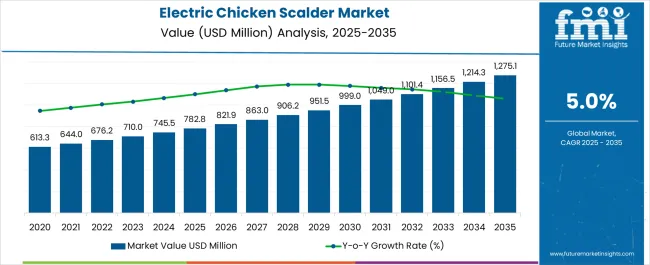

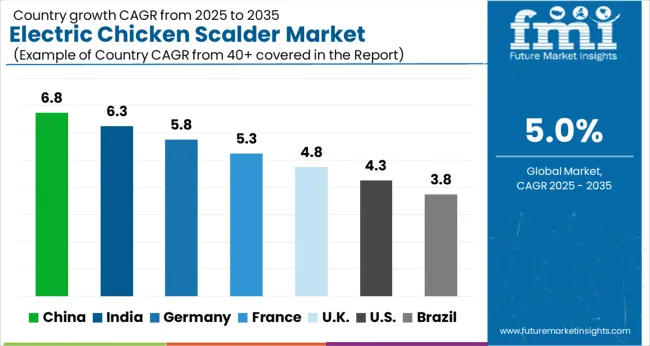

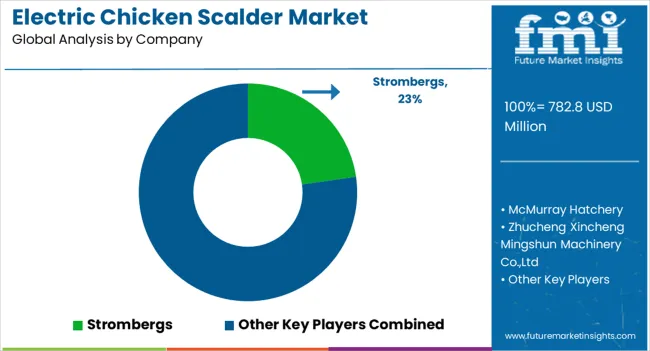

The Electric Chicken Scalder Market is estimated to be valued at USD 782.8 million in 2025 and is projected to reach USD 1275.1 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Electric Chicken Scalder Market Estimated Value in (2025 E) | USD 782.8 million |

| Electric Chicken Scalder Market Forecast Value in (2035 F) | USD 1275.1 million |

| Forecast CAGR (2025 to 2035) | 5.0% |

The electric chicken scalder market is experiencing strong growth supported by increasing demand for automation and efficiency in poultry processing. Rising consumption of poultry meat worldwide, coupled with growing emphasis on hygienic and standardized processing, is driving adoption of advanced scalding equipment.

Regulatory requirements related to food safety and quality assurance are further influencing market expansion, encouraging commercial processors to invest in electric scalders that ensure consistency and reduce manual dependency. Technological improvements such as temperature control systems, energy efficiency, and enhanced safety features have also contributed to wider adoption.

With the poultry industry focusing on productivity, operational efficiency, and compliance with international standards, the outlook for electric chicken scalders remains positive, offering opportunities across both commercial and small scale processing units.

The market is segmented by Mode of Operation, Application, and Sales Channel and region. By Mode of Operation, the market is divided into Manual and Automatic. In terms of Application, the market is classified into Commercial and Household. Based on Sales Channel, the market is segmented into Direct Sales and Retail Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

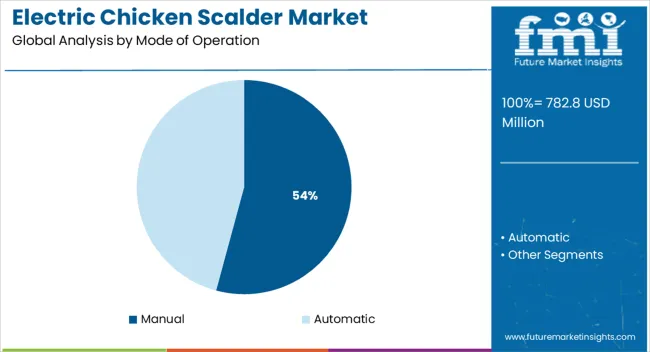

The manual mode of operation segment is expected to account for 54.20% of total market revenue by 2025, making it the largest segment. Its dominance is attributed to affordability, ease of availability, and suitability for small and medium scale poultry processors.

Manual scalders require lower initial investment compared to automated models, making them attractive for emerging markets and independent poultry businesses. Their simple design and lower maintenance needs further reinforce adoption.

Despite the gradual shift toward automation, manual models continue to maintain strong presence due to their cost effectiveness and practicality in regions with limited access to advanced equipment.

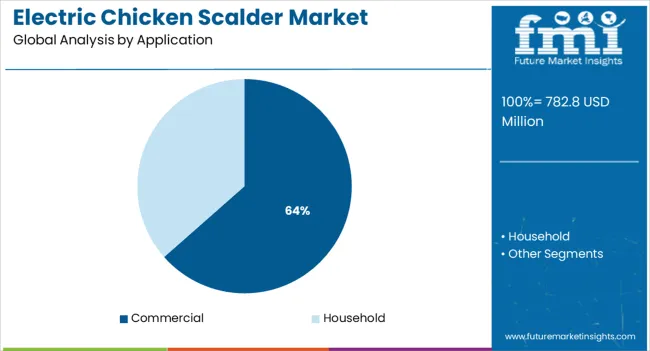

The commercial application segment is projected to hold 63.50% of overall market revenue by 2025, positioning it as the leading application category. Growth in this segment is being driven by rising demand for processed poultry in quick service restaurants, food service chains, and export oriented operations.

Commercial processors prioritize equipment that delivers consistent scalding, minimizes downtime, and meets hygiene regulations. Electric scalders offer operational efficiency and compliance with industry standards, making them the preferred choice in large scale poultry processing facilities.

Expanding global poultry trade and investment in industrial slaughterhouses continue to reinforce the prominence of this application segment.

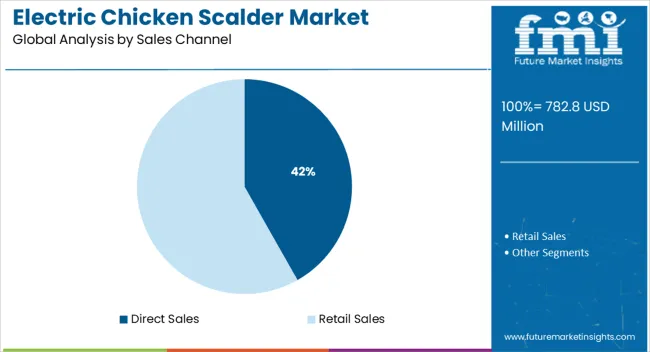

The direct sales channel segment is projected to contribute 41.80% of total market revenue by 2025, establishing it as the primary distribution method. This share is supported by the preference of poultry equipment manufacturers to build direct relationships with end users, ensuring better after sales service and customization options.

Direct sales enable manufacturers to offer tailored solutions, installation support, and long term maintenance contracts, thereby increasing customer confidence.

As commercial processors and independent businesses prioritize reliability and technical assistance, direct sales have emerged as a dominant channel for the distribution of electric chicken scalders.

The market for electric chicken scalder is growing at a steady pace, driven by several key factors. Increased demand for sustainable and eco-friendly products is a prominent driver of the electric chicken scalder industry. Electric chicken scalders are considered more environmentally friendly than traditional gas-powered scalders, as they do not produce emissions or require fuel. This is particularly important as consumers and businesses alike are becoming more conscious of their impact on the environment and are looking to make more sustainable choices.

One of the prominent sales driver of electric chicken scalder is rising labor costs. Electric chicken scalders are often more efficient and require less labor to operate, which can help reduce labor costs for manufacturers. In addition, advancements in technology have led to the development of newer and more advanced electric chicken scalder models with better features, improved efficiency, and reduced maintenance costs.

Government initiatives and regulations to promote the use of energy-efficient equipment are also anticipated to boost the adoption of electric chicken scalder during the forecast period. These factors are making electric chicken scalder an attractive investment opportunity for companies looking to tap into the growing market.

| Report Attributes | Details |

|---|---|

| Electric Chicken Scalder Market Value (2025) | USD 710 million |

| Electric Chicken Scalder Market CAGR (2025 to 2035) | 5% |

| Anticipated Electric Chicken Scalder Market Value (2035) | USD 1,157 million |

According to Future Market Insights, the electric chicken scalders industry has been on a steady growth trajectory, with a CAGR of 4.5% from USD 613.3 million in 2020 to USD 782.8 million in 2025. This growth can be attributed to several key factors, including the increasing demand for improved processed meat driven by the growth of fast food and restaurant chains, as well as rising per capita income and consumer preferences for food with added value.

Profit margins for manufacturers of electric chicken scalders are closely tied to technological advancements in the food processing sector. These advancements, such as integrating all process equipment into a single component, aim to reduce labor requirements and improve cleanliness.

| Attribute | Valuation |

|---|---|

| 2025 | USD 782.77 million |

| 2035 | USD 906.16 million |

| 2035 | USD 1101.44 million |

The market is anticipated to rise at a CAGR of 5% from 2025 to 2035, surpassing USD 1,157 million by 2035.

Automation Leads the Way: The Rise of Automatic Electric Chicken Scalder

Automatic electric chicken scalder is the leading segment in the market with a share of 45% during the forecast period. The growth of this segment can be attributed to the increasing demand for automated and efficient processing of poultry products in the commercial sector. Automated electric chicken scalders are more effective and humane than manual defeathering and are capable of handling high volumes of poultry products.

Commercial Sector Dominates: The Growth of Electric Chicken Scalder in the Commercial Application

Commercial electric chicken scalder is the leading segment in the market with a share of 35% during the forecast period. The growth of this segment can be attributed to the increasing consumption of processed poultry products in the commercial sector, such as fast-food chains and restaurants. In addition, the rise of small and medium-sized enterprises in emerging nations that require pre-processed poultry products to meet the demands of their customers and adhere to stringent food safety and hygiene standards also drives the demand for commercial electric chicken scalder.

Retail Sales on the Rise: The Convenience of Purchasing Electric Chicken Scalder in Retail Outlets

The retail sales channel is the leading segment in the market with a share of 30% during the forecast period. The growth of this segment can be attributed to the increasing awareness among consumers about the benefits of electric chicken scalders and the convenience of purchasing them through retail channels. In addition, the widespread availability of electric chicken scalders in various retail outlets across the globe also drives the demand for retail sales of electric chicken scalder.

| Country | The United States |

|---|---|

| Market Share (2025 to 2035) | 30.6% |

| Market Value by 2035 (in USD million) | 1275.1 |

| Country | Germany |

|---|---|

| Market Share (2025 to 2035) | 18.4% |

| Market Value by 2035 (in USD million) | 164.4 |

| Country | United Kingdom |

|---|---|

| Market Share (2025 to 2035) | 5.4% |

| Market Value by 2035 (in USD million) | 101.2 |

| Country | China |

|---|---|

| Market Share (2025 to 2035) | 9.1% |

| Market Value by 2035 (in USD million) | 91.0 |

| Country | Japan |

|---|---|

| Market Share (2025 to 2035) | 5.3% |

| Market Value by 2035 (in US million) | 35.9 |

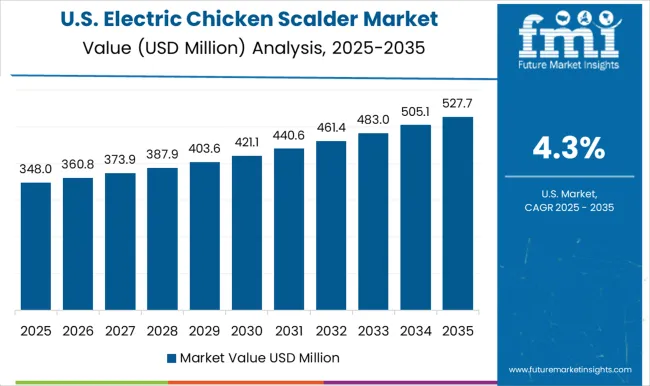

United States to Lead the Electric Chicken Scalder Industry Holding a Share of 30.6% from 2025 to 2035

The United States electric chicken scalder market is anticipated to surpass USD 1275.1 million by 2035, accounting for a 30.6% share during the forecast period. This growth can be attributed to several factors, including the increasing popularity of fast food and restaurant chains, rising per capita income, and consumer preferences for food with added value.

The fast food and restaurant industry in the United States is a major contributor to the growth of the electric chicken scalder market. The increasing popularity of fast food and restaurant chains in the country is driving the demand for processed meat, which in turn is driving the demand for electric chicken scalders. Also, rising per capita income and consumer preferences for food with added value are also key factors influencing electric chicken scalder sales.

In addition, the increasing awareness about food safety and hygiene standards is also expected to drive market growth. The United States has stringent food safety regulations, and this is expected to drive the demand for electric chicken scalders as they are considered to be more hygienic and efficient than manual defeathering.

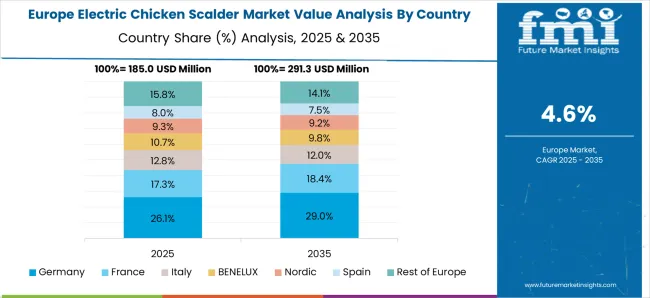

Germany Account for a Substantial Share in the European Electric Chicken Scalder Market

The electric chicken scalder industry in Germany is expected to be worth USD 164.4 million by 2035, accounting for an 18.4% share during the forecast period. This can be attributed to the country's strong poultry processing industry, as well as the presence of major players in the food processing sector. Additionally, the implementation of stringent food safety and hygiene regulations in Germany is expected to drive the demand for electric chicken scalders.

The electric chicken scalder market in the United Kingdom is expected to be worth USD 101.2 million by 2035, growing at a CAGR of 5.4% during the forecast period. This can be attributed to several key factors, including the increasing demand for improved processed meat driven by the growth of fast food and restaurant chains, as well as rising per capita income and consumer preferences for food with added value.

Japan Electric Chicken Scalder Market Outlook

Japan's electric chicken scalder industry is to reach USD 35.9 million by 2035, expanding at a CAGR of 5.3% over the projected period. This growth is driven by several factors, including increasing demand for poultry meat in Japan, advancements in technology and automation, and government support for the industry. One of the main drivers of growth in the electric chicken scalder industry in Japan is the increasing demand for poultry meat. As the population of Japan continues to grow and the economy improves, consumers can afford more protein-rich foods, such as chicken.

Another factor contributing to the growth of the electric chicken scalder industry in Japan is the advancements in technology and automation. These advancements have led to increased efficiency and cost savings for producers, making it more profitable for them to invest in the industry. Automation also allows for greater consistency and precision in the production process, which is important in meeting the high-quality standards of Japanese consumers.

Due to the High Demand for Electric Chicken Scalders, China to Hold a 9.1% Share by 2035

China accounts for a 9.1% share of the electric chicken scalder industry, growing at a CAGR of 4% during the forecast period. By 2035, due to high poultry meat consumption in the region, China's electric chicken scalder industry is anticipated to surpass USD 91 million. The demand for electric chicken scalder in China is anticipated to increase as family income rises, eating habits change, and customer tastes move toward value-added items.

A significant portion of China's total agricultural production is composed of chicken production. Electric chicken scalders are extensively utilized in China as a result of strong acceptance rates for the technology and the emergence of new competitors with innovative products.

Electric chicken scalder manufacturers have adopted several innovative growth strategies to capture a larger share of the market. Some of these strategies include:

Strombergs, McMurray Hatchery, and Zhucheng Xincheng Mingshun Machinery Co., Ltd are some of the leading manufacturers of electric chicken scalder machines. These companies have been at the forefront of innovation in the industry, and have contributed significantly to the growth of the market.

Strombergs:

The company has been known for its innovative and high-quality electric chicken scalder machines. They have developed an electric chicken scalder that uses a water-based scalder that is more efficient and sustainable than traditional oil-based models. This product innovation has helped the company to stand out in the market and capture a larger share of the market.

McMurray Hatchery:

McMurray Hatchery has been a leader in the electric chicken scalder industry for many years. They have developed an electric chicken scalder that uses a unique combination of heat and pressure to remove feathers quickly and effectively. This product innovation has helped McMurray Hatchery to increase its customer base and gain a larger share of the market.

Zhucheng Xincheng Mingshun Machinery Co.,Ltd:

The company is well-known for its electric chicken scalder machines, they have developed an electric chicken scalder with high-tech sensors that can detect and remove any feathers that were missed during the plucking process. This product innovation has helped the company to stand out in the market and increase its market share.

The global electric chicken scalder market is estimated to be valued at USD 782.8 million in 2025.

The market size for the electric chicken scalder market is projected to reach USD 1,275.1 million by 2035.

The electric chicken scalder market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in electric chicken scalder market are manual and automatic.

In terms of application, commercial segment to command 63.5% share in the electric chicken scalder market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA