The electronic manufacturing services (EMS) industry is expected to experience steady growth between 2025 and 2035 as demand for affordable production models increases, technology evolves, and electronic components become more complex in various industries.

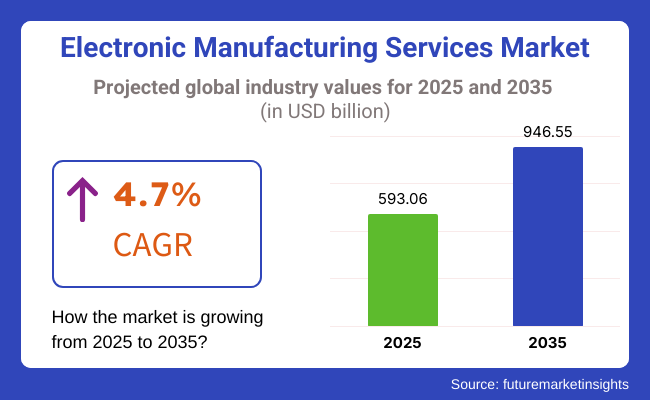

The industry is expected to expand from USD 593.06 billion in 2025 to USD 946.55 billion by 2035, with a compound annual growth rate (CAGR) of 4.7% during the forecast period.

The growing demand for electronic components in consumer electronics, automotive, telecommunication, and industrial markets is inducing the growth of the EMS market. By outsourcing manufacturing operations to competent EMS vendors, firms can establish core competencies, lower operational costs, and improve efficiency in production. Furthermore, increasing product complexity and time-to-market requirements are leading companies to outsource design, testing, and supply chain management to EMS providers.

The EMS industry is dominated by increasing needs for high-technology electronic products and flexible manufacturing capacity. Automation and intelligent manufacturing technologies are being adopted on a broader level and are enabling EMS providers to attain greater manufacturing efficiency, cost savings, and improved product quality.

The growth in the Internet of Things (IoT), the rollout of 5G, and increased complexity in semiconductor and electronics components are inducing organizations to have their manufacturing work done by experienced EMS providers adept at managing sophisticated assembly and testing needs.

The automotive sector, and the electric vehicle (EV) segment in particular, is also a major growth driver, with electronic control units (ECUs), battery management systems, and advanced driver assistance systems (ADAS) seeing increasing demand. Despite the rosy picture, the industry does have some issues that could hinder growth.

Dependence on a few suppliers for key components elevates the risk of supply chain disruption. Geopolitical tensions, tariffs, and volatile raw material prices can also impact growth conditions. Intellectual property conflicts and data security risks are also among the most important issues for companies outsourcing manufacturing to third-party suppliers.

There is vast growth potential in the telecom, healthcare, and automotive sectors. Autonomous cars, connected cars, and electric vehicles are creating a demand for sophisticated electronic components and control systems. The increasing application of medical imaging systems, wearable health devices, and diagnostic devices is creating new opportunities for providers in the healthcare sector.

Explore FMI!

Book a free demo

From 2020 to 2024, the market changed dramatically, fueled by the increasing need for smart devices, IoT solutions, and automobile electronics. The rollout of 5G and the spread of IoT compelled manufacturers to develop high-performance parts, which resulted in investment in advanced PCB assembly and semiconductor packaging. Automation and AI-based production became focal, with the likes of Foxconn, Flex, and Jabil embracing smart manufacturing processes, such as AI-based quality control and robot-based assembly.

The COVID-19 pandemic brought supply chain vulnerabilities into focus, resulting in semiconductor shortages and necessitating localized manufacturing. Governments in America and Europe launched incentives to aid local semiconductor production, lowering dependence on Asian vendors.

Sustainability picked up, with producers embracing circular economy strategies, concentrating on recycling components, and enhancing energy efficiency. By 2024, the providers had responded to supply chain interruptions and labor shortages by adopting automation, regionalization, and environmentally friendly production practices.

From 2025 to 2035, the market will be influenced by AI-powered automation, leading-edge semiconductor technologies, and sustainability. Defect detection with AI, predictive analysis, and digital twin simulations will maximize production effectiveness and supply chain management.

Chip-making will migrate to 2nm and even smaller sizes to enable quantum computing and AI accelerators. Adoption will be stimulated by sustainability via biodegradable PCBs, renewable power, and closed-loop recycling processes. 3D printing will support on-demand part manufacturing, decreasing inventory expenses and lead times.

Reshoring will accelerate with multi-regional production clusters supporting supply chain agility. Edge computing and embedded AI solutions will create demand for purpose-driven components for autonomous vehicles, smart cities, and industrial automation. Security will be of utmost importance, with hardware-based encryption and anti-counterfeiting capability in place to ensure product integrity and intellectual property rights. By 2035, AI, automation, and sustainable methods will transform the landscape, promoting efficiency and innovation across industries.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Supply chain transparency requirements | AI-based compliance enforcement, cybersecurity regulations |

| AI-based automation, robot assembly | Quantum computing chips, 2nm semiconductor fabrication |

| 5G rollout, IoT growth | Edge computing, AI-optimized embedded electronics |

| Automated defect detection, predictive maintenance | Digital twin-based manufacturing, on-demand 3D printed PCBs |

| Circular economy implementation, energy-efficient factories | Carbon-neutral electronics manufacturing, closed-loop recycling |

| AI-based quality control, smart supply chains | Real-time AI-powered predictive analytics, blockchain-based component tracking |

| Semiconductor shortages, regionalized manufacturing | Reshoring of EMS facilities, diversified production hubs |

| Demand for advanced consumer electronics, IoT devices | AI-powered industrial automation, fully decentralized manufacturing ecosystems |

The growth of the EMS market is linked to the rise in the demand for outsourced manufacturing, miniaturization of electronics, and automation-driven production. The manufacturers of consumer electronics mainly focus on cost efficiency and production speed because of the need for high-volume production.

Automotive and healthcare sectors work on the basis of custom requirements, compliance with regulations, and technological integration to be in line with safety standards and innovation. Industrial-use applications are made of hard materials and come with a reliable supply chain as well as global manufacturing regulations.

Aerospace and defense businesses need exactness, tight quality inspection, and following rules on military standard materials. Integration of Industrial Internet of Things, Artificial Intelligence-driven automation, and 5G connectivity helps Providers to meet the needs of customers by shifting towards smart factories, sustainable manufacturing, and strong supply chains.

In 2024 and early 2025, the industry demonstrated significant momentum, driven by rising demand for advanced production techniques, automation, and digital transformation in manufacturing processes. Leading players such as Foxconn, Flex, Jabil, Celestica, and Sanmina have secured major contracts and strategic partnerships, underscoring the sector's commitment to innovation, efficiency, and sustainable production in a rapidly evolving global marketplace.

| Company | Contract Value (USD million) |

|---|---|

| Foxconn | Approximately USD 100 - 110 |

| Flex | Approximately USD 80 - 90 |

| Jabil | Approximately USD 70 - 80 |

| Celestica | Approximately USD 60 - 70 |

| Sanmina | Approximately USD 90 - 100 |

Dependence on sourcing from around the globe for the industry makes it prone to vulnerabilities in the supply chain sector. Geopolitical tensions, trade restrictions, or shortages in raw materials, especially semiconductors, are reasons for the production delays, high costs, and possible contract penalties for manufacturers who rely on just-in-time supply chains. Labor and operational risks are quite critical. The majority of providers happen to be in areas with unstable labor industries and regulatory changes.

The costs of technical personnel, inflation of wages, and the necessity to comply with environmental and labor are risk factors that can increase operational expenses and, thus, impact the profit margin. Moreover, while the adoption of automation requires investment in the short term, it cuts down on labor needs in the long term. Manufacturing defects and product recall risks are some of the difficulties that must be handled. Deviation in the production process, defective spare parts, or breach of industrial standards (ISO, IPC) are the things that can make a product to be faulty.

As a result, there will be expensive recalls, harm to the good name, and legal matters, especially in industries like medicine, aviation, and automobiles. With rapid innovation and obsolescence, companies must be agile and address these changes continuously. As products rapidly change, EMS must add capabilities, including advanced manufacturing methods, like artificial intelligence (AI)-driven automation, Internet of Things (IoT) integration, and Industry 4.0 solutions. The backing away from the latest machines will mean that contracts have to be given to better companies.

| Segment | Value Share (2025) |

|---|---|

| Medical and Healthcare | 53.2% |

In 2025, the medical & healthcare segment will account for an estimated 53.4% of the Global share due to emerging trends in digital health, telemedicine, and wearable medical devices. Case in point, healthcare solutions are leveraging AI, IoT, and cloud computing to provide better remote patient monitoring, diagnostics, and personalized treatment.

Paralleling the above, interest in body-worn sensors, digital biomarkers, and real-time health analytics is proliferating, especially in relation to managing chronic diseases (like diabetes, cardiovascular, and respiratory diseases). Medtronic, Abbott, and BioIntelliSense are among the companies designing AI-enabled biosensors that monitor vitals like temperature, heart rate, and oxygen levels. The continued adoption of electronic health records (EHRs), predictive analytics, and wearable technology is expected to alter hospital workflows and home health care radically.

In addition, surgeries that are assisted by robots, along with connected medical devices, are enhancing patient care. The growth of 5 G-powered remote surgeries and smart implants like pacemakers that send real-time data are transforming patient care. With the global telemedicine industry predicted to grow from USD 120 billion in 2022 to more than USD 280 billion by 2025, demand for secure medical data transfers in real time will inevitably increase.

By 2025, the defense & aerospace segment is expected to maintain 46.6% of Global Market Share, thanks to the growing utilization of autonomous systems, AI-based surveillance, and advanced battlefield monitoring. This is why governments and defense organizations around the world have been pouring significant investment into military-grade sensors, biometric wearables, and secure communication systems.

The utilization of an on-body sensor to track the soldiers' health is one of the primary driving factors. Military forces are deploying biometric wearables that monitor signs of vital health hydration levels, body temperature, stress markers that enable them to maximize the effectiveness of troops sent into extreme environments such as the USA.

The DoD (Department of Defense) and NATO are currently in the process of launching these body sensors with integrated AI to gain an effective advantage over their competitors on the battlefield. Manufacturers such as Garmin, FLIR Systems, and Vivalink are creating robust, high-performance biosensors capable of operating in the harshest military conditions.

In aerospace, predictive maintenance and real-time aircraft health monitoring promote segment growth. Aerospace groups, including Boeing, Lockheed Martin, and Airbus, use fiber optic sensing to detect structural weaknesses to improve flight safety and maximize fuel efficiency. Hypersonic planes and space exploration are also pushing the development of temperature and pressure sensors that can withstand extreme conditions.

Additional Security and Airplane Engineering Technologies With THE growing cyber security risks and the increase in international tensions, future defense and aerospace technologies will continue to be driven by secure communication networks, AI-enabled threat detection, and unmanned defense systems.

| Country | Projected CAGR (2025 to 2035) |

|---|---|

| The USA | 5% |

| The Uk | 4.5% |

| France | 4.2% |

| Germany | 4.8% |

| Italy | 4% |

| South Korea | 6% |

| Japan | 5.5% |

| China | 5.2% |

| Australia | 3.8% |

| New Zealand | 3.5% |

The USA is likely to achieve a CAGR of 5% during the period between 2025 and 2035. This growth is driven by heavy investment in defense electronics, electric vehicles, and semiconductor manufacturing. The Inflation Reduction Act and CHIPS Act government initiatives are luring local manufacturing, and industry majors like Intel, Qualcomm, and Texas Instruments are being attracted. The USA is a hub for technologically advanced, high-value services in aerospace, healthcare, and automobiles.

High-tech electronic component demand is fueled by Apple, Tesla, and General Electric, requiring innovation from EMS vendors. AI-fostered automation and implementing smart factories are driving the USA industry further. Domestic investment and reshoring should minimize threats, in spite of the threat of labor shortages and China issues.

The UK will be growing at 4.5% CAGR from 2025 to 2035. The country is interested in more advanced semiconductor design and high-accuracy manufacturing as opposed to chip fabrication on mass scales. Growth is being driven by compound semiconductor investment, which is key for electric vehicles, telecommunication, and industry.

They are ARM Holdings and BAE Systems, which promote EMS innovation, particularly in the aerospace and defense sector. The demand for electric mobility and sustainability in the UK provides an opportunity for EMS providers with battery management systems and low-power electronics capability. Brexit creates supply chain risks and regulatory compliance issues, and thus is a constraint to growth.

France is expected to grow at a CAGR of 4.2% through the forecast period. The country is building its semiconductor and electronics manufacturing sector, with an emphasis on aerospace, defense, and industrial automation. Promoting government backing for local production and investments in AI-driven electronics also supports the industry.

Companies such as Thales, Schneider Electric, and Asteelflash are the pillars of EMS. French environmentally friendly production trends are harmonized with the global trend to create a demand for energy-saving consumption and reusable electronics. Additionally, technology startup collaborations with suppliers are driving the embracement of smart infrastructure and innovative health technology models.

Germany will grow at 4.8% CAGR during the period 2025 to 2035. Europe's most powerful automotive and automation sector, its manufacturing hub, supports the demand for EMS in Germany. Electric drive of vehicles and smart factories require advanced electronic systems, which introduce growth.

Siemens, Bosch, and Infineon Technologies are at the forefront of automotive component and industrial electronics innovation. Industry 4.0 initiatives, patronized by the government, and smart energy solutions provide further opportunities. Dependence on raw material imports and rising production costs will, however, undermine competitiveness against Asian producers.

Italy will expand with a CAGR of 4% during the forecast period. Industries such as automotive, industrial machinery, and medical electronics are the drivers of demand in Italy. Electric mobility and digital health technology are driving the country towards local production.

Italian firms like Fiat, Leonardo, and STMicroelectronics lead the trends. In addition, Italy's precision engineering expertise and automation technology also consolidate its leadership in specialty EMS applications. Despite these advantages, Italy must fight against labor cost issues and dependence on semiconductor imports.

South Korea will grow at 6% CAGR from 2025 to 2035. South Korea is a global leader in the semiconductor sector, with companies like Samsung Electronics and SK Hynix being some of the strongest drivers in the EMS sector. Demand for chips with high performance for AI, 5G, and electric vehicles is pushing local manufacturers to expand capacity.

South Korea's leadership in consumer electronics, robotics, and auto electronics also promotes EMS development. Government expenditures on high-technology materials and ultra-fine processing technologies form the basis of its global competitiveness. Relying too heavily on export markets, however, makes South Korea vulnerable to volatility in international trade.

Japan will grow at a CAGR of 5.5% over the forecast period. The country's advanced precision manufacturing and automation technology capabilities place it among the world's top providers. The growth of the demand for electronic components in industries such as robotics, medical devices, and energy storage is propelling the sector.

Sony, Panasonic, and Toshiba lead the way with innovation, and miniaturization and high-efficiency electronics. Japan's demand for environmentally friendly manufacturing processes follows world trends and boosts demand for green electronic components. An aging population and high labor costs, however, are limiting factors for long-term growth.

China will grow at a 5.2% CAGR between 2025 to 2035. The country is the world's largest producer of electronics, from electric vehicles to mobile phones. Despite rising labor costs, China's vast supply chain infrastructure continues to give it an edge.

These consumers are propelling EMS expansion, particularly for consumer electronics, EVs, and 5G products. China's push towards semiconductor self-reliance and technological innovation in AI-based manufacturing further underpins the Chinese market. However, geopolitics and changed global supply chains could hinder future expansion.

Australia is anticipated to register a 3.8% CAGR over the forecast period. Niche manufacturing, compared to mass manufacturing, is of utmost significance to Australia, and its drivers for growth are medical devices, defense, and clean energy. Increased usage of automation and IoT in the mining and agricultural industries also drive demand.

ResMed and Cochlear are examples of companies driving Australia's growth, both leaders in health technology innovation. Government support for advanced manufacturing and clean energy initiatives also complements development. Nonetheless, a relatively undersized domestic electronic industry and reliance on imports persist as issues.

New Zealand will see a 3.5% CAGR between 2025 and 2035. The country has a strength in high-value, low-volume electronics manufacturing with high-end applications in renewable energy, medical technology, and agritech. Investment in automation and smart systems is solidifying the local EMS.

Fisher & Paykel Healthcare and others like them drive growth, particularly in medical electronics. The aerospace and defense industries are prospects, with local players offering electronic components for satellites and UAVs. New Zealand may have a limited staffing pool and high import reliance as drawbacks, but focusing on quality solutions guarantees sustained growth.

The electronic manufacturing services (EMS) industry is witnessing significant growth owing to the increasing requirement for scalable, cost-efficient, and technology-enabled production solutions in various sectors, such as consumer electronics, automotive, aerospace, and healthcare. By availing of end-to-end services designed for assembly, testing, and supply chain management, we aim to improve operational efficiency and streamline processes.

Foxconn, Pegatron, Jabil, Flex, and Sanmina are the top players, backed by their high-volume manufacturing, enhanced automation, and global production networks. Startups and niche players focus on customized, high-mix, low-volume manufacturing for specialized areas such as medical devices and industrial automation.

Changes are happening with automation, AI-driven quality control, and sustainable manufacturing processes, which enable faster and more reliable production. The use of IoT, robotics, and predictive analytics increases operational efficiency and visibility into the supply chain.

Some strategic factors driving the competition include geopolitical supply chain realignments, manufacturing localization, cost optimization, and sustainability initiatives. The outsourcing of production by OEMs to EMS providers, coupled with continued investment in smart factories and digital transformation, means that the industry would remain highly competitive and innovation-driven.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Foxconn (Hon Hai Precision Industry) | 35-40% |

| Pegatron Corporation | 15-20% |

| Jabil Inc. | 12-16% |

| Flex Ltd. | 10-14% |

| Sanmina Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Foxconn | Specializes in the mass production of consumer electronics with an emphasis on automation and efficiency. |

| Pegatron Corporation | Offers top-notch PCB assembly and ODM solutions to tech industry leaders and automotive companies. |

| Jabil Inc. | Provides innovations in end-to-end supply chain solutions by taking advantage of AI and IoT for smart manufacturing. |

| Flex Ltd. | Sustainable manufacturing focuses on design-driven electronics and medical devices. |

| Sanmina Corporation | Supplies high-reliability electronic products for aerospace, defense, and industrial applications. |

Key Company Insights

Foxconn (35-40)

Foxconn stands above all others in the entire industry with its range of production capacity and continues to outpace its competition through its robotics- and AI-based efficiency-enhancing and cost-reducing factors for some of the largest technology companies in the world.

Pegatron Corporation (15-20)

Pegatron provides high-quality manufacturing and assembly services, such as PCB assembly and design, for the consumer electronics and automotive industries while ensuring quality and scalability.

Jabil Inc. (12-16%)

Jabil is a digital manufacturing pioneer, introducing production through AI and IoT for improved product lifecycle management and operational agility.

Flex Ltd. (10-14%)

Flex is a remarkably innovative company in sustainable EMS solutions, more than just offering holistic design-to-production services; its core focus is renewable energy and healthcare technology.

Sanmina Corporation (6-10%)

Sanmina is the expert in manufacturing in critical missions, manufacturing electronics earmarked in aerospace and defense integrated with precision engineering and durability.

Other Key Players (30-40% Combined)

The overall size of the electronic manufacturing services market was USD 593.06 billion in 2025.

The electronic manufacturing services market is expected to reach USD 946.55 billion in 2035.

The demand will grow due to increasing outsourcing of electronics manufacturing, advancements in automation, and rising demand for consumer electronics.

The top 5 countries driving the electronic manufacturing services market are China, the USA, Germany, Japan, and South Korea.

PCB assembly and semiconductor manufacturing services are expected to command a significant share over the forecast period.

By industry, the segmentation is into electronic manufacturing services for medical and healthcare, defense and aerospace, industrial applications, IT and telecommunication, and other applications.

By region, the segmentation is into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa.

Telecom Managed Service Market Trends - Growth & Forecast 2025 to 2035

Push-to-Talk Market Trends - Demand & Growth Forecast 2025 to 2035

Network Engineering Service Market Trends – Demand & Forecast 2025 to 2035

Quantum Cryptography Market Insights - Growth & Forecast 2025 to 2035

Silicon Capacitor Market Insights - Demand & Growth Forecast 2025 to 2035

Synchronous Generator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.