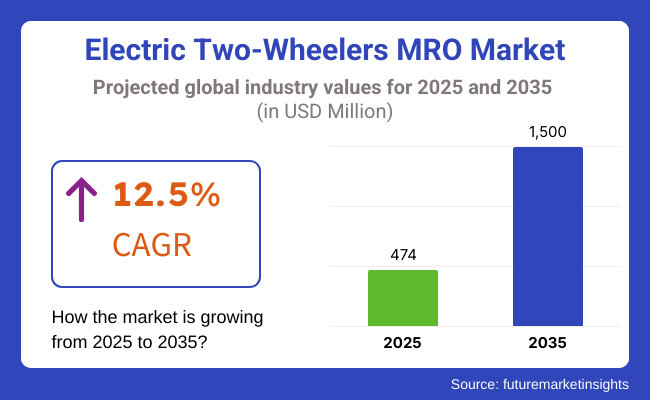

The electric two-wheelers MRO market value is projected to be USD 474 million in 2025, and it will multiply to USD 1500 million in 2035, with a strong CAGR of 12.5% throughout the forecast period. The main factors driving this broadened scope of improvement are the reduction of government subsidies, the upgrade of EV charging infrastructure, and the rising popularity of the fleet-sharing model using e-scooters.

The two-wheeler electric MRO market is expected to exhibit significant growth from 2025 to 2035 due to the increased use of electric motorcycles, technological developments in battery markets, as well as the growing requirement for high-quality aftermarket services.

Due to the global transition to eco-friendly transportation and the introduction of stricter emission laws, the need for specialized MRO (Maintenance, Repair, and Overhaul) services has gone up to ensure that electric two-wheelers are durable and perform at their best.

A critical problem in the market of maintaining, repairing, and operating electric two-wheelers is the lack of technicians who are capable of running the program that is needed for dealing with battery diagnostics and software troubleshooting.

This have made the market penetration difficult in certain geographic locations. In addition, the costs of additional components such as battery management systems, specialized EV tires, and electric motor parts have been high which in turn has added maintenance expenses.

The lack of common repair guidelines for electric two-wheelers has resulted in further impact on service delivery, especially to the independent service providers.

Also, battery degradation is a major concern as it can compromise the longevity of the vehicle and its cost-effectiveness in the longer term thereby potentially reducing the acceptance of high-quality battery products. Besides, there are some risks which are monetary and/or technical that come with MI implementation.

Nevertheless, there are many opportunities of market advancement. The introduction of predictive analytics that are driven by AI, cloud-based diagnostics, and remote monitoring has transformed the process of repairing from being reactive to being proactive, therefore, making service delivery much easier.

Subscription-based maintenance plans that include periodic servicing and battery replacements have proven to be an effective strategy for customer retention and brand loyalty.

The installation of battery swapping networks and ultra-fast charging stations is reducing downtime and is enhancing fleet utilization rates. In addition, the government-backed programs to deposit the MRO hubs, train the technicians who are tackling EV Maintenance, as well as the introduction of waste management and battery recycling regulatory frameworks, are expected to further foster the market expansion.

Moreover, the launching of IoT-empowered service management platforms is prominent in the optimization of maintenance scheduling and consequently bettering overall service efficiency while cutting repair costs.

As these technologies keep progressing, the MRO market in the electric two-wheelers segment will see substantially rising sales also due to the increased utility and durability of the mobility solutions across the globe.

Fleet operators and service center capacity utilization received high ratings on maintenance cost and efficiency, attesting to the necessity of minimizing fleet downtime and optimizing repair workflows. Similarly critical is spare parts availability, rated highly by these groups, so these replacement items are easily available to enable rapid turnarounds.

While service turnaround time is a key priority for fleet operators and service centers, for end users and manufacturers, it is rated much lower, implying both parties them do not prioritize speedy service in their own contexts.

Integration is of medium significance to fleet operators and service centers, and very important for manufacturers as they leverage new diagnostic and repair technologies into their offerings. If low-frequency performance and the ability to take a lick and keep on ticking are factors, then the durability and reliability are rated from moderate to high.

Warranty and post-sales support moderate in importance across the board, which reinforces the importance of effective aftersales services to build customer satisfaction and operational continuity.

The electric two-wheeler Maintenance, Repair, and Overhaul (MRO) market flourished during the years 2020 to 2024, which could mostly be attributed to the increasing acceptance of e-mobility in conjunction with government incentives that were put in place for electric vehicles.

Shared mobility services at the same time experienced a boost as well as an increase in last-mile delivery fleets which increased the demand for MRO services including battery maintenance and software diagnostics. Nonetheless, the industry was marred by some of the key challenges including inadequate numbers of trained technicians, lack of spare parts, and costly initial servicing for sophisticated electric powertrains.

Between 2025 and 2035, the MRO ecosystem will see drastic change with AI-based predictive maintenance, remote diagnosis, and automated service platforms. Downtime will be cut by battery-swapping networks, while improvements in solid-state and fast-charging batteries will reshape maintenance requirements.

Manufacturers will use Blockchain-based service records to ensure transparency and reliability. Sustainability issues will also push recycling and refurbishment of battery components to ensure cost-effectiveness and environmental compliance in the expanding electric two-wheeler ecosystem.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments introduced incentives for EV adoption and mandated periodic safety checks for electric two-wheelers. | AI-powered diagnostic systems, blockchain-maintained operation records, and standardized modular batteries replace solid-state batteries. |

| EV servicing improved with AI diagnostic tools, predictive battery health analysis, and cloud-based fleet management. | Lubricants from nanotechnology, solid-state battery cyclical design, and quantum-limited maintenance simulations drive innovation. |

| MRO services focused on battery maintenance, motor diagnostics, and controller firmware updates. | AI-driven predictive analytics, self-repairing battery systems, and over-the-air updates optimize MRO services. |

| Key market products included diagnostic aids, battery sensors, real-time monitoring systems, and cloud-based service platforms. | Autonomous repair robots, self-maintaining AI-based EVs, and decentralized service centers transform repair models. |

| High demand for cloud service platforms, diagnostic equipment, and real-time monitoring systems with battery sensors. | AI-powered self-maintenance EVs, decentralized service stations, and autonomous repair robots lead market innovation. |

| Digital twins and smart monitoring improved service efficiency, prolonged service life, and enhanced reliability. | AI enables blockchain-based decentralized service networks and disruptive maintenance paradigms. |

| Battery refurbishments, second-life utilization, and AI-based predictive maintenance explored for cost efficiency. | Quantum computing optimizes MRO, AI predicts failures, and real-time component monitoring revolutionizes predictive maintenance. |

Lack of universal maintenance protocols, combined with different battery and software designs for each brand, limits the ability of independent repair businesses to offer users local access to service, which creates a risk for users. Part availability is another problem, with electric two-wheeler manufacturers being mostly startups with poor supply chains.

If a brand shuts down, finding replacement parts becomes complicated, and players may not even be able to service some vehicles. Battery safety is a major pain-point-abuse can result in fire hazards-prompting stricter regulatory scrutiny (46% of the total energy storage market which represents millions of energy storage systems) and liability for service providers.

In addition, electric two-wheelers also require much lower routine maintenance than a traditional petrol-based internal combustion engine bike, which also means lesser overall service frequency and revenue potential for repair shops. OEMs are monopoly players, making it difficult for independent MROs because of exclusive service networks and doorstep repairs.

In addition, the proliferation of battery-swapping infrastructure could render servicing batteries obsolete, further undermining traditional repair models. In order to continue garnering business, MRO providers must shift priority towards value-added services specifically battery diagnostics, software uploads, or even aftermarket customization, whilst balancing compliance with changing safety and regulatory standards.

Due to consumer expectations of lower maintenance costs for electric two-wheelers compared to gasoline-powered bikes, pricing points for associated MRO services should also account for this drawback. Routine maintenance, including brake checks and software diagnostics, is generally less expensive, with workshops providing bundled service packages to keep customers.

Specialized services like battery diagnostics, refurbishment, or cell replacements are priced comparatively higher with value-based pricing since they require a high degree of technical expertise and specialized equipment.

Subscription-based maintenance plans, in which OEMS offer to sell customers prepaid service packages that provide periodic checkups at a fixed cost over several years, are also becoming popular as a way to retain customers and provide a predictable stream of revenue. Pricing competitive is essential as independent repair shops need to adjust rates with OEM service centers but provide extra amenities or tailored services.

To combat declining per-vehicle service revenue, MRO providers are expanding their portfolios with accessory installations, insurance renewals and fleet maintenance contracts, Dunlop said. The matured market drives businesses to adopt a pricing strategy that maintains full accessibility to the consumers while capitalizing on premium products in the areas of specialization.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 5.0% |

| The UK | 4.6% |

| European Union (EU) | 4.7% |

| Japan | 4.8% |

| South Korea | 5.0% |

| Germany | 8% |

FMI is of the opinion that the USA electric two-wheelers MRO industry is slated to grow at 5% CAGR during the study period.

The industry is slowly expanding due to rising use of electric scooters and motorcycles, government incentives for eco-friendly transport, and technological advancements in the battery industry. According to statistics from the USA Department of Energy, the extensive use of electric two-wheelers is needed to create specialty MRO services such as motor repair, software upgrades, and battery management systems.

Industry expansion is being fueled by growing volumes of electric bicycles, and particularly electric two-wheelers, and ride-sharing scooters. Bird and Lime and electric motorbike manufacturers like Zero Motorcycles are creating demand for MRO services like controller reconditioning, battery testing, and tire replacement.

Moreover, AI-based maintenance packs and IoT-based diagnostics are minimizing downtime and increasing repair cost. Mobile and remote MRO service growths are transforming traditional MRO models by offering real-time solutions to riders on the go.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Government Incentives | Fed green transport and clean energy incentives are driving the adoption of electric two-wheelers. |

| Fleet Expansion | Massive e-bike and ride-sharing scooter rollouts are generating more demand for streamlined MRO services. |

| Technological Advances | AI-based diagnostics and IoT connectivity are transforming MRO services into cost-effective and efficient ones. |

| Mobile Repair Services | On-wheels mobile repair solutions are enhancing convenience and reducing downtime for electric two-wheeler owners. |

The United Kingdom Electric Two-Wheeler MRO market is developing vigorously with the growth driven by the rise in the adoption of electric vehicles (EVs), pro-clean energy policies by the government, and increased demand for last-mile delivery options.

The government of the UK is encouraging the use of electric scooters and e-bikes through grants, tax relief, and other benefits. The electric mobility companies such as Zapp and NIU also contribute to the battery maintenance, motor repair, and firmware update requirements driving the growth of the industry.

The National Grid and utilities are complementing the EV infrastructure by installing additional charging points and service stations. Moreover, AI-based diagnostic tools in workshops are improving the quality of service, reducing downtime, and increasing vehicle life. Subscription and mobile repair services have entered the industry to cater to individual riders and fleet purchasers.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Government Support | Tax relief initiatives and grants encourage EV uptake and address the need for MRO services. |

| Infrastructure Development | Development of EV charging and maintenance infrastructure ensures increased access to MRO services. |

| AI-Enabled Diagnostics | AI-based diagnostic software enhances diagnostic precision, reducing downtime and extending vehicle life. |

| Mobile and Subscription Services | Mobile repair capacity and subscription schemes offer the advantage of managing fleets and vehicles. |

The FMI is of the opinion that the European Union Electric Two-Wheeler MRO industry is slated to grow at 4.7 % CAGR during the study period and expanding with the support of supportive government policies towards sustainability, increased demand for efficient repair options, and rapid expansion of scooter-sharing networks.

EU Green Deal, where funds are being offered for clean transport, is playing a major role in propelling the scale of the electric two-wheeler industry and supporting MRO services. Germany, France, and Italy are some of the nation’s driving this growth with some of the manufacturers such as Vespa Elettrica and BMW Motorrad.

The use of telematics and real-time diagnostics in MRO services is making service more streamlined, enabling predictive maintenance, and reducing the frequency of breakdowns. Moreover, on-demand service platforms and mobile repair workshops are widening the scope of availability of maintenance to direct customers and fleet operators.

Growth Factors In European Union

| Key Drivers | Details |

|---|---|

| Green Deal Funding | Government investment in green transport fuels electric two-wheeler adoption and MRO service demand. |

| Telecommunication Integration | Telematics and real-time diagnostic technologies improve the productivity of service and reduce maintenance costs. |

| Scooter-Sharing Growth | Increased shared mobility platforms are fueling the need for quick, efficient MRO services. |

| On-Demand Repair Services | Mobile repair workshops provide convenience to individual and fleet customers and allow easy availing of MRO services. |

FMI is of the opinion that the industry is slated to grow at 4.8 % CAGR during the study period. Japan Electric Two-Wheelers MRO industry is expanding because of an aging population, tight environmental regulations, and strong government incentives for the adoption of electric vehicles.

Japan was a technology leader in automotive and is heavily investing in EV-related infrastructure with high demand for next-generation MRO solutions such as battery wellness monitoring, firmware downloads, and motor maintenance.

Deployment of AI-driven predictive maintenance technologies at service centers is improving the effectiveness of service, reducing maintenance costs, and increasing the reliability of electric two-wheelers. Intelligent battery-swapping stations are also reducing maintenance overhead and providing a smoother experience for EV users.

Growth factors in the Japan

| Key Drivers | Details |

|---|---|

| Aging Population | Japan's aging population is opting in large numbers for electric two-wheelers as they are eco-friendly. |

| Government Support | The Japanese government's pro-EV policies and investments in infrastructure are promoting mass adoption of EVs. |

| Predictive Maintenance | Artificial intelligence-driven maintenance systems optimize the performance and reliability of electric two-wheelers. |

| Smart Battery Swapping | Battery-swapping centers reduce maintenance costs and facilitate the process for owners. |

South Korean Electric Two-Wheelers MRO industry is growing at a fast pace because of the increased adoption of electric vehicles, quicker repair needs, and the government's strong backing of EV infrastructure. The Ministry of Trade, Industry, and Energy has invested heavily in promoting e-mobility and to back battery diagnostics, motor maintenance, and AI solutions.

5G telematics and IoT real-time monitoring technologies are being converged in large volumes to drive electric two-wheeler maintenance through failure possibility reduction. Furthermore, South Korea's robust e-commerce ecosystem with participants like Coupang is fueling MRO demand and supply. Repair on mobile also is gaining momentum, providing riders' and fleet operators' comfort.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Government Expenditures | South Korean government initiatives supporting e-mobility infrastructure propel uptake of electric two-wheelers. |

| IoT and 5G Integration | Advanced telematics and real-time monitoring increase the dependability of service and reduce operation breakdowns. |

| E-Commerce Growth | Internet platforms like Coupang enable greater availability and ease of MRO services in South Korea. |

| Repair Services in the Field | Field repair services offer immediate, convenient repairs to individual customers and fleets. |

Germany's Electric Two-Wheelers MRO industry will expand significantly with increasing sales of electric scooters and motorbikes, particularly in urban and suburban areas. Berlin, Hamburg, and Munich will dominate the MRO services industry when it comes to high population density and high EV penetration. Green concerns in Germany are pushing MRO institutions to emphasize recycling and refurbishment of important components like batteries and motors.

Implementation of predictive maintenance systems and IoT-based diagnosis will improve the efficiency of MRO services, reduce downtime, and ensure better vehicle performance. As a leader in automotive technology, Germany's established OEMs such as BMW Motorrad, independent service shops, and local workshops will lead the development of electric two-wheeler MRO.

Growth factors in Germany

| Key Drivers | Details |

|---|---|

| Urban Adoption of EV | Increasing-density cities are at the forefront of MRO service development given the increasing adoption of electric two-wheelers. |

| Environmental Objectives | Germany's sustainability drive is prompting MRO centers to focus on recycling and part refurbishment. |

| Predictive Maintenance | Coupling IoT with MRO services will reduce downtime and improve operational efficiency. |

| Significant OEM Footprint | Operators like BMW Motorrad are developing service networks in order to increase adoption of electric two-wheelers. |

In the electric two-wheelers MRO market, the battery and motor maintenance segments account for the highest share as fleet operators, individual users, and service providers are more interested in the efficient and economical maintenance solutions which are the only means to guarantee the vehicle's longevity, optimize the performance, and minimize downtime.

The electric scooter and motorcycle penetration is soaring up, the MRO services bearing the brunt of such changes and walking the extra mile provide redundant parts and thus carry the functional reliability of the whole vehicle.

Battery maintenance services are becoming a major part of maintaining electric two-wheelers, with lithium-ion (Li-ion) and lead-acid battery packs demanding of regular monitoring, diagnostics, and replacements that can stop the performance degradation.

In contrast to internal combustion engines (ICEs), electric two-wheelers are entirely dependent on battery efficiency which makes battery health monitoring, thermal management, and charge cycle optimization

Motor and controller maintenance services are key growth drivers of the electric two-wheeler MRO market, as they focus on efficiency as the main driver, therefore, prevention of motor overheating, and seamless power delivery. . IoT-enabled remote diagnostics and cloud-based performance tracking that service providers utilize are mostly the two key factors to pre-checks on the motormisalignments, winding degradation, and ECU failures.

The connected electric two-wheelers trend has contributed to the demand for the real-time software update, AI-based fault-finding, and smart telemetry integration. While fleet and ridership owners turn to digital maintenance platforms, they effortlessly benefit from remote firmware updates, motor optimization, and the rapid dispatch of failure alerts in order to continue operations without interruption.

The electric two-wheeler MRO market is rapidly evolving, with key players focusing on service expansion, battery-swapping infrastructure, and strategic partnerships to enhance customer experience and operational efficiency.

As it is gaining momentum, electric mobility is increasingly encouraging players to move toward a more customer-centric, scalable service model that improves accessibility, reliability, and energy efficacy.

Ola Electric is on an aggressive drive to add more sales and service outlets in both urban and rural settings in addressing the issues it had in its previous service arrangements. Through its shared mobility model, Yulu will be able to fit BaaS solutions as well as ensure their seamless operations through high frequency battery swaps.

Gogoro and SUN mobility, on the other hand, have pioneered battery-swapping technologies to minimize downtime and improve convenience for their users. For instance, Gogoro has partnered with manufacturers to adopt a standardized battery-swapping model with Hero MotoCorp, and SUN Mobility promotes quick, highly efficient energy interchange through its modular Smart Battery network.

Their initiatives are all building toward a larger infrastructure-driven growth trend-supported increasingly by service reliability, automated diagnostics, and seamless energy solutions as a prerequisite for enabling a growing adoption rate of electric two-wheelers.

Companies that will fuse predictive maintenance, AI-driven diagnostics, robust charging networks will have a competitive advantage in this dynamic and growing market.

Market Share Analysis by Company

| Company Name | Estimated Market Share |

|---|---|

| Bosch eBike System | 12-17% |

| TVS Motor Company | 10-14% |

| Hero Electric | 9-13% |

| Ather Energy | 7-11% |

| Ola Electric | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch eBike system | Offers advanced diagnostic tools, battery maintenance solutions, and AI-integrated predictive maintenance for e-bikes. |

| TVS Motor Company | Focuses on comprehensive after-sales services, battery refurbishment, and smart maintenance programs for electric scooters. |

| Hero Electric | Provides on-site and remote maintenance services, battery swapping networks, and fast-charging station integration. |

| Ather Energy | Produces real-time vehicle health monitoring, over-the-air (OTA) updates, and high-efficiency battery diagnostics for preventive maintenance. |

| Ola Electric | Focuses on mobile MRO services, AI-driven predictive analytics, and integrated service centers for electric scooters. |

Key Company Insights

Bosch eBike Systems (12-17%)

Bosch got the title of the king of the electric two-wheeler MRO as it offers the predictive maintenance using the AI, detains that are advanced, and Connected solutions for e-bike maintenance. The company integrates smart sensors and real-time monitoring to enhance service efficiency.

TVS Motor Company (10-14%)

TVS offers a plethora of MRO services, such as battery refurbishment, digital diagnostics, and specialized service networks for its electric two-wheelers. The company emphasizes customer-centric maintenance solutions.

Hero Electric (9-13%)

Hero Electric is all about battery swapping networks, on-demand repair services, and integrated diagnostic platforms for the extension of lifetime for electric two-wheelers.

Ather Energy (7-11%)

Ather Energy's product is intelligent vehicle health monitoring systems that make it feasible to perform OTA updates and remote diagnostics proactively for electric scooters.

The small share of 5-9% is of Ola Electric

Ola Electric has revolutionized the market of urban electric mobility by providing AI-enabled predictive analytics, mobile MRO services which give immediate assistance, & integrated service hubs.

Other Key Players (45-55% Combined)

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 13: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 15: Asia Pacific Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Table 16: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: MEA Market Value (US$ Million) Forecast by Service Provider, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 13: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Service Provider, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 28: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Service Provider, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Service Provider, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 58: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by Service Provider, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 62: Asia Pacific Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 63: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 70: Asia Pacific Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 73: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 74: Asia Pacific Market Attractiveness by Service Provider, 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 76: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 77: MEA Market Value (US$ Million) by Service Provider, 2023 to 2033

Figure 78: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 83: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 84: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 85: MEA Market Value (US$ Million) Analysis by Service Provider, 2018 to 2033

Figure 86: MEA Market Value Share (%) and BPS Analysis by Service Provider, 2023 to 2033

Figure 87: MEA Market Y-o-Y Growth (%) Projections by Service Provider, 2023 to 2033

Figure 88: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: MEA Market Attractiveness by Service Provider, 2023 to 2033

Figure 90: MEA Market Attractiveness by Country, 2023 to 2033

The electric two-wheelers MRO market is expected to generate USD 474 million in revenue by 2025.

The market is projected to reach USD 1500 million by 2035, growing at a CAGR of 12.5% from 2025 to 2035.

Key players in the market include ABB Group, Bharat Heavy Electricals Ltd., KREMPEL GmbH, MacLean-Fogg Company, NGK Insulators Ltd., PFISTERER Holding AG, Siemens Energy, Toshiba Corporation, WT Henley, and Hubbell.

Regions with a growing adoption of electric two-wheelers, such as Asia-Pacific and Europe, are expected to offer significant growth opportunities for MRO services.

Battery maintenance and replacement services dominate the market due to the high wear and tear of lithium-ion batteries and increasing demand for battery performance optimization.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA