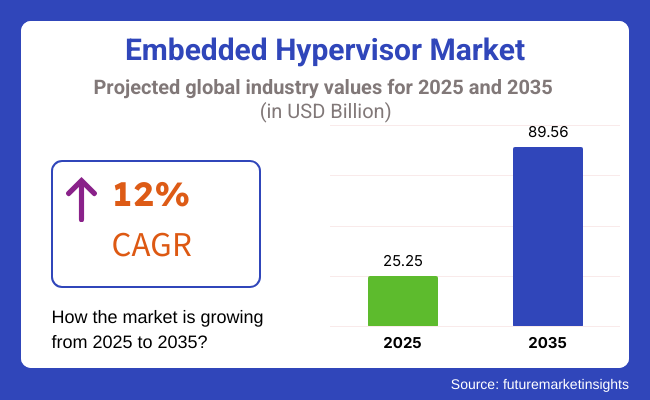

The embedded hypervisor market will be USD 25.25 billion in 2025 and grow to USD 89.56 billion by 2035, with a CAGR of 12% during the forecast period. Organizations are eagerly adopting them to achieve superior virtualization performance, security, and real-time capabilities in mission-critical segments such as the automobile, industrial automation, aero, and telco businesses.

In addition, investments on workload management empowered with AI, next-generation compute platforms, and embedded systems with IoT will be boosting the industry further.

Integrated hypervisors play a crucial role in enabling secure partitioning, multi-OS support, and hardware consolidation and enabling effective system resource utilization with high reliability. The integration of AI-powered analytics, container-based virtualization, and real-time OS support will further improve system performance and extend industry applications.

Growing need for secure and efficient virtualization in healthcare, aerospace, automotive, and industrial automation is driving the industry. As IoT-based embedded systems, AI-optimized workload optimization and container-based virtualization gain prominence, companies are using hypervisors to drive real-time performance, reduce hardware dependency, and improve security.

Explore FMI!

Book a free demo

The industry is growing due to the swift growth of virtualization in high-end applications of automotive, aerospace, industrial automation, and healthcare industries. Real-time efficiency and safety are an imperative in the automotive industry, particularly for autonomous and connected car applications.

Mission-critical functions are currently given prime importance by the aerospace & defence industry as far as compliance, security, and real-time processing capabilities are concerned. Cost-effectiveness and scalability are key factors in industrial automation that require the implementation of hypervisors that enable IoT-based smart manufacturing. Additionally, consumer electronics emphasize cost-effectiveness and scalability as the main goal for devices to perform better and at a lower energy consumption level.

Ensuring high security and compliance in medical devices and patient monitoring systems. Healthcare applications require finding ways to guarantee data integrity with the help of high-security measures and compliance. For example, Fraction of resources used to expand the industry among companies that increasingly incorporate AI, IoT, and cloud computing.

| Company | Contract Value (USD Billion) |

|---|---|

| Broadcom Inc. | Approximately USD 60 - USD 62 |

| KKR & Co. Inc. | Approximately USD 3.8 - USD 4.2 |

In November 2023, Broadcom Inc. completed the acquisition of VMware for approximately USD 60 - USD 62 billion, integrating VMware's virtualization technologies, including them, into its portfolio. This strategic move aims to enhance Broadcom's software offerings and expand its presence in the virtualization industry.

Subsequently, in February 2024, KKR & Co. Inc. agreed to acquire Broadcom's End-User Computing (EUC) Division, which includes VMware's Horizon and Workspace ONE products, for approximately USD 3.8 - USD 4.2 billion. This acquisition is set to bolster KKR's position in the virtualization and embedded hypervisor industry.

These developments reflect significant consolidation in the industry, with major players engaging in strategic acquisitions to enhance their technological capabilities and industry positions.

Between 2020 and 2024, the industry grew with industries embracing virtualization to improve security, resource utilization, and real-time system management. The development of autonomous vehicles, industrial automation, and edge computing pushed demand for hypervisors with safe partitioning of non-critical and critical workloads.

Firms into automotive control units, medical devices, and IoT devices to maximize performance and lower hardware costs. 5G and software-defined networking (SDN) continued to propel hypervisor use in telco and cloud-edge ecosystems.

AI-facilitated workload management further enhanced efficiency by incorporating perception intelligence into workload management. Automotive safety and industrial security regulation compliance impacted hypervisor design. Despite improvement, system complexities and real-time performance limits discouraged adoption, leading to investment in lightweight architecture and AI-driven security frameworks.

Hypervisors in 2025 to 2035 will get infused with AI automation, quantum-secure virtualization, and edge computing based on decentralized methodologies. AI-enabled hypervisors will guarantee optimal workload scheduling in real-time to use the least power. Protection against quantum computer-based attacks will be augmented with quantum-resistant cryptography, while blockchain technology will ensure immutable audit trails.

Autonomous system growth will require ultra-low-latency hypervisors for enabling mission-critical workloads. Predictive maintenance using AI will enhance system reliability, with energy-efficient architectures reducing computational overhead, thus supporting sustainability in embedded computing.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter security requirements (ISO 26262, IEC 61508, DO-178C, GDPR) made embedded hypervisor necessary for secure partitioning and real-time compliance for safety-critical applications. | AI-driven, zero-trust hypervisor architectures deliver real-time regulatory compliance, security verification automation, and decentralized runtime monitoring for mission-critical embedded systems. |

| AI-based embedded hypervisor improved resource allocation. enhanced workload balancing, and predictive failure analysis. | AI-born, self-aware hypervisors automatically optimize hardware usage, allow real-time adaptive virtualization, and increase security with AI-powered anomaly detection. |

| The growing application in vehicle ECUs, industrial automation, and robotics increased system dependability and functional safety. | AI-accelerated, real-time embedded hypervisor support autonomous vehicle safety monitoring, AI-enabled predictive maintenance, and transparent multi-OS integration for smart automation. |

| They allowed multi-core operation, supporting safe execution of mixed-criticality workloads on automotive, aerospace, and defense systems. | Heterogeneous, AI-driven hypervisor architectures dynamically schedule mixed-criticality workloads, dynamically partition resources, and offer ultra-reliable real-time computing for future cyber-physical systems. |

| The advent of edge computing necessitated low-latency, high-performance virtualization support in them for IoT and AI workloads. | AI-based, edge-native hypervisors provide real-time, self-governing workload management, anticipatory AI inference optimization, and lightning-fast data processing for distributed computing environments. |

| Embedded virtualization platforms followed rigorous automotive (ISO 26262 ASIL-D) and avionics (DO-178C DAL-A) safety certifications. | Compliance-based, AI-powered hypervisor platforms self-certify real-time system integrity, support AI-driven fault tolerance, and provide high-assurance system partitioning for safety-critical applications. |

| Growing cyber threats resulted in more widespread use of hardware-based security features, encrypted hypervisor layers, and AI-based security monitoring. | AI-native, quantum-safe hypervisors automatically identify security vulnerabilities, impose real-time encryption, and provide AI-based self-healing virtualization for cyber-resilient embedded systems. |

| Increased connectivity improved real-time virtualization for autonomous vehicles, industrial robots, and high-speed networks. | AI-driven, 6G-hypervisors provide ultra-low latency edge computing, SDN with AI-driven software programming, and real-time workload scheduling for next-gen intelligent infrastructure. |

| Firms optimized them to be power-optimized, powering green computing across IoT, automobiles, and industry automation. | Carbon-aware, AI-driven hypervisors intelligently manage power distribution, provide real-time power-efficient virtualization, and can be integrated into renewable-powered edge devices for efficient embedded computing. |

| Enterprises investigated blockchain-secured hypervisor platforms for tamper-resistant data integrity, secure software delivery, and trusted execution environments. | AI-driven, decentralized hypervisors provide trustless real-time workload management, smart contract security enforcement, and AI-driven distributed system authentication for mission-critical infrastructure. |

The industry clearly shows its distinctive risks since it is integrated into automotive, industrial automation, aerospace, and IoT systems. The main risk factors are the increased hacking chances, the problems regarding real-time-performance, the need for compliance, and the rapid decomposition of technology.

One important issue is the cybersecurity risks. An embedded hypervisor controls multiple VMs on a single hardware unit thus it is very attractive to the hackers including malware, unauthorized access, and system breaches. As they are widely used in the critical infrastructure, automobiles control units, and the medical devices, any security issues can lead to data leaks, system malfunctions, or even the life of people.

Another problem is the real-time performance reliability. Many fields such as automotive (such as ADAS systems) and industrial automation require an environment with low-latency and high-reliability. If an embedded hypervisor introduces the latency or performance bottleneck, it will lead to malfunctions, safety, and compliance failures in mission-critical applications.

Pressure for regulatory compliance is yet another significant risk. Embedded hypervisor in aviation, automotive, and healthcare must adhere to various industry standards such as ISO 26262 for automotive safety, DO-178C for avionics software, and IEC 62304 for medical devices among others. If this not met, there can be product recalls, punitive damage, and dwindled business.

Technological development is also a danger. Through the course of time, the embedded systems that are used, for instance, the Polish start-ups that develop sustainable energy, will require to be rebuilt by using new processor architectures, AI-based automation, and have a demand for edge computing. Vendors that turn a blind eye to adapt and develop might, in the end, have their products obsolete, hence losing their industry relevance.

In the electronic cartography industry, the share of RTOs - Real-time Operating Systems is 36.2%. Major growth drivers for this segment specifically are the component demand for real-time correlated geospatial data, notably for vehicle autonomy, aeronautical navigation, and military endeavors.

Within the defense/payment arena, RTO is crucial for situational awareness and reconnaissance, as well as threat detection and precision targeting, ensuring effective integration of navigation technologies with operational platforms.

Garmin Ltd., Thales Group, or Honeywell Aerospace dominate the segment, providing solutions that focus on real-time navigation while improving accuracy, responsiveness, and efficiency. For instance, the embedded flight management systems provided by Honeywell are used in numerous commercial and military aircraft and provide real-time navigation, improving the safety and operational effectiveness of the flight.

Managed Services largely dominate the industry with 53.5% industry share. The expanding demand for AI navigational services and cloud-based mapping solutions is at the heart of this growth. Cloud-hosted geospatial solutions, offering a reliable source of real-time data updates, enhanced security, and advanced analytics, can enable governments and enterprises to minimize their dependence on physical infrastructure.

Leading providers, like HERE Technologies, TomTom, and Esri, provide scalable Managed services for applications such as fleet management, smart city planning, and defense or military logistics. For instance, cloud-powered navigation systems from TomTom deliver real-time traffic conditions and route optimization, benefiting logistics companies and city planners.

Managed Services offer benefits such as low operational cost, higher data accuracy, and improved navigation, which have been the key factors in the increase in the adoption of managed services by various industries.

This can be enabled with server virtualization, which can help process high volumes of geospatial data for use cases like smart city planning, military intelligence, and autonomous driving, among others. With the need for electronic navigation charts to be processed in real-time, there is a growing trend in server virtualization, where there are distributed servers, collated and analyzed geospatial data, minimized hardware, etc.

Taking advantage of cloud and virtual environments allows businesses to improve their operational efficiency and scalability. Cloud-hosted geospatial solutions can help businesses and governments reduce reliance on physical infrastructure, offering them a reliable source of real-time data updates, enhanced security, and advanced analytics.

For more complex digital map purposes, the big suppliers (VMware, Microsoft Azure, AWS, etc.) additionally offer high-throughput virtualized server options. For example, cloud-based GIS platforms provided by AWS can promote large-scale mapping activities and improve navigation accuracy and situational awareness in real-time, including commercial applications and defence-related scenarios.

According to application industries, including fleet management, maritime navigation, and remote map access, desktop virtualization has also been a prominent key technology in the industry. Coming End users can connect and manage navigation with added safety anywhere from access to advanced remote geospatial data and navigation.

This method enables real-time map updates and progressive geospatial analytics and does not require expensive local hardware. This could be particularly useful for field workers, maritime companies, and logistics companies that need 24-hour access to its maps online.

Citrix, Oracle, and Dell Technologies are industry leaders in desktop-as-a-service (DaaS). They offer state-of-the-art desktop virtualization solutions for better data accessibility, security, and operational efficiency. Marine providers, for example, have access to follow-the-sun navigational chart data with Citrix's virtual desktop infrastructure (VDI), which allows them to plan their routes instantly and safely.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

| UK | 9.5% |

| European Union | 9.6% |

| Japan | 9.7% |

| South Korea | 9.9% |

The USA industry increases significantly as businesses adopt virtualization solutions to improve security, enhance resource utilization, and boost real-time processing capacity. The automotive sector employs them to facilitate real-time processing in advanced driver-assistance systems (ADAS) and electric vehicle (EV) designs.

Industrial automation vendors implement these solutions to provide faultless operation in robotics and smart manufacturing systems. The telecommunication sector uses them for network function virtualization (NFV) and 5G infrastructure.

Security and protection of critical infrastructure policies are also propelling industry growth. For instance, the National Institute of Standards and Technology (NIST) issues guidelines for embedded security to direct companies to invest in secure hypervisor solutions. Additionally, enhanced multi-core processing and edge computing enhance the adoption of embedded virtualization across various industries.

FMI is of the opinion that the USA industry is slated to grow at 9.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Growth in the Automotive Industry | ADAS and EVs require virtualization in real time to ensure enhanced system performance. |

| Industrial Automation | Intelligent factories and robotics require hypervisors for multi-OS, secure operations. |

| 5G and Telecommunications | They make NFV and edge computing a reality in next-generation networks. |

The UK industry expands as companies embrace AI-based virtualization to enhance embedded system security and operation efficiency. The automotive industry uses them in backing autonomous car development and in-car infotainment. Virtualization helps in the IoT industry by optimizing the use of resources in smart city deployments, connected healthcare devices, and industrial IoT (IIoT) solutions.

Government policies involving cybersecurity and digitalization promote hypervisor adoption. Organizations are now using these products in financial sectors and defense as secure multi-OS infrastructure becomes a priority. AI-driven automation also boosts the demand for them in data analysis and processing.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Autonomous Cars | They enable secure real-time system control. |

| IoT & Smart Cities | Virtualization allows for optimal resource utilization in smart city development. |

| Cybersecurity Regulations | Government policies necessitate safe computer systems. |

The industry grows as businesses embrace real-time virtualization, artificial intelligence-based security, and cloud computing. Germany, France, and Italy dominate the industry with the application of them in automobile safety systems, industrial control systems, and intelligent infrastructure.

Virtualization in the automotive sector is employed by car manufacturers to enhance electronic control units (ECUs) and facilitate over-the-air (OTA) software updates. Industrial automation gains from them to enhance operating effectiveness and safety for smart factories.

Stricter cyber security and data protection laws throughout the EU lead businesses to adopt secure, high-performance embedded virtualization platforms. The perpetual trend away from multi-core processors as an adopted architecture also encourages the embedding of such technologies throughout strategic industry verticals.

FMI is of the opinion that the European Union industry is slated to grow at 9.6% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Car Industry Innovation | Efficiency and capability of ECU of hypervisors, as well as over-the-air update features. |

| Industrial Control Systems | Virtualization is applied for optimization in smart factories. |

| Data Protection Laws | Companies follow strict security laws. |

The industry expands with the injection of real-time virtualization, artificial intelligence-driven system control, and secure software-defined space in various industries. They contribute to autonomous vehicle technology, which offers multi-OS and real-time processing support by auto vendors.

Virtualization facilitates the industrial robotics industry in machine performance optimization and predictive maintenance. Consumer electronics firms also use them to facilitate smarter appliance connectivity and communication.

Japan's emphasis on high-performance computing and cybersecurity powers widespread adoption. Financial and defense sectors also leverage them to make data more secure and digitize infrastructure.

FMI is of the opinion that the Japanese industry is slated to grow at 9.7% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Smart & Autonomous Vehicles | Hypervisors provide real-time support in autonomous applications. |

| Industrial Robots | Virtualization by AI reinforces robotic automation. |

| Consumer Electronics | Embedded solutions help smart home connections. |

The industry experiences robust growth due to the uptake of AI-driven virtualization, IoT security software, and high-speed computing platforms. The government encourages the development of smart technologies, leading to increased use of them in automotive, telecom, and industrial applications. Businesses implement real-time multi-OS virtualization and secure containerization to enhance the performance of embedded systems.

Expansion of 5G network infrastructure and edge computing increase the need for telco and cloud hypervisor applications. Automotive companies produce next-gen vehicles with hypervisor-enabled safety features and infotainment systems. Smart manufacturing companies simplify operations with virtualized industrial control systems.

FMI is of the opinion that the South Korean industry is slated to grow at 9.9% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| 5G & Edge Computing | Hypervisors enhance telecommunication and cloud applications. |

| Automotive Safety Systems | Virtualization enhances real-time automotive performance. |

| Smart Manufacturing | Industrial IoT is underpinned by secure and effective hypervisors. |

The industry is steadily building momentum as its client industries seek to consolidate their virtualization solutions while providing greater security, efficiency, and real-time processing capabilities to the respective embedded systems.

Thus, they find crucial applications for the isolation of critical workloads, for the enablement of multi-OS environments, and for the enhancement of system reliability in industries such as automotive, aerospace, industrial automation, and telecommunications.

Major dominators in this industry include Wind River, SYSGO (Thales Group), Green Hills Software, BlackBerry QNX, and Siemens (Mentor Graphics) with their real-time hypervisors, secure virtualization frameworks, and AI-based solutions for workload management. Meanwhile, lighting up the business are startups and niche providers in lightweight hypervisors, open-source virtualization, and hardware-assisted security for embedded applications.

The competition in the marketplace has heightened due to the increased adoption of software-defined vehicles, IoT-enabled industrial automation, and cybersecurity-based hypervisor solutions. Companies are investing in cloud-integrated embedded virtualization, AI-based hypervisor management, and ARM-based hypervisor optimizations for performance and scalability.

Factors like the rising demand for automotive hypervisors in connected and autonomous vehicles, aerospace & defense applications requiring certified security, and industrial IoT solutions demanding real-time processing are intensifying the competition. The companies are working on low-latency virtualization, edge-computing integration, and hypervisor-based security architectures to stay at the forefront in this fast-evolving landscape.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Wind River Systems | 20-25% |

| SYSGO (Thales Group) | 15-20% |

| Green Hills Software | 12-17% |

| Blackberry QNX | 8-12% |

| Siemens (Mentor Graphics) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Wind River Systems | Develops real-time embedded hypervisors, AI-powered workload management, and secure virtualization solutions. |

| SYSGO (Thales Group) | Provides real-time, safety-critical hypervisors for aerospace, automotive, and industrial applications. |

| Green Hills Software | Specializes in high-security embedded virtualization, multi-core processing, and OS partitioning. |

| Blackberry QNX | Focuses on automotive-grade embedded hypervisors, real-time OS integration, and cybersecurity solutions. |

| Siemens (Mentor Graphics) | Offers cloud-based embedded hypervisors, real-time computing solutions, and industrial automation support. |

Key Company Insights

Wind River Systems (20-25%)

AI-driven workload management, real-time virtualization, and cloud-based hypervisor solutions constitute Wind River Systems' offerings for the industry.

SYSGO (Thales Group) (15-20%)

SYSGO is a specialist in safety-critical hypervisors integrated into real-time operating systems with security-oriented virtualization for aerospace and automotive applications.

Green Hills Software (12-17%)

With high-assurance embedded virtualization, multi-core processing, and OS partitioning, Green Hills software improves security and enables high performance.

Bob QNX (8-12%)

With the integration of cybersecurity, Blackberry QNX powers ideal embedded hypervisor provision for automotive, IoT, and mission-critical applications.

Siemens (Mentor Graphics) (5-9%)

Siemens (Mentor Graphics) has a cloud-based embedded hypervisor, industrial automation provision, and AI-embedded virtualization tools.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 25.25 billion in 2025.

The industry is predicted to reach a size of USD 89.56 billion by 2035.

IBM Corporation, Microsoft Corporation, VMware, Inc., QNX Software Systems Limited, SYSGO AG, Siemens EDA, WindRiver Systems, Inc., ENEA, Sierraware, TenAsys Corporation, Lynx Software Technologies, Inc., Green Hills Software, Acontis Technologies GmbH, Citrix Systems, Inc., Proxmox Server Solutions GmbH, Real-Time Innovations (RTI), DDC-I, and CoreAVI are the key players in the industry.

South Korea, with a CAGR of 9.9%, is expected to record the highest growth during the forecast period.

Managed services are among the most widely used solutions in the industry.

By solution, the industry is divided into embedded hypervisor software, bare-metal hypervisors (Type 1), hosted hypervisors (Type 2), real-time operating systems (RTOs), services, professional services (consulting, integration & deployment, support & maintenance), and managed services.

By technology, the industry includes server virtualization, desktop virtualization, and data center virtualization.

By enterprise size, the industry is classified as small & medium enterprises (SMEs) and large enterprises.

The industry is classified into BFSI, Automotive, Aerospace & Defense, Consumer Electronics, Healthcare & Medical Devices, Industrial Automation, and Others.

By region, the industry spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.