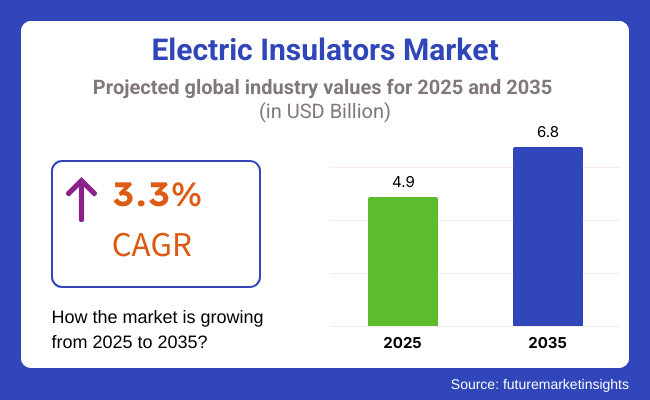

Electric insulators that work using electricity are expected to thrive from USD 4.9 billion in 2025 to USD 6.8 billion by 2035, and this is a result of a CAGR of 3.3%. Investments in power infrastructure are increasing; the sector of renewable energy is expanding and electricity demand all over the world is increasing are driving factors of this development.

Insulating materials are in greater demand as countries ensure their electrical grids undergo modernization and the government forces them to use high-voltage direct current (HVDC) transmission systems.

The performance scale is pushed more for the technology market due to regulatory norms which advocate upon efficiency and reliability. Composite insulators not only outperform traditional ceramic and glass types but are also much lighter thus are increasingly being adopted.

Companies, on the other hand, are focusing on energy efficiency and are thus investing their resources to improve insulation systems in the quest for better electrical networks. For instance, across the USA and Europe, polymer insulators that are installed by utilities are now being used to replace the old ones with the ones that are corrosion-free, endure harsh environments, and have an additional design of a longer life.

Nonetheless, one of the big problems the company strategist must tackle is the difficult starting the advanced insulating materials like composite and polymer insulators. Although they need the project to be durable and efficient, the manufacturing and installation costs are so high that these utilities often decide against them.

Apart from that, fluctuations in raw materials' prices such as silicon, ceramics, and polymers also affect the production costs and create a dilemma for manufacturers and suppliers in terms of pricing. In addition to that, regulatory compliance causes significant greenhouse gases losses, as governments often demand high levels of safety and performance for electric insulators.

To be able to meet the global certification requirements, therefore, the manufacturers need extra investment in research and development, which in turn further raises operational expenses.

Besides this, environmental issues like weather extremes, industrial pollution, and salt deposits in coastal areas result in the insulator degeneration that in turn increases the need for operability diversity and therefore raises the costs on maintenance and replacements.

For example, electrical transmission in areas with heavy rainfall or sandstorms would require the use of water-resistant insulators to assure the reliability of the transmission.

However, the electric insulators market is a great place to be with so many opportunities around even though there are those difficulties. Demand for sensor-enabled insulators, which are equipped with the Internet of Things (IoT) and artificial intelligence (AI) technologies, mainly stems from the proliferation of smart grids and digital surveillance technologies.

Digital surveillance is more efficient, offers more transparency, and fits the criteria for IoT at the same time. Smart grids privatize energy supply diversification in addition to managing market processes more efficiently.

Explore FMI!

Book a free demo

The above table provides such crucial elements to the electric insulators market across four stakeholder groups including utility companies, equipment manufacturers, installers, and regulatory bodies.

Inspectors, installers, and equipment manufacturers all give insulation strength and reliability top marks, and it is universally accepted that strong, high-performance insulators are critical for the protection of electrical systems. The first three groups consistently regard cost and value as of moderate importance, while regulators see cost as less important.

Ease of installation ranks as the most important factor for the installers, who attached a high ranking to it while the remaining groups gave it a medium value.

Finally, the compliance with standards is extremely important to any regulatory body and gained a very high score, while still being important, but less so for utility companies and installers. In conclusion, this analysis sheds insight into both the technical, operational, and compliance priorities that propel market demand for electric insulators.

The period from 2020 to 2024 observed growth in the electric insulators market because of the growing need for electricity, grid modernization, and moving towards renewable energy. The adoption of composite and polymeric insulators grew, replacing the erstwhile standard of ceramic and glass insulators due to their better performance under extreme conditions.

The rapid growth of transmission and distribution infrastructure projects, especially in emerging economies, further buoyed demand in the market. Yet, disruptions in the supply chain and changes in raw material pricing adversely affected the manufacturers.

From 2025 to 2035, smart grid technology and HVDC (high-voltage direct current) transmission development will spur innovation in electric insulators. Investments will increase in sustainable and recyclable materials for eco-friendly solutions for grids. With the increased scale of offshore wind farms and electric vehicle charging networks, the demand will grow for high-performance insulators.

Moreover, self-cleaning and condition-monitoring insulators with IoT-enabled predictive maintenance will boost grid reliability, which will lower the downtime and operational costs for present-day power systems.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 → 2025 to 2035 |

|---|---|

| Regulatory Landscape | Harsh safety and performance standards; reliability and grid modernization focus → Emphasis on the use of eco-friendly materials for insulation, more sustainability directives and smart grid regulations. |

| Technological Advancements | Emergence of polymer insulators for high efficiency and resistance → Nanotechnology, self-repairing material, and artificial intelligence-based monitoring systems. |

| Industry-Specific Demand | From the initial use of recyclable materials along with bio-based insulators → Very strong focus on fully recyclable, biodegradable, and low-carbon footprint materials. |

| Sustainability & Circular Economy | From the initial use of recyclable materials along with bio-based insulators → Very strong focus on fully recyclable, biodegradable, and low-carbon footprint materials. |

| Production & Supply Chain | Global supply chain interruptions caused raw material shortages and increased costs → Regionally located production to promote resiliency with AI-enabled supply chain optimization. |

| Market Growth Drivers | Infrastructure upgrading, increased power demand, and grid reliability concerns → Smart grid implementation, electric transportation, and new tech for insulation materials. |

Some factors place the electric insulators market at the risk of market fluctuations due to its dependence on raw material inputs- porcelain, glass and polymer composites being key components in the manufacture of electric insulators, which is subjected to disruptions in the global supply chain and price volatility. Cost is also exposed to changes in fuel prices through energy-intensive manufacturing processes.

China’s predominance in material supply means the country’s export restriction or shift in economic direction can shake prices and supply. Another major consideration is regulatory compliance, as there are stringent industry standards around dielectric strength, pollution resistance, and environmental sustainability.

Falling short of the evolving standards can lead to liability risks, contract losses, and fines. The competition is fierce, too, with Chinese manufacturers offering low-cost alternatives that amplify the pressure on prices and drive established players to innovate, or cut costs. Technological risks - new grid solutions, such as superconducting transmission or underground cables, may reduce demand for existing overhead insulators.

Climate change is even more of a factor, as manufacturers face rising R&D costs due to extreme weather conditions creating a need for more durable products.

Utility investment cycles also drive demand in unpredictable ways, and revenue streams have become vulnerable to market slowdowns or changes in policy. To mitigate such risks, firms should zero in on supply chain diversification, compliance with emerging standards and product differentiation via innovation.

The pricing in the electric insulators market largely depends upon the competition available in the market as the electric insulators market is a competitive bidding market where manufacturers follow cost plus pricing strategy to ensure profit margins while remaining competitive in price.

For example, standard insulators - whether used in common grid applications - reassure a lot of pricing pressure, uplifting commoditization, which generally pushes vendors to optimize costs through cost-efficient manufacturing as well as bulk production.

In contrast, for advanced polymer insulators and high-voltage applications, performance, installation benefits, and service life will drive value-based pricing and justify premium rates. Custom and made-to-order insulators likewise carry inflated prices because of the engineering involved and specialized materials used.

Long-term contracts with utilities help the company nail down its prices; these contracts often include volume based purchase discounts to lock in large volume orders.

Increases in prices may also be impacted by global competition, with tariffs related to imports affecting both government tariffs and domestic manufacturers. In addition, rising material and energy costs exert upward pressure on the pricing while new technologies like lightweight composites and smart insulators enable companies to command premium pricing.

To remain competitive, suppliers should seek a careful balance between products and services that technically meet budgetary constraints and those that meet specifications for long-term performance gain.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 2.8% |

| European Union | 3.0% |

| China | 3.8% |

| India | 4.1% |

| Japan | 2.6% |

As per research conducted by FMI, The USA electric insulator industry is expanding moderately at a 2.8% CAGR, driven by robust drivers such as aging infrastructure, grid modernization plans, and rising investments in renewable energy.

The key trend is the need for composite insulators, which offer better performance, longer lifespan, and cost advantages over traditional materials. Government stimulus for the use of smart grid technology and green measures is driving the industry, although still present volatility of raw material prices and supply chains.

Investment in the smart grid is one of the prime drivers of the industry. America's utilities are spending heavily on smart grid technology in efforts to enhance efficiency as well as minimize transmission loss in accordance with the government's efforts to modernize the grid. Replacement of aging infrastructure, particularly in urban cities, is creating demand for new insulators.

Composite insulators are being used more and more with their lower weights, higher strengths, and lower prices compared to conventional ceramic insulators. Governments' policy measures towards renewable power such as federal grants and tax credits are driving the expansion of wind and solar power and that necessitates special high-end insulators.

Growth drivers in the USA

| Key Drivers | Details |

|---|---|

| Smart Grid Investments | Utilities are investing in smart grid technology to enhance grid efficiency and reduce transmission loss. |

| Replacement of Aging Infrastructure | Aging infrastructure, particularly transmission lines in metropolitan areas, is driving demand for new insulators. |

| Increase in Composite Insulator Use | Composite insulators are lighter, stronger, and cheaper compared to traditional ceramic insulators. |

| Renewable Energy Policy | Government policies, such as federal grants and tax incentives, are stimulating the growth of wind and solar energy, creating demand for high-end insulators. |

According to FMIs analysis the electric insulator industry for the European Union is expected to grow at a 3.0% CAGR since the region has strong sustainability and carbon reduction momentum. The European Green Deal and robust environmental regulations are driving the need for sustainable material and technology.

Germany and France are investing aggressively in high-voltage direct current (HVDC) transmission systems, thus fueling the growth of the industry too. Despite the huge demand, there exist compliance expenses as well as constant material development needs.

EU emphasis on sustainability is among the strongest drivers since governments are increasingly favoring green energy technology and green insulation materials. Investment in HVDC transmission systems is propelling long-distance transmission of power, which requires best-class insulators. Green and environmental law is driving demand for non-toxic and recyclable insulation material.

Growth Drivers in European Union

| Key Drivers | Details |

|---|---|

| Sustainability Emphasis | Governments are prioritizing green energy sources and environmentally friendly insulation materials. |

| Increased Investment in HVDC Systems | HVDC transmission systems are improving long-distance power transmission, increasing demand for efficient insulators. |

| Increased Demand for Environment-Friendly Products | Stricter environmental regulations require the use of non-toxic and recyclable insulator materials. |

As per FMIs research, China's electric insulator industry is evolving significantly at a 3.8% CAGR due to its strong industrial growth, infrastructural growth, and government initiatives. Smart grid initiatives and extra-high voltage transmission lines are the strongest drivers of demand.

Constant urbanization and electrification of rail transport are also growing high-capacity insulator demand. Competition in the industry, price sensitivity, and availability of low-cost players are issues.

Government expenditure on higher-capacity transmission systems is a significant driver, with the Chinese government increasing the power grid to satisfy increased industrial and residential energy requirements.

The nation's growing railway and industrial infrastructure also increases demand for higher-capacity insulators. China is a dominant producer and exporter of electric insulators but remains a captive industry for insulators whose price competitiveness affects profit margins.

Growth Drivers in China

| Key Drivers | Details |

|---|---|

| Government Investments in Transmission | Government-backed initiatives are expanding power grids to meet the growing energy demand. |

| Developing Railway and Infrastructure | Urbanization and rail electrification are creating additional demand for high-capacity insulators. |

| Strong Domestic Manufacturing Strength | China is the largest producer and exporter of electric insulators both domestically and internationally. |

| Challenges of Competitive Pricing | Local manufacturers offer low-cost products, leading to intense competition and margin pressure. |

India's electric insulation industry is expanding at a rapid 4.1% CAGR, led by rural electrification, industrialization, and urbanization. Government policies like "Make in India" and "Power for All" are encouraging infrastructure growth and local manufacturing.

Foreign direct investment (FDI) growth in power transmission projects is also propelling industry growth. Raw material price volatility and regulatory changes remain challenges.

Mass rural electrification schemes are one of the key drivers, where government schemes are attempting to extend power supply to villages, also contributing significantly to demand for insulators. The government's "Make in India" campaign is promoting local manufacturing and putting an end to reliance on imports from abroad.

Long-term investment in transmission gear in the power industry is improving delivery of power and boosting demand for better insulators. Raw material price volatility, especially polymer and ceramic raw material price volatility, is creating hurdles in production cost.

Growth drivers in India

| Key Drivers | Details |

|---|---|

| Rural Electrification Schemes | Government policies focused on rural electrification are driving demand for insulators. |

| Government Support to Local Production | Initiatives like "Make in India" encourage local manufacturing of insulators and reduce dependence on imports. |

| Increased Investment in Power Transmission/Grid Expansion | Large-scale grid expansion projects are boosting demand for high-quality insulators. |

| Unstable Raw Material Prices | Fluctuating prices of materials like ceramics and polymers affect production costs. |

The industry for electric insulators in Japan is rising steadily at a 2.6% CAGR. The demand for strong infrastructure, since the country is prone to earthquakes and natural disasters, is what drives the industry.

The power sector in Japan is rising steadily but is repressed by some restrictions. Technological advancements in the insulating material are what are driving the expansion in the industry, but development growth in the infrastructure is very sluggish.

Japan focuses on grid resilience and disaster-proofed buildings because of seismic activity. Seismic-resistant power equipment takes priority so that reliability is made possible. Additional innovation in insulation technology is creating demand for improved material that not only boosts efficiency but also delivers better life.

But evolution in Japan's mature power sector is gradual enough to cap expansion in the industry, and excellent quality standards in the nation mean only quality insulator products are employed.

Growth Drivers in Japan

| Key Drivers | Details |

|---|---|

| Grid Resilience and Disaster-proof Infrastructure | Earthquake-resistant power infrastructure is a top priority in Japan’s power grid development. |

| Innovation in Insulation Technologies | Advances in insulation technology are driving the demand for more efficient and durable insulators. |

| Mature Power Sector | Slow growth in Japan's mature power sector limits new opportunities for industry expansion. |

| Quality Standards | Japan's high standards for quality ensure that only top-grade insulators are used in the power system. |

Owing to their excellent mechanical strength, electrical resistance and durability, ceramic insulators account for a majority share in the industry. They are extensively utilized in high voltage transmission and distribution networks for stable and reliable power flow. Because they’re highly resistant to extreme weather conditions, pollution, and heat stress, they’re perfect for outdoor installations.

The use of Al2O3-based insulators for HVDC applications enables long-distance electricity transmission for governments and utilities that invest in HVDC systems. Moreover, their cheap production and long life play a key role in mass adoption in areas with extreme climatic conditions. Some of the dominant players in the industry are Lapp Insulators, TE Connectivity, and General Electric.

Composite insulators are becoming more popular owing to their lightweight design, excellent contamination resistance and flexibility. The fiberglass-reinforced polymer materials provide great mechanical strength and strong environmental resistance to humidity, salt deposits, and industrial pollution.

Wood and ceramic insulators lose their properties at high humidity, but composite insulated systems continue to behave effectively. The proliferation of smart grids and the shift to renewable energy sources is driving the demand for these insulators as they require less maintenance and have a longer service life in contrast to ceramic and glass based counterparts.

Others inclined towards affordable insulator technology can look up to ABB, Hubbell, and Sediver which lead the composite insulator manufacturing industry.

Utilities in developed nations are updating old infrastructure, while rapid electrification in emerging economies is further driving industry growth. The USA Grid Modernization Initiative - and India’s Revamped Distribution Sector Scheme (RDSS) - call for advanced insulation solutions, for example.

The transition to renewable energies - including wind farms, solar parks, and power generation at sea - also needs modern insulators to enable interference-free transmission of electricity. Key suppliers in this space are Siemens Energy, General Electric, and ABB.

Manufacturing industries are heavily dependent on stable power supply for operational activities, resulting in high demand for electric insulators which, in turn, is providing a boost to the electric insulator industry. High Voltage Do Insulation In industries such as oil gas, mining, steel, chemicals, and heavy machinery, high-voltage insulation is necessary to ensure safety and continuity of the operations.

Market growth is also accelerated by the deployment of equipment such as industrial automation, energy management systems, and high-voltage electrical components. Furthermore, industries are focusing on energy conservation and environmentally friendly production, which is driving investment in technology-driven insulators.

Megatrends such as industrialization and factory expansions combined with surging demand for better efficiencies are driving demand for electrical insulation solutions in the Asia-Pacific region, specifically in China and India. Some of the key players in the market include Hubbell, TE Connectivity, and NGK Insulators.

The electric insulator market is highly competitive, with key players leveraging technological innovation, strategic partnerships, and global market expansion to strengthen their positions. The growing demand for dependable and efficient power transmission and distribution systems necessitates improvements in materials, durability, and smart grid compatibility to keep these companies competitive.

The energy infrastructure requirements are now being catered to by various established manufacturers and growing players according to their own marketing strategies.

ABB, Siemens Energy, and GE Grid Solutions dominate competition through organic and inorganic growth strategies and thus securing contracts in emerging markets of India and the Middle East to expand their outreach. Technological advancement and product diversification in high-performance solutions for modern power grids are strategic goals for NGK Insulators Ltd. and Aditya Birla Insulators.

Meanwhile, Hubbell Power Systems, MacLean-Fogg Company, and Seves Group offer insulator solutions for niche markets while focusing on quality upgrades and regional expansions.

Innovative solutions in composite and ceramic insulators along with smart grid integration, as well as sustainable manufacturing, will propel companies further in transforming the emerging complete landscape, thus responding to the global demand for high-voltage and high-performance insulation solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABB Group | 20-24% |

| Siemens Energy | 15-19% |

| NGK Insulators Ltd. | 12-16% |

| MacLean-Fogg Company | 8-12% |

| Bharat Heavy Electricals Ltd. (BHEL) | 6-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABB Group | Specializes in high-voltage insulators and smart grid solutions for power transmission as well as distribution. |

| Siemens Energy | Offers transformer insulation systems, focusing on energy-efficient and environmentally friendly technologies. |

| NGK Insulators Ltd. | Develops ceramic insulators with advanced dielectric properties for enhanced electrical performance. |

| MacLean-Fogg Company | Provides customized composite insulators with high mechanical strength and durability. |

| Bharat Heavy Electricals Ltd. (BHEL) | It manufactures high-voltage porcelain and polymer insulators for utility and industrial applications. |

Key Company Insights

ABB Group (20-24%)

A global leader in power transmission and distribution equipment, ABB puts significant efforts into the development of smart insulation technology and environmental-friendly materials.

Siemens Energy (15-19%)

Concentrates on highly efficient insulating solutions, including dry transformer insulators and high-voltage grid components.

NGK Insulators Ltd. (12-16%)

A major supplier of high-quality ceramic-based insulators with special emphasis on long-term use in electrical applications.

MacLean-Fogg Company (8-12%)

Specializing in customized composite insulators tailored for utility and industrial applications.

Bharat Heavy Electricals Ltd. (6-10%)

High-voltage insulator manufacturer specializing mostly in power plants, substations, and transmission networks.

The market was valued at USD 4.9 billion in 2025.

The market is predicted to reach a size of USD 6.8 billion by 2035.

Key companies in the market include ABB Group, Bharat Heavy Electricals Ltd., KREMPEL GmbH, MacLean-Fogg Company, NGK Insulators Ltd., PFISTERER Holding AG, Siemens Energy, Toshiba Corporation, WT Henley, and Hubbell.

India is expected to be a prominent hub for electric insulators manufacturers.

The most widely used product segment in the market is ceramic insulators.

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Drag Reducing Agent Market Growth 2025 to 2035

Electronic Board Level Underfill Material Market Analysis - Size, Share & Forecast 2025 to 2035

Condensing Unit Market Trends-Growth, Demand & Forecast 2025 to 2035

Cryogenic Pump Market Size & Trends 2025 to 2035

Electroplating Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.