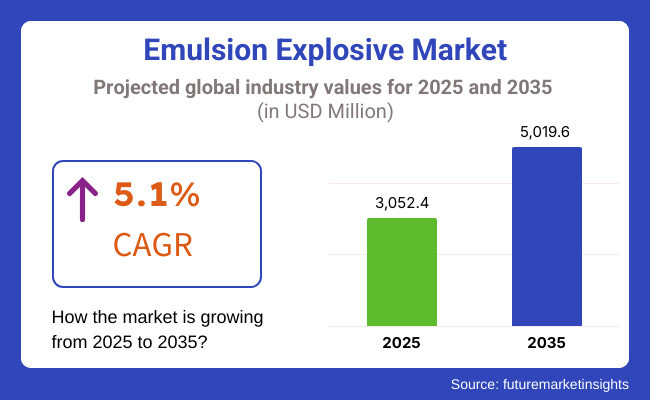

The global emulsion explosive market is expected to witness steady growth, driven by increasing demand from mining, construction, and quarrying industries. The market is projected to reach USD 3,052.4 million in 2025 and is anticipated to grow to USD 5,019.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.1% during the forecast period.

The demand for high-performance and safer explosive alternatives, stringent safety regulations, and advancements in emulsion technology are key factors contributing to market expansion.

Emulsion explosives are the best choice as they have a good deal of extra stability, energy efficiency, and less environmental impact over traditional explosives. The major part of their spreading is on mining, infrastructure, and tunneling where they are being implemented broadly. Furthermore, the change to big emulsion explosives, which offer even greater safety and handling benefits, is the main factor behind the multiplying market needs. The continuous development of the technology in the area of emulsification processes and the control of detonations is also thought to be a strong runner for the industry growth

The emulsion explosive market has a strong potential for constant growth driven by the rising demand from main end-use sectors, the innovations in emulsion formulations, and the demand for substitute blasting that are safer and more sustainable. Although regulatory issues and cost worries are still present, disruptive technological advancements and the market gain in undeveloped countries will pave the way for further development.

Periodic funds in research and development assure the emulsion explosive sector is loaded with opportunities and in turn will, in future, develop sustainable blasting applications and incentives. Besides periodical investment of funds in the research and development sector, the market is well on the path for breakthroughs that are going to be vast and will be embraced by the society in the time frame of a decade.

Explore FMI!

Book a free demo

The emulsion explosive market in North America is largely due to the increase of mining operations in the USA and Canada. These countries, which have an extensive development of mineral resources, are experiencing an uninterrupted demand for fast and reliable explosives for the extraction purpose. Adoption of modern blasting technology along with strict regulatory policies are the factors that directly influence the growth of the market.

These regulations lay the framework for the emulsion explosive market growth by stipulating the necessary conditions gas, handling the materials, and proper storage, and all. The increasing construction and infrastructure sectors in the region are also valuable sources of demand for explosives in demolition and excavation activities, thus, supporting the market's development in North America.

The emulsion explosive market in Europe is characterized by the regulations designed to protect the environment that promote the deployment of smaller, safer blasting technologies. Countries like Germany and Sweden have a stable demand for these explosives through the well-formed mining and construction sectors.

With the environmental issues intensifying, more mining projects are being implemented sustainably, thus the demand for fewer negatives lines inventively is increasing. Mitigating environmental risks is another action that greatly concerns EU authorities who are promoting the development of technologies that decrease the impact of blasting activities. The factors mentioned above, together with the construction and infrastructure project requirements, assure the emulsion explosive market in Europe remains strong and advances toward greener and safer alternatives.

The emulsion explosive market in the Asia Pacific region is expected to experience the fastest growth in the world, being driven by an increasing mining sector and infrastructure development. China, India, and Australia are the major contributors in this regard. The mining industry and infrastructure development in China and India are increasing their demand for emulsion explosives.

The region is a hub of mineral resources, and the mining industry is bustling to extract the resources as fast as possible in response to the increasing worldwide demand. In addition, governments in the area are greatly invested in constructing roads, railways, and urban developments as well as creating a need for effective blasting technologies. These aspects combined with the growing concern for safety and production in mining, and construction will drive strong demand for emulsion explosives in the Asia-Pacific region.

Challenges

The stringent safety and environmental restrictions

In the emulsion explosive market, one of the primary issues faced by manufacturers is the stringent safety and environmental restrictions imposed on the use of explosives. Adhering to these regulations helps to prevent accidents, promote proper handling, and minimize the environmental impact, but they also create barriers for both producers and consumers. The mandate of safety compliance entails extra costs in terms of the technology, training and infrastructure that the companies have to invest in. Additionally, these restrictions often result in the prohibition of certain chemicals and materials that can be used, thereby causing a spike in overall production costs.

To address environmental concerns, manufacturers have to shift to more viable options, which means they need to come up with green solutions and innovative new products. Although such regulations are critical to avoid danger, they may cause delays, incur extra costs, and impose restrictions that undermine the market's growth and profitability benefits.

High transportation and storage costs

Along with high transportation and storage costs, the emulsion explosive market deals with another major challenge. These explosives are regarded as hazardous materials, which are subject to an array of specific handling, transportation, and storage conditions. Therefore, the costs of shipping and storing emulsion explosives turn out to be more expensive than non-hazardous goods.

The need to operate secure temperature-controlled storage areas and use specialized vehicles in the process of transportation, brings about other operational deficits in terms of cash flow for manufacturers and distributors. The risk of accidents arising from transport or storage could also lead to costly delays and legal liabilities. This combination of factors enhances the overall cost structure of emulsion explosives, which in turn affects the profitability of the market and limits the growth opportunity of the companies in the sector.

Development of Eco-Friendly and Non-Toxic Emulsion Formulations

The new opportunity that the emulsion explosive market generates is the production of eco-friendly and non-toxic emulsion formulations. Due to the increasing global concern about the environmental impact, explosives that considerably lower their harmful effects on ecosystems and human health are in high demand. Manufacturers have been focusing their investments on research and development to generate products with a lower ecological footprint like products with biodegradable and non-toxic methodologies.

These purposes are not only parallel to regulatory transformation but also can draw the interest of "green" sectors. Eco-friendly products can increase mine safety, decrease the risk of contamination, and help the mining industry adopt sustainable practices so as to open new market opportunities for the companies and positively project their image to the public. As regulations become tougher, the quest for such green substitutes will escalate, thereby, pitching the emulsion explosive business as the place to gain remarkable growth.

Growth in the emulsion explosive market comes from the higher need for slavish dynamite in the mining and construction sectors

Another main chance for growth in the emulsion explosive market comes from the higher need for slavish dynamite in the mining and construction sectors. As the mining operations increase and the infrastructure development accelerates, the requirement for reliable, cost-effective explosives is crucial for achieving higher productivity and safety. Emulsion explosives showcase their performance as well as being a good choice for large blasting projects that demand accuracy and energy.

In mining, they are utilized to extract minerals in an efficient manner, while they assist in demolition and excavation work in construction. As environmental protection and quality certifications drive the development of new technology, industries globally are growing due to urbanization and industrialization fast. By the way, it would still be an awesome chance for companies to innovate and to produce blasting materials which could cover increased productivity, safety, and environmental standards, thus finding themselves in the top of the line

The Emulsion Explosive market has shown considerable growth from 2020 to 2024, as a result of increased demand from the mining, construction, and quarrying sectors. The outstanding safety, stability, and performance features of emulsion explosives have turned them into a popular product compared to other traditional explosives like ANFO and dynamite.

Moreover, the regulatory norms that require safer handling and decreased environmental impact have become the major drivers in the adoption of these explosives. The technical progress of bulk emulsion formulations and on-site mixing have also played a role in this development.

The period of 2025 to 2035 has the perspective of further advances arising from the increased automation in blasting operations, sustainability concerns, and newly developed safety regulations. The greening of the emulsion explosives will be the trend with the use of less carbon emission and less toxicity. In addition, the escalated needs for infrastructure development projects, underground mining, and oil and gas exploration will also feed the market's growth.

The Emulsion Explosive business is on the track for continued expansion with the industries shifts focus on blasting solutions that are safer and more efficient. The coupling of AI and IoT in blasting operations will facilitate real-time data collection, which will lead to more efficient operations, and environmental protection. Environmental sustainability programs will lead to the creation of greener products, while the expansion of infrastructure in developing countries will maintain the demand. Businesses that concentrate on innovation, respective regulation roles, and local production will have a market advantage in the shifting environment.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with safety regulations like MSHA, ATF, and UN classification. |

| Technological Advancements | Improved emulsifier technology, sensitizing agents, and bulk delivery systems. |

| Industry-Specific Demand | High demand from open-pit mining, construction, and tunneling. |

| Sustainability & Circular Economy | Initial efforts to reduce NOx emissions and hazardous byproducts. |

| Production & Supply Chain | Global supply chain with regional manufacturing hubs for bulk production. |

| Market Growth Drivers | Increasing mining activities, infrastructure development, and safety regulations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental policies and sustainability-driven regulations requiring low-carbon and biodegradable formulations. |

| Technological Advancements | AI-driven blast optimization, real-time monitoring of explosives, and nanomaterial-based emulsions. |

| Industry-Specific Demand | Increased adoption in underground mining, smart mining operations, and oil exploration. |

| Sustainability & Circular Economy | Strong focus on bio-based emulsifiers, recyclable packaging, and carbon-neutral explosives. |

| Production & Supply Chain | Localization of production, enhanced supply chain resilience, and just-in-time delivery models. |

| Market Growth Drivers | Rising automation in blasting, demand for eco-friendly explosives, and new applications in deep-sea and geothermal drilling. |

According to the research, the USA market for emulsion explosives will expand at a compound annual growth rate (CAGR) of 4.8% throughout the period between 2025 and 2035, as a result of the strong demand for these products from the mining and construction industries. The government infrastructure investments are the main force behind the market's expansion. The modernization of the blasting process by means of electronic detonators not only increases safety but also enhances efficiency. More stringent environmental regulations are the main driving force behind the promotion of the development of cleaner and safer explosive alternatives.

In addition, the growing demand for emulsion explosives in oil extraction operations which demonstrates the energy development. Jointly, the mentioned factors are the USA market's drivers for the growth. With the implementation of digital technology, the existing technologies evolve. Furthermore, the fast pace of regulatory requirements is reshaping the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The United Kingdom emulsion explosive sector is anticipated to rise at 4.6% CAGR during the period of 2025 to 2035. The tunneling and underground construction projects, in which precision blasting is that the basic need are the main drivers of the growth. The deployment of modern, low-end emissions is also on the rise, which is being guided by the environmental problem.

The government tightly enforces ordinal rules on blasting safety and environmental impact, therefore, safer choices are the only options. Also, the utilization of explosives in demolition and controlled excavation work is recently on the rise. Another factor that positively affects the emulsion explosives market is the expansion of quarrying operations in the country, which is an additional source for making the sector for future growth more dynamic and promising.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

From 2025 to 2035, the emulsion explosive market in the European Union is forecast to grow at a compound annual growth rate (CAGR) of 4.9%. One of the major factors causing this growth is the increasing requirement of explosives for large construction and mining projects. The use of new formulations is also on the rise, which is driven by stringent safety and environmental regulations.

The EU is making significant investments in the sustainable blasting technologies sector to accomplish the clean energy goals it has set. Besides, the rise of underground mining in crucial areas like Germany and Sweden increases the need for explosives as well. During the period of their expansion, they are also now creating new market opportunities for emulsion explosives, which are controlled explosions necessity in several of these projects.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

India’s emulsion explosive market is forecasted to grow at a CAGR of 5.9% from 2025 to 2035, driven by rapid infrastructure expansion and a growing demand in metal and coal mining operations. The Indian government’s policies are increasingly focused on safe and efficient blasting practices, which further boosts market demand.

The surge in investments for road and railway projects creates a consistent need for blasting technologies. Additionally, there is rising demand for safer, controlled explosive solutions that minimize environmental impact. As the country’s industrialization accelerates, the emulsion explosive market will continue to expand, supported by these factors.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.9% |

According to a recent report, Japan will see the emulsion explosive market growing at a compound annual growth rate of 4.5% from 2025 to 2035. The primary factors for this are the country's ever-increasing tunneling and underground construction activities, requiring exact and low-impact explosives.

Japan stringent government regulations have pushed for the implementation of safer and more controlled blasting techniques, which in turn have been a helping hand for market growth. Emulsion explosives demand due to the expansion of the mineral extraction operations is another factor contributing to it. Also, modular technology in electronic detonation systems is more precise, less risky, and more efficient now. These elements are responsible for the slow but consistent increase in the emulsion explosive market in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

South Korea’s emulsion explosive market is projected to grow at a CAGR of 5.3% from 2025 to 2035, driven by the growth of the mining, quarrying, and construction sectors. The rapid expansion of infrastructure development projects creates significant demand for explosives in various applications.

South Korea is increasingly adopting high-efficiency emulsion explosives, which are more reliable and safer compared to traditional alternatives. There is also a growing focus on automation in blasting operations, making processes more controlled and efficient. The expansion of controlled excavation and demolition activities further contributes to the rising demand for these explosives.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

Bulk emulsion explosives dominate the emulsion explosive market because of their cost-effectiveness and high energy output making them the preferred choice in large-scale mining, construction, and demolition projects. These explosives are mostly produced and transported in bulk which results in significant cost savings compared to packaged products. Their high energy output makes them very effective for blasting in hard rock and deep mining applications, providing optimal results with just a few detonation delays.

The flexibility and the increased effectiveness of bulk emulsion propellants guarantee their application in different types of blasting, such as excavation and tunneling. Additionally, technological innovations have made the handling of emulsion explosives much safer, such as the implementation of improved storage and transportation protocols.

The demand for these explosives is still high, particularly in those industries that need large lots and reliable performance, thus, the solidification of their position in the market. Thus, bulk emulsions are one of the leading drivers of the global emulsion explosive market.

Cartridge emulsion explosives are kept in demand, especially in specialized types of mining, which are precision and controlled blasting operations. Unlike bulk emulsions, cartridge emulsions are pre-packaged, for that reason, they are very good for small mines or places which are hard to access.

These types of explosives are more flexible and accurate, which is especially important in underground mining, tunneling, and other confined areas where safety and control are most crucial. The pre-packaged nature of cartridge emulsions is also such that they guarantee consistent performance thus minimizing the chances of mistakes during the blasting process.

Apart from mining, cartridge emulsion explosives are also used in demolition activities and controlled excavation projects where precision is of great importance. Despite being more expensive than bulk emulsions, their performance in harsh situations, as well as the possibility to adjust the explosive charge to specific needs, justify their use in special applications. This regular request sustains their presence in the market.

Emulsion explosives have a significant share in the mining sector which is a major reason for the surging global demand for emulsion explosives. Emulsion explosives are a choice among mining industries for their high energy output, affordability, and safety features. They are often used in the blasting of hard rock, a feature common in both open-pit and underground mining.

These explosives break the more efficiently, leaving less experience of drilling and thus, increase productivity. Due to the rise in global minerals demand, particularly in the areas of construction, electronics, and energy, there has been a surge in mining operations which in turn results in a demand for emulsion explosives.

Additionally, mining companies are employing better blasting practices to enhance safety, preserve the environment, and maximize operational efficiency for which emulsion explosives are a crucial part. Thus, the mining sector is still the leading factor in the progress of the global emulsion explosive market and it secures its superiority in the industry

The Emulsion Explosive sector is observing steady uptrend due to rising interests in mining, construction, and infrastructure. The emulsion explosives are highly preferred due to their high water resistance, safety, and excellent detonation performance, which is why they are used in underground and surface mining, tunneling, and quarrying. The growth of the market is due to innovation in formulation technology, environmental concerns and the need for effective blasting solutions.

The emulsion explosives market is primarily determined by technological progress, regulatory policies, market consolidation, and regional demand. Technological turnarounds facilitate the invention of safer, higher-energy formulations, which, in turn, increase the efficiency and precision of blasting operations in the mining and construction sectors.

The new products thus introduced boost safety while fulfilling the demand for better performance. Environmental regulations are tightening, resulting in companies being pushed to comply with standards for having less environmental effect and for the safe practices of handling.

This has furthermore promoted the development of the production of eco-friendlier and sustainable explosives, which corresponds to global environmental goals. Market consolidation as a result of mergers and acquisitions of the major actors will reinforce distribution networks and enable companies to expand their presence and improve efficiency. The regional demand is very high in the Asia-Pacific area because of the rapid growth of industry and infrastructure, after North America and Europe, where construction, and mining activities still drive the demand for emulsion explosives.

The Emulsion Explosive market is expected to continue traditional growth patterns as a result of increased interests in mining, infrastructure, and construction. The major companies are pushing for innovation in technology, sustainable practices, and digital connectivity in order to develop efficiency and safety. The future of the market will depend on the new green explosive formulations and the introduction of automation in blasting technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Orica Limited | 20-25% |

| Dyno Nobel (Incitec Pivot) | 15-20% |

| AEL Mining Services | 10-14% |

| Austin Powder Company | 8-12% |

| EPC Groupe | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Orica Limited | Leading supplier of emulsion explosives with advanced blasting solutions and digital integration. |

| Dyno Nobel | Specializes in high-performance bulk emulsion explosives with a focus on sustainability. |

| AEL Mining Services | Provides customized explosives and initiation systems for mining operations. |

| Austin Powder | Develops safe and efficient emulsion explosives for mining, quarrying, and construction. |

| EPC Groupe | Supplies innovative explosive solutions with a focus on safety and precision blasting. |

Key Company Insights

Orica Limited

Orica Limited remains the undisputed market player with emulsion explosives, holding 20-25% of the market share. The corporation is recognized for its strong financial commitment to innovation and development, especially in the field of digital blasting solutions and sustainability. Orica's product spectrum includes state-of-the-art bulk and packaged emulsion explosives, mainly catering to mining and civil construction operations.

The company is on a growth trajectory in developing regions, giving way to strategic Takeover targets to drive this expansion. Orica is an innovator, and its concentrated efforts on employee safety and environmental sustainability draw it close to becoming the market leader. The company makes continuous attempts to develop new, more energetic, and environmentally friendly explosive systems.

Dyno Nobel (Incitec Pivot)

Dyno Nobel, which is owned by Incitec Pivot, has a market share of 15-20% in emulsion explosives. The company is environmentally friendly with the emulsion explosives it adopts, seeking to reduce the environmental pollution their products create. The company invests heavily in the automation and digital blasting technologies designed to boost blasting operation precision and efficiency.

Furthermore, the company's participation in globally spread supply chains allows it to enhance its product range, especially in mining, construction, and energy sectors. Dyno Nobel's innovation and sustainability tenets help the company retain its level of competitiveness in a market that is experiencing growth.

AEL Mining Services

AEL Mining Services holds a 10-14% market share and is well-acclaimed as a key player in an extensive emulsion explosives and initiating systems portfolio. The company’s business model is focused on dominating the African continent and building on its eminence as a provider for international mining. AEL specializes in the provision of high-grade explosives for different mining and industrial applications.

Alongside its leading products, the company is also focusing on research to develop eco-friendly and energy-efficient explosives that are low on environmental hazards. AEL Mining Services is dynamically growing by using expunction strategies and innovation, thereby connotating itself as a significant entity in the global emulsion explosive market.

Austin Powder Company

Holding an 8-12% market share, Austin Powder Company is a well-known supplier of explosives to the construction, mining, and quarrying operations with safety and reliability concerns. The company provides bespoke blasting solutions that conform to the characteristics and requirements of different industries to give them that best blasting efficiency in their applications.

Austin Powder is in the process of expanding its manufacturing capacity to meet the increasing demand globally, which in turn will strengthen its position in the international market. Although the focus is on safety and operational accuracy, Austin Powder keeps growing strong relationships with clients and drives the sector forward with explosive efficiency.

EPC Groupe

EPC Groupe commands a market share of 5-9%, emphasizing precise blasting and a novel emulsion formulation. The company is committed to driving the blasting technologies and high-performance explosives standardization through new methods and new products. Moreover, EPC Groupe is also expanding its logistics framework to further penetrate international markets and serve the rising quality explosives demand.

Continually adhering to safety and ethical obligations, EPC Groupe product offerings follow the set international standards thus becoming a trustworthy partner in the emulsion explosive trade. Its commitment to developing innovative products and tailored customer solutions is a major growth factor.

The global Emulsion Explosive market is projected to reach USD 3,052.4 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.1% over the assessment period.

By 2035, the Emulsion Explosive market is expected to reach USD 5,019.6 million.

The Bulk Emulsion segment is expected to hold a significant market share due to its high demand in Emulsion Explosive.

MAXAM, BME (Bulk Mining Explosives), Solar Industries India Ltd., Hanwha Corporation, Yunnan Civil Explosives Co. Ltd., Sasol Nitro, Keltech Energies Ltd., NOF Corporation

Bulk ,Cartridge ,Recycled Oil

Mining, Surface Mining, Underground Mining, Quarrying, Others (Hard Rock, Air Blasting, Colliery, Maritime Blasting/Seismic, General Blasting, Tunneling)

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East and Africa (MEA).

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.