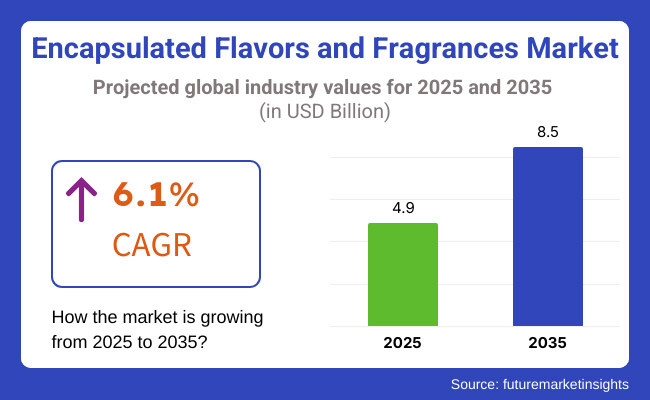

The global encapsulated flavors and fragrances market is set to depict USD 4.9 billion in 2025. The industry is poised to register 6.1% CAGR from 2025 to 2035 and witness USD 8.5 billion by 2035.

Encapsulated fragrances and flavors are composite ingredients where active ingredients are embedded inside a protective outer layer for maximum stability, shelf life and controlled release. It assists in reducing the degradation of nutrients, flavor, and fragrance due to heat, light, or water, thus ensuring they retain potency.

Encapsulation is extensively used in food, beverages, personal care, and home care products and it facilitates enhanced product performance, shelf life, and delivery. Natural, sustainable, and high-end sensory experiences keep on growing, and this is why the encapsulated flavors and fragrance market keeps growing backed by improvement in microencapsulation and sustainability-glycol-free ingredient technologies.

As it improves stability, shelf life, and controlled release of fragrances and flavors, encapsulation technology comes to the fore. This is revolutionizing the market and consumers who are demanding transparency in foods, drinks and personal care products are creating increased demand for natural and clean-label ingredients. Hence, manufacturers developed microencapsulation methods to preserve the performance of natural ingredients without losing the sensory benefits.

Companies such as Firmenich, Givaudan, and Symrise are currently expanding their portfolios for bio-based technologies and sustainable techniques for encapsulation. The companies are also adding production volumes to meet the growing demand. Firmetich has also focused on expanding its encapsulation manufacturing capabilities to offer custom flavor release solutions, while the International Flavors and Fragrances (IFF) company has implemented cutting-edge technologies to facilitate the efficiency of its encapsulated products.

Additionally, the demand for such flavors in functional food, dietary supplements, and plant-based applications further propels market growth. This shift, combined with increasing demand for clean-label and organic formulations, has driven fragrance makers toward innovations such as embedded botanical extracts and essential oils. In response, Symrise and Sensient Technologies have invested in research and development to enhance their microencapsulation processes that can ultimately provide long-lasting fragrance in personal care and home care products.

Explore FMI!

Book a free demo

The global market is experiencing significant growth owing to increasing demand for enduring, controlled-release ingredients in food, beverages, personal care, and pharmaceutical products.

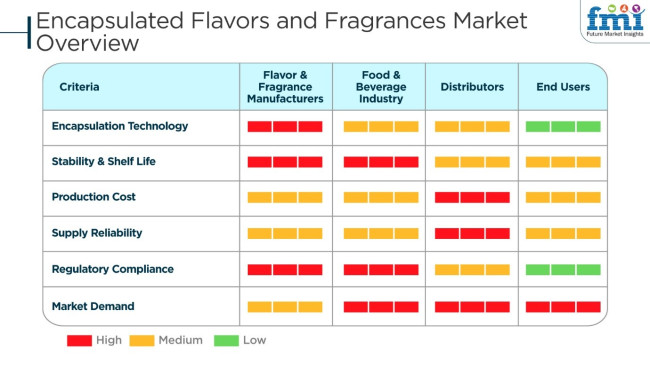

Flavor & fragrance producers rely on cutting-edge encapsulation technologies such as microencapsulation and nanoencapsulation to deliver enhanced product stability and regulatory approval. Food & beverages highlight shelf life improvement and reproducible flavor delivery, vital in the case of processed and packaged foodstuffs.

Distributors concentrate on supply chain efficiency and economy of costs to achieve availability at all places, whereas end-users such as cosmetics and perfumes as well as dietary supplements aim at cost-effective, high-performance products for enhanced product quality.

With growing consumer demand for natural, sustainable, and clean-label ingredients, the market is likely to expand at a strong rate across the world. The main trends are biodegradable encapsulation materials, functional food applications, and technology development to improve flavor and fragrance retention.

The table below presents a comparative assessment of the variation in CAGR over six-month periods for the base year (2024) and the current year (2025) in the global market. This analysis highlights key performance shifts and revenue realization trends, providing stakeholders with a clearer understanding of market growth. The first half of the year (H1) spans from January to June, while the second half (H2) covers July to December.

| Particular | Value CAGR |

|---|---|

| 2024 to 2034 (H1) | 4.9% |

| 2024 to 2034 (H2) | 5.5% |

| 2025 to 2035 (H1) | 5.1% |

| 2025 to 2035 (H2) | 5.6% |

In the first half (H1) of the decade from 2025 to 2035, the industry is expected to grow at a CAGR of 4.9%, followed by an identical growth rate of 5.5% in the second half (H2). Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR remains steady at 5.6% across both halves. The market experienced an increase of 20 BPS in H1 and a decrease of 20 BPS in H2.

Encapsulation for Multifunctional Benefits

The encapsulated flavors and fragrances industry is witnessing a shift toward multifunctional ingredient solutions that offer benefits beyond traditional aroma and taste enhancement. Consumers are increasingly looking for flavors that deliver extended freshness, controlled release, and sensory differentiation across various applications, including food, beverages, personal care, and home care products.

Manufacturers are focusing on advanced microencapsulation techniques to ensure prolonged fragrance retention in cosmetics and enhanced flavor stability in functional foods. Additionally, encapsulation is being optimized to deliver active ingredients such as probiotics, vitamins, and antioxidants in food and beverage applications.

Companies are developing multi-layered encapsulation technologies that enable gradual release and improved bioavailability, catering to the growing consumer preference for value-added products. This trend is reshaping innovation strategies, with manufacturers emphasizing precision release mechanisms to enhance product differentiation in a competitive industry.

Shift Toward Non-Synthetic Encapsulation Materials

Consumers' increasing demand for clean-label and natural products is driving manufacturers to move away from synthetic encapsulation materials toward natural alternatives. Traditional synthetic polymers, widely used in encapsulation, are being replaced by plant-derived coatings such as alginate, starch, cellulose derivatives, and chitosan.

This shift is influencing R&D investments in biodegradable and edible encapsulation materials that maintain the stability and efficacy of flavors and fragrances without compromising sustainability credentials. Manufacturers are focusing on enhancing the compatibility of natural encapsulation materials with volatile compounds to ensure prolonged shelf life and optimal performance.

This trend has led to collaborations with biotechnology firms to create bio-based encapsulation matrices that improve ingredient stability while meeting regulatory compliance. The shift toward non-synthetic encapsulation materials is also aligning with consumer transparency demands, reinforcing brand trust and product credibility in the industry.

Encapsulation for Heat and pH Stability in Industrial Applications

The demand for encapsulated flavors and fragrances with improved heat and pH stability is increasing across various industries, including bakery, confectionery, and personal care. High processing temperatures in baked goods and acidic conditions in beverages pose significant challenges to flavor retention and stability.

To address this, manufacturers are developing encapsulated solutions that provide enhanced resistance to extreme conditions while ensuring optimal flavor release during consumption. Innovations in lipid-based and carbohydrate-based encapsulation techniques are allowing manufacturers to protect sensitive aromatic compounds from degradation.

Additionally, the fragrance industry is leveraging pH-responsive encapsulation systems to enhance long-lasting scent diffusion in personal care products. The increasing need for encapsulation solutions that withstand diverse processing conditions is driving continuous advancements in material science and formulation techniques, positioning heat and pH stability as a key factor in industry competitiveness.

Growing Application in Functional and Sports Nutrition

The expansion of functional and sports nutrition products is driving the need for encapsulated flavors that mask undesirable tastes and enhance product palatability. Protein-based beverages, energy drinks, and dietary supplements often have bitter or metallic aftertastes, which manufacturers are addressing through advanced encapsulation techniques.

This trend is particularly strong in the fortified food and supplement industry, where consumers seek enhanced sensory experiences without artificial additives. Encapsulation is also being utilized to improve the bioavailability of active ingredients such as amino acids, caffeine, and botanical extracts, ensuring their gradual release for sustained efficacy.

Manufacturers are focusing on developing flavor systems tailored for sports nutrition applications, ensuring stability in liquid and powder formulations. This trend is shaping product development strategies, with companies investing in encapsulation solutions that maintain functional ingredient integrity while enhancing consumer acceptance.

The requirements for improved flavor stability, controlled release, and shelf life extension in food, beverages, and personal care markets have propelled the industry for encapsulated fragrances and flavors. Encapsulated solutions with retained natural ingredient authenticity and long-term freshness have been increasingly demanded by consumers. The trend has been driving the uptake of microencapsulation and spray-drying processes, which allow manufacturers to safeguard volatile substances against oxidation and environmental influences.

Between 2025 and 2035, the industry is likely to grow even more as industries pay close attention to enhancing sensory effects and maximizing the effectiveness of active ingredients. Spiraling clean-label and functionality needs are compelling makers to make investments in bio-based encapsulation technology. Along with this, advancing developments in coating processes and encapsulation materials enable manufacturers to achieve optimum controlled release mechanisms in uses.

Through continuing innovation along with heightened concentration on biodegradable and eco-friendly encapsulation procedures, it can be predicted to propel industry development, making encapsulated scents and flavor an imperative part of many different markets.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growth in demand for encapsulated fragrances and flavors in food, drinks, and personal care products for extended shelf life and controlled release. | Pharmaceuticals, nutraceuticals, and functional foods expansion, fueled by advances in targeted delivery and bioavailability. |

| Microencapsulation and spray drying were prevalent methods of flavor and fragrance protection. | Nanotechnology, coacervation, and bio-based encapsulation innovations improve efficiency and sustainability. |

| Clean-label and natural ingredient trends raised the demand for organic and non-GMO encapsulated flavors. | AI-formulation optimization enhances natural ingredient stability without compromising sensory properties. |

| Supply chain disruptions and volatility in raw material prices impacted the cost of encapsulation production. | Artificial intelligence-driven supply chain management and precision fermentation enhance the efficiency and stability of sourcing. |

| Regulatory pressures on synthetic solvents and carriers brought more R&D to plant-based encapsulation materials. | Biodegradable and edible encapsulation materials gain widespread adoption, meeting stricter sustainability regulations. |

| Growth in adoption in premium confectionery, dairy, and bakery products for enhanced flavor retention. | Smart encapsulation systems enable real-time flavor release customization based on temperature, pH, or moisture levels. |

Raw material price volatility is one of the major risks in the encapsulated flavors and fragrances market. The essential oils, natural extracts, and synthetic aroma compounds used in encapsulation depend on climatic conditions, supply chain disruptions, and the political climate. Any rise in the price of main raw materials can have a significant effect on the production costs and profit margins.

Having technology and formulation difficulties can also be viewed as possible risk factors. The precision and accuracy of the spray drying, fluid bed coating, and molecular inclusion processes must be ensured to make these encapsulation technologies work optimally. Operating a machine improperly can cause low reliability, wrong discharges, and damaged sensory performance which in turn result in poor quality products and affect consumer perceptions.

Regulatory compliance and safety standards are very important in this industry. Encapsulated flavors and fragrances should maintain food, cosmetic, and pharmaceutical safety regulations which include FDA (USA), EFSA (Europe), and REACH (EU chemical safety standards). Not meeting the clean-label, allergen-free, or sustainability standards may cause product recalls, legal actions, and reputation loss.

Additionally, the increasing demand for natural, organic, and allergen-free products has pressured manufacturers to cut the usage of synthetic carriers and embrace gasifiable materials as the encapsulating solutions. Not addressing this issue may mean the company faces a slide in industry share.

Industry positioning is mainly driven by competitive factors and alternative technologies. The industry has stiff competition from conventional liquid flavors and fragrances and particularly with the emergence of new technologies such as nano-encapsulation and bio-based systems. A company that does not put any effort into R & D (research and development) will be left behind with the times.

Encapsulation ensures protection from heat, oxidation, and moisture to give processed foods and functional beverages the same flavor that consumers expect. The increase in fortified and sports nutrition products has led to higher demand for encapsulated flavor solutions.

For example, some top players, including Firmenich, Givaudan, Kerry Group, and Symrise are investing significantly in some breakthrough encapsulation methods such as spray-drying, coacervation, and fluidized-bed coating to enhance flavor stability and precision-controlled release of flavor systems.

Spray drying, one of the most widely used encapsulation techniques, is low cost, scalable and preserves volatile compounds, making it highly applicable to the food, beverage and personal care markets.

Spray drying formularies are used in the food and beverages industry, mainly to encapsulate fruit flavors, essential oils, and dairy-based ingredients to help them offer an extended shelf life, stability, and controlled release in instant beverages, confectionery, or other bakery products. This technology is applied in the personal and home care sectors, such as perfumes, detergents, and skincare products, to preserve fragrance.

Modified starches find extensive application since they possess fine encapsulation properties, which are essential for encapsulating sensitive chemicals like fragrances and flavors. The starches are altered through a number of processes to achieve enhanced functionality, including their ability to improve their solubility, stability, and film formation.

Modified starches are good at creating stable protective shells around encapsulated substances to ensure that the volatile compounds such as flavors and fragrances do not get lost and are released slowly when desired. This controlled release is particularly useful in foods, beverages, and personal care products where it is important to preserve the integrity of the flavor or fragrance over a period of time.

In the food & beverages industry, encapsulated fragrances and flavors are utilized to maintain flavor integrity and stability, such that they are not weakened while stored and consumed. Encapsulation preserves sensitive molecules, such as volatile flavors, from heat, light, oxygen, and water, thereby enhancing shelf life and avoiding degradation. In chewing gum, for example, the encapsulated flavor facilitates an extended release of flavor, yielding a longer-lasting more pleasurable experience.

Encapsulated powder is majorly favored owing to its versatile applications across multiple industries. The powdered forms benefit from a variety of factors that include simplicity in addition to dry food products, ease of handling and transportation, and great stability. The powdered form of the encapsulated fragrance and flavor may be simply mixed into a food product, drinks, and other household items in order to bring about even dispersion and accurate fragrance release.

Micro-encapsulation is generally favored because it can provide controlled release, stability, and protection of sensitive ingredients, including flavors and fragrances. Micro-encapsulation is a process where small particles, usually in the micrometer range, are encapsulated in a protective layer, which protects the active ingredients from external influences such as heat, moisture, oxygen, and light. This protection guarantees that the flavors or fragrances are effective during production, storage, and use.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| Germany | 5.0% |

| China | 4.2% |

| India | 3.8% |

| Japan | 5.5% |

FMI is of the opinion that the USA industry is slated to depict 4.5% CAGR during 2025 to 2035. The country's vast food and beverage sector is one of the key growth drivers, propelled by the growing demand for processed and convenience foods, which places pressure on integrating encapsulation technology to enhance flavor stability and increase shelf life.

Furthermore, the market's home and personal care segments use encapsulated fragrances extensively to provide enduring scent experiences in response to the needs of consumers for quality-scented products. The presence of large industry players and R&D efforts enhance industry growth.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Strong Food & Beverage Sector | Rising demand for convenience food and processed foods. |

| Rising Demand for Long-Lasting Fragrances | Fragrance endures longer with encapsulation for personal and home care applications. |

| Technological Developments in Encapsulation | Microencapsulation and nanoencapsulation technologies improve product stability. |

FMI states that China's encapsulated flavors and fragrances market is set to expand at 4.2% CAGR during 2025 to 2035. The expanding middle-class population and increasing urbanization in the country have spurred increased consumption of processed food and beverages that need advanced encapsulation technologies for maintaining product quality and flavor retention.

Besides that, China's booming personal care industry is adopting encapsulated fragrances to meet consumers' demands for premium and long-lasting scented products. Local manufacturers are spending on R&D to develop encapsulation technologies and compete with foreign industry leaders.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Increasing Consumption of Processed Food | Urbanization is driving demand for improved flavorings. |

| Rising Personal Care Industry | Fragrances encapsulated are gaining popularity in cosmetics and skincare. |

| R&D Spending & Local Producer Development | Chinese companies are creating encapsulation technology for both the domestic and international markets. |

FMI states that India's encapsulated fragrance and flavor market is anticipated to grow at a CAGR of 3.8% during 2025 to 2035, with rising demand in the food, beverage, and personal care industries. Increased counts of quick-service restaurants (QSRs) and packaged food consumption are improving the use of encapsulated flavors to preserve taste and aroma.

The personal care and cosmetics industry is also witnessing more use of encapsulated fragrances as consumers look for long-lasting, high-quality products. Additionally, affordable production and developments in microencapsulation are turning India into a major player in international supply chains.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Boosted Demand for Processed Foods | Packaged foods and QSRs dictate the encapsulation of the flavors. |

| Surge in Personal Care Industry | Enhanced acceptance by high-end products for encapsulated scents. |

| Economically Preferable Manufacturing | Low manufacturing cost makes India an important source. |

As per FMI, Japan's encapsulated fragrances and flavors market will grow at a 5.5% CAGR from 2025 to 2035 because of innovations in functional foods, cosmetics, and premium perfumes. Consumers in Japan look for stability, quality, and accuracy in fragrances and flavors; hence, manufacturers are motivated to utilize the latest encapsulation technologies.

The country's state-of-the-art R&D labs for nanoencapsulation and controlled-release technologies are setting the industry trend. Further, the increasing demand for clean-label and sustainable ingredients persuades companies to look at bio-based encapsulation alternatives.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Innovation in Nanoencapsulation | High-end products are enhanced with controlled-release technologies. |

| Growing Functional Food Industry | The flavor encapsulants add nutritional and sensory value. |

| High-Quality, Long-Lasting Fragrance Choice | Demand for fragrances encapsulated in high-end perfumes is on the rise. |

Germany is a leading player in the European industry for encapsulated fragrances and flavors, with a projected CAGR of 5.0% from 2025 to 2035, cites FMI. Technology focus and quality specifications in the country propel the application of encapsulation processes to enhance flavor stability and shelf life in food and beverages.

German consumers prefer clean-label and natural products, and manufacturers aim to develop high-tech encapsulation methods that deliver natural flavor and aroma without artificial additives. Further, Germany's established personal care industry utilizes encapsulation for enhanced fragrance stability in cosmetics and toiletries.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Natural & Clean-Label Products Focus | Demand for synthetic-free encapsulation is on the rise. |

| High Food & Beverage Segment Standards | Firms are implementing advanced encapsulation technologies. |

| Strong Personal Care Industry | Encapsulated perfumes enhance fragrance longevity in cosmetics. |

The global encapsulated flavors and fragrances market is fiercely competitive, driven by a need for increased product stability, controlled release, and prolonged shelf life among applications in food, beverage, personal care, and household products. The industry is innovated by microencapsulation technologies such as spray drying, coacervation, and liposomal encapsulation, which are proving beneficial in enhancing the efficacy of products and improving the sensory experiences of consumers.

Major contenders in the industry include Firmenich, Givaudan, Symrise, International Flavors & Fragrances (IFF), and Sensient Technologies, having solely established themselves by using advanced formulation techniques and proprietary delivery systems under extensive research and development investments. However, new startups and niche providers continue to come into the industry with specialized solutions responding to the demand for natural, long-lasting, and clean-label ingredients.

Besides, such a competitive factor as sustainability drives companies toward the use of bio-based encapsulation materials, eco-processing technologies, and low environmental footprints.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| International Flavors & Fragrances (IFF) | 14-18% |

| Givaudan | 12-16% |

| Firmenich | 10-14% |

| Symrise | 9-13% |

| Sensient Technologies | 7-11% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| International Flavors & Fragrances (IFF) | Leading provider of encapsulated flavors for food, beverages, and personal care, integrating AI-driven formulation techniques. |

| Givaudan | Innovates in fragrance encapsulation with sustainable biodegradable microcapsules for cosmetics and home care. |

| Firmenich | Pioneering multi-layer encapsulation for enhanced aroma retention and controlled release in personal care and food applications. |

| Symrise | Expanding R&D in encapsulated flavors for functional beverages and dietary supplements. |

| Sensient Technologies | Focuses on natural and plant-based encapsulation technologies to align with clean-label consumer preferences. |

Key Company Insights

IFF (14-18%)

First, in pure encapsulated flavors and fragrances, AI and bio-based technologies will be used in innovations for the future.

Givaudan (12-16%)

This company is now pushing biodegradable encapsulation more extensively for fragrance applications to meet eco-conscious consumer demands.

Firmenich (10-14%)

Provides solutions that deliver a controlled release of flavors and fragrances within a formulation, such as investments in biodegradable and nature-derived encapsulants.

Symrise (9-13%)

Building volume in functional nutrition also broadens its expertise in the encapsulation of beverages.

Sensient Technologies (7-11%)

Offering encapsulation technologies that are clean-label and plant-based for health-conscious consumers.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 4.9 billion in 2025.

The industry is predicted to reach USD 8.5 billion by 2035.

Key players include International Flavors & Fragrances (IFF), Givaudan, Firmenich, Symrise, Sensient Technologies, Takasago International Corporation, Mane SA, Robertet Group, Kerry Group, and T. Hasegawa Co., Ltd.

Japan, slated to grow at 5.5% CAGR during the forecast period, is poised for the fastest growth.

Encapsulated powders are widely used.

The industry is segmented by product type into flavor blends, fragrance blends, essential oils & natural extracts, and aroma chemicals.

Technology classifies the industry into mechanical (emulsification, spray drying, spray chilling/cooling, fluidized-bed coating, centrifugal extrusion), chemical, coacervation, freeze drying, supercritical fluid technique, nano precipitation, and others.

In terms of wall material, the industry is divided into maltodextrin (DE<20), corn syrup solid (DE>20), modified cellulose, gum arabic, modified starch, gelatin, cyclodextrin, lecithin, whey protein, hydrogenated fat, and others.

By end-use, the industry is divided into consumer goods and food and beverage.

In terms of encapsulated form, the industry is divided into powder, paste, and granules.

The industry is segmented by process into micro-encapsulation, nano-encapsulation, hybrid-encapsulation, and macro-encapsulation.

In terms of region, the industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.