This segment is also on the way to enormous growth with the rate of growth and development of a global dry vacuum pump market of around 7.0% and to reach at about USD 5,971 million in the year 2035. Such rapid growth will come due to its high demand and increase in usage from oil-free energy-efficient vacuum pumps for varied types of applications from semiconductors and pharmaceuticals, food processing to chemical manufacturing.

With increasing emphasis on cleanroom standards and energy conservation, dry vacuum pumps are now gaining prominence over the conventional wet vacuum systems as they outperform the latter and are also eco-friendly.

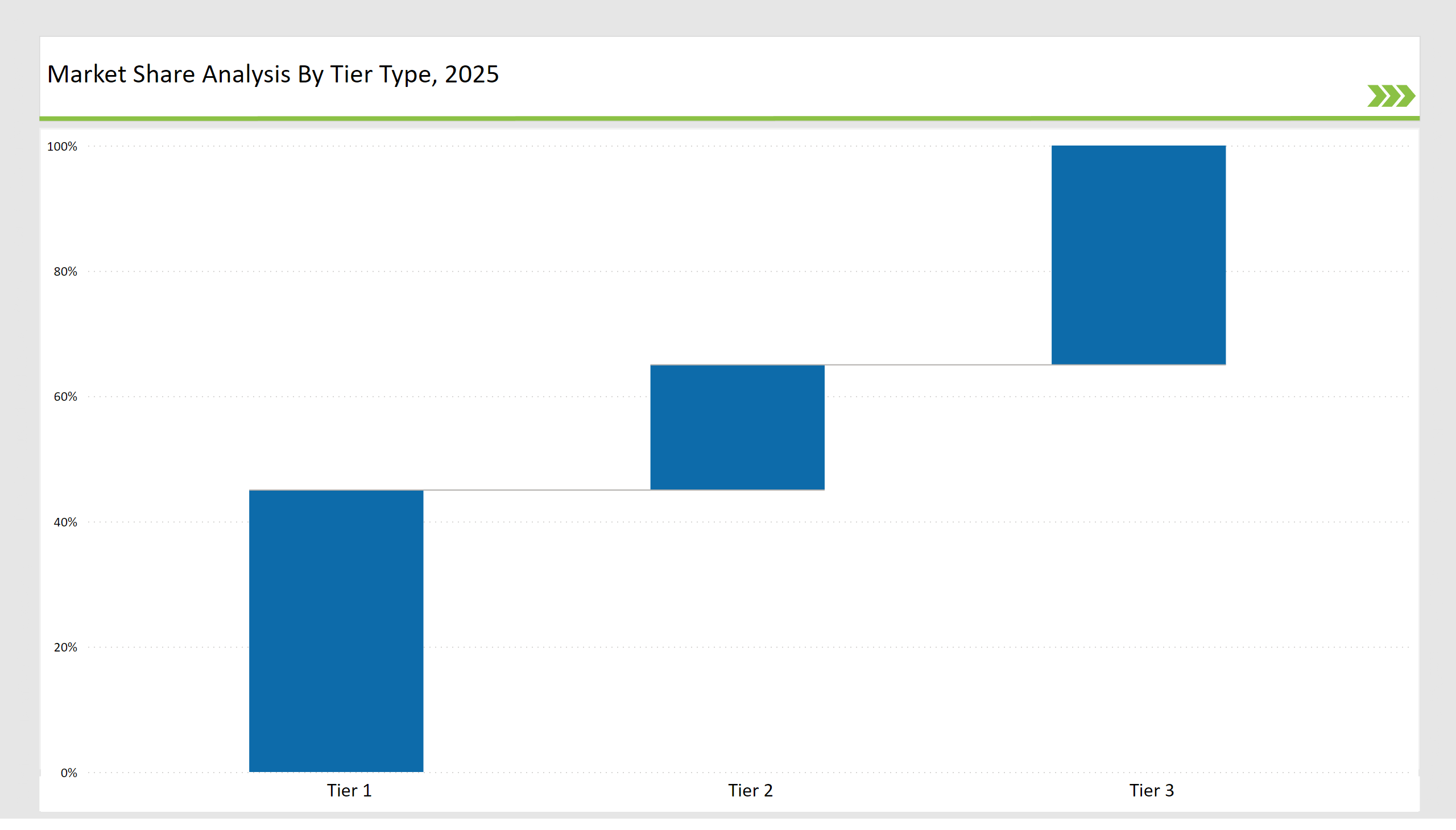

The market is moderately consolidated, with Tier 1 players Edwards Vacuum, Pfeiffer Vacuum, and Atlas Copco holding around 45% of the global market share. The top players have taken advantage of their superior quality offerings, technological competencies, and wide customer base to claim a good portion of the market growth.

This has helped place them ahead in the demand trend-shaping curve and diversification of use of dry vacuum pumps in a variety of end-user markets.

The product type market share is dominated by dry screw vacuum pumps, with 40% of the global market share. These are highly efficient for large volumes of gases and particles, which makes them very popular in industrial applications.

The market by capacity is also led by medium-capacity pumps, which hold a 50% share due to their versatility and wide applicability These factors place the dry vacuum pumps market for high growth in the near future.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 5,971 million |

| CAGR (2025 to 2035) | 7.0% |

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 Players (Edwards Vacuum, Pfeiffer Vacuum, Atlas Copco) | 45% |

| Next 2 of 5 Players (Busch Vacuum Solutions, Ebara Corporation) | 20% |

| Rest of Top 10 Players | 35% |

The market is fairly consolidated with leading players driving innovation and global distribution.

Dry screw vacuum pumps have a market share of 40%. This is because the product is more efficient in dealing with corrosive gases and particles. Thus, they are playing a significant role in chemical, pharmaceutical, and semiconductor industries. Edwards Vacuum dominates by providing robust, tailored solutions that fulfil the high-demand applications.

Dry scroll vacuum pumps also hold a preference as they are compact, noise-free, and energy efficient. This mainly goes for laboratories, medical equipment, and small-scale manufacturing. Pfeiffer Vacuum specializes in this segment with precision-engineered scroll pumps.

Dry diaphragm pumps have a strong preference for applications that demand chemical resistance and low maintenance. For instance, analytical instruments and laboratory setups have been strong areas of interest for Busch Vacuum Solutions.

Also, dry claw and hook pumps are appreciated for being strong and more than capable to support severe industrial processes, and Atlas Copco offer superior designs for heavy-duty application. This category also has hybrid as well as application-specific vacuum pumps for niche markets such as food processing and aerospace, further diversifying the industry landscape.

Medium-capacity pumps hold the biggest market share of 50%. These pumps are versatile, and their wide use in various industries, including pharmaceuticals, electronics, and general manufacturing, propels them. These pumps ensure a balance of performance and efficiency.

Thus, these pumps are the favourite for various applications in industries. The market leader for Pfeiffer Vacuum is in the segment with reliable, energy-efficient solutions that perfectly fit precision industries. The major applications of high-capacity pumps lie in heavy industrial activities such as chemical processing and semiconductor manufacturing.

In such areas, continuous operation and robust performance are very essential. Edwards Vacuum is the product specialist in this area, providing advanced, high-performance vacuum systems for demanding applications. On the other hand, low-capacity pumps find their application in the laboratories and research areas due to its compactness and cost-effectiveness.

Busch Vacuum Solutions is targeting this niche, providing innovative diaphragm and scroll pump solutions that guarantee precision and efficiency for scientific and analytical setups. These segments, therefore, represent the changing vacuum pump industry landscape and meet the needs of the unique end-users.

Edwards Vacuum

Edwards Vacuum has just launched a new family of high-performance dry screw pumps, which are tailored for semiconductor manufacturing and high-capacity chemical processing applications.

With superior efficiency and enhanced reliability and reduced maintenance requirements, the dry screw pumps deliver an added advantage of contaminant-free operation that is required for precision applications.

The company has been growing its footprint in the Asia-Pacific region very aggressively through strategic partnerships with local distributors. Edwards Vacuum intends to expand its market presence, customer support facility, and availability of products across major hubs in the region.

The collaborations are for improving the company's service capabilities to support growing demand for high-performance vacuum solutions in semiconductor fabrication, chemical production, and other critical industries. In such efforts, Edwards Vacuum has a strategic place at the head of the vacuum technology market. The company is dedicated to innovation and expansion on a global level.

Pfeiffer Vacuum

The firm introduced a new set of energy-efficient scroll pumps for laboratory and medical applications. These pumps come with minimal noise levels, lower vibration, and superior energy efficiency, making it the most suitable environment for precision and reliability.

Product customization is offered through the firm with a focus on high-precision industries such as aerospace and electronics. Pfeiffer Vacuum will be trying to improve operational efficiency and performance through tailoring vacuum solutions to meet the unique demands of these sectors while reinforcing its position as a trusted provider of advanced vacuum technology.

Atlas Copco

Atlas Copco expanded its portfolio of dry claw and hook pumps that are specifically designed to meet the needs of the food processing and heavy-duty manufacturing industries. These advanced vacuum solutions have great reliability and lower maintenance costs with improved operational efficiency.

It especially is suitable for industrial applications at demanding sites. Further strengthening its position in the marketplace, the company has enhanced its research and development spend.

Currently, it is emphasizing energy efficiency and durability of its products. The use of innovative technologies by Atlas Copco aims to ensure sustainable and cost-effective vacuum solutions for the industries' evolving needs of robust and efficient vacuum systems.

Busch Vacuum Solutions

Busch Vacuum Solutions has recently developed a new low-capacity diaphragm pumps range, especially designed for analytical instruments and laboratory applications. These pumps offer precise and reliable vacuum performance with minimal contamination and increased efficiency for sensitive processes.

They are designed with compactness and durability in mind, meeting the stringent demands of research labs and analytical setups. In response to growing market demand, Busch has also added manufacturing facilities within Europe.

Its growth is basically towards upscaling the production capacities, rationalizing the supply chains and increasing the product availability so that Busch could keep up with the innovations and rapidly changing requirements of scientific and industrial application.

Ebara Corporation

Ebara Corporation has placed significant emphasis on its medium-capacity pumps for applications such as chemical processing and general manufacturing.

Affordability and performance were the drivers of developing cost-effective solutions to match the demands of emerging markets, and such solutions are developed based on their demand.

High-durability and efficiency and the ease with which they are maintained, these are reasons why vacuum manufacturers look forward to using this series.

Through solutions for the exclusive needs of the developing economies, Ebara shall increase its business boundaries and offer industrial vacuum technology to be advanced, yet affordable to its customers. This is to align with Ebara's commitment toward innovation and to global growth within the industrial vacuum space.

| Tier | Examples |

|---|---|

| Tier 1 | Edwards Vacuum, Pfeiffer Vacuum, Atlas Copco |

| Tier 2 | Busch Vacuum Solutions, Ebara Corporation |

| Tier 3 | Regional and Niche Players |

Key performance indicators in the dry vacuum pumps market include:

| Company | Initiative |

|---|---|

| Edwards Vacuum | Launched high-capacity screw pumps for semiconductor and chemical applications, focusing on efficiency. |

| Pfeiffer Vacuum | Launched compact scroll pumps for precision applications, including aerospace and electronics. |

| Atlas Copco | Expanded claw and hook pump offerings for food processing and heavy-duty industrial operations. |

| Busch Vacuum Solutions | Low-capacity diaphragm pumps for laboratory and analytical applications- emphasized value. |

| Ebara Corporation | Medium-capacity systems for chemical processing and expanding the base in emerging markets. |

Strong growth is also expected in dry vacuum pumps. The industry would increasingly look toward clean, energy-efficient, and reliable vacuum solutions. Medium-capacity systems and screw pumps are currently driving the dry vacuum pump market by efficiency and their wide applications, respectively.

Manufacturers must cater to these product types to meet growing demand and focus on developing more advanced technologies that enhance operational efficiency through smart features and automation.

Emerging markets provide much scope for expansion and development because of the rising rate of industrialization and usage of clean technologies. A strategic collaboration with the industrial major would help address the global requirement and expand their reach into the new markets.

Through a tie-up with established firms, manufacturers will be able to get access to new technologies as well as access distribution networks.

Looking ahead, growth in material sciences and the embedding of the Internet of Things (IoT) into dry vacuum pumps will continue shaping the future landscape of the market.

These new breakthroughs are anticipated to drive more innovative, powerful, long-lasting, and intelligent vacuum systems to help attract new players into the market and expand on their existing portfolios. Manufacturers should be agile and reactive to the latest technological trends, as industries continue to shift to remain competitive in the growing market.

Edwards Vacuum, Pfeiffer Vacuum, Atlas Copco command about 45% share in the overall market.

Dry screw vacuum pumps have a market share of 40% of the overall market.

Regional and domestic companies hold nearly 35% of the overall market.

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

Medium-capacity pumps hold the biggest market share of 50% offering significant growth prospects to market players.

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.