The edible films and coating industry is developing rapidly as food firms seek new ways to extend the shelf life of products, reduce plastic usage, and enhance the safety of foods. Consumers are demanding more sustainable and biodegradable packaging, so firms are launching plant-based films, antimicrobial coatings, and functional edible packages. Firms are using clean-label, allergen-free, and high-barrier coatings for freshness in foods as well as to adapt to shifting regulations.

Producers are investing in bio-based materials, nano-coatings, and smart packaging technologies to improve performance and sustainability. The industry is shifting towards polysaccharide-based, protein-based, and lipid-based edible films with improved moisture retention and oxygen barrier properties.

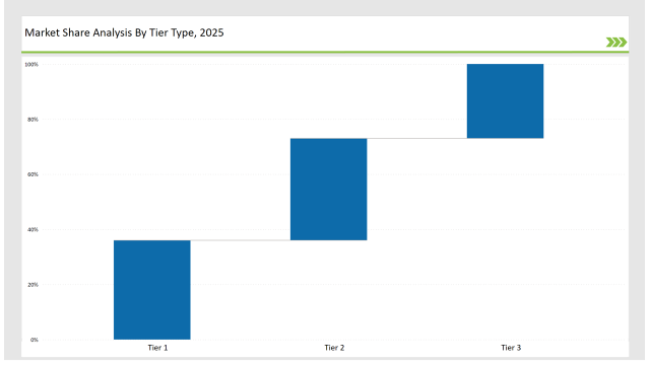

Tier 1 companies like JRF Technology, Dupont, and Tate & Lyle hold 36% of the market share based on their food science knowledge, global manufacturing capacity, and continuous material innovation.

Tier 2 companies, such as Watson Inc., Ingredion, and Kerry Group, capture 37% of the market by offering cost-effective, functional edible coatings for fresh produce, meat, bakery, and dairy products.

Tier 3 consists of regional and niche players specializing in biodegradable films, antimicrobial coatings, and sustainable edible packaging, holding 27% of the market. These companies focus on localized production, natural ingredient sourcing, and customized solutions.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (JRF Technology, Dupont, Tate & Lyle) | 18% |

| Rest of Top 5 (Watson Inc., Ingredion) | 12% |

| Next 5 of Top 10 (Kerry Group, Cargill, Mantrose-Haeuser, Nagase America, MonoSol) | 6% |

The edible films and coatings industry serves multiple food segments where freshness, sustainability, and safety are key. Companies are investing in functional coatings and edible film innovations to meet consumer demands.

Manufacturers are optimizing edible film and coating production with innovative ingredients, enhanced functionalities, and sustainability-driven solutions.

Sustainability and functional performance are driving the edible films and coatings industry. Companies are integrating AI-driven production, natural antimicrobials, and bio-based polymers to create smarter, more efficient packaging solutions. They are also enhancing oxygen barrier properties to preserve food freshness. Manufacturers are exploring edible films fortified with vitamins and probiotics to add nutritional value. Additionally, firms are developing water-resistant coatings to improve durability in high-moisture food applications.

Technology suppliers should focus on automation, sustainable material innovation, and intelligent edible film solutions to support the evolving food packaging market. Partnering with food producers and regulatory agencies will accelerate adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | JRF Technology, Dupont, Tate & Lyle |

| Tier 2 | Watson Inc., Ingredion, Kerry Group |

| Tier 3 | Cargill, Mantrose-Haeuser, Nagase America, MonoSol |

Leading manufacturers are advancing edible film technology with AI-driven production, sustainable ingredients, and high-performance coatings.

| Manufacturer | Latest Developments |

|---|---|

| JRF Technology | Launched plant-based, high-barrier edible films in March 2024. |

| Dupont | Introduced biodegradable, water-soluble coatings in April 2024. |

| Tate & Lyle | Expanded clean-label edible film portfolio in May 2024. |

| Watson Inc. | Released moisture-resistant coatings for baked goods in June 2024. |

| Ingredion | Strengthened polysaccharide-based edible films in July 2024. |

| Kerry Group | Developed antimicrobial edible coatings for meat and seafood in August 2024. |

| Cargill | Innovated protein-based edible films for dairy packaging in September 2024. |

The edible films and coatings market is evolving as companies focus on sustainable materials, advanced barrier properties, and antimicrobial functionalities.

The industry will continue integrating AI-driven formulation, sustainable ingredient innovation, and smart food packaging solutions. As regulations tighten, manufacturers will accelerate the transition toward fully biodegradable and active edible coatings. Companies will also enhance food traceability with blockchain-enabled transparency. They will develop edible coatings infused with natural antioxidants to prolong food freshness. Businesses will adopt nanotechnology to improve the strength and flexibility of edible films. Additionally, firms will explore hybrid film solutions that combine polysaccharides and proteins for enhanced barrier performance.

Leading players include JRF Technology, Dupont, Tate & Lyle, Watson Inc., Ingredion, Kerry Group, and Cargill.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 36%.

Key drivers include sustainability, food safety, shelf-life extension, and regulatory compliance.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.