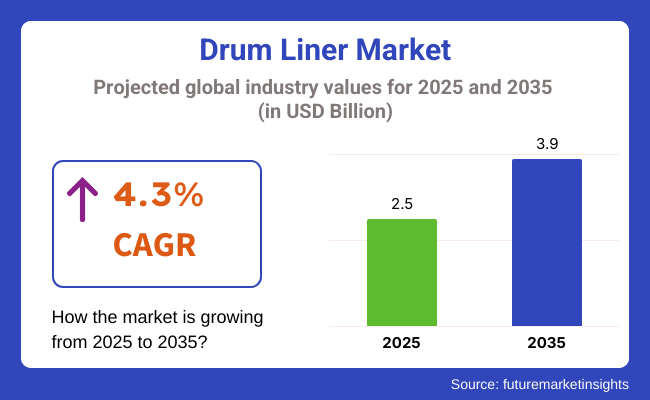

The global drum liner market is worth USD 2.5 billion in 2025 and is anticipated to reach USD 3.9 billion by 2035, with a CAGR of 4.3%. This growth is primarily driven by the increasing demand for drum liners across industries such as chemicals, food, and pharmaceuticals, where secure, contamination-free packaging is essential.

Drum liners provide an effective solution for protecting products, preventing leakage, and maintaining the integrity of contents during transport and storage. As global industrial production rises and the need for safe and reliable packaging increases, the drum liner market is expanding to meet these demands, offering more efficient and reliable solutions.

Looking forward, the drum liner market is likely to continue its growth, driven by technological advancements and increasing consumer demand for eco-friendly and recyclable solutions. Innovations in material technologies are expected to enhance the durability and functionality of drum liners, making them more resistant to chemicals, temperature fluctuations, and other environmental factors.

As sustainability becomes a priority for industries worldwide, the demand for environmentally conscious packaging alternatives will push manufacturers to develop more sustainable drum liners. This shift, combined with the growing industrialization of emerging markets, will further contribute to the market's expansion, driving new growth opportunities for manufacturers globally.

Government regulations are playing a significant role in shaping the drum liner market by ensuring safety, environmental sustainability, and compliance with transportation standards. Regulatory bodies such as the USA Environmental Protection Agency (EPA) and the European Union’s REACH regulations impose strict guidelines on the materials used in drum liners, especially those coming into contact with hazardous or food-grade substances.

These standards help ensure the safe handling, storage, and transportation of goods. With increasing emphasis on reducing plastic waste and promoting recyclability, manufacturers will need to adhere to stricter environmental regulations, encouraging the development of more sustainable drum liners to meet regulatory requirements.

The below table presents the expected CAGR for the global drum liner market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.7%, followed by a lower growth rate of 3.9% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.7% |

| H2 (2024 to 2034) | 3.9% |

| H1 (2025 to 2035) | 4.9% |

| H2 (2025 to 2035) | 3.7% |

Moving into the subsequent period, from H1 2024 to H2 2035, the CAGR is projected to increase to 4.9% in the first half and decrease to 3.7% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), the market witnessed a decrease of 20 BPS.

The section contains information about the leading segments in the market. More than 33 gallons projected to grow at a CAGR of 4.2% through 2025 to 2035. Additionally, industrial chemical end uses are predicted to grow at a CAGR of 4.9%.

| Design Type | Value Share (2025) |

|---|---|

| Straight-Sided Liners | 65.8% |

The drum liner market is forecast to be dominated by straight-sided drum liners in terms of value, with a market share of 65.8%. These liners are versatile and ensure the highest grade of containment for a variety of products-chemicals, pharmaceuticals, food-grade materials. Such consistent demand is owing to the ability of the liner to easily fit into standard drums, which also means effective storage space and reduction in leak chances.

These liners are very favored in industries with strict regulations over product integrity and safety. Further, they are easily adaptable to the drum size and materials and can be preferred for the manufacturer’s requirement of efficient and cost-effective packaging solutions that will provide good bulk storage and transportation.

| Drum Liner Type | Value Share (2025) |

|---|---|

| Flexible Drum Liner | 63.2% |

Flexible drum liners are anticipated to be the most value-dominant product in the drum liner market with a considerable market share of 63.8%. They are highly in demand as they can be conformed to the shape of the drum and hence a versatile solution for industries dealing with liquids, powders, and chemicals. They are best suited for applications requiring easy installation and removal in the chemical, food and beverage, and pharmaceutical sectors.

Manufacturers prefer flexible liners since they are economical, as they minimize between-use cleaning necessity and protection against contamination. Increasing trends on sustainability also reflect in the demand for flexible drum liners because they are now being sold in sustainable eco-friendly materials that help support the green packaging initiatives in increasing its market domination.

Industrial Chemicals and Oil & Gas Drive Demand for Heavy-Duty Drum Liners

Growth in industrial chemicals and oil & gas is a strong market pull for drum liners. As these sectors expand, there is also greater demand for secure, efficient, and compliant storage and transport solutions for chemicals, oils, and lubricants of all kinds. Especially in these industries, the drum liners above 33 gallons are crucial since they ensure proper containment of the bulk materials.

The materials here are hazardous chemicals, acids, solvents, and oils. They require heavy-duty and strong packaging to avoid leakage, prevent damage during transport, and preserve the integrity of the products.

With increasingly stringent regulatory environments around safety, environmental protection, and transportation, firms are looking for better-quality drum liners to satisfy such requirements. This is because the oil & gas industry consumes considerable volumes of fluids, drilling lubricants, and chemicals in multiple operations. Increased demand for drum liners is pushing the growth of the market within these industries, as it also satisfies the needs for large, safe containment systems.

Regulatory Pressure Drives Demand for Drum Liners in Key Industries

Strict government rules and safety conditions will greatly call for the drum liners in chemical, pharmaceuticals, and food-grade materials used industries. It is mainly dominated by regulatory bodies such as EPA, FDA, and the DOT. The organizations have also issued rules concerning appropriate storage, movement, and disposing of hazardous as well as harmless materials. These are strictly demanded by the above packages not to leak or damage or pollute the environment. Therefore, in that condition, this will definitely demand the necessity of a drum liner.

In other related chemicals also, it demands drum liners as leakage of them can cause pollution or may even hurt the worker and also results in damage in the surrounding environment. Drum liners in the food-grade products ensure that the products will be kept safe and their integrity as well as quality preserved by preventing contamination through transportation as well as storage.

As the rules become more stringent and with more stringent compliance expectations coming to age, the markets for the industries find a way to incorporate the use of drum liners into becoming highly viable solutions able to meet requirements under the rigid marks set in aspects of safety, environment, etc. The very market is driven by increasing pressures through regulatory pressure.

Supply Chain Disruptions and Raw Material Shortages Challenge Drum Liner Growth

The major challenge in the drum liner market was disruption of the supply chain and raw material shortages. Some of the readily available key raw materials for producing drum liners are high-density polyethylene, low-density polyethylene, and specialty resins whose availability and price are subject to change over time.

Breaks in a global supply chain, mostly brought about by geopolitical concerns, natural disaster, or logistic bottlenecks, carry challenges with respect to the timing of production and availability of required materials. That would not only lower the level of production but also increase the cost of raw material; hence, increases production costs for the drum liner manufacturer.

This increases lead times for customers and potential loss of business due to unavailable materials that are readily used. Manufacturers will experience a problem in fulfilling the excess orders as the demand is absorbed through these key industries of chemicals, pharmaceuticals, and food packaging. This supply chain problem will decelerate the growth of the market as the production capability drops and the cost goes up for both the manufacturers as well as the end-user.

Tier 1 company leaders distinguish themselves with high production technology and a wide product portfolio. These market leaders leverage their extensive expertise in manufacturing and reconditioning across multiple packaging formats, backed by a broad geographical reach and a robust consumer base.

They offer a wide range of series, including reconditioning, recycling, and manufacturing, using the latest technology and meeting regulatory standards to ensure the highest quality. Prominent companies within Tier 1 include ILC Dover LP, Protective Packaging Ltd, EMPAC Verpackungs GmbH, Chiltern Plastics (UK).

Tier 2 companies are defined by a strong global presence and in-depth market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in Tier 2 include ROUNDLINER GmbH, NITTEL B.V., BERNHARDT Packaging & Process.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the market analysis for the drum liner market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.3% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 6.0% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

| Canada | 2.7% |

| Brazil | 2.9% |

| Argentina | 4.2% |

| Germany | 3.0% |

| China | 5.4% |

| India | 6.0% |

The increasing demand for packaging solutions in the chemical manufacturing sector for storage and transport of industrial solvents and adhesives has driven the USA drum liner market.

With growing automotive, construction, and aerospace industries, the requirement for safe and reliable containment solutions that can avoid leaks, contamination, and environmental hazards has also increased. High-quality polyethylene and similar raw materials drum linings protect all these chemicals in transit from absorption of moisture or temperature variation to mechanical damage during transportation.

Particularly, in the demand side, the drum liners that are eco-friendly and reusable have seen an increase in demand due to strict regulations over hazardous materials. Companies invest in advanced drum liners, focusing on meeting environmental standards with high safety requirements.

The interest in sustainable packaging solutions is encouraging manufacturers in the USA to innovate and adopt drum liners tailored to the different needs of industrial solvents and adhesives, thus boosting market growth.

German pharmaceutical companies need drum liners and ranks among the top largest pharmaceutical manufacturing industries in Europe. These companies have increased their demand with a rise in demand for safety and compliant packaging.

Drum liners are a must in safe transport and storage for bulk pharmaceutical ingredients, which includes APIs, excipients, and liquid formulations. Such materials should be kept free from contamination and maintained under strict safety standards to meet regulatory requirements.

German pharmaceuticals tend to focus upon quality production that is sustainable food-safe and not toxic drum liner has been becoming increasingly used food contact applications as well.

But in addition the growing demand to switch to "green" packages for pharmaceutical solutions makes pharmaceutical firms consider using returnable and recycled drum liners thus preventing waste disposal with minimal possible ecological footprint the need for those specific drum liners became in vogue in German markets.

| Attribute Category | Details |

|---|---|

| Industry Size (2024) | USD 2.4 billion |

| Industry Size (2025) | USD 2.5 billion |

| Projected Market Size (2035) | USD 3.9 billion |

| CAGR (2025 to 2035) | 4.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion/Volume in million liner units |

| Segments by Drum-liner Type | Flexible Drum Liner (≈ 63.2 %), Semi-rigid Drum Liner |

| Segments by Material Type | LLDPE, LDPE, Polypropylene, HDPE |

| Segments by Design Type | Straight-sided (≈ 65.8 %), Accordion, Combination, Others |

| Segments by Capacity | <15 gal, 15 - 33 gal, >33 gal (fastest at ≈ 4.2 % CAGR) |

| Segments by End Use | Industrial Chemicals (fastest at ≈ 4.9 % CAGR), Petroleum & Lubricants, Food & Beverages, Paint/Inks/Dyes, Cosmetics & Pharmaceuticals, Building & Construction |

| Key Regions | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | ILC Dover LP, ROUNDLINER GmbH, NITTEL B.V., Protective Packaging Ltd, BERNHARDT Packaging & Process, EMPAC Verpackungs GmbH, Chiltern Plastics (UK), FRAMAPACK, Lormac Group, Pack Tech A/S |

| Additional Attributes | Growth fueled by REACH/OSHA hygiene rules, export drum-reuse programs, and e-commerce chemical kits; producers adopt recycled-content liners and RFID-tagged clean-room bags |

| Customization & Pricing | Region-specific forecasts, resin-cost sensitivity, and competitive benchmarking available on request |

In terms of drum liner type, market is separated into flexible drum liner and semi rigid drum line.

In terms of material type, the market is divided into LLDPE, LDPE, polypropylene and HDPE.

In terms of design type, the market is segregated into straight-sided liners, accordion liners and combination liners, others.

In terms of capacity, market is divided into less than 15 gallons, 15-33 gallons and more than 33 gallons.

The market is classified by end use such as industrial chemicals, petroleum and lubricants, food and beverages, paint, inks and dyes, cosmetics and pharmaceuticals, building and construction.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

The global drum liner market is projected to witness CAGR of 4.3% between 2025 and 2035.

The global drum liner market stood at USD 2.4 billion in 2024.

The global drum liner market is anticipated to reach USD 3.9 billion by 2035 end.

South Asia & Pacific region is set to record the highest CAGR of 5.4% in the assessment period.

The key players operating in the global drum liner market include ILC Dover Lp, Roundliner Gmbh, Nittel B.V., Protective Packaging Ltd, Bernhardt Packaging & Process, Empac Verpackungs Gmbh, Chiltern Plastics (Uk), Framapack, Lormac Group, Pack Tech A/S.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 8: Global Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 14: North America Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 16: North America Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 20: Latin America Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 22: Latin America Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 24: Latin America Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 28: Western Europe Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 30: Western Europe Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 32: Western Europe Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 40: Eastern Europe Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 52: East Asia Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 54: East Asia Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 56: East Asia Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Design Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Design Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Drum Liner Type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Drum Liner Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End-Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 10: Global Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 14: Global Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 18: Global Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 21: Global Market Attractiveness by Design Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 23: Global Market Attractiveness by End-Use, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 34: North America Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 38: North America Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 42: North America Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 45: North America Market Attractiveness by Design Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 47: North America Market Attractiveness by End-Use, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 58: Latin America Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 62: Latin America Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 66: Latin America Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Design Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End-Use, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 86: Western Europe Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 90: Western Europe Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Design Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End-Use, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Design Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End-Use, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Design Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End-Use, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 154: East Asia Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 158: East Asia Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 162: East Asia Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Design Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End-Use, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Design Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Drum Liner Type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End-Use, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Design Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Design Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Design Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Design Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Drum Liner Type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Drum Liner Type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Drum Liner Type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Drum Liner Type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End-Use, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Design Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Drum Liner Type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End-Use, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in the Drum Liner Industry

Drum Melters Market Size and Share Forecast Outlook 2025 to 2035

Drum Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Drum To Hopper Blends Premix Market Size and Share Forecast Outlook 2025 to 2035

Drum Pump Market Growth - Trends & Forecast 2025 to 2035

Drum to Hopper Blends Market Insights - Precision Mixing & Growth 2025 to 2035

Drum Handling Equipment Market

Drum Pulper Market

Drum Funnel Market

Drum Plugs Market

Steel Drums & IBCs Market Size and Share Forecast Outlook 2025 to 2035

Steel Drum Industry Analysis in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Steel Drum Market Trends - Growth, Demand & Forecast 2025 to 2035

Fiber Drums Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Steel Drum Market Share

Examining Market Share Trends in Steel Drums and IBCs Industry

Competitive Landscape of Fiber Drums Market Share

Japan Steel Drum Market Analysis – Trends & Forecast 2023-2033

Korea Steel Drum Market Growth – Trends & Forecast 2023-2033

Western Europe Steel Drum Market Insights – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA