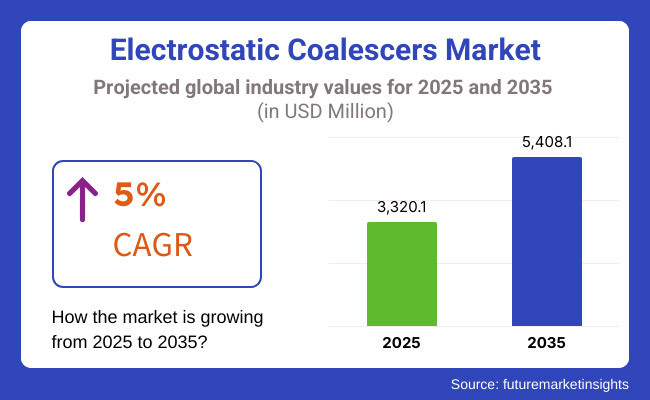

Monetary expansion in the electrostatic coalescers market will persist through 2035 as businesses within the oil & gas and chemical industries boost their demand for effective oil-water separation systems. Electrostatic coalescers drive vital separation improvements, which decrease crude oil water content and maximize operational performance during petroleum production processes. The market starting at USD 3,320.1 million in 2025 is expected to grow to USD 5,408.1 million by 2035 due toan anticipated 5% compound annual growth rate during the forecast period.

Market expansion occurs because industries increasingly focus on various aspects, including process efficiency, water management, and crude oil quality enhancement. The market demand for electrostatic coalescers increases because of strict environmental rules that govern wastewater treatment and crude oil desalting processes.

The market grows because oil extraction operations continue to implement upgraded separation systems in both offshore and onshore production facilities worldwide. The widespread acceptance of electrostatic coalescers faces barriers because of high implementation expenses and operational difficulties related to treating mixtures containing emulsified oil and water. The manufacturing sector works to resolve system automation issues while enhancing both energy efficiency and the capabilities to process multiple crude oil compositions.

Market segments in the electrostatic coalescers industry are organized by product type and application since additional applications emerged from the oil and gas, chemical, and petrochemical sectors. Experienced analysts divide electrostatic coalescers into three basic categories: AC electrostatic coalescers, DC electrostatic coalescers, and hybrid AC-DC systems.

AC electrostatic coalescers hold the market lead through their high effectiveness in processing water-in-oil emulsions and improving crude oil grade. DC electrostatic coalescers deliver specific separation outcomes in heavy crude processes yet combined AC-DC hybrid systems increase adaptability of refining operations in complex environments. The oil & gas sector represents the market segment with the highest application of electrostatic coalescers since these devices enhance the efficiency of processing crude oil and treating water.

Manufacturers within the chemical and petrochemical sectors heavily depend on advanced separation technologies because they need these systems to treat industrial wastewater and recover solvents. Manufacturers use technological advancements to include automated systems with remote monitoring capabilities and efficient electrodes to optimize performance, which lowers the costs of maintenance.

The North American electrostatic coalescers market offers lucrative growth opportunities owing to the rise in oil production activities and strict environmental regulations on water disposal. Electrostatic coalescers are witnessing increasing usage in refining and offshore oil extraction in countries like the United States and Canada due to technological developments in the separation processes.

Government initiatives to promote efficient crude oil treatment and enhanced oil recovery are also driving the market's growth. Furthermore, continuous studies on energy-efficient coalescer designs foster industrial development in the long run.

The Europe electrostatic coalescers market is gaining from the surging investments in advanced separation technologies and environmental compliance initiatives. Germany, Norway, and the UK are driving growth in the region as demand from the offshore oil & gas sector and chemical processing industries remains strong.

In industrial applications, the adoption of high-performance electrostatic coalescers has accelerated due to stringent wastewater treatment regulations. Also, European oil refineries use electrostatic coalescers to increase the system's efficiency and reduce the water mixture in the crude oil streams to meet sustainability goals.

The electrostatic coalescers market is expected to exhibit its highest growth in the Asia-Pacific region, owing to the increasing oil refinery capacity, growing chemical production, and demand for effective water treatment solutions across the region.

Market demand is increasing due to major investments in crude oil processing infrastructure, particularly in countries like China, India, Japan, and South Korea. Further market growth is provoked by government projects that encourage refining in an energy-efficient way as possible and sustainable water management. Increased adoption of automation and process optimization holds long-term potential for the region despite high equipment costs presenting challenges.

Challenge

High Capital Investment and Complex Maintenance Requirements

Electrostatic coalescers are an essential unit operation used for separating emulsified water and impurities from crude oil and other industrial fluids. However, the significant challenges to the widespread adoption of MHT systems are high initial investment costs and complex maintenance requirements.

These systems not only need stringent voltage control, specialized electrodes, and advanced automation, but also lead to higher procurement and operational costs. Moreover, variability in crude oil quality and flow rates impacts the separation efficiency, requiring constant optimization and specialist technical know-how. Because of these cost and operation constraints, smaller operators and new markets tend to shy away from investing in electrostatic coalescers.

Opportunity

Increasing Demand for Efficient Crude Oil Processing and Sustainable Separation Technologies

The growing inclination toward efficient crude oil refining and water-in-oil separation is expected to substantially contribute to the growth of the electrostatic coalescer market during the assessment period. With strict environmental policies, industries are constantly looking for energy-efficient and environment-friendly separation processes to reduce chemical consumption and wastewater discharge.

Enhanced dielectric material innovation, smart automation, and high-voltage pulse coalescence create operational efficiency and adaptability in a broad spectrum of crude oil compositions. Also, the installation of electrostatic coalescers in biofuel production and industrial waste treatment has market applications beyond traditional oil refining.

Market demand for electrostatic coalescers grew steadily between 2020 and 2024 due to their high efficiency in dehydrating crude oil and industrial fluid purification. Businesses invested in automated and real-time monitoring systems to improve the precision of the separation process and cut operational costs. However, high costs and technical expertise requirements remained some of the significant challenges for adoption in cost-sensitive regions. Work on electrode durability and process optimization to enhance system lifetime and efficiency.

From 2025 onwards, the marketplace will progressively shift towards advanced AI-driven adaptive coalescers that can dynamically adjust voltages and separation parameters to process various feedstock compositions during operation. The incorporation of nanotechnology-based dielectric coatings helps improve coalescer efficiency thereby minimizing maintenance requirements. In addition, electrostatic separation technology will penetrate into renewable energy fields such as biofuel refining and high-end wastewater treatment, further promoting the application of electrostatic separation technology in the broader market. Modular and scalable coalescer designs will drive broader adoption of these systems by smaller and emerging industry players.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter environmental standards pushed industries toward advanced separation technologies. |

| Technological Advancements | Improved electrode materials and automation enhanced separation efficiency. |

| Crude Oil Processing | High demand for water-in-oil separation in upstream and downstream oil operations. |

| Cost and Maintenance Barriers | High capital investment and maintenance complexity restricted adoption. |

| Emerging Applications | Limited to oil & gas refining and industrial emulsions. |

| Environmental Sustainability | Focus on reducing chemical demulsifiers and wastewater disposal costs. |

| Market Growth Drivers | Growth is driven by oil refining demand and regulatory compliance pressures. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global sustainability policies will mandate energy-efficient and chemical-free separation solutions. |

| Technological Advancements | AI-driven adaptive control systems and nano-coated electrodes will redefine performance and longevity. |

| Crude Oil Processing | Enhanced electrostatic separation for heavy crude and biofuel refining will drive innovation. |

| Cost and Maintenance Barriers | Scalable, modular electrostatic coalescers will increase affordability and accessibility. |

| Emerging Applications | Expansion into biofuels, wastewater treatment, and food processing will diversify market applications. |

| Environmental Sustainability | Green separation technologies with minimal waste generation will dominate industry adoption. |

| Market Growth Drivers | Expansion is fuelled by renewable energy integration, smart automation, and sustainability goals. |

The United States electrostatic coalescers market is driven by the expansion of the oil & gas industry, rising demand for water-oil separation technologies, and environmental regulations on produced water treatment. The average use of closed-loop demulsifiers is further driving demand in the market, particularly with an increasing interest towards improved crude oil demulsification processes in refineries and upstream oil production.

Organizations such as the Environmental Protection Agency (EPA) are introducing policies to help oil and gas companies utilize separation technologies that minimize water contamination so that oil recovery efficiency can be improved under these separation methods. The expansion of the USA petrochemical industry and offshore drilling activities are also driving the demand for electrostatic coalescers for crude oil desalting & dehydration applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

The UK electrostatic coalescers industry is expanding due to the rising demand for the effective separation of oil and water in oilfields both offshore and onshore. The existence of mature oil and gas fields in the North Sea has driven the implementation of more complex demulsification and dehydration technologies to optimize crude oil quality with respect to refining.

Stringent government environmental regulations in the United Kingdom regarding the treatment of wastewater and disposal of produced water are also anticipated to drive market demand. Additionally, investment in oilfield modernization projects and the use of digital monitoring technology in oil separation systems are aiding market growth. The drive to carbon-neutral operations in oil refining is also encouraging the development of energy-efficient electrostatic coalescers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

The European Union electrostatic coalescers market is supported by strict environmental regulations, rising oil recovery projects, and growth in petrochemical production. Electrostatic coalescers are gaining traction in oil refining and water treatment applications, particularly in Germany, Norway, and the Netherlands.

Refineries and offshore platforms are investing a large amount of money into high efficiency electrostatic separation systems following the coming into force of EU regulations governing produced water treatment and the desalting of crude oil. Moreover, the growth of the renewable fuels and bio-based chemicals industry is further driving up demand for coalescer technologies for emulsion separation and phase separation processes.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.1% |

The moderate growth in the Japan electrostatic coalescers market is mainly due to increasing investment in process optimization in refineries, petrochemical production, and wastewater treatment. The increasing need for high-purity crude oil processing is driving the implementation of advanced demulsification and separation technologies in oil refineries.

Moreover, Japan’s energy transition strategies are compelling oil and gas companies to invest in energy-efficient separation technologies, which help reduce operational equipment expenses and enhance environmental compliance. The growth of lubricant and specialty chemical companies also contributes to market expansion; in fact, electrostatic coalescers are employed in the fine separation and dewatering process in these devices.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.0% |

The growth of the South Korean electrostatic coalescers market is driven by refinery modernization, enhanced oil recovery, and industrial wastewater treatment investments. Demand for high-performance separation technologies is also driven by South Korea’s petrochemical sector, which is one of the largest in Asia.

Stringent environmental regulations in the country regarding wastewater discharge and oil-water separation have propelled the oil refineries and the industrial plants to adopt electrostatic coalescers for phase separation. The market is also witnessing growth due to the wide-scale expansion of offshore oil drilling and FPSO (Floating Production Storage and Offloading) projects. Similarly, a range of automation and IoT-powered separation system is generating efficiency in the process, spearheading South Korea’s refining market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The electrostatic coalescers market is ruled by a combination of AC and DC and upstream application segments, owing to the increasing demand for better separation efficiency in the oil and gas industry. Electrostatic coalescers are extremely important in separating water and contaminants from crude oil to ensure that quality is optimal. Using both AC electrostatic and DC separation systems improves efficiency by exploiting the properties of both types of electrical fields. Upstream oil extraction processes, which depend on electrostatic coalescers to remove impurities early in production, also rely heavily on these separation units to mitigate operational disruptions and minimize refinery costs.

Oil producers and energy companies are focusing on process optimization and environmental compliance, so the need for high-performance electrostatic coalescers continues to grow. These segments are well-positioned in the market with advanced separation technology and a rise in offshore and onshore drilling activity. In addition, the sustained global shift towards sustainable oil extraction practices has spurred innovation in electrostatic coalescers, paving the way for their continued adoption across upstream operations.

AC plus DC has been established as a leading technology in the electrostatic coalescers market, owing to its better separation efficiency and flexibility. Single-current systems may not perform well in emulsions with multiple droplet diameters. Still, hybrid AC and DC coalescers utilize the strengths of each field type for optimized water droplet coalescence. The AC portion breaks emulsions and causes coalescence, and the DC field enhances merging of droplets, resulting in accelerated and more efficient phase separation.

With the introduction of hybrid AC/DC electrostatic coalescers, oil processing facilities are able to achieve higher separation rates at lower chemical demulsifier addition rates. This operational edge means lower operating costs, better crude quality and improved environmental compliance. Hybrid systems also adapt better to separate more complex emulsions present in chassis oils, as they can be used in areas where crude oils with varying compositions require flexible separation solutions.

AC and DC combination coalescers have also been accepted in offshore and deep water drilling environments, where the removal of water is critical to the nature of crude oil. By limiting the water content in crude oil, these systems help in reducing downstream processing costs by lowering the burden on dehydration units and pipeline conveyance systems. The combination AC and DC electrostatic coalescer market grows as energy companies are developing more effective means of crude oil separation, making these devices a standard of modern oilfield practice.

Recent advances in electrostatic coalescers, such as the emergence of the AC/DC energy-efficient hybrid system, have focused on power reduction. They utilize smart voltage control systems that automatically modulate the electric field based on emulsion properties to separate oil more effectively, with the lowest up-scaled energy consumption. These breakthroughs reflect sector-wide agreements to minimize carbon footprints and replicate oil-processing practices.

Toughening environmental guidelines are driving oil producers to increasingly deploy electrostatic coalescers with improved AC/DC capabilities to achieve water discharge targets and minimize chemical dependence. By eliminating water and fine particulates with minimal use of chemical additives, crude oil processing can have a lower environmental impact. Moreover, hybrid systems enable the recycling of separated water, promoting wastewater management programs in the upstream production units.

Top manufacturers are already improving upon AC/DC electrostatic coalescer designs with new automation, remote monitoring, and predictive maintenance features. Smart coalescers with real-time data analytics help operators better understand separation efficiency, which can be measured in the volume of separated liquids removed and hydrocarbons retained. With energy companies shifting towards digitalized oilfield operations, the intelligent AC/DC electrostatic coalescer market is predicted to showcase healthy growth in the long run, further underlining the strategic importance of these technologies in contemporary crude oil processing.

With oil producers increasingly looking for reliable solutions to optimize water-oil separation at production locations, upstream applications have been the key driver propelling the growth of electrostatic coalescers market. The extraction stage benefit significantly from water elimination to minimise transport costs, reduce pipeline corrosion, and optimise downstream refining. Electrostatic coalescers are critical in increasing the purity of crude oil before further processing to meet industry quality standards.

Electrostatic coalescers are field-proven to effectively separate water, salts, and other contaminants from crude oil streams before they reach transportation and refining systems. This early removal of excess water allows operators to mitigate equipment degradation over time, thereby minimizing maintenance expenditures and enhancing overall operational efficiency. Such upstream applications, particularly in enhanced oil recovery (EOR) processes, also gain from the use of electrostatic coalescers where separating emulsified water from produced fluids remains critical to maintaining extraction efficacy.

The upstream production segment, in turn, is witnessing increased global energy demands with exploration in challenging environments, such as Deepwater and unconventional reservoirs, thus increasing the demand for advanced electrostatic coalescers. For example, offshore oilfields have water-cut levels that require high-performance separation solutions, as well as compliance with environmental discharge regulations. With growing investments made in offshore oil production, demand for upstream electrostatic coalescers continue growing, solidifying their position as an essential component in the oilfields of today.

Highly efficient separation techniques are frequently required to ensure process stability when dealing with complex emulsions at oil production sites. Electrostatic coalescers are a gentle, energy-free approach to emulsion breakdown that minimizes the need for chemical demulsifiers and mechanical separation technologies. Such coalescers can facilitate water extraction without affecting crude oil integrity, enabling operators to lower the production bottlenecks while ensuring product quality.

Outside of the traditional oilfield, electrostatic coalescers are being used in shale oil, heavy crude and offshore deep water upstream applications. This versatility in electrostatic separation technology allows producers to increase the amount of material processed while minimizing interruptions across the plant. Progress in electrode design and dielectric materials has further increased the lifetime within the coalescer, and provides durability in the upper leaving a high-pressure, high-temperature environment.

Electrostatic coalescers are increasingly integrated with automated control systems, allowing oilfield operators to monitor and optimize the process in real time. Now, they can be “smart” coalescers that are IoT-enabled, enabling remote diagnostics, predictive maintenance, and automatic performance adjustments with minimal physical human interaction. With the rise of digital oilfield solutions, electrostatic coalescers are adapting to the industry's drive for data-driven efficiency improvements, which will enable continued adoption in upstream applications.

The global market for electrostatic coalescers is set to grow significantly, thanks to demand for effective oil separation technologies, environment-friendly practices, and process efficiency. This included a broader trend in the overall market which was fragmented, involving Maine Electrostatic coalescer, encompassing the emergence of modular electrostatic coalescers, eco-friendly coalescer materials, and more efficient energy methods of electrostatic separation.

Modular electrostatic coalescers provide flexibility and scalability, customizing separation systems to all suitable operational needs for oil producers. Modular units provide the utmost adaptability for traditional and non-traditional oil production environments, holding the perfect balance for water-oil separation in varying field environments. Furthermore, studies on different dielectric materials focus on the enhancement of the coalescer performance that promotes the separation of complex emulsions comprised of broad chemical compositions.

Maintaining a focus on energy efficiency, the industry has witnessed the development of low-power electrostatic coalescers that deliver low electrical consumption, all while maintaining optimal separation capabilities. Energy savings at high throughput coefficients are supplemented by improved high-frequency alternating and direct current optimization methods. Increasing regulatory pressures on the disposal of water and also on the quality of crude oil are expected to fuel demand for advanced electrostatic coalescers with better environmental compliance capabilities.

Thus, the electrostatic coalescers market is poised to grow further with more investments being made in intelligent oilfield technologies and websites that remotely monitor aspects of oilfield operation. As industry players focus on operational efficiency, cost reduction and sustainability, electrostatic coalescers will be a key part of optimizing oil processing operations and meeting regulations across both upstream and downstream applications.

The electrostatic coalescers market operates as a competitive business sector because of expanding requirements to achieve efficient oil-water separation during crude oil processing and wastewater treatment. The technology employs powerful electrostatic fields that enhance water droplets' coalescence and create efficient dehydration of oil and reduce contaminants. Key manufacturers concentrate on creating improved coalescer systems and enhancing operational efficiency, but also add automation capabilities for continuous process surveillance. Upstream and downstream oil industry providers as well as separation technology specialists and equipment manufacturers lead this market sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schlumberger Limited | 20-25% |

| National Oilwell Varco (NOV) | 15-19% |

| FMC Technologies (TechnipFMC) | 12-16% |

| Alfa Laval AB | 8-12% |

| VME Process | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schlumberger Limited | Develops high-performance electrostatic coalescers for crude oil dehydration, integrating automation for enhanced separation efficiency. |

| National Oilwell Varco (NOV) | Manufactures modular electrostatic coalescers designed for offshore and onshore oilfields, optimizing water separation. |

| FMC Technologies (TechnipFMC) | Provides advanced oil-water separation systems with electrostatic coalescence technology, enhancing flow assurance. |

| Alfa Laval AB | Offers high-efficiency electrostatic coalescers for oil refining and petrochemical applications, ensuring energy-efficient separation. |

| VME Process | Specializes in custom-engineered electrostatic coalescers for crude oil treatment, emphasizing operational flexibility and scalability. |

Key Company Insights

Schlumberger Limited (20-25%)

Schlumberger leads the market with high-performance electrostatic coalescers that improve crude oil dehydration and separation efficiency, integrating automation and process optimization.

National Oilwell Varco (NOV) (15-19%)

NOV specializes in modular electrostatic coalescers tailored for offshore and onshore oilfields, ensuring efficient oil-water separation with minimal downtime.

FMC Technologies (TechnipFMC) (12-16%)

FMC Technologies provides oil-water separation solutions using electrostatic coalescence, helping oil producers optimize flow assurance and reduce processing costs.

Alfa Laval AB (8-12%)

Alfa Laval offers energy-efficient electrostatic coalescers for the oil refining and petrochemical sectors, ensuring high separation efficiency in complex fluid streams.

VME Process (5-9%)

VME Process specializes in custom-engineered electrostatic coalescers, designed to handle varying crude oil compositions and improve overall production efficiency.

Other Key Players (30-40% Combined)

Several other companies contribute to the electrostatic coalescers market, focusing on specialized separation technologies and cost-effective solutions for the oil and gas industry:

The overall market size for electrostatic coalescers market was USD 3,320.1 Million in 2025.

The electrostatic coalescers market expected to reach USD 5,408.1 Million in 2035.

The rising need for efficient oil-water separation, increasing demand from the petroleum and chemical industries, and growing emphasis on reducing environmental impact fuel the Electrostatic Coalescers Market during the forecast period.

The top 5 countries which drives the development of electrostatic coalescers market are USA, UK, Europe Union, Japan and South Korea.

Combination of AC and DC Current and Upstream lead market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrostatic Coating Stations Market Size and Share Forecast Outlook 2025 to 2035

Electrostatic Discharge (ESD) Packaging Market Growth - Forecast 2025 to 2035

Electrostatic Precipitator Market Growth - Trends & Forecast 2025 to 2035

Wet Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Dry Electrostatic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Plate Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Manufacturing Scale Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Chemicals And Petrochemicals Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA