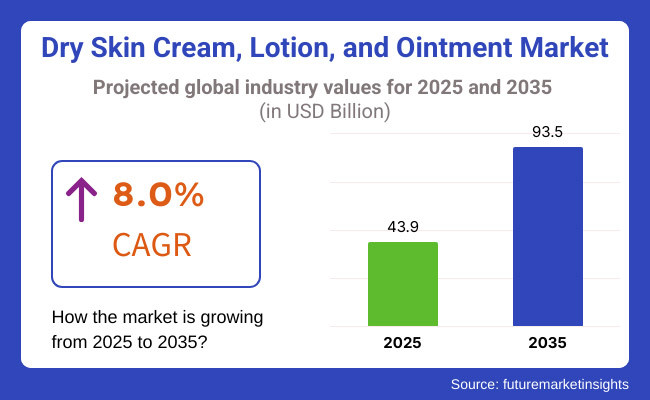

The dry skin cream, lotion, and ointment market is anticipated to be valued at USD 43.9 billion in 2025. It is expected to grow at a CAGR of 8.0% during the forecast period and reach a value of USD 93.5 billion in 2035.

Dry skin cream, ointment, and lotion is hydrate, soothe, and heal dry, irritated, or sensitive skin by replenishing the natural moisture barrier of the skin. They are used extensively in dermatology, individual skincare, and medical treatment of conditions such as eczema, psoriasis, and severe dryness.

The market for dry skin cream, ointment, and lotion aims at moisturizers that provide dry skin care for dry skin afflictions. It is boosted by growing awareness towards skincare, increased incidence of psoriasis and eczema, organic formulation demands, and e-commerce expansion with dermatological knowledge and customer tendency towards hydration, generating sales in a wide range of demographics.

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth due to rising skincare awareness and demand for moisturizing products. | Accelerated expansion with advanced formulations, natural ingredients, and personalized skincare. |

| Preference for fragrance-free, dermatologist-recommended, and hypoallergenic products. | Shift toward organic, vegan, and sustainable skincare solutions. |

| Emphasize traditional moisturizers such as glycerin, shea butter, and petroleum jelly. | Growing demand for plant-based, probiotic, and microbiome-friendly products. |

| Limited integration of smart skincare and AI-based solutions. | Global usage of AI-powered skin analysis software, personalized products, and virtual skin mapping. |

| Initial steps toward eco-friendly packaging and reduced plastic use. | Strong emphasis on zero-waste packaging, biodegradable materials, and ethical sourcing. |

| Growing recognition of clinical moisturizers for eczema and psoriasis. | Increased use of prescription-grade, biotech-infused skincare and regenerative creams. |

| Online sales growth, but traditional retail stores remain dominant. | E-commerce and direct-to-consumer (DTC) brands are leading with AI-driven personalized recommendations. |

| Urban areas have high demand, with moderate adoption in rural regions. | Widespread market penetration across all demographics, with inclusivity and accessibility at the forefront. |

| Strong competition among global brands and emerging local players. | Consolidation of large companies through mergers, acquisitions, and brand strategies based on technology. |

Personalized and Adaptive Skincare Solutions

Drying skin creams, lotions, and ointments have become a vital part of the consumer's needs. The brands can now create AI diagnostic tools, skin microbiome assessments, and personalized ingredient blends for formulating hyper-customized products using the latest technologies.

Adaptive skincare concerning conditions prevalent in the outside environment, such as humidity and temperature, is becoming a trend. Such innovations are necessary to give the user the best possible hydration and barrier protection facilities according to their lifestyle and climate.

Waterless and High-Concentration Formulations

The increasing focus of consumers on waterless and highly concentrated skin care products is a testament to their green priorities. Companies produce balms, solid lotions, and oil treatments that do not require excessive packaging and preservatives to support potent hydration. Travel ease and shelf life appeal particularly to eco-conscious consumers. Poorly emollient products are overly nourishing in that they treat conditions of extreme dryness and protect sensitive skin.

| Attributes | Details |

|---|---|

| Top Product | Creams |

| Market Share in 2025 | 46.8% |

The creams segment is anticipated to lead the market, with an estimated market share of 46.8% in 2025. When moving to creams as a preference, it is because of balance and good effectiveness, along with a light feel that does not cling to the skin. Furthermore, simplicity and day-to-day skincare routines have made creams popular among consumers, especially in the busy lifestyle category.

As with any product, the creams can be formulated for a variety of skin conditions and types, so the products become more attractive to consumers. Manufacturers currently create more advanced formulations, mixing natural and chemical ingredients to meet the different needs of customers wanting moisture and soothing relief from dehydrated skin.

| Attributes | Details |

|---|---|

| Top Composition | Synthetic |

| Market Share in 2025 | 64.0% |

As per FMI analysis, the synthetic composition segment is projected to maintain its dominance, with an estimated market share of 64.0% in 2025. Natural and organic products are becoming increasingly popular, but synthetic formulations are still chosen because they are cheaper and have a longer shelf life. This is the time when consumers must start valuing the familiarity and proven efficacy of synthetic ingredients for dry skin concerns, especially those that are being sought after by manufacturers.

To many consumers, synthetic products infuse a sense of stability and consistency, along with remarkable advances in their formulation performance to deal with specific skin conditions and choices. Continuous innovations will ensure that synthetic products hold a fairly sizable share of the market.

The dehydrated skin segment is poised to hold a substantial market share since it is becoming more and more known for skin hydration and moisture retention. Environmental stress, aging, and harsh skin care products keep increasing the requirement for deep moisturization. The hyaluronic acid, ceramides, and glycerin products, which are in trend now, effectively hydrate the skin.

As personalized skincare becomes more common, brands are beginning to create targeted solutions for dehydrated skin; solutions that include items cleared by dermatologists and are hypoallergenic formulations. Alongside the above trend, the preference for clean-label products is also rising, hence bringing the increase in the number of paraben-free and fragrance-free serum products. The quest for more multifunctional products to marry hydration, anti-aging, and sun protection propels further innovations for this segment.

| Countries | CAGR |

|---|---|

| USA | 8.20% |

| France | 6.70% |

| Japan | 7.90% |

| China | 8.50% |

| India | 7.70% |

E-Commerce Boom and Global Brand Influence Drive Market Growth

With a population boom and the e-commerce industry growth contributing to accessibility to skincare products, the Chinese market is expected to achieve a CAGR of 8.5% by 2035. The influx of global brands and the popularity of Korean skincare products further contribute to market expansion.

Increased personal care product spending, propelled by the rising middle class, supports market growth, as does the increased awareness of skincare procedures and the growing availability of skincare products that address a wide array of skin problems in China.

Innovation and Natural Trends Shape Market Expansion

The market is expected to experience a CAGR of 8.2% in the United States in 2035. The high prevalence of skin conditions such as psoriasis, which causes dry and itchy patches, has increased demand for effective dry skin products. Consumers are seeking advanced formulations to manage these conditions.

The USA market is supported by a strong beauty and skincare market, with major research and development investment. The natural and organic product trend also contributes to consumer preferences, encouraging manufacturers to develop new products and product lines to fulfill this requirement.

High Standards and Skin Health Awareness Drive Market Demand

By the year 2035, the average market of Japan is expected to generate a CAGR of 7.9%. High prevalence of atopic dermatitis among both children and adults creates a very strong demand for effective skin care solutions targeted specifically at dry skin. Much of this demand drives continuous innovation and development in the market.

Japanese consumers place the utmost importance on quality and effectiveness, giving preference to products with documented benefits. The culture of skin care also influences the market as consumers spend on more complex routines of specialized creams, lotions, and ointments that cater to specific skin concerns.

Rising Middle-Class Spending and Climate Impact Market Growth

The Indian market is expected to expand at a CAGR of 7.7% in 2035. Increasing incomes as a result of economic development and the growing middle-class population enhanced the overall number of disposable incomes and related increases in spending on personal care items. The exposure of social media to global beauty has raised awareness and demand for specialized products tailored for skincare solutions.

India's climatic diversity gives rise to different skin problems, like drying up, which is an important consideration for consumers as they look for targeted products. Both local and global brands are increasing their presence and making available a broad portfolio of products that meet the distinct requirements of Indian markets and fuel growth.

Luxury and Natural Skincare Trends Shape Consumer Preferences

France is likely to grow at a CAGR of 6.7% by 2035. The country has a strong ecosystem of international skincare brands, such as L'Oréal, that provide good-quality dry skin products for pampered consumers, placing strong emphasis on skincare routines.

The French consumers appreciate products that favor efficacy and sensory enjoyment, tending toward formulations that deliver good, yet pleasant, effects. The market also increasingly favors natural and organic foods, as consumers become better educated on the value of getting ingredients sustainably with minimal environmental impact.

The dry skin cream, lotion, and ointment market is fragmented, with both global giants and emerging local brands competing across various product segments. International companies in skincare products will own the market with any cream, lotion, or ointment for dry skin.

They work through cutting-edge dermatological research and availability at an extended retail distribution. Their branding and added innovation will also have been proven by dermatologists to ensure a balance of consumer preference. They comprise high-end mass-market ranges and manage availability at pharmacies, supermarkets, and on the internet.

These companies are R&D intensive investors, investing money into diversified product formulations for different skin problems, all under strict regulatory standards. Such expertise in bringing highly advanced, hypoallergenic, and dermatologist-endorsed products provides them with even greater legitimacy for their leadership. Gaining the trust of the public through synergy with healthcare professionals and skincare experts leaves an additional guarantee for long-term compliance over unknown brands.

The established players are the ones who decide on the price strategies and consumer behaviors that subsequently make it very hard for a new brand to penetrate the market. These economies allow them to produce high-quality products while keeping their production costs in check. With really something for everybody in terms of strong online operations supported by most major chains and retail partnerships, they maintain a commanding presence, further curtailing or sidelining smaller competitors.

Large firms are moving into a more specialized realm within skincare products, from those prescribed to eco-friendly alternatives, while the competitive landscape remains concentrated. Such companies consolidate their leadership through patents on unique ingredients and the use of biotechnology to enhance the efficacy of their products.

The domain of dry skin formulations, lotions, and ointments is an ever-changing and competitive section of the larger skincare industry, driven by an evolving consumer awareness of skin health and an increasing demand for credible moisturizing solutions. The market encompasses a vast variety of products aimed at mild dehydration through deep xerosis, concerning varying consumer needs and preferences, so there is something for everyone.

Prominent and high-profile participants in the market are high-end established brands such as Neutrogena, Nivea, Eucerin, and Aquaphor. Neutrogena is a Kenvue company that provides dermatologist-recommended solutions for healthy hydration and repair of dry skin. Nivea's connection with Beiersdorf AG, gives the brand a well-established history within the skincare sector, with a wide range of moisturizing creams and lotions available for all skin types and conditions.

Eucerin, again a Beiersdorf brand, is targeted at medical skincare solutions; it offers products that treat specific skin concerns, including but not limited to severe dryness and atopic dermatitis. Aquaphor, being another Beiersdorf brand, is known for its healing ointments, which create a protective barrier to promote regeneration and retain moisture within the skin.

Innovations are continuously brought into the competitive arena as firms invest enormous amounts in research and development to make advanced formulations ready for increased hydration, absorption, and long-lasting effects.

Brands have moved towards the use of natural and organic ingredients to meet consumer demand for clean, sustainable skincare products. Increasing demand for personalized skincare solutions has also witnessed firms branching out towards creating products to treat particular skin issues, environmental conditions, and personal preferences.

The marketing practices in this industry are digit-driven, and companies are employing social networks, influencer marketing as partners, and online targeted ads for building mass audiences. Celebrity endorsements influence people's attitudes and drive product popularity: La Mer's Crème de la Mer, a high-end moisturizer, boasts the highest celebrity endorsement from Jennifer Lopez and Chrissy Teigen, among others.

Likewise, Dr. Barbara Sturm and Bioderma products became popular due to celebrity endorsement and social media exposure. The second very much filled with clinical validation and dermatologist endorsements, a notion not far off from the consumers' aversion toward products distantly informed by scientific research and validated by relevant professionals.

The dry skin cream, lotion, and ointment market is projected to reach USD 93.5 billion by 2035, growing at a CAGR of 8.0% from USD 43.9 billion in 2025.

Sales prospects for dry skin cream, lotion, and ointment are strong, driven by increasing skincare awareness, demand for advanced formulations, and expansion of e-commerce and personalized skincare solutions.

Key manufacturers include Johnson & Johnson, Beiersdorf, L’Oréal, Unilever, Estée Lauder, Walgreens Boots Alliance, Shiseido, and Sanofi Consumer Healthcare.

China is expected to generate lucrative opportunities due to its booming e-commerce sector, rising middle-class spending, and growing influence of global and Korean skincare brands.

The market is segmented by product into creams, lotions, and ointments.

Based on the composition, the market is segmented into herbal and synthetic.

The market is categorized based on indication, including dehydrated skin, sensitive skin, eczema, psoriasis, ichthyosis, rosacea, and others.

Based on distribution channel, the market is segmented into hospital and retail pharmacies, drug stores, supermarkets/hypermarkets, and e-commerce.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.