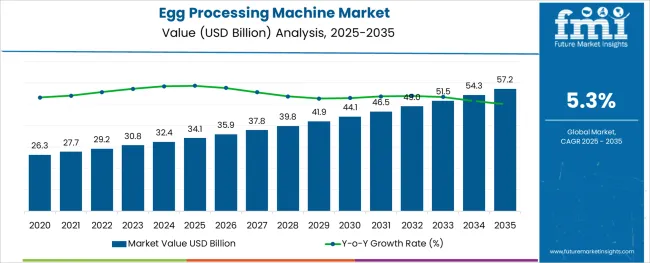

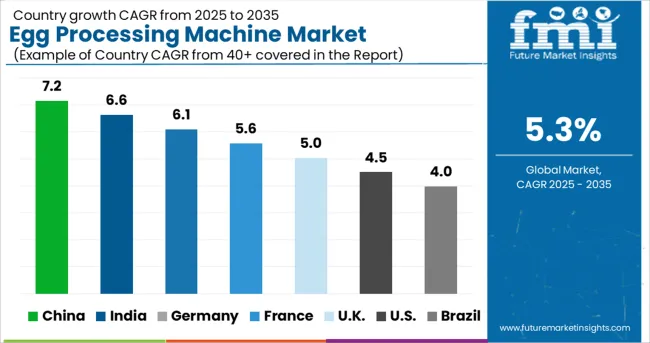

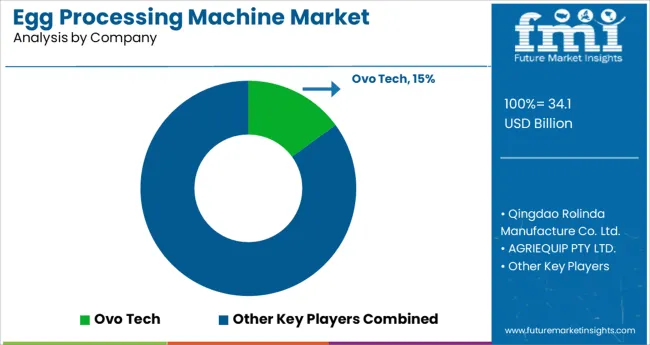

The Egg Processing Machine Market is estimated to be valued at USD 34.1 billion in 2025 and is projected to reach USD 57.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The egg processing machine market is undergoing notable expansion as the demand for automated, efficient, and hygienic egg processing solutions continues to rise globally. This growth is being shaped by the increasing need for high-volume egg handling in compliance with food safety regulations, coupled with labor cost optimization in food production facilities.

Technological advancements in machinery design, material durability, and energy efficiency are enabling producers to improve productivity and minimize wastage, fostering stronger adoption. Future prospects appear favorable as evolving consumer demand for processed egg products, such as liquid eggs and powdered forms, creates consistent pressure for scalable solutions.

Further momentum is expected as producers seek to modernize operations in response to stricter hygiene standards, higher throughput requirements, and the push for sustainable, resource-efficient practices. These dynamics are paving the way for both incremental improvements and transformative innovations within the egg processing machinery sector.

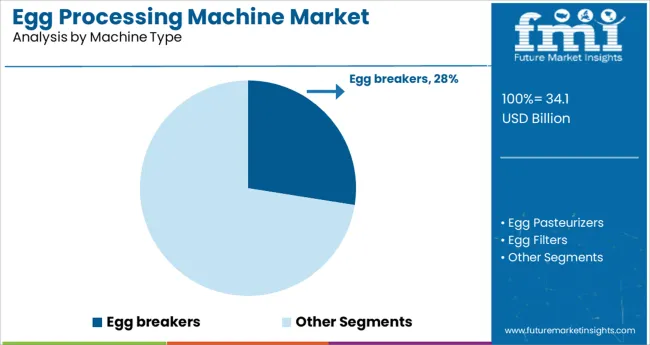

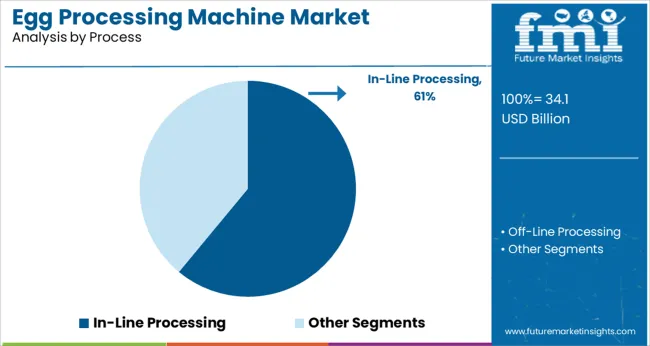

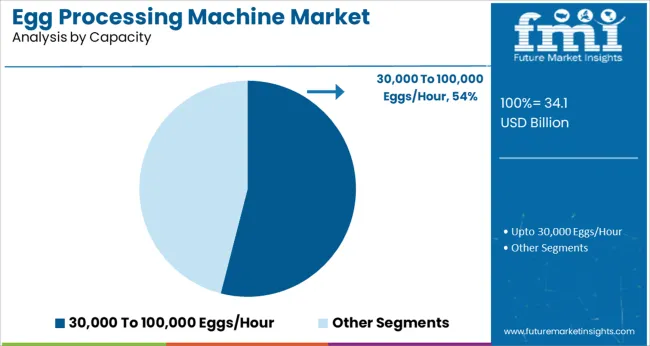

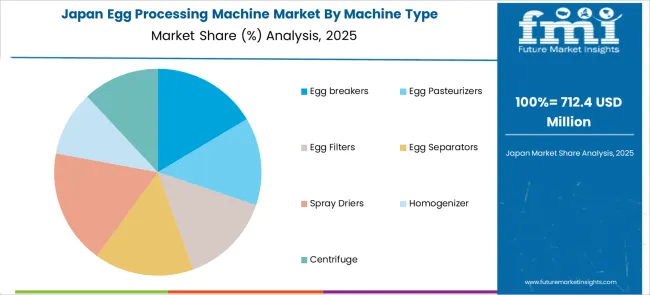

The market is segmented by Machine Type, Process, Capacity, Application, and End Product and region. By Machine Type, the market is divided into Egg breakers, Egg Pasteurizers, Egg Filters, Egg Separators, Spray Driers, Homogenizer, and Centrifuge. In terms of Process, the market is classified into In-Line Processing and Off-Line Processing. Based on Capacity, the market is segmented into 30,000 To 100,000 Eggs/Hour and Upto 30,000 Eggs/Hour. By Application, the market is divided into Bakery, Confectionary, Dairy Machine Type, Ready-to-Eat, and Soups & Sauces. By End Product, the market is segmented into Liquid Eggs, Powdered Eggs, and Frozen Eggs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by machine type, the egg breakers segment is estimated to hold 27.5% of the total market revenue in 2025, securing its place as the leading machine type. This leadership is being attributed to the essential role of egg breakers in enabling high-speed separation of egg whites and yolks with precision and minimal contamination.

Demand for egg breakers has been further strengthened by their ability to deliver consistent output while meeting stringent hygiene and quality requirements in industrial food production environments. Advancements in automation, easy-to-clean designs, and reduced maintenance needs have enhanced their efficiency, making them indispensable in medium and large-scale operations.

The integration of gentle handling techniques to minimize breakage losses and maximize yield has also supported their continued preference among processors. These factors collectively reinforce the egg breakers segment as a critical contributor to operational efficiency and product consistency.

When analyzed by process, the in line processing segment is projected to account for 61.0% of the market revenue in 2025, establishing itself as the leading process segment. This prominence is being driven by the ability of in line systems to streamline egg processing operations by integrating breaking, separating, and packaging in a continuous flow.

Such configurations have reduced the need for intermediate storage and handling, lowering contamination risks while enhancing throughput and operational control. The preference for in line systems is also being reinforced by their space-saving design and compatibility with automated cleaning systems, which contribute to improved food safety compliance.

Furthermore, processors are increasingly favoring in line setups due to their capacity to minimize labor dependency and optimize energy consumption, delivering cost-effective and scalable solutions. These advantages have consolidated the in line processing segment’s leadership position in the market.

Segmenting by capacity shows that machines capable of processing between 30000 to 100000 eggs per hour are expected to capture 54.0% of the market revenue in 2025, making this the dominant capacity segment. This dominance is being supported by the segment’s ability to address the operational needs of medium to large processors who require a balance between high output and manageable equipment size.

The appeal of this capacity range lies in its flexibility to handle varying production demands while maintaining product integrity and meeting strict hygiene norms. Improved engineering that enables sustained operation at high speeds without compromising quality has been key to its widespread adoption.

The segment’s efficiency in terms of energy use, maintenance costs, and space utilization has made it particularly attractive for businesses seeking scalable yet economically viable solutions. As a result, machines in this capacity range have emerged as the preferred choice for processors aiming to enhance productivity and operational resilience.

Advanced heat treatment & WAVE technology for pasteurization

Manufacturers of egg processing machines strive for a more sustainable future, and hence, take pride in optimizing the customer’s product end-use possibilities and by doing so, they harness its full potential. Key players are committed to delivering the right processing equipment to meet the increasing demand for high-quality proteins owing to the growing population. They further provide specialized and personal support by their experts from the nexus of the customer’s product idea, to the start-up of the dryer at their factory. These factors contribute to the global egg-processing machine market growth.

They strive to improve their pasteurization performance with advanced heat treatment and wave technology. It is essentially a system that applies high frequency/high voltage electrical fields to the liquid product which enables the product to be heat treated at an extremely high temperature while leaving the functional properties of the product unchanged.

This is a very crucial step that has now been mandated by governmental bodies, to remove bacteria/parasite growth in raw, unprocessed eggs, since various cultures across the globe prefer to consume raw eggs. Market players claim that they are dedicated to building and supplying egg handling and processing equipment to their revered end users irrespective of the size of the egg production, and that accurately matches their requirements, ensuring safe, efficient, and smooth production. These amenities drive the sales of egg processing machines.

Market players have gathered all their knowledge and experience within egg processing in handbooks with the aim to serve as a guide for end users as egg processors. The guidebooks are available online as well, and they explain all the necessary steps within egg processing. The players guarantee maximum uptime, high yield, improved product quality, etc. every day as a key to optimizing their end user’s business which may eventually lead to them being a lifetime performance partner.

An experienced team of technicians and project and service managers makes sure that their customer’s order is fulfilled in the best way possible, as soon as an agreement is entered. This is expected to bolster the demand for egg-processing machines. Furthermore, certain market players also offer robotic automation programs that surge the adoption of egg processing machines, as it provides a number of flexible and efficient robots that are a crucial part of any modern egg handling and processing factory.

The deployment of robotics technology is not only attributed to reducing labor, but also to increasing biosecurity, product quality, and maximizing yield. In addition, the players also provide sustainable packaging for end users who practice eco-friendly strategies and productions. The processing machines they produce provide a shelf life of eggs of up to 12 weeks. For egg suppliers, market players offer various amenities, especially for their online presence, such as generating quality leads for their business, staying visible for 365 days of the year, receiving product inquiries and responding to meeting requests directly, improving the company's online presence through ‘Search Engine Optimization’, etc. These factors are anticipated to lead to create market opportunities, higher product demand, and effectively expand the global egg processing market size.

| Attributes | Details |

|---|---|

| Egg Processing Machine Market Size (2025) | USD 34.1 billion |

| Egg Processing Machine Market Size (2035) | USD 57.2 billion |

| Egg Processing Machine Market CAGR | 5.3% |

Processed eggs eliminate the need to manually break shells, and separate various components of eggs, namely the egg white, and yolk. Moreover, major companies have introduced innovative pasteurizing equipment that minimizes salmonella presence in egg products which may cause food poisoning, thus leading to more innovations in the egg processing machine market trends.

The changing food lifestyles, owing to the rising urban and rural population, have led to an increased demand for convenience foods, packaged and processed foods. Additionally, commercial food industries need to process millions of eggs per day and hence, a rising demand for eggs in the culinary industry due to their associated health benefits is likely to surge product demand.

The statistics accumulated by Future Market Insights, reveal the global forum of egg processing machines which has witnessed an unprecedented surge over the past few years. The manufacturers in the market are in conjunction with the increasing demand for egg processing machines. There has been a gradual rise from a CAGR of 4.1% registered during the period of 2020 to 2025 and is likely to expand at a steady 5.3% in the forecast period.

The significant growth in the market can be attributed to the increasing demand for eggs and egg-based products across the globe as staple food products. Eggs have several health benefits, for instance, it is a very good source of protein (both whites and yolk). They also contain heart-healthy unsaturated fats and are a great source of important nutrients such as vitamins B6, B12, and D.

Consequently, the processing of eggs needs to be done with utmost care and supervision as they are fragile, and cracks on the shells can cause bacteria and germs to penetrate, therefore ruining the contents inside. Therefore, the product demand is estimated to skyrocket in the next few years due to the requirement influx from supermarkets and other retailers for eggs, as it is one of the highest-selling food products across the globe.

To meet the increasing demand in the competitive global egg-processing machine market, players are continuously upgrading their product portfolios. Eggs need to be thoroughly cleansed, pasteurized, graded, and packaged with caution for consumers to derive the complete nutritional value of eggs starting from clean shells to the contents inside. This can be tedious to do on billions of cartons of eggs and requires heavy machinery. Hence, this is not only anticipated to secure the adoption of egg processing machines in the coming years but also to effectuate creative market opportunities. Key players are already involved in incorporating advanced technologies such as robotics, artificial intelligence (AI), etc. into these machines.

Egg Pasteurizers - By Machine Type

By machine type, the market is segmented into egg breakers, egg pasteurizers, egg filters, egg separators, spray driers, homogenizers, and centrifuges. It has been studied by the analysts at Future Market Insights that the egg pasteurizers segment is estimated to hold a major market share, recording a CAGR of 24.6% through the forecast period.

In-line Processing - By Process Type

By process type, the market is segmented into in-line processing and offline processing. It has been researched by the analysts at Future Market Insights that the in-line processing segment is likely to hold a major market share, recording a CAGR of 60.4% through the forecast period.

People are aware of the numerous health benefits that can be procured from eggs such as protein and vitamins. Moreover, fitness gurus and nutritionists usually suggest the consumption of eggs for several fitness goals such as weight management, muscle gain, etc. These factors are estimated to lead to high sales of egg processing machines.

Egg processing machines provide assurance of safety, reduced risk of contamination, and extended shelf-life. In addition, the growing food & beverage industry always requires the freshest produce as their ingredients. These factors are also likely to contribute to global market growth.

Governments across the globe have implemented stringent standards pertaining to methods, and substances used in the processing and handling of eggs. Furthermore, there has been a growing demand for the identification of sources of eggs to eliminate the entry of unsafe eggs is gaining significant traction. These factors are expected to propel the adoption of the egg-processing machine.

There has been a shifting trend toward vegan food in recent times, that have led to the food & beverage industry producing egg substitutes. Moreover, these machines have very high initial and maintenance costs that may hinder their adoption, especially in developing economies where people prefer to wash them manually. These factors are major challenges expected to restrain the market growth.

Food-borne illnesses and other microbiological hazards are the results of unsafe and contaminated eggs. Hence, there have been numerous technological advancements such as integrated assembly lines with improved production rates and reduced operational costs. Furthermore, through the use of big data and system integration for the improvement of egg production chain, participants involved in the egg processing machinery continue to innovate in line and grow, leading to lucrative market opportunities.

The United Kingdom holds an adequate share of the global egg processing machine market with a revenue of 3.5%. This is attributed to the availability of innovative, high-quality, and high-performing egg processing machines of all types and capacities, coupled with the fast-paced life of the major population.

Many processors and producers have been investing heavily in egg packing equipment, particularly with a view to becoming less reliable on labor, as claimed by an operation manager from a top provider in the UK Furthermore, egg packing businesses and producers are getting larger, reflecting the size of the orders and contracts from supermarkets and other retailers that need to be met, which evidently surges the demand for egg processing machine.

The key providers claim that they have produced special egg processing machines where eggs can be broken; the machine opens the egg, empties out the contents, and discards the shells. Moreover, this machine breaks 12 breaks in a second, which means it allows the user to break a million eggs in a sensible working week. This is likely to expand the egg-processing machine market size.

Consumers in the UK gravitate towards these egg processing machines owing to their convenience since they facilitate the process of separating dozens of eggs in a very short period, handling, pasteurization of eggs, etc. Additionally, these egg processing machines are incredibly useful as the egg contents are inspected for quality, then filtered to remove ‘chelaze’.

Legislation in the UK requires egg to be heated to 64.4 °C for 2.5 minutes in order for it to be classed as pasteurized. This temperature/time is enough to destroy all pathogens and reduces total bacterial counts to a low level. Hence, breaking machines along with these facilities are expected to drive the demand for egg processing machines.

Market players in France use high-quality technologies and continue to develop their intelligent solutions as their goal is to go into mass production so that they can look for high-quality at competitive prices. Furthermore, they strive to guarantee great service and support and be the ultimate supplier for their end users.

The main objective of market players in France is to improve existing equipment and consider new ideas to develop new products in order to meet their client’s requirements and adapt to the market. Moreover, each project goes through in-depth study and personalized monitoring to ensure that equipment and processes are mastered, owing to their incorporated Design & Engineering Office.

The sales of egg processing machines are rising in France as these compact stainless steel structures are able to operate with both plastic and cardboard packaging. In addition, these machines are offered with different configurations and provide robustness, easy daily maintenance, and a very long life.

China holds a significant share of 6% in the global egg processing machine market. Manufacturers in China are committed to providing stainless steel, highly efficient liquid eggs, and production lines in the egg processing machines sector.

The egg products market in China is saturated with all the equipment one would need with regard to the handling and processing of eggs. This list includes an automatic egg loading machine, egg cleaning machine, egg drying machine, egg candling machine, and egg breaking & separating machine. In addition, market players in this region focus on the research and development (Research and Development), manufacturing, and service of egg processing equipment and intelligent breeding facilities and aim to promote the development of the industry by providing equipment.

Top manufacturers in the country emphasize the main features of their machines such as their low maintenance, strong reliability, easy cleaning, and gentle egg handling. Moreover, they ensure that all the machines have passed extensive testing before being shipped to end users across the globe. Hence, they strive to establish long-term and friendly business partner relationships with clients and businessmen from all over the world. These factors are expected to propel the sales of egg processing machines.

Japan holds an accumulated revenue of 5.4% in the global egg processing market. This is owing to the high demand for egg and egg-based products in this country, as they are extensively used in various culinary techniques and recipes. Much like most countries, the egg is a staple food product for almost the entire population of Japan.

In Japan, most families enjoy a hot bowl of white rice over which they prefer to pour a raw egg flavoured with soy sauce. This is unlike other countries where eating eggs without cooking them is considered a bad idea as it could surge the risk of salmonella and other infections. Therefore, the highly advanced egg processing machines oversee the entire process of cleaning, checking, and sorting eggs to ensure that they are safe to eat raw.

The Japanese population enjoys unconventional cooking methods of egg, along with the usual conventional methods. Hence, key manufacturers have brought out several processing machines one for each preparation of egg such as hard-boiled, soft-boiled, poached-egg, onsen-egg, lava egg, pan mee egg, etc. Additionally, they guarantee that their machines benefit business owners as they process a large number of eggs, save the cost of processing, increase revenue, ease the workload, and reduce manpower.

Start-up companies recognize the importance of processing eggs, so that they do not spread infections from bacteria and parasites found in unpasteurized eggs. This allows people to consume eggs in any form, raw or cooked and is expected to secure the growth of the egg processing machine market size.

NevonProjects - It grows exponentially through its research in technology. NevonProjects works towards the development of research-based software, embedded/electronics, and mechanical systems for research & development purposes. They automate a mechanical system to fulfill this purpose using a smart egg breaker machine that also separates the egg yolk as required by industry.

Power Scrub (Egg Washer) - It is a manufacturer and distributor of automatic egg washer machines. They offer an egg washing machine that is built using a variable speed drive and is capable of washing heavily soiled chicken eggs. After passing over the optional LED candler, soiled eggs are fed into the egg cleaning machine, and clean eggs proceed for further sale or consumption.

The egg processing machines market share is expected to increase as manufacturers are looking to expand their production and presence in the market, through various collaborations and product launches. Furthermore, the industry is becoming highly competitive amongst market players in terms of product variation and pricing.

TOP MARKET PLAYERS IN THE EGG PROCESSING MACHINE MARKET:

Actini Group - It ensures the design and manufacture of processes for the decontamination of pharmaceutical effluent, and designs and develops equipment for the pasteurization and sterilization of food liquids for milk and dairy products, juices and fruit purees industries, and many other applications.

Moba Group B.V. - It is the recognized leading manufacturer of egg grading, packing, and processing machines. Their head office is located in Barneveld in the Netherlands.

Sanovo Technology Group - They provide a complete solution for the egg processing industry has been our main activity for more than 60 years. They also specialize in many other business areas such as enzymes, pharma, hatchery, biosecurity, traceability, and spray drying, which give us the opportunity to interact and build relationships with various prospering industries.

Ovobel Foods Limited - In collaboration with Ovobel, NV Belgium, they manufacture and export Whole Egg, Yolk, Albumen Powders, or Frozen. Their products have replaced fresh eggs in Industrial Food Processing Applications in Baking, Pasta, Doughnut Premixes, Mayonnaise, Baby Food, Fish & Meat, and Food Service. Their quality management system is FCCS certified.

Pelbo S.P.A. - It is a global leading manufacturer of Egg Processing Equipment for the Industry of pasteurized liquid egg production. Founded in the early 80s Pelbo Spa has matured a solid experience in the design and manufacturing of highly specialized equipment for the pharmaceutical and food industry.

The global egg processing machine market is estimated to be valued at USD 34.1 billion in 2025.

It is projected to reach USD 57.2 billion by 2035.

The market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types are egg breakers, egg pasteurizers, egg filters, egg separators, spray driers, homogenizer and centrifuge.

in-line processing segment is expected to dominate with a 61.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg and Egg Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Egg Packaging Market by Packaging Type & Material from 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Egg Substitute Market Insights – Plant-Based Alternatives & Industry Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA