The drone sensor market is expected to witness a CAGR of 20.0% during the period between 2025 and 2035 and is a key area capturing the major segment of the market and ensuring the growth of the market sector over the forecast period. The demand for drones for applications that include aerial surveillance, infrastructure monitoring, agricultural mapping, delivery services, and disaster management has increased, which in turn has caused rapid growth of advanced drone sensors. Overview of drone sensor.

The drone sensors are the sensors that provide all the necessary data and sensing capabilities to provide an efficient operation based on its environment. The increasing use of drones in various applications such as infrastructure inspection, forest monitoring, aerial photography, etc., has also driven the demand for advanced sensor technologies.

Further, the growing commercial drone market, especially in logistics, agriculture, and surveillance, has continued to spur demand for high-performance sensors including thermal sensors, LIDAR sensors, and ultrasonic sensors. Although highly useful for several applications, the growing market of UAV platforms necessitates the use of advanced sensor solutions that are both reliable and rugged.

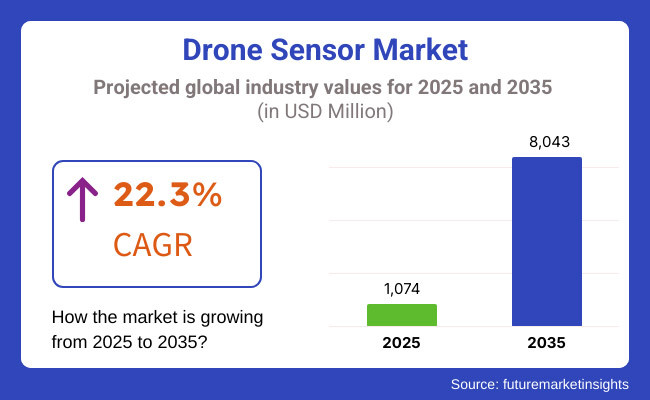

The market is expected to grow with a CAGR of 22.3% during the forecast period owing to growing deployment of drones for mapping, surveying, and environmental monitoring. The rapid increase in demand for industrial fit sensors like accelerometers, gyroscopes, altimeters, and pressure sensors is in sync with expanding use of drones for operational efficiency across industries.

In recent years, the increasing need for autonomous and semi-autonomous drones in applications such as defence, border protection and disaster relief has led to the widespread adoption of multi-sensor systems for area navigation, elemental tracking and target recognition.

Moreover, industrial manufacturers have served with safety equipment across drone machines, improving the safety augments the industrial manufacturers have introduced to improve drone safety and reduce accidents through government-initiated policies.

Market growth has also been driven by the application of sensors for agricultural monitoring, crop health analysis, precision farming, and smart irrigation. The growing funds in the development of autonomous drone props are projected to drive the demand for high-end sensor systems across numerous end-use sectors.

Based on their function, drone sensors fall under a few categories: thermal sensors, LIDAR sensors, ultrasonic sensors, image sensors, proximity sensors, and navigation sensors. Thermal sensors are mainly used for temperature monitoring, target identification, and aerial inspection in disaster management, agriculture, and defines applications.

LIDAR (Light Detection and Ranging) sensors ideal for construction, monitoring infrastructure, and surveying topography, provide accurate three-dimensional mapping and terrain analysis. Ultrasonic sensors are common sensors in collision avoidance, obstacle detection, and environmental monitoring, particularly in higher-risk functions, such as those involving mining, defines surveillance, and energy infrastructure inspection.

High-resolution cameras and multi-spectral imaging systems, as examples of image sensors, are heavily utilized in photography, videography, and environmental data collection. Navigation Sensors: GPS modules, accelerometers, gyroscopes, etc. help to use Navigation sensors in drones for site-to-site manoeuvring and stable flight control to ensure accurate data capture in various industrial applications. The increased need for multi-sensor integration in order to enable real-time monitoring, autonomous navigation, and remote operations in drones has further fuelled market growth.

Explore FMI!

Book a free demo

The drone sensor market is segmented into Americas, Europe, and Asia-Pacific, based on regions. North America captured the highest market share in terms of revenue in 2016, due to the increasing adoption of drones for agriculture in the USA, defines & surveillance, monitoring infrastructure, and humanitarian projects.

Due to high defines expenditure and quick UAV technology growth, demand for advanced sensor technology for military and commercial drones has been on the rise in the United States and Canada. The growing use of drones for infrastructure inspection, search and rescue missions, and disaster management has boosted the demand for such sensors as thermal cameras, LIDAR systems and infrared sensors.

Moreover, rising utilization of drones for crop monitoring, soil health analysis, and irrigation management for precision agriculture is further driving the growth of the market. The rising demand for high-precision drone sensors in the region can also be attributed to regulatory systems introduced by the federal aviation administration (FAA), which are designed to improve the safety of drones, as well to minimize the risks of mid-air collision.

The prominent market of drone sensor lies in Europe owing to the growing use of drones for environmental monitoring, inspection of infrastructure, and aerial mapping. Germany, the UK, and France are each investing money into specific drone capabilities for forestry management, power line inspection, railway monitoring, and fire response, etc.

In the energy sector, drones are widely used for oil and gas pipeline monitoring as well as offshore wind farm inspections, which is leading to an increasing demand for LIDAR, gas detection sensors, ultrasound sensors, etc. European governments mandating the deployment of drones in sustainable farming applications such as crop analysis, pesticide spraying, soil analysis and smart irrigation is also working to propel demand for agricultural drone sensors.

The increasing focus toward decreasing carbon emissions and deploying sustainable energy infrastructure has additionally provided a continuing impetus to the market growth within the area.

The Asia-pacific region is projected to represent the highest growth in the drone sensor market with increasing industrialization, expanding agricultural business and higher demand for surveillance drones during the forecast period. Analysts have noted that in countries like China, Japan and India, and South Korea, there has been an increased use of drones for commercial applications such as border reconnaissance, power line patrol and industrial inspection.

Furthermore, the increasing implementation of smart farming through the use of drones for yield prediction, pesticide spraying, and plant health assessment is also fuelling the demand for agricultural drone sensors significantly.

The need for real-time surveillance in border management, disaster response, and traffic monitoring applications continue to spur automation and drive growth across the sensor technologies including LIDAR, thermal cameras, and proximity sensors. The growing government spending on smart city framework and transport monitoring in the Asia-Pacific region is expected to drive the adoption of high-accuracy drone sensors.

Challenge

High Cost of Advanced Sensor Technologies and Regulatory Restrictions

The high cost of advanced sensor technologies for drones is challenging the industry critical to the adoption of drones in end-use industries in the sensor market. Drones collect data, with heavy reliance on sensors comprising of thermal sensor, LiDAR sensor, hyperspectral sensor, and multispectral sensor for use in applications spanning from aerial mapping, precision agriculture, infrastructure monitoring and defines surveillance.

But the integration of these advanced sensors is expensive, increasing drone costs and imposing barriers to use on small and medium-sized enterprises (SMES) and individual consumers. Moreover, the maintenance and operating costs of advanced sensor system, even on a petty level, holds back market penetration

The stringent regulatory environment of using a drone is one of the major challenges faced by the drone sensor industry. The United States, Canada, China and many European Union countries have set super-sensitive rules on airspace restrictions, drone registration, safety compliance and so on.

However such regulations delay the implementation and adoption of drones across commercial and industrial industries, hampering the growth of drone sensor market. And growing regulatory and consumer fatigue over privacy invasions and data security breaches have slammed a brake on any unauthorized surveillance via UAVs equipped with sophisticated sensors.

For this, market players have to address the challenges by working towards cost-effective, lightweight, and modular sensor solutions that ultimately lower the overall operational cost of drones.

The standardization of drone technologies could be a result of collaborative synergy between sensor manufacturers, drone manufacturers, and regulatory authorities, which can help in engaging those necessary hurdles of regulatory compliance while catalysing a larger adoption of drone technologies. Moreover, rising R&D spending to improve sensor efficiency, data precision, and compatibility with multiple drone platforms can create new opportunities in the market.

Opportunity

Increasing Demand of Drones in Commercial and Industrial Application

The growing use of drone sensors in various commercial and industrial verticals signals great prospects for drone sensor market growth. Thanks to their ability to deliver real-time intelligence, aerial imagery, and geo-spatial mapping, these high-precision sensor-equipped drones are becoming widely adopted across industries like agriculture, infrastructure monitoring, construction, mining, and environmental monitoring.

An example is agriculture, where multispectral and hyperspectral sensors have been widely employed in crop health monitoring, pest detection, soil analysis, and yield estimation enabling farmers to use resources efficiently and increase productivity. So, as precision agriculture continues to make progress, the demand of advanced drone sensors will rise which will give the market growth.

Another very significant opportunity is the growing commercial acceptance of drones for infrastructure monitoring of public safety. The use of drones with thermal and LiDAR sensors is widespread for bridge and power lines inspections, oil pipeline inspection and construction site monitoring, allowing near real-time monitoring and drastically reducing the need for manual labour.

Furthermore, emergency response agencies are using drones equipped with high-resolution sensors for search and rescue operations, disaster management, and surveillance activities which in turn is expected to spur demand for advanced drone sensors. The growing need for drone-based monitoring and surveying with urbanization and development of infrastructure is expected to drive the market growth.

In addition to this, the proliferation of drones for defines & security applications is also extending profitable growth opportunities to the drone sensor market. Global defines agencies are employing drones outfitted with sophisticated sensors for border surveillance, reconnaissance missions, target identification and situational awareness.

Geopolitical tensions are escalating and the focus on border security has continued to grow, driving investments into drone sensor technologies, namely thermal imaging, radar sensing, and optical sensors. However, with the rapidly developing sensor technologies, the drone manufacturers are emphasizing on the multi-sensor systems, which can achieve high resolution data in real time, which will continue to improve operational efficiency and contribute to growth in the market.

From 2020 to 2024, the drone sensor market significantly grew due to the rising applications of drones in sectors such as agriculture, infrastructure monitoring, environmental surveillance and defines. Adoption of thermal sensor, optical sensors, and multispectral sensors in precision agriculture and monitoring construction sites were key drivers, as well.

Besides, several key regions' regulatory authorities (e.g., FAA and EASA) also started to prepare operational frameworks to enable commercial drone operations, which facilitates orderly deployment of drones with advanced sensors. Despite this, the market struggled with issues around high cost, regulatory complexity, and privacy, preventing widespread adoption in specific regions.

The industrial market is all set to witness a transformation in 2025 to 2035 era, spearheaded by technology, industrial applications and effective regulatory policies. Key Growth Determinants Dominance of lightweight, affordable, high-resolution sensors with multifunction capabilities additionally, the use of drones for smart city development, urban infrastructure monitoring and emergency response services will present additional growth opportunities for the sensor manufacturers.

Furthermore, growing R&D investments to improve sensor performance, lower operating costs, and ensure data precision will serve as a possible driver of market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing implementation of drone usage regulations and airspace restrictions |

| Technological Advancements | Deployment of thermal, multispectral, and hyperspectral sensors in commercial drones |

| Industry Adoption | Growing use of drones in agriculture, construction, and infrastructure monitoring |

| Supply Chain and Sourcing | Dependency on imported sensor components and high production costs |

| Market Competition | Dominance of a few large drone sensor manufacturers |

| Market Growth Drivers | Demand for drones in agriculture and infrastructure monitoring |

| Sustainability and Energy Efficiency | Limited focus on energy-efficient sensors |

| Integration of Smart Monitoring | Basic data collection capabilities using standard sensors |

| Consumer Awareness and Adoption | Limited consumer knowledge about drone sensor capabilities |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of standardized regulatory frameworks promoting large-scale drone deployment |

| Technological Advancements | Introduction of multi-functional sensors with advanced imaging, real-time mapping, and precision data capture |

| Industry Adoption | Widespread adoption of drones for defines, industrial inspection, and smart city development |

| Supply Chain and Sourcing | Localization of sensor manufacturing, reducing overall production and operational costs |

| Market Competition | Emergence of small and medium-sized sensor manufacturers offering cost-effective solutions |

| Market Growth Drivers | Increasing use of drones for public safety, environmental monitoring, and industrial inspections |

| Sustainability and Energy Efficiency | Large-scale development of low-power, high-precision sensors to extend drone battery life |

| Integration of Smart Monitoring | Advanced real-time data analytics and high-resolution imaging for precision monitoring |

| Consumer Awareness and Adoption | Increased awareness of multi-sensor capabilities and their impact on operational efficiency |

Up to 26 percent of Drone Sensor Market growth in the USA will come from North America. The demand for drone sensors in the country is being propelled by the USA Department of Defence (DOD) extensively investing in drone technologies for surveillance, intelligence, and military operations.

As the advancements in drone technology have reached a peak, the rising use of drones in agriculture for crop monitoring, soil analysis, and pesticide application has actually propelled the market for drone sensors. Major drone manufacturers including Lockheed Martin, Boeing, and General Atomics are incorporating high-performance sensors, delivering advanced capabilities, and promising healthy market growth.

Surge in Commercial Implementation of Drones in Emergency Response, Infrastructure monitoring, delivery services have elevated market for advanced drone sensors in United States.

Furthermore, government measures to promote drone innovation and integration across different sectors, along with rising investments in UAV technology for urban air delivery services, are additional factors elevating market growth. During the forecast period, high adoption of sensors such as thermal, infrared, LiDAR, and multispectral sensors is expected to spur market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 23.1% |

Demand for drones in defines, agriculture, and infrastructure monitoring applications is increasing, which is one of the major contributing factors to the rapid growth of the Drone Sensor Market in the United Kingdom. The increasing use of drones for surveillance, border control, and military operations by the Ministry of Defence has immensely increased the demand for advance drone sensors in the UK

Moreover, the rising adoption of drones in commercial sector for surveying, inspection, and delivery services has further driven the growth of the market. Major drone manufacturers like BAE Systems and QinetiQ are investing in sophisticated sensor technologies, driving market growth well into the future.

The demand for drone sensors in infrastructure monitoring, aerial mapping, disaster response, and agricultural applications is increasingly on the rise across the UK, together with between a wide range of government-backed initiatives that are implemented towards the end-use of drone technology for procuring critical infrastructure and urban mobility is boosting the demand for high-precision sensors.

Also, the increasing adoption of multispectral sensors, LiDAR, and thermal sensors in operation in autonomous and semi-autonomous UAVs has positively impacted the market growth in the United Kingdom.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 21.9% |

The EU Drone Sensor Market is growing due to the growing adoption of drones across the defines, agriculture, energy, and transportation sectors. Germany, France and Italy are making huge investments in many UAV technologies for surveillance and intelligence collection, as well as monitoring agricultural activities, which further increases the needs for advanced drone sensors.

The European army has also been working closely with the industry to promote drone technology innovation through the European Defence Fund (EDF), driving demand within the market. Furthermore, drone adoption across inspection: infrastructure: pipeline: and urban air mobility sectors has also endowed positive growth towards the market.

In addition, the growing uptake of drone sensors for commercial delivery, industrial inspection, and environmental monitoring in the EU have propelled demand for the market. The market is anticipated to grow with the increasing adoption of advanced sensors including LiDAR, hyperspectral, thermal, and gas sensors used for surveying and monitoring by drones. Moreover the strengthening of market growth is attributed to the European Commission regulatory framework aimed at enabling drone operations across numerous sectors.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 22.7% |

According to a new report available on JDMarketResearch, the Japan Drone Sensor Market is expected to witness immense growth in the near future. Japan’s Ministry of Defence has been actively allocating drones to military reconnaissance, surveillance, and security operations commanding a notable demand for advanced drone sensors.

Moreover, the increasing utilization of drones in precision agriculture for crop health monitoring, pesticide spraying, and field mapping has been providing a further boost to the market growth. Drone efficiency and operational capabilities are being improved by incorporating high performance sensors, such as LiDAR, Infrared, and gas sensors, by Japanese drone manufacturers such as Yamaha and ACSL.

The fast-paced expansion of drone delivery services, infrastructure inspection, and public safety edicts in Japan has propelled the growth of sophisticated sensor technologies. In addition, the plans of the Japanese government to develop smart cities and the associated solutions, which also include drones for urban surveillance and infrastructure monitoring, have played crucial role in the market growth.

The burgeoning investment in research and development for drones along with significantly high demand for precision drone sensors are essential factors anticipated to fuel the market through the forecast period.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 22.9% |

The South Korean Drone Sensor Market is growing at a tremendous pace; due to the growing application of various types of drones in military surveillance, agriculture, and smart city development. The South Korean military has been leveraging its drones, fitted with sensors, heavily for border monitoring, intelligence gathering and disaster response, dramatically increasing demand in the market as well.

Moreover, the application of drones for crop checking, area examination, and pest control in horticulture also drives the market for drone sensors in the country. Leading enterprises like Samsung and Hyundai are rushing to invest in drone sensor tech in order to enhance their operational efficiencies.

The South Korea market is further driven by the increasing adoption of autonomous drones in logistics, infrastructure monitoring, and environmental inspection. Furthermore, the rising demand for high-performance sensors, including LiDAR, thermal, and multispectral sensors, due to government initiatives aimed at promoting UAVs for use in commercial services, disaster management, and industrial automation, is also expected to fuel the market growth. Market growth during the forecast period is also expected to be driven by smart city development initiatives in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 23.3% |

According to a recent report by Research, inertial sensors account for more than one-fourth of the market share in the drone sensor market, primarily due to increasing demand for precise flight control, navigation, and stability in UAVs. One such component is inertial sensors, including accelerometers, gyroscopes, and magnetometers, which are used to achieve high-precision flight performance by measuring the drone's orientation, acceleration, and angular velocity.

The increasing use of these platforms in commercial, defines and industrial applications has generated demand for innovative inertial sensor technologies to aid in accommodating new levels of stability and control in flight operations.

Inertial Sensors Market is especially high in defines and military applications, where the use of drones for surveillance, reconnaissance and tactical operations are growing. Thus, the accurate positioning and flight control is crucial to achieving mission success, leading the defines agencies to invest in high-precision inertial sensors.

Additionally, in the commercial market, applications for aerial photographs, infrastructure inspection, and agricultural monitoring all need stable and uninterrupted drone operations and therefore are further increasing demand for advanced inertial sensors.

The rapid development of micro-electromechanical systems (MEMS) technology has greatly aided in the downsizing and cost reduction of inertial sensors, resulting in these devices becoming increasingly widespread, even among small and medium-sized drone manufacturers.

In even recent history, the combination of multi-axis inertial measurement units (IMUs) and sensor fusion technologies have radically improved not only the accuracy of drone (or multi-copter as it can also be referred to) positioning but also the responsiveness and reliability of those operations.

Despite these advancements, factors like sensor drift, temperature sensitivity, and effects of real-world signals remain a limiting factor in the performance of inertial sensors, leading to continuous research and development for better sensor calibration and error correction methods.

The high performance inertial sensor demand is likely to remain strong with the increasing commercialization of drones over delivery services, infrastructure monitoring and emergency response. The increasing use of autonomous drones in precision agriculture, logistics, and disaster management are expected to drive the adoption of inertial sensors in the worldwide drone sensor market.

Drone Sensors Market Drone sensors market by sensor type (Lidar, computer vision, image sensors, opto-eye, multi-spectral sensors, NIR sensors, IR sensors & atmospheric sensors) The global drone sensors market is further segmented by type into Lidar, computer vision, image sensor, opto-eye, multi-spectral sensors, NIR sensors, IR sensors, and atmospheric sensors, Out of these sensor types AVAS have highest expected growth rate in global drone sensors market owing to growing demand for high-resolution aerial imaging, increase in awareness and adoption of drones, and remote sensing applications in different domains.

Drones are fitted with image sensors for different purposes, for example, mapping, monitoring and visual inspection to tailor the drone to collect visual data. The rapid commercial and industrial adoption of drones in applications such as infrastructure inspection, land surveying, wildlife monitoring etc. will also force the deployment of high-resolution image sensors.

Additionally, Luxembourg tech image sensors are gaining popularity in the defense sector and it will also further strengthen the global image sensor market growth for the forecast period. For military and defence operations worldwide which need aerial imagery, drones equipped with advanced sensors have become an essential tool that can record crystal-clear, high definition images in real time whilst on the move.

These drones are equipped with imaging sensors and are extensively deployed in the commercial sector for agricultural monitoring, land surveying and cinematography, to monitor crops, check land and shoot aerial videos.

Image sensor technologies such as CMOS (Complementary Metal-Oxide-Semiconductor) and CCD (Charge-Coupled Device) improve the image quality, light sensitivity, and overall power efficiency of the drones.

Moreover, drones can be equipped with thermal and multispectral imaging sensors, which can be useful in industrial inspection research, search-and-rescue operations, and disaster response missions.” Meanwhile, image sensors are limited by challenges related to image processing, low-light performance, and sensor heating.

Integration of image sensors with artificial intelligence (AI) and machine learning algorithms for real-time object detection, terrain mapping, and obstacle avoidance is also expected to spur the growth of the market Also, increasing government spending on smart city infrastructure and disaster response programs is projected to boost the demand for drone-based image sensors over the forecast period.

As the demand for position tracking, navigation and positioning in the operations of drones continue to increase, position sensors have collectively emerged as a major segment in the drone sensor industry.

Vital role of position sensors position sensors like Global Positioning System (GPS), Global Navigation Satellite Systems (GNSS), and differential GPS play a significant role in ensuring stability in drones, tracking flight positions, and enabling autonomous navigation for the drone. The growing penetration of drones in logistics, infrastructure and environment education have increased the need for the advanced position sensor technologies.

Position sensors are important in defines and military applications such as mission-based drone operations (border surveillance, aerial reconnaissance, tactical air strikes, etc.). Position sensors have been integrated into drones to improve operational efficiency via real-time location tracking, geofencing and autonomous return to home capabilities.

In the commercial realm, positioning sensors enable delivery drones and enable mapping for construction sites and precision farming, allowing for exact flight control and automated navigational routes.

Recently, developments in satellite navigation technologies, high-precision GNSS receiver and real-time kinematic (RTK) positioning systems have enabled drone navigation with higher accuracy and reliability.

Additionally, the integration of position sensors with artificial intelligence (AI) technologies deployed on board the drones has allowed them to offer autonomous navigation, obstacle avoidance and real-time path optimization have further boosted the adoption of position sensor working together in various commercial and industrial applications.

If we consider the position sensors, they are still remarkably restricted by the signal interference, multipath errors as well as GPS jamming assaults, particularly in urban as well as indoor sort of times.

To address this, players in the market are seen as focusing on sensor fusion technologies that integrate GPS data with INS and VIO, so as to allow drone navigation in difficult environments. Increasing usage of drones such as for service delivery, smart cities, and emergency response operation, is expected to fuel strong demand for position sensors in the global drone sensor market.

Driven by the growing adoption across industry verticals including agriculture, infrastructure inspection, logistics, and media verticals, commercial drones hold the majority market share of the drone sensor market. High-performing sensors are integrated into commercial drones to capture data for crop monitoring, aerial photography, land survey, and delivery, allowing companies to improve operational efficiency and reduce costs.

As commercial drone deployment increases, there is a growing demand for advanced sensors in drones, driven by the increasing adoption of precision agriculture systems, smart infrastructures, and same-day delivery systems.

The significant growth of commercial drones in agriculture for precision farming, pest control, and irrigation management, has bolstered the uptake of sensor franchises including image sensors, multispectral sensors, and thermal sensors.

Moreover, the growing use of e-commerce and last mile delivery services have increased the need of drones, which are provided with high-precision position sensors and inertial sensors for accurate navigation and delivery management.

Finally, the growing use of commercial drones for inspecting infrastructure, monitoring construction sites, and maintaining utilities has created additional demand for drone sensors that can deliver high-resolution imaging, real-time positioning, and obstacle avoidance.

Limited regulatory environment, airspace, and data privacy concerns will continue to be the challenges for the mass adoption of commercial drones, regulating the growth of the overall sensors market.

The demand for high-performance sensors is being fuelled primarily due to rising deployment in surveillance, reconnaissance, and combat missions. Defence agencies across the globe are making significant investments in drone sensor technologies that deliver real-time situational awareness, target tracking, and mission planning.

With the development of inertial sensors, image sensors, and position sensors, defines drones have undergone immense upgrades and played a significant role in the precision operation of the military by allowing for operations to be carried out with little human intervention.

Thermal imaging, LiDAR, and radar sensors have seen significant demand in defines-based applications, where drones can perform night-time surveillance, target detection, and map terrains effectively. Increased usage of combat drones by defines agencies, armed with sophisticated sensor fusion technologies, integrating inertial navigation with the help of GPS and computer vision for mission-critical operation

On the other hand, expanding availability of high-end sensor technology in defines and military drones is fuelling a need for advanced sensor technologies even when the initial investment costs are significant and operational complexities are anticipated. This would ensure a continuous demand for high end drone sensors in the global market owing to increasing government defines budgets, cross-border surveillance initiatives, and counter-terrorism operations.

Indeed, the increasing uptake of drones for aerial mapping, surveillance, environmental monitoring, agriculture, and logistics has ramped up the need for sophisticated drone sensors. The most critical transformational areas within the market are high-resolution thermal imaging sensors, advanced LIDAR (light detection and ranging) sensors, multispectral sensors, and proximity sensors for improved drone navigation and operational accuracy.

Rise in integration of drone sensors with advanced data analytics & real-time monitoring solutions is expected to add to the growing market adoption across key industries. Furthermore, drone manufacturers are focusing on sensor miniaturization and lightweight technologies to enhance drone efficiency and battery utilization metrics, which is likely to propel market expansion.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| TE Connectivity Ltd. | 20-24% |

| Bosch Sensor Tec GmbH | 15-19% |

| Trimble Inc. | 12-16% |

| amps-OSRAM AG | 10-14% |

| TDK InvenSense | 8-12% |

| Other Companies (combined) | 25-35% |

| Company Name | Key Offerings/Activities |

|---|---|

| TE Connectivity Ltd. | Offers a wide range of sensors for drones, including pressure, humidity, and proximity sensors designed for precision navigation and aerial data collection. |

| Bosch Sensortec GmbH | Provides high-performance IMU (Inertial Measurement Unit) sensors, motion sensors, and altitude sensors for accurate drone navigation and stabilization. |

| Trimble Inc. | Specializes in high-precision LiDAR sensors, GPS/GNSS systems, and positioning sensors used for geospatial mapping, surveying, and infrastructure monitoring. |

| ams-OSRAM AG | Develops optical and multispectral sensors for drones, enabling high-quality aerial imaging, environmental monitoring, and crop health analysis. |

| TDK InvenSense | Offers advanced gyroscopes, accelerometers, and magnetometers for drone flight stabilization, navigation, and obstacle detection. |

Key Company Insights

TE Connectivity Ltd. (20-24%)

TE Connectivity dominates the drone sensor market with a comprehensive portfolio of sensors, including pressure, humidity, and gyroscopic sensors designed for drone navigation, mapping, and data acquisition. The company focuses on providing rugged and high-performance sensor solutions to support industrial and commercial drone applications.

Bosch Sensortec GmbH (15-19%)

A leading innovator in sensor technology, Bosch Sensortec provides Inertial Measurement Unit (IMU) sensors, pressure sensors, and altitude sensors, ensuring precise drone navigation, altitude control, and data capture. The company primarily caters to drone manufacturers focused on defense, agriculture, and industrial monitoring.

Trimble Inc. (12-16%)

Trimble is recognized for its advanced LiDAR and GNSS sensor systems, widely used in drones for high-precision aerial surveying, mapping, and infrastructure monitoring. The company’s sensors are heavily utilized in agriculture, mining, and environmental monitoring applications.

ams-OSRAM AG (10-14%)

ams-OSRAM specializes in producing high-resolution optical, multispectral, and infrared sensors for drone imaging and environmental monitoring. The company focuses on improving drone camera efficiency for high-precision aerial imaging and thermal monitoring applications.

TDK InvenSense (8-12%)

TDK InvenSense offers advanced motion sensors, including gyroscopes, magnetometers, and accelerometers, ensuring flight stability, navigation accuracy, and obstacle avoidance in drones. The company caters to both consumer and commercial drone manufacturers.

Other Key Players (25-35% Combined)

Several other companies contribute significantly to the drone sensor market by offering specialized and customized sensor solutions for aerial data collection, flight stability, and environmental monitoring. These include:

The overall market size for the Drone Sensor Market was USD 1,074 million in 2025.

The Drone Sensor Market is expected to reach USD 8,043 million in 2035.

The increasing deployment of drones across defense, agriculture, logistics, and infrastructure inspection, coupled with the growing need for high-precision navigation, altitude control, and motion tracking, fuel the Drone Sensor Market during the forecast period. The rising adoption of drones for commercial delivery services and security surveillance further accelerates market growth.

The top 5 countries driving the development of the Drone Sensor Market are the United States, China, Germany, Japan, and India.

On the basis of application, Inertial Sensors are expected to command a significant share over the forecast period, driven by their critical role in stabilizing flight, enhancing navigation accuracy, and improving overall drone performance across various end-use industries.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.