Transformative growth is to be expected for the global market for electrified aircraft propulsion as sustainability and stringency in carbon reductions are mandated within the aviation industry. CAGR of 12.1%, reaching USD 28.2 billion by 2035, shows a rapid acceleration of hybrid electric and fully electric propulsion systems in this market.

Governments and regulatory agencies like the European Union, FAA, and ICAO are setting stringent targets for reducing emissions, thus pushing aerospace manufacturers to invest in the next generation of battery technologies, fuel cells, and power electronics.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 28.2 billion |

| CAGR during the period 2025 to 2035 | 12.1% |

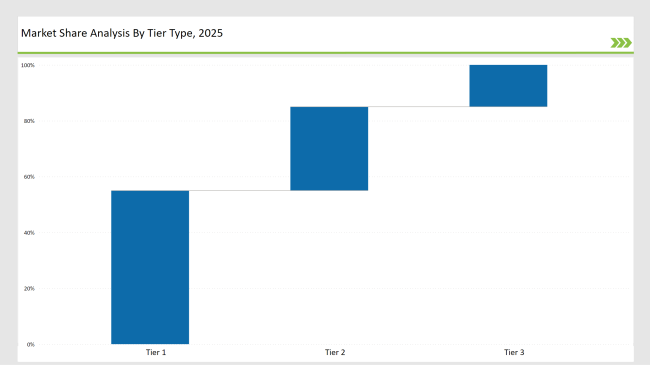

EAPs are most likely to find their early adoption in urban air mobility (UAM) and regional aviation because of the smaller flight distances involved and increased need for clean and efficient air transportation solutions. Competitive landscape remains moderately consolidated, with Tier 1 companies holding over half the market. Tier 2 companies are catching up strongly with specialized technologies.

The current battery component dominates at 35%. Breakthroughs in energy density and charging have driven the penetration of these units. The power conversion application currently leads with a 40% market share and underlines the critical role efficient energy transformation has in electrified propulsion.

Companies such as Airbus, Rolls-Royce, and GE Aviation are investing massively in superconducting electric motors, hydrogen-powered aircraft, and fuel-cell-based propulsion to reflect the various technological approaches to achieving a zero-emission flight. Still, despite the high growth prospects, there are some challenges ahead, especially with energy storage limitations, readiness of infrastructure, and economic viability in terms of large-scale EAP deployment.

The promise of solid-state batteries and AI-powered power distribution networks is exciting, but the commercial viability of long-haul electrified aircraft will require a significant step forward in terms of battery capacity and weight optimization.

In addition, the acceleration of electrified propulsion will require collaboration among aerospace manufacturers, energy companies, and regulatory bodies. While regional and short-haul applications will lead initial commercialization, scaling EAP for mainstream commercial aviation will define the market's long-term success.

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players(Airbus, Rolls-Royce, GE Aviation) | 55% |

| Rest of top 5 (Honeywell Aerospace, Safran S.A.) | 30% |

| Rest of Top 10 | 15% |

The Electrified Aircraft Propulsion market is relatively consolidated, though leading players make all the significant decisions in determining pricing strategies and technological advancements alongside strategic partnerships involving aerospace and the aviation sector. Regional and speciality companies ensure their existence as they provide regional air mobility-based and niche markets-specific cost-efficient solutions.

Presently, batteries comprise a 35% market share of the Electrified Aircraft Propulsion market due to technological developments in lithium-ion and solid-state battery technology. The growth for high energy density batteries comes in as the aviation industry's prime manufacturers advance toward hybrid electric and fully electric propulsion systems in search of efficient performance and reduction of emissions in aircraft.

Next-generation battery system developments are under way by leaders in the market Airbus and Rolls-Royce through lightweight and high-capacity energy storage. With sustainability targets set by the aviation regulatory bodies, innovation in battery performance and charging infrastructure is a continuous process to scale electric aviation.

The application segment is led by power conversion, accounting for 40% of the market share, since the efficient transformation of stored energy into propulsion power is still a major challenge in electric aviation. Advanced inverters, converters, and high-voltage systems are necessary for aircraft to optimize power usage and enhance efficiency.

Leaders in this area are GE Aviation and Airbus, investing in cutting-edge power conversion technologies to ensure that energy storage and electric propulsion would seamlessly work together. In this fast-paced trend toward electrification in the aviation industry, the effective improvement of power conversion efficiency would be essential in achieving greater flight ranges with operational viability.

AirBus

Airbus is one of the leading aerospace manufacturers and is involved in the development of hybrid electric and hydrogen-based propulsion technologies. The company is headquartered at Toulouse, France, and has led some of the sustainable aviation efforts. Recently, Airbus began its ZEROe hybrid-electric test flights, a step toward developing fuel-cell powered aircraft.

The company is also working on the integration of next-generation batteries and fuel cells to achieve commercial aviation by 2035 with no emissions. Meanwhile, Airbus will continue investing in electrified propulsion, further building its global strength, and bringing the industry towards the goal of carbon-neutral aviation in step with regulatory ambitions.

Rolls-Royce

Rolls-Royce, a UK aerospace and defense technology leader, continues to push for innovation in high-efficiency electric propulsion systems. The company develops high-thrust superconducting electric motors for regional aircraft with the highest-in-class power density and efficiency for hybrid-electric aviation.

Rolls-Royce is working towards developing scalable architectures for electric propulsion suited to hybrid and fully electric aircraft.With a focus on the development of superconducting materials and advanced power distribution systems, the company has ambitions to reshape electrified propulsion and to act as an essential enabler in next-generation sustainable aviation.

GE Aviation

GE Aviation, a business unit of General Electric and located in the United States, is stepping up the pace for fuel-cell-based electric propulsion. GE Aviation has announced high-efficiency fuel cells targeted at hybrid-electric aircraft and urban air mobility (UAM) applications.

GE Aviation applies its capabilities in power electronics and energy storage to develop lightweight, high-performance electric propulsion solutions. It has taken the company a strong focus on reducing aviation emissions, expansion in capabilities concerning hydrogen fuel cell integration and advanced electric motor technologies.

Honeywell Aerospace

Honeywell Aerospace is actually a company of excellence in aerospace technologies worldwide. The advancement it is pushing into battery and energy storage solutions in an electric aircraft will prove to be beneficial. Solid-state battery technology research continues, with the company aiming to extend the flight range of electric aviation.

Honeywell is headquartered in the United States and also targets power management and distribution systems that will help the electrified propulsion platforms be much more efficient. Honeywell Aerospace, integrating cutting-edge innovations in batteries and intelligent energy systems, is ready to take the lead in transitioning to next-generation electric aviation.

Safran S.A.

Safran S.A., an aerospace and defense company located in France, is pioneering the innovation of AI-powered power distribution networks for electric aircraft. In real-time power management, the company optimizes energy efficiency through enhancing reliability and safety of electrified propulsion systems.

Safran is also working with principal industry players to develop advance power electronics and electric actuators that support the electrification of flight control and propulsion systems. Safran is, therefore focused on optimizing operational efficiency through the application of AI-driven optimization for enhancing the pace of sustainability and promoting the introduction of more environmentally friendly aviation solutions.

| Tier | Examples |

|---|---|

| Tier 1 | Donaldson Company, Camfil Group, Parker Hannifin Corporation |

| Tier 2 | Nederman Holding AB, Mann+Hummel |

| Tier 3 | Regional and niche players |

| Company | Initiative |

|---|---|

| Honeywell International Inc. | Expanded research in solid-state battery technology to enhance energy density and extend electric flight ranges. |

| Safran S.A. | Expanded AI-based power distribution networks for real-time energy optimization in electrified aircraft. |

| Thales Group | Developed next-generation avionics and flight control systems for hybrid-electric and fully electric aircraft. |

| GE Aviation | Introduced high-efficiency hydrogen fuel cells for next-generation sustainable air mobility applications. |

| Ametek Inc. | Developed advanced power conversion and distribution solutions to enhance electric aircraft performance. |

| Astronics Corporation | Designed high-voltage electrical power systems to support hybrid and all-electric aircraft development. |

| Crane Aerospace & Electronics | Engineered lightweight power conversion and distribution devices for more efficient electrified aviation. |

| Rolls-Royce | Developed superconducting electric motors for next-gen hybrid-electric regional aircraft. |

| GE Aviation | Introduced fuel-cell-based electric propulsion systems to reduce aviation emissions. |

By 2035, the electrified aircraft propulsion market will be driven by AI-powered, hybrid-electric, and zero-emission systems, with a strong focus on achieving sustainable, long-range electric aviation. Industry leaders will prioritize innovations in solid-state batteries, hydrogen-electric propulsion, and next-generation power distribution networks to meet the growing demand for efficient, eco-friendly aircraft.

The integration of smart energy management systems, alongside the use of digital twin-based predictive analytics, will play a pivotal role in enhancing the efficiency, safety, and reliability of electrified propulsion systems. These technological advancements will not only reduce carbon emissions but also enable commercial and regional electric aircraft to operate over longer distances, ushering in a new era of sustainable aviation.

Major players in the Electrified Aircraft Propulsion market include Airbus, Rolls-Royce, GE Aviation, Honeywell Aerospace, and Safran S.A., with Airbus and Rolls-Royce leading advancements in hybrid-electric and hydrogen-powered propulsion systems. These companies dominate due to their innovations in energy storage, fuel cell technologies, and electric motor systems.

The leading product segment in the Electrified Aircraft Propulsion market is batteries, which hold 35% of the market share. Lithium-ion and solid-state battery technologies are driving the development of hybrid and fully electric aircraft, enabling longer flight ranges and reducing emissions.

Regional and domestic companies hold a combined share of approximately 45% of the market. These companies focus on niche applications and regional air mobility, contributing to the expansion of electric propulsion systems for shorter-range and urban air mobility platforms.

The Electrified Aircraft Propulsion market is moderately concentrated, with Tier 1 players (Airbus, Rolls-Royce, GE Aviation) holding 55% of the market share. This indicates that while there are several dominant global players, there is still room for regional and specialized companies to innovate and capture a significant portion of the market.

Germany Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United Kingdom Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

United States Electric Golf Cart Market Growth - Trends & Forecast 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Run Flat Tire Inserts Market Growth - Trends & Forecast 2025 to 2035

Decorative Car Accessories Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.