The duct tape industry is undergoing a metamorphosis driven by growing demand for high-performance, highly durable, and multipurpose adhesive solutions. Given increased applications in construction and automotive, packaging, and DIY projects, manufacturers are prompting the innovation of stronger adhesives for performance, weatherproof materials, and environmentally friendly alternatives, as these brands pivot to biodegradable, heatresistant, and industrial-strength duct tape in compliance with standards and preferences.

Investments are being made into enhanced reinforced materials, PR Adhesives, and the latest in coating technologies by the manufacturers to realize the improved performance and lessen the environmental impact. Eco-friendly adhesives, fiber-reinforced duct tapes, and flame-retardant materials will make duct tape more functional and sustainable in the future.

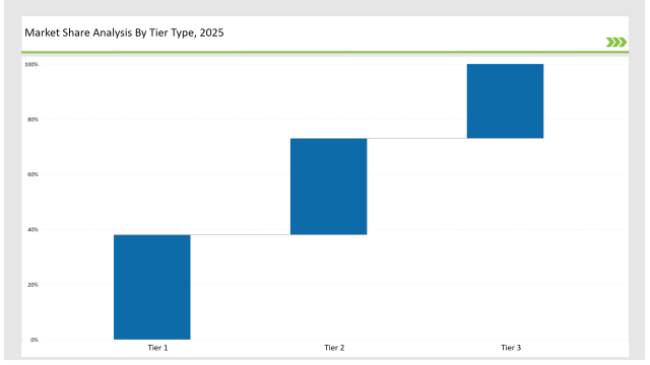

38% of the market is held by Tier 1 players such as 3M, Intertape Polymer Group, and Berry Global, based on their background in adhesive technology, their vast distribution network, and innovative product development.

The Tier 2 players include the likes of Tesa, Shurtape Technologies, and Scapa Group, which represent about 35% of the market by providing duct tapes with cost-effective yet high performance for industrial and consumer applications.

Tier 3 consists of regional and niche players, focusing on specialty tapes, sustainable materials, and custom adhesive solutions, holding 27% of the market. These companies focus on localized production, high-strength adhesives, and industry-specific customization.

Explore FMI!

Book a free demo

| Category | Market Share (%) |

|---|---|

| Top 3 (3M, Intertape Polymer Group, Berry Global) | 19% |

| Rest of Top 5 (Tesa, Shurtape Technologies) | 12% |

| Next 5 of Top 10 (Scapa Group, Avery Dennison, Nitto Denko, Beiersdorf, Saint-Gobain) | 7% |

The duct tape business operates across a range of industries where adhesion strength, durability, and versatility are essential. Companies are now designing solutions for high-performance duct tapes in response to increased demand for multiple industrial and commercial applications.

To provide the markets with a better class of tape, manufacturers are optimizing the production processes of making duct tapes, thereby enhancing adhesive formulations, durability, and sustainability.

Duct tape is evolving as manufacturers develop adhesives that combine sustainability with high performance. Companies are adopting AI-driven manufacturing, low-VOC adhesives, and reinforced backing materials to meet changing customer demands and regulatory standards. They are also engineering thinner, high-tensile tapes to reduce material usage without compromising strength. Additionally, firms are integrating solvent-free adhesives to enhance eco-friendliness and improve overall durability in extreme conditions.

Technology suppliers should focus on automation, sustainable adhesive innovation, and intelligent tape solutions to support the evolving duct tape market. Partnering with construction, automotive, and packaging companies will drive adoption.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | 3M, Intertape Polymer Group, Berry Global |

| Tier 2 | Tesa, Shurtape Technologies, Scapa Group |

| Tier 3 | Avery Dennison, Nitto Denko, Beiersdorf, Saint-Gobain |

Leading manufacturers are advancing duct tape technology with sustainable adhesives, AI-driven manufacturing, and specialty coatings.

| Manufacturer | Latest Developments |

|---|---|

| 3M | Introduced ultra-strong, weather-resistant duct tapes in March 2024. |

| Intertape Polymer Group | Launched biodegradable, eco-friendly duct tape solutions in April 2024. |

| Berry Global | Expanded flame-retardant, high-temperature duct tapes in May 2024. |

| Tesa | Released fiber-reinforced, high-tensile duct tapes in June 2024. |

| Shurtape Technologies | Strengthened waterproof and double-coated duct tape offerings in July 2024. |

| Scapa Group | Developed solvent-free, heat-resistant adhesive tapes in August 2024. |

| Avery Dennison | Pioneered RFID-enabled tracking duct tapes in September 2024. |

The duct tape market is evolving as companies focus on sustainability, high-strength adhesives, and specialized performance features.

The industries will keep on the integration of AI-based manufacturing practices, resort to green adhesive alternatives, and utilize smart tracking technologies. As rules become stricter, it is highly probable for manufacturers to fast-track the movement toward solvent-free adhesives and the use of biodegradable duct tapes. Companies are also putting into effect visibility in their supply chains through blockchain-enabled traceability.

Leading players include 3M, Intertape Polymer Group, Berry Global, Tesa, Shurtape Technologies, Scapa Group, and Avery Dennison.

The top 3 players collectively control 19% of the global market.

The market shows medium concentration, with top players holding 38%.

Key drivers include sustainability, high-performance adhesives, heat resistance, and automation.

Eco-friendly Paper Plates Market Insights - Trends & Future Outlook 2025 to 2035

EPE Liner Market Analysis – Size, Growth & Demand 2025 to 2035

Electron High Barrier Packaging Film Market Growth - Forecast 2025 to 2035

Electrostatic Discharge (ESD) Packaging Market Growth - Forecast 2025 to 2035

Envelope Market Insights – Growth & Trends Forecast 2025 to 2035

Envelope Sealing Machines Market Trends - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.