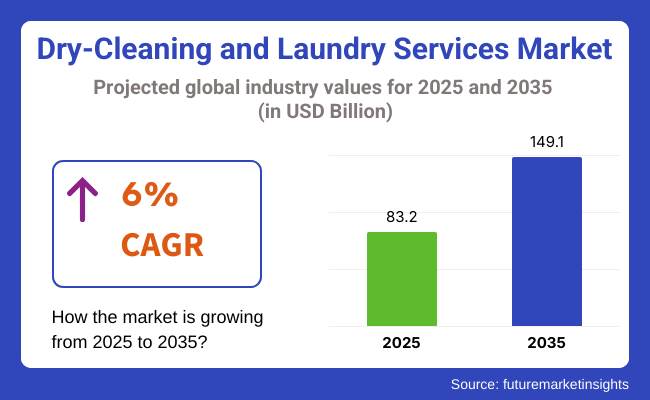

The size of the global dry-cleaning and laundry services market was USD 83.2 billion in 2025 and is anticipated to grow at a 6% CAGR during 2025 to 2035. The size of the global dry-cleaning and laundry services industry is expected to increase to USD 149.1 billion by 2035. The key driver of this growth is the rising demand for convenient and time-saving garment care products among urban dwellers with fast-paced lifestyles.

An increase in disposable income and two-income households has also further increased dependence on professional laundry services compared to the conventional in-house cleaning system. Technological advancements in garment treatment, including hydrocarbon solvents, ozone cleaning, and automatic folding machines, have also significantly enhanced service efficiency, quality, and environmental friendliness.

The service providers are using these technologies to minimize environmental impact while delivering high-quality fabric care. In parallel, digitization is transforming customer interaction with mobile apps, real-time monitoring, subscription models, and AI-based scheduling software, which all lead to greater retention and higher satisfaction among customers.

Corporate customers such as restaurants, hotels, hospitals, and industrial wear are a strong top-line for the industry. Institutional buyers such as them need high-volume, regular service with rigorous standards of hygiene and turnaround time. With companies looking to outsource these operations even further, the demand for scalable and reliable B2B solutions has gone through the roof, offering plenty of room for industry growth.

The premium garment care and cleaning segment, represented by high-value garment cleaning and handling of subtle fabrics with tender loving care, is seeing stable growth with customers investing in fashion and brand attachment. Bespoke services like wardrobe management, ecological packaging, and same-day pickup have become disruptors in the segment. It is primarily dominated by urban pockets where convenience and quality are given a high premium.

The intersection of sustainable and smart logistics will be the driver of competitive power. Firms that engineer systems with biodegradable solvents, energy-efficient machinery, and carbon-aware logistics will be able to attract green-conscious buyers as well as institutional orders. Consolidation in the industry, franchising, and service automation will also further streamline operations, setting the industry up for strong and sustainable growth.

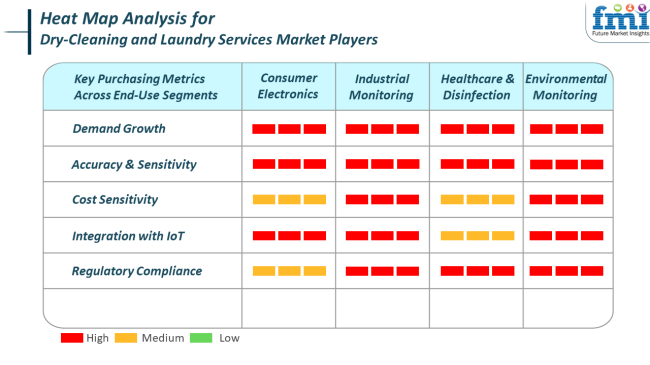

Whereas direct product is apparel care, laundry and dry-cleaning services fall increasingly under overall technological and environmental standards typical of the high-precision industries. Greater use of smart lockers, RFID monitoring of clothes, and route-optimized delivery locations mirrors IoT integration trends in consumer electronics and logistics.

In the medical and industrial fields, laundry facilities must meet strict hygiene, safety, and regulatory conditions-mirroring identical metrics used for industrial monitoring and disinfection processes. These include antimicrobial treatments, sterilization levels, and waste-water control, emphasizing the necessity of precision and consistency in service provision.

Environmental monitoring indicators also come into play, as the sector is under increased scrutiny for solvent use, power consumption, and emissions. Closed-loop water systems, eco-labeled processes, and green packaging are now make-or-break differentiators. Across all end-use segments, customer preference is not only dictated by cleanliness but also by trust in a provider's technological capability and environmental sensitivity.

The industry is subject to several key risks, primarily because of its heavy dependence on energy, water, and chemical inputs in operations. Fluctuating utility costs or supply constraints can directly impact profitability, and more stringent environmental controls on water consumption and chemical solvents might necessitate costly upgrades or limit operating capacity for non-compliant companies.

Price competition and industry fragmentation are additional threats. With few entry barriers, the industry is overly saturated in many locations, resulting in price deflation pressure that is capable of annihilating margins. Those that fail to differentiate on the grounds of service excellence, sustainability, or digital innovation risk being outperformed by agile, technology-driven operators.

Consumer behavior trends also present risks, especially against the background of the growing casualization of fashion and home-based work culture, which can lower the frequency of garment care needs, particularly for office wear. The willingness of service providers to adapt to diversified services-domestic textile care, B2B agreements, and sustainable services-will be instrumental in combating the volatility of demand and pursuing stable long-run growth.

Between 2020 and 2024, the industryincreased as a result of increased demand for hygiene services, partly because of the COVID-19 pandemic. The increasing trend of urbanization and consumer behavior with an emphasis on convenience also contributed.

Companies focused on on-demand and web-based services, such as convenient pick-up and delivery, to meet evolving customer needs. Environmentally friendly operations such as biodegradable soap and energy-saving washing machines gained prominence. Concurrently, intelligent technology gained popularity to automate processes and enhance customer experience.

Over the period 2025 to 2035, the industry will be changed radically. On-demand dry-cleaning companies, based on mobile apps and subscription-based models, will transform the way customers interact with dry-cleaning services. AI-and robotics-driven automation will enhance operational efficiency and reduce human intervention.

Sustainability will continue to be a focus area, with increasing numbers of companies employing water-saving technologies and eco-friendly packaging. The shift towards customized services, such as tailored garment care, will also be a leading influence as companies adapt to individual customer requirements.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Awareness of health & hygiene (COVID-19), urbanization, convenience, and e-commerce. | Automation, on-demand, AI integration, sustainability, and personalized offerings. |

| Adopting smart cleaning solutions, green detergent, and energy-efficient behavior. | Robotics, AI, mobile applications, intelligent systems, and automation to maximize operating efficiency. |

| Pick-up and drop-off services with a few app-based models. | On-demand services, subscription models, and customized services via digital platforms. |

| Use of biodegradable detergents, water-saving machines, and eco-friendly business practices. | Widespread adoption of energy-efficient equipment, zero-waste operations, and eco-friendly cleaning products. |

| Focus on convenience, quality, cleanliness, and value. | Increased need for personalized, sustainable, and technology-driven services. |

| Competitive pricing, service quality, and operations management. | Technological advancement, green infrastructure investment, and shifting customers' expectations. |

The largest sub-segment is laundry services, currently constituting an estimated 60-65% of the global dry-cleaning and laundry services market. This industry share is predominantly driven by urban dwellings' increasing demand, particularly in high-density countries such as Asia-Pacific and North America.

Increased demand for on-demand laundry applications such as Rinse, Cleanly and Laundrapp, as well as increased adoption of the trend of higher dual-income households, has been driving steady demand. Companies like Alliance Laundry Systems and Alsco are developing B2B solutions for hospitals, hospitality, and industrial clients.

Modes of service are evolving with pickup/drop-off, subscription laundry, and environmentally friendly detergents. Laundry services from 2025 to 2035 will register a CAGR of 6.5%, with growth coming from consumption based on convenience and expansion of urban infrastructure.

Dry cleaning and duvet cleaning form the secondary segment of services, which account for around 35-40% of the total industry. Dry cleaning, which is estimated to be 30%, is the need for fine fabrics and evening wear, with consistent demand coming from professionals, hotels, and event spaces.

Duvet cleaning, the niche but growth segment (about 5-7%), grows in popularity based on rising hygiene awareness and the seasonal usage phenomenon. Tide Cleaners (P&G) and ZIPS Dry Cleaners, among other companies, are increasing the availability of services with digital lockers and same-day delivery. Despite dry cleaning having a forecast CAGR of 7%, duvet cleaning could see a higher CAGR of 7.4%, as spurred by higher consumer education regarding the cleanliness of beds and short-stay rentals that require bulk linen services.

Residential consumption is the biggest industry and occupies around 65% of the demand. The increasing burden of time management on working populations, especially in the urban population, continues to remain a major inducement for demand for outsourced laundry and dry-cleaning services.

The rise in disposable income, the post-COVID shift towards hygiene, and the craze for home service apps have resulted in a robust growth rate in this space. In emerging economies like India, Indonesia, and Brazil, residential laundry services are being propelled by technology-fueled scheduling and contactless pickup in startup hubs.

Industry champions like Urban Company (India) and Hampr (US) are tailoring services to both family-unit and single-occupancy homes. In the forecast period, residential services will clock a CAGR of 7.2%, with the highest growth expected to be in emerging urban economies.

Commercial applications include the secondary application industry, which is about 35% of the industry demand and is concentrated in the hospitality, healthcare, and aviation industries. Restaurants, hotels, hospitals, and gyms outsource bulk laundry and linen washing to meet high-frequency, high-volume needs with guaranteed sanitation levels.

Aramark, Sodexo, and Alsco dominate this segment through long-term service agreements that deliver revenue predictability. With post-pandemic health protocols still influencing practice operations, clinics and hospitals nowadays need more advanced sterilization and fabric handling. Commercial use will expand at 6.8% CAGR between 2025 and 2035, driven by the expansion of global tourism and healthcare and the increasing adoption of uniforms in various sectors.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 5.2% |

| France | 4.8% |

| Germany | 4.5% |

| Italy | 4.3% |

| South Korea | 6% |

| Japan | 3.9% |

| China | 6.8% |

| Australia-NZ | 5% |

The USA industry will grow at 5.9% CAGR throughout the study. This growth is fueled by rising urbanization, an active lifestyle, and a rising number of dual-income families looking for convenience in household work. The on-demand laundry service segment is witnessing high acceptance in urban locations because of mobile app integration and rapid turnaround services.

Growing awareness of cleanliness and the utilization of sophisticated cleaning technologies also add substantially to the industry growth. The commercial space, particularly the hospitality and healthcare segment, continues to be a substantial driver of industry demand.

Hospitals and hotels are offloading laundry processes to specialized providers to maximize efficiency in operations and ensure strict levels of hygiene. Also, the trend of environmental sustainability has resulted in the use of green cleaning solutions and energy-efficient machines. With increased disposable income and concern for personal looks and personal care, dry cleaning services for clothes and accessories remain popular with a large customer base across major urban centers in the nation.

The UKindustry is projected to expand at 5.2% CAGR throughout the study. Demand for laundry and dry-cleaning services is increasing owing to the rising demand for convenience in urban households, particularly in London and other metropolitan cities. The penetration of digital platforms that provide subscription-based or on-demand pick-up and delivery of laundry services has improved customer convenience and service efficiency.

Additionally, the commercial need, especially from sectors like hospitality, healthcare, and care homes, is further solidifying industry expansion. Most businesses are contracting out their laundry work to concentrate on core activities while ensuring high standards of cleanliness. Development in green solvents and the adoption of automated sorting and cleaning equipment are also being incorporated into new laundry plants.

Growing concern for fabric care and the inclination toward professional garment treatment is driving a steady customer base. The move toward sustainability is also stimulating investment in green technology and biodegradable detergents, making environmentally friendly laundry services more appealing to customers.

The French industry is likely to expand at 4.8% CAGR over the research period. Increasing urbanization and lifestyle pattern shifts are impacting the demand for organized laundry and dry-cleaning services. The industry is increasingly moving away from conventional launderettes towards technology-driven and professional service providers that are convenience- and sustainability-oriented.

French consumers are extremely quality-conscious and seek expert services for apparel, like dry-cleaning special fabrics and fashion wear. The business segment, especially luxury hotels and high-end restaurants, contributes to the need for large-scale and high-frequency laundry services.

Government regulations encouraging energy efficiency and environmental protection are also driving service providers to invest in cutting-edge cleaning technologies and minimize water and chemical consumption. The expansion of online platforms providing home pick-up and delivery facilities is transforming the competitive dynamics and enhancing customer experience, especially in high-density urban areas.

The German industry will register a growth rate of 4.5% CAGR over the period of study. Among the major growth drivers is the robust hospitality and healthcare infrastructure in the country, which depends on bulk laundry facilities to maintain operational hygiene levels. High-end cleaning technologies and an order-oriented and efficient culture ensure the professionalization and growth of the industry. Growing consumer demand for sustainability is affecting both customers and service providers.

German customers are increasingly sensitive to the environment-friendliness of laundry chemicals and processes. Therefore, providers are implementing biodegradable chemicals, water-efficient equipment, and low-temperature cleaning technologies.

Residential demand in Germany is modest relative to other nations, though the increasing pool of working professionals and student communities in urban areas is driving on-demand laundry services. Mobile phone-based schemes and subscription approaches are increasingly finding favor, presenting both convenience and economic value to busy people.

The Italian industry will grow at 4.3% CAGR over the forecast period. The usage of dry-cleaning and laundry services is increasingly on the rise, particularly among urban dwellers and working individuals. Although conventional laundromats are still prevalent in smaller towns, major cities are witnessing increased demand for technologically sophisticated and mobile-enabled laundry services. Italy's robust fashion sector drives demand for high-end garment care services in which consumers are prepared to pay a premium to protect designer clothing.

The business segment, especially at boutique hotels and upscale restaurants, leads to recurring demand for linen and uniform washing services. Yet, the industry's fragmentation is both a challenge and an opportunity for organized players to increase their presence. Green consumers are also driving the change towards sustainable practices, prompting providers to employ environmentally friendly detergents and energy-saving washing machines. This emphasis on quality and sustainability will determine the Italian industry's future.

The South Korean industry is anticipated to expand at a 6% CAGR throughout analysis. A highly urbanized and tech-savvy population, coupled with high urban density, favors quick take-up of app-based and automated laundry services.

The hectic lifestyle and growing population of single-household individuals are driving robust demand for outsourced laundry services that provide convenience and reliability. South Korean service providers are renowned for integrating cutting-edge features, including real-time tracking of orders, cashless transactions, and AI-based sorting systems.

Dry-cleaning demand is especially high because of the popularity of formal attire and bespoke fashion, which needs expert care. Moreover, the government's sustainability drive has prompted most companies to invest in green laundry technologies, such as water recycling systems and chemical-free cleaning solutions.

The business industry, particularly hotels and beauty clinics, also brings in consistent demand. The union of technology penetration, eco-sensitivity, and customer preference for quality service will likely propel continuous growth in the industry.

The Japanese industry will grow at 3.9% CAGR over the study period. Although it is a mature industry, new prospects are arising because of the aging population and the prevalence of mobile technologies. The cleanliness and order culture in Japan continues to drive the demand for dry-cleaning and laundry services, particularly in urban areas. Japan boasts one of the highest per-capita numbers of laundromats, and recent years have witnessed the reformatting of conventional outlets as modern, automated, and self-service facilities.

Subscription services and intelligent lockers for garment delivery and collection are becoming increasingly popular, serving time-conscious professionals. Hospital, hotel, and spa commercial demand is also supporting stability in the industry.

Environmental concerns are gaining growing importance, as there is a growing emphasis on conserving water and using non-poisonous cleaning products. With the change in consumer expectations toward quicker and more efficient service, the providers are improvising to stay competitive in a highly disciplined industry.

The China industry will grow at 6.8% CAGR over the study period. Urbanization, increasing middle-class income, and growth in e-commerce have contributed to a supportive environment for dry-cleaning and laundry service growth. Time shortages and improved standards of living have led to a growing preference for professional garment care. Technology dominates the delivery of services with extensive usage of mobile apps, automated kiosks, and digital payment platforms.

Tier 2 and Tier 1 cities experience a rise in organized players providing subscription-based and on-demand models. The commercial industry, particularly in hospitality, education, and manufacturing, adds substantial volume to laundry operations.

In addition, green regulations are compelling businesses to implement sustainable strategies, including employing biodegradable chemicals and water conservation. The size of the population and the rate of digital development place China at the forefront of growth industries in the Asia-Pacific region.

Australia-New Zealand industry is anticipated to register a growth of 5% CAGR over the forecast period. New lifestyles, longer working days, and urbanization in Sydney, Melbourne, and Auckland are significant drivers of the growing demand for easy laundry solutions. Consumers in both nations have experienced higher adoption levels of mobile app-based, pickup-and-delivery laundry models that serve residential and small business clients.

Healthcare and hospitality are the leading commercial industries utilizing laundry services with rigorous cleaning quality expectations and strict turnaround times. A focus on environment-friendly consumerism is persuading laundry operators to invest in power-efficient machinery, reusable cover wraps, and environmental cleaning solutions.

Players are also introducing intelligent automated lockers as well as scheduled smart facilities in order to enrich the customers. Though the industry remains fragmented, there are significant opportunities for organized, tech-enabled suppliers to expand operations in urban as well as suburban areas with a rising emphasis on quality, speed, and sustainability.

The industry for dry-cleaning and laundry services at the global level is fast moving towards an amalgamation of traditional as well as technological innovations in service delivery models. The scenario includes a combination of well-established regional companies and new start-ups using the app-based pickup and delivery models.

Major ones include Alliance Laundry Systems LLC, Rinse, Inc., ZIPS Dry Cleaners, Alsco Pty Limited, and Tide Dry Cleaners (Procter & Gamble), among others that highly compete in automating, pushing sustainability in the environment, and franchising scales.

Alliance Laundry Systems plays a significant part in all commercial laundry operations throughout the world by providing automated systems that assist in improving laundry operations for service providers. In contrast, with its franchising initiative all over the USA

industry, Tide Dry Cleaners has been associated with Procter & Gamble to profit on the country regarding its brand awareness, convenience, and proper standards of services to sustain its credibility. The one-price policies and the competitive pricing model offered by ZIPS Dry Cleaners have much permissiveness for growth within suburban and urban areas across North America.

Alsco Pty Limited, an international service provider for textile rentals and laundry services, takes advantage of the industrial and health sectors that highly require development in regulatory compliance and cleanliness. At the same time, Rinse, Inc. is another one that needs to use the mobile app to introduce the concept of on-demand laundry as a tech-driven modern type of service to push the industry further to digitization.

The family often dominates regional industries to establish personalized services and local trust, though increasingly, many companies incorporate customer relationship platforms and eco-friendly practices into their offerings.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Alliance Laundry Systems LLC | 10-13% |

| Tide Dry Cleaners (P&G) | 8-11% |

| Alsco Pty Limited | 7-10% |

| ZIPS Dry Cleaners | 6-8% |

| Rinse, Inc. | 5-7% |

| Other Players | 53-64% |

| Company Name | Offerings & Activities |

|---|---|

| Alliance Laundry Systems LLC | It supplies commercial laundry machinery globally, as well as automation and industrial-scale support. |

| Tide Dry Cleaners (P&G) | Franchised dry-cleaning chain; eco-friendly solvents; and app-enabled drop-off services. |

| Alsco Pty Limited | Global textile and uniform rental service; strong B2B portfolio in hospitality and healthcare. |

| ZIPS Dry Cleaners | The flat-rate pricing model focuses on speed, affordability, and nationwide franchise growth. |

| Rinse, Inc. | App-based laundry and dry-cleaning pickup/delivery service; AI-driven logistics and eco focus. |

Key Company Insights

Alliance Laundry Systems LLC (10-13%)

A global leader in commercial laundry equipment, indirectly shaping the operations of thousands of service providers through cutting-edge automation.

Tide Dry Cleaners (8-11%)

Uses strong consumer brand loyalty to scale franchise operations; innovation in green solvents and app-based engagement are core strengths.

Alsco Pty Limited (7-10%)

A major player in institutional laundry services, with deep penetration into regulated industries like healthcare and food service,

ZIPS Dry Cleaners (6-8%)

Known for flat pricing and fast turnaround, ZIPS is expanding aggressively through franchising in USA suburban industries.

Rinse, Inc. (5-7%)

Digital-native service delivering convenience in metropolitan areas; utilizes smart logistics and eco-certified cleaning processes.

Other Key Players

By service type, the industry is segmented into laundry, dry-cleaning, duvet clean, and others (including ironing and specialty garment care).

By end use, the industry is categorized based on end users, including individual/household customers and commercial clients such as hotels and hospitality, hospitals and healthcare facilities, corporate offices, restaurants, and others.

By sales channel, the industry is segmented by sales channel into online services and offline stores.

By region, the industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 83.2 billion in 2025.

The industry is predicted to reach a size of USD 149.1 billion by 2035.

Key companies include Alliance Laundry Systems LLC, The Huntington Company, ZIPS Dry Cleaners, Alsco Pty Limited, Rinse, Inc., Marberry Cleaners & Launderers, Inc., Tide Dry Cleaners (Procter & Gamble), City Dry Cleaning Company, East Rand Cleaners, and Cleanly.

China, slated to grow at 6.8% CAGR during the forecast period, is poised for fastest growth.

Laundry services are being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Services, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Services, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 13: Global Market Attractiveness by Services, 2023 to 2033

Figure 14: Global Market Attractiveness by Application, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Services, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 28: North America Market Attractiveness by Services, 2023 to 2033

Figure 29: North America Market Attractiveness by Application, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Services, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Services, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Services, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Services, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Services, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Services, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Services, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Services, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Services, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Services, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Services, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Services, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Services, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Services, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Dandruff Control Shampoos Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Hand & Arm Protection (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA