There is stable growth in the electrohydraulic pump market owing to growing demand in industrial automation, electric vehicles (EVs), & construction equipment. The electrohydraulic pump industry is estimated to rise from USD 1.47 billion in 2025 to USD 2.71 billion by 2035 with a CAGR of 5.5% due to rising demand in manufacturing, aerospace, defense, and automotive end-users.

In 2024, the electrohydraulic pump industry experienced a gradual growth due to heightened adoption in industrial automation, electric vehicles (EVs), and construction equipment. The trend toward efficient and intelligent hydraulic systems was apparent in North America and Europe, as stricter emission norms drove businesses to replace conventional hydraulic pumps with electrohydraulic alternatives.

Key trends in the survey indicate a move toward energy-efficient and smart hydraulic systems, with industries emphasizing precision control, lower emissions, and greater operational efficiency. In North America and Europe, strict environmental standards are driving the high adoption rate of electrohydraulic systems for conventional hydraulic pumps owing to their lower energy usage and a decrease in carbon footprint.

On the other hand, Asia-Pacific is experiencing rapid industrial growth, where countries such as China, Japan, and South Korea are investing heavily in factory automation and EV manufacturing, further driving demand.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1.47 billion |

| Market Size (2035F) | USD 2.71 billion |

| CAGR (2025 to 2035) | 5.5% |

Explore FMI!

Book a free demo

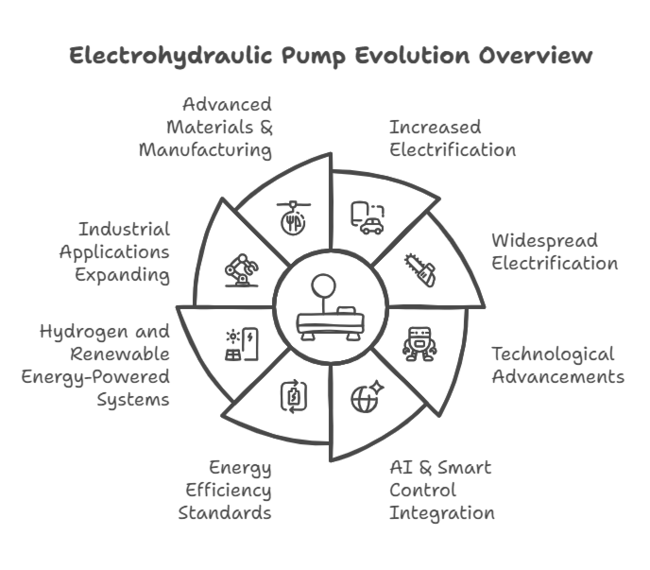

| 2020 to 2024: Foundations & Growth | 2025 to 2035: Future Innovations |

|---|---|

| Increased Electrification: Rising adoption in EVs, hybrids, and industrial machinery. | Widespread Electrification: Expanding into heavy industries (construction, agriculture, marine). |

| Technological Advancements: BLDC motors, variable speed drives for efficiency. | AI & Smart Control Integration: Predictive maintenance, IoT-enabled performance monitoring. |

| Energy Efficiency Standards: Regulatory push for low-emission, high-efficiency solutions. | Hydrogen and Renewable Energy-Powered Systems: More sustainable EHP applications. |

| Industrial Applications Expanding: Adoption in automation, robotics, and aerospace. | Advanced Materials & Manufacturing: 3D printing, solid-state hydraulics for lightweight, high-performance systems. |

| Industry Shift from Traditional Hydraulics: Transition from mechanical to electrohydraulic solutions. | Energy-Recycling Systems: More regenerative and self-sustaining EHPs. |

Efficiency & Performance

Regional Variance

High Variance Across Regions

Diverging Views on ROI

Consensus

Regional Variance

Shared Challenges

Regional Differences

Manufacturers

End-Users

Alignment Across Regions

Regional Investment Trends

High Consensus

Key Variances

| Countries/Region | Regulatory Impact on Electrohydraulic Pumps |

|---|---|

| United States | EPA energy efficiency regulations and CAFE fuel economy standards encourage electrohydraulic steering and braking systems in vehicles. OSHA workplace safety laws drive adoption of safer, more efficient hydraulic systems in industrial applications. |

| United Kingdom | UK Net Zero Strategy promotes low-emission industrial machinery and vehicle electrification, increasing demand for efficient electrohydraulic pumps. Post-Brexit CE/UKCA certification requirements impact manufacturers. |

| Germany | Industry 4.0 policies push for smart, IoT-enabled electrohydraulic systems. EU Ecodesign and energy efficiency laws drive demand for low-power hydraulic solutions in manufacturing and automotive sectors. |

| France | EU Green Deal regulations and CO₂ reduction targets encourage energy-efficient industrial hydraulic systems. Government support for sustainable mobility boosts demand in electric and hybrid vehicle applications. |

| Italy | EU machinery safety and emission directives require advanced, eco-friendly hydraulic solutions. Industrial modernization programs support automation in manufacturing. |

| Australia & NZ | Mining and agricultural safety regulations drive demand for rugged, high-efficiency electrohydraulic pumps. Energy conservation laws promote adoption of low-power hydraulic systems. |

| China | Dual Carbon Goals (Carbon Peak by 2030, Neutrality by 2060) enforce energy-efficient industrial automation. New Energy Vehicle (NEV) regulations accelerate electrohydraulic adoption in electric vehicles. |

| South Korea | Green Growth policies and Smart Factory initiatives encourage advanced electrohydraulic systems. Stringent industrial safety standards drive the demand for high-precision, reliable pumps. |

| Japan | Top Runner energy efficiency program mandates low-energy hydraulic solutions. Smart manufacturing incentives encourage integration of electrohydraulic pumps in industrial automation. |

Leading players in the electrohydraulic pump (EHP) industry are battling on a platform of pricing policies, innovation, strategic alliances, and international growth. While others are targeting the cost leadership path by providing reasonably priced but highly efficient EHP solutions for volume industry applications, others are aiming at high-performance premium products focused on EVs, industrial automation, and heavy machinery.

Innovation is also a battleground where leading companies are heavily investing in AI-based predictive maintenance, IoT-based monitoring, and emerging materials like graphene and silicon-based thermoelectric materials to increase efficiency and longevity.

To fuel growth, businesses are aggressively venturing into Asia-Pacific's emerging markets, Latin America, and Eastern Europe, where demand for affordable electrohydraulic solutions is increasing. In countries with stringent environmental regulations, companies are emphasizing low-emission and sustainable EHP technologies to meet government policies. R&D spend is also another key growth pillar, with dominant players innovating energy-saving, modular, and AI-enabled electrohydraulic systems to address the varied requirements of electric mobility.

Bosch Rexroth AG

Estimated Industry Share: ~15-20%

Reasoning: Bosch Rexroth, a subsidiary of Robert Bosch GmbH, is a global leader in hydraulic and electrohydraulic technologies. Its acquisition of HydraForce in 2023 strengthened its compact hydraulics portfolio, particularly in North America and Asia. The company’s focus on smart, energy-efficient pumps for industrial and mobile applications gives it a significant edge.

Parker Hannifin Corporation

Estimated Industry Share: ~12-15%

Reasoning: Parker Hannifin is a major player in motion and control technologies, including electrohydraulic pumps. Its NX8M series (launched in 2024) targets compact construction vehicles, and its broad presence in automotive and aerospace sectors bolsters its market position.

Eaton Corporation PLC

Estimated Industry Share: ~10-12%

Reasoning: Eaton’s expertise in power management and hydraulics extends to electrohydraulic solutions for industrial and mobile equipment. Its focus on energy efficiency and electrification aligns with market trends, securing a strong share.

Moog Inc.

Estimated Industry Share: ~8-10%

Reasoning: Moog specializes in high-precision electrohydraulic systems, particularly for aerospace, defense, and industrial automation. While its market is niche, its technological leadership ensures a solid presence.

Danfoss Power Solutions

Estimated Industry Share: ~7-9%

Reasoning: Danfoss excels in mobile hydraulics and electrification, offering electrohydraulic pumps for construction, agriculture, and marine applications. Its innovation in variable displacement pumps contributes to its competitive share.

Depending on their motor types, the electrohydraulic pumps are of different types, each suited for specific applications. Permanent magnet motors are more compact and efficient than their AC or DC counterparts, and thus, they are preferred for electric power steering and automotive applications.

It delivers a higher torque density and improved thermal performance. Variable displacement pumps offer a dynamic way to control flow rate, which allows for lowered power usage, greater energy efficiency, and reduced heat generation. Their ability to adjust makes them valuable in industrial automation in which hydraulic circuits and mobile machinery subjected to fluctuating load conditions.

Several industries use electrohydraulic pumps in a variety of applications. In modern vehicles, EPS (Electric Power Steering) has been gradually replacing traditional hydraulic steering systems. Industrial automation widely uses electrohydraulic circuits and systems for motion tasks like pressing, molding, and lifting, which require precise control of fluid power.

Industries such as aerospace, mining, and heavy equipment heavily utilize them, as they require consistent hydraulic power. Growing emphasis on lightweight materials in automotive and aerospace sectors will boost demand for the advanced hydraulic system.

Electrohydraulic pumps are an essential component in various transport and heavy equipment applications. Electrohydraulic pumps are essential for efficient operation in even the most challenging environments for construction equipment like excavators, loaders, and cranes. The transition to hybrid and electric construction equipment is driving the demand for sophisticated hydraulic technologies.

The same goes for agricultural implements like tractors, harvesters, sprayers, etc., which benefit from electrohydraulic systems to enable precision and automated farming. Electric hydraulics are enhancing productivity in smart agriculture as the demand for these systems continues to grow.

Power-Lift System and Closed Loop partners are now driven by this demand to further develop and differentiate their options over others. The rising adoption of electric and hybrid vehicles has propelled the demand for electrified hydraulic steering and braking systems.

The evolution of energy-efficient hydraulic solutions in line with demand for electric power steering driven by the USA government's initiative to reduce carbon emissions is anticipated to influence industrial applications positively.

Another major driver of segment growth is the construction industry, supported by infrastructure development projects. In the USA, companies such as Parker Hannifin, Eaton, and Honeywell play a leading role, concentrating on research and development (R&D).

FMI opines that the United States electrohydraulic pump sales will grow at nearly 5.9% CAGR through 2025 to 2035.

Key Trends In the UK, the automotive and industrial automation industries are the key contributors to the electrohydraulic pump sector. With the government promoting sustainability in transport through electrification initiatives, the ongoing vehicle electrification and growth in the electric and hybrid vehicle sector is generating demand for power steering systems that use electrohydraulic technology.

Electrohydraulic pumps are also extensively utilized in wind turbines and hydroelectric power stations, which support the growth of the renewable energy sector, thereby driving segment growth. Leading manufacturers such as IMI Precision Engineering and Moog Inc. are heavily investing in research to introduce high-efficiency hydraulic systems.

FMI opines that the United Kingdom electrohydraulic pump sales will grow at nearly 5.1% CAGR through 2025 to 2035.

The service battery industry for electric vehicles, which is used in automotive applications in automotive applications such as engine configurations for hybrid electric vehicles and launch control systems for Formula One racers, forms a notable segment in France’s electrohydraulic pump industry, which is intertwined with its automotive, aerospace, and industrial automation verticals.

Automakers are focusing on a move into electric and hybrid vehicles, which use electrohydraulic braking and steering systems, including automakers such as Renault and Peugeot. Airbus is another big customer in the aerospace industry consumes a large quantity of electrohydraulic pumps that are used in systems that actuate aircraft landing gears and control surfaces.

FMI opines that the France electrohydraulic pump sales will grow at nearly 5.2% CAGR through 2025 to 2035.

Germany is among the top markets for electrohydraulic pumps because of its robust automotive, industrial, and construction sectors. Germany is the home of giant automakers like BMW, Mercedes-Benz, and Volkswagen, and so far has moved aggressively to include electrohydraulic power steering systems on next-gen vehicles. Industrial sectors use hydraulic actuators and pumps, including valves, in a wide variety of applications for factory automation and robotics.

Companies such as Bosch Rexroth, Siemens, and Voith are investing heavily in efficient hydraulic solutions with digital control systems. Renewable energy projects in Germany are spurred by an increased demand for electrohydraulic solutions.

FMI opines that the Germany electrohydraulic pump sales will grow at nearly 6.0% CAGR through 2025 to 2035.

The Italian sector for electrohydraulic pumps is powered by its robust manufacturing, automotive, and construction sectors. The Italian manufacturers Interpump Group and Duplomatic lead the way when it comes to hydraulic innovations. With the country’s determination for precision manufacturing and automation, demands for hydraulic control systems in industrial machinery have increased.

Within the automotive industry, brands like Ferrari, Fiat, and Lamborghini are adding electrohydraulic steering and braking systems to their high-performance cars.

Another major sector is construction, where hydraulic excavators, cranes, and lifting equipment are used in major infrastructure projects. Italy’s agricultural sector also heavily depends on hydraulically driven agricultural machinery.

FMI opines that the Italy electrohydraulic pump sales will grow at nearly 4.8% CAGR through 2025 to 2035.

The electrohydraulic pump industry in South Korea is closely related to the automotive, shipbuilding, and industrial automation sectors. The inductive demand for electrohydraulic steering and braking systems is being driven by leading automotive manufacturers, such as Hyundai and Kia. South Korea’s world-leading shipbuilding industry, which includes Samsung Heavy Industries and Hyundai Heavy Industries, depends on hydraulic control systems for steering and cargo-handling operations.

The South Korean government is investing in smart factory initiatives which helps to increase the demand for automated hydraulic systems in manufacturing. The country’s growing robotics sector is integrating precision-controlled electrohydraulic actuators into state-of-the-art automation for a new generation of high-end systems.

FMI opines that the South Korea electrohydraulic pump sales will grow at nearly 6.0% CAGR through 2025 to 2035.

The automotive, robotics, and heavy machinery verticals back up the electrohydraulic pumps industry in Japan. Japanese automakers such as Toyota, Honda, and Nissan are taking the lead in the evolution toward electrified and hybrid vehicles that require sophisticated electrohydraulic steering and braking systems.

Companies like Fanuc and Yaskawa typically drive the robotics industry, which includes hydraulically driven robotic arms and industrial automation. Japan's construction equipment sector heavily relies on hydraulic solutions for excavators, loaders, and cranes. The electrohydraulic systems segment's integration with these innovations for predictive maintenance and smart automation is also gaining traction in this country.

FMI opines that the Japan electrohydraulic pump sales will grow at nearly 5.3% CAGR through 2025 to 2035.

The largest consumer and producer of electrohydraulic pumps is China, fueled by its automotive, construction, and industrial sectors. As the production of electric vehicles accelerates, electrohydraulic power steering and braking systems are seeing increased adoption from manufacturers such as BYD and NIO in efforts to improve energy efficiency. Massive infrastructure projects power the construction industry, which depends on hydraulically driven heavy machinery.

Hydraulic-driven heavy machines like excavators, cranes, and road pavers. Domestic enterprises such as SANY and XCMG have been continuously investing in hydraulic research, striving to optimize system efficiency. Machine and control with digitalization powered by AI/IoT is the next trend of digital transformation for industrial automation in China.

FMI opines that the China electrohydraulic pump sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The construction and mining industries propel the electrohydraulic pump landscape in Australia and New Zealand. Australia has some of the largest mining sector depends on electrohydraulic solutions for drilling, excavation, and transport machinery.

Tractors, harvesters, and irrigation systems powered by hydraulics are critical to agriculture in both New Zealand and Australia. Rising focus on sustainable technologies is further supporting the uptake of electrohydraulic pumps in renewable energy projects.

Urban construction projects are also driving a high demand for hydraulic-driven main machinery. Growing government regulations on energy-efficient industrial equipment would propel manufacturers to invest in next-generation electrohydraulic systems, consume less fuel and produce lower carbon emissions.

FMI opines that the Australia & New Zealand electrohydraulic pump sales will grow at nearly 4.7% CAGR through 2025 to 2035.

The electrohydraulic pump sector is in line for strong growth, fueled by trends toward electrification, automation, and sustainability. The automotive industry, particularly electric and hybrid vehicles, offers a significant opportunity for electrohydraulic steering and braking systems.

Growing construction and mining activities are driving demand for hydraulic-driven heavy equipment, especially in Asia-Pacific and North America. Moreover, smart factories and industries are compelling IoT-integrated hydraulic solutions to improve efficiency and predictive maintenance.

To leverage these opportunities, pump manufacturers need to concentrate on making energy-efficient, digitally controlled pumps. R&D investments in AI-based diagnostics and high-performance, lightweight materials can also enhance the competitiveness.

Furthermore, venturing into growing industries such as India and Southeast Asia, where infrastructure development is thriving, will fuel long-term growth. Sustainability-oriented innovations will also meet stringent global energy standards.

The electrohydraulic pump industry belongs to the automation and industrial machinery sector, directly associated with the automotive, construction, aerospace, agriculture, and manufacturing industries. It is driven by mega infrastructural expenditures, vehicle production, and the expanding use of automation technologies. Faced with competition in the capital goods market, its demand comes from these very factors.

The global economy is one factor driving the sector from a macro-economic perspective. As we witness growth in various economies along with increasing investments in smart factories, electrification, and automation. Increasingly stringent sustainability and carbon reduction policies are driving the transition to electrified and hybrid vehicles which drives the demand for electrohydraulic power steering and braking solutions.

The sector also faces challenges over prices of raw materials and supply chain disruptions, as well as over geopolitical tensions that impact global trade. The cost of steel, aluminum and electronic components is on the rise, and that can affect production costs.

Scenarios where electrohydraulic pumps can primarily be utilized are (automotive systems (such as electric power steering and braking); industrial automation; construction and agricultural machinery; aerospace applications). They allow for exact fluid power management, enhancing efficiency in heavy-duty machinery and robotic manufacturing operations.

These are designed to minimize energy waste by adjusting hydraulic power according to requirements. Then also, these advanced models utilize variable displacement technology and electronic controls that dynamically regulates flow rates, thus reducing energy consumption, minimizes heat generation as well as better efficiency of the whole system.

The growing uptake of hybrid and electric vehicles, the move to automation of production, and the demand for energy efficient hydraulic solutions are some of the main driving factors. Moreover, the development of IoT-integrated hydraulic systems and the government initiatives regarding emissions are also anticipated to fuel the growth.

Industries including automotive, construction, aerospace, agriculture, and renewable energy are most positively affected by this technology. These enhance the performance of heavy machinery, industrial automation and smart grid energy applications.

Electrohydraulic systems are also being revolutionized by innovations in areas such as AI-powered predictive maintenance, IoT-enabled monitoring, and lightweight high-performance materials. These innovations help guarantee reliability, increase lifetime service and real-time performance monitoring.

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.