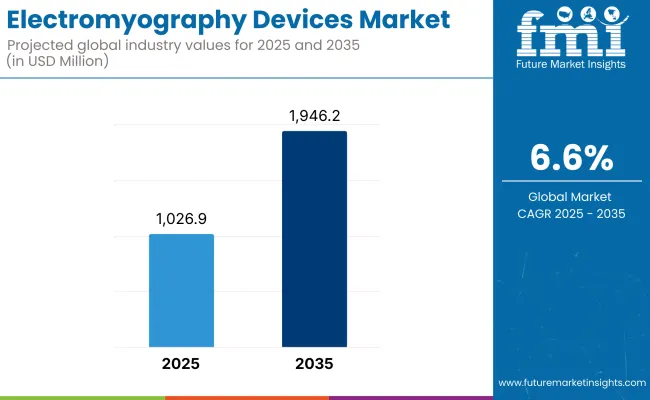

The global market for electromyography devices is forecasted to attain USD 1,026.9 million by 2025, expanding at 6.6% CAGR to reach USD 1,946.2 million by 2035. In 2024, the revenue of Electromyography Devices was around USD 965.4 million

The increasing global burden of neurological diseases, particularly in aging populations, is prompting greater reliance on EMG studies for early diagnosis and patient monitoring. Furthermore, technological advancements such as wireless and portable EMG systems, miniaturized sensors, and integration with digital health platforms are enabling broader accessibility across clinical, academic, and home-care settings are the leading factors that drive the market growth.

Telemedicine and remote monitoring trends are also boosting interest in user-friendly and wearable EMG systems, particularly for rehabilitation and chronic condition management. In research, EMG is being utilized in neurophysiology, ergonomics, and human-machine interface studies. While adoption may be challenged by the high cost of EMG systems and the requirement for trained personnel to interpret results, industry players are addressing these hurdles through automation.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,026.9 Million |

| Industry Value (2035F) | USD 1,946.2 Million |

| CAGR (2025 to 2035) | 6.6% |

North America remains the leading region in the EMG devices market, attributed to its highly advanced healthcare infrastructure, early adoption of innovative neurodiagnostic technologies, and widespread awareness of neuromuscular disorders. The United States, in particular, benefits from a strong network of neurology clinics, academic medical centers, and rehabilitation institutions that routinely employ EMG for diagnostic and therapeutic applications.

Robust reimbursement policies under Medicare and private insurers also support wider clinical use. The region has also seen a surge in demand for wireless and portable EMG devices used in outpatient settings, sports performance labs, and remote rehabilitation programs.

Ongoing investments in research and development, coupled with increasing integration of EMG in wearable are expected to sustain growth. Canada mirrors these trends on a smaller scale, with federal healthcare support helping expand access to EMG diagnostics across urban and regional centers. Together, these factors reinforce North America’s position as a hub for EMG innovation and adoption.

Europe presents a robust and steadily growing market for EMG devices, supported by an aging population, expanding healthcare coverage, and greater awareness of neurological and musculoskeletal health. Countries such as Germany, France, the UK, and Italy have well-established neurodiagnostic services and are experiencing increased demand for EMG-based assessments in both inpatient and outpatient care.

The EU's focus on early diagnosis and chronic disease management is contributing to the integration of EMG into broader neurology and physical therapy frameworks. In physiotherapy, the use of portable EMG systems is growing as practitioners seek objective metrics for muscle activation and rehabilitation progress.

Reimbursement policies in many European nations cover EMG evaluations under national health plans, although access may vary in rural or under-resourced regions. The emphasis on post-acute care and rehabilitation following strokes, orthopedic surgeries, and neurological injuries is creating new opportunities for EMG implementation.

Furthermore, academic and clinical research collaborations across Europe are advancing the development of software-enabled EMG analysis tools, which enhance diagnostic accuracy and reduce clinician workload.

The Asia Pacific region is emerging as the fastest growing EMG devices market, driven by improving healthcare infrastructure, growing prevalence of neurological conditions, and rising demand for early diagnostic technologies. Countries such as China and India are investing heavily in upgrading diagnostic capabilities at public and private hospitals, with EMG being introduced in tertiary care centers, neurology clinics, and rehabilitation units.

The increase in diabetes and other chronic diseases that can lead to peripheral neuropathy is creating a growing need for EMG diagnostics. Meanwhile, countries like Japan and South Korea already known for high healthcare standards are incorporating EMG into post-operative and geriatric rehabilitation programs.

There is also significant interest in wearable EMG systems among Asia’s expanding physical therapy and sports performance sectors. Startups and medical device manufacturers in the region are focusing on affordable, compact EMG solutions suitable for widespread adoption, including mobile applications and Bluetooth-enabled systems.

Though the market faces challenges like uneven reimbursement and limited trained professionals in rural areas, targeted government initiatives and cross-border collaborations are expected to accelerate growth and improve accessibility.

Comprehensive Analysis of Challenges Impacting the Electromyography Devices Market

One of the primary challenges in the EMG devices market is the high initial cost of equipment, particularly advanced systems with multi-channel capabilities, wireless sensors, and integrated software analytics. These capital-intensive solutions may be out of reach for smaller clinics, especially in emerging markets. Additionally, the operation and interpretation of EMG require skilled professionals, such as neurologists and trained electrophysiologists, who are in limited supply in many regions.

Inconsistent reimbursement policies also create disparities in access, with coverage often dependent on diagnosis, geography, or type of healthcare provider. Technical limitations, such as motion artifacts and signal noise, can affect data reliability especially in dynamic or ambulatory testing conditions.

Furthermore, variability in international clinical protocols for EMG can result in inconsistent application and diagnostic interpretation. Addressing these challenges requires investments in training, affordable device innovation, and global standardization of clinical guidelines and reimbursement policies.

Emerging Opportunities and Innovations Driving Growth in the Electromyography Devices Market

The EMG devices market is rich with opportunities for innovation and expansion. As rehabilitation moves toward home-based and decentralized care, there is growing demand for compact, user-friendly EMG systems that can monitor patient progress remotely. Wearable EMG solutions with wireless transmission and cloud-based analytics are particularly attractive in sports science and physical therapy, offering real-time feedback for training optimization and recovery tracking.

Another major opportunity lies in integrating EMG with advanced devices to assist clinicians in automated signal interpretation, anomaly detection, and predictive analytics. This can help overcome the current shortage of specialized personnel while improving diagnostic speed and accuracy. Additionally, EMG’s application in neuroprosthetics, robotics, and human-computer interaction is expanding, opening new frontiers in assistive technologies and rehabilitation engineering.

Collaborations between medtech companies, rehabilitation centers, and research institutions are also facilitating the development of multifunctional devices that combine EMG with electroencephalography (EEG), kinematics, and virtual reality platforms for immersive therapy and research applications.

The major trend is the utilization of EMG signals in the development of neuroprosthetics and human-computer interaction systems. Surface EMG is increasingly being used to control prosthetic limbs, exoskeletons, and communication aids for individuals with physical impairments.

Advanced algorithms are translating muscle intentions into smooth, real time actions, creating more intuitive and responsive assistive technologies. This trend is expanding EMG’s utility from diagnostics into therapeutic and functional enhancement applications, offering a new dimension of opportunity for device manufacturers, rehabilitation specialists, and biomedical engineers alike.

From 2020 through 2024, the global Electromyography Devices market experienced steady growth, driven by the increasing prevalence of neuromuscular disorders, advancements in healthcare infrastructure, and a growing emphasis on early diagnosis and treatment of neurological conditions.

The growth was supported by technological advancements in EMG devices, including the development of portable and wireless systems that enhance diagnostic accuracy and patient comfort. However, challenges such as high costs associated with advanced devices and the need for specialized training to operate EMG equipment have impeded broader market expansion during this period

Looking ahead to 2025 to 2035, the EMG devices market is poised for continued growth, propelled by ongoing technological innovations, increased investment in healthcare infrastructure, and a growing emphasis on personalized medicine.The development of next-generation EMG devices with enhanced functionalities, such as integration of real-time data analysis, is expected to improve diagnostic capabilities and patient outcomes.

Additionally, expanding applications of EMG devices in sports medicine and rehabilitation, along with increasing awareness of neuromuscular disorders, are anticipated to drive market growth

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Implementation of guidelines ensuring the safety and efficacy of EMG devices, leading to standardized protocols and usage regulations. |

| Technological Advancements | Introduction of portable and wireless EMG devices with improved functionalities, enhancing diagnostic accuracy and patient comfort. |

| Consumer Demand | Increased adoption of EMG devices among healthcare providers, driven by the need for accurate diagnosis of neuromuscular disorders and monitoring of rehabilitation progress. |

| Market Growth Drivers | Rising prevalence of neuromuscular disorders, advancements in healthcare infrastructure, and a shift towards early diagnosis and treatment of neurological conditions. |

| Supply Chain Dynamics | Dependence on specialized suppliers for high-quality components, with efforts to localize production to mitigate supply chain disruptions observed during global events. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Continuous monitoring and potential harmonization of regulations across countries to balance patient safety with technological innovation, alongside expedited approval processes for novel EMG technologies addressing unmet medical needs. |

| Technological Advancements | Development of next-generation EMG devices incorporating AI and machine learning algorithms for real-time data analysis, improving diagnostic precision and enabling personalized treatment plans. |

| Consumer Demand | Growing preference for non-invasive and user-friendly EMG devices, driven by patient-centric approaches and the expansion of telemedicine services, leading to widespread adoption across diverse healthcare settings. |

| Market Growth Drivers | Expansion of healthcare services in emerging markets, increasing investments in medical research and development, continuous technological innovations enhancing EMG device capabilities, and a global emphasis on personalized medicine and rehabilitation. |

| Supply Chain Dynamics | Strengthening of local manufacturing capabilities through technological advancements and strategic partnerships, leading to reduced dependency on imports, improved supply chain resilience, and the ability to rapidly respond to emerging healthcare needs. |

Market Outlook

The USA is the leading market for electromyography devices, driven by a strong prevalence of neuromuscular disorders, robust rehabilitation infrastructure, and increasing use of EMG in sports medicine, orthopedics, and pain management. The demand is also fueled by the expansion of outpatient neurophysiology labs and growing use of portable EMG systems for remote diagnostics and research.

Market Growth Factors

Market Forecast

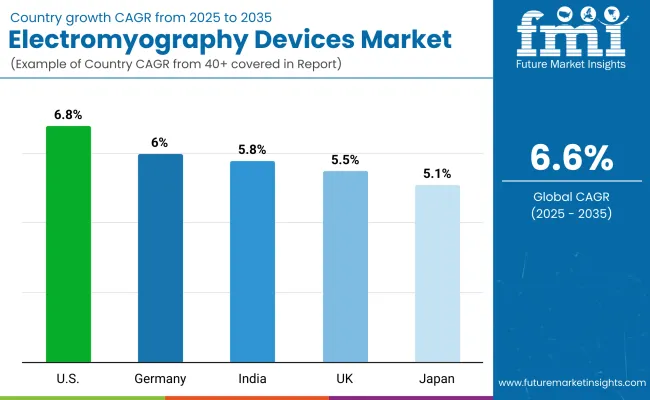

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.8% |

Market Outlook

Germany’s EMG devices market is well-established, supported by a mature healthcare system, strong demand for neurodiagnostics, and growing use of EMG in clinical rehabilitation and academic research. German hospitals and specialty neurology centers are adopting high-precision EMG systems for motor neuron disease diagnostics and intraoperative neurophysiological monitoring.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.0% |

Market Outlook

India’s EMG devices market is expanding rapidly, driven by the increasing incidence of neuromuscular and metabolic conditions, expanding neuro-diagnostics infrastructure in urban centers, and the rising demand for cost-effective portable EMG solutions. While penetration remains limited in rural areas, growth is strong in neurosciences hospitals, teaching institutions, and sports therapy centers.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.8% |

Market Outlook

Japan’s EMG devices market is advancing steadily, supported by a high demand for neuromuscular diagnostics in the elderly, growing use in stroke and spinal cord injury rehab, and strong academic interest in biomechanics and neurophysiology research. Japanese hospitals are also leveraging EMG as part of robotic-assisted rehabilitation and motor learning therapy.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 5.1% |

Market Outlook

The United Kingdom’s EMG devices market is growing steadily, with rising clinical demand for nerve conduction studies and EMG assessments in both public and private neurology services. EMG is increasingly used for diagnosis of peripheral neuropathy, radiculopathies, and muscular dystrophies, along with growing application in occupational health and sports rehab.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

EMG Machines (Standalone & Portable Systems)

EMG machines are used to record electrical activity of skeletal muscles and assess neuromuscular abnormalities, such as neuropathies, myopathies, and motor neuron diseases. These devices are essential in neurology, orthopedics, rehabilitation, and pain management specialties.

The market for EMG machines is driven by the increasing prevalence of neurological disorders, such as ALS, carpal tunnel syndrome, and muscular dystrophy, alongside rising demand for point-of-care diagnostics. Standalone systems are primarily used in hospital-based neurophysiology labs, while portable EMG machines are gaining popularity among rehabilitation clinics, sports medicine centers, and home-based care providers.

North America and Europe lead the market due to strong neurological healthcare infrastructure and reimbursement support. Future innovations include AI-powered EMG interpretation, wireless EMG systems, and integration with motion capture technologies for functional muscle assessment.

Electrodes (Surface and Needle Electrodes)

Electrodes are vital accessories for EMG procedures, categorized into surface electrodes (non-invasive) and needle electrodes (used for invasive, localized recordings). Surface electrodes are widely used in physical therapy, sports science, and rehabilitation, while needle electrodes are essential for clinical diagnostics of deep muscle conditions.

The growing adoption of non-invasive diagnostics, rising use of wearable EMG tech in research and sports medicine, and increased demand for disposable electrodes to prevent cross-contamination are fueling market growth.

Asia-Pacific is witnessing robust expansion in this segment, driven by growing investment in rehabilitation and diagnostics. Future trends include biocompatible, flexible electrodes, dry electrodes for long-term monitoring, and textile-based EMG sensors for smart wearables.

Hospitals and Neurology ClinicsLeading the Electromyography Devices Landscape

Hospitals and neurology clinics remain the primary end-users of EMG devices, particularly for comprehensive neurodiagnostic evaluations, intraoperative neuromonitoring, and post-stroke rehabilitation assessment. These settings benefit from multi-channel EMG systems integrated with nerve conduction velocity (NCV) tools, enabling detailed motor and sensory function analysis.

The rising incidence of neurodegenerative diseases and trauma cases, coupled with greater awareness and physician specialization, supports strong demand in this segment.

North America, Western Europe, and Japan dominate usage in hospital settings. Future innovations include EMG systems with cloud-based storage, real-time data sharing, and AI-assisted diagnostic decision support.

Growing Demand for Electromyography Devices in Rehabilitation Centers and Sports Medicine Clinics

EMG is increasingly utilized in musculoskeletal rehab and performance optimization, allowing therapists and trainers to quantify muscle activation, identify imbalances, and tailor therapy regimens. This end-user segment is growing due to rising sports injuries, post-operative rehabilitation programs, and preventive care trends among aging populations.

Portable and wireless EMG systems are particularly in demand in this setting, enabling dynamic muscle testing during exercise or therapy. The USA, Germany, and South Korea are among the early adopters of EMG for sports and rehab. Future trends include EMG-integrated biofeedback platforms, tele-rehab compatible EMG systems, and data analytics for long-term functional tracking.

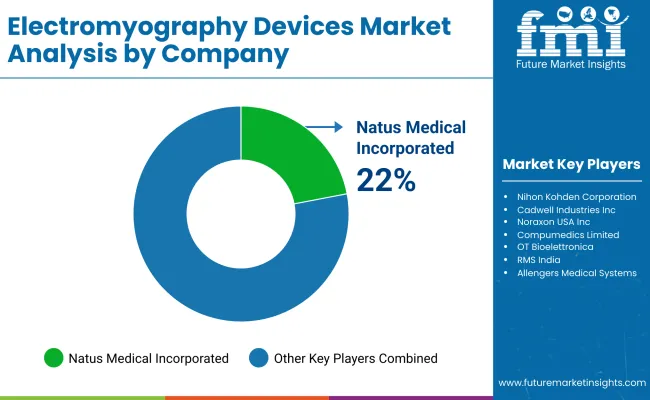

The electromyography (EMG) devices market is competitive and steadily growing, fueled by rising neuromuscular disorder diagnoses, increased use of EMG in sports medicine and rehabilitation, and technological advancements in wireless and portable EMG systems.

The demand is supported by applications in clinical diagnostics, physiotherapy, orthopedics, and neurological research. The market comprises established medical device manufacturers, diagnostic technology companies, and neurophysiology solution providers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Natus Medical Incorporated | 22-26% |

| Nihon Kohden Corporation | 18-22% |

| Cadwell Industries, Inc. | 12-16% |

| Noraxon USA Inc. | 8-12% |

| Compumedics Limited | 5-9% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Natus Medical Incorporated | Offers EMG and nerve conduction study (NCS) systems integrated with neurology diagnostic platforms. |

| Nihon Kohden Corporation | Provides comprehensive EMG solutions with advanced signal accuracy and user-friendly interfaces. |

| Cadwell Industries, Inc. | Develops portable and multi-channel EMG systems for use in clinical neurophysiology and intraoperative monitoring. |

| Noraxon USA Inc. | Specializes in wireless surface EMG systems for biomechanics, sports science, and rehabilitation. |

| Compumedics Limited | Offers neurodiagnostic solutions with EMG modules tailored for sleep and neurology research applications. |

Other Key Players (25-35% Combined)

Other companies contributing to the electromyography devicesmarket include:

These companies offer innovative EMG solutions ranging from basic diagnostic systems to advanced wireless platforms suited for clinical, research, and performance monitoring environments.

EMG machine and Accessories

Hospitals, Neurological Clinics, Rehabilitation Centers, Sports Medicine Clinics, and Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for electromyography devices market was USD 1,026.9 million in 2025.

The electromyography devices market is expected to reach USD 1,946.2 million in 2035.

Increasing prevalence of conditions like muscular dystrophy, multiple sclerosis, carpal tunnel syndrome, and ALS (amyotrophic lateral sclerosis) is likely to drive the demand for EMG devices during the forecast period.

The top key players that drives the development of Electromyography Devices market are, Natus Medical Incorporated, Nihon Kohden Corporation, Cadwell Industries, Inc., Noraxon USA Inc. and Compumedics Limited.

EMG machine in product type of electromyography devices market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Modality, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Modality, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Modality, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Modality, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Modality, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Modality, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Modality, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Modality, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Modality, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Modality, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Modality, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Modality, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Modality, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Modality, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Modality, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Modality, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Modality, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Modality, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Modality, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Modality, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FBAR Devices Market

Snare devices Market

C-Arms Devices Market Size and Share Forecast Outlook 2025 to 2035

Timing Devices Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Spinal Devices Market Size and Share Forecast Outlook 2025 to 2035

Hearing Devices 3D Printing Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Market Size and Share Forecast Outlook 2025 to 2035

Network Devices Market Size and Share Forecast Outlook 2025 to 2035

Medical Devices Secondary Packaging Market Analysis by Material and Application Through 2035

Hearable Devices Market Size and Share Forecast Outlook 2025 to 2035

Lab Chip Devices Market Size and Share Forecast Outlook 2025 to 2035

Orthotic Devices, Casts and Splints Market Size and Share Forecast Outlook 2025 to 2035

Lacrimal Devices Market Size, Trends, and Forecast 2025 to 2035

Global Ablation Devices Market Trends - Growth, Innovations & Forecast 2025 to 2035

Orthotic Devices, Splints & Orthopedic Braces Market Analysis - Trends & Forecast 2024 to 2034

Ear Tube Devices Market

Pathology Devices Market Size and Share Forecast Outlook 2025 to 2035

Neurotech Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Strapping Devices Market Trends - Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA