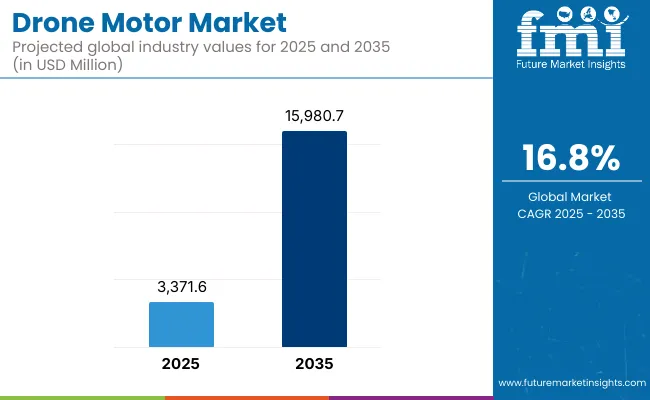

The global Drone Motors market was reported at USD 2,498.3 million in 2023. With a strong year-on-year growth projected at 15.1%, the market is expected to grow to USD 2,893.6 million in 2024. This market is expected to record a compound annual growth rate (CAGR) of 16.8% from 2025 to 2035, achieving a market size of USD 15,980.7 million by the end of 2035.

| Attributes | Key Insights |

|---|---|

| Estimated Size (2025E) | USD 3,371.6 million |

| Projected Value (2035F) | USD 15,980.7 million |

| Value-based CAGR (2025 to 2035) | 16.8% |

All types of drones, whether fixed-wing or rotary-wing, need drone motors, which can be defined as specialized thrust-generating, stability and maneuverability providing high-performance systems. These motors help to maximize the output and efficiency of engines within the framework of tasks, which range from carrying out agricultural activity to drone-based photography and industrial inspections.

Expected possibilities include advancement of brushless motor technologies, increased utilization of drones for business purposes, and explosion of autonomous systems in the logistics and defense sectors.

It is expected that logistics and delivery will represent more than 30 percent of the world demand by 2024. The Global Drone Logistics and Transportation market was valued at USD 6.5 billion in 2024.

This robust growth stems from the urgent need for on-site, timely delivery of industrial goods and emergency supplies. Additionally, ongoing innovation in game-changing technologies like autonomous systems and AI drives expansion by enhancing drone efficiency, safety, and scale.

Dronamics, the Bulgarian startup, has made considerable progress in the cargo drone by introducing a fixed wing drone having a capacity to carry 350 kg which helps in meeting same day deliveries with a range of 1,553 miles.

The company recently signed a deal with DHL and also got the EU license to self-approve flights, which is a big achievement for the company. In the USA, Zipline, a drone delivery company, received federal clearance in 2022 to conduct business as a small passenger airline, allowing it to extend its delivery services for e-commerce and medicines.

Drone Motor demand is expected to grow 4.7 times its current level by 2035, driven by driven by several key factors. Growing commercial and industrial sectors such as logistics, agriculture, surveying and infrastructure inspection, will increase the need for dedicated motors which have higher efficiencies and longer flight durations.

Moreover, innovations such as efficient brushless motors and battery systems will expand the usability of drones. Development of airspace integration frameworks will ease regulation around drones and will allow wider use of drones in different industries.

North America especially the USA drone motor market is witnessing growth due to increasing adoption of drones, technology development and even regulatory frameworks. The Federal Aviation Administration (FAA) issued over 1 million sources of registered drones in the USA owing to 403,358 Commercials Drones and 387,355 Recreational drones as of 2024.

This kind of wide usage demonstrates the completeness of the region’s drone environment which necessitates for the high-class as well as dependable engines for these drones. Also, the USA has been leading in the application of complex solutions such as AI, autonomous system in drones, which also stimulates development in the motor structure and functions.

The table below presents the annual growth rates of the global Drone Motors industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 15.5% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 15.5% (2025 to 2035) |

| H2 2024 | 16.1% (2025 to 2035) |

| H1 2025 | 16.3% (2025 to 2035) |

| H2 2025 | 16.7% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 16.3% in the first half and relatively increase to 16.7% in the second half. In the first half (H1), the sector saw an increase of 80 BPS while in the second half (H2), there was a increase of 60 BPS.

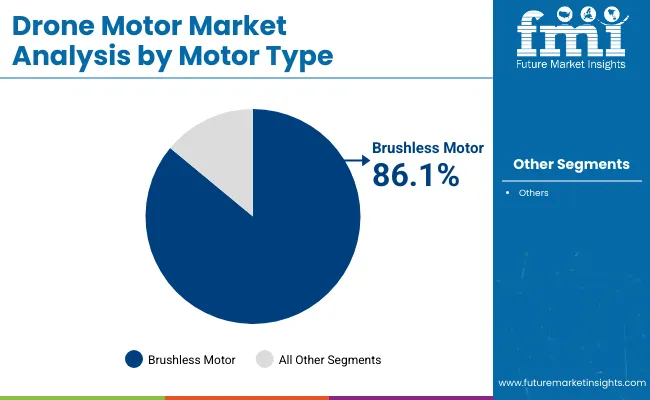

The section explains the growth trends of the leading segments in the industry. In terms of Motor type, the Brushless Motor will likely disseminate and generate a share of around 86.1% in 2025.

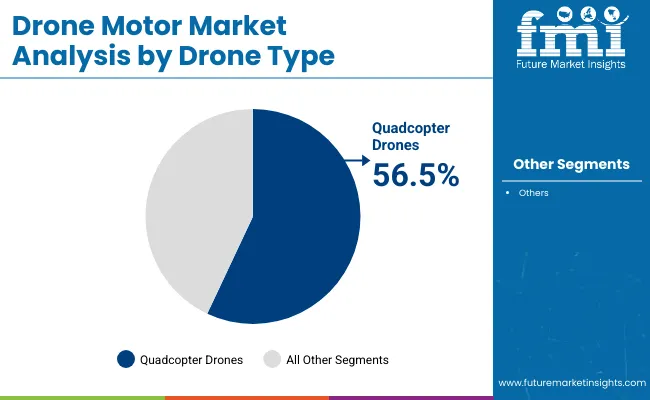

Based on Drone Type, the Quadcopter Drones segment is projected to hold a share of 56.5% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Brushless Motor (Motor Type) |

|---|---|

| Value Share | 86.1% |

In 2025, Brushless Motor are projected to hold a substantial market share of approximately 86.1%. The growing demand for brushless motors in the drone market is driven by their superior energy efficiency, lightweight design, and high performance.

These motors enhance drone flight time and operational precision, crucial for applications such as aerial photography, mapping, and delivery services. Their durability and low maintenance, owing to fewer moving parts, ensure reliability even in harsh conditions, making them ideal for agriculture and defense applications.

Brushless motors also operate quietly, a significant advantage for surveillance and environmental monitoring where noise sensitivity is a concern. Additionally, the rapid expansion of drone applications in logistics, construction, and inspection fuels the need for advanced and efficient motor solutions. With the increasing focus on drone innovation and performance, brushless motors remain the cornerstone of the evolving drone industry.

| Segment | Quadcopter Drones (Drone Type) |

|---|---|

| Value Share | 56.5% |

The quadcopter drone segment is witnessing a surge in popularity, significantly impacting the drone motor. Known for their versatility and stability, quadcopters have become the preferred choice for a wide range of applications, from aerial photography and videography to precision agriculture and infrastructure inspection. This versatility necessitates advanced motor designs capable of delivering optimal performance, control, and reliability.

The affordability and ease of use of quadcopters have fueled their adoption among hobbyists and professionals, driving demand for motors tailored to this drone type. Additionally, the expansion of commercial applications, such as logistics and last-mile delivery, highlights the need for motors that support payload capacity and energy efficiency.

Innovations in brushless motor technology have further enhanced quadcopter performance by extending flight times and reducing maintenance. As quadcopters gain traction in defense and surveillance, the demand for high-precision, durable motors is expected to grow, solidifying their role in the expanding drone motor market.

Civil and military UAV applications are driving new potential for drone motors

The growing adoption of Unmanned Aerial Vehicles (UAVs) across both civil and military sectors is a key driver for the expansion of the drone motor market.

Drones are no longer limited to recreational use but have found significant applications in industries ranging from agriculture and logistics to defense and surveillance. This broadening of use cases has created a surge in demand for efficient, high-performance drone motors that can meet the diverse requirements of both commercial and military applications.

In the civil sector, drones are increasingly used for tasks such as precision agriculture, delivery services, infrastructure inspection, and disaster response. For example, in agriculture, drones equipped with advanced motors are used for crop monitoring, pesticide spraying, and soil analysis.

These motors need to be powerful, reliable, and energy-efficient to ensure long flight times and accurate performance. Similarly, in logistics, companies like Amazon and UPS are exploring the use of drones for last-mile delivery, requiring motors that can support heavy payloads and provide sustained power for longer distances.

In the military sector, UAVs are used for surveillance, reconnaissance, and combat missions. The increasing need for surveillance in challenging terrains and conflict zones has spurred the development of high-end drone motors that can withstand harsh conditions, offer extended flight durations, and carry advanced sensor systems.

The USA military, for instance, has significantly increased its investment in UAV technology, including drones like the MQ-9 Reaper, which require powerful and reliable motors to carry out missions effectively over long durations.

Technological Advancements in Drone Motors Driving Market Growth

Technological advancements in drone motors are a key driver of the rapid growth in the drone motor. Continuous improvements in motor efficiency, durability, and overall performance are enhancing the capabilities of drones, enabling them to handle a broader range of applications with higher efficiency and reliability.

Among the most notable innovations are developments in brushless motors, lightweight materials, and high-performance motor designs, all of which are pushing the boundaries of drone functionality.

Brushless motors have become the standard in the drone industry due to their superior efficiency and longer lifespan compared to brushed motors. These motors eliminate the need for physical brushes, which reduces friction and heat generation, allowing for quieter operation, longer flight times, and improved reliability.

Companies like DJI and Parrot have adopted brushless motors in their consumer and commercial drone models, enabling their devices to achieve longer flight times and carry heavier payloads.

Advancements in lightweight materials and high-performance motor designs are enhancing the payload capacity and maneuverability of drones. The integration of carbon fiber and advanced composites into drone frames, combined with powerful yet lightweight motors, has resulted in drones that are more efficient, stable, and capable of operating in diverse environments.

For example, Quantum Systems, a drone manufacturer, uses innovative lightweight motor designs in their Quantum Trinity F90+, a drone designed for industrial surveying. The motor advancements allow the drone to carry heavier sensors and operate over longer distances with improved efficiency.

Growing Trend of Strategic Mergers and Acquisitions in the Drone Motor Market

In the drone motor landscape, strategic mergers and acquisitions (M&A) are becoming a significant trend, driven by the need to expand technological capabilities and gain a competitive edge. As drone manufacturers aim to enhance their product offerings and strengthen their position, many have turned to M&A to access new technologies, innovative designs, and advanced motor solutions.

These partnerships help businesses improve the efficiency and performance of drone motors, meeting the increasing demand from diverse sectors such as logistics, agriculture, and surveillance.

One notable example is Xiaomi's acquisition of a controlling stake in Hubsan, a leading player in the drone manufacturing industry. This move, made in early 2024, allowed Xiaomi to integrate advanced motor technologies into its existing product line, significantly improving the performance of its drones.

The acquisition enhanced Xiaomi’s position in the global market by providing access to high-efficiency brushless motors and other key components needed to optimize flight performance.

Another example is Intel's acquisition of AscTec, a German drone manufacturer, in 2023. AscTec's expertise in drone motors and propulsion systems boosted Intel's drone product line, particularly for applications in agriculture and aerial surveying. The acquisition enabled Intel to integrate cutting-edge motor technology into its drones, offering enhanced flight times and payload capacity, which are crucial for commercial applications.

Increasing Demand from Delivery and Logistics Sector Fueling Growth in Drone Motors

The growing demand from the delivery and logistics sector is a significant driver of the drone motor. As e-commerce continues to thrive globally, companies are looking for innovative ways to enhance delivery speeds, reduce costs, and improve operational efficiency.

Drones, equipped with advanced motor technology, are emerging as a solution for last-mile delivery, especially in urban and remote areas where traditional delivery methods face challenges. This trend is driving the need for specialized drone motors capable of handling the demands of rapid and reliable parcel transport.

Amazon has been at the forefront of drone delivery innovation with its Prime Air service. The company aims to deliver packages to customers within 30 minutes of placing an order, which requires drones that are fast, efficient, and capable of carrying moderate payloads.

To achieve this, Amazon uses high-performance brushless motors in its drones, which provide longer flight times and greater reliability, even with heavier packages. As a result, the demand for motors that can provide high power output while maintaining energy efficiency is expected to rise.

The global Drone Motor recorded a modest CAGR of 11.7% between 2020 and 2024, with total industry revenue reaching approximately USD 2,893.6 million in 2024. The global drone motor faced several challenges between 2020 and 2024, primarily due to the impact of the COVID-19 pandemic.

The pandemic caused widespread disruptions in manufacturing and supply chains, leading to production delays and reduced consumer demand, which negatively impacted motor sales in 2020 and 2021.

Global economic instability during this period led to more cautious investments, and many companies scaled back their plans for expansion, resulting in slower adoption of drones across various industries. Additionally, regulatory hurdles, including unclear airspace integration and safety standards, created delays in the broader deployment of drones.

While consumer drone sales showed some growth, commercial applications in sectors like logistics, agriculture, and surveying were still in the early stages of adoption, limiting the growth potential of the drone motor.

Looking forward to 2025 to 2035, the global Drone Motor is projected to witness a robust CAGR of 16.8%. Looking ahead to the forecast period from 2025 to 2035, the drone motor is expected to experience significant growth.

Technological advancements, particularly in brushless motor efficiency, battery life, and quieter operations, will enhance drone performance, driving demand for motors across various applications. The expansion of commercial and industrial drone usage, especially in logistics, autonomous farming, and infrastructure inspection, will contribute to higher demand for high-performance motors.

As regulatory frameworks mature and UAV traffic management systems are developed, the environment for widespread drone deployment will improve, further boosting motor sales. Cost reductions in manufacturing and growing investment from both public and private sectors will make drones more affordable and accessible, creating a larger market for motors.

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 million. These companies are currently capturing a significant share of 15% to 20%. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within this tier I players include Nidec Corporation, FAULHABER MICROMO, LLC., Constar Micromotor Co., Ltd and Others..

Tier 2 companies encompass most of the small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues between USD 50-100 million. These businesses are notably focused on meeting local demand and are hence categorized within the Tier 2 segment. They are small-scale participants with limited geographical presence.

In this context, Tier 2 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one. Tier II Players such as Mechtex, T-motor, RC Motors, KDE Direct & Hacker Motor USA And others have been considered in this tier where they are projected to account for 30-35% of the overall market.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche having revenue below USD 50 million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. The manufacturers such as Tier III Players such as MAD Components, NeuMotors, and others are expected to hold 50-55% of the share.

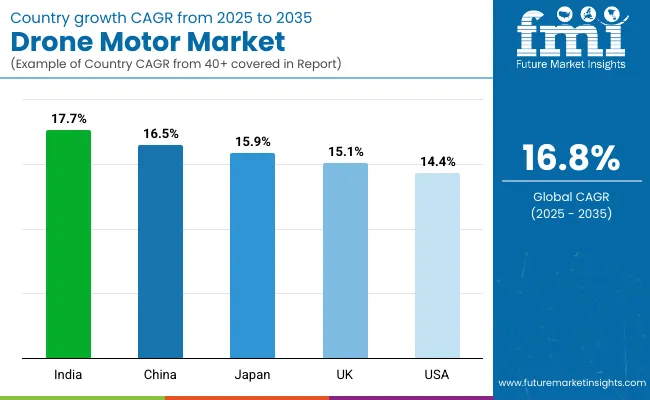

The below table shows the estimated growth rates of the top three countries. India, China, and Japan are set to record higher CAGRs of 5.1%, 4.7%, and 4.1% respectively, through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| India | 17.7% |

| China | 16.5% |

| Japan | 15.9% |

| UK | 15.1% |

| USA | 14.4% |

The China Drone Motor is poised to exhibit a CAGR of 16.5% during the assessment period. It is expected to attain a valuation of USD 1,651.9 Million by 2035.

As of August 2024, China continues to lead global drone development with nearly 2 million drones registered, marking an impressive increase of 720,000 from the previous year. The country’s commitment to becoming a dominant force in the global UAV market is further evidenced by its forecasted output of civilian drones, expected to exceed 200 billion yuan (USD 109.76 million) by 2025.

This growth is driven by significant investments in drone manufacturing, which are supported by both government policies and the rapid adoption of drone technology across industries such as agriculture, logistics, and surveillance.

China’s drone services sector, encompassing operations, logistics, and data processing, is expanding rapidly, positioning the nation to maintain its leadership in the UAV industry. With the government’s ambitious plans and increasing demand for drones, China is set to solidify its position as the largest and most technologically advanced drone in the world.

India’s drone manufacturing industry is set for considerable expansion, with investments expected to exceed INR 5,000 Cr over the next three years, according to the Ministry of Civil Aviation.

This surge in investment is expected to result in the annual sales turnover of the industry growing from INR 60 Cr (USD 7.32 million). in FY 2020 to 2021 to over INR 900 Cr (USD 109.76 million) in FY 2023 to 2024. This rapid development will also create over 10,000 direct jobs, contributing to the country’s economic growth.

The drone services industry, which includes sectors such as operations, logistics, and traffic management, is projected to grow to a staggering INR 30,000 Cr (USD 3,658.54 million) during this period.

This boom will support the creation of more than 500,000 jobs, enhancing India’s position as a key player in the global drone. The government's proactive policies and focus on self-reliance in technology and manufacturing are central to the rapid expansion of India's drone ecosystem.

Sales of Drone Motors in India are projected to soar at a CAGR of around 17.7% during the assessment period. The total valuation in the country is anticipated to reach USD 1,068.7 Million by 2035.

The UK Drone Motor size is projected to reach USD 404.4 Million by 2035. Over the assessment period, Drone Motor in the United Kingdom is set to rise at 15.1% CAGR

The UK drone market is on track to make a substantial economic impact by 2030. According to recent estimates, the UAV industry will contribute £42 billion to the UK’s GDP and generate £16 billion in cost savings across various sectors, including logistics, agriculture, and infrastructure inspection. In addition to these financial gains, the sector is expected to become a significant job creator.

By 2030, approximately 628,000 jobs will be available within the UK drone industry, with over 76,000 drones operating in British airspace. The government's regulatory efforts to safely integrate drones into national airspace, alongside advancements in drone technology, are key drivers of this expansion.

With increasing commercial and industrial applications for drones, the UK is poised to become a leader in the European drone economy, creating a sustainable and vibrant UAV ecosystem.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries. It analyzes advancements in manufacturing and identifies the latest trends poised to drive new applications in the.

A few key players in the Drone Motor are actively enhancing capabilities and resources to cater to the growing demand for the compound across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster resource base.

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies. Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive.

Key companies are investing in continuous research for producing new products and increasing their production capacity to meet end-user demand. They are also showing an inclination toward adopting strategies, including acquisitions, partnerships, mergers, and facility expansions to strengthen their footprint.

Industry Updates

Motor Type included in the study are Brushed Motor (Up to 1,000 KV, 1,000 to 2,000 KV, 2,000 to 3,000 KV and Above 3,000 KV), and Brushless Motor (Up to 1,000 KV, 1,000 to 2,000 KV, 2,000 to 3,000 KV and Above 3,000 KV).

Propeller Size included in the study are Up to 3 Inches, 3 to 7 Inches and Above 7 Inches.

The Sales Channel included in the study are Online Sales and Offline Sales.

Drone Type included in the study are Twin-Motor Drones, Tri-Copter, Quadcopters, Hexacopters, Octocopters and Decacopters.

End Use included in the study are Consumer Drones (Photography & videography, Recreational use) Commercial Drones (Agriculture ,Logistics & Delivery, Surveillance & Security., Inspection & Monitoring) , and Military Drones.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global market was valued at USD 2,893.6 million in 2024.

The global market is set to reach USD 3,371.6 million in 2025.

Global demand is anticipated to rise at 16.8% CAGR.

The industry is projected to reach USD 15,980.7 million by 2035.

Nidec Corporation, FAULHABER MICROMO, LLC., Constar Micromotor Co., Ltd, Mechtex, T-motor, RC Motors., are prominent companies.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drone Test Stand Market Size and Share Forecast Outlook 2025 to 2035

Drone Simulator Market Size and Share Forecast Outlook 2025 to 2035

Drones For Emergency Responders Market Size and Share Forecast Outlook 2025 to 2035

Drone Inspection and Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Drone Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Drone Warfare Market Size and Share Forecast Outlook 2025 to 2035

Drone Analytics Market Size and Share Forecast Outlook 2025 to 2035

Drone Battery Market Size and Share Forecast Outlook 2025 to 2035

Drone Delivery Service Market Analysis by Delivery Distance, Propeller Type, End User, and Region, and Forecast from 2025 to 2035

Drone Sensor Market - UAV Advancements & Forecast 2025 to 2035

Toy Drones Market Size and Share Forecast Outlook 2025 to 2035

Anti-Drone Technology Market

LiDAR Drone Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Medical Drones Market Report – Growth & Forecast 2025-2035

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Consumer Drones Market

Fumigation Drone Market Size and Share Forecast Outlook 2025 to 2035

Inspection Drone in Oil and Gas Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA