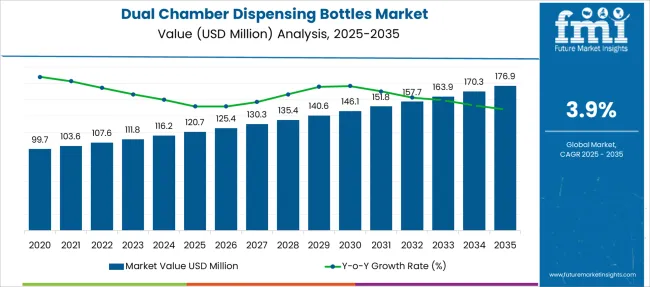

The Dual Chamber Dispensing Bottles Market is estimated to be valued at USD 120.7 million in 2025 and is projected to reach USD 176.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

| Metric | Value |

|---|---|

| Dual Chamber Dispensing Bottles Market Estimated Value in (2025 E) | USD 120.7 million |

| Dual Chamber Dispensing Bottles Market Forecast Value in (2035 F) | USD 176.9 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

The dual chamber dispensing bottles market is gaining traction due to evolving product formulation needs and consumer demand for convenience, precision, and extended product shelf life. Increasing product launches in skincare, personal hygiene, and pharmaceutical applications have accelerated the adoption of dual chamber formats that enable separation and controlled mixing of active ingredients.

Advances in manufacturing techniques, including precision blow molding and multi-layer extrusion, are enhancing compatibility with various materials and viscosities. Growing focus on clean-label formulations and preservative-free solutions is also supporting demand, particularly in personal care and wellness industries.

The ability to extend formulation stability and offer customized dispensing experiences is positioning dual chamber bottles as an attractive innovation for brands targeting premium and functional product segments. Sustainability trends are further driving material optimization and interest in refillable or recyclable designs across key end-user categories.

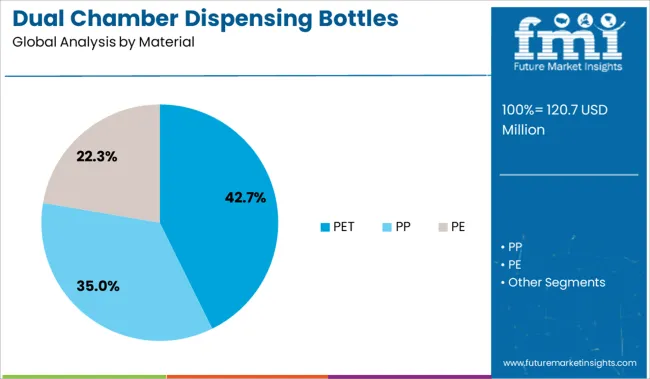

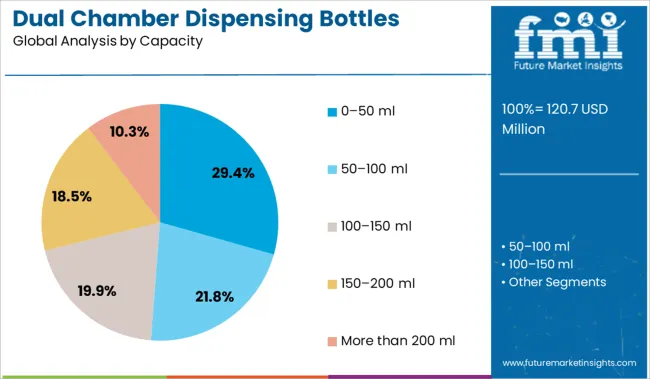

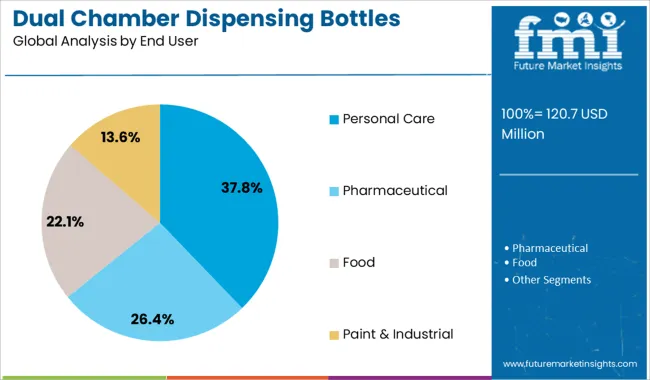

The market is segmented by Material, Capacity, and End User and region. By Material, the market is divided into PET, PP, and PE. In terms of Capacity, the market is classified into 0–50 ml, 50–100 ml, 100–150 ml, 150–200 ml, and More than 200 ml. Based on End User, the market is segmented into Personal Care, Pharmaceutical, Food, and Paint & Industrial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene terephthalate (PET) is anticipated to hold 42.7% of the total revenue in the dual chamber dispensing bottles market in 2025, emerging as the most preferred material segment. Its lightweight nature, high impact resistance, and clarity make it ideal for showcasing product formulations while maintaining durability during use.

PET is also compatible with precision molding processes, enabling complex chamber and nozzle designs required for dual dispensing formats. The material’s recyclability and alignment with circular economy initiatives have enhanced its adoption among sustainability-conscious brands.

Additionally, PET’s chemical compatibility with a wide range of formulations in personal care and pharmaceutical applications supports its continued dominance.

The 0–50 ml capacity range is expected to contribute 29.4% of market revenue by 2025, establishing it as the leading capacity segment. This preference is being driven by rising demand for travel-size, sample, and single-use packaging formats, particularly in skincare and medicated solutions.

Compact bottles in this size bracket allow precise portioning and prevent ingredient wastage, which is especially valuable when handling active or multi-phase formulations. Brand strategies targeting high-margin personal care and wellness offerings have favored premium packaging designs that incorporate portability and ease of use.

Furthermore, strict compliance with formulation stability standards in regulated industries has boosted the uptake of smaller, sealed dual-chamber formats.

Personal care is projected to dominate the end-user landscape, accounting for 37.8% of total revenue in 2025. This leadership is supported by increasing product segmentation across anti-aging, haircare, and skincare lines that require ingredient separation and controlled application.

Consumer demand for convenience, hygiene, and premium aesthetics has pushed brands to innovate within the packaging layer making dual chamber solutions highly relevant. High growth in the clean beauty and natural ingredient space has also reinforced the need for packaging that supports preservative-free formulations.

In addition, the premiumization of personal care routines and expansion into wellness and self-care have made dual chamber bottles a functional differentiator in highly competitive shelf environments.

Due to its convenience, the demand for dual chamber dispensing bottles is expected to rise amongst various end users, such as cosmetics, pharmaceuticals, healthcare, food and beverage, and industrial markets.

However, the disposal of rigid plastic material substances such as HDPE and PET used to make these bottles can harm the environment, which is a significant challenge for the market. Conversely, manufacturers, primarily cosmetic and personal care products, are looking to develop aesthetic packaging designs to appeal to various consumer segments.

FMI’s research report on dual chamber dispensing bottles suggests that the growing preference of consumers and end users for eco-friendly packaging materials is invoking lucrative options for the dual chamber dispensing bottles market trends. This is because global packaging manufacturers are becoming increasingly aware of environmental and sustainability issues to enhance their brand image and reduce their carbon footprint.

The pharmaceutical industries have keenly interested in adopting dual chamber dispensing bottles. This is because the mechanism of these bottles in the pharma industry is equipped with “fixed-dose dispensing technology” to avoid any overdosing or under-dosing of medicines, fuelling the sales of dual chamber dispensing bottles.

Some dual chamber dispensing bottle manufacturers also deliver extra configurations to carry hot and cold beverages in a single, dual chamber dispensing bottle. Other industry titans operating in the dual chamber dispensing bottles market have introduced dual chamber dispensing bottles in the past that were well received by consumers.

Given that the dual chamber dispensing bottles market is marked by steady introductions of innovations and a broadening consumer base, which, in turn, is expected to propel the sales of dual chamber dispensing bottles in the dual chamber dispensing bottles market.

The dual chamber dispensing bottle industry's need to reduce plastic consumption is its sole obstacle. In addition, the industry is seeing an increase in demand for sturdy bottles. Biodegradable bottles are being used by businesses.

Dual chamber dispensing bottles' versatility in use is likely to accelerate market expansion. Despite having dual chamber dispensing, the bottle doesn't take up a lot of room because it is made to be vertical. The dual chamber dispensing multi-use bottle is also anticipated to accelerate the sales of dual chamber dispensing bottles.

Athletes and the populace who are interested in fitness are embracing dual chamber dispensing bottles and dual compartment bottles. The dual chamber dispensing bottles have become a standard for a smart gadget-like item carried by sports enthusiasts and sportsmen since they allow users to carry two beverages in a single bottle.

Due to the growing demand for dual chamber dispensing bottles, producers in the industry have developed a wide selection of models that are appealing to a variety of consumers. The market's top producers of dual chamber dispensing bottles are undertaking innovations by designing bottles with horizontal separation and top dual flip lids that enable consumers to pour one beverage at a time.

Other trends in the dual chamber dispensing bottles market include a vacuum-insulated container with two drink compartments and an extra storage area for other everyday necessities. Furthermore, businesses offer an optional configuration that allows customers to carry both hot and cold beverages in a single two-compartment bottle.

Multiple players in the dual chamber dispensing bottle industry had previously released dual chamber dispensing bottles that were favorably appreciated by customers. Given that the market for dual chamber dispensing bottles is characterized by the consistent introduction of innovations and a growing customer base, this is projected to drive the sales of dual chamber dispensing bottles during the forecast period.

A global study on dual chamber dispensing bottles suggests that the visual appeal and convenience of application are likely to increase the demand for dual chamber dispensing bottles. These factors offer a high potential for packaging cosmetic products, such as hair care, skin care, deodorants, etc., and are expected to drive market growth during the forecast period.

To avoid contamination of products, the pharmaceutical and cosmetic industries are increasingly deploying these bottles to dispense the appropriate amount of product needed. Moreover, due to product innovations such as smart dispensing and airless packaging, dual chamber dispensing bottles are growing in demand, especially amongst haircare product manufacturers.

Dual chamber dispensing bottles market demand analysis explains that the packaging industry benefits significantly owing to the growing adoption of dual chamber dispensing bottles. This is because these dispensing bottles cater to the inflating demand for product differentiation, as the mechanisms in these bottles optimize the product life-cycle and increase the product's value.

Restraints:

When disposed of in landfills, plastic substances produce poisonous gases that further pollute the environment. This is likely to curb the sales of dual chamber dispensing bottles and the decline of the global market growth.

Furthermore, the physical properties of dual chamber dispensing bottles may vary depending on the type of resin used in manufacturing them. However, maintaining effective reverse logistics operations to ensure the proper and correct disposal of these bottles is expensive and results in high operating costs for manufacturers, and is therefore likely to hamper the market size growth.

On the contrary, manufacturers are increasingly implementing changes in packaging formats in order to meet consumer demands. Haircare product manufacturers, for example, are shifting from using traditional bottles to airless dispensers to ensure convenience for consumers.

With a revenue of 19%, North America is the largest dual chamber dispensing bottle market. This is owing to increased consumer beauty consciousness and increased availability of advanced products.

The dual chamber dispensing bottles market outlook explains that the North American population is increasingly shifting to safe skin and hair care products due to the increased concern about the side effects caused by unhealthy synthetic products.

Hence, with the launch of two new products: Micro ECO and Mezzo ECO, manufacturers of dual chamber dispensing bottles are expanding the use of post-consumer recycled resin (PCR) in their airless line, expanding the dual chamber dispensing bottles market size.

The market survey of Dual chamber dispensing bottles explains that consumers are demanding product packaging with every feature. They require product packaging that is convenient, easy to use, eco-friendly and reusable. Hence, start-up companies are developing creative innovations on several packaging products, such as 3D technology, including dual chamber dispensing bottles.

Due to the availability of a wide variety of dispensing systems, the dual chamber dispensing bottle market share is highly competitive. Key manufacturers are coming up with creative innovations that are likely to cater to different applications across various industrial verticals.

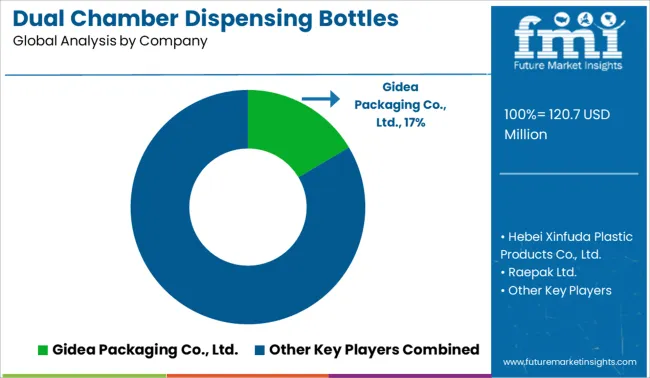

Ningbo Gidea Packaging Co. Ltd. - The company produces cosmetic and cleaning packages which supply to cosmetic, medicine, health care, household chemical and cleaning products manufacturers.

Hebei Xinfuda Plastic Products Co. Ltd. - The company focuses on plastic peterinary container like various liquid bottle & powder jars. They meet the GMP Standard and are equipped with high precision injection moulding machines, filling equipment, cap liner inserting machine, pad printing machine and thermal transfer printing machine (most machines are imported overseas). Xinfuda enhances mechanization and automatization degree which make Quality First real.

Raepak Ltd. - It is a global supplier of plastic packaging: distributing and manufacturing recyclable plastic bottles, jars, biopolymer flexible tubes, closures, caps and dispensing pumps, covering commercial & domestic product markets.

Amigo Laboratories - The company guarantees best quality of RTSoft products and solutions both by uniquely qualified engineering staff and deep expertise in different sectors, such as energy industry, nuclear industry, oil and gas, metallurgy, transportation, instrumentation, IT and telecommunication, building automation and utilities, aerospace.

O.Berk Co. LLC - It is a leading supplier of both custom and stock packaging: glass and plastic containers, a variety of closure options, as well as decorating services. Their entire team of packaging professionals specializes in a particular market segment: beauty/personal care, food/beverage, pharmaceuticals/healthcare, or household/industrial. They can provide, source, or create the container and closure that best satisfies the customer's product requirements.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.9% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Material, Capacity Type, End User, and Region. |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | Ningbo Gidea Packaging Co. Ltd.; Hebei Xinfuda Plastic Products Co. Ltd.; Raepak Ltd.; Amigo Laboratories; O.Berk Co. LLC; Quadpack Industries SA, Shanghai Hopeck Packaging Co. Ltd.; Shijiazhuang Xinfuda Medical Packaging Co. Ltd.; Berlin Packaging UK Ltd.; Bettix Ltd.; Hangzhou Luzern Packaging Trading Co. Ltd.; Matsa Group Ltd.; Cospack America Corp.; etc. |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global dual chamber dispensing bottles market is estimated to be valued at USD 120.7 million in 2025.

The market size for the dual chamber dispensing bottles market is projected to reach USD 176.9 million by 2035.

The dual chamber dispensing bottles market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in dual chamber dispensing bottles market are pet, pp and pe.

In terms of capacity, 0–50 ml segment to command 29.4% share in the dual chamber dispensing bottles market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual-Channel Tactical Communication Headset Market Size and Share Forecast Outlook 2025 to 2035

Dual P-channel MOSFET Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Probe Market Size and Share Forecast Outlook 2025 to 2035

Dual Wavelength Raman Spectrometer Market Size and Share Forecast Outlook 2025 to 2035

DualMode Automated Tow Tractor Market Size and Share Forecast Outlook 2025 to 2035

Dual Clutch Transmission Market Size and Share Forecast Outlook 2025 to 2035

Dual Frequency Ultrasonic Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Dual Screen Laptops Market Size and Share Forecast Outlook 2025 to 2035

Dual Ovenable Trays and Containers Market Size and Share Forecast Outlook 2025 to 2035

Dual Relay Board Market Size and Share Forecast Outlook 2025 to 2035

Dual Voltage Comparator Market Size and Share Forecast Outlook 2025 to 2035

Dual and Multi-Energy Computed Tomography (CT) Market Size and Share Forecast Outlook 2025 to 2035

Dual-Phase Cleanser Market Size and Share Forecast Outlook 2025 to 2035

The Dual Balloon Angioplasty Catheter Market is segmented by Peripheral, and Coronal from 2025 to 2035

Dual Biomarker Assays Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Dual Ovenable Lidding Films Market by Material, Seal Type, Application & Region - Forecast 2025 to 2035

Dual Axis Solar Tracker Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Dual Ovenable Lidding Films Manufacturers

Dual Containment Pipe Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA