The electronic board level underfill material market is going to see consistent growth over a decade. An increase majorly influences the growth in demand for compact, high-performance electronic devices across consumer electronics, automotive, telecommunications, and industrial automation. The industry is estimated to be around USD 362.9 million in 2025 and increase to USD 597.7 million in 2035, representing a compound annual growth rate (CAGR) of 5.12% during the forecast period. This growth also indicates how much these materials matter in the areas of mechanical integrity, thermal stability, and long-term performance of the electronic assemblies.

Underfill materials are specially formulated using epoxy-based compounds to be injected into the spaces between semiconductor chips and substrates like flip-chip and ball grid array (BGA) packaging. These materials act as serious protective agents in absorbing mechanical stresses, solder joint failure, and thermal cycling along with vibration, which are becoming critical to today's advanced electronic packaging processes.

One of the most important factors driving the Industry is miniaturization. This is especially observed with consumers from various ranges, such as handheld devices like smartphones, tablets, wearables, and laptops, whose semiconductor packaging densities have increased manifold because of the demand for miniaturization. This further adds stresses to the solder joints and interconnections, emphasizing high-reliability and high-performance underfill materials that ensure the longevity of such devices across diverse environmental and mechanical conditions.

Need for high-performance and high-reliability semiconductor packaging solutions has had a huge growth effect due to the fast-expanding networks for 5G and high-speed computing. Operating at higher frequencies and temperatures, electronic boards will be unable to function efficiently when the conditions demand underfill materials that are both thermally conductive and electrically stable. Thus, manufacturers are investing in advanced underfill technologies and will focus on the evolving requirements of next-generation wireless infrastructure, AI, and edge computing devices.

Another significant contributor to the overall industry growth includes the automotive electronics segment. The increasing number of ECUs, sensors, ADAS (Advanced Driver Assistance Systems), entertainment units, and battery management units that integrate into electric and autonomous vehicles greatly increases the need for such ruggedly packaged and thermally stable devices. Furthermore, underfill materials increase the reliability of automotive-grade components that experience harsh conditions, including extreme temperatures, vibration, and moisture.

The industry seems to be trending toward environmentally friendly and low-VOC (volatile organic compound) underfill materials to meet the company's position on various environmental regulations and sustainability goals. The manufacturers intending to work toward compliance with global standards such as RoHS and REACH, which regulate the use of hazardous substances in electronic components, will find this crucial.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 362.9 million |

| Industry Value (2035F) | USD 597.7 million |

| CAGR (2025 to 2035) | 5.12% |

Explore FMI!

Book a free demo

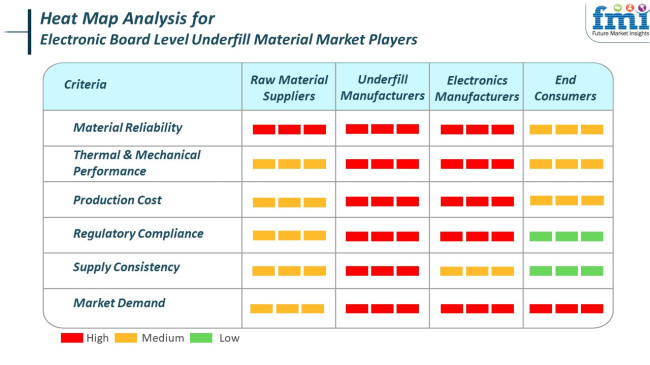

The market for electronic board underfill materials makes sure that they are reliable for high-performance electronic applications. The focus of raw material suppliers and underfill manufacturers is on all aspects of material reliability and thermal/mechanical performance (red) in cases where there is a need to prevent solder joint failures and enhance product life. Also, underfilling manufacturers are tuned in quite closely to the issues of production costs, regulatory constraints, and consistency of supply within an industry that demands accuracy and volume embedding.

OEMs (electronics manufacturers) look with similar intensity at performance, production costs, and regulatory compliance (red), as their quest is to try to balance lifespan and durability vs. miniaturization and compliance with global standards (e.g., RoHS, REACH). Meanwhile, end consumers are not as concerned about the technicalities but cherish devices that prove to be dependable and durable with respect to their own lives; hence, they are also contributing to the indirect demand for the industry (red). This segmentation gives the impression of being a very technical, performance-oriented industry that is driven by reliability, innovation, and compliance with electronic standards.

Between 2020 and 2024, the industry saw moderate but growing demand, driven by the miniaturization of electronics, rising complexity in semiconductor packaging, and the surge in mobile and consumer electronics. Underfill materials-employed for reinforcement of solder joints and to add mechanical stability-became crucial in flip-chip, ball grid array (BGA), and chip-scale packaging (CSP) technology. Industry leaders were epoxy-based capillary underfills with dominance coming through reliability, yet growing demand emanated from smartphones, tablets, wearables, and automotive electronics. Thermal stress, warpage, and extensive curing times remained a challenge though.

The industry will be on the brink of innovation for 2025 to 2035 with the onset of AI-supported electronics, 5G electronics, and quantum computer hardware. There will be rising nanofiller-reinforced and low-temperature cure underfill compounds, enhancing thermal conductance and mechanical integrity for the support of enhanced ultra-thin device performance. The environmental restrictions will heighten demand for halogen-free and biodegradable formulations. In addition, smart manufacturing systems employing AI and real-time defect monitoring will enhance process reliability. Underfill materials will develop as well to accommodate flexible wearable electronics and new packages such as 2.5D and 3D ICs.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Miniaturization of devices, growing mobile and consumer electronics, rise in automotive ECUs. | Expansion of 5G, AI hardware, foldable electronics, advanced chip architectures, and smart manufacturing. |

| Capillary flow underfill (epoxy-based), no-flow and moldable underfill . | Nano-engineered underfills , flexible and bio-based underfills , hybrid thermosetting systems. |

| Enhanced adhesion promoters, filler-modified systems, focus on thermal shock resistance. | Nanofiller -enabled thermal conductivity, low-temp curing, halogen-free & biodegradable compositions. |

| Smartphones, tablets, wearables, automotive ECUs, LEDs. | 3D ICs, AI processors, foldable/wearable electronics, space tech, smart sensors, and quantum computers. |

| Long curing times, sensitivity to warpage and voids, standard flip-chip integration. | Rapid-curing, AI-controlled void detection, adaptive flow for ultra-small geometries and flexible substrates. |

| Limited focus on eco-friendly chemistries, presence of halogens. | Shift to halogen-free, recyclable, and biodegradable underfill systems in compliance with RoHS and REACH. |

| Standard SMT assembly with passive process control. | Smart assembly lines with real-time AI quality control and digital twin monitoring for precision application. |

| Dominated by Asia-Pacific (China, Taiwan, South Korea), with growth in automotive sectors in EU/US. | Stronger presence in North America and Europe as advanced semiconductors and green electronics industries expand. |

| Void formation, thermal mismatch, reliability under high-cycle conditions. | Integration with flexible substrates, ensuring mechanical strength in foldable and 3D IC designs, and meeting environmental standards. |

| Compliance with RoHS and basic environmental safety requirements. | Stricter global environmental compliance, circular economy mandates, and sustainable electronics standards. |

The Industry has a multitude of potential risks that could threaten its growth path and operational stability. A primary risk, of course, is the instability of the prices of raw materials, particularly epoxy resins and other specialty chemicals used in underfill formulations. Often, fluctuations in global petrostates or damage in the supply chain tend to increase production costs, thus impinging on manufacturers' profit margins. Another area of concern is technological obsolescence.

As fast as the designs of electronic equipment evolve, so must the underfill materials evolve to withstand ever-increasing performance standards such as increased thermal conductivity, lower curing temperatures, or improved adhesion. Those companies that do not change fast enough will find themselves out in the cold, especially as the demand moves to new-generation packaging technologies like 2.5D and 3D ICs.

Regulatory and environmental compliance pose considerable risks, as the increasing global weight on sustainability and some hazardous substance restrictions (like RoHS and REACH regulations) would limit the employment of certain components and force companies to reformulate their products or manufacture expensive compliance methods.

Furthermore, manufacturing complexity presents operational risks. The production of high-quality underfill materials would require stringent process control and testing; even slight inconsistencies can lead to defective batches that would have to be recalled at great cost or could lead to a loss of trust by clients, particularly in high-reliability applications such as aerospace and automotive electronics.

Supply chain dependency is yet another risk element. The underfill material supply chain often relies on individual raw material suppliers and the regional chemical industry, particularly in Asia-Pacific. Geopolitical tensions, natural disasters, or global pandemics can severely hit this chain to affect availability and lead times.

Furthermore, the industry is concentrated, with only a few players dominating the industry, which reduces competition and consumers to pricing and supply risks. In general, although the Industry has a lot of opportunities for expansion, each stakeholder must forwardly prepare itself against the operational, technological, regulatory, and supply-chain risks of the material to keep pace and ensure sustainability in competitiveness.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| UK | 5.8% |

| France | 5.6% |

| Germany | 6.1% |

| Italy | 5.3% |

| South Korea | 6.7% |

| Japan | 5.9% |

| China | 7.5% |

| Australia | 5.2% |

| New Zealand | 4.8% |

The USA market will exhibit a robust growth trend driven by sustained investments in high-performance computing, 5G infrastructure, and advanced packaging technologies. Robust semiconductor fabrication facility presence and sustained innovation in chip-scale packaging fuel demand for advanced underfill materials. The automotive sector's use of electronic control units and ADAS further enhances industry potential.

Large USA-based companies, along with major global suppliers, are aggressively pursuing R&D to develop next-gen materials with improved thermal conductivity and mechanical reliability. Alignments between material suppliers and chipmakers will support the USA dominance in underfill material development across the forecast period.

The UK industry is to witness moderate but steady growth as a result of the country's expanding electronics manufacturing capabilities and digitalization plans. Continued advancements in aerospace electronics and telecommunications systems create mounting demand for reliable packaging solutions.

University-industry research centers and government-assisted semiconductor projects are expected to play a decisive part in developing underfill chemistry. The possession of specialized materials firms and overseas supply chain sourcing are enhancing UK. competitiveness in the specialty niche segment of the electronics materials industry.

France's industry is predicted to grow steadily, with increasing demand from the consumer electronics, automotive, and industrial automation sectors. There is a trend towards eco-design and cleaner electronic manufacturing, which is affecting the development of new material formulations that reduce environmental impact.

Key French firms in electronics assembly and microelectronics packaging are collaboratively working with European research institutes to improve the performance and product's long-term life. Coupled with the development of local semiconductor competence, the advancement is boosting underfill material industry growth over the next decade.

Germany is poised to see strong growth in the underfill materials market due to its leadership in industrial electronics, automotive innovation, and high-tech manufacturing technology. Electric mobility and smart factory solutions growth are driving the shift to implementing reliable packaging solutions, where board-level underfill is a mission-critical solution.

Major industry players in Germany are utilizing material advancements to meet stringent performance and quality specifications, especially in harsh operating environments. Continued local chemical company innovation and high process automation in the production of electronics are forecast to drive long-term demand for underfill materials.

Italy's electronic board-level underfill materials market is projected to expand moderately, driven primarily by growth in consumer electronics and medical device manufacturing. The country's emerging semiconductor assembly infrastructure and increasing interest in electronic miniaturization are stimulating demand for high-performance encapsulation solutions.

Local contract manufacturers and electronic design firms increasingly incorporate advanced materials into their manufacturing to enhance product reliability. Even in the early stages of development, the local industry benefits from local partnerships and participation in EU-funded research efforts on electronic packaging innovation.

South Korea will showcase robust growth in the industry through its dominance in semiconductor manufacturing and electronic device fabrication. Large-scale production of smartphones, memory chips, and display panels ensures a steady demand for reliable underfill solutions.

Key South Korean conglomerates are leading developments in material science and packaging technology, frequently working with international material suppliers. Integration of next-generation chipsets and high-density interconnects will continue to fuel demand for thermally stable and mechanically robust underfill materials.

Japan's market will expand at a steady pace, supported by the country's leadership in precision electronics, robotics, and automotive electronics. An aging population of legacy electronics is being displaced by new, miniaturized devices that require enhanced protection against thermal and mechanical stress.

Japanese manufacturers dominate the production of low-viscosity, high-purity underfill compounds designed for sophisticated semiconductor packages. Backward compatibility with traditional manufacturing equipment and emphasis on reliability and longer product lifetimes support consistent market expansion throughout the forecast period.

China is forecast to have the highest growth rate among the countries analyzed, spurred by broad-based growth in semiconductor manufacturing, consumer electronics, and 5G infrastructure development. Government-led initiatives and large-scale capital investment in chipmaking facilities are creating a massive demand for board-level underfill materials.

Domestic suppliers are rapidly increasing capacity, while international firms are increasing local alliances to match volume and quality demands. With a significant focus on achieving technological autonomy, China will be the foremost impetus of the global underfill material industry through 2035.

Australia's industry is anticipated to grow with time, with the strong impetus coming from increasing activity in the defense, aerospace, and telecom sectors. Even though electronics production in Australia remains low, strategic investments in research infrastructure are encouraging the use of advanced packaging materials.

University-electronics firm's new entrant collaborations are powering innovation in the design and integration of materials. Although the comparatively specialized Australian industry is being spurred by its location in regional technology supply chains, increasing demand driven by a growing requirement for robust electronic assemblies in high-stress applications is providing the stimulus.

New Zealand is projected to experience moderate growth in the underfill materials market as spurred by gradual industrial automation development and electronics integration in niche equipment. Although New Zealand lacks large semiconductor factories, local system integrators and electronic assembly service providers are propelling increasing demand.

Technological advancement in environmentally friendly materials and focus on quality control in electronics manufacturing are the key drivers in industry growth. Regional collaboration and access to imported high-performance materials are expected to sustain growth momentum over the forecast period.

Capillary underfill materials are expected to maintain the largest share in the Industry in 2025, as they would occupy close to 65%, whereas edge bond underfill materials would only hold 35%. It indicates the emerging trend of modern encapsulation techniques in semiconductor packaging and circuit board protection.

Capillary underfills are still leading due to established reliability and performance in very high-density electronic assembly applications, especially for flip-chip and BGA packages. The materials are formulated to flow into very narrow channels between a chip and its substrate by a mechanism of capillary action, providing excellent resistance to mechanical stress, thermal cycling, and moisture ingress.

A sudden acceptance has taken place for such materials, considering the long-term reliability properties become ever more necessary in some critical applications like smartphones, automotive control units, and consumer electronics. Henkel, Namics Corporation, H.B. Fuller, and others manufacture a variety of capillary underfill formulations characterized by fast flow, low viscosity, and strong adhesion to suit the packaging requirements of different applications. For instance, Henkel's LOCTITE series is used in mobile devices and automotive electronic equipment due to its fast processing and excellent thermal performance.

Edge bond underfills garner only a 35% share in the industry; hence, their use is becoming increasingly attractive in applications where only partial underfill is adequate or where cost-sensitive manufacturing is a priority. Edge bonding materials reinforce the chip or component perimeter, accordingly, providing merit in relatively benign environments or smaller package avenues. AIM Solder and Master Bond manufacture edge-bond alternatives for cost versus reliability applications, e.g., in consumer electronics and IoT devices.

In 2025, epoxy-based materials are projected to account for around 40% of the Industry and follow quartz/silicone materials, having around 15%. This hierarchy reflects the preferences of the industry in terms of performance characteristics, cost, and application-specific requirements.

Epoxy-based underfill compounds surpass other kinds of materials in mechanical strength, chemical resistance, and thermal stability. These adhesives create a perfect low coefficient thermal expansion (CTE) for solder joints in flip-chip as well as BGA packages, which gives the maximum efficiency in protecting solder joints from fatigue and delamination with the effect of thermal cycling.

Such significant features pose themselves in the most demanding applications: for example, in automotive electronics, in the infrastructure for 5G communications, and in aerospace applications, which have heightened reliability needs in a harsh environment.

Leading companies have developed custom epoxy formulations for advanced semiconductor packaging, including Henkel, NAMICS Corporation, and Panacol-Elosol GmbH. For instance, Henkel's LOCTITE Eccobond series is now mostly used in consumer electronics and telecom devices because of its superior flowability and cure speed in conditions of high-volume production.

Quartz/silicone-based underfills have at least a 15% share of the industry; however, it is such an incredibly blessed resource, as it is flexible along with excellent thermal conduction. These materials typically find use in very specific applications that require enhanced heat dissipation and flexibility, such as LED modules and sensors in automotive/military applications.

Silicone-based underfills have, for example, gotten a lot of appreciation for their temperature resistance quotient, under which they withstand high temperatures without cracks or loss of adhesion. The manufacturers Shin-Etsu Chemical and Dow supply custom silicone compositions at specialized interfaces between thermal interface and protection under delicate or high-temperature environments.

The competitive scenario for the industry consists of well-established manufacturers of chemicals and specialty materials. Henkel AG & Co. KGaA, Namics Corporation and the ASE Group account for the major share of the industry with state-of-the-art formulations meant to improve the reliability and durability of semiconductor packaging.

These companies have the R&D strength to innovate epoxy-based, capillary flow continuously, and no-flow underfills that give science to thermal cycling performance and mechanical strength in electronics. Their strong network of global supply chains further complements their strong rapport with semiconductor and electronics manufacturers to lead the industry.

MacDermid Alpha Electronic Solutions, Parker LORD Corporation, and H.B. Fuller Company compete with tailored solutions for miniaturized and high-performance electronic applications. They can formulate high-purity, low-stress underfill materials to satisfy the demand for advanced IC packaging, such as flip-chip and ball grid array (BGA) components. The sustainability goal of these companies lies in designing low-VOC and halogen-free materials that comply with high environmental regulations in key industries such as North America, Europe, and Asia.

Dow Inc., ELANTAS GmbH, and Zymet also distinguish themselves by investing in nanotechnology and next-generation polymer chemistries to enhance adhesion and thermal conductivity. These players emphasize customization and offer specialized underfill solutions for applications in automotive electronics, 5G infrastructure, and aerospace electronics. Their strategic partnerships with semiconductor foundries as well as contract manufacturers give them a competitive advantage in niche industries that require high-reliability materials.

Hitachi Chemical Co., Ltd., Panasonic Corporation, and AI Technology, Inc., and new entrants include Indium Corporation and YINCAE Advanced Materials, LLC, thus adding diversity to the industry by providing high-performance underfill materials designed for their specific applications. Investments by these players in process automation and AI-enabled material formulation allow consistent product quality as well as reliability in high-volume production.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Henkel AG & Co. KGaA | 15-19% |

| Namics Corporation | 12-16% |

| ASE Group | 10-14% |

| MacDermid Alpha Electronic Solutions | 8-12% |

| Parker LORD Corporation | 6-10% |

| Others (combined) | 30-40% |

| Company Name | Key Offering and Activities |

|---|---|

| Henkel AG & Co. KGaA | High-reliability epoxy-based underfills for advanced semiconductor packaging and miniaturized electronics. |

| Namics Corporation | No-flow and capillary underfill optimized for flip-chip and high-performance computing applications. |

| ASE Group | Integrated underfill solutions for semiconductor assembly, emphasizing durability as well as heat resistance. |

| MacDermid Alpha Electronic Solutions | Advanced polymer-based underfills for automotive, 5G, and aerospace electronic components. |

| Parker LORD Corporation | Environmentally friendly underfill adhesives with enhanced adhesion and shock resistance for sensitive electronic assemblies. |

Key Company Insights

Henkel AG & Co. KGaA (15-19%)

Top underfill solution supplier with high-performance products, including AI-formulated material integration for improved electronic durability and reliability.

Namics Corporation (12-16%)

Grows semiconductor packaging presence with ultra-low-stress underfill solutions targeting 5G and high-frequency applications.

ASE Group (10-14%)

Increasing supply chain integration through underfill formulation protection to increase flip-chip packaging efficiency and thermal stability.

MacDermid Alpha Electronic Solutions (8-12%)

Committed to sustainable underfill chemistries, meeting the demand for halogen-free and lead-free products in premium semiconductor packaging.

Parker LORD Corporation (6-10%)

Developing nanomaterial-enriched underfill solutions for increased adhesion and mechanical stress reduction in automotive and industrial electronics.

Other Key Players

The industry is estimated to be worth USD 362.9 million in 2025.

Sales are expected to grow to USD 597.7 million by 2035, supported by rising demand for compact, high-performance electronics in smartphones, automotive systems, and IoT devices.

China is leading the industry with a 7.5% growth rate, backed by its dominant electronics manufacturing base and growing semiconductor industry.

Capillary underfill materials are the dominant type, widely used for protecting solder joints and improving device reliability in advanced packaging applications.

Key companies include Henkel AG & Co. KGaA, Namics Corporation, ASE Group, MacDermid Alpha Electronic Solutions, Parker LORD Corporation, H.B. Fuller Company, Dow Inc., ELANTAS GmbH, Zymet, Hitachi Chemical Co., Ltd., Panasonic Corporation, AI Technology, Inc., Indium Corporation, Sanyu Rec Co., Ltd., Dymax Corporation, Epoxy Technology, Inc., Protavic International, and YINCAE Advanced Materials, LLC.

By product type, the industry is segmented into capillary and edge bonds.

By material type, the industry is categorized into quartz / silicone, alumina based, epoxy based, urethane based, acrylic based, and others.

By board type, the industry is segmented into CSP (chip scale package), BGA (ball grid array), and flip chips.

By region, the industry is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Drag Reducing Agent Market Growth 2025 to 2035

Countertop Market Size & Demand 2025 to 2035

Construction Polymer Market Trends - Growth, Demand & Forecast 2025 to 2035

Construction Aggregates Market Trends - Growth, Demand & Forecast 2025 to 2035

Condensing Unit Market Trends-Growth, Demand & Forecast 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.