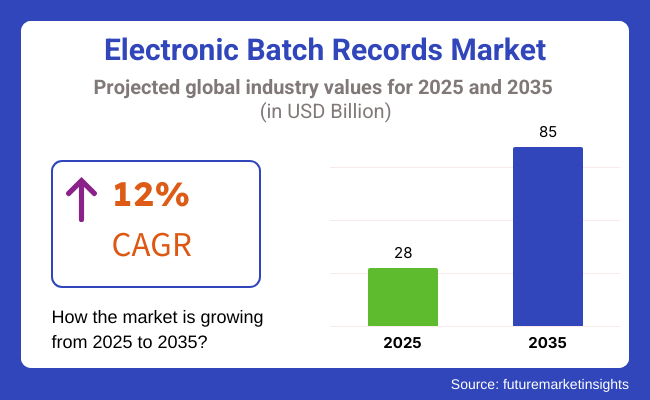

The electronic batch records market is set to grow to USD 28 billion in 2025 and grow to USD 85 billion by 2035, at a CAGR of 12% through the forecast period. Organizations are increasingly implementing AI-based electronic batch records (EBR) solutions, cloud-based documentation, and real-time compliance monitoring solutions to improve manufacturing effectiveness and regulatory compliance. Investments in digital transformation, automated quality monitoring, and GMP-compliant data management will also fuel industry growth.

Companies utilize electronic batch records to power manufacturing operations, enhance traceability, and facilitate regulatory compliance with strict standards. AI-powered analytics, blockchain-protected record maintenance, and IoT-enabled production monitoring will make real-time tracking and automation even better.

Implementation of electronic batch record (EBR) is revolutionizing manufacturing businesses by adding efficiency, regulatory compliance ease, and data accuracy automation. Being overlapped by AI, blockchain, and IoT-driven automation, pharmaceutical, life science, and automotive company businesses are optimizing production processes and reducing operational risk.

Explore FMI!

Book a free demo

The electronic batch records (EBR) is one of the segments that has been following the upward graph due to the growing regulatory requirements and the necessity for data accuracy across sectors including pharmaceuticals, food & beverage, chemicals, and biotechnology. Pharmaceutical companies and biotechnology firms are particularly concerned about regulatory compliance, data accuracy, and automation for the purpose of adhering to stringent industry standards.

Food and beverage manufacturers keep cost-effectiveness and user-friendliness as the primary objective to guarantee trouble-free installation in the production process. The chemical industry is more inclined to automation and security to optimize operational efficiency and prevent unauthorized access to sensitive data.

Across all sectors, utilization of cloud-based EBRs is on the rise due to the need for real-time monitoring of data, less paperwork, and enhanced efficiency. EBR solutions are not just getting improved due to progress in AI and IoT but also have predictive analytics and easy interfacing with other enterprise systems.

| Company | Contract Value (USD Mn) |

|---|---|

| Emerson and Siemens | Approximately USD 150 - USD 200 |

| ABB and Lonza Group | Approximately USD 100 - USD 120 |

| Honeywell International and Pfizer | Approximately USD 130 - USD 150 |

During the period 2020 to 2024, the e-batch records (EBR) market grew extensively as pharmaceutical, biotech, and food manufacturing firms embraced digital technologies for utmost compliance and efficiency. The companies changed from paper-based to cloud-based and AI-based EBR solutions with improved data integrity, reduced errors, and continuous regulatory compliance. The COVID-19 pandemic hastened this shift, with more emphasis on remote access and digitalization.

Compliance requirements like FDA 21 CFR Part 11 and GMP fueled demand for secure, automated batch records. AI-facilitated data validation, real-time tracking, and cloud-based integration with ERP and MES systems maximized batch production efficiency and audit readiness. Although, data security compromises, interoperability issues, and resistance from people slowed adoption, thus the investments went to AI-based cybersecurity and blockchain-secured EBR platforms.

Between 2025 and 2035, predictive analytics based on AI, quantum-resistant cryptography, and decentralized data exchange will revolutionize the EBR marketplace. AI batch monitoring will enhance predictive quality control, minimizing deviations and guaranteeing maximum consistency. Quantum computing will enhance the security of data, while blockchain will enable immutable audit trails for compliance purposes.

IoT and edge computing will provide intelligent manufacturing to guarantee maximum real-time monitoring of manufacturing and process optimization. Sustainability will be at the centre, with resource planning based on AI reducing wastage and digital twins simulating batch processes to prevent risks prior to implementation.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter compliance rules (FDA 21 CFR Part 11, EU Annex 11, GMP) compelled pharma and biotech companies to transition from paper-based batch records to computer-based systems for enhanced traceability and compliance. | Artificial intelligence-enabled, blockchain-protected EBR platforms provide real-time compliance to regulations, audit trails automation, and distributed validation for tamper-proof integrity of batch records in all industries. |

| AI-enabled EBR solutions automated data entry, identified anomalies, and optimized batch release processes for fewer errors and plant holdups. | AI-given, self-learning EBR environments enable predictive batch analytics, automated deviation discovery, and instant quality optimization for advanced pharmaceutical and biotech production. |

| Firms embraced cloud-hosted EBRs due to scalability, access to real-time data, and intuitive integration with enterprise resource planning (ERP) and manufacturing execution systems (MES). | Decentralized AI-driven EBR architectures support real-time cross-site batch synchronization, predictive compliance monitoring, and AI-driven resource optimization for optimized manufacturing processes. |

| IoT-connected sensors and real-time monitoring equipment integrated with EBRs, allowing for automated data capture and real-time batch monitoring. | AI-based, edge-native EBR solutions automatically handle IoT-driven process validation, optimize batch production in real time, and offer AI-augmented manufacturing decision-making. |

| Manufacturers used digital twins to virtually test batch processes for quality control prior to implementation. | AI-powered, real-time digital twin EBR environments facilitate autonomous predictive batch changes, self-adjusting manufacturing processes, and AI-optimized production yield predictions. |

| Businesses deployed multi-factor authentication (MFA), encrypted data storage, and AI-powered anomaly detection to safeguard sensitive batch records. | AI-native, quantum-secure EBR solutions detect cyber threats independently, block unauthorized access, and validate tamper-proof, real-time compliance in regulated manufacturing facilities. |

| 5G networks made it possible to have improved batch record synchronization to facilitate real-time monitoring and prompt decision-making in global manufacturing plants. | AI-driven, 6G-powered EBR platforms facilitate real-time processing of data, speed-of-light validation processes, and AI-driven risk assessment in real time for automated compliance handling. |

| Manufacturers calibrated EBR models to minimize paper usage, conserve power-guzzling data storage, and maximize green manufacturing processes. | AI-based, carbon-smart EBR platforms incorporate cloud computing, which is energy efficient, predictive maintenance for green manufacturing, and AI-driven workflow optimization to reduce ecological footprint. |

| Blockchain-enabled EBRs enabled tamper-evident audit trails to support transparent and immutable record-keeping for regulatory bodies. | AI-based, decentralized EBR systems facilitate trustless batch verification, predictive compliance audits with AI, and automated regulatory reporting in real-time for international manufacturing traceability. |

| Firms applied AI-based automation to batch processing, minimizing human involvement and maximizing quality control. | AI-based, autonomous EBR systems use self-learning algorithms, real-time AI-based corrective actions, and adaptive compliance frameworks to facilitate problem-free, error-free batch production. |

The electronic batch records market carries various risks from the compliance with regulations and security of data to the integration of systems and adoption by users. Risks of these kinds are to be managed for an efficient, accurate, and global acceptance in the industry.

One of the most serious problems within the EBR industry is the adherence to regulations. Industries such as pharmaceuticals, biotechnology, and food production, which are under very strict rules, such as the FDA 21 CFR Part 11 or the EU Annex 11, require electronic records to be strictly controlled. Non-compliance could result in heavy fines, audits, and the loss of business credibility.

Another major risk is concerned with data security and cyber threats. Since the EBR systems carry sensitive manufacturing and quality control data, they are generally the targets of cyberattacks, data breaks, or system failures.

Additionally, one of the biggest risk is the system integration challenges. The EBR solutions must connect smoothly with other systems such as ERP (Enterprise Resource Planning), MES (Manufacturing Execution Systems), and QMS (Quality Management Systems). Low integration may result in elaborate processes like data inconsistencies, workflow disruptions, and increased operational costs.

On top of that, user resistance and training requirements are the reasons for the slow rate of adoption. Staff members are used to the paper records and find digital systems more complex and cumbersome, leading to errors and inefficiency. Companies should promote through comprehensive training programs to use an interface that is friendly to the user, thereby encouraging successful adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 9.8% |

| UK | 9.5% |

| European Union | 9.6% |

| Japan | 9.7% |

| South Korea | 9.9% |

The USA industry is one of the foremost industries, and pharma, biotech, and manufacturing companies are adopting digital solutions to ensure higher levels of compliance, easy documentation, and increased efficiency. Companies implement AI-based EBR solutions, which automate recording, reduce man-made errors, and ensure compliance. Growing business for cloud-based EBR solutions, real-time monitoring, and secure data storage drive the growth of the industry.

The USA industrial, life sciences and healthcare sectors implement electronic batch records to put an end to paper-based procedures and increase traceability-also, regulatory instructions prompt organizations to invest in secure and FDA-compliant solutions for EBR. FMI is of the opinion that the USA industry is slated to grow at 9.8% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| AI-powered EBR systems | Organizations save time and errors through automatic record-keeping and compliance with regulations. |

| Cloud-based solutions | Firms invest in secure data storage and real-time monitoring. |

| Regulatory support | FDA regulations propel the use of electronic batch records. |

The industry expands as pharmaceutical and manufacturing companies adopt cloud-based EBR solutions to achieve maximum operational efficiency. Companies adopt EBR platforms to ensure data integrity, automate compliance reporting, and reduce manufacturing cycle times.

Increased reliance on digital transformation, AI-powered analytics, and paperless manufacturing fuels industry expansion. In addition, regulatory environments enabling GMP compliance and data protection propel the adoption of advanced electronic batch records.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Digital transformation | Upgraded manufacturing procedures with AI-fueled analytics. |

| Cloud-based EBR platforms | Companies streamline efficiency and automate reporting requirements. |

| GMP compliance regulations | Regulatory protocols trigger the use of secure electronic batch records. |

The industry grows as AI-powered compliance tracking, automated documentation, and cloud-based execution systems for manufacturing are implemented across industries. The industry is controlled by Germany, Italy, and France, as these countries implement EBR solutions across pharmaceutical production and industrial quality checks.

The regulatory standards in the EU are rigorous, and the companies are compelled to invest in GDPR-enabled and automatic EBR platforms. In addition, growth in IoT and blockchain technology leads to greater deployment of digital batch records in regulated industries. FMI is of the opinion that the European Union industry is slated to grow at 9.6% CAGR during the study period.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| AI-powered compliance | Automated monitoring raises regulatory compliance to a new level. |

| Cloud-based deployment | Electronic batch records make industrial and pharma quality control easy. |

| GDPR-compliant solutions | Companies invest in secure EBR platforms to comply with strict EU regulations. |

The Japanese industry expands as companies adopt AI-driven batch tracking, real-time quality control, and paperless documentation solutions. Companies develop advanced EBR platforms to enhance traceability, ensure regulatory adherence, and automate production processes.

Japan's focus on precise manufacturing and digitalization drives the expansion of advanced EBR systems. Furthermore, the pharmaceutical, electronics, and chemical manufacturing sectors invest in cloud-based EBR systems to enhance productivity and data security. FMI is of the opinion that the Japanese industry is slated to grow at 9.7% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Batch tracking using AI | Enables traceability and regulatory compliance in manufacturing. |

| Cloud-based documentation | Paperless documentation simplifies processes and reduces complexity. |

| Digital transformation | Japan's precision manufacturing focus promotes EBR adoption. |

The South Korean industry has grown exponentially with the adoption of AI-based documentation, automated compliance solutions, and cloud-based batch processing by manufacturers. Digital transformation initiatives are supported by the government, promoting EBR adoption in the pharmaceutical and industrial sectors.

Producers embed AI-powered analytics, real-time production monitoring, and blockchain-enabled security functionalities to render manufacturing traceable. 5G connectivity and cybersecurity propel the industry growth further. FMI is of the opinion that the South Korean industry is slated to grow at 9.9% CAGR during the study period.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| AI-based documentation | Production monitoring and compliance are boosted by automation. |

| Blockchain security | Enhances traceability and data integrity. |

| 5G-based EBR solutions | Efficiency and real-time monitoring are enhanced through high-speed connectivity. |

Based on the industry outlook, the industry is further segmented into pharmaceuticals and life sciences, where pharmaceuticals dominate as the most prominent for compliance with strict regulatory and high production complexity measures. By 2025, pharmaceuticals will hold 65% of the industry share, and life sciences will account for 35%. The expansion across both industries is spurred on by the growing use of digital solutions for manufacturing efficiency and compliance.

Because of stringent regulations like the FDA’s 21 CFR part 11, where electronic records should be kept in an electronic form, and the EMA’s Annex 11, a regulation regarding computerized systems in manufacturing, pharmaceuticals have the largest use of electronic batch record solutions. More regulations mean companies need to adopt strong digital solutions for data integrity, traceability, and compliance.

Leading EBR solution providers that cater to pharmaceutical companies, which provide the manufacturing life-cycle from raw materials to finished goods and warehousing, offering an integrated solution ensuring compliance with the FDA and other regulatory authorities are Siemens (Opcenter Execution Pharma) Werum PAS-X (Körber Group): It is a popular MES software, used by many pharmaceutical giants that provides real-time batch tracking capabilities, helping to reduce human errors and increases production efficiency.

Rockwell Automation also provides EBR offerings in combination with its FactoryTalk Pharma Suite for process automation of pharmaceutical facilities. As a cloud-based EBR solution, MasterControl may be particularly flexible for pharmaceutical contract manufacturers (CMOs).

As batch process efficiency, decrease in paper-based errors, and the need for improving productivity have become vital for pharmaceutical manufacturers, EBR systems have emerged as an invaluable solution. Pharma companies such as Pfizer, Novartis, and Merck adopted Digital Transformation, blending Electronic Batch Records with AI-driven predictive analytics for operational and production efficiency in drug manufacturing.

This demand has accelerated significantly since the pandemic and is further driving the adoption of EBR (Electronic Batch Record) solutions in pharmaceutical manufacturing.

EBR systems are being adopted in areas such as biotechnology, medical devices, and clinical research to streamline and standardize data management. It is, however, quite adopted less compared to pharmaceutical drugs, so chalk out to a mere 35% industry share by 2025.

Biotech organizations are adopting EBR solutions to improve the accuracy of batch records to bring complex therapies especially biologics and cell & gene therapies. Some of the top players in this space include Dassault Systèmes (BIOVIA Discoverant), which is a popular choice among biotech product firms and combines EBR with predictive analytics capabilities to optimize process performance.

POMS Corporation - MES and EBR solutions for biotech, personalized medicine. Oracle Health Sciences has cloud-based solutions that bring together EBR clinical research and drug development. Life sciences firms closely utilize SAP (SAP Digital Manufacturing Cloud) to govern batch records and embed automation for compliance.

The electronic batch records (EBR) market seems to be on the rise, bringing new developments to pharmaceutical, biotechnology, and other manufacturing companies to increase their compliance, efficiencies, and data integrity, all via digital solutions. With EBR, production workflow, regulatory documents, and quality control processes can be restructured within the manufacturing process, reducing the observer proportion of manual error and improving multiple aspects of traceability.

Leaders in the industry space, such as SAP, Rockwell Automation, Emerson Electric, and Sparta Systems, offer cloud-based EBR platforms integrated with AI-automated features and complete MES. Meanwhile, startup and niche providers are targeting such segments by focusing on ease-of-use-oriented, economically viable digital batch processing and compliance-driven solutions for small and mid-sized manufacturers.

Industry evolution is also driven by increased adoption of Industry 4.0 as well as real-time data analytics for predictive quality assurances and very stringent regulatory requirements such as FDA 21 CFR Part 11 compliance. To enhance operational transparency and efficiency, companies invest in blockchain-based records authentication, IoT-enabled production monitoring, and AI-based automation of batch release.

Such strategic factors are partially contributing to increasing competition in the industry- the transition to paperless manufacturing, the heightened need for supply chain traceability, and growing digital transformation initiatives in life sciences. Thus, organizations are investing in scalable cloud solutions, cybersecurity-enhanced EBR platforms, and cross-functional data integration, especially for industry positioning and spurring innovation in digital batch record management.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| SAP SE | 20-25% |

| Rockwell Automation | 15-20% |

| Emerson Electric Co. | 12-17% |

| Sparta Systems (Dassault Systèmes) | 8-12% |

| MasterControl | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| SAP SE | Provides AI-driven digital batch record solutions, cloud-based data storage, and regulatory compliance tools. |

| Rockwell Automation | Develops real-time production monitoring, automated documentation, and process control solutions. |

| Emerson Electric Co. | Specializes in manufacturing execution systems (MES), AI-powered analytics, and workflow automation. |

| Sparta Systems (Dassault Systèmes) | Focuses on digital quality management, regulatory tracking, and cloud-based EBR solutions. |

| MasterControl | Offers automated document control, real-time batch record processing, and compliance management tools. |

Key Company Insights

SAP SE (20-25%)

SAP leads this industry for EBR by providing AI batch record solutions, cloud regulatory compliance, and integrated data management tools.

Rockwell Automation (15-20%)

Rockwell Automation enhances the manufacturing process through real-time production monitoring, automated batch processing, and workflow optimization.

Emerson Electric Co. (12-17%)

Emerson Electric Co. specializes in manufacturing execution systems, AI predictive analytics, and digital transformation solutions for batch processing.

Sparta Systems (Dassault Systèmes) (8-12%)

Sparta Systems provides digital quality management, cloud batch recordkeeping, and AI advisories on regulatory compliance.

MasterControl (5-9%)

MasterControl is an automated document control, real-time batch record processing, and industry compliance tool provider.

Other Key Players (20-30% Combined

The electronic batch records market will continue to grow as industries integrate AI, cloud computing, and real-time data tracking to optimize compliance, improve efficiency, and enhance production processes.

The industry is slated to reach USD 28 billion in 2025.

The industry is predicted to reach a size of USD 85 billion by 2035.

The key players of this industry include SAP SE, Rockwell Automation, Emerson Electric Co., Sparta Systems (Dassault Systèmes), MasterControl, Honeywell Process Solutions, Siemens AG, Oracle Corporation, Werum IT Solutions (Körber) & LZ Lifescience.

South Korea, with a CAGR of 9.9%, is expected to record the highest growth during the forecast period.

The pharmaceutical segment is widely being used in the industry.

By End User, the industry is divided into pharmaceuticals, life sciences, automobiles, and others.

By region, the industry spans North America, Latin America, Asia Pacific, the Middle East & Africa, and Europe.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.