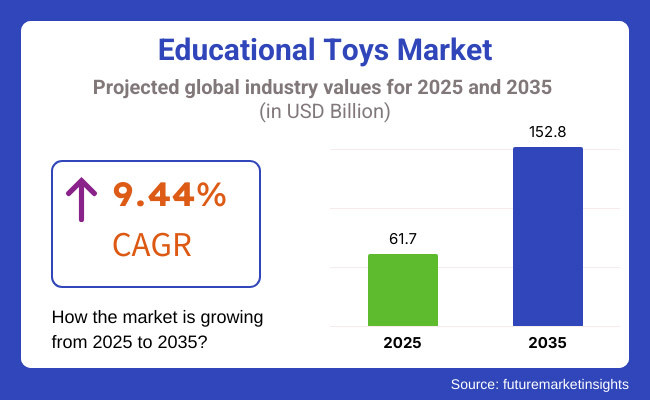

The educational toy market has an optimism of increasing its share globally due to the fast-growing of its bigger segment. The segment has been evaluated, and its growth has been forecasted through time reflecting the amount it will take to cross from USD 61.7 billion in 2025 to USD 152.8 billion by 2035 at a reliable rate of 9.44% Annual Compound Growth Rate (CAGR).

Interactive and creative educational toys that are designed for children to play with not only help them have fun during the game but also develop their cognitive, problem-solving, and motor skills. These interesting games are teachers of physics, mathematics, and language through play.

The market is dominated by new products like learn-and-develop-skill items, ranging from STEM-based popping to digital educational tools. Increased demand for STEM toys, along with the promotion of awareness of parental developmental benefits and a general shift toward greener materials, are the most important factors for this market growth.

Technology development such as augmented reality and artificial intelligence in the field of educational toys has made it possible more participative and involving learning. An important consumer trend that sets its mark on the market is the rise of preference for green toys.

The children’s toys that are made of plant-based plastics, recycled materials, and biodegradable components are what parents often demand aligning with their sustainability values. This has caused to the production of eco-friendly educational playsets by brands such as Green Toys.

The trend in STEM and STEAM toys has shifted to focusing on/according to such aspects but creativity, teamwork, and community dealing with issues in science, technology, engineering, arts, and mathematics. Products such as Snap Circuits, which assemble electronic devices, and Melissa & Doug’s tactile learning sets are popular among children.

Digital architecture is yet another commensurate trend, with the integration of AR and AI into toys, such as LeapFrog's interactive learning systems, that adapt the content of learning to the kid's individual development.

Personalization becomes a significant concern, with parents becoming more likely to play along with children in terms of choosing their own age. There are some smart toys now that follow child's development, like Fisher-Price's interactive playsets, which are very popular now. Moreover, the inclusivity of toys has become the main propeller in this market with various brands including products that resonate with cultural, gender and disability differences among children.

A perfect example is Mattel's products which included dolls that portray varied backgrounds and health states to enable kids to see themselves in their toys. Moreover, part of the purchasing decisions is also due to smirk of nostalgia as parents lean towards classics rebranded with modern features. Toys such as Lincoln Logs and Tinkertoys have been fun resources for many years; the new versions will receive upgrades merging the eras of traditional and innovative.

Explore FMI!

Book a free demo

This table reflects a broad overview of important indexes and ratings between educational toy consumers, educational centers, educational toy manufacturers, and educational toy sales channels. Toys that add educational value and keep children engaged rank highly among parents and educational institutions alike, showcasing the need for learning-based toys that aid in cognitive development.

Both born-digital and analogue media receive high marks for safety and durability - indicating an essential need for products that are both secure and long-lasting. Creativity and innovation are highly valued by toy manufacturers and educational institutions, they are a crucial aspect of distinguishing products in a crowded marketplace, while retailers rate this aspect lower.

All stakeholders believe it is moderate price/value for money. Regulatory and quality standards and even packaging and presentation receive somewhat middling scores-they help inform purchase decisions, but do not necessarily drive the transaction.

In 2020 to 2024, the education toy industry grew steadily as parents pay special attention during the early development of a child. Growth accelerated due to increasing adoption of remote education and online learning, both of which escalated demand for play-and-learn and digital and interactive toys.

Personalized experiences from AI-led and app-activated toys and devices were top favorites. A sustainability trend likewise emerged, led by companies creating green materials and recyclable packaging, as environmentally inclined consumers drove trends in the toy industry.

Between 2025 and 2035, AI, AR, and VR advancements will revolutionize educational toys into more immersive and responsive learning tools. Intelligent toys with real-time language translation, emotional intelligence detection, and personalized learning pathways will redefine early education.

Coding kits, robotics, and science toys will remain in demand, developing STEM skills at an early stage. Sustainability will continue to be the focus, with biodegradable materials and ethical sourcing becoming increasingly important. As digital integration goes deeper, the educational toys will be more interactive, customized, and suited to changing learning demands.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Becoming more and more tech-enabled, they attached the STEM-based toys to traditional, stationary educational ones, which were the main ones. | Affiliation with AI and tech learning tools.. |

| Mainly the benefit of early childhood learning was the most powerful factor behind children's educational toys becoming widely popular. | Parents, as the main actors, demanded sustainable, skill-building, and holistic development toys for their children. |

| The original idea was ludic play and sneaking in some education like puzzles, and games to build. | Promoters of experiential and immersive learning through the addition of AR/VR toys, robotics, and coding games. |

| The absence of biodegradable and environmentally friendly options was unspoken. | Plastic wastes were further reduced and recyclable materials were used by the companies which led to more ecological toys on the market. |

| The major distribution channels are the toy store and supermarket, with e-commerce being the slowest. | Online sales have increased greatly, providing convenience and product varieties for consumers globally. |

| The integration of smart technologies was not so high, as the focus was on plain electronic toys. | Children's learning was made more individual and interactive due to the integration of AI, IoT, and app-connected toys. |

| The initiation of the early education program was mainly intended for toddlers and pre-schoolers at the time. | Also older kids are included in the program with the advanced technologies in coding, robotics, and logical thinking. |

Toys in the educational toy market have to meet strict safety standards to avoid risks like choking, toxicity, and flammability, including ASTM F963 and EN71 requirements. Anything short of that can lead to recalls, litigation, and damage to your brand. Another threat comes from counterfeit and unregulated toys, especially in emerging markets, which can compromise consumer trust and hurt legitimate brand sales through unsafe knock-offs.

There is stiff competition as well with large global brands as well as startup brands flooding the space and putting pressure on price as well as putting product at risk of commoditization. Most educational toys are quick to imitate and lose their market profitability and uniqueness. Moreover, shifting consumer trends and the growth of digital alternatives pose a challenge to traditional toy sales as kids choose educational apps and interactive screens over physical playthings.

The educational toy marketplace is split into high-end premium and low-end budgets segments which price at quality, brand, and delivery of learning value. Value-based pricing is what is used for premium toys like STEM kits, robotics, and Montessori materials, with an emphasis on developmental benefits and durability to warrant a higher price.

Seasonal pricing is one of the most important behind-the-scenes factors that determine how and when items are sold during peak periods, especially during the holidays. Consumer sensitivity to prices has prompted brands to launch cost-effective alternatives, smaller kits and value packs to hold market share.

Educational institutions are also often given bulk pricing so institutional sales become a steady source of income. Competing harder means that brands will need to maintain competitive pricing while still ensuring that value (real and perceived) is matched when it comes to things such as innovation and educational relevance if they are to maintain margins and remain profitable.

Games and puzzles have been the most important class of educational toys they bear 20.50% of this section. They promote logical reasoning, creativity, and problem-solving skills, thus being one of the most preferred types of toys among parents and educators. Top brands like LEGO creative cubes, Ravensburger jigsaw puzzles, and HABA Town strategy games fit varying age groups, like magnetic maze games and group jigsaw puzzles.

The popularity of brainy STEM-based puzzles like ThinkFun’s Gravity Maze and SmartGames’ IQ series is increasing, as they combine fun with critical thinking and an understanding of spatial relationships. The digital shift has also brought smart puzzles and app-integrated learning games, including Osmo’s interactive learning kits, which are further fueling segment growth.

Because of their growth benefits in areas such as fine motor skill development, hand-eye coordination, and self-expression, arts and crafts kits hold a market share of 15.75% around the world. These kits range from painting sets to DIY crafting kits to model-building sets by brands like Crayola, Melissa & Doug and Faber-Castell.

As a response, schools and extracurricular programs are incorporating art-based activities into STEAM (Science, Technology, Engineering, Arts, and Math) education and emphasis on hands-on creativity. Brands such as Green Kid Crafts and Eco-Kids are already introducing biodegradable and safe craft materials to meet the demand for eco-friendly, sustainable and non-toxic crafting supplies. Further, social media trends around DIY crafting influencers and YouTube art tutorials have stoked consumer interest in creative play.

The pre-school segment holds the largest share in the educational toys, since children of this age group are involved in sensory exploration, role-playing as well as early cognitive learning. Montessori-inspired toys. Educational toys like shape sorters, stacking blocks and interactive puzzles develop problem-solving skills, facilitate motor coordination, and foster creativity. This industry is dominated by brands such as Fisher-Price, VTech and Melissa & Doug, selling items designed to correlate with early childhood development frameworks.

The increasing interest in STEM-based learning toys in this segment is apparent as evidenced by the popularity of LeapFrog’s interactive learning tablets and Baby Einstein’s sensory activity toys. The emergence of subscription-based educational toy kits (e.g., KiwiCo Panda Crate) is increasing access as well, especially in emerging markets.

In the 4-8 years age group, kids are starting to move from free play into structured learning, and that is platforming more and more demand for building sets, interactive books, science kits and educational board games. Brands like LEGO Education, SmartGames, and Thames & Kosmos make popular toys that foster skills like logical reasoning, early math, and understanding of science.

Demand for STEM-themes toys, like Osmo Genius Kits and Snap Circuits, are on the rise as parents place a greater emphasis on school-readiness and critical thinking skills.

The rapid integration of learning-through-play strategies by governments and educators is contributing towards developing the marketplace especially in Asia-Pasific and Latin America. The growth of edutainment platforms and AR/VR-integrated learning tools is similar to support this segment's rapid development.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 9.50% |

| Germany | 9.90% |

| China | 10.10% |

| India | 10.30% |

| Australia | 10.60% |

FMI is of the opinion that the USA educational toy industry is slated to grow at 9.50% CAGR during the study period. This will be led by technological innovation in new technologies, start-up ecosystems, and the rapid pace of digitalization in big industries like healthcare, retail, and infrastructure.

Importantly, public sector investment in upgradation of infrastructure and private sector investment in new technologies such as AI and green energy will continue to drive economic growth. Adoption of telemedicine and AI-based diagnosis by the healthcare industry, for instance, is driving high growth. However, inflation, political uncertainty, and manpower shortage in dominant industries can hinder the growth unless the situation is addressed.

Growth Drivers in The USA

| Key Drivers | Details |

|---|---|

| Emergence of digital growth in the USA | Advancements in AI, cloud computing, and IoT across all sectors like healthcare, retail, and logistics are driving growth. |

| Public and Private Sector Investments | Public sector investments in infrastructure and private sector innovation through AI and green energy are driving economic growth. |

FMI is of the opinion that the. Educational toy industry is slated to grow at 9.90% CAGR during the study period. This can be well understood in the education sector where the toy industry is booming because there has been a total shift in the aspirations and education trends among parents.

German parents have come to realize more and more about the importance of mental growth in young children, and problem-solving, creativity, and STEM-themed toys for learning have now become the priority in bringing up their child. With the trend of robotics and coding toys coming into the industry, it has grown even more in shaping the learning process of a child.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Cognitive Development Focus | German parents are emphasizing cognitive development in children, and learning toys that stress creativity and problem-solving are thereby gaining popularity. |

| STEM Education Integration | Education toys that encourage STEM education, such as coding sets and engineering sets, are in such high demand today because they address future job requirements. |

This is primarily boosted by China's emphasis on preschool education and increasing emphasis on the study of STEM. As parents are spending money on toys that are stimulating thought, imagination, and problem-solving, China has also seen an eye-popping increase in the industry for learning toys.

Further, the introduction of cutting-edge technologies like AI, AR, and app-based learning into toys is revolutionizing the industry. FMI is of the opinion that the educational toy industry in china is slated to grow at 10.10% CAGR during the study period.

Growth Drivers in the China

| Key Drivers | Details |

|---|---|

| Early Childhood Education | Increased emphasis on early childhood education is driving the demand for toys that are stimulating cognition and creativity. |

| Technological Integration | Convergence of AI, AR, and learning through apps into toys is transforming the edutainment toy industry. |

India's edutainment toy industry is expanding at a CAGR of 10.30% between 2025 to 2035. This is because of the shift in family structure with a greater number of nuclear families and working parents, thereby necessitating greater demand for learning and stimulating toys. Parents are increasingly realizing the importance of developing problem-solving, creative, and logical skills in children at an early age, leading to greater demand for such skill-enhancing toys.

The government initiatives like "Digital India" and "Skill India" are also reinforcing the position of early education, raising the demand for educational toys even further. The e-commerce boom has made it easier for parents in small towns to access a variety of educational toys, thus making them more accessible.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Increasing Demand for Early Learning | Growing focus on early childhood education and building problem-solving and cognitive abilities is fueling growth in the education toy industry. |

| Growth in E-commerce | Emergence of e-commerce in India has made educational toys more accessible, fueling industry growth. |

As per research conducted by FMI, Australia is expected to witness a growth of 10.60% for the education toy industry in 2025 to 2035. The increased interest in learning STEM courses and childhood development is boosting the educational toy sales in Australia.

The education system and parents from Australia are keen on developing their kids at an early age with critical thinking, problem-solving skills, and creativity. Therefore, educational and fun toys, such as STEM kits and coding robots, become popular.

The Growth Drivers in Australia

| Key Drivers | Details |

|---|---|

| Greater Focus on STEM Education | Increased implementation of STEM education across schools is propelling the adoption of learning toys that introduce kids to technology, engineering, and coding. |

| Cognitive Development | Australian parents are increasingly looking for toys that facilitate early childhood social and cognitive development through imaginative play and problem-solving. |

The educational toy segment has become concentrated, and there are only a few Tier 1 companies that dominate this industry. These manufacturers that are the biggest in the world utilize their large resources, the newest manufacturing machines, and existing channels to maintain their operating power. Companies like LEGO, Mattel, and Hasbro have become the flagship entrepreneurs of technology integration with the aid of play.

Through the creation of strong brand ties, alongside licensing and digital platform collaborations, international industry reach in the previously mentioned and new markets is achieved.

Notwithstanding the presence of smaller firms and niche players, Tier 1 companies remain the primary indicators of the educational toy and toy industry. They implement strategic acquisitions that allow them to draw in and then share intellectual property, as well as to increase their own range of products, thereby making the risk of smaller rivals ineffective. In addition, they capitalize on the increase in the demand for STEM-based learning by rolling out the majority of toy products that are involved in coding, robotics, and engineering.

These products that, in contrast to the old ones, have built-in technology that facilitates the learning process, increase the number of customers who buy them, and in such way the companies obtain the competitive edge. Industry titans are maintaining their lead by predicting changes in education and developing their global supply chain which makes them more secure thus solidifying their dominance in the industry.

The educational toy industry is defined by intense competition, brand-driven innovation, and the integration of digital learning experiences. The best companies use technologies, entertainments, and sustainable initiatives to give a differentiating edge to their offerings, while at the same time expanding their industry reach. Lego is one such company that competes vigorously against its rivals and has managed to diversify its product offerings to include adults as well as traditional brick sets.

For instance, its strategic partnerships with several popular entertainment franchises, focus on interactive play experiences and commitment to sustainability materials continue to consolidate its leadership. In this way, Lego continues blending between its physical and digital learning to adopt new trends and shifting preferences among consumers but still retaining that brand loyalty within consumers.

Spin Master also has joined the competition by making acquisitions, creating many entertainment-driven toy lines, and bringing digital expansion into play. It has introduced franchises such as paws Patrol, which sells toys and has got beyond toys into a TV series and digital platforms, thus enhancing cross-platform engagement. It also builds investments in educational technology, which keep it above the traditional toys-online learning divide and relevant these days, where technology-influenced consumers mature.

Other major players include Hasbro, Mattel, and Melissa & Doug. Hasbro and Mattel hold on to licensed products, STEAM-based learning, and sustainability initiatives to manage consumer changes. Companies developing fun, educational, environmentally friendly toys will continue designing competition in line with what is increasingly being sought after by customers.

Market Share Analysis by Company

| Company Name | Estimated Share (%) |

|---|---|

| Lego System A/S | 20-25% |

| Mattel, Inc. | 15-20% |

| Spin Master Corp. | 10-15% |

| Hasbro, Inc. | 8-12% |

| Melissa & Doug | 5-10% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| Lego System A/S | Industry leader in educational toys, integrating physical and digital play with STEAM-based learning experiences. |

| Mattel, Inc. | Offers iconic educational toys under brands like Fisher-Price, Barbie, and Hot Wheels, focusing on early learning and skill development. |

| Spin Master Corp. | Leverages digital play, licensing partnerships, and educational content to enhance engagement. |

| Hasbro, Inc. | Strong presence in board games and licensed products, fostering collaborative learning and interactive play. |

| Melissa & Doug | Specializes in hands-on, screen-free educational toys designed for early childhood learning. |

Key Company Insights

Lego System A/S (20-25%)

Lego dominates the industry with its interactive building sets and a strong focus on STEAM-based education and sustainability initiatives.

Mattel, Inc. (15-20%)

A key player in early childhood education, offering a diverse range of learning-based toys and licensed products.

Spin Master Corp. (10-15%)

Continues to bridge the digital and physical toy experience with its interactive and tech-driven educational toys.

Hasbro, Inc. (8-12%)

A leader in licensed board games and collaborative play, leveraging its strong entertainment partnerships.

Melissa & Doug (5-10%)

Focuses on hands-on, sensory-driven learning experiences, catering to parents seeking screen-free play solutions.

The industry is expected to generate a revenue of USD 61.7 billion in 2025.

The industry is projected to reach USD 152.8 billion by 2035, growing at a CAGR of 9.44% from 2025 to 2035.

Key players in the industry include Mattel, CocoMoco Kids, Melissa & Doug, Ravensburger, The Simba Dickie Group, TOMY, JAKKS Pacific, Inc., GoldLok Toys, WowWee Group Limited, and LEGO System A/S.

Regions with a strong emphasis on early childhood education and STEM learning, such as North America and Europe, are expected to offer lucrative growth opportunities.

STEM-based educational toys are among the most widely used segments, driven by increasing parental interest in science, technology, engineering, and math-focused learning tools.

The types contain: Arts and Crafts; Role-play; Games and Puzzles; Motor skills; Musical Toys; Stem Toys; and Other Toys.

This is further segmented as 4 years Old, Age 4-8 years and those Above 8 years.

The distribution channels are divided into Supermarkets and Hypermarkets, Specialty Stores, E-commerce, and Others.

This categorization acknowledges regions like North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

Foot Care Product Market Analysis by Product Type, Distribution Channel and Region Through 2035

POU Water Purifier Industry Analysis In MENA: Trends, Growth & Forecast 2025 to 2035

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.