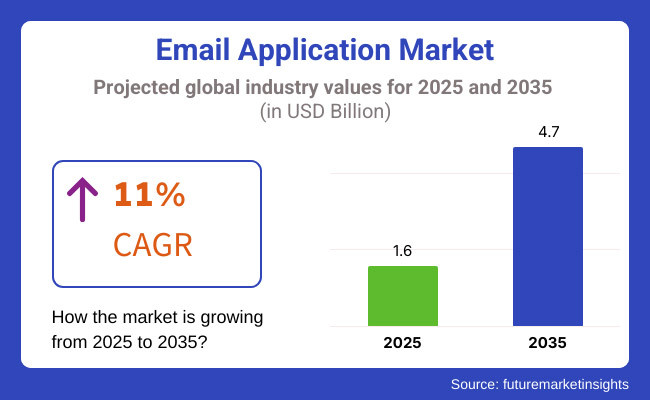

The global email application market is projected to grow at a CAGR of 11%, from USD 1.6 billion in 2025 to USD 4.7 billion in 2035. The increasing adoption of cloud-based email services is a major factor contributing to the industry's growth, as they allow users to securely retrieve emails from any location via any device and reduce IT infrastructure expenses. AI-based spam filters, real-time email classification, and predictive analytics for improving user experience, estimating cyber-attacks, and automating workflow are major organization foci.

This industry is the all-in-one solution provider of secure, efficient, intelligent business, government, and individual communication. Over the years, email applications have become more than just communication tools; they have integrated AI-based automation, encryption technology, and cloud storage to enhance productivity and data security. As privacy regulation compliance and seamless enterprise collaboration are becoming a priority, next-gen email solutions are necessary for secure and efficient communication across industries.

AI assistants handle things like managing email, real-time translation of languages, and providing better search performance, thus allowing us to communicate more efficiently and with greater personality. Additionally, the rising concern regarding data privacy and the need to ensure regulatory compliance further drive the demand for embraced email offerings, which provide a secure data passage and keep the email safe from phishing schemes and cyber-attacks.

More organizations are integrating their email management systems with the companies' online software, such as customer relationship management (CRM) systems, project management tools, and cloud storage. Integrating seamlessly, these tools enhance productivity by enabling teams to access and share information seamlessly in a secure ecosystem. Real-time analytics and automated email processes have also pushed companies to spend on large, business-friendly email systems that are scalable and cost-effective.

The industry is also seeing long-term growth due to continuous advancements in AI-based security measures and rapidly evolving cloud computing, automated communications software, and others. Investment in advanced email technologies will increase as enterprises and employees focus on effective, secure, compliant email solutions. Email apps are adapting to developing digital ecosystems rapidly and offer more security and smooth collaboration that should result in better workflow management in a more digital world.

Explore FMI!

Book a free demo

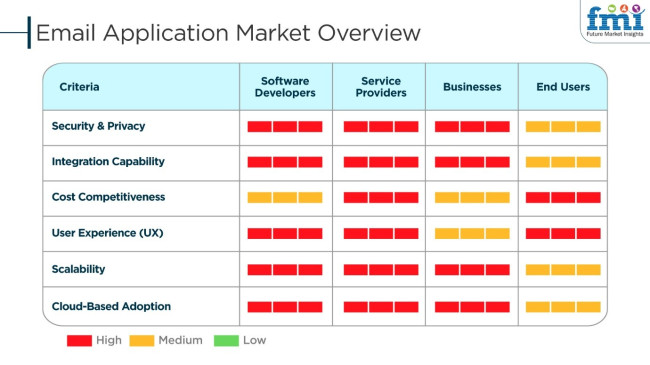

The Email Application Market is currently experiencing rapid growth which is due to the increased shift towards cloud-based systems, AI-driven automation, and security improvements in order to satisfy the requests from businesses, service providers, and individual users.

Enterprises mainly see the need for connection with operational software packages, security adherence, and collaboration tools, which is why features such as full encryption, spam filtering, and AI-assisted sorting emerge as perquisites. In contrast, service providers deal with the issue of affordability, expansion, and access to multiple devices, even though they first traverse it with such instruments as a steady operation and an instant customer support.

Clients prefer to have customer-friendly user interfaces, be able to afford the applications, and use them via a smartphone; thus, they are more inclined to use free or subscription-based models which come with additional features like smart inbox management and cloud storage integration.

Developers are pouring money into projects such as AI-based email assistants, voice-controlled emailing, and blockchain-based applications for security improvements all for the user’s benefits. Electric purchasing criteria are data protection, cross-platform interoperability, and automation as well, but the change towards zero-trust security and real-time collaborative working tools in business setup matters is becoming visible.

| Company | Microsoft |

|---|---|

| Contract/Development Details | Microsoft secured a contract to provide its Outlook email application to a global financial services firm, aiming to enhance secure communication and collaboration across the organization's international branches. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 50 million |

| Estimated Renewal Period | 3 years |

| Company | |

|---|---|

| Contract/Development Details | Google expanded its partnership with a multinational technology company to integrate Gmail with the company's internal systems, facilitating seamless communication and data sharing among employees worldwide. |

| Date | July 2024 |

| Contract Value (USD Million) | Approximately USD 75 million |

| Estimated Renewal Period | 5 years |

| Company | IBM |

|---|---|

| Contract/Development Details | IBM entered into an agreement with a leading healthcare provider to implement its email platform, focusing on improving patient data security and compliance with healthcare regulations. |

| Date | October 2024 |

| Contract Value (USD Million) | Approximately USD 40 million |

| Estimated Renewal Period | 4 years |

In 2024 and early 2025, the industry experienced significant growth, driven by strategic contracts and technological advancements. Microsoft's contract with a global financial services firm underscores the demand for secure and efficient email solutions in the finance sector.

Google's expanded partnership highlights the trend of integrating email platforms with internal systems to enhance organizational communication. IBM's agreement with a healthcare provider emphasizes the importance of data security and regulatory compliance in email communications within the healthcare industry. These developments reflect a broader trend of organizations investing in robust email applications to improve operational efficiency and security.

From 2020 to 2024, the industry experienced a significant boost with the growth of remote work, digital communication, and enhanced cybersecurity threats. Secure and collaborative email solutions were a priority for organizations to boost productivity and safeguard confidential data.

Cloud-based email applications became popular due to their scalability, accessibility, and integration with productivity software. AI-driven capabilities like smart inboxes, predictive text, and automated sorting enhanced user experience and productivity.

Between 2025 and 2035, the industry will move towards intelligent communication ecosystems that utilize AI-fuelled personalization, blockchain security, and extended digital immersion. Email apps will get more deeply embedded into digital workspaces through real-time collaboration, voice-to-text, and AR-empowered interactions. The direction will be toward privacy-oriented communications, decentralized email networks, and quantum-resistant encryption to protect digital identities and confidential information.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| AI-powered features such as predictive text, smart replies, and automated sorting improved user productivity and email management. | Advanced AI models will enable hyper-personalized communication, real-time language translation, and cognitive email assistants that predict user needs. |

| Email applications implemented end-to-end encryption and multi-factor authentication to protect sensitive information. | Quantum-proof encryption, peer-to-peer email networks, and identity authentication with blockchain technology will guarantee effective privacy and data security. |

| Harmonization with productivity applications (such as calendars, task planners, and cloud drives) enriched group collaboration. | Smart AI-enhanced virtual workplaces will facilitate live co-authorship, voice-to-text recognition, and fully immersive AR/VR interfaces for facilitating easy remote collaborations. |

| Cloud-centric email solutions emerged in favour of scalability, universal access, and remote labour enablement. | Hybrid cloud architectures with edge computing will enhance performance, security, and compliance for enterprise communication environments. |

| Easy-to-use interfaces, dark mode, and theme customization enhanced user experience and user engagement. | AI-driven personalization, contextual communication, and voice-activated interfaces will deliver intuitive and adaptive user experiences. |

| Email applications integrated with CRM, ERP, and social media platforms for unified communication management. | Unified communication ecosystems will seamlessly integrate email, messaging, video calls, and social interactions, powered by AI-driven contextual intelligence. |

| Adherence to data protection laws (e.g., GDPR and CCPA) impacted email security and data storage behaviours. | Compliance monitoring using AI, decentralized identity management, and regulatory automation will ease data governance as well as cross-border interactions. |

| Voice integration was restricted to minimal voice-to-text and email dictation capabilities. | Voice-controlled communication, speech recognition powered by AI, and holographic interactions will redefine email experiences and productivity levels. |

| Core AR capabilities (e.g., email previews) and rich media support boosted engagement. | Immersive AR/VR environments, holographic email experiences, and metaverse integration will transform digital communication and virtual collaboration. |

| Businesses, SMEs, and schools used email applications for communication and productivity. | Digital workplaces, remote-first businesses, and decentralized autonomous organizations (DAOs) will fuel demand for smart and privacy-focused email solutions. |

Cybersecurity hazards such as phishing attacks, data breaches, and malware infiltration are the main risks in the industry. Since email still serves as a central communication medium for companies and individuals, it is therefore a must for providers to heavily invest in encryption, multi-factor authentication (MFA), and AI-based threat detection in order to avoid the risk of security vulnerabilities. The failure to deal with these risks can result in regulatory fines, legal liabilities, and even the loss of customer trust.

The other major challenge is regulatory compliance that comes up when email applications are supposed to conform to data protection laws such as GDPR, CCPA, and HIPAA in cases where they are handling user data.

A breach of these legal rules, of course, can lead to heavy fines and the imposition of operational restrictions in certain locations. Besides, the transfer of data across national borders, which is also regulated, makes it more difficult for the company to provide its service on a global scale, thus requiring the implementation of localized data storage.

Market competition and saturation are also significant threats. Pre-existing companies like Microsoft Outlook, Gmail, and Apple Mail cover most of the area in the sector so that it becomes next to impossible for newcomers to find a suitable place in the industry. Also very important is the differentiation of the email that is more secure, AI-enabled features, and interoperability with other productivity tools that are necessary for the smaller enterprises to stay in business.

Gmail, a cloud-based solution, is preferred by organizations nowadays due to its eco-friendliness, cost-effectiveness, security, and scalability. Since these systems are hosted in the cloud, they no longer require an on-premise infrastructure to deliver email services to businesses, irrespective of their location or time. Services like Gmail or Outlook offer advanced features like AI-powered spam filtering, end-to-end encryption, and integration with productivity tools.

In this space, you have software from Google LLC (Google Workspace - Gmail for Business the dominant player in this segment), cloud-hosted information technology (IT) systems and services hosted exchange with integrated AI capabilities for protecting mail against ever-evolving security threats, multi-device synchronization, and real-time collaboration. These properties assist organizations in streamlining their operations and maintaining data confidentiality.

Another major player is Zoho Corporation, which offers the cloud-based email service Zoho Mail, which is geared toward companies of all sizes. It offers a secure, ad-free experience with email hosting in an encrypted format and productivity integrations. Cloud-based email is popular with businesses because it automatically updates, increases data security, and is more compliant with international regulations like GDPR and HIPAA.

Enterprise messaging platforms go beyond traditional email services to include instant messaging, video conferencing, and collaboration tools. They enable organizations to communicate in real-time and manage workflow through these platforms that are geared towards enhancing workplace collaboration.

Microsoft Corporation (Teams Integration in Outlook 365) - A leading enterprise messaging vendor combining email, instant messaging, and video conferencing. It seamlessly integrates with Microsoft Teams, enabling organizations to move between email communication and real-time collaboration.

Cisco Systems, Inc. (Cisco Webex Email & Messaging), another big player in this space, provides enterprise-grade messaging solutions that come with AI-based security features, data loss prevention (DLP), and compliance tools, especially for big enterprises in need of collaboration platforms for the remote and hybrid workforce.

Owing to its low cost, ease of scalability, and low maintenance requirements, public cloud deployment is widely adopted in the industry. So, in this model, on third-party cloud servers, you will host email services available for businesses, offering affordable solutions where you do not need hardware on your premises. Email on public cloud is the preferred service for start-ups, SMEs, and Enterprises that need flexible and remote-accessible email services.

AWS Work Mail Amazon Web Services (AWS Work Mail) is one of the major players in public cloud email hosting, providing secure business email services that include encrypted storage, AI-powered threat detection, and integration with other AWS cloud services. By design, AWS WorkMail provides high availability and redundancy, making it an ideal enterprise solution.

Another one, Proton Mail, has end-to-end encryption and focuses on public cloud email services that prioritize privacy in email communication. As a result of rising interest in encrypted business communications, public cloud email providers appease enterprise needs by adding new security measures.

On-premise email solutions are crucial for organizations wanting full control of their email infrastructure. This is often preferred by industries with highly sensitive data, including, but not limited to, healthcare, government, or financial institutions, where regulatory compliance and data sovereignty are of the utmost importance.

On-premises email systems (e.g., IBM Domino Mail) offer robust and encrypted security options and advanced administrative features. A large pitch outside of the enterprise context is about data privacy, which IBM Domino Mail offers over the use of third-party cloud providers.

A prominent player, IceWarp Inc. provides on-premises business email and collaboration solutions that can be self-hosted, enabling the organization to have complete control over its data. IceWarp solutions serve industries needing strict data protection and adherence to regional data laws.

| Countries/Regions | CAGR (2025 to 2035) |

|---|---|

| USA | 9.5% |

| UK | 9.1% |

| European Union | 9.3% |

| Japan | 9.2% |

| South Korea | 9.6% |

The USA industry is growing as businesses, educational institutions, and individuals embrace sophisticated email solutions to enhance security, automate workflow, and provide an enhanced user experience.

Organizations create AI-driven email solutions to enhance encryption, enhance real-time collaboration, and facilitate communication. The technology and business verticals implement intelligent email solutions for higher productivity and embrace cloud-based solutions. Policy requirements also get organizations to invest in GDPR-compliant, secure email solutions for data security and compliance.

Growth Drivers in the USA

| Top Drivers | Reason |

|---|---|

| AI-Driven Email Platform Adoption | Higher efficiency in workflows is achieved through greater automation and security. |

| Demand for Cloud-Based Collaboration | Firms employ intelligent email solutions to work together collaboratively in real time. |

| Secure Email Service through Regulatory Compliance | Policies influence investment in secured and compliant solutions. |

The UK industry is growing, with companies moving their email solutions to the cloud for higher efficiency and security. Companies implement AI-based automation and spam filtering to improve productivity and secure communication.

The growing use of remote work, enterprise emailing solutions, and digitalization drives industry growth. State policies regarding data protection and information security legislation drive the adoption of new email solutions even higher.

Growth Drivers in the UK

| Key Drivers | Details |

|---|---|

| Increased Trend towards Cloud-Based Email Services | Businesses embrace secure and scalable email services. |

| AI-Powered Email Automation Implementation | Better spam blocking and security enhance communications. |

| Government Cybersecurity Policies | Induce investment in business email solutions with encryption. |

The EU industry is expanding as organizations and businesses adopt AI-based email applications for workflow automation and secure communication. Germany, Italy, and France are leading the charge with enhanced cloud-based email solutions with cutting-edge cybersecurity features.

The EU has strong data privacy laws, and the outcome has been that businesses have invested in encrypted and GDPR-compliant email solutions. Machine learning and real-time threat protection improvements also make enterprise email systems more productive and secure.

Drivers of Growth in the EU

| Key Drivers | Detail |

|---|---|

| Strong Data Privacy & Security Legislation | Companies invest in encrypted email solutions to meet the requirements. |

| Improvements in AI & Threat Intelligence | Machine learning improves security and spam filtering for email. |

| Cloud-Based Email Service Development | Businesses implement flexible and secure communications solutions. |

Japan's email app industry is growing as companies and schools use AI-based email management apps to provide better organization, security, and group collaboration. Companies create intelligent email solutions for better spam blocking, automation, and workflow automation.

The nation's emphasis on electronic communication and business productivity drives adoption. Technology, healthcare, and finance sectors invest in AI-based email security and automation to secure communication networks and automate business processes.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Development of AI-Driven Email Management | Companies implement intelligent solutions for email management. |

| Secure Enterprise Communication Demand | The finance and healthcare sectors implement encrypted email systems. |

| Cloud and Mobile Email Platform Development | Companies implement AI-based solutions for collaboration. |

South Korea's email app industry is growing exponentially as companies and individuals adopt AI-powered email security, smart inbox management, and cloud collaboration software. Government spending on digital infrastructure and cybersecurity accelerates industry growth even more.

Companies engineer end-to-end encryption, AI-powered spam filtering, and real-time analytics to protect and accelerate emails. 5G networks and mobile email app innovations increase accessibility and simplify business communication.

Growth Drivers in South Korea

| Key Drivers | Details |

|---|---|

| AI-Driven Email Security & Spam Blocking | Businesses utilize real-time analysis to make decisions on threats. |

| Innovations in 5G & Mobile Email Solutions | Real-time connectivity improves communication productivity. |

| Government Spending on Digital Infrastructure | Policies are supportive of cybersecurity and cloud email solutions. |

The industry continues to see a heavy competition due to the ever-growing demand for secure communication, AI enhancements, and seamless integration. The industry players distinguish themselves with advanced security features, AI automation, and integration deep into ecosystems.

Microsoft Outlook has a firm foothold with strong productivity tools, cloud integration, and collaboration features in the enterprise space. AI has been used extensively to organize emails and relies on Google's Gmail, which also works with real-time security enhancements.

Apple iCloud Mail pursues a user-privacy concern strategy with a straight-through synchronization system across its ecosystem. Yahoo Mail still banks on monetization opportunities through ads on a huge-plus user base profile. Meanwhile, Zoho Mail attracts companies that emphasize privacy with customizable solutions, ad-free experience, and end-to-end encryption.

In this evolving competitive space, the companies that will have the upper hand are those that invest directly in AI automation, end-to-end encryption, and integrated workspace solutions as organizations and individuals might want to enhance their email security, productivity, and the ability to access email from multiple platforms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Outlook | 25-30% |

| Gmail (Google) | 20-25% |

| Apple Mail | 12-17% |

| Yahoo Mail | 8-12% |

| Zoho Mail | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Outlook | Provides enterprise email solutions, AI-driven productivity tools, and seamless integration with Office 365. |

| Gmail (Google) | Offers AI-powered email filtering, cloud storage, and smart reply features. |

| Apple Mail | Delivers secure and private email communication with deep iOS and macOS integration. |

| Yahoo Mail | Focuses on personalized inbox management, large storage capacity, and spam protection. |

| Zoho Mail | Develops business email solutions with end-to-end encryption and workflow automation. |

Key Company Insights

Microsoft Outlook (25-30%)

Microsoft Outlook leads the industry by offering enterprise-grade security, AI-powered productivity enhancements as well as seamless Office 365 integration.

Gmail (Google) (20-25%)

Gmail serves its purpose of being a strong email platform that holds power with spam filtering through AI and cloud cooperation with smart inbox management.

Apple Mail (12-17%)

Apple Mail emphasizes privacy and security through encryption and smooth integration across devices with an easy-to-use interface.

Yahoo Mail (8-12%)

High storage limits, personalization in inbox organization, and spam protection collectively enhance the user experience in Yahoo Mail.

Zoho Mail (5-9%)

Zoho Mail provides encrypted business email services along with workflow automation and AI-based inbox management.

Other Key Players (20-30% Combined)

The industry is slated to reach USD 1.6 billion in 2025.

The industry is predicted to reach USD 4.7 billion by 2035.

The key companies in the industry include NEC Corporation, Alphabet, Inc., International Business Machines Corp., Microsoft Corporation, Micro Focus International plc, Hitachi, Ltd., Myriad Group, Proofpoint, Inc., Unisys Global Technologies, and Dell Inc.

South Korea, slated to grow at 9.6% CAGR during the forecast period, is poised for the fastest growth.

Cloud-based emails are being widely deployed.

The industry covers cloud business email, enterprise messaging platforms, consumer email, and email clients by product type.

In terms of deployment, the industry includes public and on-premise deployment.

Region-wise, the industry spans North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.