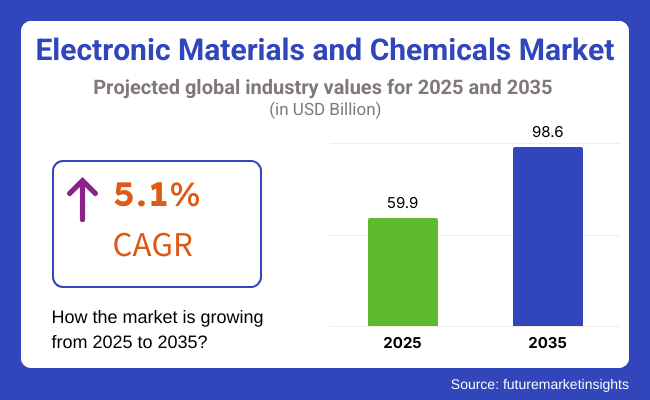

The electronic materials and chemicals market is on a consistent growth trajectory from 2025 to 2035 due to new technologies in semiconductor manufacturing, consumer electronics, electric vehicles (EVs), and upcoming technologies like 5G and AI. The total market is expected to first come in at USD 59.9 billion in 2025 and then balloon to nearly USD 98.6 billion by 2035, which would represent a compound annual growth rate (CAGR) of 5.1% during 2025 to 2035.

The digitalization of industries has seen semiconductor production witnessing a bumper year with the requisite of top-range electronic components. High-performance chemicals, specialty gases, dielectric materials photoresists, and more are among the products whose demand is spiking.

Also, the advent of smart devices, the IoT, and ultramodern computing technologies are the reasons behind the resulting need for electronic materials such as transistors that could be built smaller, consume less energy, and have improved performance; besides, these devices, in turn, offer the same advantages.

The transition from gas-powered to electric vehicles and the integration of renewables have been other big drivers, as a result, battery materials, electric insulation, advanced components for EV batteries, photovoltaic systems, and electronics have suffered from a shortage. Disruption in things that are in a research phase or upcoming trends like nanomaterials, organic semiconductors, and quantum computing are affecting the market as well.

This scenario of increased complexity in microelectronics fabrication is leading to the demand for high-purity electronic materials with precise fabrication, longer life cycles, and lower resistivity. The semiconductor industry is the first that comes to my mind that grows with high-end computing, memory chips, and flexible electronics.

Water-soluble materials, wet chemicals, etchants, dopants, and specialty gases are primary materials used in the semiconductor industry. Also, the need for low-power, high-speed processors in smartphones, data centers, and autonomous vehicles is causing innovations in materials like photoresists, dielectric materials, and conductive polymers.

Environmental and Regulatory Compliance New tough environmental regulations put pressure on the industry to cut toxic emissions and green chemical formulations have to be resorted to. Laws targeting fluorinated compounds, VOC emissions, and hazardous waste disposal necessitate heavy investment in R&D to switch to eco-friendly materials.

Development in AI, 5G, and Quantum Computing The progress in AI, 5G technology and quantum computing have made a rapid rise in the requirement of advanced semiconductor materials and the high-performance PCB coatings. The chips for neuromorphic computing and the storage of high-density memory together with the new dielectrics and nonmaterial are the things to look forward to.

The Growth of EV Batteries and Renewable Energy Electronics The global shift toward electric-powered transportation and smart utility networks has led to the increase in the need for battery materials, power semiconductors, and energy-efficient circuit boards. Solid-state batteries, including silicon anodes, are among the new-generation battery chemistry categories and are presumed to lead to the design of alternative materials characterized by higher conductivity and better thermal stability.

Sustainable and Biodegradable Electronic Materials The industry is moving towards recyclable, biodegradable flexible electronics and printed circuit materials. As green regulations are made more stringent, companies are embarking on using low-carbon, renewable sources to counteract their environmental footprint without any adverse effect on performance.

Explore FMI!

Book a free demo

During the period from 2020 to 2024, the electronic materials and chemicals industry showed a good growth as the semiconductor technology was booming. This expanded the demand for consumer electronics, which then led to a high-flying growth in the electric vehicle (EV) and renewable energy industries.

The growth of 5G networks, artificial intelligence (AI), and Internet of Things (IoT) solutions drove demand for high-purity chemicals and materials involved in the manufacturing of chips, printed circuit boards (PCBs), and displays.

Stringent environmental regulations and sustainability objectives also compelled manufacturers to introduce environmentally friendly chemicals and seek out alternative processing approaches. But the market struggled with supply chain disruptions occasioned by the COVID-19 pandemic, shortage of semiconductors, and geopolitical tensions over raw materials availability.

Forward to 2025 to 2035, the market for electronic chemicals and materials will transform under the impact of miniaturization of electronic components, AI-powered smart manufacturing, and the advent of quantum computing. The evolution of next-generation semiconductors (e.g., gallium nitride (GaN) and silicon carbide (SiC)), flexible electronics, and innovative energy storage technologies will unlock new growth prospects.

In addition, sustainable manufacturing processes, such as low-carbon chemical processing, circular economy-based models, and renewable resource-based materials, will determine the future of the industry. Greater adoption of blockchain and digital twins in supply chains will strengthen material traceability and process efficiency.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory Landscape: Environmental regulations pushed for reduced hazardous chemicals in semiconductor and display manufacturing, but adoption was gradual. Circular economy discussions began, but large-scale implementation was limited. | Sustainability-driven policies mandate the use of low-carbon, recyclable, and bio-based electronic chemicals. Circular economy is increasingly being adopted in semiconductor and display manufacturing. |

| Semiconductor Industry Trends: 5nm and 3nm semiconductor production became more popular, with ultra-high purity chemicals required for extreme ultraviolet (EUV) lithography. Chip design with AI increased momentum. | Sub-3nm semiconductor growth accelerates high-purity electronic chemicals demand. Neuromorphic and quantum chip manufacturing requires sophisticated materials for improved performance and thermal management. |

| Display & PCB Technologies: OLED and microLED displays saw broader adoption, with flexible and foldable displays gaining market acceptance. PCB manufacturing relied on traditional materials with incremental upgrades. | Next-generation conductive polymers and ultra-thin insulators are needed for holographic and transparent display, roll-to-roll printed electronics, and graphene-based PCBs. |

| Energy Storage & EV Market Impact: Lithium-ion battery advancements were focused on increasing energy density and charging efficiency. Silicon anode research was of increasing interest but demonstrated limited commercial relevance. | Solid-state and sodium-ion battery development stimulate innovation in the development of novel electrolyte formulas, self-repairing battery materials, and fire-proofed coatings. |

| Advanced Materials Innovation: Quantum dots and 2D materials research was underway but commercialization was still in the nascent stages. Spintronics had promise but did not have widespread applications. | Quantum dots, spintronic materials, and 2D materials are picking up momentum in next-generation computing and ultra-fast data processing. Material choice is impacted by growth in biodegradable electronics. |

| Sustainability & Circular Economy: Green chemistry initiatives gained initial traction, but carbon neutrality efforts in chip manufacturing were limited. Recycling of electronic materials was in pilot stages. | Green chemistry with strong focus, carbon-neutral chip manufacturing, and closed-loop recycling systems for semiconductor and electronic materials. |

Critical Electronic Chemicals and Sourcing Risks in the Industry

Producers are concerned about the growing volatility in the electronic materials and chemicals market due to supply chain disruptions, both from geopolitical tensions and technological advancements. More than 80 percent of rare earth elements (REEs) including neodymium and yttrium come from China, posing risks in an age of trade restrictions. A global helium shortage has led to semiconductor etching, and restrictions on hydrogen fluoride (HF) between Japan and South Korea affected the supply of high-purity chemicals. Funds like the USA CHIPS Act (USD 52 Billion) and EU semiconductor funds (€43B) are pushing for domestic chip manufacturing, resulting in an uptick in demand for localized suppliers.

Advanced nodes (≤3nm) require a major portion of chips manufacturing chemicals, such as semiconductor chemicals, photoresists, CMP slurries, ultra-high-purity gases (NF₃, CF₄, NH₃), etc. Diversifying supply chains is critical. Taiwan, South Korea and Japan provide alternative sources of key chemicals. Australia and Canada are also ramping up rare earth production to become less dependent on China. Firms such as Intel and TSMC are locking up their own chemical supplies via upstream investments.

Proximity production continues to grow. New high-purity chemical plants in Arizona (USA), Germany, and Japan complement semiconductor fab expansions. Critical materials such as TEOS, BCl₃, and HF are stockpiled to avoid shortages. To stay competitive in fast-changing electronics market, suppliers need to obtain long-term contracts, invest in alternative sourcing and form joint ventures to stabilize supply chains and remain competitive.

| Innovation Area | Insights |

|---|---|

| High-K & Low-K Dielectrics | New insulating and conductive materials replacing traditional options to support higher transistor density in advanced semiconductor nodes. |

| Hybrid Organic-Inorganic Materials | Growth in perovskite-based semiconductors and flexible electronics, requiring novel encapsulants, conductive inks, and adhesion promoters. |

| Extreme Thermal & Conductive Solutions | Increasing demand for high-performance TIMs (Thermal Interface Materials) and ultra-low resistance interconnects in AI chips and 3D-stacked devices. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

| UK | 4.9% |

| European Union | 5.1% |

| Japan | 4.8% |

| South Korea | 5.5% |

The USA electronic chemical and material business is experiencing sustained growth, buoyed by fast-paced semiconductor chip production, consumer electronics technology development, and the growing electric vehicle (EV) space. Pressure by the USA administration to increase local production of semiconductors, especially through the CHIPS Act, has been driving noteworthy investment in the high-purity chemicals, etching chemicals, and deposition chemicals involved in producing chips.

Besides, the demand for 5G technology, AI computing, and next-gen data centers is also increasing and, therefore, the demand for photoresists, specialty gases, and sophisticated dielectric material is also demanded. Electronic grade solvents and specialty chemicals are also on a rise because of the expanding PCB market and trends in displays, OLEDs, and quantum computers. Besides, the move towards environment-friendly and lead-free materials is influencing market dynamics according to regulations on sustainability. Country CAGR (2025 to 2035)

Growth Factors in USA

| Key Factors | Details |

|---|---|

| Rising Semiconductor Manufacturing | Increased investments in domestic chip production under the CHIPS Act. |

| Strong R&D Ecosystem | Presence of major tech firms driving innovation in electronic materials. |

| High Demand for Advanced Electronics | Growth in 5G, IoT, and AI-driven technologies. |

| Government Support | Federal incentives to reduce dependence on foreign semiconductor supply chains. |

The UK chemical and electronic material market is expanding at a medium rate. This is because of investment in green electronics, high-performance computing, and semiconductor research. The demand for etchants, doping chemicals, and deposition chemicals is being encouraged by the government's focus on domestic chip fabrication and PCB fabrication.

The UK's focus on 5G infrastructure development, electric vehicle (EV) battery materials, and printed electronics is also fueling market growth. Moreover, clean energy initiatives are driving demand for high-purity silicon wafers, dielectric materials, and conductive polymers for solar panels and energy storage systems.

Quantum computing, photonics, and flexible electronics are some of the areas where research and development are in progress, the market is poised for gradual growth, particularly for green and recyclable materials.

Growth Factors in UK

| Key Factors | Details |

|---|---|

| Focus on Sustainable Electronics | Emphasis on eco-friendly electronic materials and recycling initiatives. |

| Growth in Printed Electronics | Expansion of flexible and printable electronic materials. |

| Investment in Quantum Computing | Government-backed programs for quantum technology research. |

| Semiconductor Research | Collaborations between universities and the private sector. |

The EU market for electronic materials and chemicals is growing as a result of the increased demand for semiconductors, printed circuit boards, and renewable energy electronics. Germany, France, and the Netherlands are at the forefront of chip manufacturing, OLED displays, and advanced sensor technologies.

The European Chips Act is driving investment in fab facilities, litho chemicals, and ultra-high-purity gases. In addition, the EU drive for green production and lead-free electronics is also stimulating innovation in bio-based polymers, non-toxic etchants, and recyclable semiconductors. The automotive sector in the region, with a fervent focus on EVs and autonomous vehicles, is in itself one of the major drivers for high-performance coatings, conductive inks, and encapsulants utilized in electronic control units (ECUs) and battery management systems (BMS).

Growth Factors in European Union

| Key Factors | Details |

|---|---|

| EU Chips Act Implementation | Aiming to boost semiconductor self-sufficiency. |

| Focus on Green Manufacturing | Stringent regulations promoting sustainable electronic chemicals. |

| Rising Demand for EV Electronics | Growth in electronic materials for electric vehicles. |

| Strong Research Institutions | High investment in nanoelectronics and advanced materials. |

Japan's chemicals and electronic materials industry is driven by the country's leadership in high-tech manufacturing, semiconductors, and display technologies. Japan is a dominant player in photoresists, IC fabrication chemicals, and high-purity specialty gases owing to the existence of big electronics majors and advanced research on next-generation materials.

Small-size electronic equipment and IoT products are increasingly being used. The demand for dielectric materials, conductive paste, and encapsulants is growing. Furthermore, Japan is also developing energy-saving and eco-friendly electronics. Because of this, technology is coming in recyclable PCB material, transparent conducting films, and high-performance flexible substrates.more investments in quantum computing, photonic chips, and wearable electronics will fuel the demand for specialty semiconductors and chemical etchants.

Growth Factors in Japan

| Key Factors | Details |

|---|---|

| High-Tech Materials Innovation | Japan leads in specialty chemicals for semiconductors. |

| Strong Consumer Electronics Industry | Demand from companies like Sony, Panasonic, and Toshiba. |

| Government Investment in Semiconductors | Collaboration with Taiwan for chip manufacturing. |

| Advanced Display Technology | Growth in OLED, microLED, and quantum dot materials. |

South Korea's electronics chemicals and materials business is expanding very rapidly, driven by its dominance in semiconductors, OLED displays, and lithium-ion batteries. Companies like Samsung, SK Hynix, and LG are leading the consumption of photoresists, high-purity etch chemistries, and advanced packaging materials.

With government incentives for the stimulation of local production of chips and 5G-smart devices, ultra-high-purity gases, silicon wafers, and conductive adhesives are in growing demand. Demand is also fueled by the nation's dominance in flexible and foldable displays through to transparent conductive films and encapsulants. South Korea's EV battery sector is also seeing robust investments with high demand for electrolyte additives, dielectric coatings, and separator films.

Growth Factors in South Korea

| Key Factors | Details |

|---|---|

| Semiconductor Industry Growth | Home to Samsung and SK Hynix, leading chip manufacturers. |

| Heavy Investment in Display Technology | Dominance in OLED and flexible display production. |

| Government Support for Materials Sector | Policies to reduce reliance on Japanese chemical imports. |

| Emerging AI & IoT Demand | Need for high-performance materials in AI-driven devices. |

The electronic materials and chemicals market is dominated by liquid electronic chemicals as they play a vital role in semiconductor fabrication processes, printed circuit board manufacturing, and display technologies. These are wet chemicals, solvents, and photoresists necessary for processing methods such as photolithography, etching, and cleaning during the production of a microelectronic device.

The fast-growing semiconductor industry powered by artificial intelligence, 5G technology and electric cars is propelling demand for high-purity liquid chemicals. The growing need for wet chemicals and ultra-pure solvents is further boosted by government and semiconductor companies heavily investing in chip fabrication facilities. Moreover, the industry is undergoing a shift toward greener and less toxic formulations which are projected to shape the future of the liquid electronic chemicals market.

The electronic materials section of gases and various electronic compounds is expected to have substantial growth for this gasses segment owing to the growing requirement for electronic materials sections such as argon gas, nitrogen gas, fluorine gas, and hydrogen gas. These gases are crucial for semiconductor manufacturing processes such as etching, doping, and plasma-enhanced chemical vapor deposition (PECVD).

As the semiconductor industry moves to ever smaller, more efficient nodes like sub-7nm technology, the need for ultra-pure gases to ensure accuracy and precision in chip manufacturing has become exponentially more important. In addition, an increasing amount of OLED and flexible display panels being produced is also driving up demand for process gases in the electronics sector. The specialty gases market should continue to grow as technology continues to evolve and the demand for high-performance semiconductors increases.

The largest market share of revenues in the electronic materials and chemicals industry is held by silicon wafers, driven by market growth in semiconductor manufacturing for consumer electronics, automotive applications, and data centers. Silicon wafers, used to make ICs, memory chips, and microprocessors, are the backbone of modern electronic devices.

A global chip shortage and push by governments in the USA, China and Europe to become self-sufficient in semiconductors are fueling heavy investments in silicon wafer production. Other Growth Drivers: Also, any advancements in wafer technologies, such as larger wafer sizes, improved fabrication techniques are creating more growth opportunities in this segment.

Demand for printed circuit board (PCBs) has the PCB laminates industry growing strong owing to the increasing usage of smartphones, wearables, medical devices, and industrial automation systems. These laminates (thermosetting and thermoplastic types), as epoxy, polyimide, PTFE, etc., offer structure and electric insulation for electronic components.

The proliferation of 5G network systems, electric cars, and smart home devices have helped to boost the PCB laminates market. When conducting modern electronics, manufacturers focus on materials that can resist a much higher heat level, have stronger signal integrity, and allow for miniaturization. And there has also been a growing focus on sustainable electronics, which is generating interest in green PCB materials with lower levels of toxic substances and driving the development of innovative materials in this segment.

The market for electronic materials and chemicals is a very competitive market driven by the fast growth of semiconductors, printed circuit boards (PCBs), displays, and electronic components. These materials and chemicals have significant applications in manufacturing, etching, doping, and cleaning electronic devices.

Due to this, they are a significant contributor to industries such as consumer electronics, automotive electronics, telecommunications, and industrial automation. Key players in this industry focus on high-purity materials, green technology, and nanotechnology advancements, as well as expanding their supply chain and R&D base to meet the growing demand for miniaturization, higher performance, and energy efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Air Products and Chemicals, Inc. | 18-22% |

| BASF SE | 15-18% |

| Linde plc | 12-15% |

| Sumitomo Chemical Co., Ltd. | 9-11% |

| Shin-Etsu Chemical Co., Ltd. | 6-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Air Products and Chemicals, Inc. | Manufactures high-purity specialty gases and chemical solutions for semiconductors, displays, and microelectronics with an emphasis on advanced etching and deposition materials. |

| BASF SE | Designs electronic-grade solvents, photoresists, and chip fabrication coatings, as well as PCB manufacturing coatings, focusing on sustainability and chemical efficiency. |

| Linde plc | Expert in high-purity process gases, etchants, and dopants for semiconductor and flat-panel display production, with capabilities in advanced materials for nanotechnology. |

| Sumitomo Chemical Co., Ltd. | Offers photoresists, CMP slurries, and OLED materials for high-performance electronic devices and displays with significant presence in Asian markets. |

| Shin-Etsu Chemical Co., Ltd. | Produces silicon wafers, dielectric materials, and high-performance semiconductor and circuit board adhesives, with an emphasis on miniaturization and high-precision uses. |

Key Company Insights

Air Products and Chemicals, Inc.

Being a world-class supplier in the area of high-purity specialty gases and electronic-grade chemicals meant for semiconductors, flat-panel displays, and microelectronics is what makes Air Products and Chemicals, Inc., one global consultant. The company's etching and deposition materials are necessary in chip fabrication and advanced semiconductor nodes.

Air Products invests significantly in research where the concentration is on next-generation materials that are more efficient for manufacturing sustainability. The company is positioned well by its global distribution and advanced gas technologies.

BASF SE

BASF SE is a development company in high-performing chemicals used in electronics, including solvents, photoresists, coatings, and conductive materials. The firm is committed to resource efficiency and sustainability, producing low-impact, high-purity materials that enable next-generation chip production. Successful collaboration with semiconductor manufacturers and the accent on innovative electronic material could enhance BASF's established status worldwide.

Linde plc

Linde plc is specialist in high-purity process gases, etchants, and dopants needing for semiconductor manufacture. Linde is also very critical in the supply of materials for extreme ultraviolet (EUV) lithography for future transistor productions. Processes are optimized by Linde for optimal yields, low defect rates, and low environmental footprint in manufacturing electronic materials.

Sumitomo Chemical Co., Ltd.

Sumitomo Chemical Co., Ltd. is a leading player in the Asian market for electronics materials with photoresists, chemical mechanical planarization (CMP) slurries, and OLED materials. It is focused on high-resolution patterning such as that done on semiconductor chips and displays in line with this trend of developing smaller and more powerful electronic components that the industry is pushing for. Sumitomo's interests in financing R&D of the next-generation materials such as quantum dot displays and flexible electronics help keep Sumitomo on top of the market.

Shin-Etsu Chemical Co., Ltd.

Shin-Etsu Chemical Co., Ltd. is a giant supplier of silicon wafers, dielectric material, and semiconductor adhesives and printed board-level semiconductor-use adhesives. Miniaturization and high-precision materials forming high-performance lifetimes of electronic components are the focal point of its businesses. In doing so, Shin-Etsu is leading-edge in the development of state-of-the-art wafer technologies and is paramount in HPC and 5G electronics.

Other Key Players (25-30% Combined)

The electronic materials and chemical sales will be worth USD 59.9 billion in 2025.

The sales are predicted to reach a value of USD 98.6 billion by 2035.

Some of the key companies manufacturing electronic materials and chemicals include Air Products & Chemicals Inc., Bayer AG, Albemarle Corporation, Ashland Global Specialty Chemicals Inc., and others.

The USA is a prominent hub for electronic materials and chemicals manufacturers.

Liquid electronic chemicals is likely to dominate the market by product type.

By product, the segmentation is as liquid, gaseous, and solid.

By application, the segmentation is as silicon wafers, PCB laminates, specialty gases, wet chemicals and solvents, photoresist, and others.

By end uses, the segmentation is as semiconductors and integrated circuits, and printed circuit boards.

By region, the segmentation is as North America, Latin America, Europe, Asia Pacific, and The Middle East & Africa.

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.