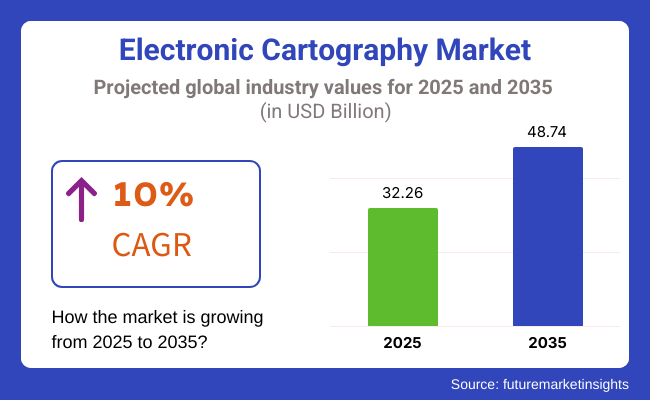

The electronic cartography market is set to witness gradual growth between 2025 and 2035, fueled by the growing demand for sophisticated navigation systems, GIS-based analytics, and AI-based mapping solutions. The industry is expected to reach USD 32.26 billion in 2025 and expand to USD 48.74 billion by 2035, reflecting a compound annual growth rate (CAGR) of 10% during the forecast period.

With the rapid development of smart cities, autonomous vehicles, and geospatial intelligence-based applications, electronic cartography is gaining importance as a vital component for real-time mapping, maritime, and precision agriculture.

The intersection of cloud-based GIS platforms, satellite imagery, and machine learning-driven cartographic solutions is also accelerating industry penetration even more.3D mapping technologies, augmented reality (AR) navigation, and blockchain-based geospatial data management are also driving innovation in the industry.

Defense and commerce are more dependent on this industry to navigate, transport, and monitor-increased development in AI, predictive analysis, and real-time processing powers more informed decision-making. Investment in space-based cartographic technology and government policy initiatives for geospatial infrastructure are further fuelling industry growth, cementing this industry as a leading contributor to digital transformation.

Explore FMI!

Book a free demo

The industry is expanding fast due to the increasing demand for the, most accurate, live mapping solutions in various areas like marine, aerospace & defense, automotive, and government. The marine part is the most important thing for data loggers because of the high level of data accuracy and the actual updates to promote safety in navigation.

The aerospace and defense departments are governed by rules and are also interested in the integration of modern navigation systems for the implementation of crucial missions. The automotive sector highlights cost and ease of use as vital purchase criteria since this industry is significantly used in the GPS and autonomous driving systems. State bodies put particular emphasis on strictly following rules and the precision of data for the purposes of arranging urban space and managing disasters.

The emergence of artificial intelligence and cloud computing has led to further innovation such as the introduction of real-time analytics and predictive mapping capabilities. With the increase in the digital change, the need for the high-definition electronic cartography solutions is also expected to grow considerably.

| Company | Contract Value (USD Mn) |

|---|---|

| Garmin Ltd. | Approximately USD 90 - USD 100 |

| Navionics (A Garmin Company) | Approximately USD 80 - USD 90 |

| C-MAP (Navico Group) | Approximately USD 70 - USD 80 |

| Maxar Technologies | Approximately USD 100 - USD 110 |

During 2020 to 2024, the industry grew at a high pace as industries such as maritime navigation, aviation, defense, and self-driving transportation adopted digital mapping technology. Increased reliance on GPS-enabled navigation, real-time geospatial processing, and AI-assisted mapping technologies created demand for this industry.

Governments and other organizations committed to mapping technology for the online world to enhance situational awareness, route optimization, and compliance with evolving safety guidelines. Smart urban planning and driverless transport promoted the use of high-accuracy maps even faster, integrating AI-driven terrain studies with real-time natural environment inputs.

When these technologies became mature, unreliable data risks, security threats, and expensive installations made widespread application exorbitant. The enterprises engaged in AI-driven mapping, blockchain-based protection of geospatial data, and cloud-based cartography platforms eschewed such risks.

Between 2025 and 2035, this industry will transform using AI-powered autonomous mapping, quantum-safe geospatial encryption, and decentralized ecosystems of mapping.AI-based real-time mapping will enhance autonomous vehicle, drone, and shipping fleet navigation accuracy. Quantum computing will enhance geospatial data encryption so that ultra-secure transmission of critical mapping information takes place.

Blockchain-based decentralized cartography will provide tamper-proof navigation data, reducing cyber risk and data tampering threats. Satellite-enabled IoT and edge computing will rise with the capacity to offer real-time updates in extremely dynamic environments, improving predictive route planning. Sustainability will take center stage with AI-optimized mapping reducing fuel consumption in transportation and promoting green navigation methods.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tightened geospatial data privacy laws (GDPR, CCPA, IMO ECDIS standards) pushed electronic cartography vendors to better encrypt data, satellite integrity, and compliance programs. | AI-driven, blockchain-based geospatial mapping solutions secure real-time regulation compliance, distributed data verification, and tamper-evident cartographic reports for defense, aviation, and maritime navigation. |

| AI-driven cartography streamlined routing planning, computed terrain analysis, and improved real-time navigation technologies. | AI-born, self-improving mapping engines create high-definition topographic maps, forecast environmental shifts, and deliver AI-based situational awareness for intelligent navigation. |

| Companies embraced cloud cartography platforms for real-time, scalable access to geospatial data and collaboration. | AI-powered, decentralized mapping systems offer lightning-fast data synchronization, predictive spatial analytics, and auto-updating digital twins for real-time geographic intelligence. |

| Maritime sectors moved to ECDIS for digital navigation, improving safety, efficiency, and compliance with IMO standards. | AI-driven, autonomous shipping navigation systems use real-time hydrographic information, AI-based risk analysis, and predictive ocean charts for future-generation ship routing. |

| AR and 3D mapping enhanced situational awareness in aviation, urban planning, and the military. | AI-based, real-time holographic mapping systems facilitate immersive geospatial visualization, AI-augmented reconnaissance, and adaptive terrain analysis for defense and disaster response. |

| Satellite data processing via AI enhanced the accuracy of land use monitoring, environmental monitoring, and disaster management. | AI-based, autonomous satellite mapping solutions interpret real-time hyperspectral images to facilitate AI-driven predictive climate intelligence and geospatial awareness on a planetary level. |

| Geospatial cyberthreats increased to the point where AI-based threat detection, end-to-end encryption-based mapping products, and encrypted digital cartography became necessary. | AI-born, quantum-safe cartographic platforms automatically identify mapping irregularities, neutralize GPS spoofing attacks, and provide real-time, tamper-evident geospatial data protection. |

| 5G-based digital mapping minimized latency for live navigation, fleet tracking, and smart city development. | AI-based, 6G-supported geospatial networks support ultra-low latency, real-time autonomous navigation of vehicles, AI-supported urban planning, and intelligent, predictive mobility planning. |

| Firms optimized geospatial analytics to minimize data processing power consumption and improve environmental monitoring. | Carbon-aware, AI-driven cartographic systems combine eco-mapping, intelligent land-use analysis, and climate forecasting to fuel sustainable urbanization and preservation. |

| Companies investigated blockchain-based geospatial data systems for secure, transparent, and tamper-proof mapping records. | Decentralized, AI-enhanced cartography solutions provide tamper-proof ownership of geographic data, trustless validation of maps, and AI-powered predictive modeling for autonomous navigation systems. |

The industry is considered to be at risk with regards to data being accurate, cybersecurity threats, regulatory compliance, and technological advancements. It is necessary to address these risks so to keep the integrity and security of the navigation, maritime, and aviation systems intact.

The major problems that arise are the lack of data accuracy and real-time updates. Electronic cartography uses satellite imagery, the geographic information system (GIS), and digital mapping technologies. Errors or obsolete data could cause maritime navigation hazards, operational inefficiencies, and safety risks for marine transportation, aviation, and defense.

Cybersecurity threats are yet another problem that is in the way. The latest electronic charts are not just standalone devices but work with cloud-based systems, GPS navigation, and IoT connections. They are thus open to cyberattacks like cloud splicing, data breaches, and device manipulations.

A single security hole in the charting system can cause military, commercial shipping, and air incidents as well. The only solution lies in strong encryption, multiple authentication access, and real-time monitoring.

Regulatory compliance is yet another impediment. The industry should follow international maritime (IMO ECDIS regulations), aviation (ICAO standards), and defense protocols. Not fulfilling these statuary obligations could format a risk for regulatory fines, operational losses, and reputational damage.

Besides, another issue is the technological antiquation which could occur because of the development of AI, the increased reality (AR), and the real-time data analytics. Thus, the companies are required to foresee continuous upgrades of their mapping solutions, in order to outmatch the competition.

The industry is dominated by the commercial sector, which represents 65% of the total industry. This segment is receiving a boost from the increasing adoption of digital navigation systems in shipping, aviation, and autonomous vehicles. For instance, the maritime industry has long since transitioned from paper charts to the use of electronic navigational charts (ENCs), with the International Maritime Organization (IMO) ECDIS mandate further driving this behavior.

Garmin, Navionics, and C-MAP (another Navico brand) are big players in this field providing advanced marine navigation systems with up-to-date information. In flight, as we have them in aviation, such as through Honeywell or Thales systems for flight management (FMS) paired with electronic cartography are provided, adding awareness of the flight on the map.

The penetration of AI-based mapping and navigation solutions triggers the growth of this sector toward cloud-enabled mapping, which is a growing trend in commercial areas. Other industries, like oil & gas exploration and commercial fishing, also utilize electronic cartography for better route optimization and geospatial analysis.

The defense sector accounts for 35% of the industry and is mainly propelled by applications such as military navigation, battlefield management, and surveillance. New projects tap into different usages of digital mapping, leveraging artificial intelligence (AI) to create highly precise digital maps for various defense applications, including tactical navigation systems, mission planning, and real-time situational awareness.

Modern warfare and intelligence operations demand the adoption of Geographic Information Systems (GIS), satellite-based navigation, or AI-enhanced cartography.

Leading defense contractors are also investing in advanced geospatial intelligence (GEOINT) platforms that combine real-time satellite imagery with it. These contractors numerically scale from Raytheon Technologies all the way to Lockheed Martin or even BAE systems. Industry growth is mainly attributed to the increasing budgets of the USA Department of Defense (DoD), European Space Agency (ESA), and NATO on digital navigation and geospatial intelligence solutions.

The navigation charts segment holds the top industry share of 55%. This growth is primarily supported by the increasing adoption of electronic navigational charts (ENCs) in commercial and defense applications. Commercial vessels are mandated by the International Hydrographic Organization (IHO) and respective national maritime authorities to ink in digital navigation charts, driving wider adoption.

Navionics (Garmin), C-MAP, and Transas (Wärtsilä) were all at the cutting edge of marine navigation chart pole position, providing real-time charts, tide predictions, and AI-optimized seafloor mapping. Defense organizations use dedicated military-grade mapping platforms like those offered by companies like Esri and Maxar Technologies for satellite-based intelligence mapping of mission-critical operations.

45% of the industry is held by navigation systems, including GPS-based electronic chart systems, FMS (flight management system), military navigation aids, and so on. This segment is expanding as companies seek integrated navigation in commercial shipping, aviation, and autonomous vehicles.

Important companies like Garmin, Honeywell Aerospace, and Thales offer advanced navigational systems for maritime, aviation, and defense applications. Thus, AI is transforming the navigation systems segment with the evolution of AI-driven navigation tools, predictive route optimization, and real-time data integration. As the investment in autonomous and AI-enabled defense systems ramps up, the industry for navigation systems will continue to evolve with new technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 10.2% |

| China | 10.9% |

| Germany | 9.7% |

| Japan | 10.1% |

| India | 11.4% |

| Australia | 9.9% |

The USA industry is growing rapidly with increasing demand for premium navigation solutions, maritime security capabilities, and GIS-based maps. The transport, marine, and defense sectors of the USA utilize it in developing situational awareness, optimizing supply chain management, and generating more efficient route planning.

Continued investment in AI geospatial analytics, cloud-enabled cartography products, and live digital mapping maintains the demand for this industry. During 2024, the USA geospatial industry alone spent more than USD 15 billion in digital mapping and cartography facilities. FMI is of the opinion that the USA industry is slated to grow at 10.2% CAGR during the study period.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| AI-Based Navigation and Geospatial Intelligence Development | Expansion in the usage of digital maps for defense, transportation, and intelligent city purposes. |

| Cloud-Based Cartography and Real-Time Mapping Technology | AI-empowered GIS technologies improve scalability, accuracy, and situational awareness. |

| Increased Applications in Maritime, Aeronautical, and Ground Navigation | Cartography is empowered by electronic cartography, which improves route planning, fleet monitoring, and terrain assessment. |

The Chinese industry is increasing with emerging digital mapping solutions, expanding deployments of AI-enabled navigation systems, and government-endorsed projects for intelligent infrastructure. As the world's largest geospatial intelligence industry, China is witnessing increasing demand for this industry for defense, maritime, and urban planning purposes.

The government initiative of indigenous mapping technology and space-based geospatial solutions has also driven industry expansion. China invested USD 18 billion in this industry and AI-based geospatial intelligence in 2024. FMI is of the opinion that the Chinese industry is slated to grow at 10.9% CAGR during the study period.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Support for Smart Infrastructure and Digital Mapping | High-resolution cartography policies drive adoption. |

| Emergence of AI and Satellite Navigation Solutions | Greater application of GIS mapping in defense, logistics, and autonomous systems. |

| Greater Need for Secure and Reliable Mapping Data | This industry improves urban planning, environmental monitoring, and land-use management. |

The German industry is picking up pace with its robust industrial landscape, growing adoption of digital navigation technologies, and emphasis on regulatory compliance and information security.

Germany, one of Europe's prime technology hubs, is funding this industry for intelligent mobility, defense, and real-time navigation. The nation's emphasis on GDPR-compliant geospatial services has boosted upgradation by organizations and government agencies. FMI is of the opinion that the German industry is slated to grow at 9.7% CAGR during the study period.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| High Demand for High-Precision Digital Mapping in Defense and Transportation | German companies utilize this industry for logistical and tactical planning. |

| Growing Use of AI-Based Mapping and GIS-Based Analytics | Encouraging investment in AI-based cartographic solutions for autonomous vehicles and urban planning. |

| Secure and Encrypted Geospatial Data Management | Increased adoption of GDPR-compliant cartography for mapping and tracing. |

Japan's industry is growing with the help of developments in autonomous vehicle navigation, AI-driven GIS applications, and maritime and aviation mapping. Japan's technology industry applies this industry in smart city planning, environment monitoring, and accurate agriculture.

AI-driven navigation and high-speed digital mapping have propelled the expanding use across various industries in Japan. FMI is of the opinion that the Japanese industry is slated to grow at 10.1% CAGR during the study period.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Integration of AI in Real-Time Map and Navigation Solutions | Japan is a leader in AI-based geospatial intelligence for smart transportation and infrastructure planning. |

| Development in Digital Twin Technology and City Planning Solutions | Increased demands for digital maps to design cities and respond to disasters. |

| Development in Satellite Imagery and Cloud-Based GIS Solutions | A higher application of electronic mapping for high-density maps and topography. |

India's industry is expanding at high speed with investment from geospatial technology, satellite navigation, and government 'smart city' plans. 'Digital India' and Geographic Information System supported by artificial intelligence fuel transportation, defense, and climate observation needs.

The expansion of domestic geospatial companies and artificial intelligence-supported mapping solutions add to faster growth. FMI is of the opinion that the Indian industry is slated to grow at 11.4% CAGR during the study period.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Government Initiatives for Digital Mapping and Intelligent City Planning | Pro-Aircraft navigation and geospatial-based service emergence. |

| Expansion of AI-Powered Navigation and Location-Based Services | Adoption of GIS mapping to increase speed with real-time traffic monitoring, tracking, vehicle fleet, and city planning. |

| Growing Demand for Scalable, Cost-Effective Geospatial Solutions | Application of cloud-based cartography platform by business firms and government agencies. |

Australia's industry is gradually expanding due to growing investments in mapping solutions based on AI, geospatial intelligence from satellites, and secure digital navigation. Various Australian sectors, such as transportation, defense, and agriculture, use this industry solutions for enhanced asset tracking, environment monitoring, and route optimization.

Australia's focus on smart infrastructure and AI-based geospatial services continues to fuel the adoption of advanced cartographic solutions. FMI is of the opinion that the Australian industry is slated to grow at 9.9% CAGR during the study period.

Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Government Initiatives in Favor of AI-Based Geospatial Intelligence and Digital Mapping | Pro-mapping policies in real-time fuel expansion. |

| Wireless GIS Solutions and New AI-Based Navigation | Growing use of geospatial analytics to enable precision farming, disaster relief, and defense planning. |

| Growing Cloud-Based Scalable Cartography Solutions Demand | Firms utilize AI-based cartographic platforms for automation, analytics, and geospatial decision-making. |

The industry is widening due to the increased adoption of digital mapping solutions, advanced navigation systems, and AI-based geographic data analytics by industries such as marine, aviation, defense, and automotive. It also enriches real-time geospatial intelligence, route optimization, and situational awareness for mission-critical and commercial applications.

The industry is dominated by leading players such as Garmin, Navionics, Maxar Technologies, and TomTom NV, which have high-precision digital mapping, cloud-based navigation platforms, and AI-based geospatial analytics. Niche and startup makers are innovating in the development of customized GIS solutions along with real-time data integration, which is necessary for cost-effective mapping approaches for emerging applications.

The evolution of this industry occurs with the increasing penetration of cloud-based GIS platforms, AI-powered geospatial modeling, and real-time mapping updates via IoT and satellite networks. Companies are making investments in autonomous navigation solutions as well as in 3D cartography and blockchain-based data security in order to enhance map accuracy and data integrity.

Certain strategic factors intensify competition, such as the increased demand for smart city mapping, increased investments in geospatial intelligence from defense, and expansion of electronic navigation systems in autonomous vehicles.

Businesses are aligning with the above strategic factors for their enhanced industry position, which includes a scalable mapping approach, cyber-security-enhanced cartography platforms, and integration with AR for next-generation digital mapping experiences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Garmin Ltd. | 20-25% |

| Navionics (Garmin) | 15-20% |

| Maxar Technologies | 10-15% |

| TomTom NV | 8-12% |

| Honeywell Aerospace | 5-10% |

| Thales Group | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| Garmin Ltd. | Advanced marine and aviation navigation systems with real-time mapping capabilities. |

| Navionics (Garmin) | AI-powered marine cartography and automated route planning solutions. |

| Maxar Technologies | High-resolution satellite imagery and geospatial data solutions for defense and commercial applications. |

| TomTom NV | AI-driven automotive navigation systems and cloud-based mapping services. |

| Honeywell Aerospace | Avionics and navigation systems with integrated real-time geospatial intelligence. |

| Thales Group | Defense-grade electronic cartography solutions for mission-critical applications. |

Key Company Insights

Garmin Ltd. (20-25%)

Garmin is a leader in this industry, with high-performance navigation systems, real-time mapping, and AI-based geospatial analytics.

Navionics (Garmin) (15-20%)

Navionics specializes in marine cartography and is known for its AI-powered route optimization and mapping solutions for commercial and recreational navigation.

Maxar Technologies (10-15%)

Maxar provides high-resolution satellite imagery and geospatial intelligence for defense, commercial, and research purposes.

TomTom NV (8-12%)

TomTom provides AI-based automotive navigation, cloud-based mapping services, and traffic analytics for smart mobility.

Honeywell Aerospace (5-10%)

Honeywell provides avionics and integrated geospatial intelligence solutions for aviation navigation and situational awareness.

Thales Group (4-8%)

Thales offers defense-grade electronic cartography solutions with precise geospatial information for military and critical infrastructure operations.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in this industry by integrating AI-driven mapping, cloud-based geospatial analytics, and IoT-enabled GIS solutions. The increasing adoption of real-time navigation, smart city planning, and autonomous vehicle geospatial intelligence continues to shape the competitive landscape of the industry.

The industry is slated to reach USD 32.26 billion in 2025.

The industry is predicted to reach a size of USD 48.74 billion by 2035.

Key companies include BAE Systems, Raytheon Technologies, Esri (Environmental Systems Research Institute), Fugro NV, Hexagon AB, Garmin Ltd., Navionics (Garmin), Maxar Technologies, TomTom NV, Honeywell Aerospace, Thales Group, and others.

India, with a CAGR of 11.4%, is expected to record the highest growth during the forecast period.

Navigation charts and navigation systems are among the most widely used segments of the industry.

By end user, the industry is divided into commercial and defense.

In terms of components, the industry includes navigation charts and navigation systems.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.