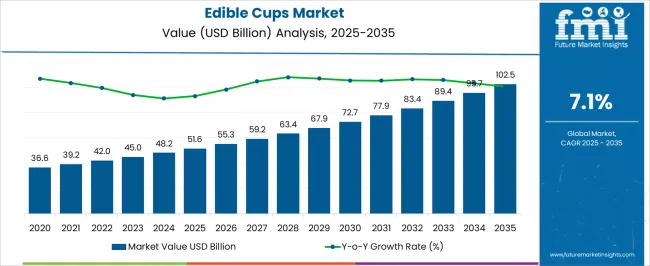

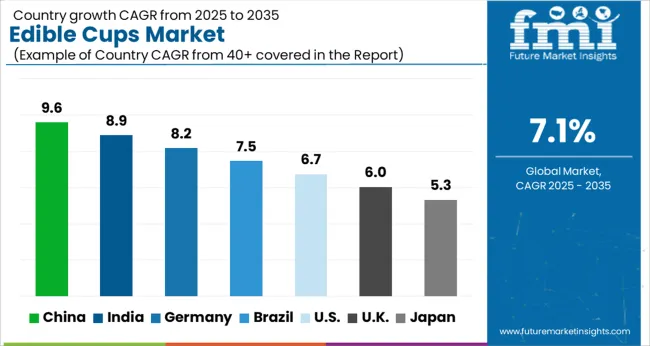

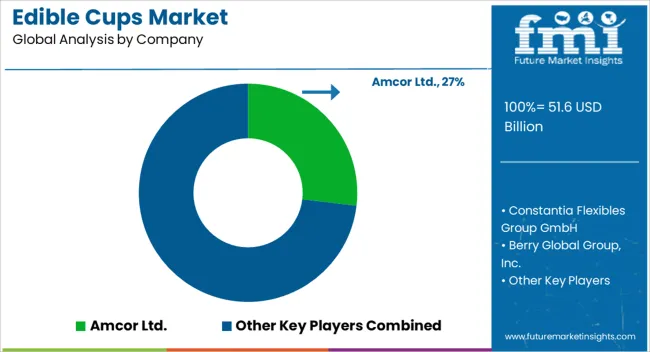

The Edible Cups Market is estimated to be valued at USD 51.6 billion in 2025 and is projected to reach USD 102.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Edible Cups Market Estimated Value in (2025 E) | USD 51.6 billion |

| Edible Cups Market Forecast Value in (2035 F) | USD 102.5 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The edible cups market is witnessing accelerated growth as sustainability and waste reduction become central to food and beverage service innovations. Increasing concerns over single use plastics and the rising adoption of eco friendly alternatives are boosting demand for edible cups across both developed and emerging markets.

Technological advances in material processing have improved durability, taste retention, and temperature resistance of these cups, making them more viable for commercial applications. Heightened consumer preference for sustainable packaging coupled with hospitality industry commitments to green practices are reinforcing adoption.

Regulatory frameworks aimed at curbing plastic consumption are further strengthening the market trajectory. The future outlook remains positive as edible cups continue to gain traction in cafes, quick service restaurants, and large scale events, offering businesses both environmental and branding advantages.

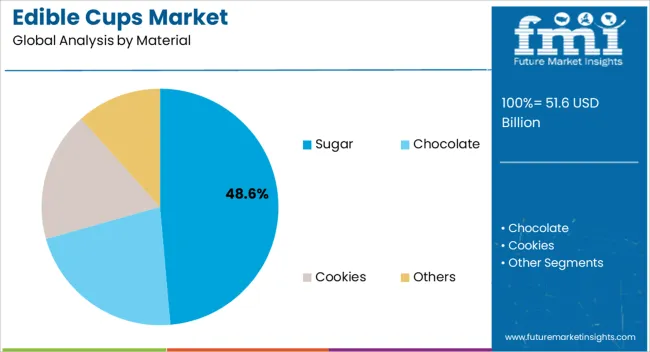

The sugar material segment is expected to hold 48.60% of total revenue by 2025, making it the dominant material type. This leadership is attributed to the material’s wide availability, ease of molding, and consumer acceptance due to its neutral flavor profile and ability to complement a variety of beverages.

Enhanced R&D has led to improvements in sugar based cup stability, allowing better performance in both hot and cold applications. The biodegradable nature of sugar further aligns with sustainability goals, reinforcing its market adoption.

These factors together strengthen its position as the leading material in edible cups manufacturing.

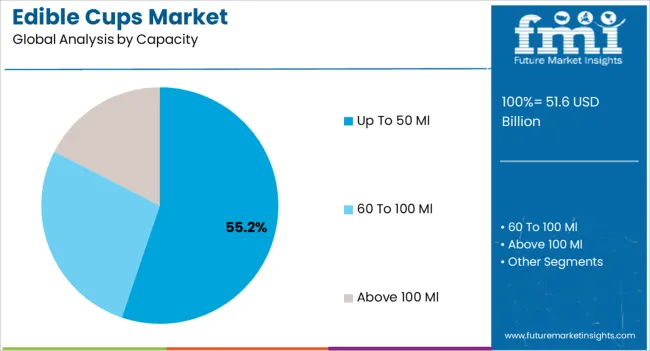

The up to 50 ml capacity segment is projected to represent 55.20% of total market revenue by 2025, positioning it as the largest size category. This preference is driven by its suitability for single serve beverages such as espresso, shots, and tasters in cafes and events.

The smaller capacity format reduces costs for producers while aligning with consumer demand for quick and sustainable consumption. Its strong presence in promotional activities and food service settings has further contributed to its widespread adoption.

Functional convenience and alignment with high turnover beverage services make this capacity the leading segment.

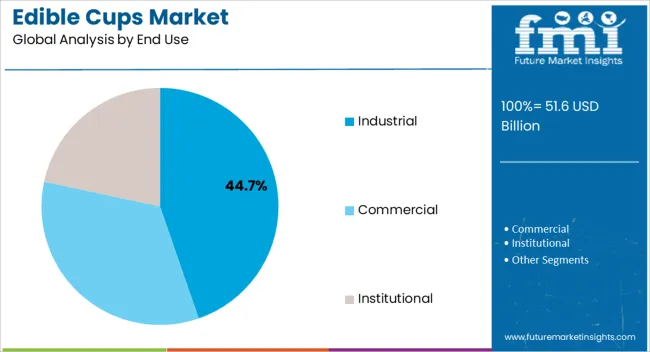

The industrial end use segment is expected to contribute 44.70% of overall market revenue by 2025, positioning it as the dominant application area. Industrial scale adoption has been driven by large hospitality chains, event organizers, and food service providers focusing on sustainable alternatives to disposable cups.

Integration into bulk service environments highlights their role in reducing single use plastic dependency at scale. The ability to combine eco friendly practices with customer engagement strategies has reinforced uptake in industrial contexts.

As sustainability initiatives become mainstream across the food service sector, this end use category continues to lead growth in edible cups deployment.

Historically, the edible cups market has experienced a steady rise in sales. Initially, the concept of edible cups was relatively unknown, limiting their market penetration. However, with the increasing focus on sustainability and eco-friendly alternatives, the demand for edible cups gained momentum.

In the early years, sales were driven by niche markets, specialty cafes, and food enthusiasts who appreciated the novelty and sustainable aspects of edible cups. As awareness grew, edible cups began to make appearances at events, festivals, and eco-conscious gatherings, further expanding their consumer base.

The market is estimated to expand at 7.1% CAGR between 2025 and 2035, in comparison to the 3.8% CAGR registered from 2020 to 2025.Looking ahead, the future demand outlook for the edible cups market is highly promising.

The adoption of edible cups by the food and beverage industry is set to expand significantly. Restaurants, cafes, and even large-scale events and festivals are recognizing the appeal and novelty of serving beverages and dishes in edible cups. As businesses strive to differentiate themselves and offer unique dining experiences, edible cups provide an opportunity to captivate customers and create memorable moments.

While the edible cups market has seen growth in various regions, there is still ample room for expansion into new markets. As awareness spreads and consumer demand increases, edible cups are likely to gain traction in emerging economies where sustainable practices and eco-consciousness are gaining momentum.

The above-mentioned factors are likely to assist the market to surpass the value of USD 102.5.0 million by 2035.

Expand Product Range: To cater to diverse consumer preferences, manufacturers can expand their product range by offering a variety of edible cup options. This includes different flavors, materials, sizes, and designs.

Enhance Production Efficiency: Increasing production efficiency is crucial for scaling operations. Manufacturers can invest in advanced machinery, automation, and optimized production processes to improve output, reduce costs, and meet growing demand.

Explore New Market Segments: While the food and beverage industry remains a primary market for edible cups, there are opportunities to explore other sectors. Manufacturers can target specific industries such as hospitality, catering, airlines, and even retail.

Invest in Marketing and Branding: A robust marketing and branding strategy is crucial for scaling in a competitive market. Businesses can invest in digital marketing campaigns, social media presence, and influencer partnerships to raise awareness and generate interest in their edible cups.

Foster Innovation and Research: Staying at the forefront of innovation is essential for long-term success. Manufacturers can invest in research and development to explore new edible cup materials, flavors, and production techniques.

Monitor Market Trends: Keeping a close eye on market trends, consumer preferences, and emerging technologies is crucial for scaling the edible cups market. Manufacturers and service providers should stay informed about changing customer demands, industry developments, and regulatory requirements.

Cold beverages in edible cups offer a range of opportunities for businesses in the edible cups market. They provide a refreshing experience, offer novelty and visual appeal, and align with sustainability and eco-consciousness.

They allow for customization and personalization is ideal for event catering and special occasions, and are well-suited for outdoor and on-the-go consumption. These factors make cold beverages in edible cups an attractive option for businesses looking to provide unique and engaging experiences for customers. While also demonstrating their commitment to sustainability.

The commercial segment captured 75.8% of the market share in 2025. Commercial establishments, such as restaurants, cafes, and fast-food chains, serve a large volume of customers daily. As a result, they require a significant quantity of cups for their operations. Edible cups provide a practical and sustainable solution to meet the demand for serving beverages, desserts, and other food items, especially in high-traffic settings.

Edible cups have a high social media appeal. Customers often share their experiences and visually appealing food and beverages on social media platforms. Commercial end users leverage this trend by serving their offerings in edible cups, encouraging customers to take photos and share them online. This leads to free promotion and increased visibility, attracting new customers and generating buzz around their establishment.

Europe is often regarded as a prominent market holding a market share of 23.5% in the edible cups market. Europe has a strong emphasis on sustainability and environmental consciousness. This focus has propelled the demand for eco-friendly alternatives to traditional single-use cups. Europe has a thriving food and beverage industry, comprising restaurants, cafes, and hospitality sectors.

These establishments have been quick to embrace the concept of edible cups, integrating them into their menus and offering unique experiences to their customers.

European cultures place a significant emphasis on food and its presentation. Edible cups add a creative and visually appealing element to the dining experience, resonating with European consumers who appreciate unique and aesthetically pleasing food concepts.

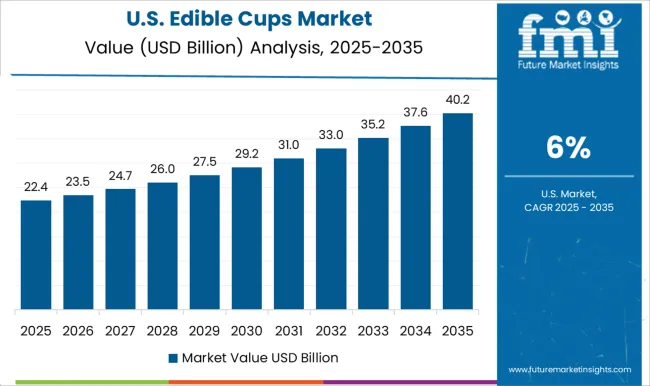

United States conquered 13.0% of the global market share in 2025. The United States is known for its entrepreneurial spirit and focus on innovation. In the edible cups market, American manufacturers and startups have been at the forefront of developing new and creative edible cup options.

The United States has a strong social media culture, where visual appeal plays a significant role. Edible cups, with their vibrant colors and Instagram-worthy presentation, have gained popularity among social media-savvy consumers. The visually captivating nature of edible cups has contributed to their market success, as customers share their experiences online, driving further demand.

India is showing all the signs of being a lucrative market with a growth rate of 8.0% during the analysis period. The food and beverage sector in India is rapidly expanding, owing to changing lifestyles, urbanization, and rising disposable incomes. The demand for inventive and one-of-a-kind dining experiences is increasing, creating an ideal market for edible cups.

To promote sustainable practices and reduce plastic waste, the Indian government has sponsored initiatives and campaigns. These initiatives, in conjunction with regulatory measures, encourage firms to investigate alternatives to standard single-use plastics.

These companies have established production capabilities, extensive distribution networks, and brand recognition. They often offer a diverse range of edible cup options and enjoy customer loyalty due to their reputation and quality.

Loliware: Loliware is a leading company that specializes in creating edible cups and straws made from seaweed-based materials.

Bakeys: Bakeys is an Indian company that produces edible cutlery, including edible cups. Their products are made from natural ingredients like rice, wheat, and sorghum, offering a unique and eco-friendly alternative to traditional cups.

Cupffee: Cupffee is a Bulgarian company that manufactures edible cups made from natural grain ingredients.

Sweets by Milka: Sweets by Milka is a company that produces edible dessert cups. While primarily focused on dessert cups, they offer a range of options suitable for serving cold beverages.

Smart Planet: Smart Planet is a global brand that offers a range of innovative and eco-friendly products, including edible cups.

Overall, the competitive landscape in the edible cup market is diverse, with a range of companies offering different designs, features, and sustainability commitments. As the demand for eco-friendly and sustainable products continues to grow, new players are likely likely to enter the market. Moreover, existing companies continue to innovate and expand their product offerings.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 7.1% from 2025 to 2035 |

| Base Year of Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and Volume in Units and F-CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, growth factors, Trends, and Pricing Analysis |

| Key Segments Covered | By Material, By Capacity, By Application, By End Use, By Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; The Middle East & Africa; Oceania |

| Key Countries Profiled | United States, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Amcor Ltd.; Constantia Flexibles Group GmbH; Berry Global Group, Inc.; Huhtamäki Oyj; Sonoco Products Company; Bemis Company, Inc.; Sealed Air Corporation; AR Packaging Group AB; Mondi Group; DS Smith Plc; CCL Industries Inc. |

| Customization & Pricing | Available upon Request |

The global edible cups market is estimated to be valued at USD 51.6 billion in 2025.

The market size for the edible cups market is projected to reach USD 102.5 billion by 2035.

The edible cups market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in edible cups market are sugar, chocolate, cookies and others.

In terms of capacity, up to 50 ml segment to command 55.2% share in the edible cups market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Edible Oil Cans Market Size and Share Forecast Outlook 2025 to 2035

Edible Shrink Tunnel Systems Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Edible Animal Fat Market Size and Share Forecast Outlook 2025 to 2035

Edible Water Pods Market Size and Share Forecast Outlook 2025 to 2035

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Nuts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Edible Collagen Casing Market Size and Share Forecast Outlook 2025 to 2035

Edible Seaweed Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Edible Oils and Fats Market Analysis by Product Type, Source, and Distribution Channel Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Edible Oil Packaging Market Growth - Demand & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Competitive Overview of Edible Collagen Casing Market Share

Industry Share Analysis for Edible Offal Providers

Competitive Landscape of Edible Flakes Providers

Edible Packaging Market Report – Key Trends & Forecast 2024-2034

Edible Fungus Market Outlook – Growth, Demand & Forecast 2024 to 2034

Edible and Soluble Films Market

Organic Edible Oil Market Analysis by Type, Distribution Channel, and Region Through 2035

Demand for Edible Nuts in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA