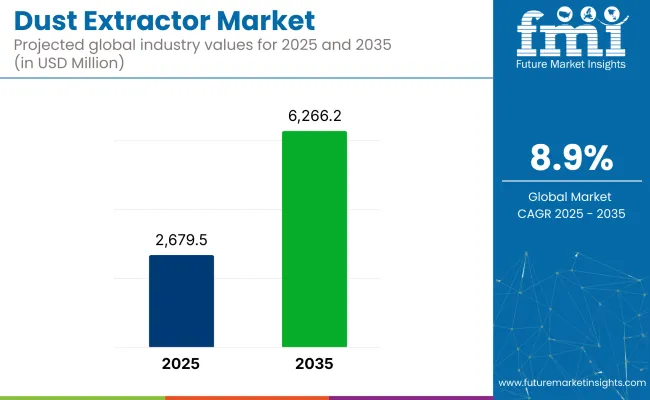

The Dust Extractor Market is set for substantial growth over the next decade, with its market value projected to expand from USD 2,679.5 Million in 2025 to USD 6,266.2 Million by 2035, reflecting a CAGR of 8.9%. This growth is primarily driven by increasing industrialization, stricter workplace safety regulations, and rising awareness about air quality management.

Industries such as woodworking, pharmaceuticals, metalworking, and construction are adopting advanced dust extraction systems to comply with occupational safety and environmental mandates. Technological advancements in filtration efficiency, energy savings, and IoT-based monitoring are enhancing the adoption of dust extraction solutions.

The rising demand for high-performance dust extractors is fueled by their ability to improve air quality, enhance worker safety, and maintain regulatory compliance. Innovations such as multi-stage filtration, self-cleaning units, and portable extraction systems will add value, especially in the industry. At the same time, companies are opting for sustainable active dust control methods as they realize the need to contribute to climate action and cut down on emissions.

The industrial sector, manufacturing, pharmaceuticals, and metal fabrication, still highly takes up dust extractors. This is mainly due to the need to curb the dustbin emissions, to prolong the lifespan of the machines, and to script every part of the production process legally. It is now very common to see the use of dust extractors in welding, grinding, woodworking, and chemical processes, the reason for this being the reduction of airborne particles and increased health safety at the workplaces.

The North American Dust Extractor Market is steadily growing due to the implementation of modernise like OSHA and EPA that lend not only to air quality mandates but also to interim measures in most industrial workplaces. The cutting-edge technology is being employed in the United States and Canada where dust extraction systems are integrated with HEPA filtration and energy efficiency measures.

Health and safety concerns related to occupational diseases seem to be on the rise which coincides with the rise in investments in automated air purification solutions, driving the market forward. But the market is still confronted with high installation and maintenance costs. Future growth will depend on the technological improvements in energy-efficient and AI-first filtration systems.

Europe is leading the way in the adoption of dust extraction technology, with strict air quality and workplace safety regulations that are fueling demand. Germany, France, and the UK are among the countries that are investing in Internet of Things-enabled and climate-friendly dust collection solutions to meet the rigid EU emissions target.

The manufacturing, metal processing, and pharmaceutical sectors' expansions are the roots of the market growth factor. The implementation of environmentally sustainable filtration material and the use of artificial intelligence in monitoring are believed to further promote the innovation of the area. Nevertheless, the market expansion is impeded by the compliance costs and by the complex regulatory frameworks.

The Asia-Pacific region is rising at a rapid rate, with the main driver being the quick industrialization of China, India, and Japan. Governmental initiatives promoting workplace safety, environmental conservation, and industrial automation are key factors in the demand for dust extraction solutions. Heavy industries, construction, and automotive manufacturing are the main sectors that provide substantial market opportunities.

However, the situation in the area is somewhat unstable due to cost constraints and the absence of standard regulations across the countries. Regional market development will depend on the establishment of cost-efficient, high-quality dust collection systems as well as local production capabilities.

MEA Dust Extractor Segment is among those that are gaining traction in the Middle East and Africa region owing to strong demand seen from construction sectors, mining, and oil & gas industries. Countries like Saudi Arabia and the UAE are making major strides in solving the industrial safety and air quality management problems.

By the way, the region could be said to be in a counterfeiting state with a small number of local manufacturers and a dependency on imported dust extraction systems. During the time, the government's pressure to construct a sustainable industrial infrastructure through initiatives and market growth will be aided by the prosperous industrial sectors.

High Initial Investment & Maintenance Costs

The issue facing the dust extractor marketplace is the high upfront costs that are expected from the industrial-level systems. The huge and advanced dust extractors with self-existing filters and automation features the overheads are technologically difficult for SMEs to cope with.

The costs for maintenance, such as the frequent filter renewals, servicing, and electricity used, hike the upkeep operational cost. To overcome these problems, suppliers are engineering semi-modular systems that are less energy-hungry while still possessing a high rate of efficiency.

Stringent Regulatory Compliance

The dust extraction systems must adhere to the universal occupational health and environmental safety regulations which differ in accordance with the region. OSHA (Occupational Safety and Health Administration), EPA (Environmental Protection Agency), and EU air quality standards not only need the abovementioned expenses on research but also the standard certification and custom equipment.

The multifaceted nature of running business in many regions which must comply with different states raises the costs of the manufacturers and results in a product not going on the market as planned. However, the advancements made in standardized and adaptable filtration technologies are a shelter for these firms in times of regulatory trouble.

Supply Chain Disruptions & Raw Material Availability

The prominent raw materials found in the dust extractor market include the high-performance filters, industrial-grade fans, and steel components. The fluctuations in the prices of raw materials due to geopolitical tensions, pandemics, and global trade restrictions convey challenges to the manufacturers. Besides, the dependence on imported materials adds a degree of vulnerability to logistics delay and price volatility. To address this, companies are opting for local sourcing as well as engaging in the production of alternative filtration media.

Growth of Smart & IoT-Enabled Dust Extraction Systems

The integration of IoT and AI-based monitoring systems in dust extractors is the next big thing in air quality management. Smart sensors enable real-time dust monitoring, predictive maintenance, and energy optimization, thereby making dust extractors more effective and cost-efficient.

These dust extractors are even programmed to changing the suction power automatically depending on the measured level of the dust in the air, which saves on energy but does not affect the performance. Besides, AI algorithms also give hints on when to replace the machine's components, which reduces downtime and maintenance expenses.

Increasing Adoption in Emerging Industries

Besides the traditional sectors such as woodworking and metal fabrication, newly-developing branches like 3D printing, semiconductor manufacturing, and battery production are becoming strong drivers for introducing new dust extraction solutions. The increasing focus on precision and contamination control in the cleanroom environment is the cause of the opportunities for specialized dust extractors. As industrial innovations continue, the requirements for compact and highly efficient dust extraction solutions will increase.

Sustainability & Eco-Friendly Innovations

The drive towards sustainability is the key factor in the innovation of energy-efficient and environment-friendly dust extractors. Manufacturers are investing in biodegradable filter media, energy-efficient motors, and recyclable components seeking to meet the global sustainability purposes.

Besides, the progression of closed-loop dust collection systems has enabled firms to recover useful substances like metal and chemical residues, which has resulted in waste reduction and resource efficiency growth. Environmental regulations are becoming stiffer, which is the reason why companies are turning to sustainable solutions for dust management.

Expansion of Industrial Automation

The increased uptake of automated processes in manufacturing is the driving force for dust collection systems with a high degree of performance. Companies are integrating robots for welding tasks, CNC machining, and automated cutting procedures to achieve such an atmosphere at work where automatic filtration of air is the necessity. Automation dust extraction also carries the mutual benefit of the dust outgo with industrial automation leading to improved efficiency, safety, and labor cost redeployment.

The dust extractor market has gone through a period of steady growth by 2020 to 2024, as a result of the introduction of more workplace safety regulations, higher public awareness of the air quality problems and, beyond all, industry development (the solvent has left the manufacturing, construction, and pharmaceuticals).

The world over, as a result of tighter dust control measures, especially in the developed economies, the demand for dust extraction systems in industrial and commercial functions has seen massive growth. The development of filtration technologies like HEPA and activated carbon filters has enhanced their efficiency, thus the application in diverse sectors.

Going forward, the 2025 to 2035 market will be quite different due to the smart dust extraction solutions' and IoT and AI predictive maintenance' adoption. The energy-efficient, low maintenance systems will grow in demand, while eco-footprint concerns will intensify pushing producers towards environmentally friendly filtering materials and technologies. Expansion in construction during the time frame in developing countries alongside stricter environmental regulations in economies cut the demand for growth in the market.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Occupational safety and health mandates (OSHA, EU directives) have demanded compliance with dust management practices. The regulatory situation was unpredictable across different areas and this led to an unequal adoption of the new regulation. |

| Technological Advancements | HEPA and activated carbon filtration improved the level of air purification. The product line of portable and industrial-grade dust extractors. |

| Specific Demand Per Industry | Surge in demand from manufacturing, construction, and woodworking sectors due to employees' safety issues. |

| Sustainability & Circular Economy | First step towards adoption of energy-efficient motors and eco-friendly filter materials taken. Initial focus was on compliance, instead of sustainability. |

| Market Growth Drivers | Stiff workplace health and safety measures, high industrial activities, and increased emphasis on air quality are some of the leading market growth drivers. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Environment-related rules worldwide are getting stricter, which means that the control measures for dust will be enforced by law. The product designs will be affected by the need to reduce carbon footprints. |

| Technological Advancements | Artificial intelligence-based monitoring systems, Internet of Things (IoT)-enabled smart sensors, and automated self-cleaning filters will be the key players. Less energy will be consumed because of the newest battery-operated extractors, which will offer better mobility. |

| Specific Demand Per Industry | Additional demand from the high-tech sector like semiconductor manufacturing and the pharmaceutical clean room industry. Investing in the small-scale industries has been on the rise. |

| Sustainability & Circular Economy | Creation of entirely recyclable filters, low-energy consumption models, and carbon-neutral production processes. Circular economy projects will lead to the development of new product designs. |

| Market Growth Drivers | Expansion of automated and AI-based industrial solutions, rising governmental financial aids for environmental compliance, and construction boom caused by urbanization are the pushing factors. |

The USA dust extractor market is witnessing growth due to serious OSHA air quality regulations and the need for more efficient dust control in industrial workplaces. Increased construction, mining, and pharmaceutical sectors are the main reason for the adoption of advanced dust extraction systems. The emphasis on workplace safety, along with government support for the reduction of air pollution, is the factor behind the investment in innovative dust collection technologies. Different sectors are opting for energy-efficient and smart automated dust extraction systems to improve operational efficiency and diminish emissions.

| Country | CAGR (2025 to 2035) |

|---|---|

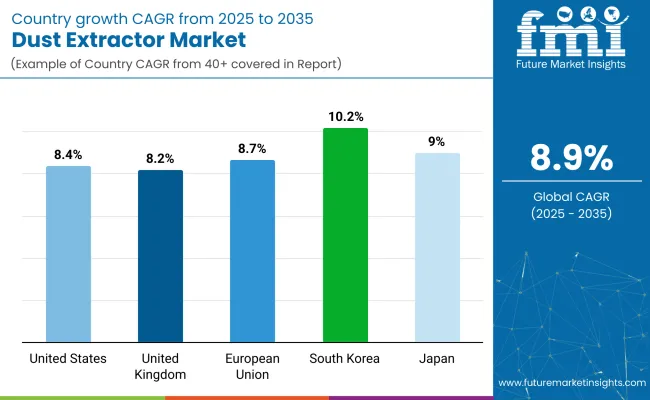

| United States | 8.4% |

The UK dust extractor market is experiencing steady growth due to strict industrial air pollution regulations and the promotion of sustainable manufacturing. The trend towards environmentally-friendly methods of manufacturing in the country is fueling the demand for energy-efficient and environmentally-friendly dust collectors. The growing industries like metal manufacturing, automotive, and pharmaceuticals are also helping in the further growth of dust extraction machines. Safety regulations are responsible for the use of explosion-proof dust collectors in high-risk industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.2% |

The European dust extractor market is expanding due to strict environmental policies under the EU Green Deal, pushing industries to adopt sustainable and energy-efficient air filtration solutions. The region’s strong industrial base, particularly in Germany, France, and Italy, is driving demand for dust extraction systems in manufacturing, automotive, and chemical processing industries. The focus on circular economy initiatives is increasing the use of recyclable and biodegradable filter materials.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.7% |

The main driving force behind the development of Japan's dust extractor market is the country being the world top player in precision engineering and strict workplace air quality standards. The surge in electric and hydrogen power vehicles is, in turn, the reason for the high demand for dust removal apparatus in battery and car production plants. The environmental move by Japan`s government is the main reason for the increased use of those dust control systems which are both high performance and energy efficient. The flourishing semiconductor and electronics arenas are also bringing demand for ultra-clean air filtration technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 9.0% |

The expansion of the dust extractor market in South Korea is majorly due to the rapid industrialization process as well as the country strong manufacturing sectors in automotive, electronics, and construction. The avalanche of smart manufacturing and Industry 4.0 initiatives is the major factor for this. The government attention towards air pollution mitigation and sustainability is further promoting industries to go for energy-efficient and eco-friendly filtration systems. Along with this, the surge in EV batteries production in South Korea brings about the need for battery manufacturing equipment that is specialized regarding dust extractors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 10.2% |

0.4 to 1 Ltr. Extractors Gain Popularity in Compact Workspaces

Dust extractors with a capacity of 0.4 to 1 liters are widely used in small-scale applications where portability and ease of handling are crucial. These compact units are popular among DIY enthusiasts, home workshops, and professionals working in confined spaces, such as electricians and painters.

Their lightweight design and energy efficiency make them ideal for quick dust removal in renovation projects, fine sanding, and surface preparation. Advancements in battery-powered extractors are increasing the adoption of small-capacity dust extractors in cordless applications, enhancing mobility and convenience for craftsmen.

1 to 10 Ltr. Extractors Dominate in Industrial and Heavy-Duty Use

Dust extractors with a 1 to 10-liter capacity are extensively used in woodworking, construction, and manufacturing sectors where high dust accumulation occurs. These larger units offer superior suction power and extended runtime, making them essential for handling sawdust, metal shavings, and fine particulate matter.

The increasing demand for industrial-grade dust management solutions, coupled with stringent workplace air quality regulations, is driving the adoption of high-capacity extractors. Innovations in HEPA filtration and auto-cleaning mechanisms are improving the efficiency and longevity of these systems, making them indispensable for professional workshops and industrial environments.

Professional Craftsmen (DIY) Segment Benefits from Portability and Versatility

The rise of do-it-yourself (DIY) projects and home-based workshops has fueled the demand for compact and portable dust extractors among professional craftsmen. These users require efficient dust management solutions for applications such as drilling, sanding, and surface finishing.

Modern dust extractors designed for craftsmen offer features like Bluetooth connectivity, auto-start functions, and multi-tool compatibility, improving convenience and usability. The growing trend of eco-friendly and dust-free working environments is further pushing manufacturers to develop quieter, low-emission, and energy-efficient extractors tailored for small workshops and DIY enthusiasts.

Woodworking Industry Drives Market Growth with High-Dust Applications

The woodworking sector remains a major consumer of dust extractors due to the high volume of fine particles generated in cutting, sanding, and shaping wood. Ensuring dust-free conditions in woodworking shops is crucial for worker safety, fire prevention, and maintaining high-quality finishes.

Advanced dust extractors equipped with high-efficiency filters and automated dust collection systems are gaining popularity in large-scale woodworking facilities. The increasing adoption of CNC routers and automated woodworking machinery is also driving demand for integrated dust extraction solutions that optimize productivity while complying with occupational safety standards.

The global dust extractor market is experiencing steady growth due to increasing industrial safety regulations, workplace air quality standards, and the rising adoption of automated filtration systems. Key industries driving demand include construction, woodworking, metal fabrication, pharmaceuticals, and food processing.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Donaldson Company, Inc. | 12-17% |

| Nederman Holding AB | 10-14% |

| Bosch Rexroth AG | 8-12% |

| Camfil Group | 5-9% |

| HafcoVac | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Donaldson Company, Inc. | Industrial dust, fume, and mist collection systems. Focus on filtration efficiency & compliance. |

| Nederman Holding AB | Smart air filtration solutions with IoT monitoring. Strong presence in European regulations compliance. |

| Bosch Rexroth AG | Portable and stationary dust extraction for automated industrial applications. High focus on energy efficiency. |

| Camfil Group | Advanced HEPA and ULPA dust filtration systems for cleanrooms and pharmaceutical industries. |

| HafcoVac | Explosion-proof and pneumatic industrial vacuums targeting hazardous dust environments. |

Key Company Insights

Donaldson Company, Inc.

Donaldson Company, Inc. which deals with industrial air filtration, is among the many that are globally rated as top suppliers of such ancillary dust, fume, and mist collection systems. The company is primarily involved in nanofiber-based filtration technology, which is not only vital for workplace safety but also reduces energy expenditure considerably.

One of the IoT-related aspects, Donaldson is implementing is a real-time monitoring system that IoT enables. The manufacturing space and metal fabrication are the key business areas where this company operate, however, it is also a company that are through procurement and patents brines, as well as, the latest technology, hot solutions expand its portfolio.

Nederman Holding AB

Nederman Holding AB is a top-in-class provider of air pollution control solutions, including the design of industrial dust and fume extractors based on sustainability and compliance with the rigorous European regulations. The company has industrial IoT designed to monitor and display the dust filter's performance and has thus optimized the efficiency of the electrostatic precipitators while simultaneously prohibiting the use of energy.

In addition, the company, apart from serving the metalworking and food processing sectors, is also part of the pharmaceutical vertical market and is well established in Europe and North America. In terms of its recent acquisitions, the company has acquired those able to perform efficiently in High dust extraction and also in explosion-proof filtration.

Bosch Rexroth AG

Bosch Rexroth AG is a dynamic player in the undervalued market of automation dust removal, which collaborates smart sensor based filtration integration in industrial applications. The company is leading with energy-efficient extraction systems, thus keeping up with the global sustainability trend.

Bosch Rexroth is a supplier of construction, manufacturing, and automotive sectors wherein it provides both portable as well as stationary dust extractors. With an investment in acquiring AI-powered predictive maintenance solutions, Bosch Rexroth AG has established itself as a role model in high-performance dust control technology.

Camfil Group

Camfil Group is widely recognized for its high-performance air filtration solutions, especially in the pharmaceutical, medical, and cleanroom environments. The company has brought to the market the HEPA and ULPA dust extraction systems which have passed the severe air quality requirements at a global level.

Camfil adopts a strategy to produce air filters that are low energy consuming but high performing. Its further presence in the Asian and North American markets is cultivated by the need of new, ultra-clean air requiring industries like semiconductor manufacturing and biotechnology.

HafcoVac

HafcoVac is the producer of explosion-proof/carbon pneumatic industrial vacuum systems for certain industries that deal with hazardous dust like oil & gas, metal fabrication, and chemical processing. The company gives the design of combustible dust extractors, which require the compliance with OSHA, and ensure the safety of the workplace. Having a focus solely on the air-powered and maintenance-free systems, HafcoVac is preferred by industries where intrinsically safe vacuum systems are required.

Oneida Air Systems

Oneida Air Systems is a trend former in cyclonic dust collection systems, mainly for the woodworking and construction industries. The company aimed to develop separators and portable extractors that are more efficient with dust collection, improve the filter life。 Oneida Air Systems is on a campaign to advance in North America, mainly with the sustainable dust management solutions connected with power tools and industrial equipment.

Festool GmbH

Festool GmbH is a business focused on the portable dust extraction systems, which are primarily applicable to professional trade, construction, and renovation industries. The company manufactures small-sized and lightweight yet highly efficient tools integrated with dust collection such as circular saws and jigsaws. The company always looks at innovation that promotes efficiency and boosts air quality in construction sites as battery-powered dust extractors with smart connectivity.

The global Dust Extractor market is projected to reach approximately USD 2,679.5 Million by the end of 2025.

The market is anticipated to grow at a compound annual growth rate (CAGR) of around 8.9% from 2025 to 2035.

By 2035, the Dust Extractor market is expected to reach USD 6,266.2 Million.

The 20-40 liter capacity segment is projected to lead the dust extractors market, driven by the introduction of various standards and norms by regulatory bodies regarding worker safety and dust control.

Key players in the Dust Extractor market include Donaldson Company, Inc., Nederman Holding AB, Bosch Rexroth AG, Camfil Group, HafcoVac, Aier Environmental, Ruwac USA, AT Industrial Products, Diversitech Inc., Makita Corporation, Imperial Systems, Inc. and Grizzly Industrial, Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dust Suppressant Market Size and Share Forecast Outlook 2025 to 2035

Dust Control System Market Growth – Trends & Forecast 2024-2034

Dust Covers Market

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA