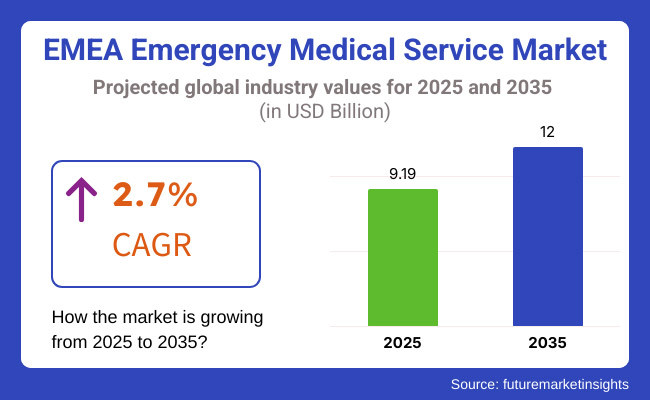

The EMEA emergency medical service market is anticipated to be valued at USD 9.19 billion in 2025. It is expected to grow at a CAGR of 2.7% during the forecast period and reach a value of USD 12.00 billion in 2035.

Emerging medical service in definition terms refers to a system that provides timely pre-hospital care, transportation, and medical assistance to individuals experiencing medical emergencies, including, but not limited to, cardiac arrest, injuries, or accidents. It is widely used in ambulances, hospitals, disaster response, and community healthcare to ensure rapid and effective medical treatment. This can be an urgent emergency entrance.

The emergency medical service market includes systems and services providing urgent pre-hospital care and transportation for medical emergencies. The course of the market is primarily increased by the growing number of accident cases, increasing cardiovascular emergencies, improving healthcare infrastructure, and advancement in technological help ambulance services to provide better turnaround times and patient outcomes in urban and rural areas.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth driven by population aging, urbanization, and increased emergency cases. | Rapid expansion fueled by AI, automation, and advanced telemedicine solutions for emergency response. |

| Adoption of GPS tracking, real-time communication, and digital patient records. | Widespread use of AI-powered emergency dispatch, 5G-connected online diagnostic facilities, and automatic medical units. |

| Increased response times due to demand outpacing resources, particularly in rural areas. | Very enhanced response times using advanced prediction analysis, AI-based dispatch, and drone-assisted emergency support. |

| Early-stage integration of telemedicine in emergency care, but with limited accessibility. | Full-fledged operation of telemedicine with AI-powered remote consultation and paramhelp support. |

| Shortage of trained emergency personnel, leading to high workload and burnout. | AI-assisted decision-making, robotic support, and enhanced training programs reducing personnel strain. |

| Limited integration with urban planning and public health networks. | Advanced coordination with smart city infrastructure, including AI-driven traffic management for ambulances. |

| Standard ambulances with incremental improvements in medical equipment. | Autonomous ambulances, AI-powered mobile ICUs, and next-generation life-saving devices. |

| Strengthened regulations for EMS safety, but slow implementation in some regions. | Standardized emergency care protocols across borders, ensuring universal access to high-quality EMS. |

| Minimal focus on sustainability, with diesel-powered ambulance fleets. | Transition to electric, hybrid, and hydrogen-powered ambulances with eco-conscious medical waste disposal. |

| There has been a growing tendency of collaboration between the government and private EMS providers even under the constraints of funding. | Stronger public-private initiatives leveraging AI and IoT to improve EMS accessibility and affordability. |

AI-Powered Emergency Response and Predictive Analytics

The reliance on AI-enabled emergency medical services that speed up response times and increase patient survivability is increasing among consumers. Companies are applying machine learning algorithms to predict emergency hotspots, develop ambulance dispatch optimization methods, and gain insights in real-time patient data so as to speed up decision-making.

These systems prepare paramedics before arrival with specific medical conditions for more effective and sometimes life-saving behaviors. As cities swell with populations and demands for quicker emergency care rise, Australians today expect fully-fledged EMS services that incorporate cutting-edge technologies offering smarter, faster, and more responsive healthcare solutions.

Telemedicine Integration for Pre-Hospital Care

The consumers now tend to embrace telemedicine solutions even in emergency medical services, providing real-time consultation for the paramedics with a specialist. Advanced mobile communication tools now make it possible for first responders to communicate live patient data, ECG readings, and video assessments with hospitals; this ensures better pre-hospital care.

This move will reduce unnecessary admissions to hospitals while improving early-intervention strategies. As digital healthcare is being adopted more and more by individuals, it will not be long before they demand EMS solutions that will introduce them to the gap from emergency care to hospital treatment, making critical care accessible and more efficient.

| Attributes | Details |

|---|---|

| Top Services | Basic Life Support |

| Market Share in 2025 | 2.9% |

As per FMI research, BLS, Basic Life Support, continues to be a primary service in the EMEA Emergency Medical Services Market with a share of 2.9% in the year 2025. There has been an increased demand for BLS ambulances programmed with trained paramedics and equipped with primary medical apparatuses with the occurrence of a non-critical emergency like minor injuries and a complaint of respiratory distress.

Pre-hospital care access is to be improved by governments with increased expansion of BLS services. Investments in new ambulances, training, and community health programs continue to expand along with an increasing emphasis on faster response times and improved emergency medical infrastructure. Digital communication tools help responders coordinate and communicate with hospitals faster so patient outcomes benefit greatly.

| Attributes | Details |

|---|---|

| Top Provider | Government EMS |

| Market Share in 2025 | 5.8% |

The Government EMS is the largest provider in the EMEA emergency medical services sector with a 5.8% market share in 2025, it is growing incomplete due to government-financed ambulance fleets, paramedic training programs, and accessible public healthcare infrastructure, thus making an appropriate emergency response service accessible in all areas-from urban to rural.

Rising public health initiatives and partnerships between government agencies and private healthcare providers are enhancing emergency response efficiency. Investments in technology-driven dispatch systems and automated patient monitoring tools further improve the quality and speed of emergency care, strengthening government EMS capabilities throughout the region.

| Attributes | Details |

|---|---|

| Top Fleet | Air Transport |

| Market Share in 2025 | 4.6% |

Air Transport stands out as an emerging segment that is projected to achieve a 4.6% market share in 2025, emerging from the increased demand for air ambulances resulting from rapid medical evacuations and emergency responses in remote areas. Air ambulance services are indeed the backbone for the transfer of critically ill patients and the provision of disaster response wherever there are road transport limitations.

Advances in airborne medical technologies, telemedicine combined with GPS tracking systems, indeed raised the effectiveness with which air ambulances perform their operations. Investment in government-private air-rescue operations has also increased to ensure speedier and safer patient transportations during critical dangerous emergencies.

Cutting-edge providers of medical equipment coupled with operators of ambulance service lines hold forth in becoming the forefront players in delivering emergency medical services in EMEA through adoption of sophisticated technological tools, regulatory know-how, and an extensive distribution network. Their prowess in stocking life-saving equipment, vehicles for emergency transport, and health solutions in the digital world enable them to hold relatively good bilateral relationships with government and health providers hence has a tightgrip on procurement and service deployment.

Regrettably, the above industry players have developed a habit of investing heavily in advanced ambulance technologies, integrating telemedicine, and designing intelligent systems for emergency care through the use of AI. Their essential expertise in their line comes from the development of trackable devices and communication platforms for high-level performance. They therefore lock out competitors from this space through long-term public health agency and private hospital contracts for steady access to service and infrastructure development.

Established corporations have all the power structures for pricing and setting industry standards through their well-thought-out alliances with and private expertise. They afford the benefits of excellent economies of scale, which entail cost-effective production of highly advanced emergency solutions, while remaining impressive in operational efficiency. Brand credibility and constant innovation collude to provide the company with an edge in sustaining consumer allegiance, which would ultimately put at risk the chances of smaller firms seeking business in large-scale emergency response services.

Concentration is still at a very high degree; the major players have ventured into the isolated or unreached regions by pursuing strategic acquisitions and going for digital transformation. Applying real time analytics, AI-powered dispatch systems, and eco-friendly ambulance fleets into their huge stock of efficiencies would further make their services smarter. That will keep most of the emergency medical logistics within grasp of established competitors to the point that it can be said to have no room for new entrants to disrupt the system.

The EMEA emergency medical services market is diverse, with several regional and international players actively competing for different service segments. The Emergency Medical Services (EMS) market for Europe, Middle East and Africa (EMEA) will continue to experience steady growth, due to an increase in demand for emergency care and breakthrough innovations in medical technology.

As of December 2023, the market is projected to reach a valuation of around USD11.69 billion by 2034, and the compound annual growth rate (CAGR) is 2.7%. This growth is a result of increasing rates of medical emergencies, an older population, and the integration of advanced technologies such as artificial intelligence and telemedicine into EMS operations.

Key players in the EMEA EMS market include major names such as Falck A/S, International SOS, and Airbus, to mention just a few. Falck A/S-a Danish multinational company-provides a comprehensive range of emergency services, such as firefighting, ambulance, and roadside assistance services, in most EMEA countries.

International SOS is headquartered in London and Singapore, and provides world-class health and security services, including emergency medical assistance and evacuation services to peoples across the globe. The company is well known for its aerospace expertise; with regard to the EMS market, Airbus provides sophisticated air ambulances and supporting technologies, improving aerial medical evacuation capabilities.

Stiff competition of both private and public EMS providers can be seen in this scenario. Companies are more focused on the enhancement of services on quality and response times. Such innovations in technology would include 5G-connected ambulances or artificial intelligence monitoring and analysis of real-time patient data.

For instance, Response Plus Medical launched in October 2023 a new generation of enhanced 5G-connected ambulances in the United Arab Emirates, which are designed to enhance the efficiency of emergency responses. Furthermore, it is becoming increasingly common to see collaborations and partnerships among EMS providers, health institutions, and technology companies for the purpose of convenient integration of futuristic solutions into emergency medical services.

Geographically, Italy and France continue emerging in Europe as key contributors to the EMS market with projected CAGRs of 2.1% and 1.6%, respectively, during the forecast period. Supported by government programs aimed at strengthening health infrastructure, growth in capital investments in emergency medical services, and a growing focus on improving patient outcomes in emergencies, the Mid East and African regions are also developing more modern EMS systems.

The EMEA Emergency Medical Service market is projected to be valued at USD 9.19 billion in 2025 and reach USD 12.00 billion by 2035, growing at a CAGR of 2.7%.

EMEA Emergency Medical Service product sales are expected to grow steadily due to increasing medical emergencies, technological advancements, and expanding government and private EMS collaborations.

Key manufacturers in the EMEA Emergency Medical Service market include Falck A/S, Airbus, International SOS, Air Ambulance Worldwide, and ER24, among others.

Europe, particularly Italy and France, along with the Middle East and Africa, is expected to generate lucrative opportunities for market players due to government investments in EMS infrastructure and rising demand for emergency care.

The market is segmented by services into basic life support, advanced life support, and patient transfer services.

Based on the provider, the market is segmented into fire-department-based EMS, government EMS, hospital-based EMS, private ambulance service, and other.

The market is categorized based on fleet, including ground transport and air transport.

In terms of region, the market is segmented into Europe and the Middle East & Africa.

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.