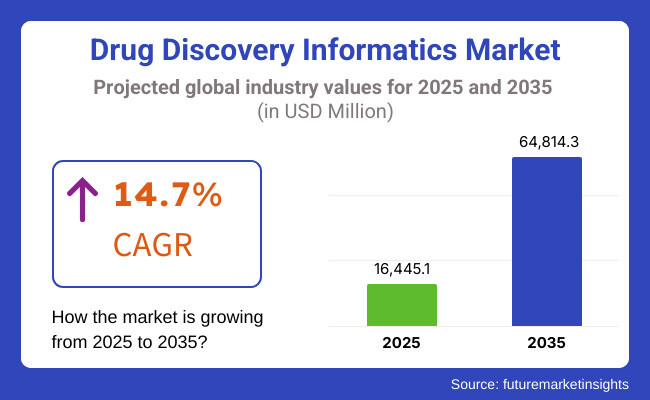

The Drug Discovery Informatics Market is expected to witness substantial growth between 2025 and 2035, driven by the increasing integration of artificial intelligence (AI) and machine learning (ML) in drug discovery processes. The market is projected to be valued at USD 16,445.1 million in 2025 and is anticipated to grow to USD 64,814.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 14.7% over the forecast period.

One of the key drivers of this market is the growing demand for data-driven drug discovery approaches. As pharmaceutical and biotech companies seek to accelerate drug development while reducing costs and failure rates, the use of advanced informatics solutions-such as computational modeling, predictive analytics, and bioinformatics-has become essential. The need to analyze massive biological datasets efficiently has further pushed the adoption of cloud computing and AI-driven tools in drug discovery informatics.

In the Services segment, Sequence Analysis Platforms dominates the market. This is driven by increasing applications of genomic and proteomic sequencing in drug discovery for drug discovery in the global market. Due to sequence analysis platforms' integration into the implementation at genomic research, they are critical in tracking potential drug targets and explaining molecular mechanism of disease and genetic variations.

And the drug discovery techniques are getting expedited and accurately interpreted due to the rapid evolution of NGS and bioinformatics tools that allow companies to analyze and interpret these vast quantities of genomic datasets. Precision medicine programs, which require better insight into genetic markers for the use of targeted therapy, are also increasing the demand for sequence analysis platforms.

Explore FMI!

Book a free demo

North America dominates the drug discovery informatics market during the forecast period, owing to the presence of well-established pharmaceutical and biotechnology industries, advanced research institutes, and increased investment in artificial intelligence (AI) and big data analytics. As most prominent pharmaceutical companies and contract research organizations (CROs) in drug discovery in the world wane in the region, the United States leads in informatics based solutions.

In addition, the region itself benefits from government support, with programs such as the National Institutes of Health (NIH) funding advanced bioinformatics research. Tools like cloud computing, high-performance computing (HPC), as well as AI based drug discovery platforms are being increasingly leveraged to deliver more efficient and faster time-to-market for new drugs. Collaborations between academic centers, tech companies and pharma firms also drive an informatics-centric approach to drug discovery.

France, the United Kingdom, and Germany are major players, and together Europe commands a significant market share in drug discovery informatics. The companies from the region have been ahead of the curve in terms of adopting data analytics, machine learning, and molecular modeling, to optimize early-stage drug development. The EMA has also been promoting greater use of informatics in drug safety assessment and the design of clinical studies.

Germany, with its strong pharmaceutical industry, has seen the growth of computational drug discovery technologies, while the UK has developed into a hub for AI-enabled drug-discovery start-ups. Biotech and IT company partnerships that are focused on developing bioinformatics-based solutions are on the rise in France. The updates of the EU's regulation on food safety and the push for precision medicine/genomics-based drug discovery have also generated further growth opportunities in this market.

The drug discovery informatics market in the Asia-Pacific is expected to grow at the highest rate due to increasing investments in pharma R&D, growing AI-based research programs, and an increasing demand for cost-saving solutions for drug development. China and India are emerging as important markets due to government-sponsored programs favoring AI and informatics for drug discovery.

The need for bioinformatics, computational chemistry, and predictive analytics has been driven by China's rapid growth in the pharmaceutical and biotechnology industries. India has a good IT infrastructure--they can afford low-cost contract research services but like every other country that India is competing with, they are also investing heavily in new cloud-based informatics platforms that can enable drug discovery.

AI-Powered Drug Discovery on the Rise: Japan and South Korea are also taking action in artificial intelligence-based solution of genomics-based drug development, make the most of the potential market. Still, factors like data privacy issues and regulatory risks could hinder growth, hence, there is a need for relationship-oriented streamlined policies for effective penetration.

Challenge

Data Integration and Standardization

One of the biggest challenges in the drug discovery informatics market is the complexity of integrating and standardizing vast amounts of heterogeneous data from various sources. Drug discovery is dependent on heterogeneous datasets such as genomic data, trial data, molecular structures, and real-world data, which present a challenge in establishing seamless interoperability across multiple platforms.

Firms in the pharmaceutical industry mostly grapple with fragmented data silos, who’s slowing down of the drug development process and effects on decision-making can be counteracted by robust data management systems and interoperability standards between research institutions and pharmaceutical manufacturers.

Opportunity

Advancements in AI and Machine Learning

The sheer pace of breakthroughs in machine learning and artificial intelligence creates a revolutionary opportunity for the drug discovery informatics market. Algorithmic solutions can speed up target identification, identify the best lead compounds, and make accurate predictions about drug response. Machine learning models can also process large-scale biomedical data, minimizing costs and maximizing efficiency in preclinical and clinical research.

As more investment in AI-enabled drug discovery platforms, organizations adopting informatics-based solutions will gain the upper hand and push faster innovation and higher success rates for drug development.

Between 2020 and 2024, the drug discovery informatics market witnessed rapid growth, driven by the increasing integration of artificial intelligence (AI), machine learning (ML), and cloud-based computational tools in pharmaceutical research.

The rising complexity of drug discovery, combined with the need for high-throughput data analysis, accelerated the adoption of informatics solutions across pharmaceutical companies, biotechnology firms, and academic institutions. AI-driven predictive analytics, deep learning algorithms, and computational chemistry played a crucial role in expediting drug candidate identification and lead optimization.

Between 2025 and 2035, the drug discovery informatics market will undergo transformative changes, driven by AI-powered automation, quantum-enhanced drug modeling, and the convergence of bioinformatics with synthetic biology. The widespread implementation of AI-driven generative models, digital twin simulations for drug discovery, and neuromorphic computing will redefine pharmaceutical research methodologies.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter compliance on AI-driven drug discovery, cybersecurity regulations, and data integrity policies. |

| Technological Advancements | AI-based target identification, quantum computing-assisted molecular simulations, and SBDD. |

| Industry Applications | Oncology, rare disease drug discovery, biologics development, and genomic-based drug research. |

| Adoption of Smart Equipment | Cloud-based bioinformatics platforms, AI-assisted virtual screening, and real-time genomic data analysis. |

| Sustainability & Cost Efficiency | AI-optimized preclinical research, cloud-driven cost reduction in drug discovery, and CRO outsourcing. |

| Data Analytics & Predictive Modeling | AI-assisted hit-to-lead optimization, deep learning-driven structure prediction, and in silico trials. |

| Production & Supply Chain Dynamics | COVID-19-driven digital transformation, increased reliance on cloud computing, and globalized informatics collaborations. |

| Market Growth Drivers | Growth driven by AI-based drug discovery, increased pharmaceutical R&D investment, and accelerated computational modeling. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered regulatory frameworks, block chain-driven data governance, and federated AI compliance standards. |

| Technological Advancements | AI-driven autonomous drug discovery, digital twin simulations, and neuromorphic computing for molecular modeling. |

| Industry Applications | Expansion into regenerative medicine, synthetic biology-driven drug design, and precision neurodegenerative disease treatments. |

| Adoption of Smart Equipment | Fully autonomous AI-driven discovery labs, federated AI models for collaborative drug research, and quantum-enhanced high-throughput screening. |

| Sustainability & Cost Efficiency | AI-driven cost reduction in R&D, decentralized research frameworks, and quantum-enabled real-time molecular simulations. |

| Data Analytics & Predictive Modeling | Quantum-powered predictive modeling, block chain-secured clinical data management, and AI-assisted real-time drug interaction simulations. |

| Production & Supply Chain Dynamics | AI-optimized decentralized informatics research, block chain-enabled data security, and global federated AI-driven pharmaceutical collaborations. |

| Market Growth Drivers | Quantum-powered AI automation, digital twin-driven drug development, and personalized medicine-driven informatics solutions. |

The USA market for drug discovery informatics is growing fast because of the solid presence of pharmaceutical and biotechnology firms, greater adoption of artificial intelligence (AI) and machine learning for drug discovery, and rising government support for life science research.

Greater embedding of cloud-based data management, bioinformatics, and high-throughput screening (HTS) technologies is also fueling market growth. Also, pharma firms' emphasis on personalized medicine and predictive analytics for candidate selection for drugs is fueling demand for sophisticated informatics solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.5% |

Continuing growth in government investment in AI-based drug discovery, coupled with the presence of leading contract research organizations (CROs), and a favorable pharmaceutical research environment, underpins strong growth in the UK drug discovery informatics market.

Tremendous use of cloud computing, big data analytics, and next generation sequencing (NGS) technologies is further resulting in market growth. For instance, such as partnership across the academic and pharma companies to develop bioinformatics instruments for the end points identification and validation is fueling market growth further.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 14.3% |

The success of EU drug discovery informatics will grow from stringent regulation enabling unprecedented data transparency in drug discovery, increased investment in AI-driven drug discovery platforms, and the growing adoption of computational biology.

Germany, France, and Switzerland are key markets driving biopharmaceutical R&D, applications of quantum computing in drug discovery, and adoption of in-silico modeling practices. Furthermore, EU aid to promote cross-border cooperation in drug informatics is so driving demand for the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 15.0% |

Japan drug discovery informatics market is expected to grow with the advancements in the computational drug design technology, increasing investments in the artificial intelligence-based drug screening and firm government support for precision medicine.

The growing use of deep learning algorithms for molecular modeling, combined with Japan's focus on automation for laboratory research and data-driven drug development, is driving the market. The market's growth is also being attributed to the increase in bioinformatics solutions tailored to regenerative medicine and gene therapy research.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 14.2% |

The market for drug discovery informatics in South Korea is being driven by growing government support for biotechnology, and the proliferation of AI-powered medication development startups and bioinformatics research infrastructure.

Strategic collaborations between South Korean universities and international pharma companies for the development of computational drug discovery platforms are expected to drive the market growth. Furthermore, clinical studies and large-scale data analytics for biomarker discovery based on cloud-based informatics tools are expected to drive the need for cloud-based solutions in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 14.8% |

Outsourced drug discovery informatics is one of the quickest developing segments, as pharmaceutical organizations and biotech organizations utilize the external master experience to hasten drug improvement. Unlike in-house informatics, outsourced equivalents provide access to cutting-edge computational resources, advanced analytics platforms, and specialized domain knowledge to drive cost-effective and efficient drug discovery.

With ever more sophisticated technologies such as high-throughput screening, AI-based data analysis, and predictive modeling being deployed in drug discovery, the demand for outsourced informatics services has surged.

The surge in production of AI-based drug discovery platforms, machine learning algorithms, automated data curation, and deep learning-based molecular predictions are some of the driving factors of market uptake in the field, enabling faster and effective decision making in predicting drug candidates.

The combination of informatics solutions supported on the block chain has enhanced the adoption rate, ensuring transparency, security, and compliance when outsourcing drug discovery through the secure sharing and storage of data, decentralized clinical trial data management, and encrypted analysis of a patient record with those who need access to it.

The dawn of partnership-based collaboration between pharmaceutical companies and informatics service providers, along with data-based target identification, predictive toxicology screening, and simulation-based pharmacokinetics modelling, has commoditized market growth, ensuring optimum research and development processes.

The implementation of cloud-based informatics platforms, with on-demand computing power, real-time information processing capabilities, as well as multi-omics analysis, has facilitated market expansion, ensuring flexibility and greater research efficacy for outsourced drug discovery solutions.

Yet, while it has the upper hand in cost savings, advanced analytics and specialized capabilities, the outsourced part of the business suffers from problems with data security threats, regulatory snarls and intellectual property rights issues.

However, the demand for outsourced drug discovery informatics services globally will continue to rise, thanks to new interests in federated learning-based data protection, drug modeling based on quantum computing, and contract analytics driven by AI that will enable data security, safety, and integrity.

Sequence analysis platforms have gained strong market adoption, particularly among genomics researchers, pharmaceutical companies, and biotech firms, as they increasingly utilize bioinformatics solutions to decode genetic sequences, identify novel drug targets, and analyze disease mechanisms.

Unlike traditional computational approaches, sequence analysis platforms provide high-throughput sequencing capabilities, precise gene annotation, and comprehensive genomic data interpretation, ensuring accuracy and efficiency in drug discovery.

The increasing demand for genomic-driven drug discovery, featuring whole-genome sequencing, transcriptomic analysis, and CRISPR-based gene editing studies, has fueled the adoption of sequence analysis platforms, as researchers seek computational tools for analyzing large-scale biological datasets.

The expansion of AI-integrated sequence analysis platforms, featuring deep learning-based genomic pattern recognition, AI-powered biomarker discovery, and automated sequence alignment tools, has strengthened market demand, ensuring more precise and data-driven decision-making in drug development.

The integration of cloud-based genomic analysis solutions, featuring distributed computing frameworks, remote data access capabilities, and real-time sequence annotation, has further boosted adoption, ensuring scalability and accessibility for drug discovery teams worldwide.

The development of pharmaceutical partnerships with bioinformatics companies, featuring collaborative research initiatives, genome-based drug repurposing projects, and AI-enhanced mutational analysis studies, has optimized market growth, ensuring more effective drug target validation and biomarker identification.

The adoption of multi-omics informatics platforms, featuring integrative genomics, proteomics, and metabolomics data analysis, has reinforced market expansion, ensuring a more comprehensive approach to understanding disease mechanisms and therapeutic interventions.

Despite its advantages in genomic precision, data integration, and high-throughput analysis, the sequence analysis platforms segment faces challenges such as computational limitations in processing large-scale genomic datasets, regulatory complexities in handling patient genetic data, and ethical concerns regarding genomic data privacy.

However, emerging innovations in quantum computing-assisted genomic analysis, AI-powered gene annotation automation, and block chain-secured genetic data management are improving efficiency, security, and scalability, ensuring continued growth for sequence analysis-driven drug discovery informatics solutions worldwide.

Docking platforms have emerged as one of the most widely adopted computational methods in drug discovery informatics, offering researchers the ability to predict ligand-target interactions, optimize molecular binding affinities, and accelerate hit-to-lead identification through AI-driven simulations.

Unlike traditional wet-lab drug screening, docking platforms provide cost-effective, high-throughput, and in silico modeling solutions, ensuring faster drug candidate evaluation. The rising demand for AI-enhanced virtual screening tools, featuring deep learning-based ligand affinity predictions, generative AI-assisted drug design, and automated binding site analysis, has fueled adoption of docking platforms, as pharmaceutical companies prioritize digital drug screening methodologies.

Despite its advantages in computational efficiency, predictive accuracy, and cost-effectiveness, the docking segment faces challenges such as limitations in modeling complex molecular interactions, data reproducibility concerns, and computational cost constraints for large-scale screening projects.

However, emerging innovations in quantum computing-enhanced docking algorithms, AI-powered molecular dynamics simulations, and federated learning-based collaborative drug discovery are improving predictive accuracy, scalability, and cost efficiency, ensuring continued market expansion for docking-based drug discovery informatics.

Molecular modeling has gained strong market adoption, particularly among pharmaceutical researchers, biotech firms, and contract research organizations, as they increasingly utilize computational methods for structure-based drug design, protein-ligand interaction studies, and conformational stability assessments.

Unlike traditional experimental drug screening, molecular modeling provides high-resolution structural insights, predictive binding energy calculations, and AI-powered optimization of lead compounds, ensuring accuracy and efficiency in drug discovery.

Despite its advantages in structural precision, high-throughput computational screening, and predictive modeling capabilities, the molecular modeling segment faces challenges such as limitations in force field accuracy, scalability issues in multi-protein docking studies, and regulatory complexities in model validation for clinical applications.

However, emerging innovations in AI-enhanced molecular simulations, hybrid quantum-classical modeling techniques, and block chain-secured drug design frameworks are improving predictive power, scalability, and data integrity, ensuring continued growth for molecular modeling-driven drug discovery informatics solutions worldwide.

The Drug Discovery Informatics Market is experiencing rapid growth with the increasing use of AI, machine learning, and cloud-based platforms in pharmaceutical research. With the growing need for high-throughput screening, virtual drug modeling, and big data analytics, players are heavily investing in computational drug discovery solutions.

The trend towards precision medicine, biologics development, and automation has also propelled the requirement for informatics-based drug discovery. Top players are concentrating on AI-based platforms, cloud-based integration of data, and collaborative models to remain ahead in this changing environment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| PerkinElmer, Inc. | 18-22% |

| Thermo Fisher Scientific, Inc. | 14-18% |

| Certara, L.P. | 12-16% |

| Collaborative Drug Discovery Inc. | 8-12% |

| Novo Informatics | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| PerkinElmer, Inc. | Offers advanced bioinformatics and cheminformatics solutions for drug discovery and development. |

| Thermo Fisher Scientific, Inc. | Provides AI-driven drug discovery platforms, molecular modeling tools, and high-throughput screening software. |

| Certara, L.P. | Expertise in pharmacokinetics, computational modeling, and drug simulation technologies. |

| Collaborative Drug Discovery Inc. | Cloud-based drug discovery informatics to facilitate collaborative research and data management. |

| Novo Informatics | Builds AI-driven computational drug discovery platforms for biologics and small molecule research. |

Key Company Insights

PerkinElmer, Inc. (18-22%)

A top informatics solutions provider to pharmaceutical and biotech companies, PerkinElmer provides computational chemistry solutions, data analytics, and predictive modeling for drug discovery. PerkinElmer's emphasis on automation and cloud solutions increases research efficiency and scalability.

Thermo Fisher Scientific, Inc. (14-18%)

A leader in drug discovery informatics, Thermo Fisher combines AI, high-performance computing, and molecular simulation software in its research platforms. The company is growing its AI-based drug discovery pipeline and cloud-based data analytics.

Certara, L.P. (12-16%)

An international model-based drug development leader, Certara focuses on pharmacokinetics, bioinformatics, and computational modeling. Its proprietary bio simulation software is heavily applied in the optimization of clinical trials as well as precision medicine research.

Collaborative Drug Discovery Inc. (8-12%)

A leader in cloud-based drug discovery informatics, CDD offers secure data sharing platforms that allow collaborative research across pharmaceutical and biotech industries. Its software solutions enable virtual drug screening and computational chemistry applications.

Novo Informatics (6-10%)

An emerging player in AI-driven drug discovery, Novo Informatics focuses on machine learning algorithms, structural bioinformatics, and genomics-based drug design. Its AI-powered platforms enhance target identification, lead optimization, and drug repurposing efforts.

Other Key Players (30-40% Combined)

The Drug Discovery Informatics Market also includes regional and emerging companies such as:

The overall market size for drug discovery informatics market was USD 16,445.1 Million in 2025.

The drug discovery informatics market is expected to reach USD 64,814.3 Million in 2035.

The increasing integration of artificial intelligence (AI) and machine learning (ML) in drug discovery processes fuels Drug discovery informatics Market during the forecast period.

The top 5 countries which drives the development of Drug discovery informatics Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of mode, outsourced services to command significant share over the forecast period.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.