Increasing demand for advanced defense technologies and rising geopolitical tensions will propel the industry to be an even more dominant force in the coming years. Between 2025 and 2035, the electronic warfare market is projected to grow at a CAGR of 5.5%, from a valuation of USD 20.7 billion in 2025 and is expected to grow to USD 35.8 billion by 2035.

Military is driving demand for electronic warfare (EW) systems, especially sophisticated ones like electronic countermeasures and radar jamming or cybersecurity solutions. EW has become a key pillar in modern defense planning as military services seek to deter emerging threats through the realms of physical and cyber space.

Superiority on the battlefield depends on EW systems that include electronic attack (EA), electronic support (ES), and electronic protection (EP). The military is shifting towards greater investment in radar jamming, cyber-warfare operations, real-time signal intelligence (SIGINT), and electronic counter-countermeasures to enhance operational capabilities and safeguard critical infrastructure. The increased use of AI and machine learning in EW solutions is also expanding the industry by driving response and threat detection mechanisms.

Increasing sophistication of electronic threats and cyber-warfare tactics has necessitated advanced EW solutions as a priority for governments and defense agencies. With border security concerns and tense geopolitical relations, countries have started to expand their EW arsenals for offense and defense.

And the integration of artificial intelligence, big data analytics, and machine learning algorithms into EW systems is enhancing the effectiveness of threat detection and response, providing enhanced battlefield awareness. In addition, technological advancements in directed energy weapons, electronic countermeasures, and cyber defense systems are increasing the application of EW solutions among military and intelligence organizations.

While industry growth is robust, numerous challenges hinder its further growth. Building and deploying such sophisticated EW systems is too costly and places a burden particularly on poorer nations already cash-strapped for defense expenditure.

Furthermore, the operational challenge of integrating EW capability into current defense infrastructure presents an issue. For example, the cyber security risk and the chance of EW systems being compromised by malicious hackers is yet another threat factor that involves constant investment in security processes.

Furthermore, defense export controls and regulatory policies are likely to interfere with industry growth in certain geographies. Changes accelerating at breakneck speed coupled with increasing chances for innovation are two issues to which the industry is currently facing to respond.

Defense contractors in collaboration with technology firms have been quicker to come together to build AI-based Electronic Countermeasures, thereby enhancing the efficacy of EW solutions.

The advent of unmanned aerial vehicles (UAVs) or satellite-based EW systems also has the potential to provide new channels for industry expansion. With increasingly sophisticated electronic threats, the industry will likely be at the center of today's defense strategies and global security concerns.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 20.7 billion |

| Industry Value (2035F) | USD 35.8 billion |

| CAGR (2025 to 2035) | 5.5% |

Explore FMI!

Book a free demo

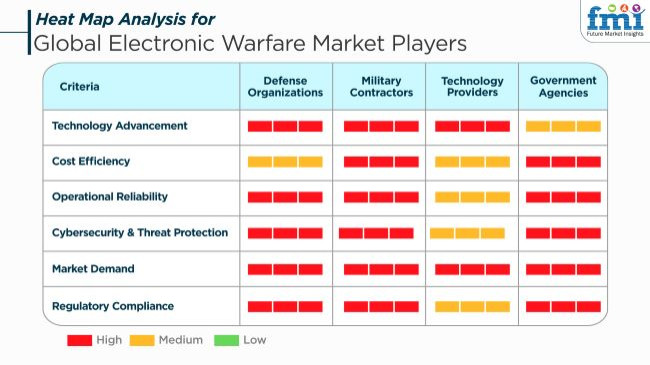

The market is expanding with high speed due to the rising geopolitical tensions, the dramatic surge in cyber-attacks, and innovations in digital warfare technologies. Military organizations focus on advanced technologies in electronic intelligence (ELINT), electronic countermeasures (ECM), and signal intelligence (SIGINT) in a bid to gain control over their battlefields. Military contractors have set their targets in the development of the next generation of EW systems fitted with artificial intelligence-powered threat detection, cyber defense, and adaptive jamming technologies.

Technology providers take the spotlight in supplying hardware and software solutions, including radar jamming, electromagnetic pulse (EMP) protection, and electronic surveillance systems. Government bodies direct their focus toward regulatory compliance, procurement efficiency, and cost-effective solutions for national security.

The main purchase factors are real-time threat detection, additional cybersecurity, interoperability with the pre-existing military infrastructure, and system deployment within a low budget. The anticipated rise in the demand for advanced EW capabilities is expected to drive the sustained growth in the market as improvements in the military and defense budgets all over the world increase.

Contract & Deals Analysis – Electronic Warfare Market

| Company | Contract Value (USD Million) |

|---|---|

| Lockheed Martin | Approx. USD 120 – USD 130 |

| BAE Systems | Approx. USD 100 – USD 110 |

| Raytheon Technologies | Approx. USD 90 – USD 100 |

| Northrop Grumman | Approx. USD 110 – USD 120 |

From 2020 to 2024, the industry experienced steady growth driven by heightened geopolitical tensions, defense expenditure, and radar and signal intelligence technology advancements. Countries were investing in the modernization of their defense by incorporating electronic attack capabilities to neutralize any emerging threats.

The injection of machine learning and artificial intelligence into EW systems brought a revolution in the detection of threats in real-time, jamming, and cyber defense. Also, the widespread use of unmanned aerial systems for military operations created a surging demand for electronic countermeasure technologies to counter threats from drones. Yet, supply chain disruptions and regulatory restraints on defense technology exports did form hurdles for industry players.

Between 2025 and 2035, next-gen EW would be marked by the emergence of AI-based cognitive EW, quantum sensing, and space electronic countermeasures. Movement toward network-centric warfare will see an integration of its capabilities spanning land, sea, air, and space domains. Defending nations will concentrate on resilient electromagnetic spectrum operations to counter cyber-electromagnetic threats. With growing software-defined, modular, and autonomous electronic warfare, the focus for adaptable, AI-enabled solutions for offensive and defensive applications will be on the defense forces.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments raised defense spending to improve EW capabilities, including electronic attack (EA), electronic protection (EP), and electronic support (ES) systems. | Artificial intelligence (AI)-based, autonomous EW systems provide real-time threat detection, adaptive jamming, and quantum-resistant cybersecurity for future battlefield superiority. |

| AI-driven signal intelligence (SIGINT) and cognitive EW improved the detection, analysis, and counter of enemy radar and communications networks. | AI-powered autonomous EW platforms provide autonomous, self-adaptive electronic countermeasures (ECMs) that can adapt in real-time without human intervention to counter new electronic threats. |

| Cyber warfare and EW systems began to become highly integrated, making it possible for attackers to cripple digital networks with electromagnetic spectrum attacks. | AI-powered, quantum-secured EW solutions protect military networks against electronic and cyber threats, making communication and command systems resilient, self-healing. |

| States have built space-based EW capabilities in response to satellite-based communication, surveillance, and navigation systems. | AI-controlled, space-deployed EW systems provide real-time jamming, GPS spoofing, and anti-satellite operations to neutralize threats in contested space environments. |

| Advanced DRFM (Digital Radio Frequency Memory) jammers enhanced the effectiveness of electronic attack (EA) missions against radar and missile guidance systems. | AI-driven, cognitive jammers with real-time spectrum adaptation counter enemy radar, drone swarms, and hypersonic missile tracking systems with precision. |

| Researchers investigated quantum sensors and photonic-based EW systems for increased detection and countermeasure capabilities. | Quantum-enhanced EW allows for unbreakable signal encryption, ultra-sensitive threat detection, and instantaneous disruption of enemy signals across the electromagnetic spectrum. |

| Unmanned EW platforms, such as drones and autonomous surface vessels, supported electronic attack and surveillance missions in contested zones. | AI-driven swarms of autonomous EW drones and sea-based EW vessels execute coordinated jamming, deception, and cyber-electromagnetic operations with minimal human oversight. |

| The advent of 5G introduced new dangers to military communications networks, requiring secure and strong EW capabilities. | 6G-augmented, AI-based EW would ensure safe military networking by offering real-time AI-powered spectrum dominance and quantum-protected battlefield communications. |

| HPM and EMP electronic weapons were experimented with by militaries in order to retaliate against enemy electronics and infrastructures. | AI-based direct energy EW systems autonomously detect and neutralize electronic targets, enabling high-precision disruption of enemy weapons and critical command systems. |

| The EW platform has seen a far greater ascendancy in demand for more efficient power-handling solutions due to increased dependence on mobile and space assets. | Low-power, AI-optimized EW systems use novel energy harvesting to extend countermeasure operations to the long end under low power. |

The industry is exposed to various risks which encompass technological advances, cybersecurity threats, regulatory restrictions, geopolitical conflicts, and supply chain vulnerabilities. The development of AI, quantum computing, and next-generation signal processing devices is a major issue affecting the EW industry. Companies that are not able to increase their innovative activities on time will lose their industry positions. Continuous research and development expenditures are a must if one wants to be competitive.

Cybersecurity threats are of vital importance since the EW systems rely a lot on the networked operation and real-time data processing. Hacking, data breaches, and electronic countermeasures can compromise military and defense operations. Therefore, it is important to implement secure encryption, AI-driven anomaly detection, and resilient communication systems. Geopolitical tensions have a direct impact on military budgets and procurement decisions. Similarly, the government’s new defense policies, military partners, and global disputes are the key factors which determine the demand for EW solutions. Businesses should adopt a diversification strategy in order to lessen regional dependency risks.

Electronic protection involves techniques and technologies to protect military assetsfrom enemy electronic attacks. These systems protect radar, communication, and navigation systems fromjamming or disruption by adversaries. EPsolutions are also critical for guaranteeing secure communications in the field, stealth capabilities, and sophisticated countermeasure techniques. In response, threats like GPS spoofing and radar jamming have led military forces around the world to adopt adaptive signal processing, frequency hopping, and encryption technologies tobe more electronically resilient.

Leadingorganizations like BAE Systems, Raytheon Technologies, and Northrop Grumman are playing a key role in the development of next-gen electronic protection systems that enable military assets to function within contested spectrum environments. Gathering, detecting, and analyzing enemy signals to determine andreact to threats through Electronic Support (ES). But, along with signal intelligence (SIGINT), electronic surveillance, and radar warning receivers, this also includes systems and devices that allow defense forces to track the enemy's activities, all through the analysis of radaremissions to enhance situational awareness. Modern ES systems employ algorithms that leveragemachine learning and artificial intelligence (AI) to sift through massive volumes of data automatically to identify threats.

Demand for jammers is likely to remain dominant during the forecast period. Jammers are deployed in aeronautic, marine, and land-based arms tofoil the communication and surveillance networks of an opponent. The development of UAVs and cyber warfare have led to anincreasing demand for counter-drone jamming, GPS spoofing, and broadband jamming solutions. Major defense contractors such as Thales Group, Saab AB, and Boeing have been developing next-gen jammersthat utilize artificial intelligence capabilities to optimize operational efficacy.

Militaryassets are equipped with Radar Warning Systems (RWS) to detect incoming tracks and alert the assets of incoming radar signals, which the system is able to prompt evasive action to assist. These systems are critical for aircraft, naval ships, and ground vehicles as they allow for early threatdetection and countermeasure deployment. Today's RWS solutions are equipped with adaptive signalprocessing, passive detection, and automated threat classification all thanks to breakthroughs in stealth technology and electronic counter-countermeasures (ECCM). Industry leaders, such as Elbit Systems, General Dynamics, andCollins Aerospace, lead the development of radar warning receivers with improved sensitivity, faster response times, and AI-based threats.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.7 |

| China | 10.3 |

| Germany | 8.9 |

| Japan | 9.2 |

| India | 10.5 |

| Australia | 8.8 |

The USA industry is growing at a faster rate due to increasing defense modernization efforts, evolving cyber threats, and demands for sophisticated signal intelligence systems. The USA defense industry is utilizing EW technologies to develop surveillance, radar jamming, and secure communications networks.

With continued investment in AI-powered EW systems, space-based defense systems, and electromagnetic spectrum operations, the demands for EW solutions are increasing. In 2024, the USA government spent more than USD 15 billion on developing EW. According to FMI, the USA industry is expected to grow at a 9.7% CAGR during the forecast period.

Growth Factors in The USA

| Key Drivers | Details |

|---|---|

| Rise in Next-Generation Warfare Systems | More emphasis is on gaining electromagnetic spectrum superiority as well as defense solutions using AI. |

| Enhancement in Radar Jamming and Signal Intelligence | Development of advanced jamming and anti-jamming technologies to boost situational awareness. |

| Growing Use in Cyber and Space Warfare | Electronic warfare technology aids cyber resiliency and space-based defense operations. |

China's industry is expanding owing to swift progress in military technology, rising geopolitical tension, and government-sponsored initiatives that encourage local defense innovation. With the title of the world's largest spender on defense, China is spending lavishly on radar jamming systems, electronic countermeasures, and AI-powered cybersecurity technology.

The government's emphasis on electromagnetic warfare and battlefield communications integration has also influenced industry growth. China invested USD 18 billion in 2024 on electronic warfare research and development. FMI predicts the China industry will grow at 10.3% CAGR over the forecast period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Support for Military Modernization by Government | Policies that support indigenous electronic warfare capabilities drive adoption. |

| Growth of AI and Cyber Warfare Capabilities | Electronic warfare is applied to a greater degree for intelligence collection in real time and for signal jamming. |

| Growing Need for Naval and Space-Based EW Systems | Electronic warfare technology promotes naval and space-based defense capabilities. |

The industry of Germany is gaining momentum not only in defense industry base, rising NATO commitments, growing focus on cybersecurity but also electromagnetic spectrum management. Being one of the strongest defense technology centers in Europe, Germany is investing in EW systems for battlefield situational awareness, cyber defense, and security of military communications. Interoperability with coalition forces has also been a reason for the country's adoption of sophisticated EW solutions. FMI believes that the German industry will grow at 8.9% CAGR over the forecast period.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong NATO Cooperation in EW | Germany is coordinating its defense systems with NATO's joint EW plans. |

| Increasing Demand for Secure Communication and Cyber Defense | Increasing investment in electronic countermeasures and cybersecurity. |

| Improved AI-Based Threat Detection and EW Systems | Increased use of AI-based early warning systems for military purposes. |

Japan's industry is growing with defense electronics technology, budgetary allocations for cyber warfare capability, and military forces integration with artificial intelligence. EW is being utilized in the Japanese defense sector for enhanced surveillance, secure communication networks, and radar countermeasures. The superiority of Japan's miniaturization and high-frequency electronic components has been driving EW technology implementation at a faster pace.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Integration of AI in EW Systems | Japan is a pioneer in AI-driven defense analytics and electronic countermeasures. |

| Expansion in Maritime and Space-Based EW Capabilities | There is a heightened need for electromagnetic spectrum operations in naval and aerospace contexts. |

| Development in Radar and Communication Disruption Technologies | There is more use of high-tech jamming systems and spectrum management technologies. |

India's industry is growing at a rapid rate due to rising defense spending, heightened geopolitical tensions, and government initiatives on indigenous defense production. With initiatives like 'Make in India' and greater joint ventures with international defense companies, India is seeing high demand for EW items in cyber defense, radar jamming, and intelligence gathering. The growing use of AI-driven battlefield operations is also propelling the industry.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Government Plans for Indigenous Defense Production | Promotion of local EW system fuels industry growth. |

| Building Space and Cyber Warfare Capabilities | Increased emphasis on AI-driven military intelligence and secure battlefield communications. |

| Increased Demand for Electronic Countermeasures and Radar Jamming | Implementation of next-generation EW solutions for land, air, and naval forces. |

Australia's industry is in continuous expansion due to rising defense technology, space-based monitoring, and investments in cybersecurity complexes. Defense forces, navies, airspace, and spy agencies of Australia are embracing EW technologies to boost military powers and national safety. The digital defense innovation trend and the focus on strategic relationships in the country are impelling the inclusion of sophisticated EW systems.

Growth Factors in Australia

| Key Drivers | Details |

|---|---|

| Government Support towards Defense and Cybersecurity Innovations | Regulations that impact future-generation EW and cybersecurity help fuel industry growth. |

| Emergence of AI and IoT-Powered EW Systems | Increased usage of AI-driven threat detection and real-time electronic countermeasures. |

| Increased Need for Secure Military Communication and Network Protection | Sectors are leveraging EW for increased national security and defense intelligence. |

Over the next decade, the industry is characterized by high competition dueto the rise in military modernization programs, geopolitical tensions, and advancements in electronic warfare systems. Battle network supremacy is not only unrivaled but also recognized in recenttimes, where countries are making an effort to create AI-oriented threat-finding, radar jamming, electronic counter-countermeasures (ECCM), and space-based EW systems. The industry is changing, too, with defense establishments adding areas like cyber warfare, electromagneticspectrum superiority, and AI-enabled EW capabilities to their strategic department.

The major players in the industry are Lockheed Martin, Northrop Grumman, BAE Systems, Raytheon Technologies, and Thales Group, capturing defense contracts for advanced electronicattack (EA), electronic protection (EP), and electronic support (ES) systems. Extremely powerful, they are used in the air, navy, naval, and land platforms and include various integrated EW suites, super stealth,radar jammers, directed-energy weapons, and cyber-electromagnetic activities (CEMA), among other systems.

The transition towards network-centric warfare, technological advancements in AI-driven signal processing, and increasedneed for electronic warfare aircraft and unmanned aerial vehicles are also driving industry growth. In response, opponents are advancing with the technology of state-of-the-art EW capabilities; Nations are increasing investments inR&D, entering alliances and Tailoring their Multi-Domain EW Solutions. To ensure competitiveness, key players are bolstering strategic partnerships and government defense procurement, as well as acquiring niche EW technologycompanies. As such, state-of-the-art advancements in satellite-based EW, cognitive EW, and next-generation jamming systems are poised to propel competition in this exceedingly sensitivedomain to new heights.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Northrop Grumman | 20-25% |

| Lockheed Martin | 15-20% |

| BAE Systems | 10-15% |

| Raytheon Technologies | 8-12% |

| Thales Group | 5-10% |

| L3Harris Technologies | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Northrop Grumman | Advanced electronic countermeasures, radar jamming, and cyber EW solutions. |

| Lockheed Martin | AI-driven EW systems, space-based EW, as well as signal intelligence. |

| BAE Systems | Integrated EW suites for fighter aircraft, naval platforms, and ground operations. |

| Raytheon Technologies | Electronic counter-countermeasures (ECCM), radar warning receivers, and cyber defense. |

| Thales Group | Tactical EW systems, jamming technologies, and battlefield signal disruption solutions. |

| L3Harris Technologies | Real-time electronic support measures (ESM) and RF spectrum dominance solutions. |

Key Company Insights

Northrop Grumman (20-25%)

Northrop Grumman is a leader in the domain with state-of-the-art countermeasure technologies, radar jamming capabilities, and cyber-resilient solutions for EW in space, with a continuous focus on innovation in the fields of AI-supported EW and even space-based defense applications.

Lockheed Martin (15-20%)

Lockheed Martin is dedicated to the development of AI-enabled EW capabilities and space-based EW solutions. It provides advanced capabilities in support of modern military operations, ground, sea, and airborne.

BAE Systems (10-15%)

BAE Systems specializes in integrated EW suites for fighter aircraft, naval vessels, and armored vehicles to bring them to operational superiority in contested situations.

Raytheon Technologies (8-12%)

Raytheon designs ECCMs and EW radar warning systems to ensure situational awareness and counter-developing threats.

Thales Group (5-10%)

Thales tactical systems EW, specializing in jamming operations on the battlefield, disrupting electronic signal and secure communication networks.

L3Harris Technologies (4-8%)

L3Harris provides real-time ESM and RF spectrum dominance solutions with the purpose of serving army-manage forces across the globe.

Other Key Players (30-38% Combined)

These firms play their part in sustaining developments in electronic warfare through the incorporation of AI-based analytics, real-time signal intelligence, and future-generation countermeasure technologies. The growing emphasis on cyber-electromagnetic operations, satellite-based EW solutions, and network-centric warfare continues to define the competitive environment of the Industry.

The global electronic warfare industry is projected to reach USD 20.7 billion in 2025.

The industry is anticipated to grow to USD 35.8 billion by 2035.

India is forecasted to grow at a CAGR of 10.5% from 2025 to 2035, making it the fastest-growing market.

The key players in the defense and aerospace industry include BAE Systems Plc., Harris Corporation, General Dynamics, Elbit Systems, Lockheed Martin, Raytheon, Northrop Grumman, Boeing, Tata Power SED, and Cobham Plc.

AI-powered systems are being widely used.

By category types, the industry is segmented into electronic protection, EW support, and electronic attack systems.

By product, the industry is segmented into jammer systems, radar warning receivers, directed energy weapons, and others in electronic warfare.

By platform, the industry is segmented into naval, airborne, ground, and unmanned electronic warfare.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.