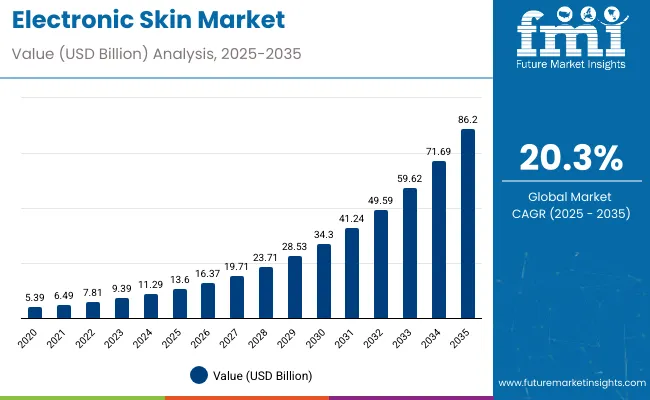

The electronic skin market is anticipated to grow significantly from USD 13.6 billion in 2025 to USD 86.2 billion by 2035, advancing at a CAGR of 20.3%. This rapid expansion is driven by increasing adoption of electronic skin technology in healthcare monitoring, robotics, and consumer electronics.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 13.6 billion |

| Market Forecast Value (2035) | USD 86.2 billion |

| CAGR | 20.3% |

The market growth reflects wider clinical acceptance, technological breakthroughs in flexible and stretchable electronics, along with rising prevalence of chronic diseases requiring continuous monitoring.

By 2030, the market is forecasted to reach USD 37.4 billion, showing a strong growth trajectory characterized by ongoing FDA approvals, integration with AI-enabled health platforms, and expansion in remote patient monitoring applications. The absolute dollar opportunity between 2025 and 2035 is expected to be USD 72.6 billion, indicating substantial opportunity in wearable medical devices, telemedicine, and personalized patient care.

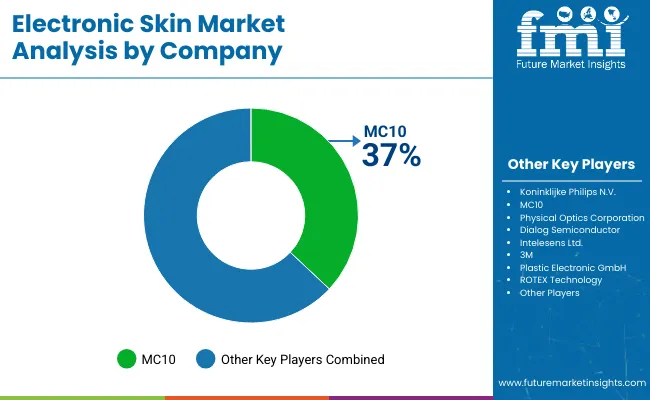

Key market players such as MC10, holding a commanding 37% share, alongside Xenoma, VivaLNK, Koninklijke Philips, and Dialog Semiconductor, are investing heavily in R&D and product innovation. Their advancements in electronic skin patches and biomedical devices are setting new standards for health monitoring solutions.Market performance is closely tied to regulatory approvals, material innovations, and the integration of AI and cloud technologies. These factors are shaping competitive dynamics and fueling adoption across healthcare and consumer technology sectors.

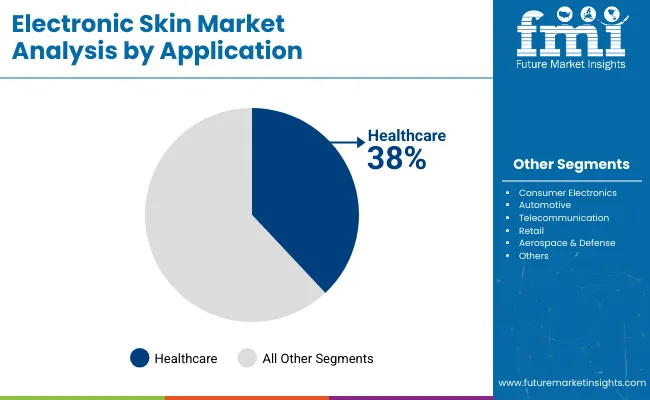

The market holds a significant and growing share in healthcare applications, accounting for about 38% of the electronic skin market in 2025, driven by its critical role in remote patient monitoring, chronic disease management, and wearable health sensors that provide continuous, non-invasive monitoring of vital signs such as heart rate and glucose levels. Electronic skin technologies account for an estimated 40% of the wearable health devices segment, reflecting their growing role in health monitoring solutions.

The market is transforming through integration with AI and IoT, which enhance real-time health data analysis and enable predictive healthcare. Companies are focusing on innovations such as self-healing materials, multifunctional sensors, and biocompatible adhesives to improve user comfort and device reliability. Collaborations with healthcare providers and digital health platforms are expanding the market reach and reshaping patient care delivery.

The market is growing rapidly due to several converging technological, demographic, and healthcare trends. Primarily, the rising demand for advanced wearable healthcare devices is driving market expansion. Electronic skin technology enables continuous, non-invasive monitoring of vital signs, enhancing remote patient care and chronic disease management, which is critical given the aging global population and increasing prevalence of ailments like diabetes, cardiovascular diseases, and respiratory disorders.

Technological advances such as stretchable circuits, flexible sensors, and integration with AI and IoT platforms have significantly improved the reliability, sensitivity, and usability of electronic skin devices. This has expanded applications beyond healthcare into consumer electronics, robotics, and prosthetics, contributing to market diversification and growth.

Moreover, increasing healthcare expenditure, supportive government initiatives, and regulatory approvals are fostering innovation and product adoption globally, especially in developed regions like North America and Europe, as well as fast-growing markets in Asia-Pacific. Consumer demand for fitness monitoring, personalized health tracking, and interactive wearable technologies also stimulates investment and market growth.

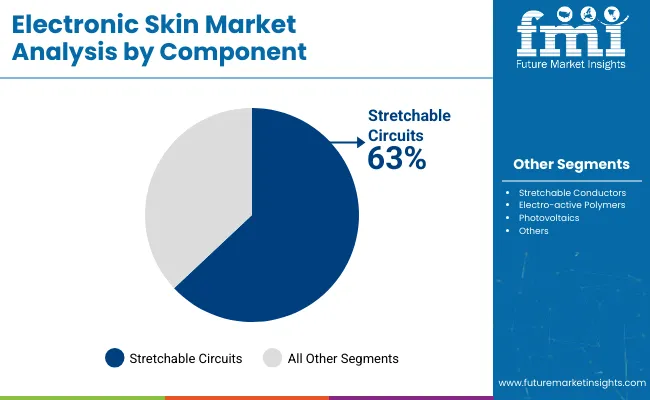

The market is segmented by component, application, and region. By component, the market is divided into stretchable circuits, stretchable conductors, electro-active polymers, photovoltaics, and others (MEMS, sensors). Based on application, the market is categorized into consumer electronics, automotive, healthcare, telecommunication, retail, aerospace & defense, and others (robotics, prosthetics). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Southeast Asia and others of Asia-Pacific (APAC), China, Japan, and Middle East & Africa.

Stretchable circuits are the most lucrative segment, accounting for 63% of the market share in 2025. This segment’s growth is fueled by its critical role in enabling flexibility, durability, and high sensitivity in electronic skin devices, which are essential for healthcare applications like remote patient monitoring and wearable health sensors. Advances in material science, including conductive elastomers and nanomaterials, enhance the performance of stretchable circuits, further driving their adoption.

Other components, such as stretchable conductors and electro-active polymers, contribute to the market but hold relatively smaller shares due to ongoing development and integration challenges. Photovoltaics and other components, including micro-electromechanical systems (MEMS) and integrated sensors, are emerging segments expected to grow with technological advancements.Overall, the stretchable circuits segment dominates the electronic skin market, supported by technological innovation, rising healthcare demand, and integration with AI and IoT for smarter, real-time health monitoring solutions.

The healthcare segment dominates the market with a substantial 38% share in 2025. This growth is primarily driven by the increasing adoption of remote patient monitoring systems and wearable health sensors, which allow continuous, non-invasive tracking of vital physiological parameters such as heart rate, temperature, and glucose levels. Chronic disease management is another significant factor sweeping the healthcare market, as electronic skin technology provides real-time health data enabling personalized care and timely interventions. These devices enhance patient comfort by mimicking the properties of human skin with flexibility and stretchabilityattributes critical for long-term wear.

Furthermore, technological advancements in materials science, integration with AI and IoT for predictive analytics, and increasing FDA approvals bolster this segment's expansion. The healthcare industry’s push towards telemedicine and home healthcare during and after the COVID-19 pandemic has accelerated acceptance, reduced hospital visits, and improved patient outcomes. Collectively, these factors consolidate healthcare as the dominant application in the electronic skin market, rendering it a key growth driver and a continuing focus for innovation and investment from 2025 to 2035.

From 2025 to 2035, rapid advancements in flexible electronics and growing healthcare needs have been driving significant growth in the electronic skin market. Increasing adoption of wearable health monitoring devices, remote patient monitoring systems, and chronic disease management solutions position electronic skin as a key technology for personalized healthcare. Rising consumer awareness about fitness and health, along with the aging global population, fuels demand for continuous, non-invasive health tracking.

Growing Technological Innovation Drives Market Growth

Technological breakthroughs in materials science, including stretchable circuits, conductive elastomers, and nanosensors, have dramatically enhanced electronic skin performanceflexibility, durability, and sensitivitythus expanding applications from healthcare into robotics, prosthetics, and consumer electronics. Integration with AI and IoT platforms improves data analytics and connectivity, offering smarter health solutions.

Innovation and Strategic Collaborations Expand Market Opportunities

Ongoing innovation in bio-compatible materials, self-healing electronics, and multifunctional sensors, along with collaborations between tech companies, healthcare providers, and research institutions, are accelerating market growth. These partnerships facilitate development of advanced products and wider adoption in emerging applications. Regulatory approvals and increasing investments in research and development further support long-term market expansion.

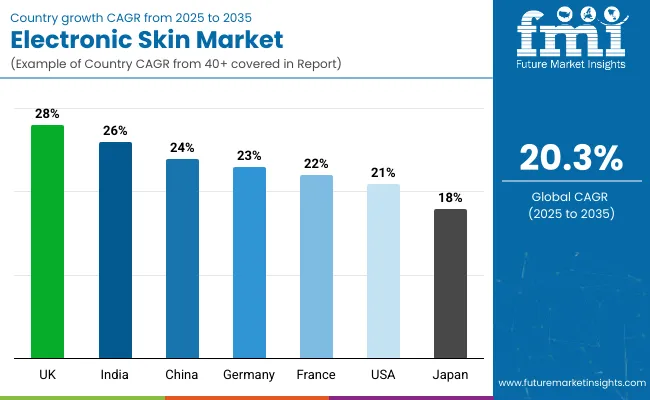

| Countries | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 28% |

| India | 26% |

| China | 24% |

| Germany | 23% |

| France | 22% |

| United States | 21% |

| Japan | 18% |

The electronic skin market exhibits varied growth rates across top countries. The United Kingdom leads with the highest CAGR of 28%, driven by strong NHS support for telehealth and digital health initiatives. India follows closely with a 26% CAGR, fueled by expanding healthcare infrastructure and rising telemedicine adoption. China shows robust growth at 24%, supported by healthcare reforms and large patient populations. Germany and France experience steady expansions at 23% and 22% CAGR, respectively, benefiting from advanced healthcare systems and aging populations. The United States, despite being a market leader, has a slightly lower CAGR of 21%, reflecting market maturity and high baseline adoption. Japan shows stable growth at 18%, with an aging demographic driving demand for elder care solutions.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from electronic skin in the UK is projected to experience a CAGR of 28% during 2025-2035, reflecting rapid market growth fueled by NHS-endorsed digital health programs and telehealth expansion. Increasing focus on predictive health and chronic condition management has accelerated adoption of electronic skin wearables. Strong public-private partnerships foster technological innovation and market access. Consumer awareness of health monitoring and wearable technologies is rising, further catalyzing demand. The UK’s forward-looking digital health policy framework creates a favorable environment for sustained electronic skin market expansion.

Revenue from electronic skin in India is forecasted to grow at a CAGR of 26% due to expanding healthcare infrastructure and rising awareness of wearable health monitoring devices. Telemedicine’s rapid adoption in both urban and rural areas enables electronic skin technology to improve chronic disease care and preventive health. Government initiatives focusing on digital health innovation enhance access and affordability. The rise of local startups and increased investment in healthcare technology startups further stimulate market growth. India’s expanding middle class contributes to growing consumer demand for health-focused wearables.

Demand for electronic skin in China leads growth with a CAGR of 24%, driven by large patient populations and healthcare modernization programs. Government reforms and smart hospital initiatives catalyze deployment of digital health technologies. Cost-efficient manufacturing and integration with AI and IoT facilitate market penetration. Urbanization and rise in chronic diseases increase demand for continuous health monitoring. Strategic partnerships with global tech firms accelerate innovation and adoption in the region’s growing health tech ecosystem.

Demand for electronic skin in Germany will grow at a CAGR of 23% supported by extensive healthcare research and infrastructure. The healthcare system’s patient-centric care model supports adoption of wearable health monitoring devices. Government incentives and reimbursement policies encourage innovation and commercialization of electronic skin solutions. High consumer trust in wearable healthcare technologies and collaborative ventures between medical institutions and technology companies boost market growth. Germany also leads in clinical adoption of electronic skin for rehabilitation and chronic disease management.

Revenue from electronic skin in France is projected to grow at a CAGR of 22%, propelled by an aging populationrequiring home health monitoring and rising healthcare expenditure. Investments in biocompatible sensor technologies and regulatory support expedite product launch and acceptance. Growth of regional health technology hubs and startup ecosystems boost innovation. Increased adoption of remote digital health platforms enhances patient care and monitoring. Public health initiatives supporting assisted living and elderly care further fuel demand for electronic skin technology.

Revenue from electronic skin in the United States is expected to grow at a CAGR of 21% from 2025 to 2035, supported by advanced healthcare infrastructure, innovation in wearable sensors, and strong government support for telemedicine and digital health initiatives. Continuous advancements in AI and IoT integration further boost demand for personalized remote health monitoring solutions. The presence of major companies accelerates product development and market penetration, strengthening consumer trust and adoption. The surge in chronic diseases and an aging population stimulate the need for expanded electronic skin applications in healthcare. Moreover, regulatory frameworks support rapid clinical approvals, facilitating faster product launches and commercialization.

Revenue from electronic skin in Japan is expected to grow at a CAGR of 18%, driven primarily by its aging population and a mature healthcare system. Government-backed telehealth initiatives and widespread acceptance of advanced medical technologies foster electronic skin adoption in elder care and chronic disease management. Strong R&D collaborations between academic institutions and industry enhance product development. Japanese consumers’ high technological literacy supports early adoption of new healthcare wearable devices. The country also benefits from significant healthcare spending focused on preventive and remote care solutions.

The market is characterized by rapid innovation and strategic collaborations among key industry players. Leading companies such as MC10, Xenoma Inc., VivaLNK, Koninklijke Philips N.V., and Dialog Semiconductor dominate the market, with MC10 holding a significant market share of 37% as of 2025. These players invest heavily in research and development to create flexible, stretchable, and highly sensitive electronic skin devices that closely mimic the tactile properties of human skin. Their focus spans healthcare, consumer electronics, and robotics applications, driving industry growth.

Strategic partnerships between technology firms, healthcare providers, and research institutions further accelerate product innovation and market penetration. Increasing demand for remote patient monitoring and chronic disease management pushes companies to improve sensor accuracy, energy efficiency, and integration with AI and IoT platforms. Emerging startups contribute cost-effective and specialized solutions, adding dynamism to the market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 13.6 Billion |

| Component | Stretchable Circuits, Stretchable Conductors, Electro-active Polymers, Photovoltaics, Others (MEMS, Sensors) |

| Application | Healthcare, Consumer Electronics, Automotive, Telecommunication, Retail, Aerospace & Defense, Others (Robotics, Prosthetics) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Southeast Asia & Others of APAC, China, Japan, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Koninklijke Philips N.V., MC10, Physical Optics Corporation, Dialog Semiconductor, Intelesens Ltd., 3M, Plastic Electronic GmbH, ROTEX Technology, VivaLNK, Smartlife, Xenoma Inc., Xsensio |

| Additional Attributes | Dollar sales by component and application, Regional demand trends, Competitive landscape, Buyer preferences for flexible versus stretchable formats, Integration with wearable electronics, Innovations in material engineering, sensor miniaturization, and fabrication for enhanced responsiveness and durability |

The global electronic skin market is estimated to be valued at USD 13.6 billion in 2025.

The market size for electronic skin is projected to reach USD 86.2 billion by 2035.

The electronic skin market is expected to grow at a CAGR of 20.3% between 2025 and 2035.

The stretchable circuits segment is projected to lead the electronic skin market with a 63% market share in 2025.

In terms of application, healthcare is expected to command a 38% share in the electronic skin market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Skin Patch Market Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Electronic Circulation Pump Market Size and Share Forecast Outlook 2025 to 2035

Electronic Lab Notebook (ELN) Market Size and Share Forecast Outlook 2025 to 2035

Electronic Control Unit in Automotive Systems Market Size and Share Forecast Outlook 2025 to 2035

Electronic Film Market Size and Share Forecast Outlook 2025 to 2035

Electronic Weighing Scale Market Size and Share Forecast Outlook 2025 to 2035

Electronic Packaging Adhesives Market Forecast and Outlook 2025 to 2035

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA