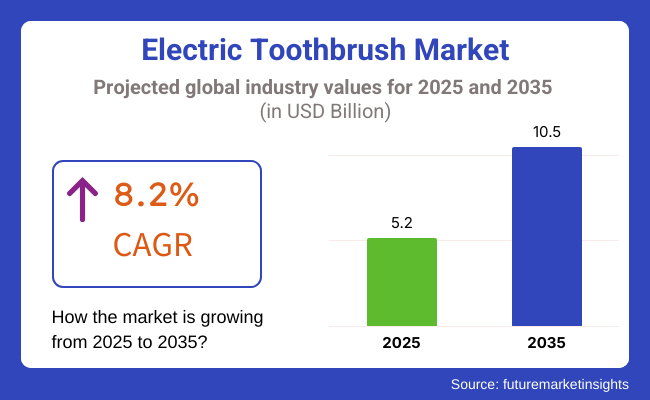

The electric toothbrush market is projected to witness significant growth from 2025 to 2035, driven by increasing consumer awareness of oral hygiene, advancements in smart brushing technology, and the growing influence of preventive dental care. The market is expected to expand from USD 5.2 billion in 2025 to USD 10.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The industry is witnessing strong and consistent growth, driven by increasing consumer consciousness about oral health and advances in dental care technology. The companies that produce electric toothbrushes, which can remove more plaque and guard gums more effectively than regular ones, are the ones that succeed in persuading most individuals looking for quick and convenient oral care solutions.

Another popular trend is the growing use of smart and rechargeable toothbrushes, which individuals believe are the primary reason for the growth. The biggest driver of this growth is the stamped-on digitization in dental clinics.

Many consumers prefer these toothbrushes that come with advanced features, like built-in pressure sensors, multiple brushing modes, and real-time feedback through mobile apps. What is more, with the increase in the knowledge of gum disease prevention and cavity protection, people are encouraged to use these toothbrushes as part of their daily oral habits.

You go on with the new premium and specialized toothbrushes part, e.g., ones for sensitive teeth, children's, and orthodontic users, that play into the diversification. The companies are moving towards the introduction of eco and biodegradable brush heads, which are in line with the increasing demand for sustainable personal care products.

Additionally, the brush head subscription service is another complementary point that helps build customer satisfaction and brand loyalty. Innovations related to sonic and oscillating-rotating toothbrushes are also supporting the broadening of brushing effectiveness and user experiences.

The coupling of AI-powered tracking with Bluetooth connectivity and interactive brushing instructions is changing how consumers think about oral health. Moreover, the growth of e-commerce and the D2C sales channel are making it easy for consumers across the globe to have access to these toothbrushes.

Notwithstanding these encumbrances, potential avenues are plentiful for the extension of the industry. The burgeoning demand for these toothbrushes in developing countries, plus the accompanying upsurge in dental health awareness, is poised to effectuate the further taking-up. What is more, the advent of smart and AI-powered toothbrushes is now a new channel for tangible product innovations.

There was a rise in sales between 2020 and 2024 because of increased awareness of dental hygiene and the convenience of using automatic brushes. Increased dental conditions such as cavities, gingivitis, and plaque led individuals to shift towards electric toothbrushes from manual toothbrushes.

Technologies such as pressure sensors, multiple brushing modes, and instant feedback through smartphone applications enhanced convenience and effectiveness. Subscription-based replacement of brush heads also assisted in development. Top-notch toothbrushes using sonic and oscillation technology were in demand because they had high cleaning performance.

High-priced merchandise and low product awareness in growing economies were some industry penetration issues. Sustainability, too, was becoming increasingly important as companies demanded recyclable components and energy-effective charging.

Internet connectivity and extended user customization will define the industry during 2025 to 2035. Toothbrushes with AI will provide real-time brushing habit analysis, with customized tips and recommendations for improvement. Wireless charging, longer battery life, and eco-friendly designs will be standard.

Biometric monitoring platform integration will allow users to monitor general dental health indexes and link them with professional dental care services. Antimicrobial bristles and biodegradable plastics will evolve with increased environmental and hyosity demands. The advances in 3D printing technology will provide customized brush head configurations, and UV sterilization technology will introduce enhanced hygiene.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The manufacturers introduce ergonomic, BPA-free, antimicrobial brush heads. Green bamboo handles become popular. | Sophisticated self-cleaning and biodegradable materials dominate. Nanotech-based bristles provide improved plaque removal and better durability. |

| Sonic and oscillating toothbrushes picked up speed. AI-aided pressure sensors enhanced gum health. | AI-enabled customized brushing routines with immediate feedback. Ultrasonic technology for deep cleaning without abrasion. |

| Development fueled by rising oral hygiene awareness and expert suggestions. Premium toothbrush sales are dominated in North America and Europe. | Expansion in emerging markets with growing disposable income. Brush head replacement with subscription-based offerings and smart toothbrushes have become mainstream. |

| Businesses minimized plastic packaging and came up with recyclable brush heads. Energy-efficient batteries reduce the environmental footprint. | Replaceable-head, fully biodegradable toothbrush models gain popularity. Carbon-neutral manufacturing practices become the norm. |

| Real-time data and brush guidance from Bluetooth toothbrushes. UV sanitation became a standard feature. | Oral health monitoring with AI-integrated predictive analysis. Wireless charging and intelligent water-saving features increase convenience. |

| Growing demand for travel-friendly, rechargeable versions. Children's toothbrushes with interactive features have started to enjoy popularity. | Personalizable toothbrush settings with user-chosen brushing modes become the standard. The expansion of environmentally conscious consumers contributes to the growing demand for sustainable, long-term models. |

The rapid growth of the industry is due to increased awareness of oral health, technological advancements, and recommendations from dentists is unimaginable. Further, the growth in demand for smart toothbrushes that utilize Bluetooth connectivity, AI-based brushing feedback, and various cleaning modes is observed in the adult segment.

The children's section is filled with products that mainly use gentle bristle technology, have appealing designs, and are paired with interactive brushing apps that affect purchase decisions. For example, parents buy secure and easy-to-use modes with timers that help the kids to get in the habit of good brushing. For the elderly, the utmost thing is that toothbrushes are lightweight, easy to hold and have automatic pressure controls to eliminate inconveniences.

Dental clinics and commercial customers are geared towards high-velocity, professional-grade toothbrushes, which are necessary for thorough cleaning and gum care for patients. The industry is moving towards not only eco-efficient rechargeable models but also biodegradable brush heads and UV sanitizing features that meet sustainability needs.

Globally, there is a surge owing to the intensifying awareness about oral hygiene coupled with the ongoing advancements in dental technology. However, the multiplicity of stringent regulations concerning battery safety, electromagnetic emissions, and water resistance makes compliance difficult for companies.

To ensure trust from the consumer and sustain credibility, enterprises need to follow international safety standards and get the required certifications. Production stability has been affected by the influx of raw material costs, semiconductor shortages, and transportation delays that have caused supply chain disruptions.

In addition, the number of components like rechargeable batteries, sonic motors, and durable bristles that are used has also increased the vulnerability. To counter such risks, businesses should diversify suppliers, look for alternative materials, and invest in resilient manufacturing processes.

The rising competition from manual toothbrushes and cheaper alternatives has been the biggest impediment to the growth. Customers want a product that is cheap, long-lasting, and has high-tech features such as AI brushing guides and pressure sensors. The brands, in this case, need to be innovative, which includes the proposal of smart features, customizable brushing modes, and a battery lifespan that is more than just a requirement.

The perceived battery lifespan, electronic waste, and possible gum sensitivity are some of the concerns expressed by consumers that affect their purchasing decisions. Customers will be inclined to buy if the product is not only eco-friendly but also includes information about the durability of the product, sustainable packaging, and if the components are recyclable.

The rechargeable toothbrushes are expected to account for 60% in 2025 as consumers are increasingly seeking long-term usability, sustainability, and advanced features. Rechargeable models come with various brushing modes, pressure sensors, and Bluetooth connectivity for real-time feedback attributes that health-conscious consumers increasingly desire.

The segment of toothbrushes for patients with specific problems or those who want to better care for their teeth and gums is well represented by brands offering these toothbrushes for home use (Philips Sonicare, Oral-B, FOREO, etc.) and electric toothbrushes provided and recommended by dental institutions (FOREO, Braun).

The environmental advantage of barring battery waste has swayed eco-minded consumers toward rechargeable products that keep with broader sustainability trends in personal care. In 2025, they’re projected to represent 40% of the battery-powered toothbrush revenue. Their low price and portability especially help make them easy and popular with first-time buyers and travelers.

Compact, battery-operated brushes from brands like Colgate, Fairywill, and Arm & Hammer are made for on-the-go oral care. However, their limited functionality and the hassle of regularly changing batteries are obstacles to wider adoption in developed industries.

The global growth is attributed to heightened awareness of oral hygiene, technological innovation in the industry, and the availability of products at different price points. Rechargeable toothbrushes should continue to make inroads, especially as access to high-end oral hygiene through e-commerce and pharmacy chains opens in emerging economies.

Online retail stores are expected to account for 35% of the revenue share by 2025, led by the expanding reach of e-commerce platforms and consumer buying trends that are shifting toward convenience and a wider range of products-online behemoths like Amazon and Walmart, and health-specific retailers offer a wide variety of prices, with plenty of reviews, discounts, and subscription packages.

More recently, direct-to-consumer (DTC) entrants, including Quip and Burst, have further stoked online sales - the growing online industry is based on customized offerings, flexible delivery, and digital marketing meant to reach young, digitally savvy consumers.

In 2025, Supermarkets & Hypermarkets are estimated to hold 30% of the total share. These channels continue to be important models for those stakeholders who are not located in urban or suburban areas but are highly dependent on their placement as they guarantee to reach the masses and provide immediate products.

Top brands such as Oral-B and Philips Sonicare have massive real estate on shelves of major distributors (Target, Costco, Tesco) where consumers can touch and try products and take advantage of treated offers. In-Person Shopping Is Still a Major Perk For many, having a physical location where they can make informed purchases remains a huge advantage of this channel.

This is a hybrid retail industry, where consumers might research online but shop from a variety of base-lines offline and online based on price, time sensitivity, and convenience. Online sales are forecast to outpace brick-and-mortar retail growth well into the future, with increasing digital literacy and a more extensive logistics network driving the trend. In contrast, brick-and-mortar stores maintain relevance through store experiences.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.5% |

| France | 5.2% |

| Germany | 5.8% |

| Italy | 4.9% |

| South Korea | 6.3% |

| Japan | 5.7% |

| China | 7.0% |

| Australia | 5.4% |

| New Zealand | 4.8% |

The USA is to expand at a CAGR of 6.1% during 2025 to 2035. Growing adoption of advanced oral care products and rising consumer interest in dental health are fueling growth. Western brand import demand for Oral-B and Sonicare is propelling the industry, and continued innovation in AI-based smart toothbrushes with real-time detection is complementing the growth. Additionally, American consumers possess a high disposable income, and as such, they are able to spend on quality oral care products.

Among the peculiar attributes of the American industry is a greater synergy of dentistry with technology and, thus, the appeal to subscription-based brush heads and intelligent toothbrushes connected to smartphone apps. Growing prescriptions by dentists for electric toothbrush use over manual use also augments adoption rates. Increasing expansion of online platforms and direct-to-consumer promotions is further strengthening penetration.

The UK is predicted to expand with a CAGR of 5.5% during the forecast period of 2025 to 2035. Growing awareness of oral care and preventive dentistry is one of the major factors driving growth. Companies like Ordo and Boots have been leading the charge in value and subscription-based models for the price-sensitive consumer base.

One of the strongest trends in the UK is the demand for more green and environmentally friendly toothbrushes, as companies launch biodegradable head sections and battery-rechargeable types. The social health-promoting function of the National Health Service (NHS) to assist in making people more conscious of toothbrushing habits has helped to drive up the popularity of these toothbrushes, particularly among young people. Higher sales online through platforms such as Amazon and local pharmacy store chains have also helped improve the availability of the product.

The French industry for electric toothbrushes is expected to register a CAGR of 5.2% between 2025 and 2035. The country's strong oral hygiene culture, driven by government healthcare schemes, is driving growth. Colgate-Palmolive, Signal, and others are growing their range of smart toothbrushes to attract tech-savvy consumers.

One of the distinctive characteristics of the French industry is the need for high-priced luxury electric toothbrushes, typically with better materials and better cleaning technologies. As consumers are increasingly adopting the trend of customized oral care, businesses are launching toothbrushes with AI learning users' brushing habits. Increased demand for electric toothbrushes for children on the back of educational programs for dental care is also driving the growth.

The German electric toothbrush market is expected to grow at a CAGR of 5.8% during the forecast period 2025 to 2035. The country's emphasis on precision engineering and product perfection has fueled the need for high-tech toothbrushes. Companies like Braun (Oral-B) are at the forefront of innovation, incorporating artificial intelligence and Bluetooth capabilities into products.

There is a prevalent trend in Germany for long-term and durable electric toothbrushes. People mostly want electric toothbrushes with removable heads and power-saving options, which is consistent with the country's high sustainability focus. Electric toothbrushes will be more covered by dental insurance schemes as the norm of excellent oral health so that they will be in greater demand.

Italy is anticipated to reach a CAGR of 4.9% during the period 2025 to 2035. Increasing awareness regarding oral aesthetics and oral health is fueling the demand. Curaprox and ION-Sei brands are focusing on ultra-soft bristle technology and antibacterial function in order to attract consumers with health concerns.

One of the unique characteristics of the Italian market is the higher demand for UV sanitization technology in these toothbrushes. Consumers are seeking more advanced sterilization functions that reduce bacterial buildup on brush heads. In addition, higher use of battery-powered travel toothbrushes caters to the travel-oriented lifestyle of Italy's population.

The South Korean electric toothbrush market is expected to clock a CAGR of 6.3% during 2025 to 2035. Highly tech-savvy consumers here are fueling demand for internet-connected toothbrushes with mobile apps and artificial intelligence connectivity. Local players LG and Dr. Philips Korea are leading the development of sophisticated ultrasonic cleaning mechanisms.

One of the interesting trends in South Korea is the trend of oral care with a focus on beauty, where these toothbrushes are marketed as general health routine products. K-beauty trends influencing oral care have resulted in higher demands for gum care and whitening toothbrushes. Subscription-replacement head models are also picking up pace.

Japan's electric toothbrush industry is also anticipated to increase with a CAGR of 5.7% from 2025 to 2035. Japan's population is aging, and it is a major driver of demand. They favor these toothbrushes because of their convenience and performance. Key leaders such as Panasonic and Omron manufacture lightweight and ergonomic products that are suitable for aging consumers.

One of the emerging trends in Japan is having self-cleaning and antimicrobial technology in toothbrushes. As people are health-conscious, companies have introduced UV-sterilizing bristles and antibacterial bristles. Sonic toothbrushes are also becoming popular, as these are not harsh to the gums yet strong enough to remove the plaque.

The Chinese electric toothbrush market will expand at 7.0% CAGR during the period 2025 to 2035, the highest among the countries under consideration. Urbanization and increasing disposable incomes in China have resulted in the demand for premium oral care products. Domestic players such as Xiaomi and Soocas are offering premium but value-for-money toothbrushes.

One of the distinguishing features of the Chinese industry is the ubiquity of e-commerce transactions. Alibaba and JD.com are the primary forces driving the adoption of these toothbrushes. Smart toothbrushes connected via mobile applications also tend to appeal to the young generation, leading to yet another surge in growth.

Australia is predicted to register a CAGR of 5.4% during the period 2025 to 2035. A high prevalence of oral care awareness campaigns and government initiatives has boosted demand among consumers. Oral-B Australia and White Glo are launching products with pressure sensors and timers.

One of the most unique trends in Australia is the growing need for environmentally friendly toothbrushes. Consumers are gravitating toward recyclable and biodegradable head brushes, reflecting the country's emphasis on sustainability.

The electric toothbrush market in New Zealand is expected to develop at a 4.8% CAGR between 2025 and 2035. Increasing awareness of preventative dental care and government-supported health initiatives is driving demand.

Among New Zealand's steady trends is the rising demand for battery-powered toothbrushes, especially in rural areas where charging stations may be scarce. Subscribers also want toothbrush delivery subscription services to replace brush heads and sanitize them constantly.

The electric toothbrush market is witnessing rapid growth due to increasing awareness of oral health, technological progress, and rising consumer particularity toward smart dental care solutions. Consumers seek better plaque removal care, good gum care, and personalized experiences while brushing.

Leading competitors include Philips, Oral-B (P&G), Colgate-Palmolive, Fairywill, and Waterpik, who have incorporated sound and oscillating technology, Bluetooth connectivity, and AI brushing feedback into their products. Emerging start-ups and niche brands entice the sustainability-conscious consumer by providing subscription models and eco-friendly brush designs.

Key innovations are toward enhancing battery life, UV sanitization, and app-based brushing analytics. The brush firms will also customize ergonomic-friendly, travel-capable head designs to meet a variety of consumer requirements.

Strategic factors that shape competition include increasing direct-to-consumer sales, increasing e-commerce presence, and endorsement by dental professionals. As demand for premium and personalized oral care keeps growing, brands have started leveraging digital marketing, loyalty programs, and smart oral health tracking in building their industry positioning.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Philips Sonicare | 25-30% |

| Oral-B (Procter & Gamble) | 20-25% |

| Colgate | 10-15% |

| Fairywill | 5-9% |

| Waterpik | 5-9% |

| Other Companies (combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Philips Sonicare | Philips Sonicare has various high-end toothbrushes that emphasize better plaque removal, gum well-being, and user convenience. |

| Oral-B (Procter & Gamble) | Oral-B has a wide variety of toothbrushes that include features such as smart technology, multiple modes, and real-time feedback. |

| Colgate | Colgate emphasizes offering good-quality toothbrushes at reasonable prices. |

| Fairywill | Fairywill has become popular with cost-effective toothbrushes. |

| Waterpik | Waterpik is famous for its water flosser technology but also provides a variety of high-quality toothbrushes intended to improve oral hygiene. |

Key Company Insights

Philips Sonicare (25-30%)

Philips Sonicare is one of the leading brands of toothbrushes, widely recognized for offering premium products with enhanced features like pressure sensors, real-time feedback, and intelligent connectivity. Philips is concentrating on launching more lines to meet the multiple needs of the consumer, ranging from children-friendly versions to ones suited for users with sensitive gums.

Oral-B (Procter & Gamble) (20-25%)

Oral-B has a dominant market position with its innovative series of toothbrushes. Oral-B continues to dominate the mid-range to premium segment by launching features such as AI-based brushing guidance and personalized feedback.

Colgate (10-15%)

Colgate's toothbrushes are targeting consumers who want quality at a reasonable price. The company's focus on providing various brush modes, pressure sensors, and timers makes it appealing to a wide audience.

Fairywill (5-9%)

Fairywill provides budget-friendly toothbrushes that focus on long battery life, easy-to-use designs, and effective cleaning. The company has become popular through its direct-to-consumer model and online retail presence, enabling it to serve price-sensitive consumers.

Waterpik (5-9%)

Waterpik is known for its water flossing technology and has further entered the industry with products that have brushing and water flossing functions. Waterpik's dual-function models have gained popularity among consumers who want an all-in-one product for oral hygiene.

Other Key Players (25-30% Combined)

The segmentation is into Rechargeable and Battery.

The segmentation is into Economy, Mid-Range, and Premium.

The segmentation is into rotation/oscillating and Sonic/side-by-side.

The segmentation is into Hypermarkets/Supermarkets, Specialty Stores, Drug Stores & Pharmacies, Convenience Stores, Online Retailers, and Others.

The segmentation is into North America, Latin America, Europe, Asia Pacific, Excluding Japan, Japan, and the Middle East & Africa (MEA).

The Electric Toothbrush Market is projected to witness a CAGR of 8.2% between 2025 and 2035.

The Electric Toothbrush Market stood at USD 4.8 billion in 2024.

The Electric Toothbrush Market is anticipated to reach USD 10.5 billion by 2035 end.

North America is set to record the highest CAGR of 7.5% in the assessment period.

The key players operating in the Electric Toothbrush Market include Philips, Oral-B (P&G), Colgate-Palmolive, Panasonic, Waterpik, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Price, 2017 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Price, 2017 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 18: North America Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Price, 2017 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 36: Europe Market Volume (Units) Forecast by Price, 2017 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 38: Europe Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 41: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 42: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 44: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 45: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 46: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Forecast by Price, 2017 to 2033

Table 47: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 48: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 49: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 50: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 51: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 52: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 53: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 54: Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 55: Japan Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 56: Japan Market Volume (Units) Forecast by Price, 2017 to 2033

Table 57: Japan Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 58: Japan Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 59: Japan Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 60: Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2017 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 64: MEA Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Price, 2017 to 2033

Table 66: MEA Market Volume (Units) Forecast by Price, 2017 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Head Movement, 2017 to 2033

Table 68: MEA Market Volume (Units) Forecast by Head Movement, 2017 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Sales Channel, 2017 to 2033

Table 70: MEA Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Price, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 15: Global Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 19: Global Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Price, 2023 to 2033

Figure 28: Global Market Attractiveness by Head Movement, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Price, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 45: North America Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 49: North America Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Price, 2023 to 2033

Figure 58: North America Market Attractiveness by Head Movement, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Price, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Price, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Head Movement, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Price, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Price, 2023 to 2033

Figure 118: Europe Market Attractiveness by Head Movement, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) by Price, 2023 to 2033

Figure 123: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 124: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 127: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 128: ASIA PACIFIC EXCLUDING JAPAN Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: ASIA PACIFIC EXCLUDING JAPAN Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 131: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 132: ASIA PACIFIC EXCLUDING JAPAN Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: ASIA PACIFIC EXCLUDING JAPAN Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 135: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 136: ASIA PACIFIC EXCLUDING JAPAN Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 137: ASIA PACIFIC EXCLUDING JAPAN Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 138: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 139: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 140: ASIA PACIFIC EXCLUDING JAPAN Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 141: ASIA PACIFIC EXCLUDING JAPAN Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 142: ASIA PACIFIC EXCLUDING JAPAN Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 143: ASIA PACIFIC EXCLUDING JAPAN Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 144: ASIA PACIFIC EXCLUDING JAPAN Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: ASIA PACIFIC EXCLUDING JAPAN Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: ASIA PACIFIC EXCLUDING JAPAN Market Attractiveness by Product Type, 2023 to 2033

Figure 147: ASIA PACIFIC EXCLUDING JAPAN Market Attractiveness by Price, 2023 to 2033

Figure 148: ASIA PACIFIC EXCLUDING JAPAN Market Attractiveness by Head Movement, 2023 to 2033

Figure 149: ASIA PACIFIC EXCLUDING JAPAN Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: ASIA PACIFIC EXCLUDING JAPAN Market Attractiveness by Country, 2023 to 2033

Figure 151: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: Japan Market Value (US$ Million) by Price, 2023 to 2033

Figure 153: Japan Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 154: Japan Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 157: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 158: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 161: Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 162: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: Japan Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 165: Japan Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 166: Japan Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 167: Japan Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 168: Japan Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 169: Japan Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 170: Japan Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 171: Japan Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 172: Japan Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 173: Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 174: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 177: Japan Market Attractiveness by Price, 2023 to 2033

Figure 178: Japan Market Attractiveness by Head Movement, 2023 to 2033

Figure 179: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Japan Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Price, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Head Movement, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 187: MEA Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 191: MEA Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 192: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: MEA Market Value (US$ Million) Analysis by Price, 2017 to 2033

Figure 195: MEA Market Volume (Units) Analysis by Price, 2017 to 2033

Figure 196: MEA Market Value Share (%) and BPS Analysis by Price, 2023 to 2033

Figure 197: MEA Market Y-o-Y Growth (%) Projections by Price, 2023 to 2033

Figure 198: MEA Market Value (US$ Million) Analysis by Head Movement, 2017 to 2033

Figure 199: MEA Market Volume (Units) Analysis by Head Movement, 2017 to 2033

Figure 200: MEA Market Value Share (%) and BPS Analysis by Head Movement, 2023 to 2033

Figure 201: MEA Market Y-o-Y Growth (%) Projections by Head Movement, 2023 to 2033

Figure 202: MEA Market Value (US$ Million) Analysis by Sales Channel, 2017 to 2033

Figure 203: MEA Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 204: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 207: MEA Market Attractiveness by Price, 2023 to 2033

Figure 208: MEA Market Attractiveness by Head Movement, 2023 to 2033

Figure 209: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Disposable Electric Toothbrushes Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA