therefore needs increasing replacement cost.

It is, however, the higher cost this cost puts up to the access barriers to the market impeding penetration in price-sensitive regions where budgets for health care are lower. While manufacturers are putting in effort towards the development of low-cost solutions, affordability remains a challenge that stands between many health care providers across the world and high-quality diagnostic device imaging.

Growing adoption of portable and wireless probes present lucrative growth opportunity

There's a big chance for growth in the Endocavity Transducer Market due to adoption of portable and wireless probes. More folks are using portable and wireless ultrasound systems. The old machines are heavy and pricey. This makes them hard to use in smaller clinics or remote areas.

Now, with new tech and smart imaging, ultrasound systems are getting smaller, cheaper, and easier to use. Portable endocavity transducers allow quick check-ups anywhere, especially in rural spots. This change fits well with the rise of telemedicine. Doctors can do ultrasound scans in real-time without needing bulky machines.

As companies make more affordable, battery-powered transducers that connect to the cloud, there’s a nice chance to reach places that need care. This could help catch diseases earlier and improve health for many people around the world.

Advancing Endocavity Imaging: Trends Shaping the Future of Ultrasound Diagnostics

Endocavity transducers find their development new directions as medical practitioners look to advanced imaging technology for minimally invasive diagnosis. This demand for ultrasound imaging of very high accuracy motivates manufacturers to build transducers with greater detection of gynecological, urological, and colorectal conditions.

The 3D and 4D endocavity transducers are being widely accepted by medical facilities, which ultimately allow more accurate images and the betterment of the diagnosis for the patient. While AI imaging solutions are increasingly automating the entire process of diagnosis, thus increasing accuracy, manual intervention is reducing.

In this regard, manufacturers are also developing such transducers that aim for patient comfort by being ergonomically designed and less painful during procedures such as transvaginal/transrectal ultrasound. The focus on infection control in hospitals has also led to an increasing demand for disposable covers for the transducers.

The market is now embracing more precise, user-friendly, and more accurate imaging technologies, which surely enhances healthcare outcomes for patients globally, considering the increase in prostate and cervical cancer cases.

During these four years, the Endocavity Transducer Market has really broadened up to its current state by the advancement in technology needing advanced diagnostics in the area of gynecology, urology, and colorectal health. This awareness for early detection and 'less-to-non' invasive procedures has increased the acceptance of the devices in hospitals, diagnostics, and clinics.

As a consequence of the threat that COVID-19 posed, the need for equipment for highly precise diagnostics in these situations has now drawn more investments in ultrasound technology.

Trends now shaping the market include artificial intelligence-induced integrated ultrasound systems for portable, wireless endocavity transducers and the advent of 3D/4D imaging aimed at achieving better diagnostic precision.

Another aspect is the constructing progress of health infrastructure, which is characteristic of emerging economies, resulting in further usage of point-of-care ultrasound (POCUS), further propelling market growth.

It is expected that in the near future innovations will lead the evolution of the market into maturity in technology, going by the upscale ambitions in sustainability initiatives, upgrades in technology, and strategic partnerships that will fully deliver the needs required in the shifting landscape of healthcare globally.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emphasis on endocavity transducer safety and performance, with regulatory bodies striving to approve devices that employ advanced imaging technologies. |

| Technological Advancements | Utilization of high-resolution imaging modalities like 3D/4D imaging and elastography that improve diagnostic information and patient health outcomes. |

| Consumer Demand | Increased understanding resulting in rising demand for minimally invasive diagnostic procedures, such as early and accurate detection of urological and gynecological conditions.. |

| Market Growth Drivers | Higher incidence rates of gynecological and urological conditions, improvements in imaging systems, and expansion of healthcare services in developed nations. |

| Sustainability | Early introduction of greener manufacturing methods and reduced environmental impact of medical devices. |

| Supply Chain Dynamics | Reliance on current distribution channels, with a focus on ensuring endocavity transducer availability in hospitals and diagnostic facilities. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Installation of strict regulations in wireless and handheld transducer equipment to provide consistent protocols and maximize patient safety. |

| Technological Advancements | Creation of machine learning and artificial intelligence algorithms for improving image analysis, creation of handheld and wireless transducer technologies for point-of-care diagnosis, and improving performance of real-time imaging. |

| Consumer Demand | Higher demand for low-cost and tailored diagnostic systems, where consumers seek latest imaging technologies delivering in-depth knowledge of health diseases and allowing customized treatment protocols. |

| Market Growth Drivers | Forays into emerging markets with better healthcare infrastructure, R&D investments in path-breaking imaging solutions, and collaborative partnerships between medical equipment companies and healthcare centers. |

| Sustainability | Complete integration of eco-friendly practices such as the use of recyclable raw materials, green energy-based manufacturing technology, and methods to reduce electronic waste from medical equipment. |

| Supply Chain Dynamics | Supply chain optimization using digital technologies, heightening transparency and efficiency, and ensuring timely delivery of devices to diverse healthcare settings, including remote and underserved markets. |

The endocavity transducer market in the USA is growing. This is mainly due to more people facing gynecological and urological issues. Also, new ultrasound technology is making a difference.

Here are some reasons for this growth

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.0% |

Market Outlook

Germany's endocavity transducer market is poised for steady growth with a well-developed healthcare system and continuous research on medical imaging technologies.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.5% |

Market Outlook

China's market for endocavity transducers is set for a huge leap forward, backed by rising health expenditure and enhanced concern for the early diagnosis of urology and gynecology diseases.

Factors in Market Growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.3% |

India's endocavity transducer market is witnessing strong growth, driven by rising disease awareness and enhanced healthcare infrastructure.

Growth Inducers of the Market

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.5% |

Brazil's market for endocavity transducers is growing fast. This is happening because there are more healthcare investments and a bigger push for early diagnosis of issues in women's and men's health.

Here are some reasons for the growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.7% |

Endocavity transducers are expected to dominate the market as they provide better pelvic imaging

Endocavity transducers represent a major segment of the product family and have been specially designed to internally image pelvic and prostatic structures. These probes are able to image deep structures at very high resolutions, which makes them appropriate for gynecological and urological examinations.

The market growth that is a result of increasing adoption of transvaginal and transrectal ultrasound procedures, increasing demand for minimally invasive imaging solutions, and advances in real-time 3D technology for ultrasound applications helps spurt this growth.

North America and Europe are the leaders in endocavity transducer adoption, while Asia-Pacific is now seeing growth due to increasing investment into advanced ultrasound technologies.. Future innovations include AI-powered real-time image enhancement, ergonomics of probe designs for patient comfort, and disposable endocavity probes for infection control.

Curvilinear transducers segment holds the second largest share due to their deep penetration into pelvic region

Curvilinear transducers are popular in obstetrics and gynecology. They provide a wide view and can go deep, which is great for looking at fetuses and pelvic areas. These probes are very helpful during transabdominal ultrasound scans. They help track pregnancy and find any issues.

There is a growing need for prenatal screenings. More people are also using 3D and 4D ultrasounds. High-frequency curvilinear probes are becoming more popular because they give better images. North America and Europe lead the market because they have advanced prenatal care. Meanwhile, Asia-Pacific is seeing more demand due to better maternal health programs.

Looking ahead, we can expect more use of AI to spot fetal issues. Portable curvilinear probes could become common for quick checks. There’s also a push to use elastography for better soft tissue analysis.

Obstetrics and gynecology segment will dominate as it is the major application

Being two of the major fields of application for endocavity transducers, obstetrics and gynecology make heavy use of the transvaginal ultrasound for fetal monitoring, early pregnancy evaluation, and gynecological assessment.

The endocavity transducers are indispensable in imaging the uterus, ovaries, and developing fetus, causing the detection of ovarian cysts, fibroid tissue, and ectopic pregnancies. The ever-increasing incidence of high-risk pregnancy, dependence on early fetal screening, and gradually increasing trend toward minimally invasive imaging in gynecology are responsible for the growth of this market.

Demand for endocavity ultrasound transducers is greatest in North America and Europe due to the evolved healthcare infrastructure and high degree of awareness toward prenatal screening, while rapidly emerging markets in the Asia-Pacific region are due to the increasing number of maternal health initiatives.

Other developments and advancements expected in the near future are AI-endocavity-powered ultrasound for automated fetal anomaly detection, wireless transducers for better mobility, and integration of 3D-4D imaging for improved diagnostic accuracy.

Urology is also a key segment due to their role in prostate condition diagnosis.

With a totally revolutionary approach, urology has produced results found mostly in application modules like endocavity transducers, which have proved instrumental in the diagnosis of prostate conditions such as benign prostatic hyperplasia (BPH), prostate cancer, and prostatitis.

Examples include transrectal ultrasound (TRUS), which is most widely used to facilitate prostate biopsy and speech for the detection of urological disorders. The increasing incidence of prostate cancer, an increase in ultrasound-guided procedures, and a growing preference for non-invasive diagnostics are driving demand for this segment.

North America as well as Europe are leading the use of TRUS with increasing adoption in the Asia-Pacific region due to increased awareness regarding prostate health and the better development of urology-related healthcare facilities. Future trends include AI-assisted prostate lesion detection, fusion imaging of MRI combined with ultrasound, reducing size for endoscopic probes for improving comfort in patients.

The endocavity transducer market is really competitive right now. There’s a big demand for better ultrasound imaging in areas like urology, gynecology, and prostate cancer checks. Companies are focusing on high-frequency transducer tech, comfortable designs, and AI imaging to keep up.

The market is influenced by established medical imaging companies, ultrasound technology companies, and new-age healthcare device innovators, each driving the dynamic space of endocavity ultrasound solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GE Healthcare | 17.1% |

| Koninklijke Philips N.V. | 14.4% |

| Siemens Healthineers | 13.8% |

| Fujifilm Holdings Corporation | 11.8% |

| Canon Medical Systems Corporation | 10.1% |

| Other Companies (combined) | 32.7% |

| Company Name | GE Healthcare |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Expanded its portfolio of high-frequency endocavity transducers, enhancing imaging precision for gynecological and urological applications. The new transducers feature AI-powered image optimization, improving diagnostic accuracy and efficiency in hospitals and diagnostic centers |

| Company Name | Koninklijke Philips N.V. |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Introduced a next-generation 3D/4D endocavity transducer, designed for superior real-time imaging in obstetrics and gynecology. The innovation integrates advanced elastography technology, enabling better tissue differentiation and early disease detection. |

| Company Name | Siemens Healthineers |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Launched a portable and wireless endocavity ultrasound system, enhancing point-of-care diagnostics in remote and emergency settings. The device offers seamless cloud connectivity, allowing real-time image sharing for telemedicine consultations |

| Company Name | Fujifilm Holdings Corporation |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Developed an ultra-lightweight endocavity transducer with biocompatible materials, improving patient comfort while ensuring high-resolution imaging. The transducer includes AI-assisted workflow automation, reducing scan time and improving efficiency. |

Key Company Insights

GE Healthcare (17.1%)

GE Healthcare is well acknowledged as a leader in endocavity transducers offering high-frequency ultrasound for gynecology, urology, and colorectal imaging. Beyond continuing development of imaging technologies, enhancements with AI in diagnostic accuracy and workflow improvements are areas of new interest.

The company has added to its product offerings intended for wireless and portable transducers in order to increase accessibility to point-of-care applications.

Koninklijke Philips N.V. (14.4%)

Philips is one of the most foremost players in advanced ultrasound imaging--bringing in a technology where the 3D/4D endocavity transducers are now combined with superior real-time imaging capabilities. The company focuses on developing ergonomic designs and elastography technology for a more precise diagnosis.

Philips is investing in ultrasound solutions that would be friendly to the environment and cost savings in the long run with their energy-efficient durability in hospitals and diagnostic centers.

Siemens Healthineers (13.8%)

Produced by Siemens Healthineers, among the many applications of AI in ultrasound capture, this particular endocavity transducers has HI magic-hd endocavity transducers in providing high image resolution for early disease detection. They also developed portable and wireless ultrasound solutions that provide the promise of real-time remote diagnostics to telemedicine.

Besides, Siemens priority is for user-friendly interfaces, automation of ultrasound procedures to speedy and efficient results.

Fujifilm Holdings Corporation (11.8%)

Fujifilm is into lightweight, biocompatible endocavity transducers, boasting of super high precision imaging for more patient comfort.

Along with the AI-imaging enhancement that allows the cutting of scan time and workflow improvement, Fujifilm is also heading toward sustainable manufacturing by using greener materials to produce ultrasound devices that would cause minimal environments.

Canon Medical Systems Corporation (10.1%)

Canon Medical is an internationally recognized innovator in Doppler ultrasound technology, widely used in providing their very sensitive endocavity transducers for urology and gynecology. The company claims precision in early-stage disease detection with new solutions for microvascular imaging that improve blood flow visualization.

Canon indeed has plans of attaining cloud-based ultrasound systems that allow seamless data sharing, thereby facilitating remote diagnostics and analysis using artificial intelligence.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global endocavity transducer industry is projected to witness CAGR of 3.9% between 2025 and 2035.

The global endocavity transducer market stood at USD 3,956.6 million in 2024.

The global endocavity transducer market is anticipated to reach USD 6,038.2 million by 2035 end.

China is expected to show a CAGR of 5.3% in the assessment period.

The key players operating in the global endocavity transducer industry are GE Healthcare, Koninklijke Philips N.V., Siemens Healthineers, Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Mindray Medical International Limited, Toshiba Medical Systems, Hitachi Medical Systems, Providian Medical, Samsung Medison, Esaote S.p.A. and others

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.